DATAGROUP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DATAGROUP Bundle

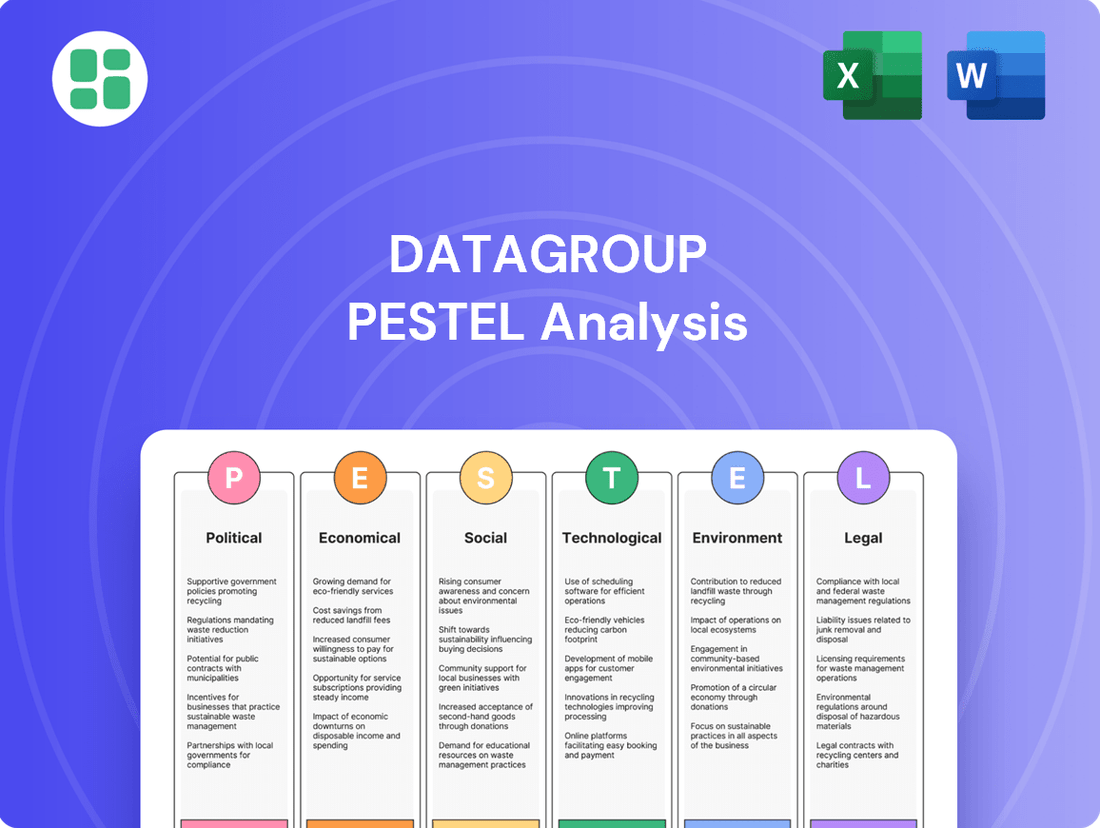

Navigate the dynamic landscape of DATAGROUP with our comprehensive PESTLE analysis. Uncover critical insights into the political, economic, social, technological, legal, and environmental factors shaping its trajectory. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Gain a strategic advantage by understanding the external forces impacting DATAGROUP's operations and future growth. Our expertly crafted PESTLE analysis provides the deep-dive intelligence you need to make informed decisions and refine your market approach. Download the full version now for actionable insights.

Political factors

The German government and the European Union are making substantial investments in digitalization, particularly within public administration and essential infrastructure. This focus directly translates into significant opportunities for IT service providers such as DATAGROUP, as public sector projects frequently entail extensive, multi-year IT outsourcing agreements.

Policies actively encouraging digital transformation are a direct driver of demand for integrated IT solutions and services. For instance, Germany's Digital Strategy 2025 aimed to accelerate digital public services, and ongoing EU initiatives like the Digital Decade target specific digital advancements, creating a robust market for DATAGROUP's expertise.

The European Union's increasing focus on data sovereignty is a significant political factor, directly influencing how companies handle their digital information. This trend is particularly strong in Germany, where there's a growing demand for cloud solutions and data processing services that are located within the EU.

DATAGROUP's private cloud platform, CORBOX, is well-positioned to capitalize on this. Clients are increasingly opting for providers that guarantee their data remains within EU borders, complying with stringent national and European data protection laws like the GDPR. This preference directly supports local providers like DATAGROUP by reducing the appeal of non-EU hyperscalers.

In 2024, the digital sovereignty market within the EU is projected to see substantial growth, with estimates suggesting a market size in the tens of billions of euros. This demand is fueled by a combination of regulatory pressure and a desire for greater control over sensitive information, which DATAGROUP's localized approach effectively addresses.

Germany's political stability, a cornerstone for business, means DATAGROUP benefits from a predictable regulatory landscape. This consistency in policy, particularly concerning digital infrastructure and data protection, fosters confidence for long-term investments. For instance, the German government's continued commitment to digital transformation initiatives, as evidenced by ongoing funding for broadband expansion and cybersecurity measures in 2024, directly supports DATAGROUP's service offerings.

Public Sector Outsourcing Policies

Government policies on outsourcing IT services significantly shape DATAGROUP's market. In 2024, many European governments continued to explore outsourcing to improve efficiency and reduce costs in public services. For instance, Germany's federal government has been actively reviewing its IT infrastructure, with a focus on modernizing digital services, which could present opportunities for experienced IT providers like DATAGROUP.

Favorable outsourcing policies directly expand DATAGROUP's potential client base within the public sector. A trend towards digital transformation in public administration across Europe, driven by a need for better citizen services and cybersecurity, often leads to increased reliance on external IT expertise. This is supported by reports indicating that public sector IT spending in the EU is projected to grow, with outsourcing forming a significant part of that growth.

Conversely, any shift towards insourcing IT functions or implementing protectionist measures that favor domestic providers over international ones could restrict DATAGROUP’s growth avenues. For example, if a particular country were to mandate that all public IT projects must be handled by in-house teams, it would directly reduce the addressable market for DATAGROUP in that specific region.

- Increased Public Sector IT Spending: European public sector IT spending was estimated to reach over €150 billion in 2024, with outsourcing expected to capture a substantial share as governments seek digital modernization.

- Digitalization Initiatives: Many national governments, including Germany and France, have launched ambitious digitalization agendas in 2024, prioritizing cloud adoption and cybersecurity, which often necessitate external IT partnerships.

- Potential for Protectionism: While outsourcing is generally favored, some national governments may introduce policies favoring local IT firms, potentially impacting market access for companies like DATAGROUP in specific tenders.

Geopolitical Tensions and Supply Chain Resilience

Heightened geopolitical tensions in 2024 and early 2025 continue to pose risks to global IT supply chains, potentially inflating costs and causing delivery disruptions for hardware and software. For instance, ongoing trade disputes and regional conflicts have already led to increased shipping costs, with some analysts projecting a 5-10% rise in logistics expenses for tech components throughout 2024.

Governments worldwide are actively implementing policies to bolster national supply chain resilience. These initiatives often favor domestic production and strategic partnerships, which could influence sourcing decisions for companies like DATAGROUP. A notable trend is the increased investment in semiconductor manufacturing within North America and Europe, aiming to reduce reliance on single-source regions.

- Increased Logistics Costs: Global shipping rates for electronics saw an average increase of 8% in late 2023, a trend expected to continue into 2024 due to geopolitical instability.

- Government Incentives for Domestic Production: The US CHIPS and Science Act, with its $52 billion in subsidies, and similar EU initiatives are actively encouraging local manufacturing of critical tech components.

- Supply Chain Diversification Efforts: Companies are increasingly exploring multi-region sourcing strategies, with reports indicating a 15% shift towards diversifying supplier bases away from single dominant countries in the past year.

- Impact on Service Continuity: Potential disruptions necessitate proactive monitoring of geopolitical events and supplier stability to ensure uninterrupted service delivery for DATAGROUP clients.

Government investment in digitalization continues to be a significant driver for DATAGROUP, with public sector IT spending in Europe projected to exceed €150 billion in 2024. This trend is bolstered by national digitalization agendas, such as those in Germany and France, which prioritize cloud adoption and cybersecurity, creating substantial opportunities for IT outsourcing providers.

The emphasis on data sovereignty within the EU, particularly in Germany, fuels demand for localized cloud solutions like DATAGROUP's CORBOX, as clients seek to comply with stringent data protection laws. This political push for EU-based data processing is expected to see the digital sovereignty market grow into tens of billions of euros in 2024.

Political stability in Germany provides a predictable regulatory environment, fostering confidence for long-term IT investments, with government initiatives supporting broadband expansion and cybersecurity in 2024 directly benefiting DATAGROUP's service offerings.

While outsourcing is generally favored, potential protectionist policies favoring local IT firms could impact market access in specific tenders, although the overall trend in 2024 points towards increased public sector IT outsourcing to drive digital modernization and efficiency.

What is included in the product

This DATAGROUP PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization, providing a comprehensive understanding of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring everyone is aligned on external factors impacting strategic decisions.

Economic factors

Germany's economic growth is a key driver for DATAGROUP. In 2023, the German economy experienced a slight contraction of 0.3%, according to preliminary data from Destatis. However, forecasts for 2024 suggest a modest recovery, with the Bundesbank projecting a 0.9% GDP increase.

The broader European Union economy also plays a crucial role. The EU economy grew by an estimated 0.5% in 2023, with projections for 2024 indicating a similar or slightly improved growth rate, potentially around 1.0% to 1.5% according to various EU economic outlook reports.

These growth trends directly impact IT spending. A recovering or growing economy typically translates to increased investment in digital transformation and IT infrastructure by German and EU businesses, benefiting companies like DATAGROUP that offer IT services.

Rising inflation and interest rates present a dual challenge for DATAGROUP. Increased operational costs, particularly for personnel and financing new ventures, are expected. For instance, the US Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, remained at a target range of 5.25%-5.50% as of early 2024, a level not seen in decades. This could impact DATAGROUP's ability to fund strategic acquisitions or investments cost-effectively.

Furthermore, higher borrowing costs can directly affect DATAGROUP's client base. Many IT projects, especially large-scale ones, are financed through loans. As interest rates climb, the cost of capital for these projects increases, potentially leading clients to delay or scale back their IT spending. This could translate into a slower acquisition rate for new contracts, impacting DATAGROUP's revenue growth trajectory.

Despite these headwinds, DATAGROUP's financial outlook remains cautiously optimistic. The company's guidance for 2024 and 2025 anticipates continued growth, signaling confidence in its ability to navigate the challenging economic environment. This suggests that DATAGROUP may have strategies in place to mitigate the impact of inflation and interest rate hikes, perhaps through enhanced operational efficiency or a strong pipeline of existing contracts.

The ongoing shortage of skilled IT professionals in Germany presents a substantial hurdle for IT service providers like DATAGROUP. This scarcity directly contributes to rising personnel costs, potentially hindering the company's capacity to expand operations and successfully execute intricate projects.

In 2023, Germany faced a significant deficit of IT specialists, with estimates suggesting over 137,000 open positions in the sector, according to the German Economic Institute (IW). This trend is expected to continue, putting upward pressure on wages and benefits as companies compete for a limited pool of talent.

To counteract these challenges, DATAGROUP needs to prioritize robust investments in talent acquisition strategies, effective employee retention initiatives, and comprehensive training and development programs. Such measures are crucial for mitigating the risks associated with the IT talent gap and ensuring continued operational strength.

Client Investment in Digital Transformation

Businesses are channeling significant resources into digital transformation, aiming to boost operational efficiency and gain a competitive edge. This surge in investment directly fuels the demand for services that DATAGROUP specializes in, such as cloud infrastructure and managed IT services. For instance, the global IT spending on digital transformation was projected to reach $2.3 trillion in 2023 and is expected to grow further in 2024 and 2025, highlighting a robust economic tailwind.

This economic trend translates into a strong market opportunity for DATAGROUP. Companies are actively seeking dependable and advanced IT solutions to manage increasingly complex business environments and stay ahead of the curve. This strategic shift by clients is a key factor influencing DATAGROUP's business performance.

DATAGROUP has directly benefited from this client behavior, observing a substantial increase in order intake within its CORBOX segment. This core business, focused on cloud solutions and IT outsourcing, is a direct beneficiary of the widespread digital transformation initiatives across various industries.

- Increased IT Spending: Global digital transformation spending is a significant economic driver, with projections indicating continued growth through 2025.

- Demand for Core Services: Client investments in digitalization directly boost demand for cloud solutions and IT outsourcing, DATAGROUP's key offerings.

- CORBOX Performance: DATAGROUP's CORBOX business has experienced strong order intake, reflecting the positive impact of these economic trends.

- Competitive Advantage: Businesses investing in digital transformation are seeking to enhance their market competitiveness, creating a need for specialized IT partners like DATAGROUP.

Competitive Landscape and Pricing Pressure

The German IT services market is a dynamic arena, characterized by intense competition from both large international corporations and specialized domestic firms. This rivalry often translates into significant pricing pressure for service providers, compelling them to constantly innovate and clearly differentiate their offerings to stand out. For DATAGROUP, this environment underscores the strategic importance of its CORBOX platform, a key enabler for service delivery and innovation, alongside a disciplined approach to targeted acquisitions that bolster its market position and capabilities.

DATAGROUP's strategy aims to navigate this competitive terrain effectively. By focusing on its proprietary CORBOX platform, the company enhances its ability to deliver integrated and efficient IT solutions, a crucial factor in a market where service quality and technological advancement are paramount. Furthermore, strategic acquisitions in 2024 and early 2025 are designed to expand DATAGROUP's service portfolio and geographic reach, directly addressing the need for continuous adaptation and competitive differentiation.

- Market Share Dynamics: Global IT service providers often leverage economies of scale, while local specialists compete on agility and deep understanding of regional client needs.

- Pricing Strategies: Intense competition forces companies to offer competitive pricing, sometimes impacting profit margins, necessitating a focus on cost-efficiency and value-added services.

- Innovation Imperative: Continuous investment in R&D and the development of proprietary platforms like CORBOX are vital for maintaining a competitive edge and offering unique solutions.

- Acquisition as a Growth Lever: Targeted acquisitions allow companies like DATAGROUP to quickly gain new technologies, customer bases, and market access, thereby strengthening their competitive standing.

Germany's economy contracted by 0.3% in 2023, with modest recovery projected at 0.9% for 2024, while the EU saw 0.5% growth in 2023, expecting similar or better in 2024. These trends directly influence IT spending, as economic recovery typically spurs business investment in digital transformation, benefiting IT service providers like DATAGROUP.

Rising inflation and interest rates, with the US Federal Reserve's rate at 5.25%-5.50% in early 2024, increase operational costs and financing expenses for DATAGROUP. Higher borrowing costs also affect clients, potentially delaying IT projects and impacting DATAGROUP's revenue growth.

The IT talent shortage in Germany, with over 137,000 open positions in 2023, drives up personnel costs and limits expansion for companies like DATAGROUP. Strategic investments in talent acquisition and retention are crucial to mitigate these challenges.

Global digital transformation spending, projected to exceed $2.3 trillion in 2023 and grow further through 2025, fuels demand for DATAGROUP's cloud and IT outsourcing services, boosting its CORBOX segment's order intake.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projection) | Impact on DATAGROUP |

|---|---|---|---|

| German GDP Growth | -0.3% | 0.9% | Supports increased IT investment |

| EU GDP Growth | 0.5% | ~1.0%-1.5% | Broadens market opportunities |

| US Federal Reserve Interest Rate | 5.25%-5.50% | (Uncertain, but elevated) | Increases financing costs, client project costs |

| German IT Specialist Shortage | >137,000 unfilled positions | (Expected to persist) | Drives up personnel costs |

| Global Digital Transformation Spending | ~$2.3 trillion | (Continued growth) | Boosts demand for core services |

Full Version Awaits

DATAGROUP PESTLE Analysis

The preview you see here is the exact DATAGROUP PESTLE Analysis document you’ll receive after purchase. It's fully formatted and professionally structured, offering immediate usability for your strategic planning needs.

Sociological factors

Germany's digital literacy is on the rise, with a significant portion of the workforce now comfortable with digital tools. This growing comfort level means businesses are more receptive to adopting sophisticated IT solutions like those offered by DATAGROUP. For instance, a 2024 Bitkom survey indicated that over 80% of German companies are actively investing in digitalization, creating a fertile ground for IT service providers.

This increased digital fluency directly translates to a quicker acceptance of cloud services, IT outsourcing, and complex business applications. Clients are less likely to require extensive training, which naturally shortens sales cycles for DATAGROUP. The ease with which businesses can now understand and implement these technologies accelerates their adoption, boosting DATAGROUP's market penetration.

The ongoing shift towards remote and hybrid work, accelerated by events in recent years, has fundamentally reshaped workplace expectations and IT needs. This societal trend has created a sustained demand for resilient and adaptable IT solutions that can support a geographically dispersed workforce.

DATAGROUP's expertise in workplace services and cloud solutions directly addresses this demand. By offering comprehensive IT support, the company is positioned to help businesses manage and enhance their distributed operations. For instance, a significant portion of companies, estimated to be over 60% in many developed economies by late 2024, are now offering some form of hybrid work, underscoring the market's reliance on such IT capabilities.

This societal evolution continues to be a significant driver for IT spending. Businesses are investing in technologies that facilitate seamless collaboration, ensure data security across various locations, and provide scalable infrastructure to accommodate fluctuating work arrangements. This sustained investment cycle benefits IT service providers like DATAGROUP.

Germany's workforce is aging, with the average age of employees in the IT sector steadily increasing. By 2024, the proportion of workers over 50 in the German labor market is projected to reach new highs, exacerbating the existing IT talent shortage. This demographic shift means DATAGROUP must implement forward-thinking recruitment and retention strategies, focusing on appealing to younger generations and upskilling existing employees to fill critical roles.

The declining birth rates in Germany mean fewer young individuals are entering the job market, directly impacting the pipeline of new IT talent. DATAGROUP needs to actively counter this by fostering an environment that attracts and retains skilled professionals, offering competitive compensation, robust professional development programs, and flexible work options that align with modern work-life expectations.

To combat the IT talent scarcity, DATAGROUP should prioritize innovative approaches such as offering attractive apprenticeship programs and partnerships with universities to secure future talent. By 2025, the demand for IT specialists is expected to outstrip supply significantly, making proactive talent acquisition and development crucial for the company's sustained growth and competitive edge.

Societal Expectations for Data Privacy and Security

Societal expectations around data privacy and security are incredibly high, with public awareness of breaches and misuse reaching unprecedented levels. This heightened concern directly impacts businesses, creating a strong demand for IT service providers like DATAGROUP that can demonstrate a commitment to robust data protection and strict privacy compliance. For instance, a 2024 survey indicated that over 70% of consumers are more likely to choose brands that are transparent about their data usage and security practices.

DATAGROUP's strategic emphasis on security services and adherence to evolving privacy regulations, such as GDPR and CCPA, positions it to effectively meet these critical societal demands. This focus is not just about compliance; it's about building trust. In 2025, we anticipate a further increase in consumer willingness to pay a premium for services that guarantee superior data security, with some reports suggesting up to a 15% uplift in perceived value.

Meeting these expectations is paramount for IT service providers. Key aspects include:

- Demonstrating proactive security measures: Companies are looking for evidence of advanced threat detection and prevention.

- Ensuring transparent data handling policies: Clear communication about how data is collected, stored, and used builds consumer confidence.

- Maintaining compliance with evolving privacy laws: Staying ahead of regulatory changes is crucial for avoiding penalties and reputational damage.

- Investing in continuous security training for staff: Human error remains a significant vulnerability, making employee education vital.

Demand for Sustainable and Ethical IT Practices

Societal expectations are increasingly pushing businesses, including IT service providers like DATAGROUP, towards greener and more ethical operations. Consumers and corporate clients alike are scrutinizing the environmental footprint and social responsibility of their partners. This shift is not just about good PR; it's becoming a material factor in purchasing decisions.

For instance, a 2024 survey by Accenture found that 72% of consumers are more likely to buy from a company that prioritizes sustainability. This translates directly to the IT sector, where demand for services aligned with Environmental, Social, and Governance (ESG) principles is on the rise. Companies are actively seeking IT providers who can demonstrate tangible commitments to these areas.

DATAGROUP's commitment to sustainability, such as through its green IT initiatives and responsible e-waste management programs, directly addresses this growing demand. Such practices are becoming crucial for maintaining a competitive edge and a positive corporate image in the current market landscape. This focus can lead to:

- Increased client acquisition: Companies actively seeking sustainable IT partners will favor providers with proven track records.

- Enhanced brand reputation: Demonstrating ethical and environmental responsibility builds trust and loyalty.

- Reduced operational risks: Proactive e-waste management minimizes regulatory penalties and environmental liabilities.

- Attraction of talent: Employees, particularly younger generations, are drawn to organizations with strong ESG commitments.

Societal expectations around data privacy and security are exceptionally high, with growing public awareness of breaches. This heightened concern fuels demand for IT service providers like DATAGROUP that prioritize robust data protection and strict privacy compliance. By 2025, consumer willingness to pay a premium for superior data security is expected to increase, potentially by up to 15%.

The increasing demand for IT services that align with Environmental, Social, and Governance (ESG) principles is a significant societal trend. Consumers and clients are actively seeking IT partners with proven commitments to sustainability and ethical operations, with 72% of consumers favoring companies that prioritize sustainability as of 2024.

German society's increasing digital literacy and comfort with technology directly benefit IT service providers like DATAGROUP. This trend accelerates the adoption of advanced IT solutions, as businesses are more receptive to digital transformation initiatives. For example, over 80% of German companies were investing in digitalization in 2024.

Technological factors

The relentless advancement of cloud computing, encompassing hybrid and multi-cloud architectures, is a significant technological force. DATAGROUP's CORBOX, a private cloud offering, is well-positioned to capitalize on the growing corporate embrace of adaptable and scalable cloud environments.

The market clearly indicates a strong preference for hybrid cloud solutions, driven by the need for enhanced resilience and operational flexibility. For instance, Gartner projected that worldwide end-user spending on public cloud services would reach $679 billion in 2024, a 20.4% increase from 2023, highlighting the broader cloud adoption trend that benefits hybrid models.

DATAGROUP's strategic focus on integrating Artificial Intelligence (AI) and automation into its IT operations is a key technological driver. This integration promises substantial improvements in efficiency and opens doors for innovative service development. For instance, by 2025, AI is widely recognized as a pivotal digital trend, impacting how businesses operate and deliver services.

The company's investments in AI, alongside cybersecurity and cloud technologies, are designed to bolster its CORBOX services. This directly supports clients navigating their digital transformation journeys, ensuring they can leverage advanced technological capabilities. DATAGROUP's commitment to these areas positions it to capitalize on the increasing demand for intelligent, automated IT solutions.

Cyberattacks are becoming more complex and happening more often, pushing companies to constantly upgrade their cybersecurity defenses. This trend directly benefits DATAGROUP, as businesses increasingly rely on its managed security services to safeguard their critical IT systems and sensitive data.

Cybersecurity is a paramount concern for businesses across all sectors, directly influencing IT budget allocations. For instance, global spending on cybersecurity solutions and services was projected to reach $215 billion in 2024, a significant increase from previous years, highlighting the market opportunity for DATAGROUP.

Emergence of 5G and IoT Technologies

The widespread adoption of 5G networks, projected to reach over 1.5 billion subscriptions globally by the end of 2024, alongside the exponential growth of the Internet of Things (IoT) ecosystem, which is expected to surpass 29 billion connected devices by 2025, are fundamentally reshaping data generation and network demands. These advancements necessitate sophisticated, high-speed, and low-latency infrastructure capable of managing vast data streams.

This technological evolution presents significant growth avenues for DATAGROUP. The company is well-positioned to capitalize on the increasing need for advanced network services, including the deployment and management of 5G infrastructure. Furthermore, the surge in IoT devices creates demand for edge computing solutions, enabling data processing closer to the source, and robust data management platforms to handle the influx of information.

DATAGROUP’s strategic focus on these areas aligns with market trends, as businesses increasingly rely on real-time data analytics and seamless connectivity to drive operational efficiency and innovation. The company's ability to provide integrated solutions for network infrastructure, cloud services, and data analytics will be crucial in this evolving technological landscape.

- Global 5G subscriptions are anticipated to exceed 1.5 billion by year-end 2024.

- The IoT market is projected to connect over 29 billion devices by 2025.

- Edge computing market is expected to grow significantly, driven by 5G and IoT adoption.

- Demand for low-latency network solutions is a key driver for infrastructure investment.

Focus on IT Service Automation and Efficiency

The drive for IT service automation and enhanced operational efficiency is a significant technological trend. Businesses are actively seeking solutions to streamline IT processes, reduce manual intervention, and boost productivity. This is a core area where DATAGROUP's offerings are highly relevant.

DATAGROUP's specialization in IT outsourcing and managed services, particularly its CORBOX platform, directly addresses this market need. CORBOX is designed to deliver standardized, automated, and highly efficient IT solutions, enabling clients to achieve substantial cost reductions and optimize their resource allocation. For instance, in 2024, the global IT automation market was projected to reach over $30 billion, highlighting the strong demand for such services.

- IT Process Automation: Companies are increasingly adopting automation tools to manage IT infrastructure, cloud services, and cybersecurity.

- Efficiency Gains: Automation can lead to significant improvements in IT operational efficiency, with studies showing potential cost savings of up to 40% in certain IT functions through automation.

- DATAGROUP's CORBOX: This platform offers a robust suite of automated IT services, from cloud management to security operations, catering to the growing demand for streamlined IT operations.

- Market Growth: The market for managed IT services, which heavily relies on automation, is expected to continue its robust growth trajectory, with an estimated compound annual growth rate of over 10% in the coming years.

The technological landscape is rapidly evolving, with cloud computing, AI, and cybersecurity at the forefront. DATAGROUP's CORBOX platform, a private cloud solution, is strategically aligned with the increasing corporate adoption of hybrid and multi-cloud environments. Gartner projected public cloud spending to hit $679 billion in 2024, showcasing the broader trend benefiting hybrid models.

AI integration and automation are key technological drivers, promising enhanced efficiency and new service opportunities. By 2025, AI is recognized as a pivotal trend impacting business operations. DATAGROUP's investments in AI, cybersecurity, and cloud bolster its CORBOX services, supporting clients' digital transformations.

The increasing complexity and frequency of cyberattacks necessitate robust security defenses, benefiting DATAGROUP's managed security services. Global cybersecurity spending was forecast to reach $215 billion in 2024, underscoring the market opportunity.

The expansion of 5G networks, with over 1.5 billion subscriptions expected by end of 2024, and the growth of IoT, projected to connect over 29 billion devices by 2025, are reshaping data demands. These trends drive the need for advanced, low-latency network infrastructure and edge computing solutions, areas where DATAGROUP is positioned to excel.

The IT service automation market, projected to exceed $30 billion in 2024, highlights the demand for streamlined IT processes. DATAGROUP's CORBOX platform offers automated IT solutions, contributing to efficiency gains and cost reductions for clients, with potential savings up to 40% in certain IT functions through automation.

Legal factors

The General Data Protection Regulation (GDPR) and similar national laws, like Germany's Federal Data Protection Act (BDSG), place stringent rules on handling personal data. For DATAGROUP, this means meticulously managing data collection, processing, and storage, ensuring all its IT services are built with privacy and data protection at their core. Failure to comply can result in substantial fines; for example, in 2023, German authorities issued significant penalties for data breaches.

The EU's NIS2 Directive, now being integrated into German law as NIS2UmsuCG, is set to significantly bolster cybersecurity across a wider array of critical sectors. This expansion means many more businesses, including those in supply chains of essential services, will face stringent new cybersecurity measures and mandatory incident reporting. For instance, the directive broadens the scope to include sectors like digital infrastructure, energy, transport, and even certain manufacturing industries, impacting potentially hundreds of thousands of companies across the EU.

This regulatory shift creates a substantial and immediate market opportunity for cybersecurity service providers like DATAGROUP. The increased demand for robust security solutions and expert guidance on compliance will drive significant revenue growth. Analysts project the cybersecurity market in Germany alone to reach over €10 billion by 2025, with directives like NIS2 acting as a key catalyst for this expansion.

The Digital Operational Resilience Act (DORA), which becomes effective in January 2025, imposes significant obligations on the financial sector and its critical third-party ICT providers, such as cloud service providers. This regulation aims to strengthen the digital operational resilience of financial entities by setting harmonized requirements for information and communication technology (ICT) risk management, governance, and testing.

For DATAGROUP, particularly if it provides services to clients within the European Union's financial sector, compliance with DORA is paramount. This involves implementing robust frameworks for digital operational resilience, comprehensive ICT risk management strategies, and detailed incident reporting mechanisms to ensure uninterrupted service delivery and data protection, aligning with the EU's goal to enhance the financial system's stability against cyber threats and operational disruptions.

Contractual Laws and Service Level Agreements (SLAs)

DATAGROUP's IT outsourcing operations are heavily reliant on strong contractual laws and meticulously crafted Service Level Agreements (SLAs). These legal frameworks are the bedrock of client partnerships, ensuring clarity on deliverables, performance standards, and accountability. For instance, in 2024, the IT services market saw significant growth, with companies increasingly scrutinizing contract terms to ensure value and risk mitigation.

Robust SLAs are not just about defining service quality; they are critical for managing client expectations and minimizing disputes. These agreements often stipulate key performance indicators (KPIs) such as uptime percentages, response times, and resolution times. Failure to meet these KPIs can lead to penalties, making compliance a paramount concern for DATAGROUP.

The legal landscape surrounding data protection and privacy, particularly in light of regulations like GDPR and similar frameworks enacted or updated through 2025, directly impacts contractual obligations. DATAGROUP must ensure its contracts and SLAs reflect these evolving legal requirements to maintain client trust and avoid substantial fines.

Key aspects of DATAGROUP's contractual legal considerations include:

- Contractual Scope and Deliverables: Precisely defining the IT services to be provided and the expected outcomes.

- Performance Metrics and Penalties: Establishing measurable KPIs and outlining consequences for non-compliance.

- Data Protection and Confidentiality: Ensuring adherence to all relevant privacy laws and safeguarding client data.

- Liability and Indemnification: Clearly allocating responsibility and outlining protection against potential losses.

Intellectual Property Rights

Intellectual property rights are fundamental for DATAGROUP, particularly given its role in software development and its proprietary cloud platform, CORBOX. Protecting its own innovations is paramount, as is ensuring that client solutions do not inadvertently infringe upon the intellectual property of others. This necessitates meticulous attention to licensing agreements and ongoing vigilance regarding evolving intellectual property legislation.

DATAGROUP's reliance on its software and platform means that robust IP protection directly impacts its competitive advantage and revenue streams. For instance, in 2024, the global software market was valued at over $700 billion, highlighting the significant economic stakes involved in IP ownership. Failure to safeguard its IP could lead to costly litigation or the loss of market share to competitors leveraging similar technologies.

- IP Protection: Safeguarding DATAGROUP's proprietary software and CORBOX platform is critical for maintaining its market position.

- Infringement Risk: Ensuring client solutions do not violate third-party IP rights requires diligent legal review and adherence to licensing terms.

- Legal Compliance: Staying abreast of changes in intellectual property law is essential for mitigating legal risks and ensuring ongoing operational integrity.

The evolving legal landscape in Germany and the EU significantly shapes DATAGROUP's operations, particularly concerning data privacy and cybersecurity. Regulations like the GDPR and the upcoming NIS2 Directive (NIS2UmsuCG in Germany) mandate strict data handling and security protocols, impacting all IT service providers. For instance, the NIS2 Directive expands cybersecurity requirements to a broader range of businesses, creating a substantial demand for compliance solutions, a market analysts project to exceed €10 billion in Germany by 2025.

Environmental factors

The global push for environmental sustainability is profoundly impacting the IT industry, creating a significant demand for Green IT solutions. This trend prioritizes minimizing energy consumption and reducing the carbon footprint of technology operations. For instance, by 2025, the global IT sector's carbon emissions are projected to reach 4.5% of the world's total, highlighting the urgency for greener practices.

DATAGROUP is well-positioned to capitalize on this growing market. Its cloud services, in particular, can be strategically marketed to clients aiming to achieve their environmental sustainability goals. By offering energy-efficient cloud infrastructure and optimized IT solutions, DATAGROUP can help businesses reduce their environmental impact, aligning with increasing regulatory pressures and corporate social responsibility initiatives.

Data centers are massive energy consumers, and their environmental footprint is increasingly a focal point. For companies like DATAGROUP, which manage their own cloud infrastructure through CORBOX, this means a growing imperative to boost energy efficiency. This focus is driven by regulatory pressures and a desire to align with sustainability goals.

The operational costs and environmental impact of data centers are directly tied to their energy consumption. DATAGROUP's commitment to sustainability necessitates strategic investments in areas like advanced cooling systems, sourcing renewable energy, and deploying more energy-efficient hardware. For instance, the global IT industry's carbon footprint is a significant concern, and optimizing data center energy use is a key mitigation strategy.

The escalating generation of electronic waste, or e-waste, from IT hardware presents a significant environmental hurdle globally. In 2023 alone, the world produced an estimated 62 million tonnes of e-waste, a figure projected to rise. This trend necessitates a shift towards more sustainable practices.

Companies are now under increasing pressure to embrace circular economy principles, focusing on extending the lifespan of IT equipment through repair, refurbishment, and responsible recycling. This approach minimizes resource depletion and reduces landfill burden, aligning with growing consumer and regulatory demands for environmental stewardship.

DATAGROUP has an opportunity to integrate robust e-waste management services or forge strategic partnerships within this domain. By doing so, the company can not only address a critical environmental challenge but also enhance its value proposition and appeal to environmentally conscious clients, potentially tapping into the growing market for sustainable IT solutions which is expected to reach billions in the coming years.

Regulatory Pressure for Environmental Reporting (ESG)

New regulations are significantly stepping up environmental reporting requirements. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) mandates more detailed ESG disclosures for companies, impacting organizations like DATAGROUP. This means greater scrutiny on environmental performance and a need for robust data collection and reporting processes.

Compliance with these evolving standards is no longer optional; it's critical for maintaining investor confidence and market access. Companies are expected to provide transparent and verifiable data on their environmental impact. This shift is pushing businesses to integrate sustainability into their core strategies and operations, directly affecting how they manage resources and report on their footprint.

The increasing pressure for environmental reporting means companies must adapt their data management and disclosure practices. This includes:

- Enhanced Data Collection: Implementing systems to accurately track and measure environmental metrics like carbon emissions, water usage, and waste generation.

- Standardized Reporting Frameworks: Adhering to established guidelines such as the Global Reporting Initiative (GRI) or the Task Force on Climate-related Financial Disclosures (TCFD).

- Assurance and Verification: Preparing for independent audits of ESG data to ensure credibility and compliance.

- Strategic Integration: Aligning environmental goals with overall business strategy to drive sustainable growth and mitigate risks.

Client Demand for Environmentally Responsible Providers

Clients, especially major corporations, are increasingly factoring environmental considerations into their purchasing decisions. This trend means that DATAGROUP's dedication to sustainability can serve as a key advantage over competitors.

By showcasing robust environmental practices, DATAGROUP can not only attract new clients but also deepen loyalty with its current customer base. For instance, a 2024 survey indicated that over 60% of B2B buyers consider a vendor's sustainability credentials when making procurement choices.

- Growing Client Scrutiny: Large enterprises are actively integrating environmental, social, and governance (ESG) criteria into their vendor selection processes.

- Competitive Advantage: Demonstrating a strong commitment to environmental responsibility can differentiate DATAGROUP in a crowded market.

- Business Development: Sustainable operations can be a powerful tool for attracting new business opportunities and expanding market share.

- Client Retention: Aligning with client values on environmental stewardship strengthens existing relationships and fosters long-term partnerships.

The environmental landscape is rapidly evolving, with a significant emphasis on reducing carbon footprints and managing e-waste. By 2025, the IT sector's emissions are predicted to hit 4.5% of global totals, underscoring the need for sustainable practices. This push is driven by both regulatory mandates and increasing client demand for environmentally responsible partners.

DATAGROUP's commitment to green IT, particularly through its CORBOX cloud services, directly addresses these environmental concerns. The company's focus on energy efficiency in data centers and robust e-waste management strategies positions it favorably in a market where sustainability is a key differentiator. A 2024 survey found over 60% of B2B buyers consider a vendor's sustainability credentials, highlighting the commercial imperative.

| Environmental Factor | 2024/2025 Relevance | DATAGROUP Opportunity/Challenge |

|---|---|---|

| IT Sector Carbon Emissions | Projected 4.5% of global total by 2025 | Opportunity to offer energy-efficient cloud solutions (CORBOX) to reduce client emissions. |

| E-Waste Generation | Estimated 62 million tonnes globally in 2023, rising trend | Challenge to manage hardware lifecycle; Opportunity for e-waste management services/partnerships. |

| Regulatory Reporting (e.g., CSRD) | Increasingly stringent ESG disclosure requirements | Challenge to adapt data collection/reporting; Opportunity to demonstrate compliance and transparency. |

| Client Procurement Criteria | >60% of B2B buyers consider sustainability (2024 survey) | Opportunity to gain competitive advantage and attract/retain environmentally conscious clients. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of public and proprietary data, ensuring a comprehensive understanding of the macro-environment. We draw from official government publications, reputable market research firms, and leading economic indicators.