Daiwa Securities Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Daiwa Securities Group's future. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Gain a competitive edge by understanding these external forces—download the full report now.

Political factors

The Japanese government, via the Financial Services Agency (FSA), is actively fostering financial market expansion and innovation. Recent deregulatory moves are intended to boost bank profitability and broaden their non-core business lines, potentially benefiting Daiwa Securities’ varied services.

Furthermore, programs like the new NISA (Nippon Individual Savings Account) are specifically designed to encourage Japanese households to move from saving to investing. This initiative directly bolsters brokerage and asset management sectors where Daiwa operates. For instance, the new NISA system, which began in 2024, aims to significantly increase household investment, with projections suggesting a substantial inflow of new capital into the Japanese equity markets.

Global geopolitical risks, such as ongoing conflicts and trade disputes, create significant uncertainty in financial markets. For instance, the continued geopolitical tensions in Eastern Europe and the Middle East have contributed to heightened market volatility throughout 2024, impacting investor sentiment and the performance of global financial institutions.

Daiwa Securities Group, with its extensive international presence, is particularly exposed to these geopolitical shifts. Fluctuations in international trade relations and the potential imposition of new sanctions can directly affect its investment banking and trading operations, influencing cross-border deal flow and market access. The firm's ability to navigate these complex political landscapes is a key determinant of its operational stability and ability to maintain investor trust.

Japan's financial regulators are actively shaping the digital asset and fintech landscape, with proposed changes in 2025 aiming to classify cryptocurrencies as 'financial assets' for tax purposes. This move, alongside the introduction of new brokerage categories for crypto asset transactions, signals a more structured approach to digital finance.

These evolving regulations present significant opportunities for Daiwa Securities Group to expand its digital offerings and services. However, the company must also navigate the complexities of compliance with new frameworks for stablecoins and other electronic payment instruments, ensuring adherence to the evolving digital financial ecosystem.

Corporate Governance Reforms

The Japanese government's ongoing commitment to corporate governance reforms, highlighted in the 2024 Annual Economic and Fiscal Report, directly impacts Daiwa Securities. These initiatives mandate stronger board independence, clearer executive accountability, and increased shareholder participation.

These reforms aim to boost corporate value and make Japanese companies more attractive to investors, both domestically and internationally. For Daiwa Securities, this means a continuous need to align its own governance practices with these evolving national standards to uphold investor confidence.

- Enhanced Board Independence: Companies are encouraged to increase the proportion of independent directors on their boards.

- Executive Accountability: Clearer frameworks are being implemented to hold executives responsible for company performance and ethical conduct.

- Shareholder Engagement: Reforms promote more active dialogue and engagement between companies and their shareholders.

Government Initiatives for Asset Management Nation

Japan's government is actively pursuing a strategy to become an 'asset management nation,' implementing policies designed to foster the growth and stability of the asset management sector. A key element of this strategy involves enhancing individual savings vehicles. For instance, reforms have been introduced to increase the contribution limits for iDeCo (individual-type defined contribution pension plans) and extend the eligible participation age. These changes are intended to encourage longer-term savings and investment behavior among the Japanese population.

These government-led initiatives directly benefit Daiwa Securities Group, particularly its asset management division. By making it more attractive and accessible for individuals to save and invest over the long term, these policies are expected to drive sustained inflows into investment funds. This creates a more favorable environment for Daiwa to expand its asset management business and achieve consistent growth.

Specific policy actions include:

- Increased iDeCo Contribution Limits: The government has raised the annual contribution limits for iDeCo, allowing individuals to save more tax-advantaged funds for retirement.

- Extended iDeCo Participation Age: The maximum age for participating in iDeCo has been extended, encouraging broader and longer-term engagement with retirement savings.

- Promoting NISA Expansion: While not exclusively iDeCo, the broader push for asset management nation status also supports the expansion and utilization of NISA (Nippon Individual Savings Account) accounts, further incentivizing investment.

The Japanese government's push to become an asset management nation, with policy enhancements like increased iDeCo contribution limits and extended participation ages, directly fuels Daiwa Securities' asset management sector. These initiatives, designed to boost long-term individual savings and investment, are projected to drive sustained inflows into investment funds, creating a more favorable operating environment for Daiwa.

Furthermore, ongoing corporate governance reforms in Japan, emphasizing board independence and executive accountability as highlighted in the 2024 Annual Economic and Fiscal Report, necessitate Daiwa Securities to continually align its own practices to maintain investor confidence.

The evolving regulatory landscape for digital assets, with proposed 2025 tax classifications for cryptocurrencies, presents both opportunities for Daiwa to expand digital services and compliance challenges with new frameworks for stablecoins and electronic payments.

Global geopolitical instability, evidenced by market volatility throughout 2024 due to conflicts in Eastern Europe and the Middle East, directly impacts Daiwa's international operations by influencing investor sentiment and cross-border deal flow.

What is included in the product

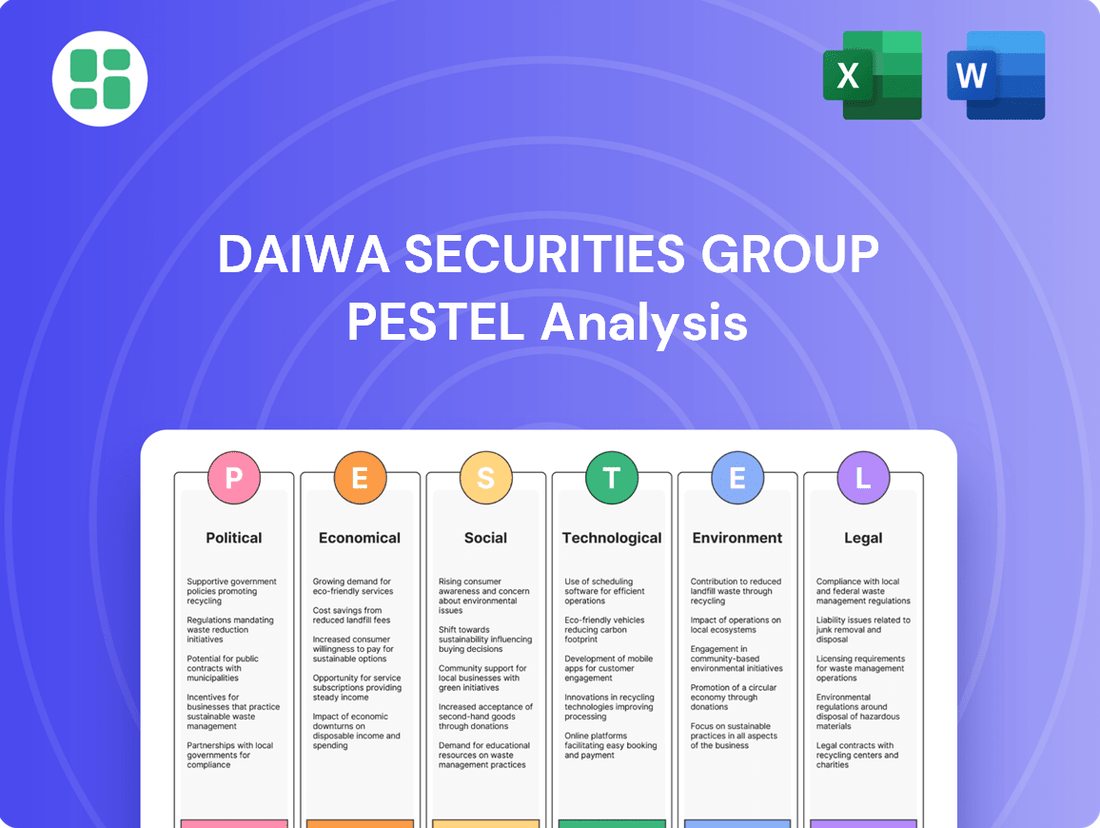

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Daiwa Securities Group, providing a comprehensive overview of the external landscape.

It offers strategic insights into how these macro-environmental forces create both challenges and avenues for growth for Daiwa Securities Group.

A Daiwa Securities Group PESTLE analysis acts as a pain point reliever by providing a structured framework to proactively identify and address external challenges, enabling more informed strategic decision-making.

This analysis serves as a pain point reliever by offering a clear, concise overview of the external landscape, allowing Daiwa Securities to anticipate and mitigate potential risks before they impact operations or profitability.

Economic factors

Japan's economic landscape is shifting significantly as the Bank of Japan moved away from its negative interest rate policy, raising its policy rate to a 17-year high of 0.1% in March 2024, with further increases anticipated. This transition from deflation to a more normalized interest rate environment directly affects Daiwa Securities Group's core businesses. Higher rates can increase borrowing costs for Daiwa's clients, potentially impacting loan demand and profitability in its banking and lending segments.

Conversely, this new interest rate regime could bolster returns on Daiwa's fixed-income investments and potentially drive demand for certain investment products that benefit from higher yields. The group's ability to navigate this evolving rate environment, balancing increased funding costs with new investment opportunities, will be crucial for its financial performance throughout 2024 and 2025.

Japan's economy is experiencing a gradual recovery, with recent data indicating a move away from prolonged deflation. In Q1 2024, Japan's GDP grew by an annualized 1.5%, signaling a positive trend. This economic upturn, marked by rising corporate profits and increased capital expenditure, is expected to boost household incomes and stimulate investment across various sectors.

The shift towards sustained growth and the potential exit from deflation are favorable for Daiwa Securities Group. Increased disposable income and a more robust investment climate directly benefit Daiwa's core businesses, including retail brokerage services and investment banking operations, as individuals and institutions are more likely to engage in financial activities.

Japanese households hold a significant amount of financial assets, projected to keep growing. Government programs like the new NISA are actively encouraging this shift from traditional savings to investment, aiming to boost domestic capital markets.

This evolving landscape presents a prime opportunity for Daiwa Securities to broaden its wealth management services. By providing a wider array of investment products and tailored financial advice, Daiwa can cater to the increasing number of retail investors looking to grow their wealth.

As of March 2024, Japanese household financial assets stood at approximately ¥2,090 trillion. The new NISA, launched in January 2024, aims to accelerate this transition, with many expecting a substantial portion of these assets to flow into investment vehicles.

Global Market Volatility

Global financial markets in 2024 and early 2025 are navigating a complex landscape marked by the persistent threat of economic slowdowns and the potential resurgence of inflation. This inherent volatility directly impacts Daiwa Securities, particularly its wholesale and investment banking operations, which are sensitive to shifts in trading volumes and asset valuations.

The interconnectedness of global markets means that events like geopolitical tensions or unexpected policy shifts can trigger widespread turbulence. For Daiwa, this translates into fluctuating revenues from its trading desks and potential impairments on its investment portfolios. For instance, the MSCI World Index experienced significant swings throughout 2023 and into 2024, reflecting these underlying economic uncertainties.

- Economic Slowdowns: Projections for global GDP growth in 2024 have been revised by various institutions, with many indicating a moderation compared to previous years, increasing the risk of reduced business activity and investment.

- Inflationary Pressures: While inflation has shown signs of easing in some major economies, core inflation remains a concern, potentially leading central banks to maintain higher interest rates, which can dampen market liquidity and asset prices.

- Market Turbulence: Events such as the banking sector stress in early 2023, though largely contained, highlighted the fragility of financial systems and the potential for rapid contagion, impacting investor sentiment and market stability.

- Impact on Trading: Increased market volatility can lead to both opportunities and risks for Daiwa's trading businesses; while wider bid-ask spreads can boost revenue, sharp downturns can result in significant trading losses.

Competition and Fee Compression in Asset Management

The Japanese asset management landscape is intensifying, forcing firms like Daiwa Securities Group to confront significant fee compression. This competitive pressure necessitates a strong focus on demonstrating value and developing innovative products to secure and keep clients. For instance, as of early 2024, average management fees for actively managed Japanese equity funds were reportedly around 0.8%, a figure that has been steadily declining.

A notable trend fueling this fee compression is the growing preference for passive investment strategies. Investors are increasingly opting for lower-cost index funds and ETFs, partly due to a recognition of the difficulty active managers face in consistently beating market benchmarks. In 2023, assets in Japanese ETFs grew by approximately 15%, indicating a clear shift in investor sentiment.

- Increased Competition: The Japanese market sees numerous domestic and international players vying for assets, driving down management fees.

- Fee Compression: Average management fees for active funds are under pressure, forcing managers to justify their costs through performance and unique offerings.

- Shift to Passive: A growing investor base is moving towards lower-cost passive strategies like ETFs and index funds.

- Performance Justification: Asset managers must clearly articulate their alpha generation capabilities to retain clients in an increasingly fee-sensitive environment.

Japan's economic transition away from deflation, marked by the Bank of Japan's policy rate hike to 0.1% in March 2024, presents both challenges and opportunities for Daiwa Securities Group. While higher rates could increase borrowing costs, they also offer potential for improved returns on fixed-income investments. The ongoing economic recovery, evidenced by a 1.5% annualized GDP growth in Q1 2024, coupled with rising household incomes and increased capital expenditure, is a positive signal for Daiwa's retail brokerage and investment banking arms.

The substantial ¥2,090 trillion in Japanese household financial assets, with the new NISA program encouraging a shift towards investment, positions Daiwa to expand its wealth management services. However, global economic slowdowns and persistent inflation in 2024-2025 create market volatility, impacting Daiwa's trading revenues and investment portfolios. Intensifying competition and a trend towards passive investing in Japan are driving fee compression, forcing firms like Daiwa to focus on performance and unique offerings.

| Economic Factor | 2024/2025 Outlook | Impact on Daiwa Securities Group |

| Monetary Policy Shift | BOJ policy rate at 0.1% (March 2024), potential further increases. | Higher borrowing costs for clients, but potential for increased fixed-income returns. |

| Economic Growth | Q1 2024 GDP growth annualized 1.5%; gradual recovery expected. | Boosts retail brokerage and investment banking; increased disposable income stimulates financial activity. |

| Household Financial Assets | ¥2,090 trillion (March 2024); NISA program encouraging investment. | Opportunity to expand wealth management services and attract retail investors. |

| Global Economic Conditions | Slowdowns and inflation concerns persist, leading to market volatility. | Impacts trading volumes and asset valuations, creating both risks and opportunities for trading desks. |

| Asset Management Competition | Intensifying competition and shift to passive investing (e.g., 15% ETF asset growth in 2023). | Fee compression necessitates focus on value demonstration and product innovation. |

What You See Is What You Get

Daiwa Securities Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Daiwa Securities Group PESTLE Analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Daiwa's strategic landscape.

Sociological factors

Japan's rapidly aging population presents a significant dynamic for Daiwa Securities. By 2025, it's projected that over 30% of Japan's population will be aged 65 or older, a demographic shift that directly influences the demand for financial products. This growing segment of older adults requires specialized services focused on retirement planning, wealth preservation, and intergenerational wealth transfer.

Daiwa Securities needs to adapt its product suite to meet these evolving needs. This includes developing more sophisticated long-term investment strategies and robust inheritance planning solutions. For instance, the increasing interest in annuities and reverse mortgages reflects the financial priorities of this demographic, with the market for such products expected to grow substantially in the coming years.

Investor preferences are shifting, with a growing demand for personalized financial advice and a keen interest in environmental, social, and governance (ESG) factors. For instance, in Japan, ESG investment funds saw significant inflows, with assets under management in sustainable funds reaching approximately ¥30 trillion by the end of 2023, indicating a strong trend.

Simultaneously, initiatives like Japan's revamped NISA (Nippon Individual Savings Account) program, which began in 2024, are designed to boost financial literacy and encourage more individuals to invest. This program aims to democratize investing, potentially bringing millions of new retail investors into the market, who may require tailored educational resources and simpler investment products.

Daiwa Securities Group must therefore refine its client engagement models and product offerings to cater to this more informed and values-driven investor base. Adapting to these evolving preferences and knowledge levels is crucial for maintaining market share and fostering long-term client relationships.

Societal expectations are increasingly prioritizing environmental, social, and governance (ESG) factors. This growing consciousness is directly influencing investment strategies, pushing financial institutions like Daiwa Securities Group to integrate these principles. For instance, by the end of 2023, global sustainable investment assets under management reached an estimated $37.5 trillion, a significant increase reflecting this societal shift.

This heightened ESG awareness compels financial firms to adapt their offerings. Daiwa, like its peers, is responding by embedding ESG criteria into its investment processes and developing specialized sustainable investment products to meet this demand. This proactive approach is crucial for maintaining competitiveness and aligning with evolving investor values.

Workforce Trends and Talent Acquisition

Daiwa Securities Group, like many in financial services, is navigating significant workforce shifts. The demand for specialized expertise in areas such as FinTech, advanced data analytics, and Environmental, Social, and Governance (ESG) investing is rapidly increasing. This necessitates a proactive approach to talent acquisition and development to ensure Daiwa remains at the forefront of innovation and client service.

Attracting and retaining skilled professionals is paramount for Daiwa's competitive advantage. The industry is experiencing a talent crunch, particularly for roles requiring digital proficiency and a deep understanding of emerging financial technologies. For instance, a 2024 report indicated a 25% year-over-year increase in demand for cybersecurity analysts within financial institutions, highlighting the critical need for specialized IT talent.

Daiwa's strategy must focus on creating an environment that fosters continuous learning and career growth. Key considerations include:

- Upskilling Existing Workforce: Investing in training programs for current employees to adapt to new technologies and market demands, potentially addressing the 15% skills gap identified in financial services by some industry surveys.

- Targeted Recruitment: Actively seeking out individuals with proven expertise in FinTech, AI, and sustainable finance to bolster key departments.

- Employee Retention Initiatives: Implementing competitive compensation, flexible work arrangements, and robust professional development opportunities to reduce turnover, which can cost companies up to 1.5-2 times an employee's annual salary.

- Partnerships with Educational Institutions: Collaborating with universities to cultivate a pipeline of future talent with relevant skill sets.

Digital Adoption by Consumers

Consumers in Japan are increasingly embracing digital platforms and cashless transactions, fundamentally altering how financial services are accessed and utilized. This shift necessitates that Daiwa Securities Group proactively strengthens its digital infrastructure, including mobile applications and online portals, to align with evolving client demands for seamless and efficient financial engagement.

The growing preference for digital interactions is evident in various statistics. For instance, by the end of 2023, Japan's e-commerce penetration rate reached approximately 60%, with a significant portion of these transactions occurring via mobile devices. Furthermore, the adoption of cashless payments, including credit cards and digital wallets, has seen a substantial rise, projected to account for over 60% of all consumer payments by 2025, up from around 30% in 2020.

- Digital Engagement: Over 80% of Japanese consumers now use smartphones for online activities, including financial management.

- Cashless Growth: The value of cashless transactions in Japan is expected to surpass ¥100 trillion by 2025.

- Mobile Banking: Mobile banking adoption in Japan has surged, with over 70% of bank customers utilizing mobile apps for their banking needs in 2024.

- Online Investment: A growing number of younger investors are turning to online platforms for stock trading and investment advice, with online brokerage accounts increasing by 15% annually.

Societal expectations are increasingly prioritizing environmental, social, and governance (ESG) factors, directly influencing investment strategies and compelling financial institutions like Daiwa Securities Group to integrate these principles. By the end of 2023, global sustainable investment assets under management reached an estimated $37.5 trillion, a significant increase reflecting this societal shift.

This heightened ESG awareness compels financial firms to adapt their offerings, with Daiwa responding by embedding ESG criteria into its investment processes and developing specialized sustainable investment products to meet this demand. This proactive approach is crucial for maintaining competitiveness and aligning with evolving investor values.

Japan's rapidly aging population, with over 30% projected to be 65+ by 2025, creates a demand for specialized financial services like retirement planning and wealth preservation. Furthermore, the revamped NISA program, starting in 2024, aims to boost financial literacy and attract new retail investors, requiring tailored educational resources.

Consumers are embracing digital platforms, with Japan's e-commerce penetration reaching about 60% by late 2023, and cashless transactions projected to exceed 60% by 2025. This necessitates Daiwa strengthening its digital infrastructure, including mobile applications, to meet client demands for seamless engagement.

| Sociological Factor | Trend/Impact | Data Point (2023-2025) |

|---|---|---|

| Aging Population | Increased demand for retirement and wealth preservation services | Over 30% of Japan's population aged 65+ by 2025 |

| ESG Focus | Shift towards sustainable investment products and strategies | Global sustainable investment assets reached $37.5 trillion by end of 2023 |

| Digital Adoption | Growing preference for online and cashless financial transactions | Cashless transactions projected to exceed 60% of consumer payments by 2025 |

| Financial Literacy Initiatives | Potential influx of new retail investors requiring tailored resources | NISA program revamp in 2024 to boost individual investing |

Technological factors

The Japanese financial sector is rapidly embracing digital transformation, with significant investments in AI, machine learning, and blockchain technologies. This shift is driven by a need for enhanced efficiency and personalized customer experiences.

Daiwa Securities Group must prioritize investments in its technology infrastructure and robust data analytics capabilities. This is crucial to remain competitive, streamline operations, and offer tailored services in an increasingly digital landscape, particularly as Japan pushes for greater cashless transaction adoption, aiming for a 35% cashless payment ratio by 2025.

Daiwa Securities, like all financial institutions, faces escalating cybersecurity threats. Sophisticated attacks such as ransomware, phishing, and distributed denial-of-service (DDoS) are becoming more frequent, intense, and complex. These threats target sensitive client data, aiming for financial disruption and reputational damage.

To counter these risks, Daiwa Securities must continually fortify its defenses. This includes significant investment in advanced, AI-powered security tools to detect and respond to threats in real-time. Furthermore, robust and ongoing employee training is crucial to build a strong human firewall against social engineering tactics.

The financial services sector experienced a significant surge in cyberattacks in 2023 and early 2024. For instance, reports indicate a substantial increase in ransomware attacks targeting financial firms, with average recovery costs reaching millions of dollars. Protecting client data and maintaining operational integrity are paramount for Daiwa Securities' continued success and client trust.

Daiwa Securities Group is actively integrating automation and AI to refine its operational efficiency and elevate client interactions. This technological shift is particularly impactful in asset management, where these tools are enabling real-time reporting and sophisticated data analysis.

By harnessing AI, Daiwa can develop highly personalized investment strategies tailored to individual client needs. Furthermore, AI significantly bolsters risk management capabilities and streamlines back-office functions, leading to cost savings and reduced error rates. For instance, AI-powered fraud detection systems can process vast datasets to identify anomalies far quicker than manual methods.

However, the increasing reliance on AI also introduces new challenges, notably the heightened risk of AI-driven cyber threats. Daiwa must therefore invest in robust cybersecurity measures to safeguard sensitive client data and maintain operational integrity in an evolving digital landscape.

Data Analytics and Big Data

The capacity to gather, dissect, and comprehend vast amounts of data is increasingly vital for grasping market shifts, understanding how clients act, and assessing potential risks. Daiwa Securities can leverage sophisticated data analytics to provide personalized financial guidance, refine investment approaches, and uncover emerging avenues for growth.

For instance, in 2024, financial institutions globally are investing heavily in AI and machine learning, with some reports indicating that over 60% of financial services firms are actively implementing big data strategies to enhance customer insights and operational efficiency. Daiwa Securities' focus on data analytics directly addresses this trend, enabling more precise risk management and the development of hyper-personalized investment products.

Key benefits for Daiwa Securities include:

- Enhanced Market Prediction: Utilizing big data to identify subtle market trends and predict future movements with greater accuracy.

- Personalized Client Services: Offering bespoke financial advice and product recommendations based on individual client data and behavior.

- Operational Efficiency: Streamlining internal processes and improving decision-making through data-driven insights.

- Risk Mitigation: Proactively identifying and managing financial risks by analyzing large datasets for anomalies and patterns.

Cloud Computing Adoption

Cloud computing adoption is a significant technological factor for Daiwa Securities Group. Financial institutions are increasingly turning to the cloud for its scalability, efficiency gains, and enhanced security capabilities. By migrating to cloud-based solutions, Daiwa can streamline its IT infrastructure, bolster data protection measures, and accelerate the rollout of innovative digital services. However, this transition necessitates diligent oversight of third-party vendor risks.

The global cloud computing market is experiencing robust growth, with projections indicating continued expansion. For instance, the worldwide cloud computing market size was valued at approximately $610 billion in 2023 and is expected to reach over $1.3 trillion by 2028, growing at a compound annual growth rate (CAGR) of around 17.4% during this period. This trend underscores the strategic importance for firms like Daiwa to leverage cloud technologies for competitive advantage.

- Scalability and Efficiency: Cloud platforms allow financial firms to dynamically adjust computing resources, leading to cost savings and improved operational agility.

- Enhanced Security: Major cloud providers invest heavily in security, often offering advanced threat detection and data encryption capabilities that can surpass on-premises solutions.

- Digital Service Acceleration: Cloud infrastructure facilitates the rapid development, testing, and deployment of new financial products and customer-facing applications.

- Vendor Risk Management: Daiwa must implement rigorous protocols for selecting and managing cloud service providers to ensure data integrity and compliance.

Daiwa Securities is actively integrating automation and AI to improve operations and client interactions, particularly in asset management, enabling real-time reporting and sophisticated data analysis.

AI allows for personalized investment strategies, enhanced risk management, and streamlined back-office functions, with AI-powered fraud detection systems processing vast datasets to identify anomalies efficiently.

The company's focus on data analytics aligns with a global trend where over 60% of financial services firms in 2024 are implementing big data strategies for customer insights and operational efficiency, enabling more precise risk management and hyper-personalized products.

Cloud computing adoption offers scalability, efficiency, and enhanced security, facilitating faster digital service deployment, though it requires diligent oversight of third-party vendor risks.

| Technology Area | Key Initiatives/Impacts for Daiwa | Industry Trend/Data (2023-2025) |

|---|---|---|

| AI & Machine Learning | Personalized investment strategies, enhanced risk management, fraud detection | 60%+ financial firms implementing big data strategies (2024) |

| Data Analytics | Improved customer insights, operational efficiency, precise risk management | Global investment in AI/ML for financial services |

| Cybersecurity | Fortifying defenses against ransomware, phishing, DDoS; AI-powered threat detection | Significant surge in cyberattacks on financial firms (2023-2024) |

| Cloud Computing | Scalability, efficiency, enhanced security, faster digital service deployment | Global cloud market ~$610B (2023) to $1.3T+ (2028), CAGR ~17.4% |

Legal factors

Daiwa Securities Group's operations are heavily regulated by Japan's Financial Instruments and Exchange Act (FIEA). This law dictates everything from how they trade securities and manage assets to their underwriting and brokerage services.

Staying compliant with FIEA is paramount. This involves rigorous adherence to disclosure rules, investor protection measures, and maintaining proper licensing. For instance, in fiscal year 2023, Daiwa Securities reported a net revenue of ¥1.2 trillion, underscoring the scale of operations requiring meticulous regulatory oversight.

Japanese authorities are intensifying their oversight of anti-money laundering (AML) and counter-terrorist financing (CFT) activities, with financial institutions like Daiwa Securities Group needing to adhere to more stringent guidelines. This increased scrutiny means Daiwa must ensure its internal controls and systems are exceptionally robust to prevent illicit financial flows, facing potentially more rigorous inspections and the possibility of further regulatory tightening in the coming years.

Daiwa Securities Group's operations are significantly shaped by Japan's Act on the Protection of Personal Information (APPI). Compliance is crucial given the increasing volume of client data handled digitally. Failure to adhere to these regulations can result in substantial fines and damage to Daiwa's reputation.

The company must maintain robust data governance frameworks to ensure the secure handling and privacy of its clients' sensitive information. This includes implementing strong cybersecurity measures and transparent data processing policies. Adapting to evolving global privacy standards, such as GDPR, is also a key consideration to avoid legal repercussions.

Corporate Sustainability Reporting Directives (CSRD) and ESG Regulations

Daiwa Securities Group, like many global financial institutions, faces evolving legal landscapes driven by sustainability mandates. The European Union's Corporate Sustainability Reporting Directive (CSRD) and its associated European Sustainability Reporting Standards (ESRS) are significantly influencing reporting expectations, even for companies with operations or significant business dealings in Europe. This means Daiwa must adapt its disclosure practices to meet these rigorous standards, which aim for greater transparency and comparability in environmental, social, and governance (ESG) matters.

Japan's own commitment to enhancing sustainability disclosures, aligning with international frameworks like the International Sustainability Standards Board (ISSB), further underscores the need for Daiwa's preparedness. By March 2025, Japan's regulatory environment will fully integrate ISSB standards, requiring companies to provide more comprehensive and standardized ESG information. This global push towards enhanced ESG reporting necessitates that Daiwa not only prepares for these new requirements but also strengthens its internal processes for data collection, assurance, and reporting to ensure compliance and maintain stakeholder trust.

The implications for Daiwa are multifaceted:

- Mandatory disclosures: Increased regulatory pressure to report on a wider range of ESG topics, including climate change, biodiversity, and social impact, under frameworks like ESRS and ISSB.

- Assurance requirements: A growing need for independent assurance of ESG data, demanding robust internal controls and potentially higher audit costs.

- Competitive advantage: Proactive adaptation to these regulations can position Daiwa as a leader in sustainable finance, attracting investors and clients who prioritize ESG performance.

Regulatory Framework for Digital Currencies and Stablecoins

Japan's Payment Services Act is actively being updated to better define electronic payment instruments, including stablecoins, and to establish registration requirements for related intermediary services. This evolving legal landscape, which may introduce new licensing for crypto-asset intermediaries, necessitates that Daiwa Securities Group continually refine its legal and compliance approaches for any engagement in digital asset activities.

The Financial Services Agency (FSA) of Japan has been proactive in this area. For instance, in 2023, the FSA continued its consultations on draft amendments to the Payment Services Act and the Financial Instruments and Exchange Act, aiming to create a more robust framework for digital assets. These discussions are crucial for entities like Daiwa as they navigate the complexities of offering or supporting digital currency services. The regulatory focus is on consumer protection and preventing illicit activities, which directly impacts how financial institutions can operate within the digital asset space.

- Evolving Legal Status: Japan's Payment Services Act is adapting to clarify the legal standing of digital currencies and stablecoins.

- Registration Systems: New rules are being implemented for registration of intermediary services related to electronic payment instruments.

- New Licenses: The potential introduction of specific crypto-asset intermediary licenses requires strategic adaptation by Daiwa.

- Compliance Adaptation: Daiwa must continuously update its legal and compliance strategies to align with these dynamic regulatory changes.

Daiwa Securities Group operates under stringent Japanese financial regulations, primarily the Financial Instruments and Exchange Act (FIEA), which governs trading, asset management, and brokerage services. The company's commitment to FIEA compliance, including disclosure and investor protection, is critical, especially given its substantial ¥1.2 trillion net revenue in fiscal year 2023.

The firm must also navigate increasingly strict anti-money laundering (AML) and counter-terrorist financing (CFT) guidelines, necessitating robust internal controls to prevent illicit financial flows.

Furthermore, Daiwa faces evolving legal frameworks concerning data privacy, notably Japan's Act on the Protection of Personal Information (APPI), and global standards like GDPR, requiring secure data handling and transparent policies to avoid significant penalties.

Sustainability reporting mandates, such as the EU's CSRD and Japan's adoption of ISSB standards by March 2025, are compelling Daiwa to enhance its ESG disclosures, impacting reporting costs and potentially offering a competitive advantage.

The legal landscape for digital assets is also transforming, with Japan's Payment Services Act being updated to define electronic payment instruments and introduce registration requirements for intermediaries, prompting Daiwa to adapt its compliance strategies for digital currency activities.

Environmental factors

Investor appetite for Environmental, Social, and Governance (ESG) integrated products is surging, with significant demand coming from major players like Japan's Government Pension Investment Fund (GPIF) and increasingly from younger demographics. This trend underscores a fundamental shift in how capital is allocated, prioritizing sustainability alongside financial returns. For Daiwa Securities, this translates into a clear imperative to broaden its suite of sustainable investment options, such as green bonds and specialized ESG funds, to capture this expanding market segment.

Climate change poses significant physical risks, such as increased frequency of extreme weather events impacting Daiwa's physical assets and client portfolios. Transition risks, driven by evolving regulations and market preferences for sustainability, also demand strategic adaptation. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework is increasingly adopted globally, with many financial institutions, including those Daiwa competes with, enhancing their climate risk disclosures.

Daiwa Securities Group must proactively assess and transparently disclose its climate-related financial risks across its investment and operational activities. This includes evaluating the potential impact of physical and transition risks on its balance sheet and client assets.

Simultaneously, Daiwa can capitalize on opportunities by financing green projects and supporting the global shift towards a low-carbon economy. The sustainable finance market is rapidly expanding, with green bond issuance reaching record levels; for example, global green bond issuance was projected to exceed $1 trillion in 2024, presenting a substantial avenue for growth and revenue generation for financial intermediaries like Daiwa.

Global and domestic regulators are intensifying scrutiny on financial institutions regarding sustainability reporting. This trend is pushing firms like Daiwa Securities Group to adopt more transparent and comprehensive disclosures on their environmental impact and sustainability efforts.

Japan's Sustainability Standards Board (SSBJ) is set to integrate the International Sustainability Standards Board (ISSB) standards by March 2025. This move signifies a significant step towards aligning Japanese sustainability disclosures with global benchmarks, requiring Daiwa to adapt its reporting frameworks to meet these evolving international expectations.

Corporate Social Responsibility (CSR) and Reputation

Societal expectations for corporate responsibility are increasingly focused on environmental stewardship, directly impacting how companies like Daiwa Securities Group are perceived. Daiwa's proactive commitment to environmental sustainability, going beyond basic regulatory compliance, significantly bolsters its brand reputation. This commitment also makes the company more attractive to investors who prioritize ethical practices and to potential employees seeking to align with environmentally conscious organizations.

Daiwa's engagement in initiatives aimed at supporting decarbonization and biodiversity can demonstrably enhance its standing in the market. For instance, in its fiscal year ending March 2024, Daiwa Securities Group reported progress on its sustainability initiatives, including efforts to reduce its own operational carbon footprint. This focus on tangible environmental action is crucial for building trust and demonstrating genuine commitment.

- Growing ESG Investment: The global sustainable investment market is expanding rapidly, with assets projected to reach $50 trillion by 2025, highlighting the financial imperative for strong CSR.

- Carbon Reduction Goals: Daiwa Securities Group has set targets for reducing its greenhouse gas emissions, aligning with global efforts to combat climate change.

- Biodiversity Initiatives: The company is exploring and implementing projects that contribute to the preservation and restoration of biodiversity, recognizing its importance for long-term ecological health.

- Stakeholder Engagement: Strong CSR performance fosters positive relationships with a wide range of stakeholders, from customers and employees to regulators and the broader community.

Green Finance Initiatives and Transition Bonds

Japan is making significant strides in green finance, aiming to attract substantial investments towards its net-zero goals. A key element of this strategy is the introduction of sovereign transition bonds, designed to fund the transition to a carbon-neutral economy.

Daiwa Securities Group is well-positioned to leverage these environmental shifts. Through its robust investment banking and asset management capabilities, Daiwa can actively participate in and facilitate these green finance initiatives, playing a crucial role in building a more sustainable financial landscape.

- Sovereign Transition Bonds: Japan's commitment to a net-zero economy is underscored by its issuance of transition bonds, a financial instrument specifically designed to support industries and projects undergoing decarbonization. This initiative aims to channel significant capital into sustainable development.

- Green Investment Targets: The Japanese government has set ambitious targets for attracting green investments, signaling a strong policy push towards environmental sustainability and creating a favorable environment for green financial products.

- Daiwa's Role: Daiwa Securities can capitalize on these trends by underwriting transition bonds, offering green investment funds, and advising clients on sustainable finance strategies, thereby contributing to the growth of the green finance market.

Daiwa Securities Group is navigating an evolving environmental landscape, shaped by increasing investor demand for ESG-aligned products and a global push towards sustainability. The company's strategic response involves expanding its offerings in areas like green bonds and specialized ESG funds to meet this growing market. This proactive approach is crucial as regulatory frameworks, such as the TCFD, become more stringent, requiring enhanced climate risk disclosures.

Japan's commitment to a net-zero economy, evidenced by initiatives like sovereign transition bonds, presents significant opportunities for Daiwa. The company can leverage its expertise to facilitate green finance, underwrite transition bonds, and advise clients on sustainable strategies, thereby playing a key role in the burgeoning green finance market.

Daiwa's own sustainability efforts, including carbon footprint reduction targets and biodiversity initiatives, are vital for enhancing its brand reputation and attracting ethically-minded investors and talent. These actions demonstrate a tangible commitment to environmental stewardship, fostering trust and aligning the company with global sustainability goals.

| Environmental Factor | Impact on Daiwa Securities Group | Opportunities/Challenges |

|---|---|---|

| Investor Demand for ESG | Surging investor appetite for ESG integrated products. | Opportunity to expand sustainable investment offerings; imperative to capture growing market segment. |

| Climate Change Risks | Physical risks (extreme weather) and transition risks (regulatory changes). | Need for robust climate risk assessment and disclosure; adaptation to evolving market preferences. |

| Green Finance Initiatives | Japan's focus on net-zero goals and transition bonds. | Potential to facilitate green finance, underwrite bonds, and offer sustainable investment funds. |

| Regulatory Landscape | Increased scrutiny on sustainability reporting; alignment with ISSB standards. | Requirement for transparent and comprehensive environmental disclosures; adaptation of reporting frameworks. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Daiwa Securities Group is meticulously constructed using data from reputable financial news outlets, official government publications, and leading economic research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the group.