Daiwa Securities Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Daiwa Securities Group navigates a complex financial landscape, facing moderate threats from new entrants and intense rivalry among established players. Understanding the subtle interplay of buyer power and the looming threat of substitutes is crucial for strategic positioning.

The complete report reveals the real forces shaping Daiwa Securities Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Daiwa Securities Group, like many in financial services, depends heavily on specialized tech. Think AI and advanced data analytics – these are becoming essential. A small pool of highly specialized AI firms that cater specifically to finance means these suppliers hold a lot of power. This concentration can drive up costs for firms like Daiwa.

In 2024, the global AI market in financial services was projected to reach over $20 billion, with a significant portion of that growth driven by specialized solutions. This means Daiwa's reliance on a few key AI providers for critical functions, such as algorithmic trading or risk management, gives those providers substantial bargaining power. They can dictate terms and pricing due to the scarcity of comparable alternatives.

Daiwa Securities Group, with its diverse operations spanning investment banking, asset management, and retail brokerage, relies significantly on the seamless functioning of its technology integrations. The quality and dependability of these integrations are paramount for maintaining operational efficiency and client trust. For instance, in 2023, financial institutions globally continued to invest heavily in digital transformation, with cybersecurity and data integrity being key concerns, highlighting the criticality of reliable service providers.

Suppliers providing essential services like payment processing and data aggregation hold considerable bargaining power. This is due to the critical nature of their offerings; any disruption in these services could lead to significant financial losses and reputational damage for Daiwa. The cost and complexity of switching these providers, often involving extensive system overhauls, further solidify their leverage.

The availability of highly skilled professionals, especially in cutting-edge fields like cybersecurity and AI development, significantly bolsters supplier power. A scarcity of talent in these specialized areas directly translates to increased labor costs for Daiwa Securities Group, potentially hindering its capacity for innovation and maintaining a competitive technological advantage.

Regulatory Compliance and Data Vendors

Suppliers of regulatory compliance software, market data, and legal advisory services wield significant influence over Daiwa Securities Group. The financial industry's highly regulated nature means that access to accurate, real-time data and compliant software is not optional, but essential for operations. For instance, in 2024, financial institutions globally faced increasing scrutiny regarding data privacy and anti-money laundering (AML) regulations, underscoring the critical need for reliable vendor solutions.

The potential for severe penalties due to non-compliance makes Daiwa heavily reliant on these specialized vendors. The costs and complexities associated with switching these vital service providers, including data migration and system integration, further solidify the suppliers' bargaining power. This dependence is a key factor in the supplier bargaining power force for Daiwa.

- High switching costs: Integrating new compliance software or data feeds requires significant time, resources, and potential operational disruption.

- Regulatory necessity: Non-compliance with financial regulations can result in substantial fines and reputational damage, making vendor reliability paramount.

- Specialized expertise: Many vendors possess unique knowledge and proprietary technology essential for navigating complex regulatory landscapes.

- Data integrity: The accuracy and timeliness of market data are crucial for trading and investment decisions, creating a strong reliance on trusted data providers.

Access to Capital and Funding Sources

Daiwa Securities Group, despite being a financial powerhouse, is not immune to the bargaining power of its capital providers. Large institutional investors and lenders, such as pension funds and major banks, hold significant sway over Daiwa's access to wholesale funding. These entities can leverage their capital to negotiate more favorable terms, especially during periods of economic uncertainty. For instance, in the face of rising inflation and interest rates, as seen throughout much of 2023 and into early 2024, these providers might demand higher yields on their investments in Daiwa, directly increasing the firm's cost of capital.

This dynamic directly impacts Daiwa's profitability and operational flexibility. When capital becomes more expensive, the margins on the services Daiwa provides, from investment banking to asset management, can shrink. For example, if Daiwa needs to secure short-term funding to meet its obligations, and lenders are demanding a premium due to perceived market risk, Daiwa's net interest income could be compressed. This was a recurring theme in financial markets during 2023, where tighter liquidity conditions led to increased funding costs for many financial institutions.

- Increased Funding Costs: In 2023, global central banks maintained higher interest rate environments, which generally translated to higher wholesale funding costs for financial institutions like Daiwa.

- Negotiating Power of Lenders: Large institutional lenders can dictate terms, especially when credit markets tighten, potentially demanding higher collateral or interest rates from Daiwa.

- Impact on Profitability: A higher cost of capital directly reduces Daiwa's net interest margins and overall profitability, affecting its ability to invest and grow.

Suppliers of specialized technology, particularly in areas like AI and advanced data analytics, wield considerable power over Daiwa Securities Group. The limited number of providers offering sophisticated financial sector solutions means Daiwa faces concentrated supplier leverage. This scarcity can lead to increased costs and dictates terms, impacting Daiwa's operational expenses and strategic technology adoption.

In 2024, the financial services AI market was projected to exceed $20 billion, with a significant portion of this growth driven by niche solutions. Daiwa's reliance on a few key AI vendors for critical functions, such as algorithmic trading and risk management, grants these suppliers substantial bargaining power due to the scarcity of comparable alternatives.

Suppliers of essential services like payment processing and data aggregation hold significant leverage due to the critical nature of their offerings. Disruptions can cause substantial financial and reputational damage, and the high costs and complexity associated with switching providers further solidify their power.

The bargaining power of suppliers is further amplified by the scarcity of highly skilled professionals in fields like cybersecurity and AI development. This talent shortage directly translates to increased labor costs for Daiwa, potentially hindering innovation and its competitive technological edge.

| Supplier Category | Key Services Provided | Impact on Daiwa | Supplier Bargaining Power Factors |

|---|---|---|---|

| Technology Providers (AI, Data Analytics) | Algorithmic trading, risk management, data processing | Increased costs, reliance on specialized solutions | High switching costs, specialized expertise, limited alternatives |

| Essential Service Providers (Payments, Data Aggregation) | Transaction processing, market data feeds | Operational risk, high switching costs | Criticality of service, high switching costs, lack of substitutes |

| Talent Providers | Cybersecurity experts, AI developers | Increased labor costs, talent acquisition challenges | Scarcity of skilled professionals, high demand |

| Regulatory & Compliance Vendors | Compliance software, market data, legal advisory | Regulatory risk, reliance on accurate data | Regulatory necessity, specialized expertise, data integrity requirements |

What is included in the product

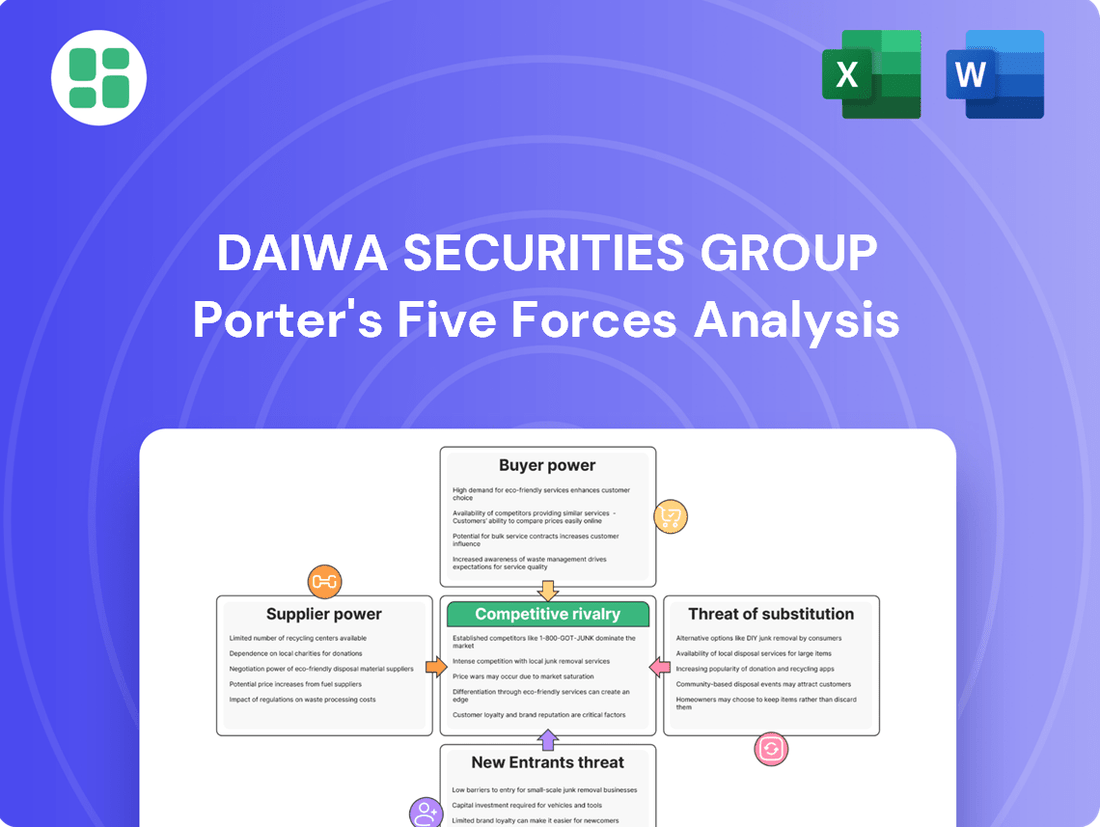

This analysis of Daiwa Securities Group reveals the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its strategic positioning.

Instantly identify and mitigate competitive threats with a visual breakdown of Daiwa Securities Group's Porter's Five Forces, highlighting key pressure points.

Customers Bargaining Power

Daiwa Securities Group caters to a wide array of clients, from individual retail investors to large institutional players and corporations. This diversity means their bargaining power varies significantly, impacting Daiwa's ability to dictate terms.

Individual investors, while numerous, typically wield less individual bargaining power. However, their collective actions, amplified by user-friendly digital trading platforms, can pressure companies like Daiwa to adjust service offerings and pricing. For instance, in 2024, the increasing adoption of low-fee robo-advisors by retail investors put pressure on traditional brokerage firms to remain competitive on fees.

Institutional clients, such as pension funds and asset managers, represent a different story. Their substantial transaction volumes and complex investment needs often allow them to negotiate more favorable commission rates and customized service packages. In 2023, institutional trading volumes on major exchanges continued to be a significant driver of revenue for investment banks, underscoring the importance of retaining these high-value clients.

The retail brokerage sector, including players like Daiwa Securities, is experiencing heightened price sensitivity among individual investors. This is largely due to the widespread availability of online trading platforms that often provide commission-free or very low-cost transaction services. For instance, by late 2023, many major online brokers in the US had already eliminated commissions on stock and ETF trades, setting a precedent that influences global markets.

This competitive pricing landscape forces firms to differentiate through more than just cost. Daiwa, like its peers, must focus on offering superior value-added services, such as enhanced research, better customer support, and user-friendly digital tools, to maintain client loyalty. The push for competitive pricing is further amplified by government initiatives, such as Japan's NISA (Nippon Individual Savings Account) system, which aims to encourage individual investment by making it more accessible and cost-effective.

Institutional clients, including major pension funds and asset managers, wield considerable bargaining power due to their deep financial expertise and substantial capital. These entities often employ specialized analysts who thoroughly evaluate investment products and services, giving them leverage to negotiate better pricing and demand tailored offerings from firms like Daiwa Securities Group.

In 2024, the average institutional investor managed portfolios exceeding $1 billion, a scale that inherently strengthens their negotiating position. Their sophisticated understanding allows them to scrutinize fee structures and service level agreements, pushing for cost efficiencies and premium service delivery.

Low Switching Costs for Certain Services

For standardized financial products like basic brokerage accounts or simple investment funds, customers often face minimal hurdles when switching providers. This ease of transition, amplified by increasingly sophisticated digital platforms, significantly boosts their influence.

The ability to readily move accounts or funds to a competitor, particularly in the retail segment, means Daiwa Securities Group must constantly innovate and offer compelling value propositions. This pressure encourages firms to differentiate themselves through superior service, research, or specialized offerings rather than relying solely on price, as customers can easily shop around.

- Low Switching Costs: For many retail financial services, the effort and expense to change providers are minimal.

- Digital Platform Impact: Online and mobile banking/brokerage services have further reduced the friction of switching.

- Competitive Pressure: This low switching cost empowers customers, forcing companies like Daiwa to compete on more than just fees.

- Customer Leverage: In 2024, the trend towards digital-first financial services continued, making it easier than ever for customers to compare and switch providers, impacting fee structures and service levels across the industry.

Growth of Digital-First Expectations

Customers, across the board, are increasingly drawn to fintech advancements, leading to a surge in expectations for smooth, digital-first interactions and customized financial services. This shift means customers have more leverage; they can readily move to competitors offering superior digital platforms and advice tailored to their changing needs.

Daiwa Securities Group must prioritize significant investment in digital transformation to keep pace with these evolving customer demands and retain its client base. For instance, by mid-2024, a significant portion of retail banking transactions globally were already conducted digitally, highlighting the urgency for financial institutions to adapt their service models. This trend is projected to continue its upward trajectory, with digital channels expected to dominate customer interactions in the coming years.

- Digital Transaction Growth: Global digital banking transactions are projected to exceed 200 billion by 2025, indicating a strong customer preference for online services.

- Fintech Adoption: In 2023, over 60% of consumers globally used at least one fintech service, showcasing a broad acceptance of digital financial solutions.

- Customer Retention Challenges: A study in early 2024 found that 40% of customers would switch financial providers for a better digital experience.

The bargaining power of Daiwa Securities Group's customers is a significant factor, particularly for institutional clients who can negotiate favorable terms due to their substantial transaction volumes. Retail investors, while individually less powerful, exert collective pressure through the increasing adoption of low-cost digital platforms, as seen with the continued trend of commission-free trading in 2024.

The ease with which customers can switch providers, especially with advancements in digital financial services, further amplifies their leverage. This necessitates that Daiwa focus on value-added services and superior customer experiences to maintain loyalty, rather than solely competing on price.

By late 2023, many major online brokers had eliminated commissions on stock and ETF trades, a trend that continues to influence fee structures globally, impacting firms like Daiwa. In 2024, institutional investors managing portfolios over $1 billion are well-positioned to demand tailored services and cost efficiencies.

The shift towards digital-first interactions means customers expect seamless online experiences and personalized advice, pushing firms to invest heavily in technology to remain competitive and retain their client base.

| Customer Segment | Bargaining Power Drivers | Impact on Daiwa |

|---|---|---|

| Institutional Clients | Large transaction volumes, financial expertise, demand for tailored services | Negotiate lower fees, customized product offerings, pressure on service quality |

| Retail Investors | Low individual power, collective pressure via digital platforms, price sensitivity | Pressure to offer competitive pricing, need for user-friendly digital tools, focus on value-added services |

| All Customers | Low switching costs, digital platform adoption, fintech advancements | Need for continuous innovation, superior customer experience, differentiation beyond price |

Same Document Delivered

Daiwa Securities Group Porter's Five Forces Analysis

This preview showcases the comprehensive Daiwa Securities Group Porter's Five Forces Analysis, offering critical insights into the competitive landscape of the financial services industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing an in-depth examination of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. What you're previewing is the final version—precisely the same document that will be available to you instantly after buying, empowering you with actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Daiwa Securities Group faces formidable competition from major domestic players like Nomura Holdings, Mizuho Financial Group, and Mitsubishi UFJ Financial Group. These Japanese financial giants possess extensive domestic networks and deep-seated client relationships, making them formidable rivals across all service areas.

The competitive arena also includes powerful global investment banks such as Goldman Sachs and Morgan Stanley. Their international reach, sophisticated product offerings, and established reputations in areas like M&A advisory and capital markets present a significant challenge to Daiwa's global ambitions.

This intense rivalry permeates every segment of the financial services industry, from retail brokerage and wealth management to investment banking and asset management. For instance, in the Japanese equity capital markets, Daiwa competes directly with these institutions for underwriting mandates and advisory roles, with Nomura often holding the largest market share.

The competitive landscape for Daiwa Securities Group is characterized by a dynamic interplay of fragmentation and consolidation. While retail brokerage remains a highly fragmented space with numerous smaller firms vying for individual investors, larger segments like investment banking and asset management are witnessing significant consolidation. This is largely fueled by mergers and acquisitions, as firms seek greater scale and efficiency to compete effectively on a global stage. For instance, in 2024, the financial services sector continued to see strategic partnerships and acquisitions aimed at expanding market reach and service offerings.

The financial services sector is in a fierce race to adopt new technologies, with companies like Daiwa Securities Group pouring resources into AI, blockchain, and advanced data analytics. This digital transformation is all about boosting efficiency and creating better experiences for customers. For instance, in 2024, global spending on AI in financial services was projected to reach over $30 billion, highlighting the scale of this investment.

This constant push for technological advancement intensifies competition. Daiwa must keep innovating to offer cutting-edge digital platforms, automated investment advice through robo-advisors, and highly personalized financial solutions to keep pace with rivals. Failing to do so means falling behind in a rapidly evolving market where digital capabilities are becoming a key differentiator for client acquisition and retention.

Regulatory Changes and Market Liberalization

Ongoing regulatory reforms in Japan, such as the push to become a premier asset management hub and adjustments to investment schemes like NISA, are significantly altering the competitive dynamics for firms like Daiwa Securities Group. These shifts are not just creating new avenues for growth but are also fueling a more aggressive competitive environment as new players enter and existing ones broaden their services.

The liberalization of markets, coupled with government initiatives to boost domestic investment, is intensifying rivalry. For instance, the expansion of the NISA (Nippon Individual Savings Account) program, with its increased contribution limits and broader investment options, encourages greater retail participation and attracts more financial institutions to compete for these investors' assets. This creates a more crowded marketplace where differentiation and customer acquisition become paramount.

- NISA Expansion Impact: The Japanese government's enhancement of the NISA program, aiming to encourage household savings and investment, directly influences the competitive landscape by drawing more retail investors into the market.

- Asset Management Hub Ambitions: Japan's strategic goal to become a leading global asset management center necessitates regulatory frameworks that foster competition and innovation among financial service providers.

- New Entrant Opportunities: Regulatory changes can lower barriers to entry, potentially allowing fintech firms or international players to challenge established securities groups by offering specialized or digital-first services.

Emphasis on ESG and Sustainable Finance

Competitive rivalry within Daiwa Securities Group is intensifying due to the increasing demand for Environmental, Social, and Governance (ESG) integration. Firms are actively competing to attract capital from investors prioritizing sustainability, making robust ESG performance and innovative sustainable finance products a critical differentiator. This push for ESG leadership means companies are not only enhancing their own operations but also developing new investment vehicles and advisory services that cater to this growing market segment.

The competition is particularly fierce as financial institutions strive to demonstrate genuine commitment to ESG principles, moving beyond mere compliance to proactive integration. Daiwa Securities, like its peers, faces pressure to offer a comprehensive suite of ESG-focused investment options, from green bonds to impact investing funds. For instance, by the end of 2023, global sustainable fund assets reached over $3.7 trillion, highlighting the substantial market opportunity and the competitive drive to capture a larger share.

- Growing Investor Demand: A significant portion of institutional investors now incorporate ESG criteria into their decision-making processes.

- Product Differentiation: Firms are differentiating themselves through the development and marketing of specialized ESG investment products and services.

- Reputational Advantage: Strong ESG credentials can enhance a firm's reputation, attracting both clients and talent in a competitive landscape.

- Regulatory Influence: Evolving regulations and disclosure requirements related to sustainability further fuel the competitive need for robust ESG frameworks.

Daiwa Securities Group faces intense rivalry from both domestic powerhouses like Nomura Holdings and global giants such as Goldman Sachs. This competition spans all service areas, from retail brokerage to investment banking, with rivals leveraging extensive networks and sophisticated offerings. The drive for technological innovation, particularly in AI and digital platforms, further intensifies this rivalry, as firms like Daiwa invest heavily to maintain a competitive edge.

The ongoing expansion of NISA accounts in Japan, coupled with the nation's ambition to become an asset management hub, is creating a more dynamic and competitive market. This regulatory environment encourages new entrants and prompts existing players to broaden their services, intensifying the fight for retail investors. Furthermore, the growing demand for ESG integration means firms are fiercely competing to offer sustainable finance products and demonstrate strong ESG credentials, a key differentiator in attracting capital.

| Key Competitors | Strengths | Areas of Competition |

| Nomura Holdings | Extensive domestic network, strong brand recognition | All financial services, particularly domestic equity capital markets |

| Mizuho Financial Group | Large banking group synergies, broad client base | Wealth management, corporate finance |

| Mitsubishi UFJ Financial Group | Global reach, strong retail presence | Asset management, investment banking |

| Goldman Sachs | Global investment banking expertise, sophisticated products | M&A advisory, capital markets, global asset management |

| Morgan Stanley | Wealth management leadership, global investment banking | Wealth management, investment banking, trading |

SSubstitutes Threaten

Individual investors are increasingly turning to direct investment options, bypassing traditional intermediaries. Online platforms now allow direct purchase of stocks and bonds, a clear substitute for services offered by firms like Daiwa Securities Group.

The proliferation of self-directed investment apps and low-cost trading platforms poses a significant threat, particularly for retail clients. These platforms empower individuals to manage their portfolios independently, reducing reliance on advisory services. For instance, the number of retail investors using commission-free trading apps has surged, with some platforms reporting millions of active users by early 2024.

Alternative financing, including private credit, crowdfunding, and peer-to-peer lending, presents a significant threat by offering corporate clients new avenues for capital beyond traditional investment banking. These options can provide greater flexibility and speed, directly competing with services offered by firms like Daiwa Securities Group.

The private credit market, in particular, has seen substantial growth. For instance, global private debt fundraising reached an estimated $1.5 trillion in 2023, demonstrating its increasing appeal as a substitute for syndicated loans and public debt issuance.

Robo-advisors and automated investment tools present a significant threat of substitutes for Daiwa Securities Group. These digital platforms, offering diversified portfolios and automated rebalancing at a lower cost, are increasingly attracting investors, particularly those who are cost-sensitive and do not require extensive human interaction. This trend could divert assets from Daiwa's traditional wealth management and retail brokerage services.

The global robo-advisory market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2030. This rapid expansion underscores the growing appeal of these low-cost, accessible investment solutions, directly challenging established players like Daiwa.

Real Estate and Direct Asset Ownership

The threat of substitutes for Daiwa Securities Group is amplified by direct asset ownership, particularly in real estate. For instance, in 2024, global real estate investment saw continued interest, with major markets like the US experiencing significant transaction volumes, potentially diverting funds that might otherwise flow into securities managed by firms like Daiwa. This direct ownership offers tangible asset diversification, a key appeal during periods of economic uncertainty.

- Real Estate as a Substitute: Direct ownership of property provides an alternative to financial market investments, appealing to those seeking tangible assets.

- Inflationary Hedge Appeal: In 2024, real estate continued to be viewed as a hedge against inflation, attracting capital away from traditional securities.

- Diversification Benefits: Investors might choose direct real estate holdings for diversification, bypassing securities and funds offered by Daiwa.

Cryptocurrencies and Digital Assets

The rise of cryptocurrencies and digital assets presents an emerging threat of substitution for Daiwa Securities Group's traditional offerings. As investor interest in these alternative assets grows, capital allocation may shift away from conventional securities. For instance, by early 2024, the total market capitalization of cryptocurrencies had surpassed $1.5 trillion, indicating a significant pool of investable funds now accessible outside traditional financial channels.

This evolving landscape means that assets like Bitcoin and Ethereum could be viewed as alternatives to stocks, bonds, or other investment vehicles that Daiwa typically manages. The increasing accessibility and perceived potential for high returns in digital assets could divert a portion of the investment flow that would otherwise be directed towards Daiwa's product suite.

- Growing Digital Asset Market: The global cryptocurrency market cap reached approximately $1.7 trillion by mid-2024, showcasing a substantial alternative investment pool.

- Investor Diversification: A significant percentage of retail investors, estimated to be around 20-30% in developed markets by 2024, reported holding some form of digital asset, indicating a trend of portfolio diversification away from traditional assets.

- Potential Capital Diversion: As digital assets mature and gain regulatory clarity, they pose a greater risk of siphoning investment capital that might otherwise be allocated to traditional financial products managed by firms like Daiwa Securities Group.

The threat of substitutes for Daiwa Securities Group is multifaceted, encompassing direct investment platforms, alternative financing, robo-advisors, real estate, and digital assets.

Direct investment apps and low-cost trading platforms empower retail investors to bypass intermediaries, a trend evidenced by millions of active users on such platforms by early 2024.

Alternative financing, like private credit, which saw global fundraising reach an estimated $1.5 trillion in 2023, offers corporate clients capital solutions that compete with traditional investment banking services.

Robo-advisors, with a global market valued at approximately $2.5 billion in 2023 and projected to grow at over 20% CAGR, attract cost-sensitive investors, diverting assets from traditional wealth management.

Tangible assets like real estate, viewed as an inflation hedge in 2024, also compete for capital that might otherwise be invested in securities.

The burgeoning cryptocurrency market, with a market cap surpassing $1.5 trillion by early 2024, presents a significant alternative investment pool, with an estimated 20-30% of retail investors in developed markets holding digital assets by 2024.

| Substitute Category | Key Characteristics | Market Indicator (2023-2024 Data) | Impact on Daiwa |

| Direct Investment Platforms | Low cost, self-directed | Millions of active users on commission-free apps (early 2024) | Reduced reliance on advisory services |

| Alternative Financing (e.g., Private Credit) | Flexibility, speed | $1.5 trillion global fundraising (2023) | Competition for corporate capital |

| Robo-Advisors | Automated, low-cost portfolio management | $2.5 billion market value (2023), >20% CAGR projected | Diversion of cost-sensitive retail assets |

| Real Estate | Tangible asset, inflation hedge | Continued strong investor interest (2024) | Capital allocation shift from securities |

| Digital Assets (Cryptocurrencies) | High potential returns, diversification | >$1.5 trillion market cap (early 2024), 20-30% retail holding (2024) | Potential diversion of investment flows |

Entrants Threaten

Fintech startups and digital-first challengers are a significant threat to established players like Daiwa Securities Group. These agile newcomers often operate with lower overheads, allowing them to undercut traditional fees and offer specialized services. For instance, in 2023, the global fintech market was valued at over $11 trillion, indicating substantial growth and investment in this disruptive sector.

These companies are particularly adept at targeting specific, profitable segments within the financial services industry. Think about mobile payment solutions or robo-advisory platforms; these digital-first entities can attract younger, tech-savvy demographics who are less tied to traditional banking relationships. This can siphon off valuable customer bases and revenue streams from incumbent firms.

The rapid pace of technological innovation, especially in areas like artificial intelligence and blockchain, further empowers these new entrants. They can quickly deploy cutting-edge solutions that offer enhanced customer experiences or greater efficiency, creating a competitive pressure that traditional institutions must actively address to remain relevant.

Japan's financial sector, while traditionally robust, is experiencing shifts that could invite new competition. The Financial Services Agency (FSA) is actively pursuing reforms aimed at fostering innovation and making it easier for new entities, particularly foreign fintech firms and asset managers, to enter the market.

These reforms, including efforts to position Japan as a premier asset management hub and a relaxation of some existing regulations, could significantly reduce the traditional barriers to entry. For instance, the FSA's push for digital transformation in financial services is designed to streamline processes, potentially lowering the capital and operational requirements for newcomers.

New entrants, particularly in the burgeoning fintech sector, frequently tap into substantial venture capital. For instance, in 2024, global fintech funding reached over $40 billion, demonstrating a robust investor appetite for disruptive financial technologies. This readily available capital allows nimble startups to rapidly scale their operations and challenge established financial institutions like Daiwa Securities Group.

Lower Infrastructure Costs with Cloud and SaaS

The rise of cloud computing and SaaS models dramatically lowers the initial investment needed to enter the financial services sector. This shift means new players can bypass the substantial legacy IT infrastructure costs that established firms like Daiwa Securities Group have historically borne.

For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating the widespread adoption and accessibility of these technologies. This accessibility directly translates to a reduced barrier to entry, allowing agile startups to deploy sophisticated trading platforms and client management systems with far less capital.

- Reduced Capital Expenditure: Cloud infrastructure eliminates the need for large upfront investments in hardware and data centers.

- Faster Time-to-Market: SaaS solutions allow new entrants to quickly deploy essential financial services capabilities.

- Scalability and Flexibility: Cloud services offer scalable operational capacity, enabling new firms to grow without immediate infrastructure constraints.

Non-Traditional Entrants (e.g., Big Tech Companies)

Big tech firms are a growing threat to traditional financial services like Daiwa Securities. These companies, with their vast customer bases and advanced data analytics, are increasingly entering the financial space. For example, in 2023, companies like Apple Pay and Google Pay continued to expand their payment services, directly competing with established players.

Their ability to leverage existing ecosystems and technological expertise allows them to quickly gain market share. This can happen through direct offerings or strategic partnerships within the financial sector. Their strong brand recognition also makes them attractive to consumers, potentially drawing them away from traditional institutions.

- Big Tech's Ecosystem Advantage: Companies like Apple and Google already have millions of users engaged with their devices and services, providing a ready-made customer base for financial products.

- Data Analytics Power: Their sophisticated data analytics capabilities allow for personalized financial offerings and more efficient risk assessment, a key advantage over traditional firms.

- Partnerships and Acquisitions: Big tech often partners with or acquires fintech companies to rapidly deploy financial services, bypassing lengthy development cycles.

The threat of new entrants for Daiwa Securities Group is amplified by regulatory shifts in Japan, aiming to foster innovation. These changes, coupled with the accessibility of cloud technology and significant venture capital flowing into fintech, lower traditional barriers to entry. For instance, global fintech funding exceeded $40 billion in 2024, enabling agile startups to challenge established players with reduced capital expenditure and faster market entry.

| Factor | Impact on Daiwa Securities | Example/Data Point |

|---|---|---|

| Fintech Innovation | Disruptive services and lower fees erode market share. | Global fintech market valued over $11 trillion in 2023. |

| Regulatory Easing | Opens doors for foreign and domestic challengers. | FSA reforms aim to simplify market entry for new financial entities. |

| Technology Accessibility | Reduced infrastructure costs for newcomers. | Global cloud computing market projected over $1.3 trillion by 2024. |

| Venture Capital Funding | Enables rapid scaling of startups. | Over $40 billion invested in global fintech in 2024. |

Porter's Five Forces Analysis Data Sources

Our Daiwa Securities Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Daiwa's annual reports, investor presentations, and official regulatory filings. We supplement this with industry-specific research from reputable financial news outlets and market intelligence providers.