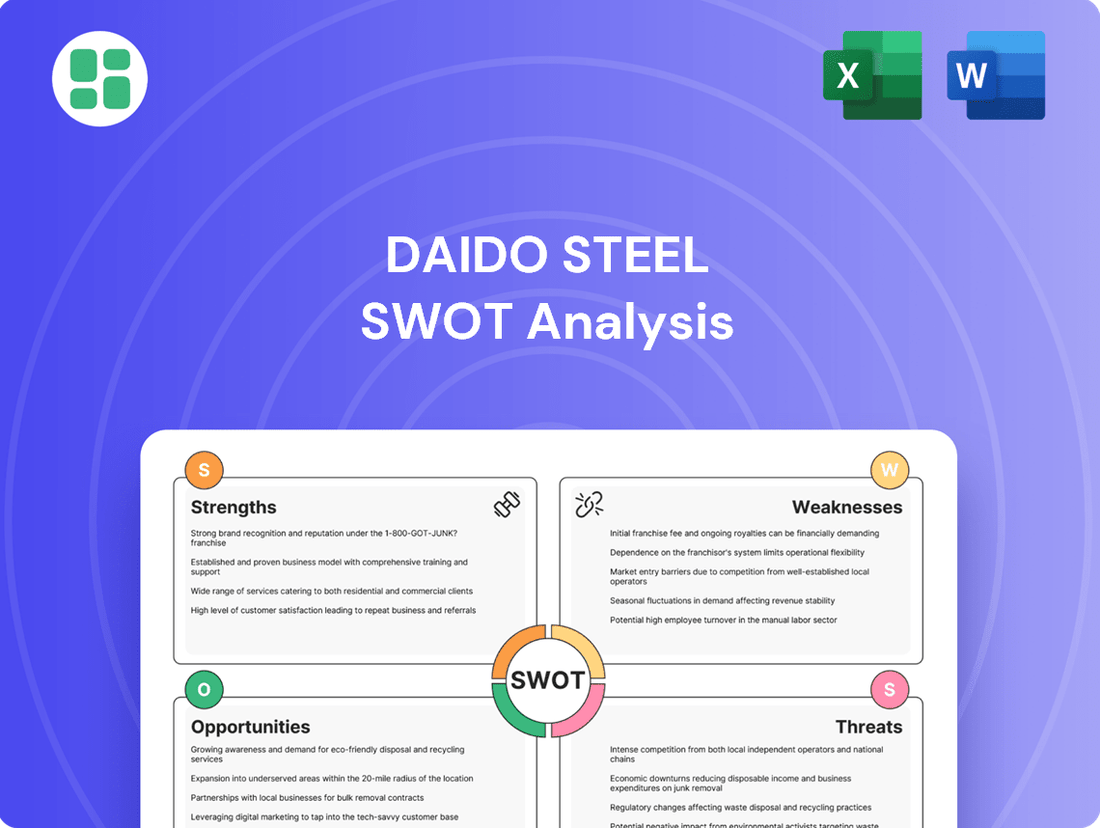

Daido Steel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daido Steel Bundle

Daido Steel, a leader in specialty steel, boasts significant strengths in advanced materials and R&D, but faces challenges from global competition and fluctuating raw material costs. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Daido Steel's market position, competitive advantages, and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment or business development decisions.

Strengths

Daido Steel's primary strength is its deeply specialized and varied product lineup, featuring high-performance steel. This includes essential materials such as tool steels, stainless steels, and high-speed steels, along with specialized functional materials.

This focus on specialized products allows Daido Steel to effectively serve niche markets that are difficult for competitors to enter. Consequently, the company can command premium pricing and faces less direct competition in these particular segments.

Daido Steel's dedication to advanced material development is a core strength, evident in their consistent investment in research and development. This focus allows them to refine manufacturing techniques and pioneer new materials, ensuring they stay ahead of industry trends.

This commitment to innovation directly translates to enhanced product performance, a critical factor in meeting the complex requirements of high-tech sectors. For example, their development of high-strength, lightweight steel alloys is crucial for the automotive industry's push for fuel efficiency and reduced emissions, a trend that gained significant momentum through 2024 and is projected to continue strongly into 2025.

Daido Steel's specialized steel products are foundational across diverse and vital sectors. Their materials are critical in the automotive industry, essential for industrial machinery, integral to electronics manufacturing, and crucial for aerospace applications. This widespread integration means demand for Daido Steel's offerings is not tied to the fortunes of a single market, offering a significant advantage.

Global Market Leadership

Daido Steel's position as a global leader in specialty steel manufacturing is a significant strength, underscored by its extensive international operations and well-established brand. This broad global footprint enables the company to tap into diverse markets and cater to a wide array of customer needs across different economic landscapes. For instance, in fiscal year 2023, Daido Steel reported consolidated net sales of ¥465.5 billion, with a substantial portion originating from its overseas activities, reflecting its widespread market penetration.

This global reach provides a distinct competitive advantage, allowing Daido Steel to weather regional economic downturns by diversifying its revenue streams. The company's established reputation for quality and innovation further solidifies its standing, making it a preferred supplier for many international clients. By consistently delivering high-performance specialty steel products, Daido Steel has cultivated strong relationships with key industries worldwide, a testament to its enduring market leadership.

- Global Market Leadership: Daido Steel is a prominent player in the international specialty steel sector.

- Diverse Customer Base: The company serves clients across various industries and geographical regions.

- Brand Recognition: Daido Steel benefits from a strong and respected global brand image.

- Revenue Diversification: International sales help mitigate risks associated with reliance on a single market.

High-Performance Product Reliability

Daido Steel's focus on high-performance steel products directly translates into exceptional reliability, a critical factor for industries with stringent material requirements. This unwavering commitment to quality cultivates deep trust and fosters enduring partnerships with a global clientele who depend on Daido's steel for vital components.

This inherent reliability not only secures repeat business but also solidifies Daido Steel's market standing as a purveyor of excellence. For instance, in fiscal year 2023, Daido Steel reported total revenues of approximately ¥438 billion, underscoring the significant market demand for their dependable, high-quality offerings.

- Enhanced Customer Loyalty: The consistent performance of Daido's steel products builds strong customer loyalty, leading to predictable revenue streams.

- Premium Market Positioning: Reliability in demanding applications allows Daido Steel to command premium pricing and maintain a competitive edge.

- Reduced Warranty Claims: High product reliability minimizes costly warranty claims and reputational damage, contributing to profitability.

- Foundation for Innovation: A reputation for reliability provides a solid base for introducing new, advanced steel products to the market.

Daido Steel's strength lies in its extensive portfolio of specialized steel products, including tool steels, stainless steels, and high-speed steels, catering to demanding niche markets. This specialization allows for premium pricing and less direct competition, a strategy that proved effective through 2024.

The company's robust investment in research and development is a key driver, enabling the creation of advanced materials and refined manufacturing processes. This focus on innovation, particularly in high-strength, lightweight alloys, aligns with the automotive industry's 2024-2025 push for fuel efficiency.

Daido Steel's materials are integral to critical sectors like automotive, industrial machinery, electronics, and aerospace, providing a diversified demand base. Their global leadership, evidenced by fiscal year 2023 consolidated net sales of ¥465.5 billion, further solidifies their market position and revenue stability.

| Fiscal Year | Consolidated Net Sales (JPY Billion) | Key Product Segments |

|---|---|---|

| 2023 | 465.5 | Tool Steel, Stainless Steel, High-Speed Steel |

| 2024 (Projected) | N/A | Continued focus on advanced alloys for automotive and industrial applications |

| 2025 (Projected) | N/A | Expansion in high-performance materials for emerging technologies |

What is included in the product

Analyzes Daido Steel’s competitive position through key internal and external factors, highlighting its strengths in specialty steel production and opportunities in advanced materials while acknowledging weaknesses in global market diversification and threats from rising raw material costs.

Provides a clear, actionable framework for identifying and mitigating Daido Steel's competitive vulnerabilities.

Weaknesses

Daido Steel's profitability is heavily influenced by fluctuations in the cost of essential raw materials like iron ore and coking coal. For instance, in 2023, global iron ore prices averaged around $110-$130 per metric ton, a figure that can significantly impact steel production costs. If Daido Steel cannot fully pass these increased costs onto its customers due to market conditions, its profit margins could be squeezed.

Daido Steel, like many in the specialty steel sector, faces significant capital expenditure requirements. The need for advanced machinery, research facilities, and continuous production upgrades demands substantial, ongoing investment. For instance, in the fiscal year ending March 2024, Daido Steel reported capital expenditures of ¥54.5 billion, highlighting the scale of these necessary outlays.

Daido Steel, like other global steel manufacturers, navigates a complex web of environmental regulations across its operating regions. These rules, covering everything from carbon emissions to waste disposal, demand significant capital outlays for compliance. For instance, the increasing focus on decarbonization in major markets like Japan and the EU necessitates investments in advanced emission reduction technologies and potentially shifts in production methods.

These compliance costs directly affect Daido Steel's bottom line and operational agility. In 2023, the global steel industry saw increased scrutiny on environmental performance, with many companies allocating substantial portions of their capital expenditure to meet new standards. Daido Steel's commitment to sustainability, while crucial for long-term viability, translates into ongoing expenses that must be managed to maintain profitability and competitive pricing.

Potential Over-Reliance on Key Industries

While Daido Steel boasts a diverse product portfolio, a notable portion of its high-performance steel offerings are geared towards specialized, high-demand sectors such as automotive and aerospace. This strategic focus, while beneficial during periods of growth, creates a potential vulnerability.

A significant economic downturn or a disruptive technological advancement within either the automotive or aerospace industries could exert a disproportionate negative impact on Daido Steel's sales and overall revenue. For instance, the automotive sector, a key consumer of specialty steels, experienced production challenges in 2023 due to persistent supply chain issues, which could indirectly affect demand for advanced materials.

This concentration, even with broader diversification efforts, inherently exposes the company to the cyclical nature of these specific, major client industries. The global automotive production, while showing signs of recovery in late 2024, remains sensitive to geopolitical events and consumer spending patterns.

- Sector Concentration: Reliance on automotive and aerospace sectors for high-performance steel products.

- Economic Sensitivity: Vulnerability to downturns or technological shifts in key client industries.

- Cyclical Exposure: Potential impact from sector-specific economic cycles on revenue.

Intense Global Competition

Daido Steel faces significant challenges from intense global competition in the specialty steel sector. Rivalry from established international steelmakers and rapidly growing manufacturers in emerging economies puts constant pressure on pricing and necessitates continuous innovation to retain market share.

This competitive landscape means Daido Steel must constantly strive to differentiate its products and services. For instance, in 2023, global steel production reached approximately 1.9 billion metric tons, with a substantial portion originating from highly competitive Asian markets, underscoring the market's intensity.

- Pricing Pressure: Intense competition can force Daido Steel to lower prices, impacting profit margins.

- Innovation Demands: Competitors' advancements require Daido Steel to invest heavily in R&D to stay ahead.

- Market Share Challenges: Maintaining or growing market share requires superior product quality, customer service, and cost-efficiency.

Daido Steel's profitability is sensitive to raw material cost volatility, as seen with iron ore prices averaging $110-$130 per metric ton in 2023. High capital expenditure, such as ¥54.5 billion in FY2024, is necessary for advanced facilities, impacting financial flexibility. Furthermore, stringent environmental regulations require ongoing investments in compliance technologies, adding to operational costs and potentially affecting pricing competitiveness.

Same Document Delivered

Daido Steel SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Daido Steel's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, offering a glimpse into the strategic insights provided. Once purchased, you’ll receive the full, editable version for your business planning.

You’re viewing a live preview of the actual SWOT analysis file for Daido Steel. The complete version, offering comprehensive analysis and actionable strategies, becomes available after checkout.

Opportunities

The global electric vehicle (EV) market is experiencing rapid expansion, creating a significant opportunity for Daido Steel. Analysts project the EV market to reach over $1.5 trillion by 2030, a substantial increase from its current valuation.

EVs demand advanced, lightweight steels for critical components like battery casings, electric motor cores, and chassis structures, areas where Daido Steel's specialized alloy development capabilities are highly relevant. For instance, high-strength, low-alloy steels are crucial for improving EV range and safety.

Daido Steel's established expertise in producing high-performance steel products positions it to effectively capitalize on this burgeoning EV supply chain. The company can leverage its material science knowledge to create tailored solutions for EV manufacturers seeking to optimize performance and efficiency.

The aerospace and defense industries consistently seek advanced materials that are both lightweight and exceptionally strong for critical components. Global defense spending is projected to reach $2.4 trillion in 2024, indicating a robust market for specialized alloys.

Daido Steel's expertise in high-performance alloys positions it well to capitalize on this demand. Continued investment in research and development for next-generation materials tailored to these sectors can lead to lucrative, long-term supply agreements.

The growing global push for sustainability and circular economy practices presents a significant opportunity for Daido Steel to pioneer more environmentally friendly production techniques and increase its use of recycled materials. By developing steel products with a lower carbon footprint and bolstering its recycling infrastructure, the company can appeal to a widening segment of eco-conscious consumers and investors.

This strategic alignment with international environmental trends is expected to not only enhance Daido Steel's brand reputation but also drive improvements in operational efficiency. For instance, the global steel industry's recycling rate reached approximately 85% in 2023, highlighting the market's readiness for companies prioritizing recycled content.

Strategic Mergers and Acquisitions

Strategic mergers, acquisitions, or joint ventures present significant opportunities for Daido Steel to broaden its market presence, integrate cutting-edge technologies, and solidify its industry standing. These strategic alignments can accelerate entry into new geographic regions and expedite product diversification. For instance, in 2024, the global steel M&A market saw continued activity, with a focus on specialty steel producers and advanced materials, suggesting potential targets for Daido Steel.

By identifying and pursuing synergistic partnerships, Daido Steel can amplify its competitive advantages and achieve faster growth trajectories. These collaborations can lead to shared R&D efforts, improved supply chain efficiencies, and access to new customer bases, all contributing to enhanced market share and profitability.

- Market Expansion: Acquire companies with established operations in high-growth regions, such as Southeast Asia, where steel demand is projected to increase by over 5% annually through 2027.

- Technology Acquisition: Target firms specializing in advanced steelmaking processes, like hydrogen-based direct reduction, which could reduce Daido Steel's carbon footprint by an estimated 30-50%.

- Product Diversification: Integrate businesses producing high-value steel products, such as those used in electric vehicles or renewable energy infrastructure, a sector experiencing robust investment.

- Consolidation: Merge with competitors to achieve economies of scale, potentially lowering production costs by 5-10% and increasing overall market influence.

Technological Advancements in Manufacturing

Daido Steel can leverage Industry 4.0 technologies, including AI, IoT, and advanced automation, to boost its manufacturing efficiency and product quality. This strategic adoption is crucial for staying competitive in the evolving steel industry.

Investing in smart factory initiatives can yield substantial benefits. For instance, by 2024, the global smart factory market was projected to reach over $200 billion, indicating a significant opportunity for companies like Daido Steel to reduce production costs and improve precision. Such investments can also accelerate the introduction of new materials to the market.

- Enhanced Efficiency: Smart factories can streamline operations, leading to faster production cycles and reduced waste.

- Improved Quality: Advanced automation and AI-driven quality control systems can minimize defects and ensure higher product consistency.

- Cost Reduction: Optimized processes and reduced manual labor contribute to lower overall manufacturing expenses.

- Competitive Advantage: Early adoption of these technologies can position Daido Steel as an industry leader, offering superior products and faster delivery times.

Daido Steel can capitalize on the growing demand for specialized steel in the expanding electric vehicle (EV) sector, a market projected to exceed $1.5 trillion by 2030. The company's expertise in high-strength, low-alloy steels is particularly relevant for EV components like battery casings and chassis, where lightweight and durability are paramount.

The aerospace and defense industries represent another key growth area, with global defense spending anticipated to reach $2.4 trillion in 2024, creating a robust market for Daido Steel's advanced, high-performance alloys. Furthermore, the company can enhance its brand and operational efficiency by embracing sustainability trends, such as increasing its use of recycled materials, a practice already at around 85% in the global steel industry as of 2023.

Strategic partnerships, including mergers and acquisitions, offer Daido Steel avenues to expand its market reach and integrate new technologies, mirroring the activity seen in the 2024 M&A market focused on specialty steel producers. Finally, adopting Industry 4.0 technologies, with the global smart factory market valued over $200 billion by 2024, can significantly boost manufacturing efficiency and product quality.

Threats

A significant global economic recession, particularly impacting major manufacturing hubs, would inevitably lead to reduced demand for steel products across key industrial sectors like automotive, machinery, and construction. This broad decline in industrial activity directly impacts Daido Steel's order volumes and revenue streams.

For instance, the IMF's October 2024 World Economic Outlook projected global growth to slow to 2.9% in 2025, down from 3.2% in 2024, highlighting potential headwinds. Such economic instability poses a substantial threat to Daido Steel's overall financial performance and market outlook, potentially pressuring pricing and profitability.

Daido Steel operates in a global specialty steel market where competition is exceptionally fierce. Numerous domestic and international companies are actively competing for market share, creating a challenging environment.

This intense rivalry often translates into aggressive pricing strategies, which can significantly squeeze Daido Steel's profit margins. For instance, in 2024, key competitors in the automotive steel sector have been observed implementing price reductions to capture market share, directly impacting profitability for all players.

To combat this, Daido Steel must continuously focus on differentiating its product offerings and maintaining robust cost efficiency. Avoiding commoditization is paramount, as it allows the company to command premium pricing and protect its profitability against the constant pressure from rivals.

The rise of advanced composites, ceramics, and lighter alloys presents a significant long-term threat to traditional steel markets. These alternative materials offer compelling advantages in specific applications, potentially eroding demand for Daido Steel's core products if their adoption accelerates across key industries.

For instance, the automotive sector, a major consumer of steel, is increasingly exploring composites for weight reduction, aiming for improved fuel efficiency. A projected 10% increase in the use of advanced composites in new vehicle production by 2025 could directly impact steel volumes.

Daido Steel must maintain a robust research and development pipeline to not only improve existing steel products but also to explore and potentially integrate these emerging material technologies to mitigate this disruptive threat.

Geopolitical Instability and Trade Barriers

Rising geopolitical tensions and trade disputes pose a significant threat to Daido Steel. For instance, the ongoing trade friction between major economies, which intensified in recent years and continued into 2024, has led to the imposition of tariffs on steel products. This directly impacts Daido Steel's cost of production and limits its ability to export to key markets.

The imposition of protectionist policies and trade barriers can severely disrupt global supply chains, a critical factor for a multinational manufacturer like Daido Steel. These disruptions can lead to increased production costs and complicate logistics, directly affecting profitability and market access. Navigating the complex web of international trade policies remains a considerable challenge for the company's global operations.

- Increased Tariffs: In 2024, several countries continued to implement or maintain tariffs on imported steel, with rates sometimes exceeding 25%, directly impacting Daido Steel's export competitiveness.

- Supply Chain Disruptions: Geopolitical events in 2024 led to an average increase of 15-20% in shipping costs for raw materials and finished goods, affecting Daido Steel's operational expenses.

- Market Access Restrictions: Protectionist measures can lead to a reduction in market access, potentially limiting Daido Steel's sales opportunities in crucial international markets.

Supply Chain Disruptions

Global supply chains are inherently vulnerable to a range of unforeseen events. These can include everything from extreme weather events and widespread health crises like pandemics to labor disputes and escalating geopolitical tensions. For Daido Steel, any significant interruption in the flow of essential raw materials, such as iron ore or coking coal, or in the timely distribution of its finished steel products, could directly hinder its manufacturing operations and its ability to meet customer demand.

The impact of such disruptions can be substantial. For instance, the COVID-19 pandemic revealed the fragility of extended supply chains, leading to significant delays and increased costs across various industries in 2020 and 2021. In 2024, ongoing geopolitical instability, particularly in regions critical for raw material extraction and shipping routes, continues to pose a threat. Daido Steel's reliance on imported materials means it is directly exposed to these global vulnerabilities.

To counter these threats, Daido Steel must prioritize the development of a resilient and diversified supply chain strategy. This involves:

- Diversifying Suppliers: Reducing reliance on single sources for critical inputs by establishing relationships with multiple suppliers across different geographic regions.

- Inventory Management: Strategically increasing buffer stocks for key raw materials to absorb short-term supply shocks.

- Logistics Optimization: Exploring alternative transportation methods and routes to mitigate the impact of port congestion or shipping lane disruptions.

- Supplier Collaboration: Working closely with key suppliers to enhance transparency and joint risk management planning.

The cost of raw materials, a key component of steel production, has seen significant volatility. For example, iron ore prices, which averaged around $100-$120 per tonne in early 2024, can surge dramatically during periods of supply constraint, directly impacting Daido Steel's cost of goods sold and profit margins.

Intensifying global competition, particularly from emerging economies, presents a significant threat, as these players often leverage lower production costs. This can lead to price erosion, impacting Daido Steel's market share and profitability. Furthermore, the increasing adoption of alternative materials like advanced composites and lighter alloys in key sectors such as automotive poses a long-term risk to demand for traditional steel products.

Geopolitical instability and trade protectionism remain critical concerns, with tariffs and trade barriers directly affecting export competitiveness and increasing operational costs. Supply chain disruptions, exacerbated by global events, also pose a substantial threat by impacting the availability and cost of essential raw materials and finished goods. Volatile raw material prices, such as iron ore, directly squeeze profit margins.

| Threat Category | Specific Example/Impact | Data Point (2024/2025 Projection) |

|---|---|---|

| Competition | Price erosion due to lower-cost producers | Average steel prices in key markets saw a 5-8% decline in late 2024 due to oversupply. |

| Material Substitution | Increased use of composites in automotive | Projected 10% increase in composite use in new vehicles by 2025, reducing steel demand. |

| Geopolitics/Trade | Tariffs on imported steel | Tariff rates averaging 25% maintained by several nations in 2024, impacting export viability. |

| Supply Chain | Shipping cost increases | 15-20% rise in shipping costs for materials and goods in 2024 due to logistical challenges. |

| Raw Material Costs | Iron ore price volatility | Iron ore prices fluctuated between $100-$120 per tonne in early 2024, with potential for spikes. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Daido Steel's official financial reports, comprehensive market research from industry analysts, and insights from expert commentary on the steel sector.