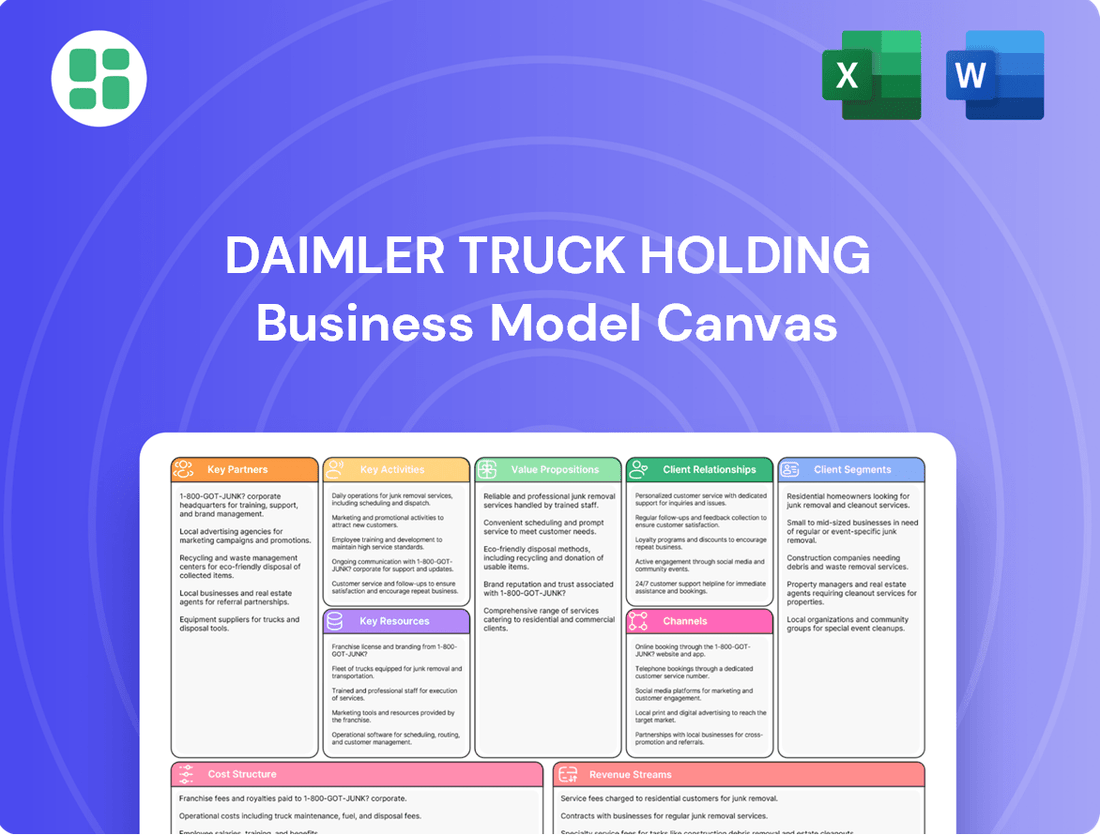

Daimler Truck Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daimler Truck Holding Bundle

Explore the strategic core of Daimler Truck Holding with its comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with diverse customer segments, forge vital partnerships, and deliver innovative value propositions in the global commercial vehicle market. Discover their revenue streams and cost structures that drive profitability.

Unlock the full strategic blueprint behind Daimler Truck Holding's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Daimler Truck actively partners with tech innovators like Torc Robotics to advance autonomous driving, targeting a market launch of SAE Level 4 trucks by 2027. These collaborations are vital for embedding cutting-edge software and sensor tech into their truck designs.

Furthermore, Daimler Truck engages in strategic joint ventures, such as Coretura with Volvo Group, to develop software-defined vehicle platforms, paving the way for future technological advancements and integrated systems.

Daimler Truck is forging strategic alliances to bolster its market presence, notably by integrating Mitsubishi Fuso and Hino Motors into a new holding company. Daimler Truck will hold a 25% stake in this venture, which is slated to begin operations in April 2026.

This collaboration is designed to establish a formidable global trucking entity, sharpening its competitive edge, especially within the crucial Asian markets.

Daimler Truck maintains crucial relationships with suppliers and component manufacturers to secure essential parts for its extensive vehicle range. For instance, their strategic investment in a U.S. battery Gigafactory, in partnership with CATL, highlights their commitment to securing battery cells for electric trucks, a key component for future mobility. This collaboration is vital for ensuring a stable supply chain for advanced technologies and supporting the production of their growing electric vehicle portfolio.

Charging Infrastructure Providers

Daimler Truck collaborates with charging infrastructure providers to accelerate the adoption of electric heavy-duty trucks. This partnership is crucial for building out the necessary charging network.

Their TruckCharge service exemplifies this collaboration, offering comprehensive charging solutions. This includes expert advice, power infrastructure setup, and ongoing operational support for fleet operators transitioning to electric vehicles.

Key aspects of these partnerships often involve:

- Joint development of charging technologies and standards

- Advocacy for government incentives and public charging infrastructure expansion

- Integration of charging solutions into fleet management systems

In 2024, the demand for accessible and reliable charging for electric trucks continued to grow, making these partnerships vital for Daimler Truck's e-mobility strategy.

Dealer and Service Network Partners

Daimler Truck relies heavily on its extensive global network of dealers and service partners. These partners are crucial for effectively selling trucks, distributing them worldwide, and providing essential aftermarket services. Their reach ensures customers have access to support wherever they operate.

The company is actively investing in this network to boost its service business. This includes efforts to improve the availability of spare parts, a critical component for keeping vehicles on the road. By enhancing parts logistics, Daimler Truck aims to minimize downtime for its customers.

Further investments are being channeled into both the retail and service segments of the network. This strategic move is designed to bring Daimler Truck closer to its customers, offering more localized support and a better overall customer experience. The goal is to strengthen relationships and ensure high levels of satisfaction.

For instance, in 2024, Daimler Truck continued to expand its dealer footprint, with a particular focus on emerging markets. The company reported a 5% increase in service revenue year-over-year, largely attributed to improved parts availability and expanded service offerings through its partner network.

Daimler Truck cultivates key partnerships with technology firms like Torc Robotics for autonomous driving advancements, aiming for SAE Level 4 truck launches by 2027, integrating advanced software and sensor technology. Strategic joint ventures, such as Coretura with Volvo Group, are crucial for developing unified software-defined vehicle platforms.

The company also forms alliances to strengthen its global presence, including a significant stake in a new holding company with Mitsubishi Fuso and Hino Motors, set to launch in April 2026, bolstering its competitive position, especially in Asia. These collaborations are essential for driving innovation and expanding market reach.

Daimler Truck's partnerships with suppliers, like CATL for battery cells, are vital for securing components for its growing electric truck portfolio, ensuring a stable supply chain for future mobility solutions. Collaborations with charging infrastructure providers, exemplified by the TruckCharge service, are critical for building out the necessary charging networks to support the widespread adoption of electric heavy-duty trucks.

Their extensive global network of dealers and service partners is fundamental for sales, distribution, and aftermarket support, with investments in 2024 focusing on improving parts availability and expanding service offerings, leading to a reported 5% year-over-year increase in service revenue.

What is included in the product

This Business Model Canvas outlines Daimler Truck's strategy of providing a comprehensive range of trucks and services, targeting diverse commercial transport needs through a global network of dealerships and digital platforms.

It details customer segments like logistics companies and owner-operators, emphasizing value propositions of reliability, efficiency, and sustainability, supported by robust after-sales services and financing.

Daimler Truck's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing for rapid identification of inefficiencies and strategic alignment.

This structured approach helps alleviate the pain of understanding and managing a global enterprise, enabling faster decision-making and more effective problem-solving.

Activities

Daimler Truck is significantly boosting its investment in research and development, especially focusing on cutting-edge electric and autonomous vehicle technologies. This commitment is reflected in their increased R&D spending for 2024.

Key areas of development include advanced battery-electric and hydrogen-powered trucks and buses, all part of their ambitious goal to achieve CO₂e-free transportation by 2050.

Daimler Truck's core activity revolves around the manufacturing and assembly of a wide range of trucks and buses. This global operation spans multiple brands and regions, including Freightliner and Western Star in North America, Mercedes-Benz Trucks in Europe, Fuso and BharatBenz in Asia, and Daimler Buses with brands like Setra and Thomas Built Buses.

In 2023, Daimler Truck reported a significant increase in sales, delivering approximately 526,000 trucks and buses globally. This robust production output underscores the scale and complexity of their manufacturing and assembly operations, which are crucial for meeting diverse market demands.

Daimler Truck manages a vast global sales and distribution network, crucial for connecting with customers across diverse markets. This includes a robust network of dealerships and direct sales operations to effectively market and sell their comprehensive range of commercial vehicles.

In 2023, Daimler Truck achieved significant sales figures, delivering approximately 526,000 trucks and buses globally. This highlights the effectiveness of their extensive dealer network and direct sales channels in reaching a broad customer base.

Aftermarket Services and Parts

Daimler Truck's aftermarket services and parts are a cornerstone of its business model, focusing on providing comprehensive support to keep vehicles operational. This involves a robust supply chain for genuine parts and a network of service centers offering maintenance and repair solutions. These activities are vital for maintaining customer loyalty and ensuring the longevity of their truck fleets.

The financial performance of this segment underscores its importance. In 2024, Daimler Truck reported that its aftermarket services and parts division generated over €8 billion in revenue. This substantial income stream is not only a significant contributor to the company's overall profitability but also plays a critical role in enhancing profit margins. Furthermore, the quality and availability of these services directly impact customer satisfaction and strengthen long-term relationships, fostering repeat business and brand advocacy.

- Extensive Aftermarket Support: Daimler Truck provides a wide array of services including maintenance, repairs, and a reliable supply of genuine parts.

- Significant Revenue Generation: This segment achieved over €8 billion in revenue in 2024, highlighting its financial importance.

- Margin Improvement: The aftermarket services and parts division is crucial for boosting Daimler Truck's overall profit margins.

- Customer Relationship Enhancement: Providing excellent aftermarket care strengthens customer loyalty and fosters enduring business relationships.

Financial Services Provision

Daimler Truck Financial Services is a cornerstone of the business, providing essential financing solutions for their extensive range of trucks and buses. This crucial activity directly supports vehicle sales by making these significant investments more accessible to customers.

Beyond mere financing, Daimler Truck Financial Services also develops and offers comprehensive ecosystems that integrate vehicle solutions with charging infrastructure. This holistic approach enhances customer value and fosters long-term loyalty.

- Financing for Trucks and Buses: Facilitates vehicle acquisition for a broad customer base.

- Holistic Ecosystems: Integrates vehicle, charging, and digital services for enhanced customer experience.

- Revenue Streams: Generates income from interest, fees, and service contracts.

- Customer Loyalty: Builds stronger relationships through integrated financial and operational support.

In 2023, Daimler Truck Financial Services reported a significant contribution to the group's overall performance, with a substantial portfolio of financed vehicles and related services supporting global sales operations.

Daimler Truck's key activities center on designing, manufacturing, and assembling a diverse portfolio of trucks and buses globally under various renowned brands. This core operation is supported by significant investments in research and development, particularly for electric and autonomous vehicle technologies, with a clear aim for CO₂e-free transportation by 2050.

Furthermore, the company actively manages an extensive global sales and distribution network, ensuring their vehicles reach customers worldwide. Complementing these sales, Daimler Truck provides robust aftermarket services and parts, a segment that generated over €8 billion in revenue in 2024, bolstering customer loyalty and company profitability.

Finally, Daimler Truck Financial Services plays a vital role by offering financing solutions and integrated ecosystems that support vehicle sales and enhance customer value, demonstrating a commitment to comprehensive customer support across the entire vehicle lifecycle.

| Key Activity | Description | 2023/2024 Data/Impact |

|---|---|---|

| Manufacturing & Assembly | Producing trucks and buses globally | Delivered ~526,000 vehicles in 2023 |

| Research & Development | Focus on electric and autonomous vehicle tech | Increased R&D spending in 2024; goal of CO₂e-free transport by 2050 |

| Sales & Distribution | Managing global sales network | Effective reach to broad customer base |

| Aftermarket Services & Parts | Maintenance, repair, and parts supply | Over €8 billion revenue in 2024; enhances profit margins |

| Financial Services | Vehicle financing and integrated solutions | Substantial portfolio supporting global sales; builds customer loyalty |

Full Version Awaits

Business Model Canvas

The Daimler Truck Holding Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally structured analysis that you will be able to edit and utilize immediately. Rest assured, there are no hidden sections or altered content; what you see is precisely what you will download.

Resources

Daimler Truck's intellectual property is a cornerstone, featuring a vast portfolio of patents. These cover crucial areas like advanced powertrain technologies, including those for their battery-electric and hydrogen fuel cell trucks, as well as sophisticated autonomous driving systems and vehicle software. This deep well of innovation is a key differentiator.

The company's proprietary technology for electric and hydrogen powertrains is particularly vital. For instance, in 2024, Daimler Truck continued to invest heavily in R&D for these sustainable solutions, aiming to lead the transition towards zero-emission commercial transport. This focus ensures they remain at the forefront of green automotive engineering.

Daimler Truck operates a vast global network of manufacturing facilities and assembly lines, crucial for its large-scale production of commercial vehicles. These plants are strategically located to serve diverse markets efficiently.

For instance, the Freightliner plant in Cleveland, North Carolina, is a key facility responsible for producing a wide array of their commercial trucks. This site exemplifies the company's commitment to maintaining robust production capabilities.

In 2023, Daimler Truck reported a significant increase in unit sales, reaching 526,053 vehicles, up from 471,000 in 2022, underscoring the operational strength and capacity of its manufacturing base to meet growing demand.

Daimler Truck relies heavily on its over 102,000 employees as of December 2024, a crucial asset for its operations. This extensive team includes highly skilled engineers, innovative designers, and specialized manufacturing experts who are the backbone of the company's ability to produce and advance its commercial vehicle offerings.

The expertise housed within this workforce is directly responsible for driving innovation in areas like alternative powertrains and autonomous driving technology. Without this deep pool of engineering talent and manufacturing know-how, Daimler Truck would struggle to maintain its competitive edge and deliver the sophisticated products customers expect.

Brand Portfolio and Reputation

Daimler Truck Holding's brand portfolio is a cornerstone of its business model, encompassing a diverse range of globally recognized names. The strong brand equity associated with Mercedes-Benz, Freightliner, Western Star, Fuso, Setra, Thomas Built Buses, BharatBenz, Rizon, and Detroit Diesel translates directly into market trust and premium positioning. This established recognition allows Daimler Truck to command pricing power and foster customer loyalty across various segments of the commercial vehicle market.

The collective reputation of these brands underpins Daimler Truck's ability to penetrate new markets and maintain its competitive edge. For instance, Freightliner consistently holds a leading market share in the North American heavy-duty truck segment, demonstrating the brand's strong appeal. In 2023, Daimler Truck reported significant revenue growth, partly driven by the continued strength and demand for its various truck and bus brands worldwide.

- Brand Strength: Mercedes-Benz, Freightliner, Western Star, Fuso, Setra, Thomas Built Buses, BharatBenz, Rizon, and Detroit Diesel are key assets.

- Market Trust: These established brands are globally recognized and command significant market trust.

- Competitive Advantage: Brand equity enables premium pricing and customer loyalty.

- Market Performance: Freightliner's leading position in North America and overall revenue growth in 2023 highlight brand impact.

Global Distribution and Service Network

Daimler Truck's global distribution and service network is a cornerstone of its business model, acting as a vital physical and relational asset. This vast infrastructure encompasses numerous dealerships, dedicated service centers, and strategically located parts distribution hubs across the globe.

This extensive network is crucial for reaching customers effectively, facilitating the timely delivery of vehicles, and providing essential ongoing support and maintenance. For instance, in 2023, Daimler Truck reported a global service network of approximately 10,000 service points, underscoring its commitment to customer proximity and operational efficiency.

- Global Reach: Operates over 10,000 service points worldwide as of 2023, ensuring widespread customer access.

- Customer Support: Facilitates efficient vehicle delivery and provides essential after-sales services, including maintenance and repairs.

- Parts Availability: A robust parts distribution system ensures quick access to necessary components, minimizing downtime for customers.

- Brand Presence: The network reinforces Daimler Truck's brand visibility and customer loyalty across diverse international markets.

Daimler Truck's key resources are a blend of tangible and intangible assets crucial for its operations. The company's intellectual property, including patents for advanced powertrains and autonomous driving, provides a significant competitive edge.

Its global manufacturing footprint, exemplified by facilities like the Freightliner plant in Cleveland, North Carolina, underpins large-scale production, as evidenced by a 2023 unit sales increase to 526,053 vehicles.

A workforce of over 102,000 employees as of December 2024, comprising skilled engineers and manufacturing experts, drives innovation and production excellence.

Furthermore, a strong brand portfolio featuring names like Mercedes-Benz and Freightliner, coupled with an extensive global distribution and service network of over 10,000 service points (2023), ensures market trust and customer support.

| Resource Type | Key Asset | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Patents (Powertrain, Autonomous Driving) | Ongoing R&D investment in sustainable solutions |

| Physical Assets | Global Manufacturing Facilities | Freightliner plant in Cleveland, NC |

| Human Capital | Skilled Workforce | Over 102,000 employees (Dec 2024) |

| Brand Equity | Brand Portfolio (Mercedes-Benz, Freightliner, etc.) | Leading market share for Freightliner in North America |

| Distribution & Service | Global Network | Over 10,000 service points |

Value Propositions

Daimler Truck Holding boasts an extensive product lineup, encompassing everything from light-duty vans to robust heavy-duty trucks and versatile city to intercity buses. This broad spectrum ensures that customers across various sectors, including logistics, public transportation, and specialized industries, can find vehicles precisely suited to their operational requirements. For instance, in 2023, Daimler Truck reported global sales of approximately 526,000 trucks and buses, highlighting the sheer scale of their comprehensive portfolio.

Daimler Truck Holding champions sustainable mobility by investing heavily in electric and autonomous vehicle technologies, offering a forward-thinking value proposition for customers seeking cleaner and more efficient transport solutions.

The company's commitment to achieving CO₂e-free transport by 2050 is backed by its expanding portfolio of battery-electric and hydrogen-powered trucks, directly addressing the growing demand for environmentally responsible logistics.

For instance, in 2023, Daimler Truck delivered around 390,000 trucks and buses, with a significant portion of their research and development budget allocated to these future-oriented technologies.

Daimler Truck is renowned for its robust engineering and the exceptionally long lifespan of its commercial vehicles, directly translating into high reliability and durability for its customers.

This commitment to quality means less unexpected downtime for fleet operators, a critical factor in maximizing operational efficiency and profitability. For instance, in 2023, Daimler Truck reported a significant increase in its service business, partly driven by the demand for maintaining its durable vehicles, underscoring the value proposition of longevity.

Advanced Safety Features

Daimler Truck Holding integrates cutting-edge safety technologies, including advancements for SAE Level 4 autonomous driving, to significantly improve vehicle and road safety. This commitment to safety directly protects drivers, valuable cargo, and all other road users, thereby minimizing accident risks and potential losses.

The company's proactive approach to safety is a key value proposition, aiming to reduce the frequency and severity of accidents. For instance, advanced driver-assistance systems (ADAS) are becoming standard, with features like Active Brake Assist 6, which can react to stationary and moving objects, including pedestrians and cyclists, even in complex urban traffic scenarios. This technology is crucial in preventing collisions.

- Enhanced Driver Protection: Features like enhanced collision mitigation and fatigue detection systems are designed to keep drivers safe and alert.

- Cargo Security: Advanced braking and stability control systems help prevent cargo damage and loss due to accidents.

- Road User Safety: Predictive cruise control and lane-keeping assist technologies contribute to smoother traffic flow and reduced incidents involving other vehicles.

- Autonomous Driving Capabilities: The development of SAE Level 4 systems promises a future with even greater safety by removing human error from critical driving situations.

Total Cost of Ownership Optimization

Daimler Truck focuses on minimizing the total cost of ownership for its clients. This is achieved through a combination of fuel-efficient vehicle designs, extensive after-sales service networks, and flexible financing options. For instance, in 2023, Daimler Truck reported that advanced powertrain technologies in their new models can lead to fuel savings of up to 7% compared to previous generations, directly impacting operational expenses.

The company's comprehensive service offerings are designed to keep vehicles running optimally, reducing downtime and associated repair costs. This includes proactive maintenance scheduling and readily available spare parts. Daimler Truck's commitment to service excellence is underscored by its network of over 1,000 authorized service centers globally, ensuring quick support for its fleet customers.

Furthermore, Daimler Truck provides tailored financial services, including leasing and financing packages, to help customers manage their capital expenditure effectively. These solutions are structured to align with customer cash flows, making the acquisition and operation of heavy-duty vehicles more predictable and affordable. Their financing arm aims to offer competitive rates, contributing to a lower overall cost of ownership throughout the vehicle's lifecycle.

- Fuel Efficiency: Reducing operational expenses through advanced powertrain technology.

- Service Network: Minimizing downtime and repair costs with extensive after-sales support.

- Financing Solutions: Optimizing capital expenditure and cash flow management for customers.

- Lifecycle Cost Reduction: Aiming for overall affordability and predictability in vehicle ownership.

Daimler Truck Holding offers a comprehensive product range, from light vans to heavy-duty trucks and buses, catering to diverse customer needs in logistics and public transport. In 2023, the company sold approximately 526,000 trucks and buses globally, demonstrating the breadth of its offerings.

The company is a leader in sustainable mobility, investing in electric and autonomous technologies to provide eco-friendly transport solutions. Their commitment to CO₂e-free transport by 2050 is supported by an expanding portfolio of battery-electric and hydrogen trucks, with significant R&D investment in these areas.

Daimler Truck vehicles are known for their robust engineering and longevity, ensuring high reliability and reduced downtime for fleet operators. This durability is reflected in their service business, which saw significant growth in 2023, driven by demand for maintenance of their long-lasting vehicles.

Safety is paramount, with advanced features like SAE Level 4 autonomous driving capabilities and systems like Active Brake Assist 6. These technologies aim to minimize accidents, protect drivers and cargo, and enhance road safety for all users.

Daimler Truck focuses on minimizing the total cost of ownership through fuel-efficient designs, extensive service networks, and flexible financing. For example, new models offer up to 7% fuel savings, and their global network of over 1,000 service centers ensures minimal downtime.

| Value Proposition | Description | 2023 Impact/Data |

|---|---|---|

| Comprehensive Product Portfolio | Wide range of trucks, vans, and buses for various industries. | Global sales of approx. 526,000 units. |

| Sustainable Mobility Solutions | Investment in electric and hydrogen-powered vehicles. | Focus on CO₂e-free transport by 2050. |

| Durability and Reliability | Robust engineering leading to long vehicle lifespan. | Increased service business driven by vehicle maintenance needs. |

| Advanced Safety Features | Integration of cutting-edge driver assistance and autonomous systems. | Development towards SAE Level 4 autonomy. |

| Minimized Total Cost of Ownership | Fuel efficiency, extensive service, and tailored financing. | Up to 7% fuel savings in new models; over 1,000 service centers. |

Customer Relationships

Daimler Truck cultivates strong customer bonds through specialized sales teams and a robust after-sales network. This commitment extends to providing essential technical support, comprehensive maintenance services, and readily available parts, ensuring continuous operational uptime for their clients.

In 2024, Daimler Truck continued to emphasize customer loyalty by enhancing its service offerings. For instance, their proactive maintenance programs aim to minimize downtime, directly contributing to the profitability and efficiency of fleet operators, a key segment for the company.

Daimler Truck's customer relationships in fleet management are significantly bolstered by digital services like Fleetboard. These offerings provide customers with advanced telematics, enabling real-time vehicle tracking, performance monitoring, and efficient logistics management. This digital integration is key to optimizing operational efficiency and delivering actionable, data-driven insights to their clientele.

In 2024, Daimler Truck's digital services are designed to foster strong, ongoing relationships by delivering tangible value. By helping customers reduce downtime and improve fuel efficiency through these digital tools, Daimler Truck positions itself as a critical partner in their success. This focus on data-driven optimization creates a sticky customer experience, encouraging continued engagement with their digital ecosystem.

Daimler Truck cultivates long-term partnerships with major fleet operators and corporate clients by offering bespoke contracts, volume-based pricing, and specialized support services. These relationships are crucial for securing consistent sales volumes and fostering customer loyalty.

These key account partnerships often feature custom vehicle configurations designed to meet specific operational needs, alongside dedicated account management teams providing proactive assistance. For instance, in 2023, Daimler Truck's focus on these strategic relationships contributed to a significant portion of their global sales, particularly in the heavy-duty truck segment.

Consultative Sales Approach for New Technologies

Daimler Truck utilizes a consultative sales approach for its new technologies, particularly electric and autonomous vehicles. This involves offering eConsulting services to guide customers through the complexities of adopting these innovations.

The company provides comprehensive training and ongoing support to ease the transition for fleet operators. This proactive engagement helps address potential hurdles concerning charging infrastructure and the operational integration of new vehicle types.

- eConsulting Services: Daimler Truck offers expert advice to help customers navigate the adoption of electric and autonomous vehicle technology.

- Training Programs: Comprehensive training is provided to ensure drivers and maintenance staff are proficient with the new systems.

- Infrastructure Support: Guidance is offered on developing the necessary charging infrastructure and managing the operational changes.

- Customer Transition: The goal is to facilitate a smooth and efficient transition for customers moving to advanced powertrain and driving technologies.

Customer Feedback and Co-creation

Daimler Truck actively seeks customer input to refine its product offerings and enhance service delivery. This feedback loop is crucial for ensuring that new vehicles and associated services align with the practical requirements and operational challenges faced by their diverse customer base.

The company sometimes engages in co-creation initiatives, where customers collaborate directly in developing innovative solutions. This collaborative approach guarantees that Daimler Truck's developments address genuine market needs and operational demands effectively.

- Customer Feedback Channels: Daimler Truck utilizes surveys, direct consultations, and digital platforms to gather feedback on vehicle performance and service quality.

- Co-creation Initiatives: Pilot programs and joint development projects are undertaken with key fleet operators to test and refine new technologies and services.

- Impact on Product Development: Feedback directly influences design modifications, feature enhancements, and the development of new service packages, ensuring market relevance.

- Service Improvement: Customer insights are instrumental in optimizing maintenance schedules, dealer support, and digital service offerings, leading to increased uptime and customer satisfaction.

Daimler Truck's customer relationships are built on a foundation of specialized support and digital integration. By offering eConsulting for new technologies and leveraging platforms like Fleetboard, they provide tangible value, aiming to reduce downtime and improve efficiency for their clients.

In 2024, this focus on customer success is evident in their proactive maintenance programs and tailored digital services, designed to foster loyalty and ensure operational uptime. Key account management and co-creation initiatives further solidify these partnerships, with feedback directly influencing product development.

| Customer Relationship Aspect | Description | 2024 Focus/Example |

|---|---|---|

| Specialized Sales & Support | Dedicated teams and robust after-sales network for technical assistance and parts. | Proactive maintenance programs to minimize fleet operator downtime. |

| Digital Services | Telematics and performance monitoring via Fleetboard for logistics optimization. | Enhancing data-driven insights to improve operational efficiency and customer engagement. |

| Key Account Management | Bespoke contracts, pricing, and dedicated support for major clients. | Custom vehicle configurations and proactive assistance for strategic partnerships. |

| New Technology Adoption | eConsulting, training, and infrastructure support for electric and autonomous vehicles. | Facilitating smooth transitions to advanced powertrains and driving technologies. |

| Customer Feedback & Co-creation | Gathering input to refine offerings and collaborative development of solutions. | Utilizing surveys and pilot programs to ensure market relevance and service improvement. |

Channels

Daimler Truck leverages an extensive global dealership network as its primary sales and distribution channel for trucks and buses. This network is crucial for reaching customers worldwide and providing essential local support.

These authorized dealerships offer comprehensive services, including sales, maintenance, and spare parts, ensuring customers have readily available assistance. This localized approach builds strong customer relationships and facilitates efficient operations.

As of the first half of 2024, Daimler Truck reported a significant global presence, with its dealership network serving customers across numerous countries, underscoring the channel's importance in its business model.

Direct sales to major fleet operators are a cornerstone for Daimler Truck, allowing for significant volume and deep client relationships. This channel focuses on large corporate clients and governmental bodies, where tailored solutions and bulk orders are the norm.

Through direct engagement, Daimler Truck can negotiate terms and customize vehicle specifications to meet the unique operational demands of these major buyers. For instance, in 2024, a significant portion of Daimler Truck's sales volume for its heavy-duty trucks, like the Mercedes-Benz Actros, is attributed to these direct fleet deals, often exceeding hundreds of units per order.

Daimler Truck Holding leverages its corporate website and dedicated digital portals to provide comprehensive product information, enabling customers to explore vehicle specifications and options. These platforms also facilitate seamless customer support and streamlined service booking processes, significantly enhancing accessibility and user experience.

In 2024, Daimler Truck continued to invest in its digital infrastructure, with its online configurators playing a crucial role in the customer journey. These tools empower potential buyers by offering detailed customization options, directly impacting lead generation and sales conversion rates.

Industry Trade Shows and Events

Daimler Truck Holding actively participates in key industry trade shows and events, such as the biennial transport logistic exhibition in Munich. These platforms are crucial for unveiling new truck models, powertrain innovations, and digital services to a global audience. In 2023, transport logistic saw over 2,300 exhibitors, providing a prime environment for Daimler Truck to engage with potential buyers and partners, fostering direct sales leads and strengthening brand presence.

These events serve as vital channels for market visibility and lead generation, allowing Daimler Truck to directly showcase its latest advancements in sustainable transportation and connectivity solutions. For instance, at the 2024 IAA Transportation show, the company highlighted its progress in battery-electric and hydrogen-powered trucks, directly addressing customer interest and regulatory trends. Such participation directly contributes to building the sales pipeline and understanding evolving market demands.

- Market Visibility: Trade shows offer a concentrated audience of industry professionals, enhancing brand recognition and product awareness.

- Lead Generation: Direct interaction at events allows for the capture of high-quality leads from interested customers and partners.

- Customer Engagement: Events provide opportunities for direct feedback and relationship building with existing and potential clients.

- Competitive Analysis: Observing competitors' offerings and strategies at these events informs Daimler Truck's own market positioning and product development.

Daimler Truck Financial Services

Daimler Truck Financial Services acts as a crucial integrated channel within Daimler Truck Holding's business model, offering seamless financing, leasing, and insurance solutions directly to customers. This internal capability significantly smooths the vehicle acquisition process, making it more accessible and attractive for buyers. By providing these financial tools, the channel directly supports sales volume and enhances the overall customer value proposition, creating a more complete offering.

In 2024, Daimler Truck Financial Services continued to be a vital contributor to the company's success. For instance, the company reported that its financing arm played a significant role in facilitating truck sales globally. This channel not only boosts immediate sales but also fosters customer loyalty by providing tailored financial packages that meet diverse business needs.

- Integrated Financing: Daimler Truck Financial Services offers in-house financing, simplifying the purchase of new and used trucks.

- Leasing Solutions: The channel provides flexible leasing options, allowing businesses to manage their fleet costs effectively.

- Insurance Coverage: Comprehensive insurance products are available, offering protection and peace of mind to truck owners.

- Sales Support: This financial arm directly supports the sales of Daimler Truck vehicles by removing financial barriers for customers.

Daimler Truck's channels are a robust mix of direct and indirect approaches. The extensive global dealership network remains paramount for sales and after-sales service, ensuring localized customer support. Direct sales to large fleet operators are also critical, enabling tailored solutions and significant volume deals.

Digital platforms, including the corporate website and configurators, enhance customer engagement by providing detailed product information and facilitating service bookings. Industry trade shows are vital for market visibility, new product launches, and direct lead generation, showcasing advancements like electric and hydrogen trucks.

Daimler Truck Financial Services acts as an integrated channel, offering financing, leasing, and insurance to simplify vehicle acquisition and boost sales. This internal financial arm is a key enabler for customers, fostering loyalty and removing purchase barriers.

| Channel | Description | Key Activity | 2024 Relevance |

|---|---|---|---|

| Dealership Network | Global authorized dealers | Sales, Maintenance, Spare Parts | Crucial for worldwide reach and local support |

| Direct Sales | To large fleet operators | Bulk orders, tailored solutions | Significant volume driver for heavy-duty trucks |

| Digital Platforms | Website, Online Configurator | Product Info, Service Booking, Customization | Enhances customer experience and lead generation |

| Trade Shows | Industry events (e.g., IAA Transportation) | Product Launch, Market Visibility, Lead Gen | Showcases new tech (e.g., e-trucks), builds pipeline |

| Financial Services | In-house financing, leasing, insurance | Facilitates vehicle acquisition, boosts sales | Key contributor to sales volume and customer loyalty |

Customer Segments

Commercial fleet operators, encompassing everyone from single-owner trucking businesses to vast global logistics networks, are a core customer segment for Daimler Truck. These businesses rely heavily on their vehicles for day-to-day operations, prioritizing dependability, fuel efficiency, and overall cost of ownership. In 2024, the demand for efficient fleet management solutions continues to grow as companies aim to optimize routes and reduce operational expenses.

For these operators, Daimler Truck's offerings are crucial for maintaining competitive advantage. A significant factor for them is total cost of operation, which includes purchase price, fuel consumption, maintenance, and resale value. For instance, advancements in powertrain technology, like those seen in Daimler Truck's latest models, directly impact fuel savings, a critical metric for fleet profitability, especially with fluctuating diesel prices throughout 2024.

Construction and vocational industries, including sectors like mining, waste management, and utilities, represent a core customer base for Daimler Truck. These clients demand highly specialized, robust heavy-duty trucks built for exceptionally demanding and often harsh operating conditions. For instance, the Freightliner Cascadia, a flagship model, is frequently configured for vocational applications, showcasing its versatility and durability in these challenging environments.

Daimler Truck's strategy involves providing tailored solutions that meet the unique operational needs of these segments. The X-Series, for example, offers enhanced capabilities and specific features designed to excel in vocational tasks. This focus ensures that customers in these critical industries receive vehicles engineered for maximum uptime and performance, directly contributing to their operational efficiency and profitability.

Public transport authorities and bus operators, both municipal and private, represent a core customer segment for Daimler Truck Holding's bus division. These entities are in constant need of reliable and efficient vehicles for city transit, intercity travel, and longer-distance coaching services. Daimler Buses, through its renowned Setra and Mercedes-Benz brands, directly addresses these requirements with a comprehensive portfolio of urban, intercity, and touring coaches.

In 2024, the demand for sustainable public transport solutions continued to grow, driven by urban population increases and environmental regulations. Daimler Buses reported significant order intake for its electric bus models, reflecting this trend. For instance, the Mercedes-Benz eCitaro saw substantial orders from major European cities aiming to decarbonize their fleets, with some cities like Hamburg placing orders for hundreds of units.

Government and Defense Sectors

Government agencies and defense organizations represent a crucial customer segment for Daimler Truck, requiring highly specialized vehicles for diverse applications such as logistics, troop transport, and public safety operations. These entities often demand robust, reliable, and adaptable solutions that can withstand challenging environments and fulfill specific mission requirements.

Daimler Truck has demonstrated a significant commitment and capability within the defense sector, evidenced by securing substantial contracts that underscore its expertise in this demanding market. For instance, in 2024, the company continued to supply its advanced truck platforms to various national defense forces, contributing to their operational readiness and logistical support capabilities.

The company’s offerings cater to the unique needs of this segment through:

- Specialized military-grade vehicles designed for extreme conditions and tactical operations.

- Robust logistics and transport solutions supporting national infrastructure and public services.

- Long-term service and maintenance contracts ensuring fleet availability and operational efficiency.

- Adaptable platforms that can be configured for a wide range of defense and governmental applications.

Logistics and Delivery Companies (Last Mile & Long Haul)

Logistics and delivery companies, encompassing both last-mile urban operations and extensive long-haul freight, represent a crucial customer segment for Daimler Truck. These businesses are actively seeking to optimize their fleets for efficiency and sustainability.

The demand for electric vehicles (EVs) is particularly strong within urban last-mile delivery networks, driven by emissions regulations and a desire for reduced operating costs in city environments. For instance, by the end of 2024, many major cities are expected to have further tightened low-emission zones, increasing the appeal of electric vans and trucks for local distribution.

Conversely, long-haul transportation continues to rely on robust and fuel-efficient solutions. Daimler Truck is responding to this by developing advanced diesel engines that meet stringent emissions standards and exploring hydrogen fuel cell technology as a viable alternative for zero-emission, long-distance hauling. The global trucking industry saw significant investment in alternative powertrains throughout 2024, with a clear bifurcation between urban electrification and long-haul efficiency needs.

- Last-Mile Focus: High demand for electric trucks and vans in urban areas due to emissions targets and operational cost savings.

- Long-Haul Needs: Continued reliance on efficient diesel technology, with growing interest in hydrogen fuel cells for zero-emission long-distance transport.

- Fleet Modernization: Companies are actively upgrading fleets to meet evolving environmental regulations and improve overall logistics efficiency.

- Total Cost of Ownership: Decision-making is increasingly influenced by the total cost of ownership, factoring in fuel, maintenance, and potential carbon pricing.

Daimler Truck's customer base is diverse, ranging from large commercial fleet operators to specialized vocational industries and public transport authorities. These segments prioritize reliability, efficiency, and total cost of ownership, with a growing emphasis on sustainability and electric mobility in 2024.

Government and defense sectors represent another key area, demanding robust and adaptable vehicles for critical operations. The company also serves logistics and delivery companies, particularly those focused on urban last-mile solutions and long-haul freight, where powertrain efficiency and emissions compliance are paramount.

| Customer Segment | Key Needs | 2024 Trends/Facts |

|---|---|---|

| Commercial Fleet Operators | Dependability, fuel efficiency, TCO | Growing demand for fleet management solutions; 2024 saw continued focus on fuel savings through powertrain advancements. |

| Construction & Vocational | Robustness, specialized features, durability | High demand for trucks configured for harsh environments; X-Series models offer enhanced vocational capabilities. |

| Public Transport | Reliability, efficiency, sustainability | Increased orders for electric buses like the Mercedes-Benz eCitaro; cities like Hamburg placed significant orders in 2024. |

| Government & Defense | Specialized, reliable, adaptable vehicles | Continued supply of advanced platforms to defense forces; focus on military-grade and logistics support vehicles. |

| Logistics & Delivery | Efficiency, sustainability, urban compliance | Strong demand for EVs in last-mile delivery; tightening low-emission zones in cities by end of 2024. |

Cost Structure

Research and Development (R&D) is a substantial expense for Daimler Truck Holding, reflecting its commitment to innovation. Significant investments are channeled into developing cutting-edge technologies, especially electric powertrains and autonomous driving systems, which are crucial for future market competitiveness. In 2024, the company saw its R&D expenditure rise by 5%, underscoring the increasing importance of these forward-looking projects.

Daimler Truck's manufacturing and production costs are significant, encompassing everything from the steel and semiconductors that go into their trucks to the electricity powering their global assembly lines. In 2023, the company reported adjusted earnings before interest and taxes (adjusted EBIT) from industrial business of €4.5 billion, with a substantial portion of this reflecting the direct costs of producing their diverse range of vehicles.

These expenses include the procurement of raw materials and components, the operational costs of their numerous factories worldwide, and the wages for their dedicated workforce. Optimizing these production processes and ensuring an efficient supply chain are critical to managing these costs effectively, especially as the company navigates fluctuating material prices and geopolitical factors impacting global logistics.

Daimler Truck's cost structure heavily features expenses tied to its extensive global sales, marketing, and distribution network. This includes the significant outlay for maintaining a worldwide sales force, developing and executing broad marketing campaigns, and managing the complex logistics of its dealership network. In 2023, Daimler Truck reported selling approximately 526,000 trucks and buses, underscoring the scale of its distribution and sales operations.

Further costs are incurred through participation in crucial industry trade shows and events, which are vital for showcasing new products and engaging with potential customers and partners. These activities, alongside ongoing advertising and promotional efforts, contribute substantially to the overall sales, marketing, and distribution budget, ensuring brand visibility and market penetration across diverse regions.

Personnel Costs

Daimler Truck's personnel costs are substantial, reflecting its global operations and diverse workforce. These costs encompass salaries, wages, and benefits for its more than 102,000 employees as of 2024. This includes the people on the factory floor, the engineers designing new vehicles, the sales teams connecting with customers, and the administrative staff keeping everything running smoothly.

Key components of these personnel costs include:

- Salaries and Wages: Compensation for all employees across manufacturing, engineering, sales, and administration.

- Employee Benefits: Health insurance, retirement plans, and other welfare programs provided to the workforce.

- Training and Development: Investments in upskilling and reskilling employees to maintain competitiveness and adapt to new technologies.

- Global Workforce Management: Costs associated with managing a diverse workforce spread across numerous countries.

Capital Expenditures and Investments

Daimler Truck's cost structure heavily involves substantial capital expenditures and investments. These are primarily directed towards property, plant, and equipment (PP&E), crucial for maintaining and expanding its manufacturing capabilities and technological infrastructure. For instance, in 2024, the company saw a significant 38% increase in its PP&E investments, reflecting a commitment to modernization and efficiency.

These investments are not limited to internal upgrades. Daimler Truck also strategically allocates capital to joint ventures and partnerships, fostering collaboration and accessing new markets or technologies. This dual approach to investment ensures both the enhancement of existing operations and the pursuit of future growth opportunities.

- Investments in PP&E: Upgrades to manufacturing facilities and new technology infrastructure are key cost drivers.

- 2024 Investment Growth: A notable 38% increase in PP&E investments highlights strategic expansion and modernization efforts.

- Strategic Partnerships: Capital is also deployed in joint ventures and partnerships to leverage external expertise and market access.

Daimler Truck's cost structure is significantly influenced by its extensive manufacturing operations and the procurement of raw materials and components. These direct production costs are a major expense, encompassing everything from steel and aluminum to advanced semiconductors essential for modern trucks. In 2023, the company's adjusted EBIT from industrial business was €4.5 billion, with a large portion of this directly attributable to the cost of goods sold.

| Cost Category | Description | Impact |

| Manufacturing & Production | Costs associated with assembly lines, factory operations, and direct labor. | High, directly tied to vehicle output. |

| Raw Materials & Components | Procurement of steel, aluminum, semiconductors, engines, and other parts. | Volatile, subject to global supply chain dynamics and commodity prices. |

| Research & Development (R&D) | Investment in new technologies like electric powertrains and autonomous driving. | Increasing; R&D expenditure rose 5% in 2024. |

| Sales, Marketing & Distribution | Costs for global sales network, advertising, and logistics for approximately 526,000 vehicles sold in 2023. | Substantial, to maintain market presence and reach customers. |

| Personnel Costs | Salaries, wages, and benefits for over 102,000 employees as of 2024. | Significant, reflecting a large global workforce. |

| Capital Expenditures | Investments in property, plant, and equipment (PP&E), with a 38% increase in PP&E investments in 2024. | Strategic, focused on modernization and expansion. |

Revenue Streams

Daimler Truck's primary revenue generation comes from selling new trucks and buses. This is a core part of their business, offering a wide range of vehicles for different needs across the globe.

In 2024, this segment was a significant contributor, with the Group reporting total revenue of €54.1 billion. This figure highlights the substantial volume and value of their vehicle sales operations.

Daimler Truck Holding's aftermarket segment is a robust revenue generator, encompassing the sale of spare parts, lucrative maintenance contracts, and essential repair services. This segment also includes advanced digital offerings, such as the Fleetboard telematics solution, which further enhances customer value and company revenue.

This crucial business area demonstrated strong performance, with revenues exceeding €8 billion in 2024. The consistent demand for reliable parts and ongoing service support underscores its importance as a stable and growing income stream for the company.

Daimler Truck Financial Services generates significant income through vehicle financing, leasing, and insurance offerings. This segment is crucial for supporting vehicle sales by providing customers with flexible purchasing options. In 2023, Daimler Truck Financial Services reported a substantial contribution to the group's overall profitability, highlighting the importance of these service-based revenue streams.

Sales of Used Vehicles

Daimler Truck Holding generates revenue through the sale of pre-owned trucks and buses, a key component of their vehicle lifecycle management. Platforms like TruckStore are instrumental in facilitating these transactions, offering a dedicated channel for used commercial vehicles.

This segment not only provides an additional revenue stream but also supports customer retention and brand loyalty by offering reliable used vehicles. In 2023, the used vehicle market continued to show resilience, with demand often driven by cost-conscious buyers and the need for flexible fleet solutions.

- Revenue Source: Sales of pre-owned trucks and buses.

- Key Platform: TruckStore facilitates these sales.

- Strategic Benefit: Manages vehicle lifecycles and creates an additional sales channel.

- Market Context: Demand for used vehicles remained robust in 2023.

Licensing and Technology Partnerships

Daimler Truck Holding generates revenue by licensing its advanced proprietary technologies and intellectual property to external companies. This allows other manufacturers or technology firms to utilize Daimler Truck's innovations, creating a valuable income stream.

Joint ventures focused on developing cutting-edge technological advancements also contribute significantly. These collaborations pool resources and expertise, with Daimler Truck sharing in the financial rewards of successful new technologies.

Partnerships, such as the one with Coretura, further bolster these revenue streams. These collaborations likely involve shared development costs, licensing fees, or revenue-sharing agreements for specific technological applications.

- Licensing Fees: Revenue generated from granting access to Daimler Truck's patented technologies and software.

- Joint Venture Profits: Daimler Truck's share of profits from collaborative technology development projects.

- Partnership Royalties: Income derived from agreements with partners like Coretura for utilizing specific technological solutions.

- Technology Access Agreements: Fees associated with providing access to Daimler Truck's R&D advancements and platforms.

Daimler Truck Holding's revenue streams are diverse, extending beyond new vehicle sales to include a robust aftermarket business, financial services, and the sale of pre-owned vehicles. Technology licensing and joint ventures also contribute to their financial performance.

In 2024, the company reported total revenue of €54.1 billion, with the aftermarket segment alone generating over €8 billion. These figures underscore the significant contributions from these varied revenue sources.

| Revenue Stream | Description | 2024 Data (if available) | 2023 Data |

| New Trucks & Buses | Core business of selling new commercial vehicles. | Part of €54.1 billion total revenue | N/A |

| Aftermarket | Spare parts, maintenance, repairs, digital services (e.g., Fleetboard). | Over €8 billion | N/A |

| Financial Services | Vehicle financing, leasing, insurance. | N/A | Significant contribution to profitability |

| Pre-owned Vehicles | Sales of used trucks and buses via platforms like TruckStore. | N/A | Robust market demand |

| Technology Licensing & JVs | Licensing IP, profits from joint technology development. | N/A | N/A |

Business Model Canvas Data Sources

The Daimler Truck Holding Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of customer segments, value propositions, and revenue streams.