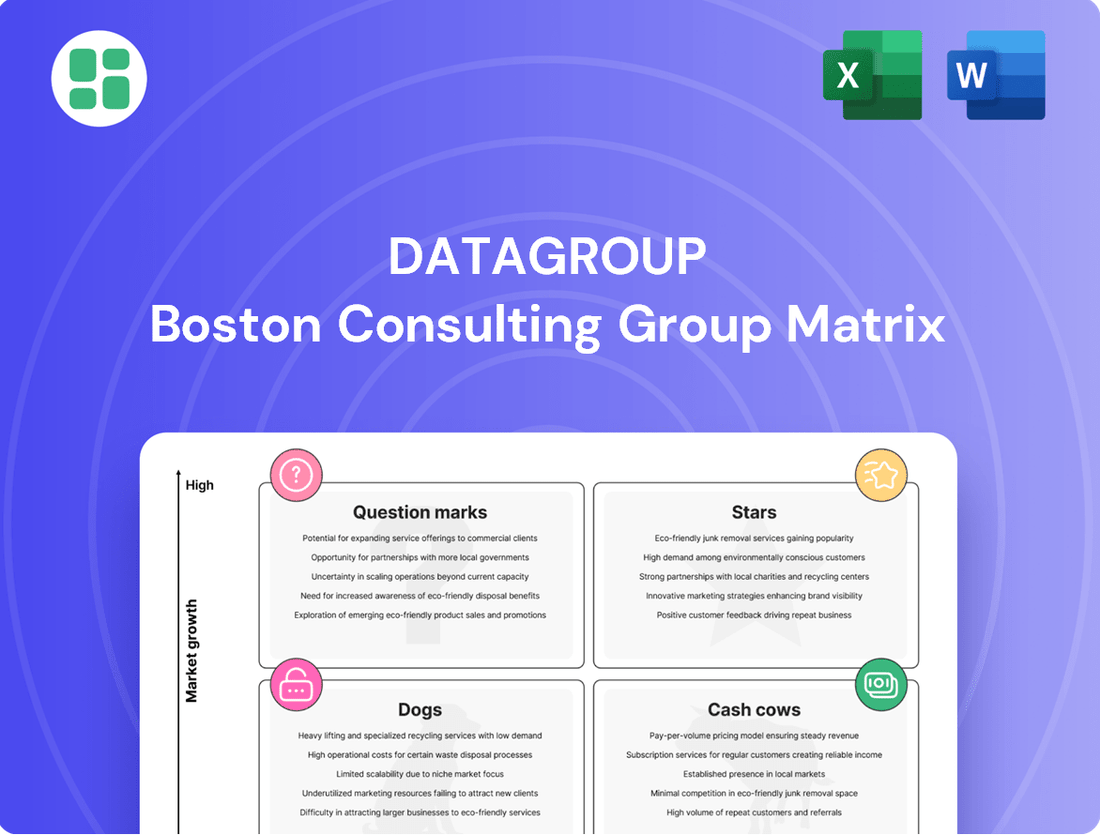

DATAGROUP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DATAGROUP Bundle

Unlock the strategic potential of your product portfolio with the DATAGROUP BCG Matrix. Understand how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in the current market landscape.

This glimpse into the DATAGROUP BCG Matrix is just the beginning. Purchase the full report to receive detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product strategy.

Stars

Cybersecurity Solutions represent a Stars category for DATAGROUP, bolstered by their Q1 2024/2025 acquisition of IT security specialist TARADOR. This move directly targets a high-growth market where DATAGROUP aims for accelerated expansion and cross-selling opportunities.

The global cybersecurity services market is projected for robust growth, with an estimated CAGR of approximately 7.4% from 2025 to 2034. DATAGROUP's strategic focus and recent acquisition position its cybersecurity offerings to capitalize on this expanding sector, likely leading to significant revenue generation and market share gains.

Germany's cloud computing market is set for significant expansion, with a projected 22% compound annual growth rate between 2025 and 2030. DATAGROUP's strategic emphasis on enhancing its cloud service offerings, such as its private cloud solution CORBOX, positions the company advantageously within this burgeoning sector. The consistent inclusion of cloud services in their new customer agreements underscores the robust market demand and DATAGROUP's success in securing a stronger foothold.

DATAGROUP is strategically positioning its Artificial Intelligence (AI) Integration Services as Stars within its BCG Matrix. The company is making substantial investments in AI, understanding its transformative power for growth and service improvement.

The German ICT market's projection of 45% growth in AI platforms by 2025 underscores the immense potential for DATAGROUP's AI-driven offerings. These services represent high-growth areas where DATAGROUP is actively cultivating market leadership and boosting automation.

Digital Workplace Management

Digital Workplace Management, a key area within DATAGROUP's portfolio, is demonstrating robust growth, evidenced by significant new customer wins in early 2024/2025. These successes highlight the company's strong market position in providing essential IT infrastructure and services for modern businesses.

DATAGROUP's commitment to this segment is underscored by substantial enterprise contracts. For instance, a notable Q1 2024/2025 order from kubus IT involves managing over 17,000 workplaces, reflecting a clear demand for comprehensive digital workplace solutions.

- Market Demand: Large enterprises are actively seeking advanced digital workplace management services to enhance efficiency and employee productivity.

- Contract Wins: DATAGROUP secured significant contracts in Q1 2024/2025, including a major deal for over 17,000 workplaces from kubus IT.

- Strategic Importance: Digital Workplace Management is a cornerstone of modern IT outsourcing, crucial for businesses navigating digital transformation.

- Growth Indicator: These contract wins signify a strong market position and a positive outlook for DATAGROUP in this evolving IT sector.

Specialized SAP Consulting & Implementation

DATAGROUP's Specialized SAP Consulting & Implementation falls into the Stars category of the BCG Matrix. The acquisition of ISC Innovative Systems Consulting AG in May 2024 significantly bolstered their SAP capabilities, a key area for many businesses. This strategic move positions DATAGROUP to leverage the substantial market demand for enterprise application services.

This expansion into SAP services allows DATAGROUP to capture a larger share of a growing market. The IT services market for enterprise applications, including SAP, is projected to see continued strong growth. For instance, global spending on enterprise application software was estimated to reach over $250 billion in 2024, with SAP solutions representing a significant portion of this expenditure.

DATAGROUP's focus on SAP consulting and implementation is a strategic advantage. They are well-positioned to benefit from the ongoing digital transformation initiatives within medium-sized and large enterprises. This segment of the IT market requires specialized expertise, which DATAGROUP is now further enhancing.

- Market Growth: The global enterprise application market is expanding rapidly, driven by digital transformation needs.

- Acquisition Impact: ISC Innovative Systems Consulting AG acquisition enhances DATAGROUP's SAP expertise.

- Strategic Positioning: DATAGROUP capitalizes on high demand for SAP implementation and consulting.

- Customer Base: Medium-sized and large enterprises are key clients for these specialized SAP services.

DATAGROUP's Cybersecurity Solutions are firmly positioned as Stars. The acquisition of TARADOR in Q1 2024/2025 significantly strengthens their cybersecurity capabilities, targeting a high-growth market. This strategic move is expected to drive accelerated expansion and unlock cross-selling opportunities within DATAGROUP's portfolio.

The global cybersecurity market is experiencing substantial growth, with projections indicating a compound annual growth rate of around 7.4% between 2025 and 2034. DATAGROUP's focused strategy and recent acquisition align perfectly to capitalize on this expanding sector, aiming for increased revenue and market share.

DATAGROUP's Cloud Services, particularly its private cloud solution CORBOX, are also Stars. Germany's cloud computing market is set for remarkable expansion, with an estimated 22% CAGR from 2025 to 2030. DATAGROUP's continuous efforts to enhance these offerings and their consistent inclusion in new customer agreements highlight strong market demand and their growing market presence.

Artificial Intelligence (AI) Integration Services represent another Star for DATAGROUP. The company's substantial investments in AI underscore its recognition of AI's transformative potential for growth and service enhancement. The German ICT market's anticipated 45% growth in AI platforms by 2025 further validates DATAGROUP's strategic focus on these high-potential services.

Digital Workplace Management is a key Star offering for DATAGROUP. Strong market demand is evidenced by significant new customer wins in early 2024/2025, including a substantial contract with kubus IT for managing over 17,000 workplaces. This segment is crucial for businesses undergoing digital transformation, and DATAGROUP's success here indicates a strong market position.

Specialized SAP Consulting & Implementation, bolstered by the May 2024 acquisition of ISC Innovative Systems Consulting AG, is a Star category for DATAGROUP. This move enhances their expertise in a critical area for enterprise clients, tapping into the robust demand for enterprise application services. The global IT services market for enterprise applications, including SAP, is projected for continued strong growth, with global spending on enterprise application software estimated to exceed $250 billion in 2024.

| DATAGROUP Star Offerings | Key Growth Drivers | Market Data & Projections | Strategic Actions | Impact |

| Cybersecurity Solutions | Increasing cyber threats, digital transformation | Global cybersecurity market CAGR ~7.4% (2025-2034) | Acquisition of TARADOR (Q1 2024/2025) | Accelerated expansion, cross-selling |

| Cloud Services (e.g., CORBOX) | Digitalization, hybrid work models | German cloud computing market CAGR ~22% (2025-2030) | Enhancement of private cloud solutions | Stronger market foothold, increased revenue |

| AI Integration Services | Automation, data-driven decision making | German ICT market AI platforms growth ~45% by 2025 | Substantial investment in AI capabilities | Market leadership cultivation, automation boost |

| Digital Workplace Management | Remote work, employee productivity | Significant enterprise contract wins (Q1 2024/2025) | Focus on essential IT infrastructure | Strong market position, positive outlook |

| SAP Consulting & Implementation | Enterprise resource planning needs, digital transformation | Global enterprise application software spending >$250 billion (2024) | Acquisition of ISC Innovative Systems Consulting AG (May 2024) | Enhanced SAP expertise, capturing market share |

What is included in the product

The DATAGROUP BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Quickly identify underperforming units with a clear, visual DATAGROUP BCG Matrix.

Cash Cows

CORBOX Managed IT Services represents DATAGROUP's strategic Cash Cow. Its foundation lies in recurring revenues, typically secured through long-term contracts spanning three to seven years, a testament to its stability and customer loyalty. This consistent revenue stream is a hallmark of a mature business with a strong market position.

The platform consistently demonstrates robust order intake, underscoring its sustained demand and DATAGROUP's ability to secure new business. As a well-proven and highly customizable service, CORBOX has solidified its status as a market leader within the IT outsourcing sector, a segment characterized by its maturity and inherent stability.

DATAGROUP's traditional IT outsourcing and infrastructure operations represent a core "Cash Cow" within its business. This segment generates a substantial and reliable revenue stream, largely due to long-standing client contracts and the mature nature of the market. In 2024, the company reported a significant portion of its revenue derived from these established services, underscoring their stability.

DATAGROUP's strength lies in its long-term recurring revenue contracts, often spanning three to seven years. This contractual foundation provides a predictable and stable cash flow, a hallmark of a cash cow.

This consistent revenue stream, derived from a diverse customer base, means DATAGROUP doesn't need to heavily reinvest in sales and marketing to maintain its income. For instance, in fiscal year 2023, DATAGROUP reported a significant portion of its revenue from recurring services, underscoring the stability these contracts offer.

Mature Data Center Operations

DATAGROUP’s mature data center operations, specifically for its CORBOX cloud services, represent a significant Cash Cow. The company’s ownership of its hardware and software infrastructure within these data centers ensures control and efficiency in service delivery. This foundational IT capability benefits from Germany’s strong position in the data center market, allowing DATAGROUP to offer stable, high-market-share services that support its broader product portfolio.

These established operations are crucial for DATAGROUP’s business model, providing a reliable revenue stream. In 2024, the demand for secure and high-performance cloud infrastructure continued to grow, with the German data center market projected to see substantial investment. DATAGROUP’s existing footprint positions it well to capitalize on this trend, leveraging its expertise to maintain its competitive edge.

- Stable Revenue Generation: The data centers consistently contribute to DATAGROUP's earnings due to ongoing demand for cloud services.

- Market Leadership in Germany: Germany's robust data center sector provides a favorable environment for DATAGROUP's established operations.

- Underpinning Portfolio: These operations are essential for delivering other DATAGROUP services, creating a synergistic effect.

- Control over Infrastructure: Owning hardware and software allows for optimized performance and cost management of CORBOX cloud services.

Standardized IT Support & Helpdesk Services

Standardized IT Support & Helpdesk Services represent a core component of DATAGROUP's business, acting as a stable revenue generator within the BCG matrix. These services, while mature, are crucial for maintaining client relationships and providing a consistent income stream.

These foundational support services are integral to DATAGROUP's comprehensive IT offerings for their enterprise clients. While not a high-growth area, their established presence and efficient delivery of these services ensure consistent, high-volume revenue and contribute significantly to overall profitability.

- Revenue Stability: These services provide predictable revenue, underpinning DATAGROUP's financial stability.

- Client Retention: Essential support fosters strong client loyalty and reduces churn.

- Profitability Driver: High volume and optimized processes ensure healthy margins.

- Market Position: DATAGROUP's established expertise in this area solidifies its market standing.

Cash Cows in DATAGROUP's portfolio, like CORBOX Managed IT Services and traditional IT outsourcing, are characterized by their strong market position and reliable, recurring revenue streams. These segments benefit from long-term contracts, typically three to seven years, which provide a stable financial foundation and allow for consistent profitability without requiring substantial reinvestment in growth initiatives. Their maturity in the market ensures predictable cash flow, a key indicator of their Cash Cow status.

These established services, including data center operations and standardized IT support, are vital for DATAGROUP's overall business model. They generate a significant portion of the company's revenue, underscoring their importance to financial stability and profitability. For instance, in fiscal year 2023, recurring services constituted a substantial part of DATAGROUP's income, highlighting the dependable nature of these offerings.

DATAGROUP's core IT outsourcing and infrastructure operations, along with its CORBOX cloud services, are prime examples of Cash Cows. These segments benefit from Germany's robust data center market and DATAGROUP's control over its infrastructure, ensuring efficiency and cost management. The demand for secure cloud solutions continued to rise in 2024, positioning DATAGROUP to leverage its established expertise.

The company’s standardized IT Support & Helpdesk Services also function as Cash Cows, providing predictable revenue and fostering client retention. These high-volume, efficiently delivered services contribute significantly to profitability and solidify DATAGROUP's market standing.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Outlook (2024) |

|---|---|---|---|---|

| CORBOX Managed IT Services | Cash Cow | Recurring revenue, long-term contracts, market leadership | Significant | Stable demand, continued growth in cloud services |

| Traditional IT Outsourcing & Infrastructure | Cash Cow | Mature market, stable client base, predictable cash flow | Substantial | Continued reliance on long-standing contracts |

| Data Center Operations (CORBOX Cloud) | Cash Cow | Owned infrastructure, operational efficiency, strong market position in Germany | Integral to Cloud Services | Capitalizing on growing demand for secure cloud infrastructure |

| Standardized IT Support & Helpdesk | Cash Cow | High volume, efficient delivery, client retention | Consistent | Maintaining profitability through optimized processes |

Preview = Final Product

DATAGROUP BCG Matrix

The DATAGROUP BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis tool, designed for clarity and professional use, will be delivered in its final, fully formatted state, requiring no further editing or revisions. You are seeing the complete, ready-to-use BCG Matrix report, which will be instantly downloadable after your purchase, allowing you to seamlessly integrate it into your business planning and decision-making processes. This preview accurately represents the high-quality, analysis-ready file you will acquire, enabling you to effectively assess and manage your business portfolio.

Dogs

Legacy IT services from expiring contracts are likely positioned as Dogs within DATAGROUP's BCG Matrix. The company's outlook for fiscal year 2024/2025 explicitly mentions a planned reduction in revenue from old contracts, indicating a strategic move away from these less profitable areas. This aligns with the characteristics of Dogs, which typically have low market share and low growth potential.

Niche, Outdated Software Maintenance represents a segment of the IT services market focused on keeping legacy systems operational. These services cater to specialized, often industry-specific software that has fallen out of mainstream development. For instance, many financial institutions still rely on COBOL-based systems, creating a persistent demand for maintenance.

Companies in this category typically hold a low market share within the broader IT services landscape, as their offerings are highly specialized. Growth prospects are also limited, as the trend is towards modernizing or replacing these older systems. In 2024, the global IT maintenance market, while substantial, saw a slowdown in growth for legacy systems, with many businesses prioritizing cloud migration and digital transformation initiatives.

Standalone commoditized IT hardware resale, when not bundled with more valuable services, typically faces razor-thin profit margins. This segment operates within a fiercely competitive landscape characterized by low growth, making it a less attractive area for significant investment or strategic focus for companies like DATAGROUP. For instance, the global IT hardware resale market, while substantial, is often driven by price competition, with players struggling to differentiate beyond cost.

Underperforming Acquired Business Units

Underperforming acquired business units within DATAGROUP's portfolio represent potential 'cash cows' that are currently draining resources. These might be smaller companies or specific service lines that haven't meshed well with DATAGROUP's main operations or haven't captured substantial market share post-acquisition. For instance, if an acquired IT services firm, known for its niche cloud solutions, only contributed 0.5% to DATAGROUP's overall revenue in 2024 despite significant integration costs, it would fall into this category.

These units require ongoing investment to maintain operations or attempt a turnaround, but they aren't generating enough profit to justify the capital outlay. This situation can become a significant drain, impacting overall profitability and the ability to invest in more promising areas of the business. For example, if a recently acquired cybersecurity consultancy, acquired for €15 million in 2023, reported a net loss of €2 million in 2024 and its market growth projection was revised downwards to 3% annually, it would be a clear candidate for re-evaluation.

- Lack of Synergies: Acquired units failing to integrate with DATAGROUP's core IT services or customer base, leading to isolated operations and limited cross-selling opportunities.

- Market Saturation or Decline: Specific service lines within acquired businesses operating in markets that are either too competitive or experiencing a downturn, hindering revenue growth.

- High Operational Costs: Acquired entities with inefficient cost structures or legacy systems that are expensive to maintain, eroding any potential profitability.

- Failure to Achieve Expected ROI: Investments made in integrating and scaling these units not yielding the projected returns, turning them into cash traps rather than growth engines.

Highly Specialized, Low-Demand Consulting Engagements

Highly Specialized, Low-Demand Consulting Engagements represent a challenging quadrant within the DATAGROUP BCG Matrix. These are consulting services in niche IT areas where demand has softened or where DATAGROUP's competitive edge isn't as pronounced. Such engagements can tie up valuable expert time and resources, diverting them from more promising ventures, without yielding significant, scalable revenue or expanding market share.

Consider the IT consulting market in 2024. While overall growth continues, specific legacy system integrations or highly niche cybersecurity protocols might fall into this category. For instance, if a particular mainframe modernization service, once in high demand, now sees only a handful of clients annually, it fits this description. These projects might require senior consultants who could otherwise be deployed on higher-growth areas like cloud migration or AI strategy.

- Resource Drain: Engagements consume expert resources that could be allocated to high-growth areas.

- Low Scalability: Revenue generation is limited due to the niche and low-demand nature of the services.

- Weak Competitive Advantage: DATAGROUP may not have a distinct edge, making profitability difficult.

- Opportunity Cost: Time spent here represents missed opportunities in more lucrative market segments.

Dogs in DATAGROUP's BCG Matrix represent business segments with low market share and low growth potential. Legacy IT services from expiring contracts, niche software maintenance, and commoditized hardware resale exemplify these "Dogs." These areas often require significant resources but yield minimal returns, acting as drains on profitability.

DATAGROUP's strategic focus in fiscal year 2024/2025 includes reducing revenue from old contracts, a clear indicator of moving away from these low-growth segments. The global IT maintenance market for legacy systems saw a slowdown in 2024, with businesses prioritizing digital transformation, further solidifying the "Dog" status of these offerings.

Underperforming acquired business units also fit the "Dog" profile if they fail to gain market share or generate sufficient returns, potentially consuming resources without contributing to growth. Similarly, highly specialized, low-demand consulting engagements, which tie up expert resources with limited scalability, also fall into this category.

These segments require careful management, often involving divestment or a strategic pivot to avoid continued resource drain and to reallocate capital to more promising "Stars" or "Question Marks."

| Segment | Market Share | Market Growth | DATAGROUP Relevance |

|---|---|---|---|

| Legacy IT Services | Low | Low | Planned revenue reduction |

| Niche Software Maintenance | Low | Low | Declining demand, focus on modernization |

| Commoditized Hardware Resale | Low | Low | Thin profit margins, high competition |

| Underperforming Acquired Units | Low | Low | Potential resource drain, low ROI |

| Low-Demand Consulting | Low | Low | Resource intensive, low scalability |

Question Marks

Emerging AI-driven software development within DATAGROUP's portfolio can be viewed as a Question Mark in the BCG Matrix. The company's strategic investment in AI technology and automation signals a strong commitment to creating novel software solutions that leverage artificial intelligence capabilities.

These nascent AI-powered products are positioned in a high-growth market, driven by the rapid expansion of AI adoption across industries. However, they currently represent a low market share, reflecting their early stage of development and market penetration, typical of new ventures in emerging technology sectors.

Highly specialized cloud migrations for complex, legacy environments are a burgeoning niche within the broader cloud services market. While cloud adoption continues its upward trajectory, these intricate projects demand deep technical expertise and tailored solutions, representing a segment with significant growth potential.

DATAGROUP is strategically positioning itself to capture market share in this high-growth area by cultivating specialized expertise. The company's focus on complex migrations for customized or legacy IT systems allows it to differentiate itself in a crowded market, potentially leading to strong future revenue streams.

DATAGROUP's new geographic market penetration initiatives, particularly within Germany or internationally, would likely be categorized as Stars or Question Marks depending on their specific market position and growth potential. These ventures would initially face the challenge of low market share in new territories, demanding substantial investment to build brand awareness and customer base, even within a growing IT services sector. For instance, if DATAGROUP were to enter a new region in fiscal year 2024, it might see initial revenue figures that are a fraction of established competitors, necessitating aggressive sales and marketing spend.

Next-Generation Cybersecurity Advisory Services

Next-generation cybersecurity advisory services, focusing on advanced proactive strategies like cutting-edge threat intelligence and zero-trust architecture for emerging threats, are positioned as a high-growth, low-market-share segment within the DATAGROUP BCG Matrix.

This category is characterized by significant potential for future expansion as organizations increasingly adopt sophisticated defenses against evolving cyber risks. The global cybersecurity market was projected to reach $232.3 billion in 2024, with advisory services forming a crucial component of this growth.

- High Growth Potential: Demand for specialized advisory on AI-driven threats and quantum-resistant cryptography is rapidly increasing.

- Low Current Market Share: While growing, these niche services are not yet widely adopted compared to foundational cybersecurity.

- Strategic Importance: Investing in these areas allows DATAGROUP to capture future market leadership and offer differentiated value.

- Innovation Focus: Development in this segment requires continuous R&D to stay ahead of sophisticated, novel cyberattack vectors.

Innovative IoT Solutions for Niche Industries

Developing and deploying specialized IoT solutions for niche industries presents a significant growth opportunity. These tailored applications, targeting specific industrial or public sector needs, could drive substantial revenue. However, due to the emerging nature of many of these IoT verticals, DATAGROUP's initial market share is expected to be relatively low, positioning these solutions in the Question Marks quadrant of the BCG Matrix.

For instance, the global IoT market in manufacturing alone was projected to reach $77.3 billion in 2024, with specialized solutions for areas like predictive maintenance in heavy machinery or smart logistics for cold chains representing nascent but high-potential segments. While these niche markets may not yet have established leaders, the potential for rapid growth as adoption increases is considerable. DATAGROUP's strategy here would involve investing in research and development to build expertise and capture early market share.

- Niche IoT Market Growth: The global IoT market is expanding rapidly, with specialized applications in areas like smart agriculture and industrial automation showing strong potential. For example, the industrial IoT market is anticipated to grow at a CAGR of over 15% in the coming years.

- Low Initial Market Share: Due to the specialized nature and early stage of many niche IoT verticals, DATAGROUP's current market share in these specific segments is likely to be low. This reflects the investment required to establish presence in these new territories.

- High Growth Potential: These niche industries, once they mature and adopt IoT technologies more broadly, offer substantial growth prospects. Early investment in these areas can lead to significant future market capture.

- Strategic Investment Focus: DATAGROUP should focus on targeted R&D and partnerships to build a strong foundation in these emerging IoT sectors, aiming to transition these offerings into Stars as market adoption accelerates.

Question Marks represent business units or product lines that operate in high-growth markets but currently hold a low market share. These ventures require significant investment to increase market share and potentially become Stars. If successful, they can generate substantial future returns.

DATAGROUP's emerging AI software development and specialized cloud migration services for legacy systems are prime examples of Question Marks. These areas are in high-growth markets, but DATAGROUP is still building its position and market share.

Similarly, new geographic market penetration and advanced cybersecurity advisory services fit the Question Mark profile. They target expanding markets but face the challenge of establishing a strong foothold against existing players.

Specialized IoT solutions for niche industries also fall into this category, offering high growth potential but currently possessing a low market share for DATAGROUP.

| Business Unit/Product Line | Market Growth Rate | Relative Market Share | BCG Category |

| AI-driven Software Development | High | Low | Question Mark |

| Specialized Cloud Migrations (Legacy) | High | Low | Question Mark |

| New Geographic Market Penetration | High (overall IT services) | Low (in new markets) | Question Mark |

| Next-Gen Cybersecurity Advisory | High | Low | Question Mark |

| Specialized IoT Solutions (Niche Industries) | High | Low | Question Mark |

BCG Matrix Data Sources

Our DATAGROUP BCG Matrix leverages a robust blend of financial statements, market research reports, and industry-specific growth forecasts to provide a comprehensive strategic overview.