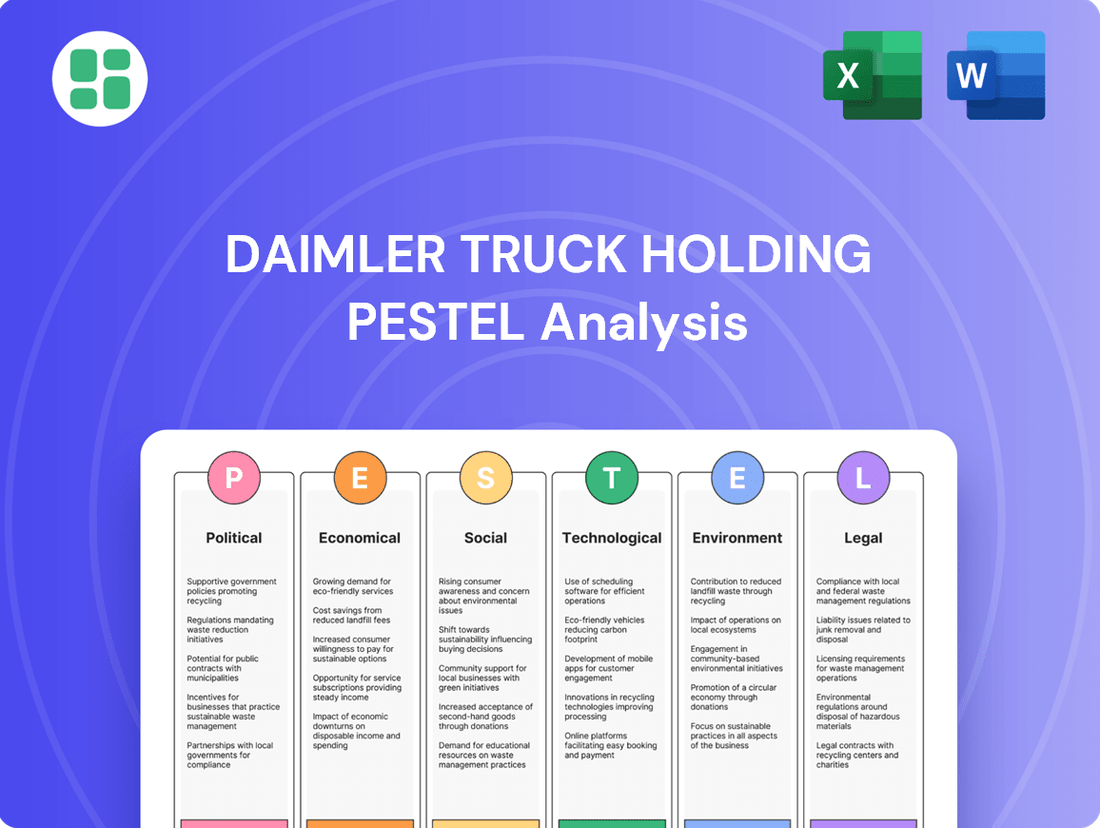

Daimler Truck Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daimler Truck Holding Bundle

Navigate the complex external forces shaping Daimler Truck Holding's future with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic shifts, technological advancements, environmental regulations, and social trends are impacting the company's operations and strategic direction. Gain a critical edge by leveraging these expert-level insights to refine your own market strategies and investment decisions. Download the full PESTLE analysis now for actionable intelligence that empowers smarter business planning.

Political factors

Daimler Truck Holding's global operations are highly sensitive to shifts in international trade policies. Tariffs and trade disputes directly influence sales forecasts and operational costs. For instance, the U.S. imposing tariffs on non-U.S. automotive content and subsequent retaliatory measures by other nations can significantly inflate production expenses and limit strategic maneuverability.

These political uncertainties create a volatile environment that impacts demand and profitability, particularly in key markets like North America. The ongoing trade tensions have contributed to Daimler Truck revising its sales outlook, reflecting the real-world consequences of protectionist policies on the heavy vehicle manufacturing sector.

Government policies offering incentives for electric and hydrogen-powered vehicles are significantly driving the shift towards sustainable transportation. These incentives are vital for making zero-emission trucks more accessible, directly impacting market demand and Daimler Truck's investment decisions in this area.

Daimler Truck is prioritizing its zero-emission vehicle expansion in Europe, a region with more robust regulatory support and financial incentives compared to the United States. For instance, in 2024, Germany alone has allocated substantial funding for hydrogen infrastructure and electric vehicle charging, making it a key market for Daimler's ZEV strategy.

These financial incentives, such as purchase subsidies and tax credits, are crucial for bridging the cost gap between traditional diesel trucks and their zero-emission counterparts. This support is instrumental in encouraging fleet operators to adopt newer, cleaner technologies, thereby boosting sales volumes for companies like Daimler Truck.

Stringent emission standards, like those set by the U.S. EPA and California's CARB, are a major political factor for Daimler Truck. These regulations directly shape the company's product development, pushing for cleaner technologies and impacting sales strategies for traditional and new energy vehicles.

Potential shifts in these regulations, such as the ongoing discussions around the U.S. Clean Truck Plan, introduce significant uncertainty. For instance, any rollback could affect Daimler Truck's ambitious sales targets for electric and hydrogen-powered trucks in crucial North American markets, potentially impacting their investment in these areas.

Safety Regulations and Mandates

Evolving safety regulations, such as mandates for Automatic Emergency Braking (AEB) and speed limiters, necessitate ongoing investment in research and development for Daimler Truck. These evolving standards directly influence vehicle design and add to compliance costs. For instance, new safety functions became mandatory for buses in the EU starting July 2024.

Further impacting the heavy-duty sector, similar safety mandates are anticipated for trucks in the U.S. in 2025. This continuous push for enhanced safety features requires significant capital allocation to ensure Daimler Truck's product portfolio remains compliant and competitive in key markets.

- Mandatory AEB and Speed Limiters: Increased R&D spending required.

- EU Bus Safety Mandates (July 2024): Sets precedent for truck regulations.

- Proposed U.S. Truck Safety Mandates (2025): Drives compliance investment.

- Impact on Vehicle Design: Necessitates engineering adaptations and increased production costs.

Geopolitical Developments and Regional Stability

Broader geopolitical shifts and the stability of various regions significantly influence Daimler Truck's operational landscape. These factors directly impact the resilience of global supply chains, the predictability of market demand, and the confidence of investors making long-term capital allocation decisions. For instance, ongoing macroeconomic uncertainty, coupled with escalating geopolitical tensions in key markets, has been explicitly identified by Daimler Truck as a factor affecting its financial outlook, particularly concerning sales projections across different geographical segments.

The company's performance is intrinsically linked to the global political climate. Daimler Truck's 2023 annual report, for example, highlighted that supply chain disruptions, partly exacerbated by geopolitical events, presented challenges. Looking ahead to 2024 and 2025, continued regional instability in areas crucial for raw material sourcing or manufacturing could further strain production and logistics. This necessitates agile strategic planning to mitigate potential impacts on delivery schedules and cost structures.

- Supply Chain Vulnerabilities: Geopolitical flashpoints can disrupt the flow of essential components, impacting production timelines.

- Market Demand Fluctuations: Regional conflicts or political instability can dampen economic activity and reduce demand for commercial vehicles.

- Investment Climate: Uncertainty stemming from geopolitical developments can lead to cautious investment, affecting Daimler Truck's expansion plans.

- Regulatory Environment: Shifting political alliances or trade policies can alter market access and compliance requirements.

Government incentives for zero-emission vehicles are a significant political driver for Daimler Truck, particularly in Europe. For example, Germany's 2024 funding for hydrogen infrastructure and electric charging directly supports Daimler's strategy, making markets like Germany crucial for its ZEV expansion. These subsidies are essential for making cleaner trucks financially viable for fleet operators.

Stringent emission standards, such as those from the U.S. EPA and California's CARB, dictate Daimler Truck's product development. Potential regulatory shifts, like changes to the U.S. Clean Truck Plan, introduce uncertainty for electric and hydrogen truck sales targets in North America. Evolving safety regulations, such as mandatory Automatic Emergency Braking (AEB) and speed limiters, also necessitate ongoing R&D investment, with new EU bus safety mandates taking effect in July 2024 and similar U.S. truck mandates anticipated for 2025.

| Political Factor | Impact on Daimler Truck | Example/Data Point |

|---|---|---|

| ZEV Incentives | Drives adoption of electric and hydrogen trucks | Germany's 2024 funding for charging infrastructure |

| Emission Standards | Shapes product development and compliance | U.S. EPA and CARB regulations |

| Safety Mandates | Requires R&D investment and design adaptation | EU Bus Safety Mandates (July 2024), U.S. Truck Mandates (2025) |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Daimler Truck Holding, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the company's strategic landscape and identifies key opportunities and threats for informed decision-making.

A concise PESTLE analysis for Daimler Truck Holding provides a clear roadmap, alleviating the pain of navigating complex external factors and enabling focused strategic decision-making.

Economic factors

The global trucking industry experienced a significant freight recession through much of 2024, driven by a combination of decreased consumer spending and persistent high inflation. This downturn directly translated into lower freight volumes, impacting demand for new commercial vehicles.

While projections for 2025 suggest a period of stabilization and a slow, gradual recovery, the pace of this rebound remains a key concern. This extended period of subdued demand continues to weigh on revenue for truck manufacturers and suppliers.

For instance, the Cass Freight Index, a key indicator of freight activity, showed a year-over-year decline of 6.7% in May 2024, highlighting the depth of the recession. Analysts anticipate a modest 2-3% increase in freight volumes for late 2024 into 2025, but this recovery is still considered fragile.

Interest rates remain a significant factor, influencing the speed of market recovery and prompting cautious fleet investment. For instance, the European Central Bank's key interest rates in early 2024 have remained elevated compared to previous years, impacting borrowing costs for businesses.

These higher financing costs can make acquiring new trucks less attractive, potentially dampening Daimler Truck's sales volumes. This is particularly true for smaller transport companies that may have tighter budgets and rely more heavily on financing for fleet upgrades.

The resulting impact on Daimler Truck's profitability is a key consideration, as reduced demand and potentially lower margins on financed sales can affect overall financial performance in the 2024-2025 period.

Persistent supply chain issues and fluctuating prices for key materials like steel and aluminum continue to drive up production expenses for truck makers. For instance, in early 2024, steel prices saw significant volatility, impacting manufacturing budgets across the automotive sector.

Tariffs also play a role, increasing overall costs and compelling companies like Daimler Truck to strategically adjust their supply chains and implement rigorous cost management practices to maintain profitability.

Currency Fluctuations

Currency fluctuations significantly impact Daimler Truck Holding's financial performance due to its extensive global manufacturing and sales footprint. For example, a stronger Euro can make Daimler Truck's vehicles more expensive for buyers in countries with weaker currencies, potentially dampening demand.

Conversely, favorable exchange rates can boost reported earnings when profits earned in foreign currencies are converted back into the company's reporting currency. In 2023, Daimler Truck reported that its foreign currency translation adjustments had a notable impact on its financial results, though specific figures are detailed within their annual reports.

These shifts also affect the cost of sourcing components and raw materials from different countries. If Daimler Truck sources parts from a region with a depreciating currency, its production costs could decrease, enhancing its profit margins. The company actively manages these risks through hedging strategies to mitigate volatility.

- Impact on Revenue: A stronger Euro can reduce the competitiveness of Daimler Truck's exports.

- Production Costs: Fluctuations affect the cost of imported components and materials.

- Profitability: Exchange rate gains or losses directly influence net income when foreign earnings are repatriated.

- Hedging Strategies: Daimler Truck employs financial instruments to manage currency risk exposure.

Market Demand and Unit Sales Forecasts

Daimler Truck Holding has recently adjusted its 2025 sales and profit outlook downward. This revision stems from persistent market weakness and a noticeable decline in demand across key regions like North America and Europe.

Despite a positive trend in battery-electric vehicle sales during 2024, the company experienced an overall decrease in unit sales. This situation points to a challenging demand environment for the broader commercial vehicle market.

- Revised 2025 Forecasts: Daimler Truck has lowered its earlier projections for sales and profits for 2025.

- Regional Weakness: The downward revision is largely attributed to deteriorating market conditions and demand in North America and Europe.

- BEV Growth vs. Overall Decline: While battery-electric vehicle sales saw an increase in 2024, total unit sales contracted, highlighting a complex market dynamic.

The economic landscape for Daimler Truck Holding in 2024-2025 is marked by a freight recession, with reduced consumer spending and high inflation dampening demand for new commercial vehicles. While a gradual recovery is anticipated for 2025, its pace remains uncertain, impacting revenue and profitability. Elevated interest rates, exemplified by the European Central Bank's key rates in early 2024, increase financing costs for fleet operators, potentially hindering new truck acquisitions.

| Indicator | Value | Period | Source |

|---|---|---|---|

| Cass Freight Index (YoY Change) | -6.7% | May 2024 | Cass Information Systems |

| Anticipated Freight Volume Increase | 2-3% | Late 2024 - 2025 | Industry Analysts |

| ECB Key Interest Rates | Elevated (compared to prior years) | Early 2024 | European Central Bank |

Full Version Awaits

Daimler Truck Holding PESTLE Analysis

The preview shown here is the exact Daimler Truck Holding PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that the detailed insights and strategic analysis presented will be identical to what you download.

Sociological factors

The trucking industry continues to grapple with a significant shortage of qualified drivers, a situation projected to persist through 2025. This scarcity directly impacts freight capacity and the overall efficiency of logistics operations.

This ongoing driver deficit is expected to drive up wages for truck drivers, with estimates suggesting potential increases of 5-10% in the coming year. Companies are increasingly prioritizing robust retention strategies, including better pay, improved working conditions, and enhanced benefits, to secure and keep their drivers.

For fleet operators like Daimler Truck Holding, these sociological factors influence purchasing decisions. The need for more efficient, potentially automated, or driver-assist technologies becomes more pronounced as the cost and availability of labor become more challenging.

Consumers and businesses alike are increasingly prioritizing speed, efficiency, and sustainability in their logistics. This shift is directly impacting the demand for advanced trucking technologies, pushing manufacturers like Daimler Truck to innovate rapidly.

The growing emphasis on environmental responsibility means there's a significant push for electric and alternative fuel vehicles. For instance, by the end of 2024, Daimler Truck had delivered over 7,000 battery-electric trucks globally, signaling a clear market preference for greener transportation options.

Furthermore, the desire for streamlined operations fuels the adoption of integrated logistics solutions and the exploration of autonomous driving technologies. These advancements aim to not only improve delivery times but also enhance overall supply chain resilience and cost-effectiveness.

As more people flock to cities, the demand for efficient urban logistics skyrockets. This means a greater need for specialized vehicles, like smaller, more nimble trucks that can navigate congested streets. Cities are also pushing for quieter and cleaner delivery options, driving innovation in electric and low-emission commercial vehicles.

The global urban population is projected to reach 68% by 2050, according to the UN. This massive shift fuels the need for last-mile delivery solutions. In 2024, the e-commerce sector continued its robust growth, with online sales accounting for a significant portion of retail, further intensifying the pressure on urban delivery networks and the types of vehicles required.

Workforce Development and Training

The automotive industry's rapid shift towards electric and autonomous vehicles necessitates a significant upskilling of the workforce. Daimler Truck, therefore, must invest in specialized training programs for both drivers and technicians to adapt to these technological advancements. This includes focusing on the safe and efficient operation of electric powertrains and autonomous driving systems.

Societal expectations also play a role, with a growing demand for skilled professionals who can manage and maintain these new technologies. For instance, by the end of 2024, there's an anticipated shortage of over 50,000 skilled EV technicians in the US alone, highlighting the urgency for robust training initiatives. Daimler Truck's commitment to workforce development directly addresses this gap, ensuring its operations and customer support remain competitive.

- Specialized Training Needs: Electric vehicle (EV) and autonomous driving technologies require new skill sets for drivers and maintenance personnel.

- Societal Impact: New technologies affect the workforce, necessitating support for programs focused on technology adoption, safety, and efficiency.

- Industry Skill Gaps: Projections indicate a significant shortage of qualified EV technicians, underscoring the need for proactive training by manufacturers like Daimler Truck.

- Daimler Truck's Role: Investing in training is crucial for Daimler Truck to maintain operational excellence and provide effective customer support in an evolving market.

Public Perception of Trucking and Environmental Impact

Public concern over the environmental footprint of commercial vehicles is a significant sociological driver, compelling manufacturers like Daimler Truck to prioritize and showcase cleaner transportation options. This societal demand directly fuels the industry's transition towards net-zero emissions, shaping corporate sustainability agendas.

Daimler Truck's commitment to CO2e neutrality, aiming for carbon-neutral production by 2025 and carbon-neutral vehicles in operation by 2039, directly addresses these public perceptions. The company's investment in battery-electric and hydrogen-powered trucks, such as the eActros and GenH2 Truck, reflects this strategic response to growing environmental awareness.

- Growing Environmental Awareness: Surveys consistently show a rising public expectation for companies to demonstrate strong environmental stewardship. For instance, a 2024 study indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions, extending to the services they rely on, like freight transport.

- Regulatory Pressure: Public opinion often translates into stricter environmental regulations. In the EU, for example, CO2 emission standards for heavy-duty vehicles have been progressively tightened, with targets for 2025 and beyond pushing for significant reductions in fleet emissions.

- Brand Reputation: A positive public image regarding sustainability is increasingly linked to brand loyalty and market share. Daimler Truck's proactive stance on emissions reduction aims to enhance its reputation and appeal to customers who are also under pressure to improve their own environmental performance.

- Shift in Logistics: Businesses are increasingly scrutinizing their supply chains for environmental impact. This means logistics providers and truck manufacturers are expected to offer solutions that align with corporate sustainability goals, driving demand for zero-emission vehicles.

The persistent shortage of qualified truck drivers, projected to continue through 2025, directly impacts freight capacity and logistics efficiency. This scarcity is driving wage increases, with estimates suggesting 5-10% hikes in the coming year, prompting companies like Daimler Truck to enhance retention strategies through better pay and working conditions.

Societal demand for faster, more efficient, and sustainable logistics is accelerating the adoption of advanced trucking technologies. Consumers and businesses alike are prioritizing greener transportation, influencing Daimler Truck’s investment in electric and alternative fuel vehicles, with over 7,000 battery-electric trucks delivered globally by the end of 2024.

Urbanization trends, with the global urban population expected to reach 68% by 2050, are increasing the demand for specialized urban logistics vehicles. This, coupled with the robust growth of e-commerce in 2024, intensifies the need for nimble, quiet, and clean delivery solutions, pushing innovation in electric commercial vehicles.

The automotive industry's rapid shift to electric and autonomous vehicles necessitates significant workforce upskilling. Daimler Truck must invest in specialized training for drivers and technicians, addressing an anticipated shortage of over 50,000 skilled EV technicians in the US alone by the end of 2024.

Technological factors

Daimler Truck is actively pursuing a dual-emission strategy, focusing on both battery-electric and hydrogen fuel-cell technologies for its commercial vehicles. This commitment is evident in its sales figures, with a 17% increase in battery-electric truck and bus sales observed in 2024.

The company is also making strides in hydrogen technology, with plans to deliver its initial heavy-duty hydrogen trucks to customers by 2025. This ambitious timeline is being pursued even as significant challenges related to hydrogen infrastructure development persist.

Daimler Truck is pushing the boundaries in autonomous driving, with a clear goal to launch SAE Level 4 autonomous trucks in the United States by 2027. This ambitious timeline highlights their commitment to leading this transformative technology.

The company is actively conducting real-world tests with trucks designed for autonomous operation. These efforts are bolstered by strategic collaborations, such as their partnership with Torc Robotics, to accelerate the development of sophisticated driverless systems.

Daimler Truck's vision extends to creating self-optimizing, software-defined trucks. This focus on advanced software integration is key to unlocking the full potential of autonomous trucking, promising increased efficiency and safety.

Daimler Truck is heavily investing in digitalization, aiming to create software-defined trucks that offer enhanced safety, comfort, and operational efficiency. This strategic shift is crucial for staying competitive in the evolving automotive landscape.

A significant move is the joint venture focused on developing a proprietary software-defined vehicle platform and a dedicated truck operating system. This platform will allow for continuous improvements and new features to be delivered via over-the-air updates, much like a smartphone, ensuring vehicles remain current and optimized.

By embracing software-defined architectures, Daimler Truck is positioning itself to unlock new revenue streams through digital services and data-driven solutions. For instance, in 2023, the commercial vehicle sector saw increasing demand for connected services, with companies like Volvo Trucks reporting substantial growth in their digital offerings, indicating a strong market appetite for these advancements.

Advanced Safety Systems Integration

Daimler Truck Holding is actively integrating cutting-edge safety technologies like Automatic Emergency Braking (AEB), lane departure warnings, and advanced electronic stability control into its truck models. These systems are designed to proactively prevent accidents, going beyond minimum regulatory requirements to enhance overall road safety significantly.

The implementation of these advanced safety features directly addresses the technological imperative for safer commercial vehicles. For instance, the widespread adoption of AEB systems is projected to reduce rear-end collisions by a substantial margin. In 2024, industry reports indicated that trucks equipped with AEB experienced up to a 30% decrease in certain types of accidents compared to those without.

These technological advancements are not merely about compliance; they represent a strategic investment in accident reduction and improved operational efficiency for fleet owners. Daimler Truck's commitment to this integration is evident in their ongoing research and development, aiming to further refine these systems for even greater impact on road safety in the coming years.

- Automatic Emergency Braking (AEB): Reduces forward collisions by automatically applying brakes.

- Lane Departure Warning (LDW): Alerts drivers when the vehicle drifts out of its lane.

- Electronic Stability Control (ESC): Helps prevent rollovers and loss of control during sudden maneuvers.

- Accident Reduction Impact: Expected to lower accident rates and associated costs for commercial fleets.

Connectivity and Data Analytics

Connectivity and data analytics are transforming fleet management for companies like Daimler Truck. Telematics systems, offering real-time GPS tracking, are now standard, enabling optimized routing and improved fuel efficiency. By mid-2024, over 80% of new heavy-duty trucks sold in North America were equipped with advanced telematics, a significant increase from previous years.

Predictive maintenance tools, powered by the data gathered from these connected vehicles, are crucial for reducing downtime. These systems analyze vehicle performance data to anticipate potential issues before they occur, allowing for proactive servicing. For instance, Daimler Truck's own predictive maintenance solutions have been shown to reduce unscheduled downtime by up to 20% for fleets utilizing them.

- Telematics Integration: Essential for real-time fleet visibility and operational control.

- Predictive Maintenance: Leverages data to minimize vehicle downtime and maintenance costs.

- Data-Driven Optimization: Enhances routing, fuel consumption, and overall asset utilization.

Daimler Truck is heavily investing in digitalization and software development to create advanced, connected vehicles. This focus on software-defined trucks aims to enhance safety, efficiency, and enable over-the-air updates, mirroring smartphone functionality.

The company is also advancing autonomous driving capabilities, targeting SAE Level 4 deployment in the US by 2027, supported by strategic partnerships like the one with Torc Robotics.

Daimler Truck's dual-emission strategy includes significant investment in battery-electric and hydrogen fuel-cell technologies, with battery-electric truck sales seeing a 17% increase in 2024 and initial hydrogen truck deliveries planned for 2025.

Connectivity through telematics is becoming standard, with over 80% of new heavy-duty trucks in North America equipped by mid-2024, facilitating optimized routing and predictive maintenance, which can reduce unscheduled downtime by up to 20%.

| Technological Factor | Daimler Truck's Focus | Key Data/Developments | Impact |

| Electrification | Battery-Electric & Hydrogen Fuel-Cell | 17% increase in battery-electric sales (2024); Hydrogen truck deliveries by 2025 | Reduced emissions, new market segments |

| Autonomous Driving | SAE Level 4 | Targeting US launch by 2027; Partnership with Torc Robotics | Increased safety, operational efficiency |

| Digitalization & Software | Software-Defined Trucks | Proprietary OS development; Over-the-air updates | Enhanced features, new revenue streams |

| Connectivity & Data | Telematics & Predictive Maintenance | 80%+ of new trucks equipped with telematics (mid-2024); Up to 20% reduction in downtime | Optimized fleet management, reduced costs |

Legal factors

Daimler Truck must navigate a complex web of global emission regulations, with many jurisdictions, including the United States and the European Union, tightening standards for internal combustion engines and pushing for zero-emission alternatives. For instance, the EPA's greenhouse gas emissions standards and California's Advanced Clean Truck (ACT) rule are driving a significant shift in the commercial vehicle sector. Failure to meet these evolving requirements, such as those targeting NOx and particulate matter, can result in substantial fines and restrict market entry.

Daimler Truck must navigate increasingly stringent vehicle safety standards and type-approval regulations, particularly those mandating advanced assistance systems. For instance, the European Union's General Safety Regulation 2 (GSR2), effective from July 2024 for new vehicle types and July 2026 for all new vehicles, requires features like advanced emergency braking systems and lane-keeping assist for heavy-duty vehicles.

Compliance impacts Daimler Truck's design, production, and certification timelines, adding complexity and cost to bringing new models to market. Failure to meet these evolving safety mandates, such as those concerning driver fatigue detection or cybersecurity, could lead to significant fines and market access restrictions, affecting sales volumes and profitability.

Changes in labor laws, such as updated driver qualification standards and revised hours of service regulations, significantly impact Daimler Truck's operational efficiency and its ability to serve customers effectively. For instance, the ongoing evolution of regulations in key markets like the European Union and North America directly influences fleet management strategies for Daimler Truck's clientele.

Daimler Truck's strategic initiatives, such as the Cost Down Europe program which involves workforce adjustments, must be carefully managed within the framework of existing labor regulations and collective bargaining agreements. In 2024, for example, navigating union negotiations and compliance with employment laws remains a critical aspect of these cost-saving measures, ensuring adherence to worker protections and contractual obligations.

Data Privacy and Cybersecurity Laws

Daimler Truck faces an increasingly complex landscape of data privacy and cybersecurity laws as its vehicles become more connected and data-rich. Compliance with regulations like the GDPR (General Data Protection Regulation) and evolving national data protection acts is paramount. Failure to secure vehicle data and customer information can lead to significant fines and reputational damage. For instance, in 2023, the EU continued to strengthen its cybersecurity framework, impacting how connected vehicle data is handled.

The company must implement robust measures to protect sensitive data generated by its trucks, including operational telemetry, driver behavior, and customer profiles. This requires ongoing investment in cybersecurity infrastructure and employee training. The increasing sophistication of cyber threats means Daimler Truck must proactively adapt its defenses to prevent data breaches and maintain customer trust. In 2024, regulatory bodies are expected to further scrutinize data handling practices within the automotive sector.

- GDPR and similar data protection laws mandate strict consent and security protocols for customer data.

- Cybersecurity incidents in the automotive sector have resulted in substantial financial penalties and operational disruptions.

- Daimler Truck must ensure secure over-the-air (OTA) software updates to prevent remote exploitation of vehicle systems.

- Compliance with evolving cybersecurity standards, such as ISO/SAE 21434, is critical for vehicle safety and data integrity.

Product Liability and Consumer Protection Laws

Daimler Truck operates under stringent product liability and consumer protection laws across its global markets. These regulations mandate high standards for product safety, quality, and fair trade practices. Failure to comply can result in significant financial penalties and reputational damage.

To navigate these legal landscapes effectively, Daimler Truck must maintain exceptionally rigorous quality control processes and adhere strictly to international product safety standards. Robust warranty programs and comprehensive after-sales service are crucial for mitigating legal risks and ensuring customer satisfaction. For instance, in 2023, the automotive industry saw a notable increase in recalls, highlighting the constant need for vigilance in product development and manufacturing to meet evolving consumer protection expectations.

- Product Safety Compliance: Adherence to global safety standards like UNECE regulations for vehicle emissions and safety features.

- Consumer Rights: Upholding warranties, providing transparent information on vehicle performance and maintenance.

- Recalls and Liability: Managing product recalls efficiently and addressing potential liabilities arising from defects.

- Regulatory Fines: Anticipating and managing potential fines related to non-compliance with consumer protection laws.

Daimler Truck faces stringent regulations concerning emissions and vehicle safety, with key markets like the EU and US pushing for zero-emission solutions and mandating advanced driver-assistance systems. For instance, the EU's General Safety Regulation 2, fully applicable from July 2026, requires features like emergency braking, impacting vehicle design and compliance costs.

Labor laws and data privacy regulations, including GDPR, also demand careful navigation, affecting workforce management and the handling of connected vehicle data. In 2024, ongoing scrutiny of data handling practices in the automotive sector means robust cybersecurity measures are essential to avoid significant penalties and reputational damage.

Product liability and consumer protection laws necessitate rigorous quality control and transparent practices, as highlighted by the increase in automotive recalls in 2023. Daimler Truck's adherence to standards like UNECE regulations and effective recall management are critical for mitigating legal risks and maintaining customer trust.

Environmental factors

Daimler Truck is aggressively pursuing decarbonization, targeting CO2e neutrality at its production facilities in the US, Japan, and India by 2025, with a global goal set for 2039. This commitment is backed by substantial investments in renewable energy sources and efficiency improvements across its operations.

These efforts are already yielding results, as evidenced by a reported 13.8% decrease in production CO2e emissions during 2024. Such progress highlights the company's dedication to environmental stewardship and its proactive approach to meeting evolving climate regulations and stakeholder expectations.

Daimler Truck is actively working to minimize its environmental footprint by reducing resource consumption and waste throughout its manufacturing operations. This commitment is underscored by a strategic focus on adopting circular economy principles.

The company's vehicle design philosophy prioritizes longevity, enabling easier reuse and repair. This approach has resulted in an impressive 93% recyclability rate for its vehicles as of 2024, with battery-electric models achieving an even higher rate of up to 97%.

Daimler Truck is making significant strides in greening its supply chain, with a key focus on electrifying inbound logistics to its manufacturing facilities. This initiative is crucial for reducing the company's overall carbon footprint.

By the close of 2024, a notable portion of the transport operations reaching Daimler Truck's Wörth plant were achieving local CO2e-free status, with approximately 20% of these inbound shipments utilizing electric vehicles or other low-emission solutions.

Climate Change Impact on Operations

Climate change presents a significant operational risk for Daimler Truck. Extreme weather events, like the severe floods impacting Germany in 2021, can disrupt production lines and supply chains, leading to costly downtime. Shifts in resource availability, such as water scarcity, also pose a threat to manufacturing processes. Daimler Truck's proactive sustainability initiatives are designed to mitigate these environmental challenges and ensure operational continuity.

Daimler Truck is actively investing in climate-resilient infrastructure and diversifying its supply chains to buffer against the impacts of climate change. For instance, the company's commitment to carbon-neutral production, with a target of achieving CO2-neutral production at its global plants by 2039, directly addresses the root causes of these environmental shifts. This strategic focus on sustainability is not just about compliance but about building a more robust and adaptable business model for the future.

- Manufacturing Disruptions: Extreme weather events can halt production, impacting output and delivery schedules.

- Supply Chain Vulnerability: Climate-related disruptions can affect the availability and cost of raw materials and components.

- Demand Volatility: Changes in climate can influence the demand for specific vehicle types, such as those used in agriculture or disaster relief.

- Resource Scarcity: Water and energy availability for manufacturing operations could be impacted by climate change.

Demand for Green Logistics Solutions

The growing call for sustainable practices across all sectors is significantly boosting the demand for green logistics. Consumers and businesses alike are prioritizing environmentally responsible supply chains, which directly translates into a stronger market for zero-emission trucks and buses. This shift is a key environmental factor influencing the transportation industry.

Daimler Truck Holding has seen this trend reflected in its own sales figures. In 2024, the company reported a notable 17% increase in sales for its battery-electric vehicles. This growth occurred even while the industry grappled with the slower-than-anticipated expansion of charging infrastructure, underscoring the strength of customer demand for greener options.

- Growing Consumer and Societal Pressure: Increased awareness of climate change fuels demand for eco-friendly logistics.

- Market Growth for Zero-Emission Vehicles: This demand directly supports the market for electric trucks and buses.

- Daimler Truck's 2024 Performance: Sales of battery-electric vehicles rose by 17% in 2024, indicating strong market adoption.

- Infrastructure Challenges: Despite infrastructure limitations, the demand for green solutions persists.

Daimler Truck is actively addressing environmental concerns by targeting CO2e neutrality in its production facilities by 2025 and 2039 globally, supported by significant investments in renewable energy. The company's commitment to sustainability is evident in its 13.8% reduction in production CO2e emissions during 2024 and a remarkable 93% vehicle recyclability rate, with electric models reaching 97%.

Climate change poses risks such as manufacturing disruptions from extreme weather and resource scarcity, which Daimler Truck mitigates through climate-resilient infrastructure and diversified supply chains. The growing demand for green logistics is also a significant driver, reflected in Daimler Truck's 17% sales increase for battery-electric vehicles in 2024, despite infrastructure challenges.

| Environmental Factor | Daimler Truck's Action/Impact | Data Point |

|---|---|---|

| Decarbonization Goal | CO2e neutral production facilities | US, Japan, India by 2025; Global by 2039 |

| Production Emissions | Reduction in CO2e emissions | 13.8% decrease in 2024 |

| Circular Economy | Vehicle recyclability rate | 93% overall; up to 97% for battery-electric models (2024) |

| Green Logistics Demand | Sales growth for battery-electric vehicles | 17% increase in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Daimler Truck Holding is built on a comprehensive review of official government reports, reputable financial news outlets, and leading industry publications. We integrate data from international economic bodies and environmental agencies to ensure a thorough understanding of the macro-environment.