Datalogic SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datalogic Bundle

Datalogic’s strong brand recognition and innovative product pipeline present significant opportunities for market expansion. However, understanding the competitive landscape and potential economic headwinds is crucial for sustained growth.

Want the full story behind Datalogic’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Datalogic's global technology leadership in automatic data capture and factory automation is a significant strength, built on over five decades of pioneering innovation. This established position is reinforced by a broad and integrated product suite, encompassing everything from barcode readers and mobile computers to advanced sensors, vision systems, and laser marking solutions, catering to diverse industrial needs.

The company's commitment to staying at the forefront of technological advancement is clearly demonstrated by its substantial investment in research and development. In 2024 alone, Datalogic allocated €66 million to R&D, a testament to its strategy of continuous innovation, supported by a dedicated team of over 460 engineers spread across ten global R&D centers.

Datalogic boasts a diverse product portfolio that spans automated data capture solutions, including barcode scanners, mobile computers, and RFID systems. This wide array of offerings caters to critical applications across multiple industries such as retail, manufacturing, transportation and logistics, and healthcare.

The company's solutions are integral to improving efficiency and accuracy in these varied sectors. For instance, in retail, Datalogic's technology aids in inventory management and checkout processes, while in manufacturing, it supports production line tracking and quality control.

This broad industry application significantly reduces Datalogic's dependence on any single market segment. This diversification provides a crucial buffer against sector-specific downturns, contributing to overall business stability. In 2023, Datalogic reported revenues of approximately €649 million, with its broad market penetration being a key driver.

Datalogic's commitment to innovation is a significant strength, evident in its substantial investment in research and development. In 2024, new products contributed 19.7% to its revenue, a notable jump from 7.4% in 2023, underscoring a strong pipeline of new offerings.

This dedication to R&D translates into tangible technological advancements. Datalogic is actively integrating Artificial Intelligence into its product lines, exemplified by its Magellan scanners, and is pioneering advanced Smart IoT solutions for enhanced device management and data analytics.

By consistently pushing the boundaries of technology, Datalogic positions itself as a leader in its field, ensuring its product portfolio remains competitive and addresses evolving market demands for smarter, more connected solutions.

Improved Financial Health and Cost Control

Datalogic has demonstrated a significant strengthening of its financial position. Despite a slight revenue dip in 2024, the company achieved a remarkable 45% increase in net profit, reaching €13.7 million. This robust performance is underpinned by a substantial reduction in net financial debt, which now stands at €9.5 million, marking a multi-year low.

These financial gains are a direct result of Datalogic's successful implementation of cost optimization measures coupled with strong cash generation capabilities. The company’s operational efficiency is further evidenced by a marginal increase in its adjusted EBITDA margin to 9.0% for 2024.

- Improved Profitability: Net profit rose by 45% to €13.7 million in 2024.

- Reduced Debt: Net financial debt decreased to €9.5 million, a recent low.

- Enhanced Efficiency: Adjusted EBITDA margin saw a slight increase to 9.0% in 2024.

- Strong Cash Flow: Effective cash generation supported the financial improvements.

Strategic Partnerships and Market Expansion

Datalogic's strategic partnerships are a key strength, enhancing its market reach and technological capabilities. A notable collaboration with Worldline integrates Datalogic's Memor handheld devices into payment solutions, improving efficiency for businesses. This focus on strategic alliances, including those pushing laser marking advancements, solidifies its competitive edge.

The company is actively pursuing market expansion, particularly in high-growth areas like the Asia-Pacific region. Datalogic's presence at significant industry events, such as NRF 2025, demonstrates its commitment to showcasing innovative solutions and reinforcing its market standing. This proactive approach to growth and partnership development positions Datalogic for continued success in the evolving technology landscape.

- Strategic Alliances: Partnerships like the one with Worldline for payment solutions and collaborations in laser marking technology.

- Market Expansion: Focused growth initiatives in key regions, notably the Asia-Pacific market.

- Industry Presence: Active participation in major events like NRF 2025 to display new products and engage with the market.

- Technological Advancement: Collaborations aimed at pushing the boundaries of existing technologies, such as laser marking.

Datalogic's technological leadership in automatic data capture and factory automation is a core strength, built on over five decades of innovation. Its comprehensive product suite, from barcode readers to advanced sensors, serves diverse industrial needs.

The company's dedication to R&D is substantial, with €66 million invested in 2024, supporting over 460 engineers across ten global centers. This focus yielded a notable increase in revenue from new products, reaching 19.7% in 2024, up from 7.4% in 2023.

Datalogic exhibits strong financial health, marked by a 45% surge in net profit to €13.7 million in 2024 and a reduction in net financial debt to €9.5 million, a multi-year low. This improvement stems from cost optimization and robust cash generation, leading to a slight uptick in its adjusted EBITDA margin to 9.0% in 2024.

Strategic partnerships, such as the one with Worldline for payment solutions, and market expansion efforts, particularly in the Asia-Pacific region, bolster Datalogic's competitive position and growth trajectory.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue from New Products | 7.4% | 19.7% |

| Net Profit | €9.4 million | €13.7 million |

| Net Financial Debt | €12.8 million | €9.5 million |

| Adjusted EBITDA Margin | 8.9% | 9.0% |

What is included in the product

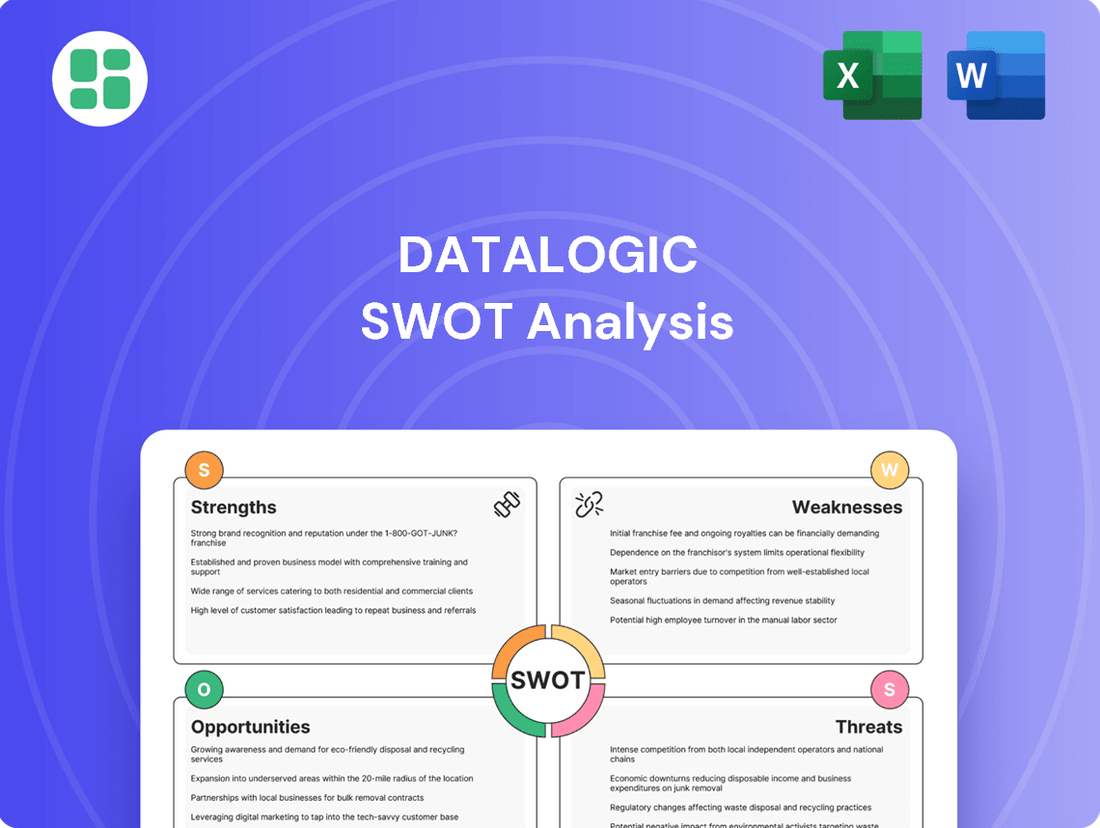

Analyzes Datalogic’s competitive position through key internal and external factors, highlighting its strengths in product innovation and market presence while identifying potential threats from emerging technologies and competitive pressures.

Offers a clear, organized framework to identify and address Datalogic's strategic challenges and opportunities.

Weaknesses

Datalogic's revenue saw a notable dip of 4.8% in 2024, falling to €493.8 million from the previous year. This downturn, even with positive performance in its Data Capture division, stemmed from weaker demand in crucial European Factory Automation sectors and delayed Logistics Automation projects in the United States. This highlights the company's susceptibility to shifts in specific market segments and broader economic conditions in key regions.

Datalogic experienced a setback in early 2025, reporting a net loss of €5.9 million for the first quarter. This marks a concerning reversal from the net profit achieved in the same quarter of the previous year. Despite positive movements in adjusted EBITDA, this net loss, coupled with an increase in net financial debt, signals potential headwinds for the company's profitability in the near term.

Datalogic's reliance on its Data Capture and Industrial Automation segments presents a notable weakness. While the company operates across various sectors, its overall financial health is significantly tied to the performance of these two core divisions.

For instance, in 2024, strong growth within the Data Capture segment was counterbalanced by a significant double-digit sales decrease in Industrial Automation. This dynamic highlights a dependency that could leave Datalogic vulnerable to market downturns or specific challenges affecting either of these key areas.

Geographical Market Volatility

Datalogic's performance is susceptible to geographical market volatility. The company faces uncertainty regarding the timing of major projects in the Americas, particularly within the Retail and Logistic Automation sectors. This unpredictability can significantly affect revenue streams and operational planning.

Further complicating matters, Datalogic experienced a revenue decline in Italy and other regions within EMEAI during the first quarter of 2025. This regional underperformance highlights the challenges in maintaining consistent growth across diverse markets.

- Project Timing Uncertainty: Delays in key projects in the Americas' Retail and Logistic Automation sectors create revenue forecasting challenges.

- Regional Revenue Decline: Q1 2025 saw a downturn in Italy and other EMEAI markets, impacting overall financial performance.

- Operational Management Difficulty: Geographical market fluctuations make it harder to manage regional operations and ensure stable profitability.

Intense Competition in AIDC Market

The Automatic Identification and Data Capture (AIDC) market Datalogic operates in is incredibly crowded. Giants like Honeywell and Zebra Technologies are major competitors, meaning Datalogic faces constant pressure on pricing. This intense rivalry also necessitates significant and ongoing investment in research and development to stay ahead, which can squeeze profit margins.

For instance, the global AIDC market was valued at approximately $50 billion in 2023 and is projected to grow, but this growth is shared among many. Companies must continuously innovate to capture even small segments of this expanding market. Datalogic's challenge is to differentiate its offerings effectively against these well-established players, ensuring its product pipeline remains competitive without overextending its financial resources.

- Intense Rivalry: Datalogic competes directly with industry leaders like Honeywell and Zebra Technologies, who possess significant market share and resources.

- Pricing Pressures: The competitive landscape often forces price reductions, impacting Datalogic's gross margins and overall profitability.

- Innovation Costs: Maintaining market relevance requires substantial and continuous investment in R&D to develop new technologies and product features, a significant expense in a fast-evolving sector.

Datalogic's financial performance exhibits vulnerability to specific market downturns and project execution challenges. The company's revenue decline in 2024, down 4.8% to €493.8 million, was partly due to weaker demand in European Factory Automation and delayed Logistics Automation projects in the US. This highlights a dependence on particular sectors and regions, making it susceptible to economic shifts and project timing issues. Furthermore, the Q1 2025 net loss of €5.9 million, despite positive adjusted EBITDA, underscores near-term profitability headwinds and an increase in net financial debt.

| Metric | 2024 Value (€M) | Q1 2025 Value (€M) | Year-on-Year Change |

|---|---|---|---|

| Revenue | 493.8 | N/A (Specific Q1 2025 revenue not provided in context) | -4.8% (2024 vs 2023) |

| Net Profit/(Loss) | N/A (Specific 2024 net profit not provided in context) | -5.9 | Reversal from profit in Q1 2024 |

| Net Financial Debt | N/A (Specific 2024 debt not provided in context) | Increased | Upward trend |

Same Document Delivered

Datalogic SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You can trust that what you see is exactly what you will get, providing a clear and accurate assessment of Datalogic's strategic position.

Opportunities

The accelerating global push for automation and the widespread adoption of Internet of Things (IoT) technologies across various sectors represent a substantial growth avenue for Datalogic. The company's sophisticated Smart IoT solutions, which encompass device management, real-time oversight, and proactive maintenance capabilities, are ideally suited to meet this escalating market demand.

This trend is further underscored by the broader Automatic Identification and Data Capture (AIDC) market, which is anticipated to experience robust expansion, with projections indicating it will reach USD 136.86 billion by 2030, providing a fertile ground for Datalogic's offerings.

The healthcare industry's growing reliance on automatic identification and data capture (AIDC) technologies presents a significant opportunity for Datalogic. This sector is actively seeking solutions to enhance patient safety, streamline inventory management, and boost overall operational efficiency.

Datalogic's specialized offerings, like its Memor 17 Healthcare Certified devices, are perfectly suited to meet these demands. These devices are designed to operate reliably in demanding healthcare environments, supporting critical tasks such as medication tracking and patient identification.

By focusing on this expanding market, Datalogic can leverage its technological expertise to secure a greater share. The global healthcare AIDC market was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, indicating substantial potential for revenue growth.

Datalogic's strategic advantage is significantly boosted by integrating AI into its barcode scanners and vision systems, like those in its Magellan product line. This technological leap allows for more precise data capture and analysis, directly impacting customer value.

These AI-driven advancements are particularly impactful in retail, where they enhance checkout accuracy and help reduce shrink, a critical concern for many businesses. For example, by improving item recognition, Datalogic's solutions can minimize errors and prevent losses.

The ability to provide advanced analytics through these AI-powered systems creates new revenue streams and deeper customer relationships. This data can inform inventory management, customer behavior insights, and operational efficiency for retailers.

E-commerce and Retail Logistics Boom

The relentless expansion of e-commerce is fueling a significant demand for sophisticated retail logistics and supply chain solutions. Datalogic's expertise in data capture, sorting, and tracking technologies is perfectly positioned to address this need, offering a prime opportunity for market penetration and growth in this dynamic sector. For instance, global e-commerce sales are projected to reach approximately $7.4 trillion by 2025, underscoring the immense potential for logistics technology providers.

Datalogic's strategic focus on developing specialized product lines, such as the Memor 12 and Memor 17 handheld computers, directly targets the unique requirements of the retail and logistics industries. These devices are engineered to enhance efficiency in inventory management, order fulfillment, and last-mile delivery, key components of a successful e-commerce operation. The company's commitment to innovation in this area is crucial for capturing a larger share of this burgeoning market.

- E-commerce Growth: Global e-commerce sales are expected to exceed $7.4 trillion by 2025, creating substantial demand for logistics optimization.

- Datalogic's Role: The company's data capture and tracking solutions are essential for streamlining retail supply chains and e-commerce fulfillment.

- Product Focus: New offerings like the Memor 12 and Memor 17 are specifically designed to meet the rigorous demands of retail and logistics environments.

Emerging Markets and Regional Growth

Emerging markets, particularly in the Asia-Pacific region, present a significant growth avenue for Datalogic. This area is projected to see the automatic identification and data capture market expand at a compound annual growth rate of 14.7% from 2025 through 2034. Datalogic can leverage this by increasing its footprint and customizing its offerings to align with the unique needs of these rapidly developing economies.

Key opportunities include:

- Expanding into high-growth Asian markets: Capitalizing on the projected 14.7% CAGR in the Asia-Pacific automatic identification and data capture sector.

- Tailoring solutions for regional needs: Developing specific product and service packages that address the distinct requirements of emerging economies.

- Strategic partnerships: Collaborating with local distributors and technology providers to enhance market penetration and customer reach.

- Focus on key industries: Targeting sectors like logistics, retail, and manufacturing within these regions, which are driving demand for data capture technologies.

Datalogic is well-positioned to capitalize on the increasing global demand for automation and IoT solutions, with its advanced Smart IoT offerings catering to this trend. The broader Automatic Identification and Data Capture (AIDC) market is projected to reach $136.86 billion by 2030, presenting a substantial growth runway for the company.

The healthcare sector's increasing adoption of AIDC technologies offers a prime opportunity, with the global healthcare AIDC market valued at approximately $3.5 billion in 2023 and expected to grow at over 7% annually through 2030. Datalogic's specialized healthcare-certified devices, like the Memor 17, are designed to meet the sector's specific needs for patient safety and operational efficiency.

AI integration into Datalogic's barcode scanners and vision systems, such as the Magellan line, enhances data capture precision and analytics, creating new value propositions for customers, particularly in retail for shrink reduction and improved inventory management.

The booming e-commerce sector, with global sales projected to hit $7.4 trillion by 2025, drives demand for efficient logistics and supply chain solutions, an area where Datalogic's data capture and tracking expertise is highly relevant. Their specialized products like the Memor 12 and Memor 17 are tailored for these demanding retail and logistics environments.

Emerging markets, especially in the Asia-Pacific region, represent a significant growth opportunity, with the AIDC market there expected to grow at a 14.7% CAGR from 2025 through 2034. Datalogic can expand its market share by tailoring solutions for these rapidly developing economies and forming strategic local partnerships.

| Opportunity Area | Market Size/Growth (2024/2025 Data) | Datalogic's Relevance |

|---|---|---|

| IoT & Automation | Global IoT market projected to reach $1.1 trillion in 2024 (Statista) | Smart IoT solutions address growing demand. |

| AIDC Market | Projected to reach $136.86 billion by 2030 (Grand View Research) | Core business aligns with market expansion. |

| Healthcare AIDC | Valued at ~$3.5 billion in 2023, CAGR >7% through 2030 | Specialized healthcare devices meet sector needs. |

| E-commerce Logistics | Global sales to exceed $7.4 trillion by 2025 | Data capture and tracking solutions enhance fulfillment. |

| Emerging Markets (Asia-Pacific) | AIDC CAGR of 14.7% (2025-2034) | Customized solutions and local partnerships can drive growth. |

Threats

Ongoing geopolitical tensions, such as the lingering effects of conflicts in Eastern Europe and the Middle East, alongside rising global inflation concerns, create a volatile economic landscape. These factors directly threaten global economic stability and can dampen market demand for advanced automation solutions.

A potential global economic downturn, predicted by many institutions for late 2024 or early 2025, could significantly reduce corporate capital expenditure. This would likely impact Datalogic's revenue streams, especially within its Industrial Automation segment, which relies heavily on businesses investing in new technologies.

For instance, a broad economic slowdown could see manufacturing clients delay or scale back automation projects, directly affecting Datalogic's order book. The International Monetary Fund (IMF) has repeatedly warned of downside risks to global growth projections, citing persistent inflation and geopolitical fragmentation as key concerns for 2024-2025.

The automatic identification and data capture sector is fiercely competitive, with many established companies and emerging players vying for market share. This intense rivalry often translates into price wars, which can squeeze profit margins and necessitate constant innovation for Datalogic to stand out. For instance, in 2023, the global barcode scanner market, a key segment for Datalogic, saw significant pricing adjustments due to increased competition from Asian manufacturers, impacting overall industry profitability.

The relentless pace of technological evolution, particularly in areas like artificial intelligence, machine learning, and novel sensing capabilities, poses a significant threat to Datalogic. The company must maintain a vigorous innovation pipeline to prevent its current product offerings from becoming outdated.

Competitors leveraging these emerging technologies could quickly gain market share if Datalogic fails to adapt, potentially impacting revenue streams. For instance, the global AI market was projected to reach $181 billion in 2023 and is expected to grow substantially, highlighting the competitive pressure from technologically advanced solutions.

Supply Chain Disruptions and Component Shortages

Global supply chain vulnerabilities, particularly concerning component shortages and logistical hiccups, pose a significant threat to Datalogic's operational efficiency. These disruptions can directly impact production schedules and the timely delivery of products to market. For instance, the ongoing semiconductor shortage, which significantly affected the electronics industry throughout 2022 and into 2023, could continue to affect component availability for Datalogic's advanced scanning and data capture devices.

Such challenges can translate into increased manufacturing costs due to expedited shipping or the need to source alternative, potentially more expensive, components. Furthermore, delayed product launches or an inability to meet existing customer demand can lead to lost revenue opportunities and a negative impact on customer satisfaction, potentially eroding market share.

- Component Shortages: Persistent issues in sourcing critical electronic components, such as advanced microprocessors and sensors, could limit Datalogic's production capacity.

- Logistical Bottlenecks: Port congestion, shipping container shortages, and rising freight costs, as seen in late 2024, can delay the inbound flow of raw materials and the outbound shipment of finished goods.

- Increased Costs: The need for premium freight or alternative sourcing can drive up the cost of goods sold, impacting Datalogic's profit margins.

- Demand Fulfillment: Inability to secure sufficient components or manage logistics efficiently could result in missed sales targets and damage customer relationships.

Currency Fluctuations

Operating globally means Datalogic is susceptible to currency fluctuations. These shifts can impact how their earnings translate back to their reporting currency, potentially affecting reported revenues and profits. For example, a stronger Euro against other currencies could make their products more expensive in those markets, impacting sales volume.

The company's financial reports often highlight the potential for unfavorable exchange rate effects. In 2024, Datalogic's financial performance will be closely watched for how well they manage these currency risks. Companies like Datalogic often use hedging strategies to mitigate these impacts, but significant market volatility can still pose a challenge.

Consider these points regarding currency fluctuations:

- Global Operations Exposure: Datalogic's international presence inherently exposes it to foreign exchange rate volatility.

- Revenue and Profit Impact: Unfavorable currency movements can diminish the value of foreign earnings when converted to the reporting currency, impacting top-line and bottom-line figures.

- Exchange Rate Sensitivity: The company's outlook may include specific projections or concerns about the potential impact of exchange rate movements on its financial results.

- Hedging Strategies: Datalogic likely employs financial instruments to hedge against currency risks, though the effectiveness can vary with market conditions.

Intensifying global competition and rapid technological advancements are significant threats, pressuring Datalogic to constantly innovate and maintain competitive pricing. Emerging markets and new entrants, particularly from Asia, are increasing market saturation, potentially leading to price erosion. Furthermore, the rapid evolution of AI and machine learning necessitates continuous investment in R&D to avoid product obsolescence.

SWOT Analysis Data Sources

This Datalogic SWOT analysis is built on a foundation of robust data, drawing from Datalogic's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded strategic perspective.