DATAGROUP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DATAGROUP Bundle

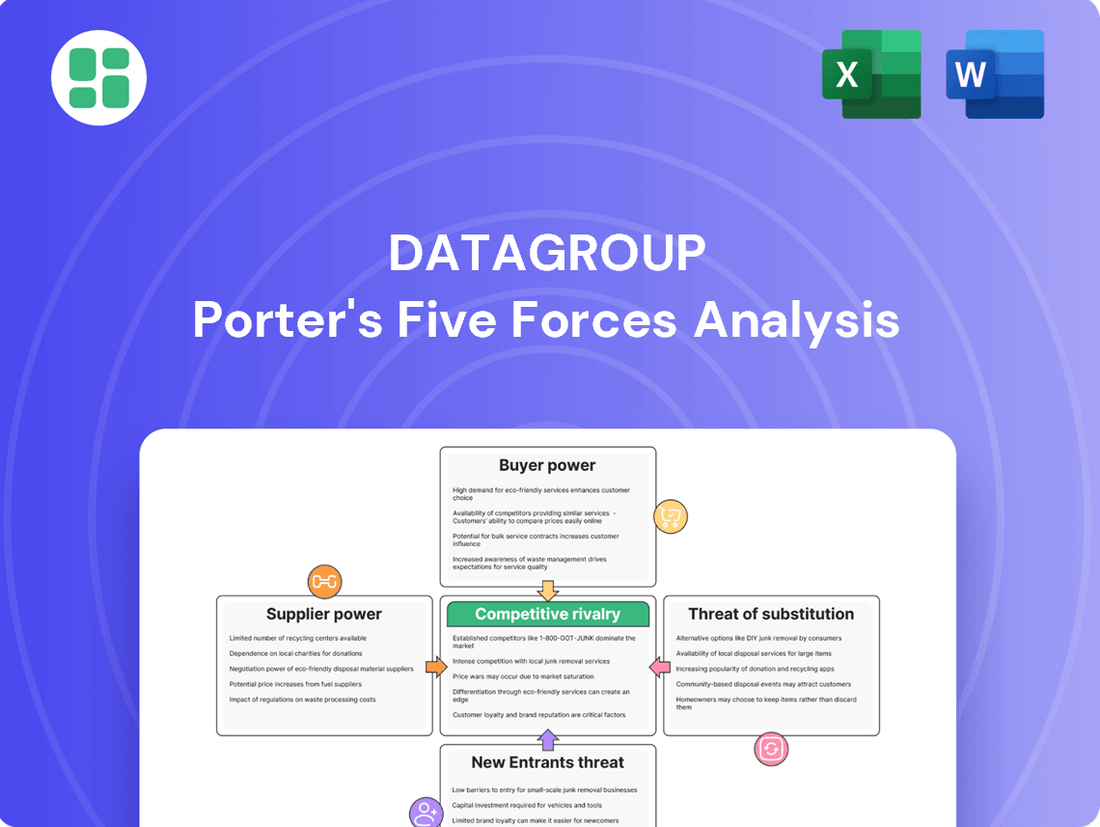

Our brief look at DATAGROUP's Porter's Five Forces reveals a dynamic market landscape, highlighting key pressures that shape its competitive environment. Understanding these forces is crucial for any stakeholder looking to navigate this sector effectively.

The complete report reveals the real forces shaping DATAGROUP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The German IT market grapples with a pronounced shortage of skilled professionals, especially in areas like cloud, cybersecurity, and system administration. This scarcity directly boosts the bargaining power of IT talent, a crucial supplier for DATAGROUP. For instance, in 2023, IT job vacancies in Germany reached record highs, with a significant portion remaining unfilled for extended periods, impacting recruitment timelines and costs for companies like DATAGROUP.

DATAGROUP's reliance on key software vendors for its IT infrastructure and business applications significantly shapes supplier bargaining power. For specialized enterprise applications and critical infrastructure software, established vendors like Microsoft or SAP wield considerable influence due to the proprietary nature of their solutions.

The high switching costs associated with deeply integrated software systems further solidify the power of these suppliers. Migrating complex IT environments can involve substantial financial investment and operational disruption, making organizations hesitant to change vendors, thereby strengthening the suppliers' negotiating position.

DATAGROUP's reliance on specialized hardware for its complex IT infrastructures means that suppliers of unique or high-performance components can hold some bargaining power. While the broader IT hardware market is competitive, the need for specific, often proprietary, elements for data center operations can limit DATAGROUP's options. For instance, in 2024, the global server hardware market saw continued demand for specialized processors and memory, with a few key manufacturers dominating these segments, potentially giving them leverage.

Growing Influence of Cloud Hyperscalers

The growing influence of cloud hyperscalers like AWS, Microsoft Azure, and Google Cloud Platform presents a nuanced challenge to DATAGROUP's bargaining power of suppliers. While DATAGROUP provides its own private cloud solution, CORBOX, the broader market is shaped by these giants. For instance, AWS announced plans for a sovereign cloud in Germany, set to launch in 2025, indicating substantial investment and a deepening presence in the region.

These hyperscalers, though not traditional suppliers, exert considerable influence. Their massive scale and ongoing innovation can set de facto pricing benchmarks and technological standards for various cloud components or services that DATAGROUP may integrate or rely upon. This dominance can indirectly impact the cost and availability of certain underlying technologies, even for a company with a proprietary offering like CORBOX.

- Hyperscaler Investment: Major cloud providers are increasing their infrastructure and service offerings within Germany, signaling a commitment to the market.

- Technological Standards: The innovation pace and scale of hyperscalers can influence the technological direction and pricing of cloud-related services.

- Indirect Supplier Influence: While not direct suppliers, their market power can affect the economics of integrating or leveraging certain cloud technologies.

Specialized Cybersecurity Solution Providers

Specialized cybersecurity solution providers can hold significant bargaining power over companies like DATAGROUP, especially given the escalating complexity of cyber threats and the increasing demand for advanced security. These niche firms often possess unique expertise and proprietary technologies that are difficult to replicate, making their services indispensable.

For instance, the global cybersecurity market was projected to reach USD 345.5 billion in 2024, indicating a strong demand for specialized solutions. Providers of advanced security tools, threat intelligence feeds, and managed detection and response (MDR) services are in a prime position to negotiate favorable terms due to the critical nature of their offerings.

- High Switching Costs: Implementing and integrating specialized cybersecurity solutions often involves substantial upfront investment and time, making it costly and disruptive for DATAGROUP to switch providers.

- Proprietary Technology: Niche providers may offer unique algorithms or data sets for threat detection and prevention that are not readily available elsewhere, creating a dependency.

- Limited Number of Competitors: The market for highly specialized cybersecurity services can be concentrated, with only a few players offering the required depth of expertise.

- DATAGROUP's Strategic Response: DATAGROUP's acquisition of TARADOR in 2023, which bolstered its in-house cybersecurity capabilities, demonstrates a strategic effort to mitigate this supplier bargaining power by building internal expertise and reducing reliance on external specialists.

The bargaining power of suppliers for DATAGROUP is influenced by the specialized nature of IT talent and software. The German IT labor market's shortage, evident in 2023's record high vacancies, empowers IT professionals. Additionally, reliance on vendors for critical enterprise applications and infrastructure software, like SAP or Microsoft, grants these suppliers significant leverage due to high switching costs and proprietary solutions.

DATAGROUP's dependence on specific hardware components, particularly for data centers, can also give suppliers leverage, especially as key manufacturers dominate niche segments. Furthermore, the growing dominance of hyperscalers like AWS, despite DATAGROUP's own CORBOX private cloud, indirectly influences pricing and technological standards in the broader cloud market, with AWS's planned 2025 sovereign cloud launch in Germany highlighting this trend.

Specialized cybersecurity providers possess considerable bargaining power due to the critical need for advanced security solutions and their unique, often proprietary, technologies. The global cybersecurity market's projected growth to USD 345.5 billion in 2024 underscores this demand. DATAGROUP's acquisition of TARADOR in 2023 was a strategic move to counter this by enhancing its internal cybersecurity capabilities.

| Supplier Type | Key Factors Influencing Power | Impact on DATAGROUP | Examples/Data Points |

|---|---|---|---|

| IT Talent | Shortage of skilled professionals | Increased labor costs, longer recruitment cycles | Record IT job vacancies in Germany in 2023 |

| Software Vendors (e.g., SAP, Microsoft) | Proprietary solutions, high switching costs | Limited vendor choice, potential for price increases | Complex integration of enterprise resource planning (ERP) systems |

| Hardware Suppliers | Need for specialized components | Potential for higher hardware costs, dependence on limited suppliers | Dominance of few manufacturers in specialized processor markets (2024) |

| Cloud Hyperscalers (e.g., AWS, Azure) | Market dominance, scale, innovation | Indirect influence on cloud service pricing and standards | AWS sovereign cloud launch in Germany planned for 2025 |

| Cybersecurity Specialists | Unique expertise, proprietary technology | High cost of specialized security solutions, reliance on niche providers | Global cybersecurity market projected at USD 345.5 billion in 2024 |

What is included in the product

This analysis delves into the competitive forces impacting DATAGROUP, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and how these shape DATAGROUP's strategic positioning.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces.

Customers Bargaining Power

DATAGROUP's extensive CORBOX portfolio, encompassing everything from IT infrastructure to application management, significantly raises the barriers for its medium and large enterprise clients to switch providers. This integration means customers rely on DATAGROUP for a broad spectrum of critical IT functions.

The process of migrating complex IT systems and operations to a new vendor is inherently disruptive, demanding considerable time and financial investment. This complexity makes it difficult and costly for customers to simply move their business elsewhere.

Furthermore, DATAGROUP typically secures its clients through long-term contracts, often spanning 3 to 5 years. These agreements effectively lock in customers, substantially diminishing their immediate power to negotiate better terms or switch providers without penalty.

For DATAGROUP's key clients, typically medium and large enterprises, IT services are absolutely essential for day-to-day business and staying ahead of the competition. This means they are looking for dependable, high-quality services that keep things running smoothly, not just the cheapest option.

Because these businesses rely so heavily on IT, switching providers can be a risky move, potentially leading to service interruptions. DATAGROUP's commitment to reliable service and guaranteed uptime, which is crucial for business continuity, significantly reduces the customers' ability to bargain down prices or demand more favorable terms.

In 2024, the increasing complexity of digital transformation initiatives further cemented the criticality of IT services. For instance, a significant majority of businesses surveyed by IDC in late 2024 reported that at least 75% of their critical business functions were directly dependent on their IT infrastructure, underscoring the high switching costs and reduced bargaining power for customers seeking stable, proven IT partners like DATAGROUP.

DATAGROUP's customer base, while diverse, can exhibit concentration in key accounts. For instance, major contracts with entities like Messe München and kubus IT are critical revenue drivers. This concentration means these large clients hold significant sway, particularly during renewal periods.

The potential loss of even one of these substantial clients could disproportionately affect DATAGROUP's financial performance. This dependence grants these major customers considerable bargaining power, enabling them to negotiate more favorable terms, impacting DATAGROUP's profitability and pricing strategies.

Demand for Customization and Value-Added Services

Customers are increasingly seeking IT solutions that go beyond standard offerings, demanding personalized services that enhance efficiency and drive digital progress. DATAGROUP's strategy, including its customizable CORBOX platform and investments in AI, cloud, and cybersecurity, directly addresses this trend.

This heightened demand for tailored IT capabilities empowers customers. They can leverage this by requesting more specific functionalities, elevated service standards, and competitive pricing for these specialized, value-added services. This puts ongoing pressure on DATAGROUP to maintain a strong pace of innovation to meet evolving client needs.

- Increased Demand for Customization: Businesses are actively seeking IT partners who can deliver bespoke solutions rather than one-size-fits-all packages.

- Value-Added Service Expectations: Customers now expect IT providers to offer services like AI integration, advanced cybersecurity, and scalable cloud solutions as standard, not extras.

- Pricing Leverage: The ability to secure customized, high-value IT services allows customers to negotiate pricing more effectively, especially when multiple providers can meet their specific requirements.

- Innovation Pressure: To retain and attract clients, IT firms like DATAGROUP must continuously invest in and develop new technologies and service enhancements to stay ahead of customer expectations.

Availability of Alternative Providers

The German IT services market is highly competitive, offering customers a wide array of choices. This abundance of providers, ranging from niche specialists to comprehensive outsourcing firms, significantly bolsters customer bargaining power.

Customers can readily compare services and pricing from domestic and international IT providers, specialized cloud vendors, and even consider developing their in-house IT capabilities. This broad spectrum of alternatives empowers customers to negotiate favorable terms and pricing.

For instance, in 2024, the German IT services market was estimated to be worth over €100 billion, with a significant portion driven by competition among a large number of vendors. This intense competition directly translates to greater leverage for buyers.

- High Vendor Density: The German IT market features numerous domestic and international players, increasing customer options.

- Diverse Service Offerings: Customers can choose from niche providers, full-service outsourcing, and cloud specialists.

- In-house Capabilities: The option to develop internal IT resources further strengthens customer negotiation power.

- Price Sensitivity: The availability of alternatives makes customers more sensitive to pricing and service level agreements.

While DATAGROUP's integrated CORBOX portfolio and long-term contracts create significant switching costs and reduce customer bargaining power, the concentration of key accounts means major clients can wield considerable influence. Furthermore, the competitive German IT market, with its abundance of providers, offers customers numerous alternatives, enhancing their ability to negotiate terms. In 2024, the German IT services market, valued at over €100 billion, saw intense vendor competition, directly benefiting buyers.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Switching Costs (CORBOX Integration) | Lowers Customer Bargaining Power | High costs and disruption associated with migrating complex IT systems. |

| Contract Length | Lowers Customer Bargaining Power | Typical 3-5 year contracts lock in customers. |

| Customer Dependence on IT | Lowers Customer Bargaining Power | Businesses rely on IT for critical functions; service interruptions are high-risk. |

| Key Account Concentration | Increases Customer Bargaining Power (for major clients) | Loss of major clients like Messe München or kubus IT has disproportionate financial impact. |

| Demand for Customization/Value-Added Services | Increases Customer Bargaining Power | Customers can negotiate pricing for personalized AI, cloud, and cybersecurity solutions. |

| Market Competition (Germany) | Increases Customer Bargaining Power | German IT market >€100 billion in 2024, with numerous domestic/international vendors. |

Same Document Delivered

DATAGROUP Porter's Five Forces Analysis

This preview showcases the complete DATAGROUP Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the IT sector. You're viewing the exact, professionally formatted document you will receive immediately after purchase, ensuring no discrepancies or hidden content. This comprehensive analysis is ready for your immediate use, providing valuable insights into DATAGROUP's strategic positioning.

Rivalry Among Competitors

The German IT services market is experiencing strong growth, fueled by widespread digitalization, increased cloud adoption, and the integration of artificial intelligence. This expansion, with the IT services outsourcing market specifically anticipated to grow at a compound annual growth rate of 7.1% between 2025 and 2030, naturally draws a significant number of companies into the sector.

This influx of players, combined with the inherently fragmented nature of the German IT services landscape, means that competition is quite intense. A multitude of companies are vying for a share of this expanding market, leading to heightened rivalry among existing participants and new entrants alike.

DATAGROUP operates in a fiercely competitive environment, facing formidable rivals like Bechtle, CANCOM, and adesso, all prominent German IT service providers. These established players boast extensive service offerings and deeply entrenched customer loyalty, directly impacting DATAGROUP's market share and growth potential.

For instance, Bechtle reported revenues of approximately €6.4 billion in 2023, showcasing its substantial market presence. Similarly, CANCOM achieved revenues of around €1.4 billion in the same year. This intense rivalry necessitates DATAGROUP's commitment to continuous innovation and superior service delivery to maintain its competitive edge.

DATAGROUP's CORBOX strategy directly combats competitive rivalry by offering a unified, full-service IT portfolio. This integrated approach aims to simplify IT management for clients, positioning DATAGROUP as a one-stop shop rather than a niche provider.

By bundling diverse IT services under the CORBOX umbrella, DATAGROUP fosters deep customer relationships, particularly through its focus on long-term, recurring revenue contracts. This strategy aims to create customer loyalty and reduce the likelihood of clients switching to specialized, potentially lower-cost competitors.

The emphasis on quality and reliability within the CORBOX framework serves as a key differentiator. For instance, DATAGROUP's commitment to service excellence helps it stand out in a market where IT outages or performance issues can be highly disruptive, as evidenced by their consistent customer satisfaction metrics.

Active M&A and Consolidation Strategy

DATAGROUP’s active participation in the IT services market consolidation, driven by its 'buy and build' strategy, directly intensifies competitive rivalry. This approach allows them to quickly gain market share and integrate new capabilities.

The acquisition of TARADOR in 2023, for instance, bolstered DATAGROUP's cybersecurity offerings and expanded its footprint in the crucial SME segment. Such strategic moves force competitors to either accelerate their own consolidation efforts or focus on niche differentiation to remain competitive.

- Acquisition-driven growth: DATAGROUP’s inorganic growth strategy directly impacts rivals by altering market structure and competitive dynamics.

- Portfolio enhancement: Acquisitions like TARADOR add specialized services, compelling competitors to match or exceed these enhanced capabilities.

- Market share gains: Consolidation through M&A leads to larger, more dominant players, increasing pressure on smaller or less acquisitive firms.

Investment in Future-Oriented Technologies

Competitive rivalry in the IT services sector is intensified by substantial investments in future-oriented technologies. Companies are pouring resources into areas like Artificial Intelligence (AI), advanced cybersecurity measures, and comprehensive cloud solutions to differentiate themselves.

DATAGROUP's commitment to these technological frontiers is vital for its market position. For instance, in 2024, the IT sector saw significant growth in AI adoption, with many companies increasing their R&D budgets. DATAGROUP's strategic allocation of capital towards AI development and cybersecurity enhancements directly addresses client demand for sophisticated digital transformation services, aiming to secure a competitive advantage.

- AI Investment: Companies are increasing AI R&D, with global AI spending projected to reach hundreds of billions in 2024.

- Cybersecurity Focus: The escalating threat landscape necessitates continuous investment in cybersecurity, a key differentiator for service providers.

- Cloud Solutions: Ongoing expansion and innovation in cloud infrastructure and services remain critical for attracting and retaining customers.

- DATAGROUP's Strategy: Strategic investments in these technologies are essential for DATAGROUP to maintain its competitive edge and appeal to clients seeking cutting-edge solutions.

DATAGROUP faces intense competition from established German IT service providers like Bechtle, which reported €6.4 billion in revenue in 2023, and CANCOM, with €1.4 billion in revenue for the same year. This rivalry is further fueled by a fragmented market and a strong trend towards digitalization and AI adoption, with the IT services outsourcing market expected to grow at 7.1% CAGR from 2025 to 2030.

DATAGROUP's CORBOX strategy, offering a unified IT portfolio and fostering long-term customer relationships, directly counters this intense rivalry. Their buy-and-build strategy, including the 2023 acquisition of TARADOR, also intensifies competition by consolidating market share and enhancing capabilities, forcing rivals to adapt.

Strategic investments in AI and cybersecurity are crucial differentiators, as global AI spending is projected to reach hundreds of billions in 2024, and cybersecurity remains a paramount concern for clients. DATAGROUP's focus on these future-oriented technologies is key to maintaining its competitive edge.

| Competitor | 2023 Revenue (approx.) | Key Strategy/Focus |

| Bechtle | €6.4 billion | Broad IT services, strong customer loyalty |

| CANCOM | €1.4 billion | Integrated IT solutions |

| adesso | Not specified (prominent player) | IT consulting and software development |

SSubstitutes Threaten

For many medium to large enterprises, building and maintaining robust in-house IT capabilities presents a significant substitute for outsourcing to companies like DATAGROUP. While the global IT services market is projected to reach $1.5 trillion in 2024, a substantial portion of this spending remains internal.

Companies often choose to keep core IT functions and sensitive data in-house to maintain direct control and security, especially for proprietary systems. This internal development can mitigate risks associated with data breaches or intellectual property leakage, which are key concerns for businesses operating in highly regulated sectors.

Customers increasingly bypass traditional IT outsourcers by directly subscribing to hyperscale public cloud services from giants like AWS, Azure, and Google Cloud. These providers offer unparalleled scalability and a vast service catalog on a pay-as-you-go basis, directly competing with core IT infrastructure outsourcing.

The German market, for instance, has seen a growth in sovereign cloud options, further strengthening the viability of direct adoption for businesses seeking localized, compliant cloud solutions. This trend represents a significant threat as it diminishes the perceived necessity of intermediaries for essential IT functions.

Customers increasingly opt for specialized IT service providers rather than a single, comprehensive vendor like DATAGROUP. This trend allows businesses to cherry-pick best-in-class solutions for specific functions, such as dedicated cybersecurity firms or niche software development houses. For instance, a company might engage a specialized AI development firm for a particular project, bypassing broader IT service offerings.

This unbundling strategy, while offering deep expertise, introduces greater complexity in managing multiple vendor relationships. In 2024, many mid-sized enterprises reported spending up to 15% more on IT management due to the overhead of coordinating several specialized IT partners, a direct consequence of the threat of substitutes.

Off-the-Shelf Software and SaaS Solutions

The rise of off-the-shelf software and Software-as-a-Service (SaaS) solutions presents a significant threat of substitution for companies that traditionally relied on custom development or extensive IT outsourcing. Businesses can now readily access cloud-based platforms for Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), and Human Resources (HR) functions, drastically reducing the need for in-house IT infrastructure or broad outsourcing contracts. This trend allows companies to deploy essential business functionalities more quickly and often at a lower cost.

The increasing accessibility and affordability of SaaS offerings directly substitute for many application management services previously offered by IT outsourcing providers. For example, in 2024, the global SaaS market was projected to reach over $200 billion, demonstrating a clear shift towards readily available solutions. This growth means that a company looking to manage its customer data, for instance, might opt for a SaaS CRM instead of outsourcing the development and maintenance of a custom system.

- SaaS CRM Market Growth: The global CRM market, largely driven by SaaS, is expected to grow significantly, with some estimates placing its value at over $60 billion by 2025.

- ERP Adoption: ERP software, with a substantial portion now delivered via SaaS, continues to see strong adoption across various industries, offering an alternative to bespoke ERP systems.

- HR Tech Innovation: The HR technology sector, heavily influenced by SaaS, provides scalable and often more cost-effective solutions for payroll, recruitment, and employee management compared to traditional outsourced services.

Hybrid IT Models and Consultancies

The rise of hybrid IT models presents a significant threat of substitutes for comprehensive IT service providers like DATAGROUP. Companies are increasingly blending on-premises infrastructure with public and private cloud solutions, seeking greater control and flexibility. This approach allows them to leverage best-of-breed services from various vendors rather than relying on a single, all-encompassing outsourcing partner.

Furthermore, the growing availability of specialized IT consulting firms offers an alternative. Customers can engage these consultancies for strategic planning and project oversight, then manage the actual implementation using in-house teams or different specialized vendors. This fragmented approach can reduce reliance on a single provider for end-to-end solutions.

For instance, a recent survey indicated that 70% of enterprises were actively pursuing hybrid cloud strategies in 2024, seeking to optimize costs and agility. This shift means that clients might opt for a combination of services, potentially bypassing integrated offerings from companies like DATAGROUP.

- Hybrid IT Adoption: 70% of enterprises were pursuing hybrid cloud strategies in 2024, indicating a growing preference for flexible, multi-vendor IT environments.

- Consultancy Role: IT consulting firms are increasingly enabling clients to manage their own implementations, reducing the need for end-to-end outsourcing.

- Customer Control: The desire for greater control over IT infrastructure and spending drives the adoption of substitute solutions.

The threat of substitutes for DATAGROUP is substantial, stemming from the increasing ability of businesses to manage IT functions internally or through readily available cloud services. Direct adoption of hyperscale cloud platforms like AWS, Azure, and Google Cloud bypasses traditional IT outsourcing entirely. Furthermore, the proliferation of specialized IT service providers and off-the-shelf SaaS solutions allows companies to cherry-pick best-in-class functionalities, fragmenting the market and reducing reliance on comprehensive providers.

The trend towards hybrid IT models, blending on-premises and cloud solutions, also empowers businesses to manage their IT more flexibly, often reducing the need for end-to-end outsourcing partnerships. This strategic shift, driven by a desire for greater control and cost optimization, directly challenges the value proposition of integrated IT service providers.

| Substitute Category | Key Characteristics | Impact on DATAGROUP |

|---|---|---|

| In-house IT Capabilities | Direct control, data security, proprietary systems | Reduces demand for outsourced IT management and development |

| Hyperscale Cloud Services (AWS, Azure, Google) | Scalability, pay-as-you-go, vast service catalog | Direct competition for infrastructure and platform services |

| Specialized IT Service Providers | Niche expertise, best-of-breed solutions | Fragmented IT spending, increased vendor management complexity |

| SaaS Solutions (CRM, ERP, HR Tech) | Accessibility, affordability, rapid deployment | Replaces need for custom development and application management outsourcing |

| Hybrid IT Models | Flexibility, blended on-premises/cloud, multi-vendor approach | Decreases reliance on single, comprehensive outsourcing partners |

Entrants Threaten

The significant capital required to establish a robust IT service infrastructure, including data centers and advanced hardware, acts as a formidable barrier for new companies aiming to compete with established players like DATAGROUP. For instance, building a hyperscale data center can cost hundreds of millions of dollars, a sum that deters many potential entrants.

The IT services sector, including companies like DATAGROUP, requires highly specialized knowledge in areas such as cloud infrastructure, advanced cybersecurity protocols, and complex enterprise resource planning systems. New companies entering this market must overcome the significant hurdle of acquiring and keeping personnel with these critical skills.

In 2024, Germany continued to grapple with a notable deficit in qualified IT professionals. This scarcity makes it exceptionally difficult for new entrants to build the robust teams needed to match the capabilities and service offerings of established providers, thereby raising the barrier to entry.

The threat of new entrants in enterprise IT outsourcing is significantly hampered by the difficulty in building customer trust and long-term relationships. Mission-critical systems demand a high degree of confidence, and new players lack the established reputation and proven track record that incumbents like DATAGROUP possess. For instance, in 2024, Gartner predicted that over 70% of IT outsourcing deals would involve existing vendors, highlighting the stickiness of established relationships.

New entrants face a steep climb in establishing the credibility and enduring partnerships essential for securing substantial, complex contracts with medium and large enterprises. DATAGROUP’s extensive history and consistent delivery have fostered deep-seated trust, making it challenging for newcomers to displace them. The average contract length in enterprise IT outsourcing, often spanning 3-5 years or more, further solidifies the advantage of established providers.

Stringent Regulatory Compliance and Security Requirements

Operating within the German IT sector, particularly for services that handle data processing and storage, demands rigorous adherence to data privacy regulations like the GDPR. Robust cybersecurity standards are also non-negotiable, creating a significant hurdle for newcomers.

New entrants face substantial upfront investments in compliance frameworks, obtaining necessary certifications, and building secure infrastructure. For instance, achieving ISO 27001 certification, a common benchmark for information security, can involve considerable time and financial outlay.

- High Compliance Costs: New entrants must allocate significant capital to legal counsel, compliance officers, and the implementation of data protection measures, diverting resources from core business development.

- Technical Expertise Required: Understanding and implementing complex security protocols and data handling procedures necessitates specialized IT talent, which can be scarce and expensive to recruit.

- Certification Hurdles: Obtaining certifications like ISO 27001 or TISAX (Trusted Information Security Assessment Exchange) for the automotive sector, crucial for trust in Germany, requires thorough audits and demonstrable security maturity.

- Evolving Regulatory Landscape: The constant updates and interpretations of regulations like GDPR mean ongoing investment in monitoring and adaptation, adding a continuous cost burden for new players.

Market Consolidation and 'Buy and Build' Strategies

The German IT services market is experiencing significant consolidation, with companies like DATAGROUP actively pursuing 'buy and build' strategies. This approach, which involves acquiring smaller firms to grow, makes it harder for new, independent companies to enter the market organically and gain traction. For instance, in 2023, DATAGROUP completed several acquisitions, integrating new capabilities and customer bases, which effectively increases the competitive barrier for startups.

Instead of building from the ground up, potential new entrants often find themselves as acquisition targets. This trend means that innovation from smaller firms is frequently absorbed by larger, established players, rather than fostering new, independent competition. The capital and operational scale required to challenge consolidated entities are substantial, making organic entry a less viable path.

- Market Consolidation: The German IT services sector saw a notable increase in M&A activity in 2023, with IT service providers being prime targets.

- 'Buy and Build' Strategy: DATAGROUP's consistent acquisition of complementary businesses strengthens its market position and deters new organic entrants.

- Acquisition Targets: Innovative startups in niche IT areas are increasingly attractive acquisition targets for larger players seeking to expand their service portfolios.

- Barriers to Entry: The need for significant scale and market penetration makes it challenging for new, independent IT service companies to compete effectively against consolidated giants.

The threat of new entrants for DATAGROUP is relatively low due to high capital requirements for infrastructure, the need for specialized talent, and established customer trust. In 2024, the scarcity of IT professionals in Germany further compounds these barriers, making it difficult for newcomers to build competitive teams. Additionally, stringent data privacy regulations and ongoing market consolidation through acquisitions by established players like DATAGROUP create significant hurdles for new companies seeking to enter the enterprise IT outsourcing market.

| Barrier | Description | Impact on New Entrants | 2024 Relevance |

|---|---|---|---|

| Capital Requirements | Building data centers and IT infrastructure costs hundreds of millions. | Deters many potential entrants. | High, as infrastructure costs remain substantial. |

| Specialized Talent | Need for expertise in cloud, cybersecurity, ERP systems. | Acquiring and retaining skilled personnel is a major challenge. | Very High; Germany faced a significant IT professional deficit in 2024. |

| Customer Trust & Relationships | Mission-critical systems require high confidence; established players have proven track records. | New entrants lack reputation and proven delivery. | High; Gartner predicted over 70% of IT outsourcing deals in 2024 involved existing vendors. |

| Regulatory Compliance | Adherence to GDPR, cybersecurity standards, and certifications (e.g., ISO 27001). | Requires significant upfront investment and ongoing adaptation. | High; compliance costs and complexity remain a constant challenge. |

| Market Consolidation | DATAGROUP's 'buy and build' strategy and M&A activity. | Makes organic entry and gaining traction harder. | High; increased M&A in 2023 strengthened established players. |

Porter's Five Forces Analysis Data Sources

Our DATAGROUP Porter's Five Forces analysis is built upon a comprehensive foundation of data, incorporating financial statements, analyst reports, and industry-specific market research. This blend of quantitative and qualitative information allows for a robust assessment of competitive intensity.