Datalogic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datalogic Bundle

Datalogic's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for any stakeholder looking to gain an edge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Datalogic’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Datalogic's reliance on a limited number of suppliers for specialized components, such as advanced microprocessors and high-performance optics, significantly impacts its bargaining power. For instance, if a key supplier of custom-designed image sensors, essential for Datalogic's barcode scanners, experiences production issues or decides to prioritize other clients, Datalogic could face increased costs or delays. The semiconductor industry, a crucial supplier for Datalogic's products, has seen consolidation, with fewer players dominating the market for high-end processors, thereby increasing their leverage.

High switching costs for Datalogic, such as the expense and time involved in re-engineering products to integrate new components or the rigorous process of re-qualifying alternative suppliers, significantly bolster the bargaining power of existing suppliers. This is especially pronounced when dealing with deeply embedded technologies that necessitate extensive integration and thorough testing before implementation.

Suppliers of highly specialized or patented technologies, like specific vision system components or laser marking modules, wield considerable influence. Datalogic's dependence on these unique inputs is crucial for sustaining its technological edge and product distinctiveness within the automatic data capture and factory automation sectors.

Threat of Forward Integration

The threat of suppliers engaging in forward integration into Datalogic's market is typically low. This is largely due to the intricate technology and specialized nature of Datalogic's offerings, which require significant expertise and investment to replicate. Furthermore, Datalogic serves a broad and diverse customer base, making it challenging for a single supplier to effectively capture this market share through integration.

However, a nuanced consideration arises with large technology conglomerates that supply critical components to Datalogic. These entities possess substantial resources and R&D capabilities. If they perceive a strategic advantage, they could potentially develop and market their own integrated solutions, directly competing with Datalogic. While this remains a distant, though not impossible, threat, it warrants monitoring.

- Low direct threat: Datalogic's specialized products and diverse clientele create barriers for supplier forward integration.

- Potential threat from large tech suppliers: Major component providers with significant R&D could develop competing integrated solutions.

- Complexity as a deterrent: The high technical demands of Datalogic's market segment make it difficult for suppliers to easily enter.

Importance of Datalogic to Suppliers

Datalogic's significance to its suppliers plays a crucial role in shaping their bargaining power. If Datalogic constitutes a substantial portion of a supplier's overall revenue, that supplier might be more inclined to offer favorable terms to maintain the relationship, thus reducing their leverage. For instance, if a specialized component supplier relies heavily on Datalogic's orders, they have less room to dictate prices or terms.

Conversely, when Datalogic is a minor client for a large, diversified supplier, its bargaining power is inherently diminished. In such scenarios, the supplier has numerous other customers and is less dependent on Datalogic's business, allowing them to exert more influence on pricing and contract conditions. This dynamic is common when Datalogic sources standard components from major industry players.

The bargaining power of suppliers is influenced by how critical Datalogic is to their business. If Datalogic represents a large percentage of a supplier's sales, the supplier may have less power. For example, if a key supplier's revenue is heavily dependent on Datalogic, they are less likely to push for unfavorable terms.

Conversely, if Datalogic is a small customer to a broad-based supplier, Datalogic's influence is reduced. This is because the supplier has other significant revenue streams and is not as reliant on Datalogic's orders, giving them more leverage in negotiations.

Datalogic's bargaining power with its suppliers is moderately high due to its significant order volumes for certain specialized components, which can make up a substantial portion of a supplier's revenue. However, this is counterbalanced by the critical nature of some proprietary technologies and the high switching costs associated with component integration. The threat of supplier forward integration is low, but large tech conglomerates supplying components pose a potential, albeit distant, competitive risk.

| Factor | Datalogic's Position | Supplier Bargaining Power |

|---|---|---|

| Supplier Concentration | Moderate (some reliance on few specialized suppliers) | Moderate to High (for specialized components) |

| Switching Costs | High (re-engineering, re-qualification) | High (for Datalogic) |

| Supplier Importance to Datalogic | High (for critical components) | Variable (depends on Datalogic's share of supplier revenue) |

| Datalogic's Importance to Supplier | High (for some specialized suppliers) | Low to Moderate (for diversified suppliers) |

| Threat of Forward Integration | Low (due to technical complexity) | Low (direct threat), Moderate (potential from large tech players) |

What is included in the product

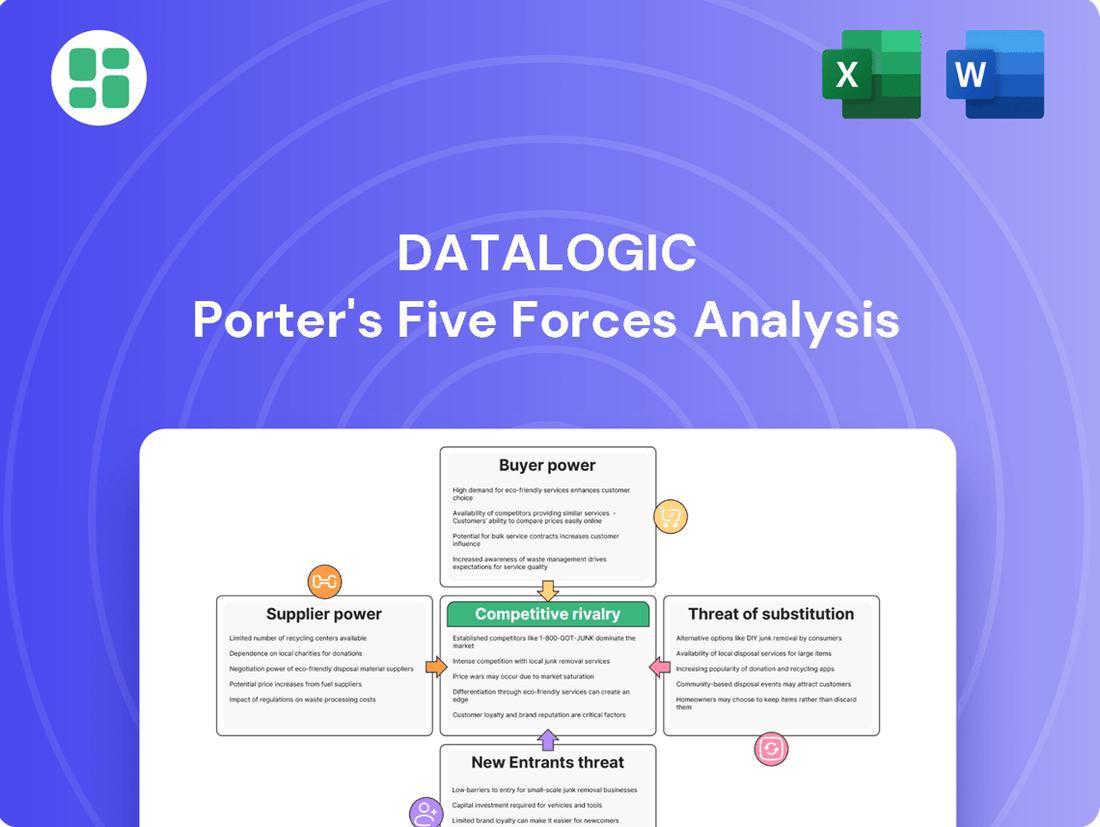

This analysis unpacks the competitive forces impacting Datalogic, examining industry rivalry, buyer and supplier power, threat of new entrants, and the risk of substitutes.

Quickly identify and address competitive threats with a visual breakdown of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Customers Bargaining Power

Datalogic's customer base spans retail, manufacturing, transportation, and healthcare, catering to both large corporations and smaller entities. This diversity means that while some customers are small, others represent significant volume.

The presence of large, high-volume clients, such as major retail chains or global manufacturing firms, significantly amplifies their bargaining power. These major players can leverage the sheer scale of their Datalogic purchases to negotiate more favorable terms, potentially impacting Datalogic's pricing and profit margins.

Customers often face significant switching costs when considering a change from Datalogic's data capture or automation solutions. These costs can include purchasing new hardware, the expense and complexity of integrating new software, retraining staff on different systems, and the potential for operational downtime during the transition. For instance, a large retail chain might spend hundreds of thousands of dollars on new scanners and barcode printers alone, not to mention the IT resources needed for seamless integration.

These substantial switching costs effectively reduce the bargaining power of Datalogic's customers. When it's costly and disruptive to switch, customers are less inclined to seek out alternative providers, even if competitors offer slightly lower prices or different features. This stickiness, driven by high switching costs, allows Datalogic to maintain stronger pricing power and customer loyalty.

Customer price sensitivity for Datalogic's products is a key factor influencing their bargaining power. This sensitivity isn't uniform; it shifts significantly depending on the industry and the specific application. For instance, while some customers in demanding industrial automation sectors might prioritize cutting-edge technology and unwavering reliability over minor price differences, others in high-volume, cost-competitive markets like retail or logistics are acutely focused on price. This latter group, often dealing with thinner margins, can exert considerable pressure on Datalogic for better pricing, thereby amplifying their bargaining power.

Availability of Alternative Suppliers

The bargaining power of Datalogic's customers is significantly influenced by the availability of alternative suppliers in the automatic data capture and factory automation markets. Competitors like Honeywell, Zebra Technologies, and Cognex offer comparable solutions, providing customers with a wide array of choices. This competitive landscape allows customers to negotiate for more favorable pricing and terms, as they can readily switch to another provider if Datalogic's offers are not met.

- Increased Competition: The presence of multiple established players like Honeywell and Zebra Technologies means customers aren't reliant on a single vendor.

- Price Sensitivity: With readily available alternatives, customers can leverage competitive pricing, potentially pressuring Datalogic's profit margins.

- Demand for Better Terms: Customers can demand better service level agreements or customization options due to the abundance of choices.

- Market Dynamics: In 2024, the industrial automation sector continued to see strong demand, but also intense competition, further empowering buyers.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing their own data capture or automation solutions, is typically low for Datalogic. This is because developing and manufacturing advanced products like Datalogic's requires significant investment in specialized research and development, along with considerable manufacturing expertise and economies of scale. For instance, the complexity of creating high-performance barcode scanners or RFID readers involves intricate optical engineering and sophisticated firmware development, areas where most customers lack the necessary capabilities.

Customers would need to replicate Datalogic's substantial R&D spending, which in 2023 was a key component of their operational strategy, to compete effectively.

- High R&D Investment: Datalogic invests heavily in innovation, requiring specialized engineering talent and significant capital for product development, making it difficult for customers to replicate.

- Manufacturing Complexity: Producing advanced data capture devices involves intricate manufacturing processes and quality control that most end-users cannot easily establish.

- Economies of Scale: Datalogic benefits from large-scale production, which lowers per-unit costs and makes it challenging for smaller, in-house operations to achieve similar price competitiveness.

- Focus on Core Competencies: Most Datalogic customers are focused on their primary business operations, not on developing and manufacturing technology hardware.

Datalogic's customers, particularly those in high-volume sectors like retail and logistics, exhibit significant price sensitivity. This means that when faced with numerous alternative suppliers, these customers can exert considerable pressure on Datalogic for more favorable pricing and terms. The availability of comparable solutions from competitors like Zebra Technologies and Honeywell in 2024 further amplifies this customer leverage.

While switching costs for Datalogic's solutions are generally high, involving hardware replacement and system integration, the sheer volume purchased by large clients can still enable them to negotiate effectively. This is particularly true for customers in cost-competitive markets where even small price advantages can impact their bottom line.

The bargaining power of Datalogic's customers is tempered by the difficulty of backward integration. Developing and manufacturing advanced data capture technology requires substantial R&D investment and specialized expertise, making it impractical for most customers to produce their own solutions.

| Customer Segment | Price Sensitivity | Switching Costs | Bargaining Power Influence |

|---|---|---|---|

| Large Retail Chains | High | Moderate to High | Significant (due to volume and price sensitivity) |

| Manufacturing Firms (High Volume) | Moderate | High | Moderate (balanced by switching costs) |

| Small Businesses | Moderate to High | Low to Moderate | Low to Moderate (limited by purchase volume) |

| Healthcare Providers | Moderate | High | Low to Moderate (focus on reliability and compliance) |

What You See Is What You Get

Datalogic Porter's Five Forces Analysis

This preview showcases the complete Datalogic Porter's Five Forces analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely the same professionally researched and formatted report you will receive immediately upon purchase, ensuring no discrepancies or missing information. You're looking at the actual, ready-to-use analysis, providing you with actionable insights for strategic decision-making without any delays.

Rivalry Among Competitors

The automatic identification and data capture (AIDC) market, Datalogic's core area, is booming. Estimates show a 13.3% compound annual growth rate (CAGR) from 2024 to 2025 and a more substantial 17.3% CAGR extending to 2029. This robust expansion offers opportunities for companies to grow their revenue streams without necessarily intensifying competition for a fixed pool of customers.

Furthermore, the broader industrial automation market, which Datalogic also serves, is projected for healthy growth. It's expected to see a CAGR of 9.1% between 2024 and 2029. Such favorable market dynamics can temper competitive rivalry, as the overall pie is getting bigger, allowing multiple players to capture increased market share through innovation and expanded offerings.

Datalogic operates in a highly competitive landscape, facing strong rivals such as Honeywell, Zebra Technologies, and Cognex. These global giants offer a broad spectrum of products, from barcode readers to mobile computers and advanced vision systems, directly challenging Datalogic's market share.

The diversity in product portfolios and distinct geographical strengths of competitors like Honeywell, which has a particularly strong presence in North America, and Zebra Technologies, with its significant footprint in enterprise mobile computing, further intensifies the rivalry. This broad competitive front requires Datalogic to constantly innovate and differentiate its offerings to maintain its position.

Competitive rivalry in Datalogic's market is significantly shaped by product differentiation. Datalogic aims to stand out by incorporating advanced features such as AI-driven barcode readers and sophisticated 3D machine vision systems, alongside integrated software. This strategy seeks to create a distinct offering compared to rivals.

However, the pace of technological innovation presents a challenge, as differentiation achieved today can quickly become standard tomorrow. For instance, while Datalogic reported a revenue of €642.2 million in 2023, indicating market presence, the need to constantly innovate to maintain a competitive edge through unique product features remains paramount.

Exit Barriers

Datalogic operates in an industry characterized by significant exit barriers, which can unfortunately prolong competitive rivalry. These barriers often stem from the substantial investments in specialized manufacturing equipment and intellectual property required for automatic data capture and factory automation solutions. For instance, companies might have dedicated production lines for barcode scanners or RFID readers that are not easily repurposed.

These high fixed costs and the need to fulfill long-term customer contracts, particularly in large-scale factory automation deployments, make it financially challenging for firms to cease operations even when facing losses. This situation forces even underperforming companies to remain active competitors, fighting for market share instead of strategically withdrawing. The industry saw significant consolidation in prior years, but remaining players often face pressure to maintain operations due to these entrenched costs.

The persistence of these exit barriers means that even less profitable firms can remain in the market, intensifying the competitive landscape. This can lead to price pressures and a constant struggle for differentiation as companies strive to secure and retain their customer base. For Datalogic, this translates into a need for continuous innovation and operational efficiency to navigate a market where exiting is not a simple option for competitors.

- Specialized Assets: High capital expenditure on dedicated manufacturing and R&D for data capture technology.

- Long-Term Contracts: Commitments to clients for factory automation solutions can span several years.

- High Fixed Costs: Significant ongoing expenses related to maintaining specialized facilities and skilled labor.

- Industry Dynamics: While consolidation has occurred, remaining players are often compelled to stay active due to these barriers.

Strategic Stakes

The automatic data capture and factory automation sectors are critically important to major industry players, including Datalogic. This strategic significance drives substantial investment and fierce competition as companies vie for market leadership. The stakes are exceptionally high, making aggressive strategies a necessity for survival and growth.

Datalogic's commitment to innovation is evident in its product development pipeline. The company reported that 19.7% of its 2024 sales originated from newly launched products, underscoring its ongoing investment in research and development to stay ahead in this competitive landscape.

- Strategic Importance: The automatic data capture and factory automation markets are vital for major players, leading to aggressive competition and significant investment.

- R&D Investment: Datalogic's focus on innovation is highlighted by 19.7% of its 2024 sales coming from new products, demonstrating a commitment to maintaining market position.

Competitive rivalry in Datalogic's markets is intense, driven by established global players like Honeywell and Zebra Technologies, who offer comprehensive product portfolios. Datalogic differentiates itself through advanced features like AI-driven readers and 3D machine vision, aiming to create unique offerings. However, rapid technological advancement means differentiation must be continuous, as innovations quickly become industry standards.

The industry faces significant exit barriers, including high capital investments in specialized equipment and intellectual property, alongside long-term customer contracts. These factors keep even less profitable companies in the market, prolonging rivalry and often leading to price pressures. Datalogic's 2023 revenue of €642.2 million reflects its presence, but the need for constant innovation to maintain its edge is paramount in this environment.

The strategic importance of automatic data capture and factory automation fuels aggressive competition and substantial investment from major industry players. Datalogic's commitment to R&D is demonstrated by 19.7% of its 2024 sales originating from new products, highlighting its proactive approach to staying ahead.

| Key Competitors | Product Focus | 2023 Revenue (Approximate) | Key Markets/Strengths |

| Honeywell | Barcode scanners, mobile computers, vision systems | $36.7 billion (Total Honeywell Revenue) | North America, broad industrial solutions |

| Zebra Technologies | Barcode scanners, mobile computers, RFID | $6.0 billion | Enterprise mobile computing, retail, healthcare |

| Cognex | Machine vision systems, barcode readers | $1.1 billion | Factory automation, quality control |

SSubstitutes Threaten

The threat of substitutes for Datalogic's core data capture products, like barcode scanners and mobile computers, is a real consideration. Alternative methods such as manual data entry, while slower, can be a substitute in low-volume scenarios. Emerging technologies like NFC and voice recognition also present potential alternatives, particularly as they become more sophisticated and cost-effective.

For Datalogic's factory automation products, such as sensors and vision systems, less sophisticated, manual processes or generic automation solutions can serve as substitutes, particularly for smaller businesses. These alternatives might be more cost-effective initially, but often lack the precision and efficiency gains that advanced automation offers. The manufacturing sector's ongoing drive for enhanced productivity and quality control generally limits the appeal of these less capable substitutes.

The increasing sophistication of software-based solutions, particularly those utilizing AI and machine learning for image recognition through common devices like smartphones, presents a significant threat. These advancements can perform tasks previously requiring dedicated hardware, potentially diminishing demand for Datalogic's specialized imaging and barcode scanning hardware in certain market segments.

For instance, in retail inventory management, advanced smartphone apps powered by AI can now offer capabilities that rival dedicated scanners, especially for less demanding applications. This trend is likely to accelerate as AI technology becomes more accessible and powerful, offering a lower-cost alternative for businesses.

Outsourcing Services

The threat of substitutes for Datalogic's offerings is significant, particularly from third-party outsourcing providers. Businesses can bypass the need to invest in Datalogic's hardware by engaging specialized service companies that handle data capture, logistics, and supply chain management. These providers leverage their own sophisticated technologies, often making direct equipment purchase by the end-user redundant.

For example, the global market for business process outsourcing (BPO) is projected to reach over $460 billion by 2027, indicating a strong trend towards delegating core functions. This growth directly represents an alternative to businesses acquiring and managing their own data collection and processing infrastructure, which is Datalogic's core business.

- Outsourcing Growth: The BPO market's expansion signifies a growing preference for service-based solutions over direct technology investment.

- Reduced Capital Expenditure: Companies can avoid large upfront costs associated with purchasing scanners, mobile computers, and software by opting for outsourced services.

- Access to Latest Technology: Outsourcing partners typically invest in cutting-edge equipment and software, ensuring clients benefit from the latest advancements without direct capital outlay.

- Focus on Core Competencies: By outsourcing, businesses can concentrate on their primary operations rather than managing complex data collection and logistics processes.

Technological Advancements in Other Fields

Rapid technological progress in adjacent sectors poses a significant threat of substitution for Datalogic. For instance, the evolution of advanced robotics equipped with sophisticated integrated sensing capabilities could offer automated data capture and analysis solutions that bypass the need for traditional Datalogic products. Similarly, the development of next-generation real-time tracking technologies, such as enhanced RFID systems that surpass current Automatic Identification and Data Capture (AIDC) capabilities, could provide functionally equivalent or superior alternatives.

These emerging technologies can directly substitute Datalogic's core offerings by providing alternative methods for data acquisition, processing, and management within supply chains and industrial environments. The market for industrial automation and tracking solutions is dynamic, with significant investment flowing into areas like AI-powered vision systems and advanced sensor networks. For example, in 2024, the global industrial robotics market was valued at approximately $60 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, indicating substantial innovation and adoption of technologies that could compete with or complement Datalogic's existing product lines.

- Technological Leapfrogging: Innovations in areas like quantum sensing or bio-integrated sensors could offer entirely new paradigms for data collection, rendering current AIDC methods obsolete.

- Cost-Effectiveness of Alternatives: As these substitute technologies mature, their cost-effectiveness may improve, making them more attractive than Datalogic's solutions, especially for smaller enterprises.

- Integration Capabilities: New technologies often offer seamless integration with broader digital ecosystems, potentially posing a challenge if Datalogic's offerings are perceived as less interoperable.

The threat of substitutes for Datalogic's products is multifaceted, ranging from simpler manual processes to advanced technological alternatives. For instance, the growing adoption of AI-powered smartphone applications for inventory management presents a direct substitute for dedicated barcode scanners, especially in less demanding retail environments. This trend is amplified as AI becomes more accessible and powerful, offering a cost-effective alternative for businesses seeking basic data capture functionalities.

Furthermore, the burgeoning business process outsourcing (BPO) market, projected to exceed $460 billion by 2027, represents a significant substitute. Companies can opt to delegate data capture and logistics to specialized service providers, thereby bypassing the need to invest in Datalogic's hardware. This outsourcing trend allows businesses to reduce capital expenditure and leverage the latest technologies without direct investment, focusing instead on their core competencies.

Emerging technologies in automation and tracking also pose a substitution threat. Advanced robotics with integrated sensing capabilities, and next-generation RFID systems, offer functionally equivalent or superior alternatives for data acquisition and management. The industrial robotics market, valued at approximately $60 billion in 2024 and growing at over 15% annually, highlights the rapid innovation in this space, potentially displacing traditional AIDC solutions.

| Substitute Category | Examples | Impact on Datalogic | Market Trend/Data |

|---|---|---|---|

| Software & AI Solutions | AI-powered smartphone apps, Machine Learning for image recognition | Direct competition for basic scanning tasks, potentially reducing hardware demand. | Increasingly sophisticated and accessible AI technologies. |

| Business Process Outsourcing (BPO) | Third-party data capture and logistics providers | Businesses bypass direct hardware investment by outsourcing. | Global BPO market projected to exceed $460 billion by 2027. |

| Advanced Automation & Tracking | Robotics with integrated sensors, Next-gen RFID systems | Offer alternative data acquisition and management methods. | Industrial robotics market valued at ~$60 billion in 2024, with >15% CAGR. |

Entrants Threaten

The automatic data capture and factory automation sectors demand significant upfront capital. Companies need to invest heavily in research and development, cutting-edge manufacturing plants, and establishing worldwide sales and support infrastructures. For instance, a new player entering the industrial scanner market might need to spend tens of millions of dollars just to develop and produce a competitive product line, let alone build a global presence.

Datalogic and its rivals possess a substantial portfolio of intellectual property, including patents covering barcode scanning, advanced vision systems, and sophisticated sensor technologies. This deep well of proprietary knowledge acts as a significant barrier to entry, requiring newcomers to undertake considerable research and development or secure costly licensing agreements to compete effectively.

Datalogic benefits from significant brand loyalty, a key barrier for new entrants. Years of delivering reliable barcode scanners and data capture solutions have fostered strong customer relationships and trust. For instance, in the retail sector, where Datalogic holds a substantial market share, businesses often prioritize established vendors for mission-critical checkout and inventory management systems. This deep-seated loyalty means newcomers face a considerable challenge in convincing customers to switch, requiring substantial investment in marketing and product differentiation to even begin eroding existing preferences.

Access to Distribution Channels

Securing access to established distribution channels presents a significant hurdle for new entrants in the market Datalogic operates within. These channels, encompassing direct sales teams, system integrators, and value-added resellers, are often already deeply integrated with incumbent players, making it difficult for newcomers to penetrate.

For example, in the industrial automation sector, where Datalogic is a key player, building a comparable reseller network can take years and substantial investment. Many of these established partners have long-standing relationships and contractual obligations with existing vendors, limiting opportunities for new companies to gain shelf space or mindshare.

- Established relationships: Incumbent firms benefit from deep-rooted partnerships with distributors and resellers, often secured through exclusive agreements or volume commitments.

- High switching costs: Distributors may face significant costs and operational disruptions if they switch from established suppliers to new entrants, deterring them from taking on new lines.

- Brand loyalty and trust: End-customers often rely on the trusted brands and established support networks provided by existing players, making it harder for new entrants to gain initial traction.

Regulatory Requirements and Standards

The industrial automation and healthcare sectors, key markets for Datalogic, are characterized by rigorous regulatory requirements and industry standards. For instance, in industrial automation, compliance with standards like ISO 13485 for medical devices or specific safety certifications for machinery is often mandatory. New entrants must invest heavily in understanding and meeting these complex regulations, which can be a substantial hurdle.

These stringent requirements act as a significant barrier to entry. Companies looking to compete with established players like Datalogic need to demonstrate a deep understanding of and adherence to these often evolving standards. This includes obtaining necessary certifications and ensuring products meet specific performance and safety benchmarks, a process that demands considerable time, resources, and specialized knowledge.

For example, the medical device industry, where Datalogic's solutions are applied, requires adherence to FDA regulations in the US and CE marking in Europe. These processes can take years and cost millions to navigate successfully. In 2024, the global medical device market was valued at approximately $600 billion, underscoring the scale of investment required to enter and compete within such a regulated environment.

- Regulatory Hurdles: Navigating complex compliance frameworks like FDA, CE marking, and ISO standards is costly and time-consuming for new entrants.

- Certification Costs: Obtaining necessary product certifications for safety and performance in automation and healthcare requires significant financial outlay and technical expertise.

- Market Access Barriers: Non-compliance can prevent new companies from accessing lucrative markets, giving established players like Datalogic a competitive advantage.

- Expertise Requirement: New entrants need specialized knowledge in regulatory affairs and quality management systems, which is a scarce and expensive resource.

The threat of new entrants for Datalogic is moderate due to substantial capital requirements for R&D, manufacturing, and global distribution, alongside significant intellectual property and established brand loyalty. For instance, developing a competitive industrial scanner line can cost tens of millions. Furthermore, navigating stringent regulatory environments in sectors like healthcare, with FDA and CE marking requirements, adds considerable time and expense, as seen in the $600 billion global medical device market in 2024.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment needed for R&D, manufacturing, and distribution networks. | Significant hurdle, requiring substantial funding to even enter the market. |

| Intellectual Property | Extensive patents in barcode scanning, vision systems, and sensor technology. | Newcomers must invest heavily in R&D or secure costly licenses. |

| Brand Loyalty | Strong customer trust and established relationships, particularly in retail. | Challenging for new entrants to convince customers to switch from reliable vendors. |

| Regulatory Compliance | Strict standards in sectors like healthcare and industrial automation (e.g., FDA, CE). | Demands significant investment in understanding and meeting complex, evolving regulations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from Datalogic's official investor relations website, annual reports, and SEC filings. We supplement this with industry-specific market research reports and competitor analysis to provide a comprehensive view of the competitive landscape.