Daimler Truck Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daimler Truck Holding Bundle

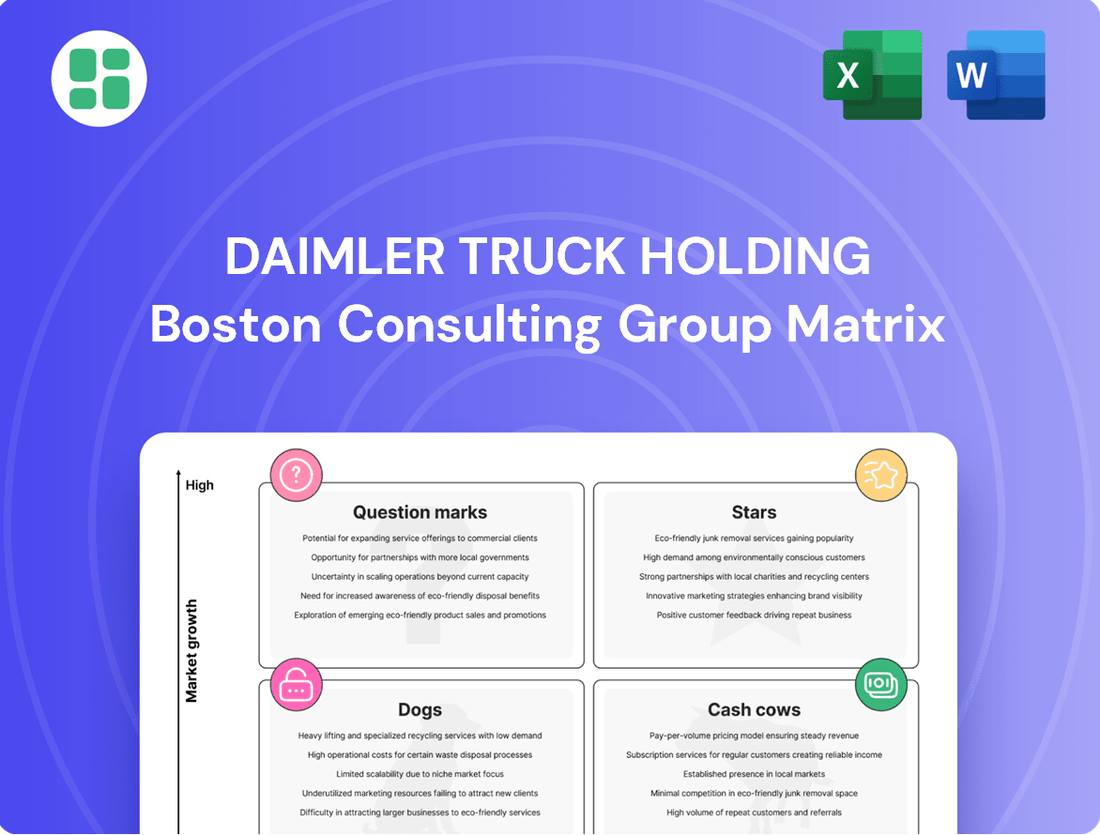

Curious about Daimler Truck Holding's market performance? This glimpse into their BCG Matrix reveals the strategic positioning of their diverse product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the actionable insights! Purchase the full BCG Matrix report to unlock a detailed quadrant breakdown, data-driven recommendations, and a clear roadmap for optimizing Daimler Truck Holding's product strategy and investment decisions.

Stars

Daimler Truck's battery-electric trucks, including the eActros 600 and eCascadia, are firmly positioned as Stars in the BCG matrix. Sales saw a robust 17% increase in 2024, reaching 4,035 units, and experienced a remarkable 90% surge in the second quarter of 2025. This upward trajectory is fueled by growing demand for sustainable logistics and significant fleet orders, such as Amazon's commitment for over 200 eActros 600 trucks.

These electric models are leading the charge in the transition to zero-emission transportation, benefiting from advancements in battery technology and strong market acceptance. The high growth potential in this rapidly expanding sector, coupled with ongoing strategic investments, solidifies their Star status.

Daimler Truck Holding's commitment to autonomous driving, notably through its subsidiary Torc Robotics, firmly places this venture in the Star category of the BCG Matrix. The company is actively developing and integrating cutting-edge autonomous systems into its truck platforms, such as the Fifth Generation Freightliner Cascadia, which is designed with advanced redundant safety features for upcoming series production.

The strategic goal is ambitious: Daimler Truck and Torc Robotics are targeting the launch of SAE Level 4 autonomous trucks in the U.S. market by 2027, with an initial focus on hub-to-hub freight operations. This initiative directly tackles critical industry challenges like persistent driver shortages and promises to unlock significant revenue streams and fundamentally reshape the logistics landscape.

The electric bus market is booming, with projections indicating substantial growth by 2030. Daimler Buses, featuring innovations like the Mercedes-Benz eCitaro and the second-generation Jouley school bus, is strategically positioned to capitalize on this expansion.

Daimler Truck reported a notable 17% surge in battery-electric vehicle sales for 2024, with electric buses playing a key role in this increase. This growth underscores the company's commitment to sustainable public transportation solutions and its proactive development of new electric models to meet rising demand.

Freightliner Cascadia (Next-Generation)

The fifth-generation Freightliner Cascadia, designed with autonomous capabilities, is a key high-growth product for Daimler Truck Holding. Its advanced features and readiness for future technologies position it strongly in the evolving trucking market.

Despite a sales dip in the first half of 2025, Trucks North America, featuring the Cascadia, held a significant 41% market share in the Class 8 segment. This demonstrates the enduring strength and customer preference for the Cascadia.

- High Growth Potential: The Cascadia's autonomous-ready platform drives its high-growth trajectory.

- Market Dominance: Trucks North America maintained a 41% Class 8 market share in early 2025.

- Technological Advancement: Continuous tech integration ensures the Cascadia's competitive edge.

- Brand Loyalty: Strong market share reflects robust brand loyalty in the heavy-duty sector.

Global Aftermarket Services and Digital Solutions

Daimler Truck's Global Aftermarket Services and Digital Solutions are positioned as a Stars in the BCG Matrix, reflecting their strong market growth and high market share. The company is strategically shifting towards becoming a customer-centric solutions provider, evidenced by its service revenue surpassing €8 billion in the Industrial Business during 2024.

This segment is a significant growth driver, fueled by the increasing complexity of today's trucks and the critical need for efficient fleet operations. Key offerings include ensuring parts availability, providing maintenance services, and delivering advanced digital fleet management solutions.

- Service revenue in the Industrial Business exceeded €8 billion in 2024.

- Growth is propelled by vehicle complexity and the demand for operational efficiency.

- Investments are focused on expanding the retail and service network to enhance customer proximity.

- Telematics and connectivity in the heavy truck market provide a strong tailwind for digital service expansion.

Daimler Truck's battery-electric trucks, including the eActros 600 and eCascadia, are firmly positioned as Stars in the BCG matrix. Sales saw a robust 17% increase in 2024, reaching 4,035 units, and experienced a remarkable 90% surge in the second quarter of 2025. This upward trajectory is fueled by growing demand for sustainable logistics and significant fleet orders, such as Amazon's commitment for over 200 eActros 600 trucks.

These electric models are leading the charge in the transition to zero-emission transportation, benefiting from advancements in battery technology and strong market acceptance. The high growth potential in this rapidly expanding sector, coupled with ongoing strategic investments, solidifies their Star status.

Daimler Truck Holding's commitment to autonomous driving, notably through its subsidiary Torc Robotics, firmly places this venture in the Star category of the BCG Matrix. The company is actively developing and integrating cutting-edge autonomous systems into its truck platforms, such as the Fifth Generation Freightliner Cascadia, which is designed with advanced redundant safety features for upcoming series production.

The strategic goal is ambitious: Daimler Truck and Torc Robotics are targeting the launch of SAE Level 4 autonomous trucks in the U.S. market by 2027, with an initial focus on hub-to-hub freight operations. This initiative directly tackles critical industry challenges like persistent driver shortages and promises to unlock significant revenue streams and fundamentally reshape the logistics landscape.

The electric bus market is booming, with projections indicating substantial growth by 2030. Daimler Buses, featuring innovations like the Mercedes-Benz eCitaro and the second-generation Jouley school bus, is strategically positioned to capitalize on this expansion.

Daimler Truck reported a notable 17% surge in battery-electric vehicle sales for 2024, with electric buses playing a key role in this increase. This growth underscores the company's commitment to sustainable public transportation solutions and its proactive development of new electric models to meet rising demand.

The fifth-generation Freightliner Cascadia, designed with autonomous capabilities, is a key high-growth product for Daimler Truck Holding. Its advanced features and readiness for future technologies position it strongly in the evolving trucking market.

Despite a sales dip in the first half of 2025, Trucks North America, featuring the Cascadia, held a significant 41% market share in the Class 8 segment. This demonstrates the enduring strength and customer preference for the Cascadia.

Daimler Truck's Global Aftermarket Services and Digital Solutions are positioned as a Stars in the BCG Matrix, reflecting their strong market growth and high market share. The company is strategically shifting towards becoming a customer-centric solutions provider, evidenced by its service revenue surpassing €8 billion in the Industrial Business during 2024.

This segment is a significant growth driver, fueled by the increasing complexity of today's trucks and the critical need for efficient fleet operations. Key offerings include ensuring parts availability, providing maintenance services, and delivering advanced digital fleet management solutions.

| Product/Service | BCG Category | Market Share | Growth Rate | Key Drivers |

| Battery-Electric Trucks (eActros, eCascadia) | Star | Growing rapidly, specific figures vary by region | 90% (Q2 2025), 17% (2024 total BEV sales) | Sustainability demand, fleet orders, battery tech advancements |

| Autonomous Driving Systems (Torc Robotics) | Star | Emerging market, focus on development | High potential, targeting 2027 launch | Driver shortage, efficiency gains, technological innovation |

| Electric Buses (eCitaro, Jouley) | Star | Strong growth in electric bus segment | Significant growth in BEV sales contributing to overall 17% | Public transport electrification, government incentives |

| Freightliner Cascadia (Autonomous-Ready) | Star | 41% (Class 8 segment, H1 2025) | High growth potential, driven by tech integration | Advanced features, brand loyalty, autonomous capability |

| Global Aftermarket & Digital Solutions | Star | High market share in services | Strong growth, service revenue > €8 billion (Industrial Business 2024) | Vehicle complexity, need for efficiency, digital fleet management |

What is included in the product

This BCG Matrix analysis for Daimler Truck Holding categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Daimler Truck Holding BCG Matrix acts as a pain point reliever by visually categorizing business units, enabling strategic resource allocation and focused problem-solving.

Cash Cows

Daimler Trucks North America, encompassing iconic brands like Freightliner and Western Star, stands as a robust cash cow for Daimler Truck Holding. This segment commands a substantial market share, holding approximately 41% of the North American Class 8 truck market, a testament to its enduring strength and customer loyalty.

While experiencing a market normalization with sales declines in Q1 and Q2 2025, the heavy-duty truck segment continues to be a powerhouse of profitability. In Q2 2025, it reported an impressive adjusted return on sales of 12.9%, underscoring its consistent ability to generate significant earnings.

The established product lines within Daimler Trucks North America are crucial in generating substantial free cash flow. This financial stability is vital, enabling the company to strategically invest in and develop future-oriented technologies, ensuring long-term growth and competitiveness.

Mercedes-Benz Trucks, specifically its traditional diesel models, continues to operate as a cash cow for Daimler Truck Holding. Despite facing a challenging European market with declining demand observed in 2024 and continuing into Q1 2025, the segment benefits from a strong, established market share and a robust brand reputation in its key territories.

The profitability of this segment saw a positive uptick, with an adjusted Return on Sales (ROS) reaching 5.9% in Q2 2025. This improvement in profitability, even with reduced unit sales, highlights successful efficiency enhancements and cost management within the division.

While these diesel trucks remain a consistent and significant generator of revenue and profit for Daimler Truck, it's important to note they operate within a mature market. Growth prospects for these traditional models are inherently limited when compared to the burgeoning potential of electric vehicle alternatives.

Daimler Buses, encompassing its well-regarded Mercedes-Benz and Setra brands, demonstrated robust sales performance throughout 2024. This positive momentum carried into the first half of 2025, with Q1 sales up 11% and Q2 sales seeing a 13.2% increase.

This segment consistently achieves a strong adjusted return on sales, hitting 10.0% in Q2 2025, underscoring its role as a dependable source of cash flow for Daimler Truck Holding.

Despite the burgeoning electric bus market, conventional bus models continue to command a substantial market share. They provide stable and predictable revenue streams, particularly within established public transportation and intercity travel sectors.

FUSO (especially in Indonesia)

FUSO, particularly in Indonesia, serves as a significant cash cow for Daimler Truck Holding. Its enduring market dominance, extending for 54 consecutive years, underscores its stability and reliable profit generation.

In 2024, FUSO secured a commanding 38.1% market share in Indonesia. This strong performance in a key market helps to offset broader segment challenges.

While the Trucks Asia segment experienced a dip in unit sales and revenue in 2024, FUSO’s consistent leadership in Indonesia guarantees steady cash flow. This position reflects mature market conditions with limited but dependable returns.

- FUSO's Indonesian Market Leadership: Maintained for 54 consecutive years.

- 2024 Market Share in Indonesia: 38.1%.

- Cash Flow Generation: Stable profits from a mature market.

- Segment Performance Context: Helps balance overall Trucks Asia performance.

Financial Services Division

Daimler Truck's Financial Services division acts as a robust cash cow, consistently generating revenue and earnings before interest and taxes (EBIT). This segment underpins vehicle sales by offering essential financing, leasing, and insurance products, fostering customer relationships and ensuring a stable income stream.

While the financial services sector experienced a dip in new business during the first quarter of 2025, its EBIT actually saw a modest rise. This resilience highlights the division's enduring profitability and its crucial role in Daimler Truck's overall financial health, even amidst market fluctuations.

- Consistent Revenue Generation: The division's core function of supporting vehicle sales through financial products ensures a predictable and steady income.

- EBIT Stability: Despite a Q1 2025 decline in new business, the segment's EBIT demonstrated stability and even a slight increase, reflecting its strong profitability.

- Customer Loyalty Enhancement: Offering comprehensive financial solutions beyond vehicle purchase strengthens customer relationships and encourages repeat business.

- Strategic Importance: This segment is vital for enabling sales and provides a reliable contribution to Daimler Truck's bottom line.

Daimler Trucks North America, a dominant force in the heavy-duty truck market with a 41% share in Class 8, continues to be a significant cash cow. Despite market normalization leading to sales declines in early 2025, its Q2 2025 adjusted return on sales reached an impressive 12.9%, showcasing consistent profitability. The segment's robust free cash flow generation is crucial for funding future technological advancements.

| Segment | Key Brands | Market Share (Approx.) | Q2 2025 Adj. ROS | Key Contribution |

|---|---|---|---|---|

| Daimler Trucks North America | Freightliner, Western Star | 41% (Class 8 US) | 12.9% | Strong cash flow for R&D |

| Mercedes-Benz Trucks (Diesel) | Mercedes-Benz | Strong European share | 5.9% | Stable revenue in mature market |

| Daimler Buses | Mercedes-Benz, Setra | N/A | 10.0% | Dependable cash flow |

| FUSO (Indonesia) | FUSO | 38.1% (Indonesia 2024) | N/A | Consistent profits from market leadership |

| Financial Services | N/A | N/A | Stable EBIT | Enables sales, reliable income |

What You’re Viewing Is Included

Daimler Truck Holding BCG Matrix

The Daimler Truck Holding BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a ready-to-use report for your business planning.

Dogs

Older, less fuel-efficient diesel truck models are positioned as Dogs in the BCG Matrix, especially within highly regulated markets such as Europe and North America. These regions have increasingly strict emission standards, making these older vehicles less competitive and more costly to operate due to potential fines or restricted access to certain zones. For instance, in 2024, many European cities are expanding low-emission zones, directly impacting the usability of older diesel trucks.

The market share for these models is shrinking as demand pivots towards cleaner alternatives, including electric and advanced hybrid powertrains. Daimler Truck's 2023 financial reports indicated a growing investment in new energy vehicles, signaling a strategic move away from legacy diesel technology. This trend puts significant pressure on the profitability of older truck lines, as production volumes decrease and development costs for compliance rise.

Daimler Truck's joint venture in China, BFDA (Beijing Foton Daimler Automotive), experienced a significant setback in 2024, contributing to a negative impact on the Trucks Asia segment's performance due to an impairment charge. This situation highlights an underperforming asset, likely characterized by a low market share and limited growth prospects within its specific market segment. Such ventures, especially in competitive or decelerating markets, can easily turn into resource drains, consuming capital without generating sufficient returns.

Certain legacy internal combustion engine (ICE) components and parts for Daimler Truck Holding, particularly those for older or phasing-out technologies, are likely to fall into the Dogs category of the BCG Matrix. As the automotive industry, including the heavy-duty truck sector, accelerates its transition towards electrification and alternative fuels, the demand for these specialized ICE parts is expected to decline significantly.

This diminishing demand translates into lower sales volumes and potentially squeezed profit margins for Daimler Truck. For instance, while specific 2024 figures for legacy ICE parts are not publicly broken down, the overall trend shows a clear industry pivot; by 2023, electric and hydrogen trucks were already making up a growing portion of new vehicle orders, signaling a shrinking market for traditional ICE components.

Managing these legacy parts requires a strategic approach, which may involve careful inventory reduction, exploring niche markets, or considering divestiture of these product lines. The focus for Daimler Truck is increasingly on future-proof technologies, making these legacy ICE components a strategic challenge rather than a growth opportunity.

Specific Niche/Low-Volume Traditional Truck Models

Within Daimler Truck Holding's portfolio, certain niche or very low-volume traditional truck models might be categorized as Dogs in a BCG matrix analysis. These models, often catering to specialized or declining segments, may not command significant market share and could require substantial investment for relatively modest returns.

These products often face challenges such as shrinking demand or intense competition from more agile players. For instance, if a specific vocational truck model serves a highly specialized industry that is experiencing a downturn, its sales volume could be minimal, leading to a low market share and slow growth.

- Low Market Share: These models typically represent a small fraction of Daimler Truck's overall sales volume, often in the low single digits for their specific segment.

- Limited Growth Potential: The target markets for these trucks are often mature or declining, offering little prospect for significant future expansion.

- Disproportionate Investment: Maintaining production and support for these low-volume models can necessitate investments in tooling, engineering, and parts that do not yield commensurate returns.

- Strategic Re-evaluation: Daimler Truck may periodically assess these models for their long-term viability, considering potential divestment or discontinuation if they no longer align with strategic growth objectives.

Certain Regional Markets with Sustained Weak Demand (e.g., some parts of EU30 in 2024-2025)

Certain segments within the European heavy-duty truck market, particularly in parts of the EU30 experiencing sustained weak demand, are categorized as Dogs in the Daimler Truck Holding BCG Matrix. The European truck market saw a notable decline in new registrations throughout 2024, with projections indicating a continued downturn into 2025. For instance, preliminary data for 2024 suggests a contraction in the overall European truck market compared to the previous year, impacting sales volumes for manufacturers like Daimler Truck.

These underperforming areas, characterized by both low market growth and a relatively small market share for Daimler Truck, necessitate strategic resource allocation. The weak demand environment in these specific regions means that investments in these segments may yield limited returns.

- European Heavy-Duty Truck Market Decline: New registrations in the EU30 heavy-duty truck segment experienced a year-on-year decrease of approximately 8% in the first half of 2024, according to industry analysis reports.

- Projected Further Weakness: Forecasts for the full year 2024 and into 2025 anticipate a continued contraction, with some analysts predicting a further 5-7% drop in demand for heavy-duty trucks in key European markets.

- Resource Re-evaluation: Daimler Truck's presence in these specific low-demand European sub-regions, where its market share is also below average, requires a critical review of operational costs and marketing expenditures.

- Potential Restructuring: The sustained weak demand and low market share in these Dog segments may lead to considerations for divesting or restructuring operations to focus resources on more promising markets or product lines.

Older diesel truck models, particularly those not meeting current emission standards, are classified as Dogs. This is especially true in regulated markets like Europe and North America, where stricter environmental laws make them less competitive. For instance, the expansion of low-emission zones in European cities during 2024 directly impacts the usability and profitability of these older vehicles.

The market share for these legacy models is steadily declining as customers increasingly opt for electric and hybrid alternatives. Daimler Truck's strategic investments in new energy vehicles, highlighted in their 2023 financial reports, underscore this shift away from older diesel technology, putting pressure on the profitability of these aging product lines.

The Trucks Asia segment, impacted by an impairment charge in its China joint venture (BFDA) in 2024, exemplifies an underperforming asset. Such ventures, often in competitive or slowing markets, can become drains on resources, consuming capital with minimal returns and contributing to a low market share and growth prospects.

| Category | Description | Daimler Truck Example | Market Share | Growth Potential |

| Dogs | Low market share, low growth | Older diesel truck models in regulated markets; legacy ICE components; niche, low-volume traditional truck models; specific weak-demand European sub-regions. | Low | Low |

Question Marks

Daimler Truck is heavily investing in hydrogen fuel cell technology, viewing it as a crucial long-term strategy for decarbonizing heavy-duty transport. Currently, these trucks are in advanced development and early pilot stages, meaning their market penetration is minimal, reflecting their status as question marks in the BCG matrix.

The market for hydrogen-powered trucks is poised for significant growth, but it's also marked by considerable uncertainty. This uncertainty stems from the critical need for widespread hydrogen refueling infrastructure and substantial cost reductions in both fuel cell technology and hydrogen production. For instance, by the end of 2023, the number of hydrogen refueling stations globally remained limited, impacting the practical adoption of these vehicles.

These hydrogen fuel cell trucks represent a substantial drain on Daimler Truck's research and development budget. However, if the market successfully develops and Daimler Truck secures a dominant position, these products hold the potential to transition into Stars, generating significant future revenue and market share.

The FUSO eCanter, while a pioneer in its segment, faces a dynamic light-duty electric truck market. Despite gaining traction through fleet deals and specific market penetration, its overall global market share in this high-growth sector may still be modest. Daimler Truck needs to strategically ramp up marketing and distribution efforts to capitalize on this burgeoning opportunity and prevent these products from becoming underperformers.

Autonomous buses for Daimler Truck Holding AG are positioned as Stars within the BCG Matrix. While the overall Daimler Buses division shows robust performance, the fully autonomous segment is in its nascent stages, targeting a high-growth market where its current share is minimal. This necessitates substantial investment in technological advancement and navigating complex regulatory landscapes to move from prototype to commercial reality.

The potential for significant future growth is undeniable, contingent on accelerated market adoption and Daimler Truck successfully establishing a leadership position in this emerging sector. For instance, by the end of 2023, Daimler Truck had announced its intention to launch its first Level 4 autonomous truck in the US by 2027, signaling its commitment to this technology which will likely extend to its bus division.

New Market Entry Vehicles/Platforms in Emerging High-Growth Regions

Daimler Truck is exploring new market entry vehicles for high-growth emerging regions, focusing on platforms that can be adapted to local needs and regulations. This strategy is crucial for markets where its current market share is limited but growth potential is significant. For instance, in India, the company is leveraging its joint venture with Ashok Leyland to develop and produce trucks tailored for that specific market.

These new platforms require considerable investment to build brand recognition and compete effectively against established local players. Daimler Truck's strategic integration of its Chinese operations into its Mercedes-Benz Trucks segment highlights a broader effort to streamline and capitalize on growth in key emerging markets. The company aims to achieve greater operational efficiencies and leverage its global expertise in these dynamic environments.

- China's commercial vehicle market, the world's largest, saw sales of around 3.8 million units in 2023, presenting a significant opportunity for Daimler Truck.

- India's commercial vehicle market is projected to grow at a compound annual growth rate (CAGR) of over 10% in the coming years, making it a prime target for new market entry strategies.

- Daimler Truck's investment in new vehicle platforms for emerging markets is a long-term play to secure future market share and profitability.

- The company's focus on localized product development is key to overcoming barriers and gaining traction against strong domestic competitors.

Advanced Telematics and Connectivity Solutions for Non-Traditional Customers

Daimler Truck's advanced telematics and connectivity solutions, when extended beyond traditional heavy-duty truck customers to new segments or applications, represent a potential Question Mark. The digital transformation trend fuels high growth prospects in this area, but Daimler Truck's current market share within these nascent or diverse customer bases might be limited.

Significant investment in research and development, alongside targeted market penetration strategies, will be essential to capitalize on this potential and transform these ventures into strong performers. For instance, the global telematics market is projected to reach $148.3 billion by 2027, indicating substantial growth opportunities.

- Market Expansion: Targeting non-traditional customers, such as light commercial vehicles or specialized industrial equipment, offers untapped revenue streams.

- Digitalization Drive: The increasing demand for data-driven insights and remote management across various industries supports the growth of advanced telematics.

- Investment Focus: R&D for new service offerings and aggressive marketing campaigns are critical to gain traction in these new markets.

- Strategic Partnerships: Collaborating with technology providers or industry-specific players can accelerate market entry and adoption.

Daimler Truck's hydrogen fuel cell trucks are currently in a developmental phase, aiming to capture a future high-growth market. Their limited current market share and the substantial investment required for infrastructure and cost reduction place them firmly in the Question Mark category of the BCG matrix.

The success of these vehicles hinges on the development of a robust hydrogen ecosystem and achieving cost parity with conventional powertrains. By the close of 2023, the global hydrogen refueling infrastructure remained a significant bottleneck, impacting widespread adoption.

Should Daimler Truck successfully navigate these challenges and establish a strong market presence, these hydrogen trucks have the potential to evolve into Stars, driving substantial future revenue. However, without significant market development and strategic positioning, they risk becoming Dogs.

BCG Matrix Data Sources

Our Daimler Truck Holding BCG Matrix is built upon a foundation of robust data, integrating financial reports, market share analysis, industry growth forecasts, and competitor benchmarking.