Daido Steel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daido Steel Bundle

Daido Steel navigates a landscape shaped by intense rivalry and the significant bargaining power of its buyers, particularly in the automotive sector. Understanding these forces is crucial for any strategic decision-making within the steel industry.

The complete report reveals the real forces shaping Daido Steel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Daido Steel's supplier bargaining power hinges on the concentration of its raw material sources. For essential inputs like iron ore, scrap steel, and critical alloying elements such as nickel and chromium, a limited number of suppliers can exert significant influence.

The price volatility of these primary inputs directly impacts steel production costs. For instance, projections indicate that raw material expenses, especially for nickel and chromium, are expected to see a rise of 3-5% in 2025, potentially squeezing Daido Steel's profit margins if these costs cannot be passed on.

The bargaining power of suppliers for Daido Steel is significantly influenced by the uniqueness and differentiation of the inputs they provide. Suppliers offering highly specialized or rare alloying elements, which are critical for Daido Steel's production of high-performance steel products, can exert considerable influence. This is particularly true when these specific inputs have few, if any, viable alternative sources available in the market.

Daido Steel's strategic emphasis on developing advanced materials means the company frequently relies on inputs that are not only of high quality but also possess specific characteristics. For instance, in 2024, the global demand for specialty steels used in electric vehicles and aerospace continued to rise, driving up the need for specialized alloys like molybdenum and vanadium. Suppliers of these particular elements, especially those with unique extraction or refining processes, found themselves in a stronger negotiating position due to the limited availability of comparable substitutes.

Daido Steel faces significant bargaining power from its suppliers due to high switching costs for specialized steel inputs. These costs encompass re-tooling manufacturing processes, rigorous quality assurance recalibrations, and complex supply chain integration adjustments, potentially running into millions of yen for each supplier change. This dependency makes it challenging for Daido Steel to readily shift to alternative sources, thereby strengthening the leverage of its current suppliers.

Threat of Forward Integration by Suppliers

The threat of major raw material suppliers integrating forward into specialty steel production could directly challenge Daido Steel. This scenario, while infrequent in the capital-intensive steel sector, would amplify supplier leverage if they possess control over essential resources and opt to enter the market as competitors.

Consider the implications if a dominant iron ore or coking coal provider, controlling a significant portion of its market share, decided to establish its own specialty steel manufacturing facilities. Such a move would transform a supplier relationship into direct competition, potentially impacting Daido Steel's market position and pricing power.

- Forward Integration Risk: Suppliers integrating into specialty steel production poses a direct competitive threat to Daido Steel.

- Capital Intensity Barrier: The high capital requirements of steel production generally make this a less common but significant threat.

- Resource Control: Suppliers who control critical raw materials gain substantial bargaining power if they choose to compete directly.

Impact of Raw Material Price Volatility

The steel industry, including specialty steel makers like Daido Steel, faces considerable swings in the cost of key raw materials such as iron ore and scrap metal, along with energy expenses. For instance, in 2024, iron ore prices experienced notable fluctuations, trading in a range that impacted production costs significantly.

While Daido Steel utilizes a surcharge mechanism to pass on these raw material cost changes to customers, persistent and erratic price hikes can still put pressure on the company's profit margins. This situation can inadvertently bolster the bargaining power of suppliers who can dictate terms more effectively during periods of high input costs.

- Iron Ore Price Volatility: In early 2024, benchmark iron ore prices hovered around $130-$150 per tonne, demonstrating the significant cost base for steel production.

- Scrap Metal Market: Scrap steel prices, another crucial input, also exhibited considerable volatility throughout 2024, influenced by global demand and supply dynamics.

- Energy Cost Impact: High energy prices, particularly for electricity and natural gas, directly affect the energy-intensive steelmaking process, adding another layer of cost uncertainty.

- Surcharge System Limitations: While surcharges help mitigate immediate impacts, they may not fully compensate for the operational and financial strain caused by rapid and sustained raw material cost escalations.

Daido Steel's suppliers hold significant bargaining power due to the concentrated nature of raw material sourcing and the critical role of specialized inputs. For essential materials like iron ore and scrap steel, a limited number of key suppliers can dictate terms, impacting Daido Steel's production costs and profitability. The company's reliance on unique alloying elements for its advanced steel products further amplifies this power, especially when few viable alternatives exist.

The bargaining power of Daido Steel's suppliers is amplified by the high costs associated with switching. These include substantial expenses for retooling manufacturing lines, recalibrating quality control systems, and re-establishing complex supply chain integrations, which can amount to millions of yen per change. This dependency makes it difficult for Daido Steel to shift suppliers, thereby strengthening the leverage of its existing partners.

The threat of forward integration by major raw material suppliers into specialty steel production presents a direct competitive challenge to Daido Steel. While the capital-intensive nature of steelmaking makes this less common, suppliers controlling essential resources could leverage their position to enter the market as competitors, significantly impacting Daido Steel's market standing and pricing power.

| Input Material | Supplier Concentration | Switching Costs | Impact on Daido Steel |

|---|---|---|---|

| Iron Ore | High (few major global producers) | Moderate (logistics, quality assurance) | Price volatility impacts production costs |

| Scrap Steel | Moderate (regional markets) | Low to Moderate | Fluctuating input costs affect margins |

| Specialty Alloys (e.g., Vanadium, Molybdenum) | High (specialized producers) | Very High (process re-engineering, R&D) | Limited alternatives strengthen supplier leverage |

What is included in the product

This analysis of Daido Steel's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the steel industry.

Instantly identify and mitigate competitive threats by visualizing Daido Steel's supplier and buyer power with a clear, actionable Porter's Five Forces analysis.

Customers Bargaining Power

Daido Steel's customer base is heavily concentrated within key industries like automotive, industrial machinery, electronics, and aerospace. These sectors are characterized by large, sophisticated buyers who possess significant bargaining power.

These major customers, due to their substantial purchasing volumes, can effectively negotiate for lower prices and more favorable terms. For instance, the automotive sector, a primary consumer of steel, is expected to see continued demand, with projections indicating a 3% growth in global vehicle production for 2025, placing considerable leverage in the hands of major automakers.

Daido Steel's products are often critical components in various industries, meaning customers have a strong need for them. For instance, their high-strength steel is vital for automotive safety features. This criticality inherently limits how much power customers wield.

The company's focus on advanced material development and innovative manufacturing processes leads to highly differentiated products. This specialization means customers seeking Daido Steel's unique, high-performance materials find it difficult to source equivalent alternatives, further diminishing their bargaining power.

Customer switching costs are a significant factor in the specialty steel market, particularly for industries like automotive and aerospace. These sectors often have lengthy qualification processes for new material suppliers, sometimes taking years to complete.

Once a specialty steel supplier is integrated into a complex manufacturing process, such as in aircraft engine components or automotive chassis, the cost and effort to switch to an alternative can be substantial. This includes re-tooling, re-testing, and potential performance validation, which can run into millions of dollars.

For instance, a major automotive manufacturer might spend upwards of $5 million on qualifying a new steel supplier for a critical chassis component. This high barrier to entry for new suppliers, and the associated costs for customers to switch, directly diminishes the bargaining power of these customers.

Price Sensitivity of Customers

Even though specialty steels are crucial, customers in sectors like automotive face significant cost pressures, making them highly sensitive to price. This sensitivity intensifies negotiations, particularly when the overall steel market experiences economic downturns or excess supply.

For instance, the automotive industry, a major consumer of specialty steels, often operates on thin margins. In 2024, many automakers continued to grapple with rising input costs and fluctuating consumer demand, amplifying their focus on sourcing materials at the most competitive prices. This directly impacts suppliers like Daido Steel, forcing them to balance quality and innovation with cost-effectiveness.

- Automotive Industry Cost Pressures: The automotive sector, a key buyer of specialty steels, frequently experiences tight profit margins due to intense competition and consumer price expectations.

- Price Sensitivity in 2024: Reports from early 2024 indicated that many automotive manufacturers were actively seeking cost reductions across their supply chains, including steel procurement, to maintain profitability amidst economic uncertainties.

- Negotiation Leverage: High price sensitivity grants customers greater bargaining power, enabling them to push for lower prices or more favorable terms, especially when alternative suppliers exist or when the broader steel market is oversupplied.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for specialty steel due to high capital requirements, can still influence negotiations. If Daido Steel's pricing or reliability falters significantly, large automotive or industrial clients might explore producing certain steel components in-house. For instance, a major automotive manufacturer, facing escalating specialty steel costs from suppliers like Daido Steel, could evaluate the feasibility of establishing its own steel processing or even melting facilities. This potential, even if not fully realized, grants significant leverage to these key buyers during price discussions.

Consider the example of major automotive OEMs. In 2024, the average cost of high-strength steel used in vehicle production saw fluctuations. If Daido Steel's pricing for critical alloys were to exceed a certain threshold, a large volume buyer might initiate a serious cost-benefit analysis for internal production. Such an analysis would weigh the substantial upfront investment in steelmaking equipment against the potential long-term savings and supply chain control. This underlying possibility acts as a constant pressure point in customer relationships.

- Capital Intensity: Specialty steel production requires immense investment in furnaces, rolling mills, and advanced processing technologies, making backward integration a formidable undertaking for most customers.

- Customer Leverage: Even the *possibility* of a major customer integrating backward can provide them with negotiation power, potentially leading to more favorable pricing or supply terms from Daido Steel.

- Market Dynamics: Significant shifts in raw material costs or Daido Steel's competitive positioning could elevate the attractiveness of backward integration for large, strategic customers.

Daido Steel's customers, particularly large entities in the automotive and aerospace sectors, possess significant bargaining power. Their ability to negotiate stems from high purchase volumes and the critical nature of steel in their production processes, though Daido's product differentiation and high customer switching costs somewhat mitigate this power.

Price sensitivity remains a key lever for customers. For example, in 2024, many automotive manufacturers faced economic uncertainties, driving them to seek cost reductions, including in steel procurement. This pressure allows them to push for more competitive pricing from suppliers like Daido Steel.

The threat of backward integration, though capital-intensive, also grants customers leverage. A major automotive OEM might explore in-house production if specialty steel costs from suppliers become prohibitive, influencing Daido Steel's pricing strategies.

| Factor | Impact on Daido Steel | Customer Leverage Example (2024/2025 Projections) |

|---|---|---|

| Purchase Volume | High for key clients | Large automakers' substantial steel orders grant negotiation power. |

| Price Sensitivity | High | Automotive sector's focus on cost reduction in 2024 due to economic pressures. |

| Switching Costs | High for specialized applications | Years-long qualification processes for new materials limit customer ability to switch easily. |

| Threat of Backward Integration | Low but present for large clients | Potential for major OEMs to evaluate in-house production if costs escalate. |

What You See Is What You Get

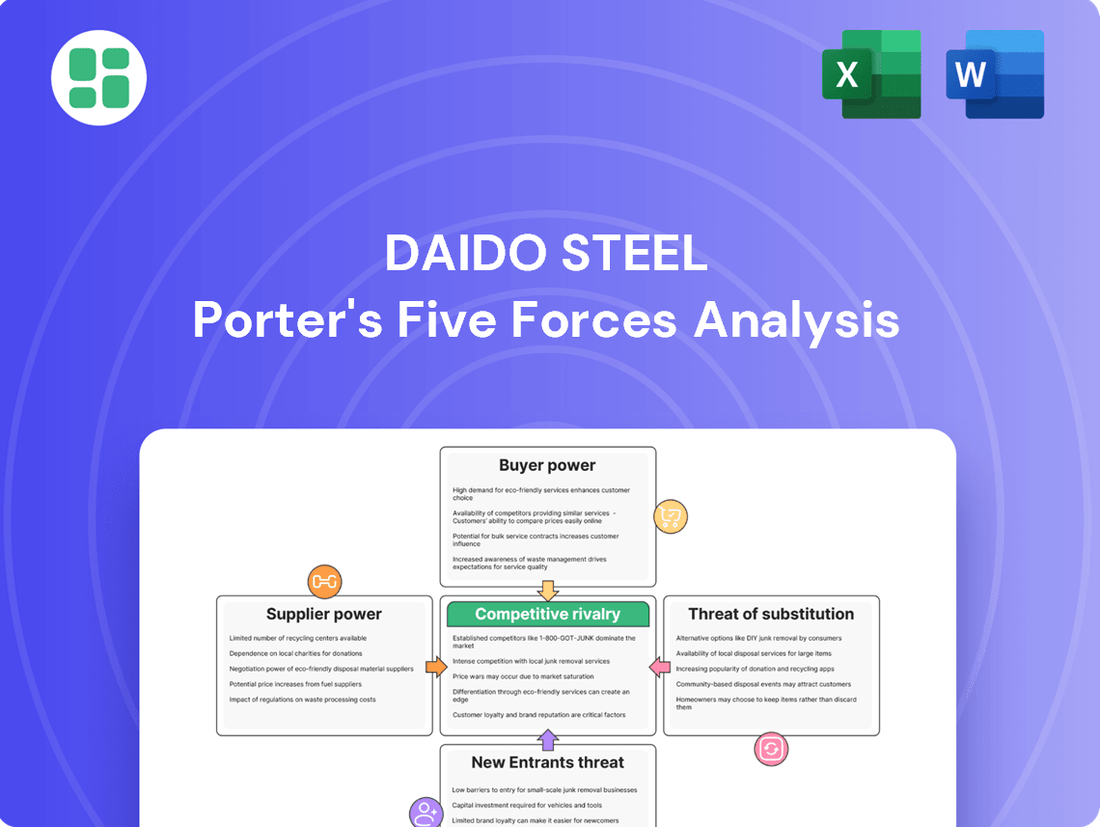

Daido Steel Porter's Five Forces Analysis

This preview showcases the complete Daido Steel Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, ensuring no surprises or missing information.

You're looking at the actual, ready-to-use analysis. Once you complete your purchase, you’ll get instant access to this exact file, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry for Daido Steel.

Rivalry Among Competitors

The global specialty steel arena is populated by numerous significant international contenders. Major players like Sanyo Special Steel, Tokyo Steel Manufacturing Co, Kobe Steel, JFE Steel, Nippon Steel, ArcelorMittal, and SSAB actively compete, presenting Daido Steel with a diverse set of rivals. This broad competitive field means Daido Steel must contend with companies possessing different core competencies, product ranges, and strategic market orientations.

The special steel market is poised for robust expansion, with a projected compound annual growth rate of 3.4% between 2024 and 2025, ultimately reaching an estimated $197.53 billion. However, this growth trajectory can intensify competitive rivalry, particularly if market saturation occurs in specific segments or if overall growth decelerates.

A slowdown in demand from key steel-consuming industries, such as construction and automotive sectors in Europe, could exacerbate competitive pressures. This scenario would likely lead to increased efforts by companies to capture market share, potentially through aggressive pricing or enhanced product offerings.

Daido Steel distinguishes itself through its focus on advanced material development and the creation of high-performance steel products. This strategy is vital in an industry where standard or commodity steels often contend with intense price pressures from rivals.

The competitive landscape sees significant rivalry driven by ongoing innovation. For instance, competitors are actively developing technologies like emission-free steel powder, while Daido Steel itself is a leader in advanced high-strength steels, demonstrating the critical role of continuous R&D in securing market position.

High Fixed Costs and Exit Barriers

The steel industry, including players like Daido Steel, is defined by substantial fixed costs. Think of the massive investments needed for blast furnaces, rolling mills, and extensive infrastructure. These capital expenditures are enormous, making it difficult for companies to simply shut down operations when demand falters.

These high fixed costs translate directly into significant exit barriers. Once a company has invested heavily in a steel plant, it's incredibly expensive to divest or repurpose that asset. This financial commitment often forces companies to keep production lines running, even if it means operating at a loss, simply to try and cover those ongoing fixed expenses.

This dynamic naturally fuels intense price competition. When multiple players are incentivized to maintain production regardless of market conditions, it can lead to oversupply. For instance, in 2023, global steel production remained robust despite economic headwinds, with many regions continuing to produce at high capacities, putting downward pressure on prices.

- High Capital Intensity: Steel production requires significant upfront investment in plant and equipment, often running into billions of dollars.

- Operational Leverage: Once operational, the cost of producing an additional ton of steel is relatively low compared to the initial fixed costs, encouraging continued production.

- Exit Barriers: The specialized nature and immense cost of steelmaking facilities make exiting the market extremely difficult and financially punishing.

- Price Wars: The need to cover fixed costs can lead to aggressive pricing strategies, especially during economic downturns, impacting profitability across the sector.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity in the global steel industry has been notably high in 2024 and is projected to continue into 2025. This trend, exemplified by strategic moves from major players such as ArcelorMittal, significantly reshapes the competitive landscape.

The consolidation driven by M&A can lead to the emergence of larger, more dominant rivals, potentially altering market share and pricing power. For instance, the ongoing consolidation aims to achieve economies of scale and improve operational efficiencies, directly impacting competitive intensity.

- Increased Consolidation: The global steel sector saw a notable uptick in M&A deals throughout 2024, with projections indicating continued activity into 2025.

- Strategic Moves by Major Players: Companies like ArcelorMittal have been actively involved in strategic acquisitions and divestitures to optimize their portfolios and market positions.

- Reshaping Competitive Landscape: This wave of consolidation is creating larger, more integrated steel producers, potentially increasing the bargaining power of these entities.

- Impact on Rivalry: The formation of bigger players can intensify competition by creating more formidable rivals for companies like Daido Steel, influencing market dynamics.

The global specialty steel market is highly competitive, featuring numerous established international players like Nippon Steel and ArcelorMittal, alongside more specialized firms. This diverse field means Daido Steel faces rivals with varying strengths and market focuses, necessitating continuous innovation and strategic differentiation. Intense rivalry is further fueled by the industry's high capital intensity and significant exit barriers, which encourage companies to maintain production even during downturns, often leading to price competition.

The steel industry, including specialty steel, is characterized by substantial fixed costs associated with production facilities. For example, constructing a modern steel mill can cost billions of dollars. These high fixed costs create significant exit barriers, as it is financially prohibitive for companies to simply close down operations. This often compels firms to continue production, even at lower margins, to cover ongoing expenses, thereby intensifying competition.

Mergers and acquisitions are actively reshaping the competitive landscape in 2024, with projections indicating continued consolidation into 2025. Companies like ArcelorMittal are strategically acquiring assets to enhance their market position and achieve economies of scale. This trend is creating larger, more formidable competitors, which can increase market concentration and potentially alter pricing dynamics for all players in the sector.

| Key Competitors | Market Focus | Key Differentiators |

|---|---|---|

| Nippon Steel | Automotive, energy, infrastructure | Advanced high-strength steels, integrated production |

| ArcelorMittal | Construction, automotive, energy | Global scale, diverse product portfolio, sustainability initiatives |

| JFE Steel | Automotive, shipbuilding, construction | High-quality steel sheets, advanced processing technologies |

| Sanyo Special Steel | Automotive components, industrial machinery | Specialty bearing steels, precision manufacturing |

SSubstitutes Threaten

The threat of substitutes for steel is significant, especially from materials like aluminum, advanced plastics, composites, and ceramics. These alternatives are gaining traction in key industries such as automotive and aerospace, driven by demand for lightweighting and specialized performance characteristics. For instance, the automotive sector saw a notable shift towards aluminum in vehicle construction, with global aluminum production reaching approximately 69 million metric tons in 2023, according to the International Aluminium Institute, demonstrating a direct substitution trend.

While Daido Steel excels in high-performance steel, substitutes like advanced composites and lightweight alloys present a significant threat. These materials can offer comparable performance in specific applications, often with advantages in weight reduction and potentially lower total system costs. For example, the automotive industry's increasing adoption of aluminum and carbon fiber reinforced polymers (CFRP) for weight savings, a trend projected to continue with growing demand for fuel efficiency and electric vehicle range, directly challenges traditional steel applications.

Ongoing research and development are continuously improving substitute materials. For instance, advancements in advanced composites and bio-sourced materials like bamboo and fiber-reinforced polymers are making them more competitive against specialty steel due to enhanced properties and sustainability. This trend suggests a growing threat as these alternatives become more capable and cost-effective.

Innovations such as 3D printing of metal components also represent a significant technological shift. This capability allows for the creation of complex parts with less material and waste, potentially bypassing traditional steel manufacturing processes for certain applications. The increasing accessibility and sophistication of these technologies directly challenge the market share of traditional steel products.

Customer Willingness to Adopt Substitutes

Customer willingness to switch from traditional steel is significantly influenced by external pressures and evolving industry demands. For instance, stricter environmental regulations, like those aimed at reducing carbon emissions, are pushing industries, particularly automotive, to explore lighter and more sustainable materials. This is a key factor in Daido Steel's competitive landscape.

The burgeoning electric vehicle (EV) market is a prime example of this shift. As automakers prioritize lightweighting to extend battery range and improve performance, they are increasingly looking beyond conventional steel. By 2024, the global EV market is projected to reach over 13 million units sold, a substantial increase from previous years, creating a growing demand for alternative materials like advanced high-strength steels, aluminum alloys, and composites.

- Regulatory Push: Emission standards and lightweighting mandates directly encourage the adoption of substitute materials.

- EV Market Growth: The rapid expansion of electric vehicles fuels demand for innovative material solutions beyond traditional steel.

- Design Evolution: Changing product design requirements often necessitate materials with different properties than conventional steel.

- Cost Optimization: Ongoing initiatives to reduce manufacturing and operational costs can also drive material substitution.

Specific Application Requirements

For Daido Steel's highly specialized products, like tool steels or materials for semiconductor manufacturing, the stringent performance demands significantly reduce the immediate threat from substitutes. These niche applications often require specific properties that are difficult for other materials to replicate. For instance, in the semiconductor industry, the purity and precise mechanical characteristics of specialized steels are paramount, making direct substitution challenging.

However, the landscape is not static. Ongoing advancements in material science could introduce viable alternatives in the future, potentially impacting even these specialized segments. While Daido Steel's 2024 performance in these high-value areas remains robust due to their established expertise, continuous innovation is key to mitigating this long-term threat.

- Limited direct substitutes for highly specialized steels due to unique performance requirements.

- Potential for future material science breakthroughs to introduce viable alternatives.

- Daido Steel's expertise in niche markets currently provides a strong defense against substitution.

The threat of substitutes for steel, particularly for Daido Steel's specialized products, is a complex issue. While general steel applications face pressure from materials like aluminum and composites, especially in the automotive sector where lightweighting is key, Daido Steel's focus on high-performance and niche steels offers a degree of insulation. For example, the global demand for specialty metals, a category that includes some of Daido Steel's offerings, was projected to see steady growth through 2024, driven by advanced manufacturing and technology sectors.

However, even in specialized areas, innovation in substitute materials is a persistent concern. Advances in ceramics and advanced polymers continue to offer improved performance characteristics, potentially challenging even high-end steel applications in the long term. The automotive industry, for instance, is exploring advanced composites for structural components, aiming for significant weight reduction. By 2024, the market for advanced composites was expected to exceed $20 billion, indicating a substantial and growing alternative material landscape.

The electric vehicle (EV) market is a significant driver for material innovation, pushing for lighter and more efficient components. As the EV market expanded rapidly, with global sales projected to surpass 15 million units in 2024, the demand for materials that enhance battery range and performance intensified. This trend creates opportunities for advanced steels but also for alternative lightweight materials that could displace traditional steel applications, even in specialized areas.

Daido Steel's strategic advantage lies in its ability to deliver highly engineered steels with properties difficult to replicate. However, the continuous development of advanced materials, coupled with industry-wide pushes for sustainability and efficiency, means that the threat of substitutes, while currently managed in niche markets, requires ongoing vigilance and innovation.

| Material Type | Key Applications | Substitute Materials | 2024 Market Trend/Data Point |

|---|---|---|---|

| General Steel | Automotive body, construction | Aluminum, advanced plastics, composites | Automotive lightweighting trend continues; aluminum consumption increasing. |

| Specialty Steel (e.g., Tool Steel) | Manufacturing tools, dies | Advanced ceramics, high-performance polymers | Growing demand in precision manufacturing sectors. |

| High-Performance Steel | Aerospace components, energy sector | Titanium alloys, advanced composites | Aerospace sector's increasing adoption of composites for weight savings. |

Entrants Threaten

The specialty steel manufacturing sector, where Daido Steel operates, demands substantial upfront capital. Establishing advanced production facilities, acquiring cutting-edge machinery, and integrating sophisticated technologies can easily run into hundreds of millions, if not billions, of dollars. For instance, a new integrated steel plant can cost upwards of $5 billion to build, a figure that deters most potential newcomers.

Existing giants like Daido Steel leverage massive economies of scale across production, raw material sourcing, and research, creating a significant cost barrier for newcomers. For instance, Daido Steel's extensive global supply chain allows for bulk purchasing discounts that a new entrant simply cannot replicate initially. This scale translates into lower per-unit costs, making it difficult for new players to compete on price.

Furthermore, Daido Steel benefits from an established experience curve in developing advanced steel materials and refining manufacturing techniques. This accumulated expertise, honed over decades, yields both cost efficiencies and superior product quality. New entrants would face a steep learning curve and substantial investment to achieve comparable levels of process optimization and material innovation.

Daido Steel's significant investment in research and development, particularly in advanced materials, creates a formidable barrier to entry. Their focus on proprietary technology, evidenced by an extensive patent portfolio covering areas like high-torque threaded connections and cutting-edge 3D printing, means newcomers would require immense capital and time to replicate these innovations and compete effectively.

Access to Distribution Channels and Customer Relationships

Newcomers face a significant hurdle in accessing established distribution channels and replicating the deep customer relationships that Daido Steel has cultivated over decades. These relationships are particularly crucial in high-stakes sectors like automotive, aerospace, and heavy industrial machinery, where trust and consistent quality are paramount.

Daido Steel's enduring reputation for superior quality and unwavering reliability acts as a powerful moat, making it exceptionally challenging for new entrants to gain traction. For instance, in 2024, the automotive sector continued to demand stringent material specifications, a benchmark Daido Steel consistently meets, solidifying its position with key global manufacturers.

- Established Customer Loyalty: Daido Steel's long-term partnerships with major players in the automotive industry, for example, mean that new steel suppliers must offer demonstrably superior value or unique capabilities to even be considered.

- Brand Reputation: The company's brand is synonymous with high-performance steel, a perception built over years of consistent delivery and innovation, which new entrants cannot easily replicate.

- Distribution Network Integration: Daido Steel is deeply integrated into the supply chains of its key clients, making it difficult for new entrants to bypass these established networks and secure orders.

Regulatory Hurdles and Environmental Compliance

The steel industry faces significant regulatory hurdles, particularly concerning environmental compliance. New entrants would need to invest heavily to meet stringent emission standards and waste management protocols, effectively raising the barrier to entry. For instance, the European Union’s Carbon Border Adjustment Mechanism (CBAM) imposes costs on carbon-intensive imports, making it more challenging for new, less established players to compete without robust decarbonization strategies.

Meeting these evolving environmental standards, especially the push for sustainable and low-carbon steel production, presents a substantial challenge. Companies must adopt advanced technologies and processes, which require considerable capital expenditure and technical expertise. The global steel sector, by 2024, was already grappling with increased pressure to reduce its carbon footprint, with many established players investing billions in green steel initiatives.

- Stringent Environmental Regulations: The steel industry is heavily regulated regarding emissions, pollution control, and waste disposal.

- High Compliance Costs: Adhering to these regulations necessitates significant investment in technology and operational changes, increasing costs for new entrants.

- Focus on Sustainability: The growing demand for green steel and decarbonization efforts further complicates market entry for those lacking advanced environmental technologies.

- Global Policy Impact: International agreements and carbon pricing mechanisms, like the EU's CBAM, create additional financial and operational burdens for new steel producers.

The threat of new entrants in the specialty steel sector, where Daido Steel operates, is significantly low due to immense capital requirements for establishing advanced production facilities, which can easily exceed $5 billion for a new integrated steel plant. Daido Steel's established economies of scale in sourcing and production, coupled with decades of expertise and a strong patent portfolio in advanced materials, create substantial cost and innovation barriers. Furthermore, deep-rooted customer relationships, particularly in demanding sectors like automotive, and a robust brand reputation for quality and reliability make market penetration extremely difficult for newcomers. Stringent environmental regulations and the increasing demand for sustainable steel production also add considerable compliance costs and technological challenges for potential entrants.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building new integrated steel plants costs upwards of $5 billion. | Extremely High |

| Economies of Scale | Daido Steel's bulk purchasing and production efficiency lowers per-unit costs. | High |

| Technology & Innovation | Extensive R&D and patent portfolio in advanced materials. | High |

| Customer Relationships & Brand | Established trust and loyalty in key industries. | High |

| Regulatory & Environmental | High costs for environmental compliance and sustainable production. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Daido Steel is built upon a foundation of publicly available company filings, including annual reports and investor presentations. We also incorporate industry-specific data from reputable market research firms and trade publications to capture competitive dynamics.