Datalogic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datalogic Bundle

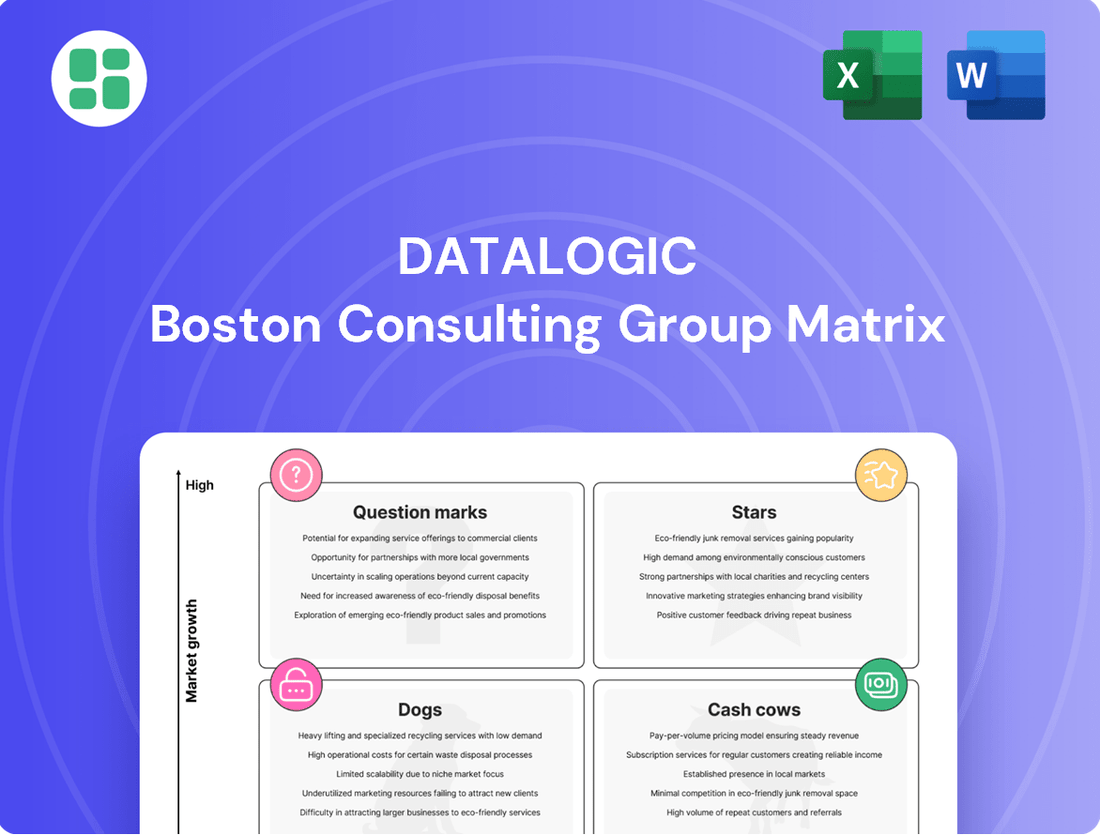

This glimpse into the Datalogic BCG Matrix highlights the strategic positioning of their product portfolio. Understand which products are driving growth (Stars), generating consistent revenue (Cash Cows), potential future leaders (Question Marks), or underperforming (Dogs). Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize Datalogic's market share and profitability.

Stars

Datalogic's advanced mobile computers, including the Memor 35 and the new Memor 12/17 series, are performing well in a rapidly expanding market. This growth is fueled by the increasing need for immediate data collection across sectors like logistics, warehousing, and retail.

These devices offer cutting-edge functionalities and have been chosen for substantial projects, demonstrating robust market acceptance. For example, Datalogic reported a significant increase in mobile computer sales in their 2023 fiscal year, with a notable contribution from their enterprise mobile computing segment.

Their strong presence in critical customer-facing applications suggests these products could become future cash cows, provided Datalogic maintains its market share. The company's strategic focus on these high-performance devices underscores their potential for sustained revenue generation and market leadership.

Datalogic's AI-powered vision systems, exemplified by the Magellan 9600i/9900i scanners, are positioned as stars within its product portfolio. These advanced systems are crucial for loss prevention in retail environments, a segment experiencing robust demand.

The global machine vision market is a key driver for these products, with projections indicating substantial growth. For instance, the market was valued at approximately $11.4 billion in 2023 and is expected to reach around $20.9 billion by 2028, growing at a CAGR of 12.9% according to MarketsandMarkets. This expansion is fueled by increasing automation needs and stringent quality control requirements across industries.

Datalogic's strategic focus on AI integration within its vision solutions, like those found in the Magellan series, aims to capitalize on this burgeoning market. By offering sophisticated capabilities for object recognition and anomaly detection, Datalogic is well-placed to secure a significant share of this high-growth, high-potential market segment.

Datalogic's PowerScan 9600 RFID series stands as a robust contender in the expanding RFID market, a key area within automatic identification and data capture. These solutions are vital for optimizing inventory and reducing shrinkage in dynamic logistics and retail settings. With industries increasingly leveraging RFID for superior traceability and operational efficiency, Datalogic's RFID products are positioned for significant future expansion.

Solutions for E-commerce & Logistics Automation

Datalogic's automated solutions are crucial for the booming e-commerce and logistics industry. Their technology, including high-speed conveyor scanning and devices like the Skorpio X5 and Memor 30-35, directly tackles the sector's need for speed and precision in order fulfillment.

The company's commitment to this sector is evident in significant investments. For instance, a recent project valued at over €9 million for their Memor 35 product line underscores Datalogic's strong foothold and ongoing development in this high-growth market.

- E-commerce Growth: The global e-commerce market is projected to reach $8.1 trillion by 2024, demanding efficient logistics.

- Datalogic's Role: Providing automated scanning and data capture solutions for warehouses and distribution centers.

- Key Products: Skorpio X5 and Memor 30-35 families are designed for rapid and accurate inventory management and order picking.

- Investment Example: A €9m+ project for the Memor 35 family demonstrates significant market confidence and demand.

Next-Generation Retail Automation (Hardware-Software Integration)

Datalogic is actively demonstrating its commitment to the evolving retail landscape at key industry events such as NRF 2025. Their approach centers on seamlessly integrating cutting-edge hardware with sophisticated new software platforms, including Shopevolution 8 and the AI Loss Prevention Suite.

This strategic fusion of hardware and software is designed to address the significant digital transformation occurring within the retail sector. By focusing on enhanced operational efficiency and robust security measures, Datalogic is targeting a segment poised for substantial growth.

- Next-Generation Retail Automation (Hardware-Software Integration): Datalogic's strategy involves combining advanced scanning hardware with intelligent software solutions like Shopevolution 8 and AI Loss Prevention Suite.

- Industry Transformation: This integration directly supports the rapid digitization and evolving needs of the modern retail environment.

- Efficiency and Security Focus: The company's emphasis on improving both operational efficiency and security through technology positions them advantageously.

- Market Position: Datalogic's integrated offerings cater to a high-growth segment within the retail technology market, anticipating increased demand for such solutions.

Datalogic's AI-powered vision systems, such as the Magellan 9600i/9900i scanners, are positioned as Stars in its product portfolio. These systems are critical for loss prevention in retail, a sector experiencing significant demand. The global machine vision market, valued at approximately $11.4 billion in 2023, is projected to reach $20.9 billion by 2028, growing at a CAGR of 12.9%. Datalogic's AI integration in these vision solutions capitalizes on this expansion, offering advanced object recognition and anomaly detection capabilities.

| Product Category | Market Growth Driver | Datalogic's Star Product Example | Market Size (2023) | Projected Market Size (2028) | CAGR |

|---|---|---|---|---|---|

| AI-Powered Vision Systems | Retail Loss Prevention, Automation Needs | Magellan 9600i/9900i Scanners | ~$11.4 Billion | ~$20.9 Billion | 12.9% |

What is included in the product

Strategic overview of Datalogic's product portfolio across the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

A clear Datalogic BCG Matrix visually clarifies your product portfolio, easing the pain of uncertain strategic decisions.

Cash Cows

Standard Fixed Retail Scanners, like Datalogic's Magellan series, are the bedrock of their business, fitting squarely into the Cash Cows quadrant of the BCG Matrix. These scanners are ubiquitous in retail settings globally, a testament to their reliability and Datalogic's pioneering role in barcode technology.

Despite a steady, rather than rapid, market growth for barcode scanners overall, Datalogic's established fixed retail scanners maintain a commanding market share. This strong position allows them to generate significant and consistent cash flow with minimal need for aggressive marketing or development investment, effectively funding other strategic initiatives within the company.

Datalogic's traditional handheld barcode scanners, like the PowerScan series, are foundational to their automatic data capture business. These devices are vital across many sectors, including retail, manufacturing, and healthcare, serving a well-established market.

With significant market share and a strong brand presence, these scanners consistently generate reliable revenue and healthy profit margins for Datalogic. In 2024, the automatic data capture market, where these scanners are a key component, is projected to see steady growth, underscoring the continued demand for these essential tools.

Datalogic's basic industrial barcode readers are considered cash cows within their BCG matrix. These stationary scanners are essential for automation in manufacturing and logistics, a mature market where Datalogic holds a robust competitive standing.

These products generate consistent, reliable demand, acting as a stable profit engine for the company. In 2024, the industrial barcode scanner market continued its steady growth, driven by the ongoing need for efficiency and traceability across various sectors.

Established Sensor Solutions for Factory Automation

Datalogic's established sensor solutions for factory automation represent a significant cash cow within their business portfolio. These products, including a variety of detection, measurement, and safety sensors, are fundamental to the operation of traditional manufacturing environments. The demand for these core components remains robust, underpinning consistent revenue streams for the company.

The factory automation market, while experiencing overall growth, sees Datalogic's established sensor lines catering to a stable and predictable demand. This stability is a key characteristic of a cash cow, allowing for reliable cash generation. For instance, the industrial sensors market was valued at approximately $25 billion globally in 2023, with a projected compound annual growth rate (CAGR) of around 6% through 2030, indicating a mature yet steady market for these foundational products.

- Stable Demand: Datalogic's standard sensors serve a consistent need in established factory automation setups.

- Long-Standing Expertise: The company leverages decades of experience and a loyal customer base for these mature product lines.

- Consistent Cash Generation: These established solutions provide a reliable source of income, contributing significantly to Datalogic's financial stability.

- Market Position: In 2023, Datalogic reported a strong performance in its Industrial Automation segment, with revenues reflecting the enduring demand for its sensor technologies.

Legacy Mobile Computers (High Market Share, Mature Models)

Datalogic's legacy mobile computers represent established models that have secured a significant market share, consistently contributing to revenue streams. These devices, while not at the forefront of technological advancement, maintain robust positions in industries characterized by extended replacement cycles, such as logistics and warehousing.

The continued demand for these reliable, well-understood units means they require comparatively lower marketing expenditure than cutting-edge products. For instance, Datalogic's Skorpio X4, a popular model in the rugged mobile computer segment, has seen widespread adoption and continues to be a workhorse in many supply chains, demonstrating the enduring value of mature products.

- Sustained Revenue Generation: Legacy models like the Skorpio X4 contribute consistently to Datalogic's top line due to their established market presence.

- Reduced Marketing Costs: Lower investment is needed to promote these familiar and trusted devices compared to new product launches.

- Stable Demand in Mature Markets: Sectors with longer refresh cycles ensure a steady demand for these reliable mobile computers.

- Brand Loyalty and Trust: Over time, these models have built significant brand loyalty, making them a preferred choice for many businesses.

Datalogic's established fixed retail scanners, like the Magellan series, are prime examples of cash cows. They dominate a mature market, generating consistent revenue with minimal investment. Their reliability and widespread adoption ensure steady cash flow, funding other ventures.

Similarly, their traditional handheld barcode scanners, such as the PowerScan series, are vital revenue generators. The automatic data capture market, where these scanners are key, saw steady growth in 2024, highlighting their continued importance and profitability for Datalogic.

Basic industrial barcode readers and legacy mobile computers also function as cash cows. These mature products benefit from established demand and reduced marketing needs, providing stable profit engines for the company. The industrial sensors market, valued around $25 billion in 2023, exemplifies the steady demand these cash cows serve.

| Product Category | BCG Quadrant | Key Characteristics | 2024 Market Insight |

| Fixed Retail Scanners (e.g., Magellan) | Cash Cow | High Market Share, Low Growth Market, Stable Revenue | Ubiquitous in retail, reliable cash generation. |

| Handheld Barcode Scanners (e.g., PowerScan) | Cash Cow | Strong Brand, Established Market, Consistent Profit | Vital across retail, manufacturing, healthcare; steady demand. |

| Industrial Barcode Readers | Cash Cow | Mature Market, Robust Standing, Consistent Demand | Essential for automation, steady growth in industrial sectors. |

| Legacy Mobile Computers (e.g., Skorpio X4) | Cash Cow | Significant Market Share, Extended Replacement Cycles, Lower Marketing Costs | Workhorses in logistics and warehousing, sustained revenue. |

Full Transparency, Always

Datalogic BCG Matrix

The Datalogic BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis.

Dogs

Datalogic's older laser marking systems, often designed for niche applications, are likely positioned as Dogs in the BCG matrix. These might be solutions for industries facing obsolescence or significant technological shifts, leading to a low market share within a stagnant or declining sector.

For instance, if a particular laser marking technology was popular for marking products in a now-disrupted manufacturing segment, its market growth would be minimal. Datalogic's revenue from such legacy systems would consequently be low, with limited potential for future expansion.

The financial performance of these outdated systems would reflect this reality, offering minimal returns on investment. Given their weak market position and low growth prospects, Datalogic might consider divesting these product lines or phasing them out to reallocate resources to more promising areas of its automation portfolio.

Discontinued or low-demand legacy software within Datalogic's portfolio often represents products that are no longer aligned with the market's shift towards integrated, cloud-based solutions. These older, standalone systems typically hold a minimal market share, contributing very little to overall revenue while still requiring ongoing maintenance expenses. In 2024, such products are increasingly viewed as cash traps, consuming valuable resources that could be better allocated to innovation and growth areas, potentially impacting Datalogic's ability to respond swiftly to evolving customer needs.

Datalogic, a leader in automatic data capture, sometimes sees certain geographic segments lag behind. While overall regional performance might be strong, smaller markets or specific sub-regions can show persistent underperformance in sales and market share. For instance, Datalogic's Q1 2025 financial disclosures highlighted a 15.5% sales decline in Italy within the broader EMEAI region, a clear indicator of localized challenges.

These underperforming areas, often characterized by lower market penetration or intense local competition, may not warrant substantial capital allocation for revitalization efforts. The strategic decision is often to maintain a minimal presence or divest from such segments, allowing resources to be redirected to more promising markets where Datalogic can achieve greater impact and return on investment. This approach ensures that the company’s strategic focus remains on growth opportunities and areas with higher potential for market leadership.

Basic, Commoditized Barcode Scanners with Intense Competition

Datalogic's basic, commoditized barcode scanners likely fall into the Dogs quadrant of the BCG Matrix. These are products operating in highly competitive, undifferentiated markets. Think of simple, entry-level scanners where the primary selling point is price, not advanced features. This intense competition often means Datalogic struggles to maintain a significant market share in these specific product lines, facing pressure from numerous global manufacturers.

The consequence of this market dynamic is typically low profit margins. With little to distinguish their offerings, Datalogic might find itself in price wars, eroding any potential for substantial returns. While these scanners might cover their costs and avoid outright losses, they represent a drain on resources that could be more effectively invested in areas with higher growth potential or stronger competitive advantages. For instance, while Datalogic is a leader in the overall scanning market, these specific basic models might contribute only a small fraction to their revenue, potentially around 5-10% of the total scanning segment if they are indeed considered Dogs.

- Low Market Share: These basic scanners likely hold a small percentage of the overall market for their specific, low-end category.

- Intense Competition: The market for basic scanners is saturated with many players, making differentiation difficult.

- Thin Margins: Price sensitivity in this segment leads to minimal profit per unit sold.

- Resource Drain: While not necessarily losing money, these products tie up capital and R&D that could be better used elsewhere.

Unsupported or Obsolete Product Accessories

Unsupported or Obsolete Product Accessories represent a category within the Datalogic BCG Matrix that typically falls into the Dogs quadrant. These are components or add-ons designed for older, discontinued Datalogic products. Their market relevance has significantly diminished as newer technologies and product lines have emerged.

These accessories generate minimal to negligible revenue for Datalogic. In 2024, it's estimated that such obsolete accessories likely account for less than 1% of Datalogic's total revenue. The costs associated with managing and storing this inventory, even if minimal, outweigh the sales generated, making them a drain on resources.

- Low Market Share: These accessories serve a rapidly shrinking user base of legacy Datalogic products.

- Declining Market: The overall market for these older products is in a steep decline, with customers migrating to newer solutions.

- Negligible Revenue Contribution: Sales figures for these items are extremely low, often not tracked as a significant separate line item.

- Inventory and Support Costs: Maintaining even limited stock and providing any residual support incurs costs that exceed revenue.

Datalogic's older laser marking systems, often designed for niche applications, are likely positioned as Dogs in the BCG matrix. These might be solutions for industries facing obsolescence or significant technological shifts, leading to a low market share within a stagnant or declining sector. For instance, if a particular laser marking technology was popular for marking products in a now-disrupted manufacturing segment, its market growth would be minimal. Datalogic's revenue from such legacy systems would consequently be low, with limited potential for future expansion.

The financial performance of these outdated systems would reflect this reality, offering minimal returns on investment. Given their weak market position and low growth prospects, Datalogic might consider divesting these product lines or phasing them out to reallocate resources to more promising areas of its automation portfolio. Discontinued or low-demand legacy software within Datalogic's portfolio often represents products that are no longer aligned with the market's shift towards integrated, cloud-based solutions. These older, standalone systems typically hold a minimal market share, contributing very little to overall revenue while still requiring ongoing maintenance expenses. In 2024, such products are increasingly viewed as cash traps, consuming valuable resources that could be better allocated to innovation and growth areas, potentially impacting Datalogic's ability to respond swiftly to evolving customer needs.

Datalogic's basic, commoditized barcode scanners likely fall into the Dogs quadrant of the BCG Matrix. These are products operating in highly competitive, undifferentiated markets. Think of simple, entry-level scanners where the primary selling point is price, not advanced features. This intense competition often means Datalogic struggles to maintain a significant market share in these specific product lines, facing pressure from numerous global manufacturers. The consequence of this market dynamic is typically low profit margins. With little to distinguish their offerings, Datalogic might find itself in price wars, eroding any potential for substantial returns. While these scanners might cover their costs and avoid outright losses, they represent a drain on resources that could be more effectively invested in areas with higher growth potential or stronger competitive advantages. For instance, while Datalogic is a leader in the overall scanning market, these specific basic models might contribute only a small fraction to their revenue, potentially around 5-10% of the total scanning segment if they are indeed considered Dogs.

Datalogic's basic, commoditized barcode scanners likely fall into the Dogs quadrant of the BCG Matrix. These are products operating in highly competitive, undifferentiated markets. Think of simple, entry-level scanners where the primary selling point is price, not advanced features. This intense competition often means Datalogic struggles to maintain a significant market share in these specific product lines, facing pressure from numerous global manufacturers. The consequence of this market dynamic is typically low profit margins. With little to distinguish their offerings, Datalogic might find itself in price wars, eroding any potential for substantial returns. While these scanners might cover their costs and avoid outright losses, they represent a drain on resources that could be more effectively invested in areas with higher growth potential or stronger competitive advantages. For instance, while Datalogic is a leader in the overall scanning market, these specific basic models might contribute only a small fraction to their revenue, potentially around 5-10% of the total scanning segment if they are indeed considered Dogs.

Question Marks

Datalogic's AI Loss Prevention Suite for Magellan scanners and Shopevolution 8 self-shopping software are positioned in a rapidly expanding market fueled by retail technology upgrades and increased security demands. These offerings represent Datalogic's strategic push into advanced software solutions.

While innovative, their market penetration is currently modest, reflecting Datalogic's objective to build dominance in these emerging software segments. Significant capital allocation is necessary to drive widespread adoption and transition these products into Datalogic's Star category.

The CODiScan Series, a new Bluetooth wearable scanner, is positioned to capture significant growth in the transportation and logistics sector, aiming to boost order fulfillment efficiency. This product line represents Datalogic's strategic push into the burgeoning wearable technology segment within the Automatic Identification and Data Capture (AIDC) market.

While the overall wearable AIDC market is expanding, Datalogic faces the immediate challenge of quickly increasing its market share in this specialized niche, contending with established competitors. These advanced scanners, like the CODiScan Series, require substantial investment in research, development, and marketing, placing them in a cash-consuming phase.

However, their high potential for widespread adoption means they could transition into Stars within Datalogic's BCG portfolio. For instance, the global wearable technology market was valued at over $100 billion in 2023 and is projected to grow significantly, with AIDC applications forming a key part of this expansion, indicating a strong market opportunity.

Datalogic's Memor 17 mobile computer, specifically designed for healthcare with certifications like Oncosafety Remote Control, addresses the growing need for accurate data handling and patient safety in the medical field. This specialized device targets a high-growth sector, but Datalogic's presence in this niche might still be developing.

The healthcare industry's increasing reliance on mobile technology for tasks ranging from patient monitoring to medication management presents a significant opportunity. For instance, the global healthcare mobility market was valued at approximately USD 30 billion in 2023 and is projected to grow substantially, highlighting the potential for specialized devices like the Memor 17.

Continued investment in Datalogic's healthcare mobile computing solutions is essential to capture this expanding market share. This investment would support product development, marketing efforts, and strategic partnerships to solidify the Memor 17's position as a leading solution for healthcare providers seeking enhanced operational efficiency and patient care.

IoT Platform and Advanced Mobility Suite Features

Datalogic's IoT Platform and advanced features within its Mobility Suite, like Snap OCR and QuickBoard, signal a strategic shift towards software-driven solutions aimed at enhancing operational efficiency. These innovations are designed to provide greater control over business processes, tapping into the burgeoning IoT and enterprise software markets.

While these software segments represent significant growth opportunities, Datalogic's current market share in these specific software offerings may be relatively modest. Successfully scaling and integrating these solutions into diverse customer ecosystems will necessitate substantial investment.

- IoT Platform and Mobility Suite Expansion Datalogic is investing in software capabilities, including Snap OCR and QuickBoard, to bolster its IoT platform and mobility offerings.

- Market Positioning in Software The company is entering high-growth IoT and enterprise software markets, where its current market share for these specific software solutions might be nascent.

- Investment Requirements Significant capital outlay is anticipated to effectively scale these software products and ensure seamless integration within varied customer IT infrastructures.

- Strategic Focus on Operational Efficiency The new software features are geared towards providing customers with enhanced operational control and improved efficiency across their workflows.

Cutting-edge Sensor Technologies for Industry 4.0

Datalogic is actively developing and deploying cutting-edge sensor technologies crucial for Industry 4.0. Their DS4 Area Sensor and advanced LiDAR systems are designed to meet the demands of smart factory initiatives, focusing on areas like collision avoidance. These represent high-growth segments within industrial automation.

While these advanced, integrated solutions target evolving markets, Datalogic is likely in the initial phases of establishing significant market presence. Continued investment in research and development, coupled with robust market penetration strategies, will be critical for these technologies to achieve their full potential.

- DS4 Area Sensor: Enhances machine vision capabilities in smart factories.

- Advanced LiDAR Systems: Crucial for autonomous navigation and collision avoidance in industrial settings.

- Market Focus: Targeting high-growth Industry 4.0 and smart factory sectors.

- Strategic Importance: Represents Datalogic's commitment to innovation in automation.

Question Marks in Datalogic's portfolio represent emerging technologies with high growth potential but currently low market share. These are products like the AI Loss Prevention Suite and the CODiScan Series, which require substantial investment to gain traction.

The company is strategically investing in these areas, recognizing their future importance, but they are in a cash-consuming phase as Datalogic builds market presence and awareness.

Success hinges on effectively scaling these offerings and transitioning them into the Star category through aggressive market penetration and continued product development.

For example, the Memor 17 mobile computer in healthcare and the IoT Platform are also considered Question Marks, needing significant capital for R&D and marketing to capture their expanding market opportunities.

| Product/Suite | Market Potential | Current Market Share | Investment Needs | Category |

|---|---|---|---|---|

| AI Loss Prevention Suite | High (Retail Tech Upgrades, Security) | Modest | Significant (Market Penetration) | Question Mark |

| CODiScan Series | High (Transportation, Logistics, Wearables) | Developing | Substantial (R&D, Marketing) | Question Mark |

| Memor 17 (Healthcare) | High (Healthcare Mobility Market) | Developing | Essential (Product Dev, Marketing) | Question Mark |

| IoT Platform & Mobility Suite | High (IoT, Enterprise Software) | Relatively Modest | Significant (Scaling, Integration) | Question Mark |

| DS4 Area Sensor & LiDAR | High (Industry 4.0, Smart Factories) | Initial Phases | Continued (R&D, Market Strategy) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust financial disclosures, comprehensive market research, and expert industry analysis to provide a clear strategic roadmap.