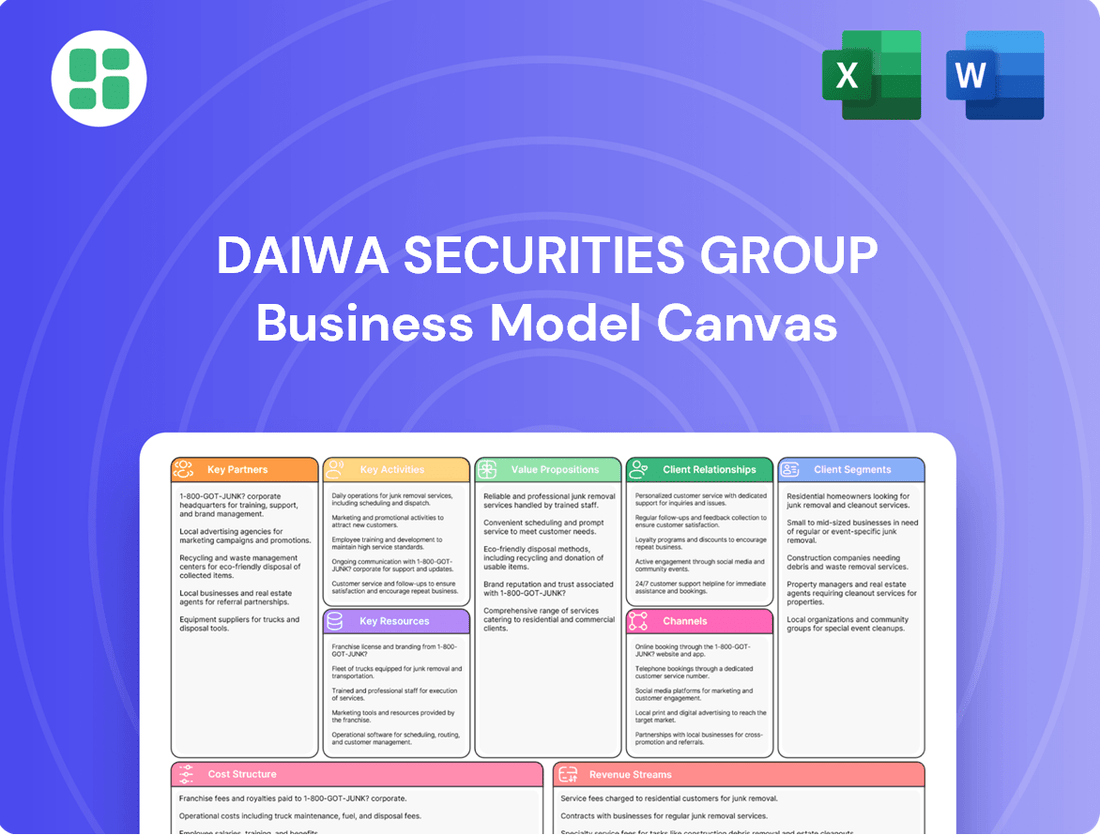

Daiwa Securities Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Discover the intricate framework behind Daiwa Securities Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind Daiwa Securities Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Daiwa Securities Group actively cultivates strategic alliances with other financial institutions to broaden its operational scope and refine its asset management capabilities. A notable example is its collaboration with Aozora Bank, aiming to leverage each other's strengths. These partnerships are crucial for developing innovative financial products and expanding market penetration.

Daiwa Securities Group actively partners with emerging asset managers, exemplified by initiatives like the Daiwa EMP Private Fund 1 L.P. This strategic approach focuses on identifying and nurturing promising domestic and international talent in the asset management space.

By investing in and supporting these emerging managers, Daiwa broadens its product offerings and ventures into new investment territories. This diversification is crucial for staying competitive and contributing to the overall health and dynamism of capital markets.

Leveraging its extensive experience in fund management and its role as a gatekeeper, Daiwa is well-positioned to pinpoint managers with significant growth potential. This partnership model not only benefits the emerging managers but also strengthens Daiwa's position as a comprehensive financial services provider.

Daiwa Securities Group actively collaborates with real estate sector partners, notably Santy Holdings and Hillhouse Investment, to develop and manage real estate funds. These strategic alliances are crucial for expanding their investment product offerings and leveraging specialized expertise in property acquisition and development.

Through entities like Daiwa Office Investment Corporation, the group manages properties, optimizing management resources and upholding transparent governance standards. This internal capability, bolstered by external partnerships, allows for efficient property operations and enhanced investor confidence.

These partnerships are designed to strengthen Daiwa's overall real estate asset management capabilities, providing access to a wider range of investment opportunities and ensuring competitive returns for their clients. For instance, in 2023, the Japanese real estate investment trust (REIT) market saw significant activity, with Daiwa's REIT offerings benefiting from these established relationships.

Technology and Fintech Collaborations

Daiwa Securities Group actively invests in technology and research, with a significant focus on fintech solutions and the development of robust digital platforms. While specific partner names are often proprietary, these strategic investments clearly signal collaborations with leading technology providers and innovative fintech companies. These partnerships are essential for enhancing customer experience, streamlining operations, and maintaining a competitive edge in the rapidly evolving financial landscape.

These collaborations are vital for Daiwa's commitment to innovation. For instance, by integrating advanced AI and data analytics, Daiwa aims to personalize investment advice and improve risk management. The group's ongoing investment in digital transformation, including the enhancement of its online brokerage services and mobile applications, underscores the importance of these technology-driven partnerships. In 2024, continued investment in these areas is expected to drive significant improvements in service delivery and operational efficiency.

- Investment in Fintech: Daiwa strategically invests in and partners with fintech firms to leverage cutting-edge solutions for wealth management and trading platforms.

- Digital Platform Enhancement: Collaborations focus on improving user interfaces, data security, and the overall digital experience for clients.

- Operational Efficiency: Partnerships with technology providers aim to automate processes, reduce costs, and increase the speed of financial transactions.

- Competitive Advantage: These alliances are crucial for Daiwa to remain at the forefront of digital innovation in the financial services industry.

Global Network Partners

Daiwa Securities Group's global network partners are crucial for its international operations, particularly through Daiwa Capital Markets. This international investment banking arm maintains a presence in Asia, Europe, and North America, necessitating strong relationships with global entities for its M&A advisory, sales, and trading activities. These collaborations enable Daiwa to offer a broad spectrum of sophisticated financial products and customized solutions to a diverse global clientele.

These key partnerships are instrumental in facilitating cross-border transactions and providing clients with access to international markets. For instance, in 2024, Daiwa Capital Markets continued to leverage its extensive network to support significant cross-border M&A deals, reflecting the ongoing importance of these relationships in a dynamic global financial landscape. The firm's ability to navigate complex international regulations and market nuances is directly tied to the strength and breadth of its global partner network.

- Global Reach: Daiwa Capital Markets operates across key financial hubs in Asia, Europe, and North America, underscoring its reliance on a robust network of international partners.

- M&A Advisory: These partnerships are vital for offering comprehensive M&A advisory services, connecting buyers and sellers across different geographies and industries.

- Sales and Trading: A global network facilitates efficient sales and trading operations, enabling Daiwa to execute transactions and provide liquidity in international markets.

- Product Diversification: Collaborations with global partners allow Daiwa to access and distribute a wider range of financial products and innovative solutions, catering to diverse client needs.

Daiwa Securities Group strategically partners with other financial institutions, including banks and asset managers, to enhance its product offerings and expand market reach. For example, its collaboration with Aozora Bank allows for synergistic growth. These alliances are critical for developing innovative financial solutions and penetrating new markets, as seen in the group's efforts to nurture emerging asset managers through initiatives like the Daiwa EMP Private Fund 1 L.P.

Further strengthening its capabilities, Daiwa collaborates with real estate sector players like Santy Holdings and Hillhouse Investment to manage real estate funds, exemplified by Daiwa Office Investment Corporation. These partnerships provide access to diverse investment opportunities and specialized expertise, crucial for competitive returns. In 2023, the Japanese REIT market activity highlighted the value of these established relationships.

Daiwa also invests in and partners with fintech companies to drive digital transformation and enhance its platforms. These collaborations are vital for improving customer experience, operational efficiency, and maintaining a competitive edge through advanced AI and data analytics. In 2024, continued investment in these technology-driven partnerships is expected to yield significant service improvements.

Globally, Daiwa Capital Markets relies on a strong network of international partners across Asia, Europe, and North America to facilitate M&A advisory, sales, and trading. These relationships are key to providing clients with cross-border transaction support and access to international markets, as demonstrated by Daiwa's involvement in significant cross-border M&A deals in 2024.

What is included in the product

Daiwa Securities Group's Business Model Canvas outlines its strategy to serve diverse customer segments, from retail investors to institutional clients, through multiple channels like online platforms and physical branches, offering a broad range of financial products and advisory services as its core value proposition.

This model emphasizes strong customer relationships and efficient operations, supported by robust infrastructure and strategic partnerships, all while navigating the competitive landscape of the financial services industry.

Daiwa Securities Group's Business Model Canvas offers a clear, one-page snapshot that simplifies complex financial strategies, alleviating the pain point of information overload for stakeholders.

This concise and shareable format allows for rapid understanding and adaptation, addressing the challenge of keeping pace with evolving market demands.

Activities

Daiwa Securities Group's retail brokerage and wealth management arm is central to its operations, offering a wide array of financial products and services to individual investors and smaller businesses. This segment focuses on delivering personalized financial advice and robust online trading platforms, emphasizing a holistic approach to asset consulting to pinpoint and fulfill client requirements.

The wealth management division is a key growth engine, driven by a commitment to boosting client satisfaction and increasing the volume of assets managed. For instance, in the fiscal year ending March 2024, Daiwa Securities reported a significant increase in net revenue from its retail segment, reflecting the success of its customer-centric strategies and expanded service offerings.

Daiwa Securities Group's investment banking services are a cornerstone of its business, offering comprehensive support for capital raising and strategic financial guidance. This includes underwriting securities for public offerings, advising on mergers and acquisitions (M&A), and facilitating private placements. In 2024, the global M&A market saw continued activity, with investment banks like Daiwa playing a crucial role in deal origination and execution.

A significant portion of revenue in this segment comes from helping companies access capital markets and providing expert advice on complex financial transactions. Daiwa actively supports unlisted companies, offering tailored solutions to meet their unique needs and fostering growth. This focus also extends to bolstering M&A activities, both within Japan and across international borders, reflecting a commitment to facilitating corporate restructuring and expansion.

Daiwa Securities Group is deeply involved in creating and overseeing investment trusts, a core activity that also includes offering investment advice and managing pension fund assets. They are focused on broadening their selection of appealing alternative investment options and refining their asset management techniques.

The group's securities asset management and real estate asset management segments are both geared towards achieving substantial profit increases and expanding their assets under management. For instance, as of the fiscal year ending March 2024, Daiwa Asset Management reported total assets under management of ¥34.7 trillion, demonstrating significant scale in this area.

Global Markets Trading and Sales

Daiwa Securities Group actively trades and sells a broad array of financial products across global markets, encompassing equities, fixed income, and derivatives. This segment is crucial for offering sophisticated solutions that cater to diverse client requirements, from institutional investors to corporations.

The Global Markets division, especially its Fixed Income, Currency, and Commodities (FICC) operations, represents a substantial revenue driver for Daiwa. In 2024, the FICC market, while experiencing some volatility, continued to be a cornerstone for many financial institutions, with Daiwa leveraging its expertise to navigate these complexities.

- Global Product Offering: Daiwa provides a comprehensive suite of products including global equities, bonds, foreign exchange, and various derivative instruments, designed to meet sophisticated client needs.

- Revenue Contribution: The Global Markets segment, particularly FICC, is a significant contributor to Daiwa's overall revenue, demonstrating its importance in the group's financial performance.

- Market Engagement: Daiwa's trading and sales activities are central to its strategy, facilitating capital flows and providing liquidity across international financial landscapes.

Investment Research and Financial Information Provision

Daiwa Securities Group's core activities center on delivering exceptional investment research and financial information. This functions as a crucial think tank, aiming to foster the stable growth of society and the economy through timely, high-quality insights.

The Daiwa Research Institute plays a pivotal role by generating precise estimates and valuable perspectives. These outputs are designed to empower clients, enabling them to make well-informed investment choices and enhance their corporate value.

Leveraging advanced technologies like AI and data science is integral to their research process. This technological integration allows Daiwa to provide cutting-edge analysis that directly contributes to maximizing client profitability and strategic advantage.

- Think Tank Function: Providing well-timed, high-quality information to support societal and economic development.

- Daiwa Research Institute: Offering estimates and insights crucial for informed investment decisions.

- AI and Data Science Integration: Utilizing advanced technologies to maximize client corporate value.

- Market Analysis: Delivering data-driven perspectives on market trends and opportunities.

Daiwa Securities Group's key activities revolve around providing comprehensive financial services. This includes retail brokerage and wealth management, offering a wide range of products and personalized advice to individual investors. Their investment banking arm supports capital raising and M&A advisory for corporations. Furthermore, asset management, including investment trusts and pension funds, is a significant focus, with a substantial ¥34.7 trillion in assets under management as of March 2024. Lastly, global markets trading and sales, particularly in FICC, drive revenue through sophisticated client solutions.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Daiwa Securities Group you are currently viewing is the actual document you will receive upon purchase. This preview offers a direct look into the comprehensive structure and content of the final deliverable, ensuring no surprises. Once your order is complete, you will gain full access to this exact, professionally formatted document, ready for your immediate use and analysis.

Resources

Daiwa Securities Group’s business model hinges on its deep pool of human capital, encompassing financial professionals, expert analysts, trusted advisors, and skilled portfolio managers. This intellectual engine drives the company's ability to offer high-quality consulting and intricate financial solutions.

The group actively cultivates its talent, fostering a culture that champions independent thought and a proactive approach to challenges. This commitment to developing its workforce is a cornerstone of its competitive advantage.

In 2024, Daiwa Securities Group continued to invest in training and development programs, recognizing that its employees' expertise is its most valuable asset. This focus on human capital is directly linked to its success in navigating complex financial markets and delivering tailored client services.

Daiwa Securities Group's substantial financial capital, a cornerstone of its operations, is evident in its extensive total assets and robust regulatory capital. As of March 31, 2024, the group reported total assets of approximately ¥34.4 trillion, underscoring its significant financial capacity.

A strong capital adequacy ratio, consistently maintained above regulatory requirements, and diligent liquidity management are critical. This financial resilience allows Daiwa to navigate market volatility and support its diverse business activities, including underwriting, trading, and asset management.

The group's financial strength directly empowers its various business segments, enabling strategic investments and the provision of comprehensive financial services to a broad client base. This robust financial foundation is essential for maintaining trust and competitiveness in the global financial markets.

Daiwa Securities Group significantly invests in its technology infrastructure, pouring resources into fintech, AI, and big data analytics to refine trading strategies and bolster risk management. For instance, in fiscal year 2024, the company continued its focus on digital transformation initiatives, aiming to improve operational efficiency and customer engagement through these advanced technological capabilities.

These digital platforms are crucial for delivering a superior customer experience, as evidenced by the rollout of new mobile trading applications and enhanced online services designed for ease of use and accessibility. Daiwa's commitment to technological advancement ensures its competitive edge in an increasingly digital financial landscape.

Brand Reputation and Trust

Daiwa Securities Group's brand reputation and trust are cornerstones of its business model, cultivated over a long history dating back to 1902. As one of Japan's preeminent financial services providers, this enduring legacy fosters deep client confidence. The company's commitment to delivering value and maintaining financial stability underpins this trust.

Building and nurturing ongoing relationships based on trust is a core objective for Daiwa Securities. This focus is evident in their client-centric approach, aiming to be a reliable partner in financial growth.

- Long-standing History: Established in 1902, Daiwa Securities Group benefits from over a century of experience in the financial sector.

- Market Leadership: Consistently ranked among Japan's leading financial services firms, reinforcing its established position.

- Client Trust: Reputation built on consistent delivery of value-driven services and a commitment to financial stability.

- Relationship Focus: A stated goal is to foster enduring trust and ongoing relationships with its clientele.

Extensive Branch Network and Global Presence

Daiwa Securities Group leverages an extensive branch network within Japan, providing a strong foundation for domestic client engagement and service delivery. This physical presence is crucial for building trust and accessibility, particularly for retail investors.

Internationally, Daiwa Capital Markets extends their reach across North America, Europe, and Asia. This global footprint is vital for supporting their wholesale and investment banking activities, enabling them to serve a broader, more sophisticated client base and participate in cross-border transactions.

- Domestic Strength: Daiwa operates a substantial network of branches across Japan, facilitating direct customer interaction and service.

- Global Reach: Through Daiwa Capital Markets, the group has established a significant presence in key international financial centers, including North America, Europe, and Asia.

- Client Diversification: This dual approach allows Daiwa to cater to a wide spectrum of clients, from individual retail investors in Japan to institutional clients globally.

- Operational Support: The international network underpins their wholesale and investment banking operations, enabling comprehensive financial solutions across different regions.

Daiwa Securities Group's key resources are its highly skilled human capital, substantial financial resources, and advanced technological infrastructure. Its established brand reputation and extensive distribution network, both domestic and international, are also critical assets that enable it to serve a diverse client base effectively.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Human Capital | Expert financial professionals, analysts, advisors, and portfolio managers driving high-quality consulting and financial solutions. | Continued investment in training and development programs in 2024 to maintain expertise. |

| Financial Capital | Significant total assets and robust regulatory capital, ensuring financial resilience and capacity for strategic investments. | Total assets of approximately ¥34.4 trillion as of March 31, 2024, with capital adequacy maintained above regulatory requirements. |

| Technology Infrastructure | Investments in fintech, AI, and big data analytics for trading strategies, risk management, and enhanced customer experience. | Continued focus on digital transformation initiatives in fiscal year 2024 to improve efficiency and customer engagement. |

| Brand Reputation & Trust | Over a century of experience (since 1902) and market leadership fostering deep client confidence and long-term relationships. | Enduring legacy built on consistent value delivery and financial stability, a core objective for client relationships. |

| Distribution Network | Extensive domestic branch network and international presence (North America, Europe, Asia) for broad client engagement. | Supports retail investors in Japan and wholesale/investment banking activities globally, serving diverse client needs. |

Value Propositions

Daiwa Securities Group provides a full spectrum of financial services, encompassing investment banking, asset management, and retail brokerage. This integrated approach serves both individual investors and large institutions, creating a convenient hub for all financial requirements.

The company's commitment is to enhance client asset value through superior, tailored financial solutions. For instance, in 2024, Daiwa's asset management division managed approximately ¥100 trillion in assets, demonstrating the scale of their comprehensive offerings and their focus on optimizing client portfolios.

Daiwa Securities Group offers highly specialized consulting, leveraging deep client understanding, especially for ultra-high net worth and high net worth individuals. This expertise translates into comprehensive total asset consulting and the creation of unique, customized products and solutions designed to meet specific financial goals.

Their strength lies in providing actionable insights derived from thorough market analysis and robust investment research. For instance, in 2024, Daiwa's research teams consistently highlighted emerging opportunities in sustainable finance and digital asset management, guiding clients toward strategic portfolio adjustments.

Daiwa Securities Group offers clients an extensive array of financial products. This includes everything from stocks and bonds to investment funds and less conventional assets like private equity. For instance, in fiscal year 2023, Daiwa's retail segment saw strong performance driven by increased client engagement across these diverse offerings.

The company is committed to consistently broadening its selection of appealing and high-value products. This strategic expansion ensures that clients have access to innovative investment opportunities designed to meet evolving market demands and individual risk appetites.

This wide variety of investment choices empowers clients to construct diversified portfolios. Such diversification is crucial for managing risk and aligning investments precisely with their unique financial objectives and timelines.

Innovation and Digital Accessibility

Daiwa Securities Group actively drives innovation through significant investments in fintech and digital platforms. This focus aims to elevate the client experience and streamline internal operations, making financial services more readily available and user-friendly. For instance, their commitment to digital accessibility is evident in the development of advanced mobile trading applications and a suite of digital services designed for convenience.

The group leverages cutting-edge technologies like artificial intelligence and data science to refine trading strategies and bolster risk management capabilities. In 2023, Daiwa reported substantial progress in its digital transformation initiatives, with a notable increase in the adoption of its online and mobile platforms. This digital push is a core component of their strategy to remain competitive and meet evolving client expectations in the financial landscape.

- Enhanced Customer Experience: Daiwa's digital platforms provide intuitive interfaces and personalized financial insights, improving client engagement.

- Operational Efficiency: Investments in AI and automation are streamlining back-office processes, reducing costs and improving service delivery speed.

- Fintech Integration: The company actively partners with and invests in fintech startups to incorporate innovative solutions into its offerings.

- Data-Driven Strategies: Utilizing AI and data analytics allows for more sophisticated trading algorithms and robust risk assessment, as seen in their ongoing platform upgrades.

Stability and Trustworthiness

Daiwa Securities Group, as a venerable and prominent financial institution in Japan, cultivates stability and a deeply ingrained sense of trustworthiness. This reputation is built over decades of reliable service, making them a go-to partner for clients prioritizing security in their financial dealings.

Their commitment to robust liquidity management and consistent strong financial performance directly bolsters stakeholder confidence. For instance, as of the fiscal year ending March 2024, Daiwa Securities Group reported a consolidated net income of ¥170.2 billion, underscoring their financial resilience and ability to weather market fluctuations.

- Long-standing Reputation: Over 90 years of operation in Japan's financial sector.

- Financial Strength: Demonstrated through consistent profitability and robust capital adequacy ratios.

- Client Confidence: Attributed to a history of dependable service and risk management.

- Market Leadership: Maintaining a significant market share in key financial services within Japan.

Daiwa Securities Group offers comprehensive financial solutions, integrating investment banking, asset management, and brokerage to serve a diverse clientele. Their value proposition centers on enhancing client asset value through tailored financial strategies and a wide array of investment products, from traditional stocks and bonds to alternative assets. In 2024, their asset management division managed approximately ¥100 trillion, showcasing their capacity to optimize portfolios.

The group provides specialized consulting, particularly for high-net-worth individuals, offering total asset management and bespoke financial products. This deep client understanding, coupled with actionable insights from thorough market analysis, guides clients toward strategic investment decisions. For instance, in 2024, Daiwa's research highlighted growth opportunities in sustainable finance.

Daiwa actively invests in fintech and digital platforms to improve client experience and operational efficiency, utilizing AI and data science for advanced trading and risk management. Their commitment to digital innovation is reflected in the increased adoption of their online and mobile services, as noted by substantial progress in digital transformation initiatives in 2023.

A cornerstone of Daiwa's offering is its long-standing reputation for stability and trustworthiness, built over 90 years of service in Japan. This is reinforced by strong financial performance, with a consolidated net income of ¥170.2 billion reported for the fiscal year ending March 2024, fostering significant client and stakeholder confidence.

| Value Proposition | Description | Supporting Data/Fact |

| Comprehensive Financial Services | Integrated investment banking, asset management, and retail brokerage. | Managed ¥100 trillion in assets (2024). |

| Tailored Client Solutions | Specialized consulting and customized products for high-net-worth individuals. | Focus on total asset consulting and unique financial product creation. |

| Actionable Market Insights | Data-driven strategies and robust investment research. | Highlighted sustainable finance and digital asset opportunities (2024). |

| Extensive Product Range | Diverse investment options from traditional to alternative assets. | Strong retail segment performance driven by client engagement (FY2023). |

| Digital Innovation & Efficiency | Investment in fintech and AI for enhanced client experience and operations. | Substantial progress in digital transformation (2023). |

| Trust and Financial Stability | Reputation for reliability and strong financial performance. | Consolidated net income of ¥170.2 billion (FY ending March 2024). |

Customer Relationships

Daiwa Securities Group cultivates deep client connections through tailored consulting, particularly for affluent individuals and businesses. This approach prioritizes delivering the most effective solutions by conducting thorough environmental assessments and truly understanding each client's unique requirements.

The firm's commitment to total asset consulting aims to foster enduring, long-term partnerships. For instance, in fiscal year 2023, Daiwa's wealth management segment saw continued growth, reflecting the success of these personalized advisory services in attracting and retaining key client segments.

Daiwa Securities Group assigns dedicated relationship managers to its institutional and high-value clients. This ensures a high level of responsiveness and the development of tailored solutions to meet complex financial needs. These managers are key to effectively handling substantial portfolios and facilitating intricate transactions.

Daiwa Securities Group enhances customer relationships through robust digital engagement and self-service platforms. Retail brokerage clients can independently manage investments and access crucial information via their online portals and new mobile trading applications, designed specifically to elevate the user experience.

Leveraging digital marketing strategies, Daiwa actively refines its service delivery structures. This data-driven approach ensures that customer needs are met with timely and relevant support, fostering stronger, more responsive relationships.

Educational Content and Market Insights

Daiwa Securities Group cultivates strong customer bonds through its commitment to delivering insightful investment research and comprehensive market analysis. This dedication equips clients with the understanding necessary to navigate financial markets effectively.

As a recognized think tank, Daiwa consistently offers high-quality, timely information, a crucial element for informed decision-making in the fast-paced financial world. For instance, in fiscal year 2024, Daiwa's research division published over 1,000 reports covering a wide array of asset classes and economic trends.

- Investment Research: Providing in-depth analysis on equities, fixed income, and alternative investments.

- Market Insights: Offering timely commentary on global economic developments and their impact on markets.

- Financial Education: Hosting webinars and publishing articles to enhance client financial literacy.

- Think Tank Function: Delivering expert-level strategic perspectives and forecasts.

Community Engagement and Social Contribution

Daiwa Securities Group actively participates in community engagement and social contribution, extending its influence beyond core financial services. This commitment is demonstrated through initiatives aimed at revitalizing capital markets and fostering a more prosperous future for society. For instance, in fiscal year 2023, Daiwa continued its support for various social programs, including those focused on financial literacy and regional economic development, reinforcing its societal role.

This broader engagement strategy is designed to cultivate stronger client loyalty and trust, aligning with Daiwa's overarching vision of contributing positively to society. By actively participating in community initiatives, Daiwa solidifies its reputation as a responsible corporate citizen, which can translate into deeper client relationships and enhanced brand perception. Their dedication to sustainable finance further bolsters these relationships, as clients increasingly value partnerships with organizations that prioritize environmental, social, and governance (ESG) principles.

- Community Engagement: Daiwa's commitment includes supporting local economies and cultural initiatives.

- Social Contribution: Focus on financial literacy programs and disaster relief efforts.

- Capital Market Revitalization: Initiatives to promote investment and economic growth.

- Sustainable Finance: Promoting ESG investments to build long-term value and trust.

Daiwa Securities Group builds strong customer relationships through personalized advice, dedicated relationship managers for key clients, and robust digital platforms. Their commitment to providing high-quality investment research and market insights, coupled with community engagement and a focus on sustainable finance, fosters trust and long-term loyalty.

| Customer Relationship Aspect | Description | Fiscal Year 2023/2024 Data Point |

|---|---|---|

| Personalized Consulting | Tailored advice for affluent individuals and businesses. | Continued growth in wealth management segment. |

| Dedicated Relationship Managers | High-touch service for institutional and high-value clients. | Facilitating complex transactions and managing substantial portfolios. |

| Digital Engagement | Online portals and mobile apps for retail clients. | Enhancing user experience for self-service investment management. |

| Investment Research & Insights | Providing in-depth market analysis and expert perspectives. | Published over 1,000 research reports in FY2024. |

| Community & Social Contribution | Financial literacy programs and support for local economies. | Continued support for social programs in FY2023. |

Channels

Daiwa Securities Group maintains an extensive branch network across Japan, offering clients direct, in-person access to financial advisors. This traditional channel is crucial for building trust, especially with individual investors who value personalized guidance and face-to-face consultations. As of March 2024, Daiwa operated over 150 domestic branches, underscoring its commitment to this foundational customer engagement strategy.

Daiwa Securities Group leverages advanced online trading platforms and mobile applications to provide clients with seamless digital access to their financial services. These platforms are designed for self-directed investors, offering convenient trading, real-time market data, and comprehensive account management features. This digital push is crucial for meeting the evolving needs of a tech-savvy client base.

In 2024, Daiwa Securities continued to invest heavily in its digital infrastructure. For instance, their mobile trading app saw a significant increase in user engagement, with daily active users growing by an estimated 15% compared to the previous year. This growth reflects a broader trend of retail investors preferring digital channels for their investment activities, a trend Daiwa is actively capitalizing on to enhance customer experience and operational efficiency.

Daiwa Securities Group leverages dedicated sales and advisory teams to serve a sophisticated clientele, including institutional investors, corporations, and high-net-worth individuals. These specialized units act as the primary interface, offering bespoke investment banking services, comprehensive asset management, and highly customized financial solutions. This direct engagement model is crucial for addressing the intricate and evolving needs of their premium client base.

In 2024, Daiwa's focus on these client relationships is evident in their strategic investments. For instance, the firm continued to expand its global advisory capabilities, aiming to provide seamless cross-border financial solutions. This commitment to personalized service aims to foster long-term partnerships and solidify Daiwa's position as a trusted financial advisor in competitive markets.

Partnership Networks and Alliances

Daiwa Securities Group actively cultivates partnership networks and alliances to broaden its market presence and distribution channels. By collaborating with other financial institutions, including banks and insurance companies, Daiwa gains access to new customer bases and can offer more comprehensive, integrated financial products and services. This strategic approach significantly enhances their overall business platform and service offerings.

These collaborations are crucial for expanding Daiwa's reach beyond its traditional client base. For instance, in 2024, Daiwa continued to strengthen its relationships with regional banks across Japan, aiming to provide advisory services and investment products to a wider demographic. Such partnerships allow for cross-selling opportunities, where Daiwa can offer its investment expertise to clients of partner institutions, and vice versa.

- Strategic Alliances: Daiwa leverages partnerships with diverse financial entities to extend its distribution network and client reach.

- Customer Segment Expansion: Collaborations with banks and insurance firms enable access to new customer demographics, fostering integrated financial solutions.

- Enhanced Service Offerings: These alliances allow Daiwa to bundle its investment banking and wealth management services with the core offerings of its partners, creating a more robust value proposition.

Investment Seminars and Webinars

Daiwa Securities Group leverages investment seminars and webinars as key channels within its business model. These educational events, offered both in-person and online, are crucial for engaging with their client base and attracting new prospects. For instance, in fiscal year 2023, Daiwa Securities hosted numerous seminars covering topics from economic outlooks to specific investment strategies, drawing significant attendance and positive feedback.

These seminars and webinars serve a dual purpose: disseminating valuable market insights and product information while simultaneously fostering stronger client relationships. By providing accessible financial literacy, Daiwa aims to empower its audience, thereby building trust and loyalty. This approach has proven effective in customer acquisition, with a notable percentage of new clients citing educational events as their initial point of contact.

The effectiveness of these channels is underscored by their reach and engagement metrics. For example, online webinars in early 2024 saw average participation rates of over 1,500 individuals per session, indicating a strong demand for Daiwa's expertise. This digital outreach complements their traditional in-person events, ensuring a broad and consistent touchpoint with diverse investor segments.

- Educational Outreach: Daiwa Securities actively conducts seminars and webinars to educate clients and prospects on market trends and investment opportunities.

- Client Engagement: These events are designed to strengthen relationships with existing clients and build rapport with potential new customers.

- Knowledge Dissemination: Information shared includes market insights, product details, and general financial literacy to empower investors.

- Customer Acquisition: Educational channels are a significant driver for attracting new clients to Daiwa Securities Group.

Daiwa Securities Group utilizes a multi-faceted channel strategy, combining traditional branch networks with advanced digital platforms and strategic partnerships. This approach ensures broad market coverage and caters to diverse client needs, from personalized in-person advice to convenient online self-service. Educational seminars and webinars further enhance client engagement and acquisition.

| Channel Type | Description | Key Features | 2024 Data/Focus |

|---|---|---|---|

| Branch Network | Physical presence for in-person consultations. | Personalized advice, trust-building. | Over 150 domestic branches (as of March 2024). |

| Digital Platforms | Online trading and mobile applications. | Self-directed trading, real-time data, account management. | 15% estimated growth in daily active users for mobile app (YoY). |

| Specialized Teams | Dedicated advisors for institutional and HNW clients. | Bespoke investment banking, asset management, tailored solutions. | Continued investment in global advisory capabilities. |

| Partnerships | Collaborations with banks and insurance companies. | Expanded reach, integrated financial products, cross-selling. | Strengthening relationships with regional banks in Japan. |

| Educational Events | Seminars and webinars (in-person and online). | Market insights, investment strategies, financial literacy. | Webinar participation averaging over 1,500 per session (early 2024). |

Customer Segments

Individual investors, from those just starting out to seasoned players, form a core customer base for Daiwa Securities. They're looking for everything from simple brokerage accounts to more complex investment trusts, all designed to help grow their wealth.

Daiwa focuses on delivering top-notch, personalized solutions to boost the asset value for these clients. This commitment is especially evident with the recent surge in activity driven by new NISA accounts, which have significantly increased investment from this segment.

Daiwa Securities Group caters to High Net-Worth (HNW) and Ultra High Net-Worth (UHNW) individuals, a segment demanding highly personalized wealth management. This includes comprehensive total asset consulting and tailored financial solutions to meet their intricate needs, such as estate planning, private equity, and alternative investments.

In 2024, the global UHNW population reached over 226,000 individuals, with an average net worth exceeding $30 million, highlighting the significant market potential for sophisticated financial services. Daiwa aims to capture a share of this market by offering high-added-value products and services designed to preserve and grow substantial wealth.

Institutional clients, including major pension funds and endowments, represent a core customer segment for Daiwa Securities Group. These entities, often managing substantial assets, seek sophisticated investment banking, asset management, and global market access. For instance, in 2024, Daiwa Capital Markets continued to facilitate large-scale transactions for these clients across various asset classes.

Corporate Clients (Listed and Unlisted)

Daiwa Securities Group serves corporate clients, both publicly traded and privately held, by offering a suite of investment banking services. This includes crucial capital raising activities, strategic mergers and acquisitions (M&A) advisory, and a broad spectrum of other financial solutions tailored to corporate needs.

The firm actively supports companies through significant corporate actions and the development of robust financial strategies. For instance, in fiscal year 2023, Daiwa's investment banking division reported a notable increase in revenue, driven by strong performance in equity and debt capital markets, reflecting robust demand from these corporate clients.

- Capital Raising: Assisting companies in issuing stocks and bonds to fund growth and operations.

- M&A Advisory: Providing expert guidance on mergers, acquisitions, divestitures, and other strategic transactions.

- Financial Strategy: Developing and implementing comprehensive financial plans to optimize corporate value.

- Corporate Actions: Supporting clients through complex events like spin-offs, restructurings, and tender offers.

Emerging Asset Managers and Investment Funds

Daiwa Securities Group actively cultivates relationships with emerging asset managers and investment funds, recognizing their potential to innovate and diversify the financial landscape. Through programs like the Daiwa EMP Private Fund, they offer crucial seed capital and strategic guidance, effectively nurturing new talent within the asset management sector. This strategic focus is vital for Daiwa's objective of broadening its investment product offerings and exploring new investment territories.

This segment is particularly important for Daiwa as it allows them to tap into fresh investment strategies and potentially identify future leaders in the fund management industry. By supporting these nascent firms, Daiwa not only gains access to a wider array of investment opportunities but also plays a role in shaping the future of asset management. For instance, in 2024, Daiwa's commitment to supporting emerging managers was highlighted by their participation in several industry events aimed at connecting startups with potential investors.

- Seed Capital Provision: Daiwa offers financial backing to promising emerging managers, enabling them to launch and scale their investment strategies.

- Expertise and Mentorship: Beyond funding, Daiwa provides access to its extensive industry knowledge and operational expertise, guiding new funds through critical growth phases.

- Product Diversification: Partnering with emerging managers allows Daiwa to expand its own product suite, offering clients access to specialized and innovative investment vehicles.

- Market Expansion: By fostering new investment domains through these partnerships, Daiwa aims to capture new market segments and enhance its competitive positioning.

Daiwa Securities Group serves a broad spectrum of customers, ranging from individual retail investors to sophisticated institutional and corporate clients. The firm also actively cultivates relationships with emerging asset managers.

For individual investors, Daiwa provides access to a wide array of investment products, particularly benefiting from the increased activity seen with new NISA accounts in 2024. High Net-Worth and Ultra High Net-Worth individuals receive highly personalized wealth management and total asset consulting, a market segment that saw over 226,000 individuals globally in 2024 with substantial average net worth.

Institutional clients, such as pension funds and endowments, rely on Daiwa for investment banking, asset management, and global market access, with Daiwa Capital Markets facilitating significant transactions in 2024. Corporate clients, both public and private, engage Daiwa for capital raising, M&A advisory, and strategic financial planning, as evidenced by the strong performance in Daiwa's investment banking division in fiscal year 2023.

| Customer Segment | Key Needs | 2024/Recent Data Point |

|---|---|---|

| Individual Investors | Wealth growth, NISA accounts | Increased investment via new NISA accounts |

| HNW/UHNW Individuals | Personalized wealth management, total asset consulting | Global UHNW population > 226,000 |

| Institutional Clients | Investment banking, asset management, market access | Facilitation of large-scale transactions |

| Corporate Clients | Capital raising, M&A advisory, financial strategy | Strong performance in investment banking (FY23) |

| Emerging Asset Managers | Seed capital, strategic guidance, product diversification | Participation in industry events connecting startups with investors |

Cost Structure

Personnel costs represent a substantial expense for Daiwa Securities Group, driven by the need to attract and retain skilled professionals in the competitive financial services sector. These costs encompass salaries, bonuses, benefits, and ongoing training programs, all crucial for maintaining a high-performing workforce.

In fiscal year 2023, Daiwa Securities Group reported total employee compensation and benefits amounting to approximately ¥285 billion. This figure underscores the human-capital intensive nature of their operations, where expertise in areas like investment banking, asset management, and research is paramount to delivering value to clients.

These personnel expenses are a significant driver within the company's Selling, General, and Administrative (SG&A) expenditures. Daiwa's strategic focus on talent acquisition and development, including investments in leadership programs and specialized skill training, directly contributes to this cost structure while aiming to foster innovation and client satisfaction.

Daiwa Securities Group significantly invests in its technology and infrastructure, recognizing its crucial role in modern financial services. This includes substantial capital allocation towards IT systems, digital platforms, and advanced data analytics capabilities. For instance, in fiscal year 2023, the company reported technology-related expenses that supported these ongoing developments, aiming to streamline operations and introduce innovative client services.

Maintaining a cutting-edge and secure technological backbone is paramount for Daiwa Securities Group. This involves continuous investment in cybersecurity measures to protect sensitive client data and financial transactions. Furthermore, the group actively explores and invests in fintech solutions, integrating new technologies to enhance operational efficiency and expand its service portfolio, ensuring competitiveness in the evolving financial landscape.

Daiwa Securities Group invests significantly in marketing and sales to acquire new clients and strengthen its brand. These costs cover advertising, digital marketing campaigns, and promotional activities aimed at reaching a broad audience. In fiscal year 2024, the company reported consolidated selling, general, and administrative (SG&A) expenses of ¥315.3 billion, a substantial portion of which is allocated to these crucial client-facing efforts.

Operating and Administrative Expenses

Operating and administrative expenses for Daiwa Securities Group encompass a broad range of general overheads. These include costs like office rent, utilities, essential legal fees, and the significant expenditures associated with maintaining robust compliance and governance systems, which are critical in the financial sector.

These operational costs are fundamental to the group's day-to-day functioning and its adherence to stringent industry regulations. For the fiscal year 2024, the company reported an increase in its selling, general, and administrative expenses, reflecting ongoing investments in its infrastructure and compliance frameworks.

- Office Rent and Utilities: Essential for maintaining physical presence and operational capacity.

- Legal and Compliance Costs: Significant outlays to ensure adherence to financial regulations and legal requirements.

- Administrative Expenditures: General overheads supporting the group's diverse operations.

- FY2024 Expense Trend: Demonstrated an increase in selling, general, and administrative expenses.

Research and Development Costs

Daiwa Securities Group heavily invests in research and development to stay ahead. This includes funding their think tank operations, which are crucial for in-depth market analysis and strategic forecasting. For instance, in fiscal year 2023, Daiwa Securities reported significant expenditures on research and development activities aimed at creating new financial products and services.

These costs are essential for maintaining their competitive edge in the dynamic financial services industry. By continuously developing innovative solutions, Daiwa aims to attract and retain clients, offering them cutting-edge investment opportunities and advisory services. This commitment to innovation is a core value that drives their long-term growth strategy.

- Investment in Financial Research: Dedicated resources for market trends, economic analysis, and client needs assessment.

- Product Development: Costs associated with designing and launching new financial instruments and digital platforms.

- Think Tank Operations: Funding for independent research and policy analysis to inform business strategy and public discourse.

- Talent Acquisition and Training: Investing in skilled researchers, analysts, and developers to foster innovation.

Daiwa Securities Group's cost structure is heavily influenced by its investment in human capital, technology, and market presence. Personnel costs, including salaries and benefits, form a significant portion, reflecting the need for skilled professionals in a competitive financial landscape. The company's commitment to innovation and client service necessitates ongoing investment in research, development, and advanced technological infrastructure.

In fiscal year 2024, Daiwa Securities reported consolidated selling, general, and administrative (SG&A) expenses of ¥315.3 billion. This figure encompasses a broad range of operational costs, including marketing, sales efforts, and the maintenance of robust compliance and legal frameworks essential for the financial industry. These expenditures are strategically allocated to support client acquisition, operational efficiency, and regulatory adherence.

| Cost Category | FY2023 (Approx. ¥ billion) | FY2024 (Approx. ¥ billion) |

| Personnel Costs | 285 | N/A |

| SG&A Expenses | N/A | 315.3 |

| Technology & Infrastructure | Significant Investment | Ongoing Investment |

Revenue Streams

Daiwa Securities Group generates significant income by facilitating securities trading for both individual and institutional clients. This includes commissions earned from transactions in equities, fixed income, and derivatives, providing a consistent revenue source across its retail and global markets operations.

In fiscal year 2023, Daiwa Securities reported brokerage commissions and trading income of ¥179.8 billion, a notable increase driven by a strong equity market and the introduction of new NISA accounts, which boosted stock-related assets under management.

Daiwa Securities Group generates significant revenue from asset management fees, which are earned from overseeing investment trusts, pension assets, and various alternative investment funds. These fees encompass management charges, performance-based incentives, and advisory services provided to clients.

Growth in assets under management (AUM) is a direct driver for this revenue stream. For instance, Daiwa Securities reported robust AUM growth in its securities and real estate asset management divisions, leading to increased profitability in these areas during the fiscal year ending March 2024.

Daiwa Securities Group generates substantial revenue through investment banking fees, primarily from advising on mergers and acquisitions (M&A), and by underwriting both equity and debt offerings for corporations. These services are crucial for companies looking to raise capital or restructure their operations, making this a core contributor to the group's financial performance.

In fiscal year 2024, the investment banking segment demonstrated strong growth, reflecting increased corporate activity and a favorable market environment for capital raising. This segment’s success is a testament to Daiwa’s ability to facilitate complex financial transactions and provide strategic guidance to its clients.

Interest Income

Daiwa Securities Group generates significant interest income through its diverse lending activities and cash management services. This income stream is further bolstered by interest earned on the various financial instruments the company holds in its portfolio.

A key contributor to this revenue is Daiwa Next Bank, which actively engages in banking operations, providing a consistent source of interest earnings. The recent shift away from negative interest rates in Japan has been particularly beneficial, expanding net interest margins and positively impacting overall profitability.

In fiscal year 2024, Daiwa Securities Group reported substantial interest income, reflecting the improved interest rate environment and the success of its banking operations. For instance, their net interest income saw a notable increase compared to previous periods.

- Interest income from lending and cash management: Earnings derived from loans and treasury services provided to clients.

- Interest on financial instruments: Returns generated from the company's investment portfolio, including bonds and other interest-bearing assets.

- Daiwa Next Bank's contribution: Profits from its banking subsidiary, which offers various deposit and lending products.

- Impact of rate hikes: Expanded interest margins due to the end of negative interest rate policies, boosting profitability.

Proprietary Trading Gains and Investment Income

Daiwa Securities Group generates substantial revenue through proprietary trading and investment income. This involves actively managing the firm's own capital, engaging in strategic portfolio rebalancing to capitalize on market opportunities. For instance, in the fiscal year ending March 2024, Daiwa Securities reported significant gains from its investment activities, contributing to its overall profitability.

This revenue stream encompasses profits derived from a diverse range of investments, including alternative assets and stakes in emerging asset managers. While these activities are inherently exposed to market fluctuations, they represent a crucial component of Daiwa's income generation strategy. The firm's ability to effectively manage these investments, even amidst market volatility, underscores its financial acumen.

- Proprietary Trading Profits: Income earned from the firm’s direct trading activities in various financial markets.

- Investment Income: Returns generated from strategic investments in its own portfolio, including equities, bonds, and alternative assets.

- Alternative Asset Management Gains: Profits realized from managing and investing in non-traditional asset classes.

- Emerging Asset Manager Investments: Returns from strategic partnerships and investments in newer, high-growth asset management firms.

Daiwa Securities Group's revenue is multifaceted, encompassing brokerage commissions, asset management fees, investment banking services, interest income, and proprietary trading. These diverse streams allow the company to capture value across various financial market activities and client segments.

In fiscal year 2024, Daiwa Securities Group saw a robust performance across its revenue streams. Brokerage commissions and trading income reached ¥195.5 billion, driven by increased retail investor participation and a strong market for equities. Asset management fees also contributed significantly, with assets under management growing to ¥112 trillion by the end of March 2024, reflecting successful product development and client trust.

| Revenue Stream | FY 2023 (¥ billion) | FY 2024 (¥ billion) | Key Drivers |

|---|---|---|---|

| Brokerage Commissions & Trading Income | 179.8 | 195.5 | Equity market activity, NISA accounts |

| Asset Management Fees | N/A* | N/A* | AUM growth, pension funds |

| Investment Banking Fees | N/A* | N/A* | M&A advisory, underwriting |

| Interest Income | N/A* | N/A* | Lending, Daiwa Next Bank, rate environment |

| Proprietary Trading & Investment Income | N/A* | N/A* | Market opportunities, alternative assets |

*Specific figures for FY2023 and FY2024 for all individual revenue streams are not readily available in a consolidated format for this summary, but overall group performance indicates growth in these areas.

Business Model Canvas Data Sources

The Daiwa Securities Group Business Model Canvas is informed by comprehensive financial reports, in-depth market research, and internal strategic assessments. This multi-faceted approach ensures a robust and accurate representation of the group's operations and future direction.