Daido Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daido Steel Bundle

Navigate the complex global landscape affecting Daido Steel with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the company's future. Gain a critical advantage in your strategic planning and investment decisions. Download the full PESTLE analysis now for actionable insights.

Political factors

Daido Steel, operating on a global scale, faces considerable influence from international trade policies and tariffs, especially those impacting the steel and automotive sectors. For instance, the US tariffs implemented in 2018 on steel imports, which initially affected various countries, created uncertainty and potential cost increases for manufacturers relying on these materials. These trade dynamics directly shape Japan's crude steel production and influence Daido Steel's export volumes, as seen in shifts in trade flows following such measures.

The global steel landscape is currently characterized by increasing trade protectionism, a trend that has been amplified by ongoing geopolitical tensions and national economic strategies. This protectionist sentiment, coupled with evolving global supply chains, means Daido Steel must remain agile in adapting to varying market access and competitive pressures. For example, reports from the World Steel Association in 2023 highlighted continued regional trade disputes and the impact of these on global steel trade volumes.

The Japanese government's commitment to decarbonization significantly impacts Daido Steel. The Act on Promoting Green Procurement encourages the use of environmentally friendly products, pushing steelmakers towards greener alternatives. Furthermore, the planned introduction of an emissions trading scheme (ETS) in 2026 will directly incentivize companies like Daido Steel to reduce their carbon footprint, potentially making Electric Arc Furnace (EAF) technology more economically attractive.

Ongoing geopolitical tensions, particularly in regions like the Middle East, continue to pose risks to global supply chains. These conflicts can directly impact the availability and cost of essential raw materials for steel production, such as coking coal and iron ore. For instance, disruptions in major shipping lanes or production areas can lead to price volatility, with iron ore prices fluctuating significantly in 2024 due to various global events.

Daido Steel must actively manage these geopolitical uncertainties by strengthening its supply chain resilience. This involves exploring diversified sourcing strategies to reduce reliance on any single region or supplier. By building a more robust and flexible supply network, the company can better mitigate the impact of unforeseen geopolitical events on its production costs and material availability.

Domestic Economic Stimulus and Infrastructure Investment

The Japanese government's commitment to economic stimulus and infrastructure development significantly bolsters domestic steel demand. Initiatives like the FY2024 supplementary budget, which included substantial allocations for disaster recovery and infrastructure reinforcement, directly translate into increased orders for steel products. This focus on urban redevelopment and upgrading transportation networks, such as high-speed rail expansion, creates a consistent demand stream for Daido Steel.

These public works projects are crucial for offsetting potential slowdowns in other steel-consuming sectors. For instance, the government's push for energy-efficient building retrofits and the development of smart cities will require advanced steel materials. The ongoing efforts to rebuild infrastructure damaged by natural disasters, a recurring challenge in Japan, also ensure a steady pipeline of construction projects reliant on steel.

Key government initiatives impacting steel demand include:

- The "New Plan for the Promotion of Urban Redevelopment" aims to revitalize urban areas, driving demand for construction steel.

- Investments in transportation infrastructure, including Shinkansen network expansion and port improvements, directly benefit steel manufacturers.

- The FY2024 budget allocated approximately ¥15 trillion (around $100 billion USD) for public works, a significant portion of which is expected to be directed towards infrastructure projects.

- Government support for green transformation (GX) initiatives, such as renewable energy infrastructure, also presents new avenues for steel product demand.

International Collaboration on Green Steel Standards

Governments and industry leaders are increasingly working together to establish international benchmarks for steel production with near-zero or low emissions. This global push aims to create a unified framework for what constitutes environmentally conscious steel. Daido Steel's involvement in groups such as the Environmentally Friendly Electric Furnace Steel Materials WG and the Study Group on Green Steel for Green Transformation demonstrates its active engagement in shaping these crucial standards.

These collaborations are vital for Daido Steel as they directly influence market access and competitiveness. For instance, by 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) is expected to impose costs on carbon-intensive imports, making adherence to emerging green steel standards a significant financial consideration. Daido Steel's proactive participation positions it to meet these evolving regulatory demands and capitalize on the growing demand for sustainable materials.

- Global Standards Development: International bodies are actively defining criteria for low-carbon steel production, impacting trade and manufacturing practices worldwide.

- Industry Alignment: Daido Steel's engagement in working groups signifies its commitment to aligning with and contributing to the formation of these essential green steel guidelines.

- Market Access and Competitiveness: Adhering to these emerging standards is becoming critical for market entry, especially with regulations like the EU's CBAM coming into effect.

The Japanese government's proactive stance on decarbonization, including the upcoming emissions trading scheme in 2026, directly incentivizes Daido Steel to adopt greener technologies like Electric Arc Furnaces. Furthermore, government-backed infrastructure spending, exemplified by the FY2024 budget's substantial ¥15 trillion allocation for public works, provides a consistent domestic demand for steel products, bolstering the company's revenue streams.

What is included in the product

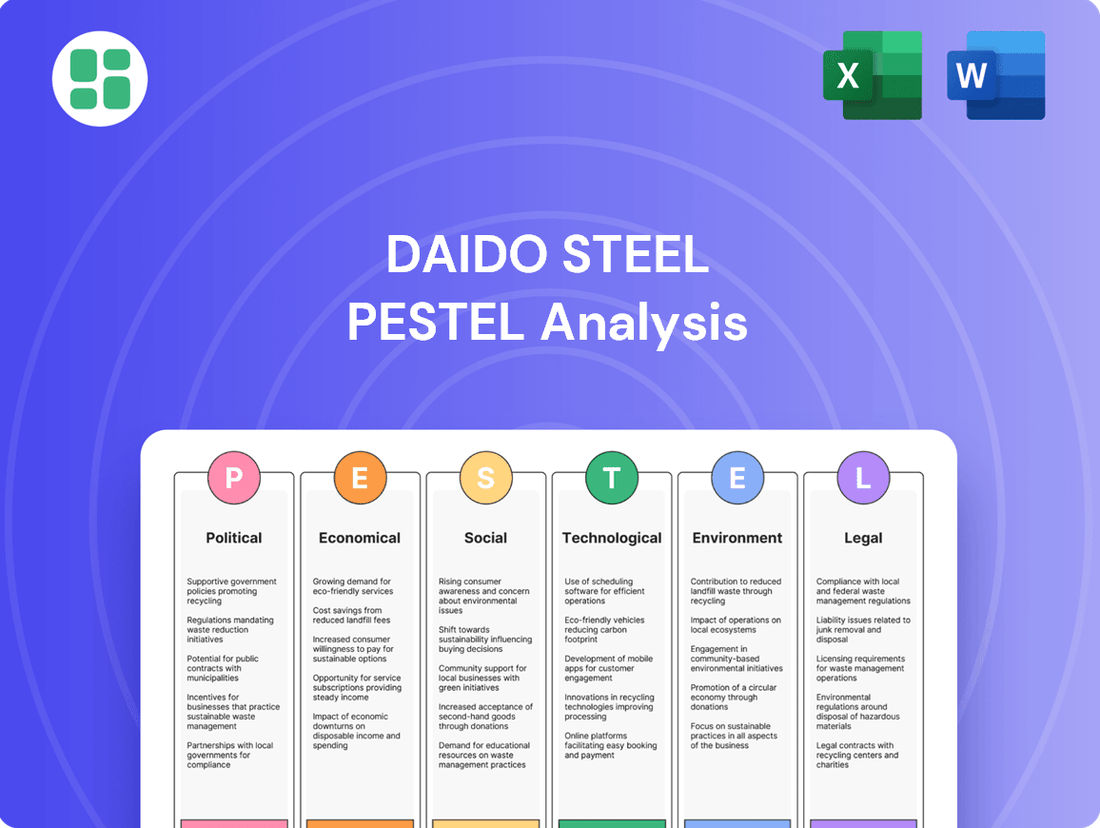

This PESTLE analysis of Daido Steel examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic positioning.

Daido Steel's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during strategic planning meetings and presentations.

Economic factors

The global economic outlook significantly impacts Daido Steel's performance, as demand for its specialized steel products is closely tied to key industries like automotive, industrial machinery, electronics, and aerospace. While 2024 presented economic headwinds, projections for 2025 suggest a modest recovery in global steel demand, with major economies expected to lead this rebound.

Industrial production figures are a crucial indicator. For instance, the IMF's World Economic Outlook update in April 2024 projected global growth at 3.2% for both 2024 and 2025, a slight improvement from earlier forecasts, which should translate to increased manufacturing activity and thus, steel consumption.

Daido Steel's profitability is directly tied to the volatile prices of key raw materials like iron ore and coking coal, alongside significant energy cost fluctuations. For instance, iron ore prices experienced considerable swings in 2024, with benchmarks like the Platts IODEX trading in a range that significantly impacted steel production costs for manufacturers globally.

The global energy crisis, amplified by geopolitical tensions throughout 2024 and into early 2025, has driven up electricity and natural gas prices, essential inputs for steelmaking. This surge in energy expenses directly translates to higher operational costs for Daido Steel, squeezing their profit margins and necessitating careful cost management strategies.

Currency exchange rate fluctuations, particularly concerning the Japanese Yen (JPY), present a significant economic factor for Daido Steel. A depreciating Yen can increase the cost of imported raw materials like iron ore and coking coal, which Daido Steel relies on, potentially squeezing profit margins. For example, in early 2024, the Yen hovered around 150 JPY to the US Dollar, a level that historically makes imports more expensive for Japanese manufacturers.

Conversely, a stronger Yen can make Daido Steel's finished steel products more expensive for international buyers, potentially impacting export competitiveness. While the Yen has seen some volatility, its overall trend against major currencies in late 2024 and early 2025 will be a critical consideration for Daido Steel's pricing strategies and international sales volume.

Demand from Key End-User Industries

The demand for specialty steel, particularly stainless steel, is on an upward trajectory. Projections indicate a significant increase in stainless steel needs for sectors like construction, aerospace, and the rapidly expanding electric vehicle (EV) market by 2025. This growth is fueled by evolving technological needs and sustainability initiatives across these industries.

Daido Steel is well-positioned to capitalize on this trend, anticipating robust growth in its stainless steel sales. This optimism stems from a projected recovery in orders from the semiconductor production equipment (SPE) sector, a critical component of global technology manufacturing. Furthermore, an anticipated rebound in global automotive production, especially from Japanese original equipment manufacturers (OEMs), will bolster demand for Daido Steel's offerings.

- Projected Stainless Steel Growth: Expected to rise by 2025, driven by construction, aerospace, and EV manufacturing.

- Semiconductor Equipment Sector: Recovery in orders from SPE manufacturers is a key driver for Daido Steel's stainless steel sales.

- Automotive Industry Rebound: Increased global auto production, particularly from Japanese OEMs, will boost demand for specialty steel.

- EV Market Expansion: The growing adoption of electric vehicles is creating substantial new demand for advanced steel materials.

Capital Investment and Shareholder Returns

Daido Steel's financial health and strategic investment decisions directly influence its shareholder returns. For the third quarter of fiscal year 2024, the company reported earnings that generally met expectations, underscoring a degree of financial predictability.

The company's commitment to a stable dividend payout ratio, coupled with ongoing considerations to enhance shareholder returns, highlights a clear strategy for capital allocation. This approach aims to balance reinvestment in the business with rewarding investors.

- FY24 Q3 Earnings: Daido Steel's financial performance in Q3 FY24 was largely in line with projections.

- Dividend Payout: The company maintains a stable dividend payout ratio, reflecting a commitment to consistent shareholder income.

- Shareholder Return Strategy: Daido Steel is actively evaluating methods to boost shareholder returns, signaling a proactive approach to capital management.

Global economic growth, projected by the IMF at 3.2% for both 2024 and 2025, underpins Daido Steel's demand. This growth supports industrial production and, consequently, steel consumption. However, raw material and energy price volatility, exemplified by iron ore price swings in 2024, directly impacts Daido Steel's production costs and profit margins.

| Economic Factor | 2024 Outlook | 2025 Projection | Impact on Daido Steel |

| Global GDP Growth | 3.2% | 3.2% | Supports demand for steel products. |

| Iron Ore Prices | Volatile, significant swings | Expected stabilization with potential for increases | Directly affects raw material costs. |

| Energy Prices | Elevated due to geopolitical factors | Continued pressure, dependent on global stability | Increases operational and production costs. |

| JPY Exchange Rate | Around 150 JPY/USD (early 2024) | Continued volatility expected | Impacts import costs and export competitiveness. |

Preview the Actual Deliverable

Daido Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Daido Steel PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to critical insights for strategic planning.

Sociological factors

The steel industry, including Daido Steel, is grappling with significant workforce demographic shifts. A key challenge is the shortage of skilled labor, especially for the advanced manufacturing processes crucial in today's steel production. This scarcity impacts operational efficiency and the ability to adopt new technologies.

To counter these labor challenges, companies like Daido Steel are increasingly investing in automation and robotics. For instance, the global industrial robotics market is projected to reach $100 billion by 2028, indicating a strong trend towards automated solutions to fill labor gaps and enhance productivity and workplace safety.

Consumer preferences are increasingly leaning towards sustainable products, a shift that directly impacts the steel industry. This growing environmental consciousness means demand for eco-friendly steel is on the rise, pushing companies like Daido Steel to innovate. For instance, by 2024, the global market for green steel is projected to see significant growth, with many major automotive manufacturers setting ambitious targets for using recycled and low-carbon steel in their vehicles, creating a clear market signal.

Daido Steel is actively integrating ESG management, with a strong emphasis on human capital, human rights, and supply chain oversight. This focus is a direct response to growing stakeholder expectations for responsible corporate behavior.

The company's sustainability reports, such as their 2023 report, detail concrete initiatives in these areas, underscoring a commitment to ethical practices. For instance, their human capital development programs aim to foster a diverse and skilled workforce, a key social responsibility.

Stakeholders, including investors and consumers, increasingly scrutinize a company's social impact. Daido Steel's proactive approach to CSR, evidenced by its detailed reporting, is crucial for maintaining its reputation and attracting investment in the current market landscape.

Health and Safety Standards in Manufacturing

Societal expectations around worker well-being are increasingly shaping manufacturing practices. Daido Steel, like its peers, faces pressure to maintain and elevate health and safety standards, a continuous sociological imperative. This focus is driven by a growing awareness of occupational hazards inherent in steel production.

The integration of advanced technologies, such as robotics and automation, directly addresses this sociological demand. By minimizing direct human involvement in high-risk areas, these innovations not only boost operational efficiency but significantly enhance the safety of the workforce. For instance, in 2023, the global manufacturing sector saw a notable increase in investments in automation, with reports indicating a 15% rise in adoption for tasks involving heavy lifting and exposure to extreme temperatures, directly impacting safety metrics.

- Societal Pressure: Growing public and employee demand for safer working environments in heavy industries.

- Automation Benefits: Robotics reduce human exposure to hazards like heat, heavy loads, and chemical fumes.

- Industry Trends: Global manufacturing saw a 15% increase in automation adoption for safety-critical tasks in 2023.

- Reputational Impact: Strong safety records positively influence brand perception and talent acquisition.

Shifting Industrial Clusters and Urbanization

Global urbanization continues to accelerate, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This trend, especially pronounced in emerging economies, directly fuels the demand for steel, a fundamental material for construction and infrastructure development. Daido Steel benefits from this by supplying essential products for the expanding urban landscapes.

The concentration of new manufacturing and construction projects in rapidly urbanizing regions significantly shapes Daido Steel's market opportunities. For instance, the Asia-Pacific region, driven by countries like China and India, is expected to remain the largest steel-consuming market. This geographical shift in industrial activity necessitates adaptive distribution strategies and targeted market penetration for Daido Steel to capitalize on these growth pockets.

- Urbanization Rate: The UN estimates global urbanization will reach 68% by 2050, up from 57% in 2023.

- Asia-Pacific Steel Demand: This region accounted for over 70% of global steel consumption in 2024.

- Infrastructure Investment: Emerging economies are channeling substantial investments into infrastructure, creating direct demand for steel products.

Societal expectations continue to shape the steel industry, with a growing emphasis on worker well-being and safety. Daido Steel, like its peers, is responding to this by enhancing health and safety standards, a crucial aspect of responsible manufacturing. The integration of advanced technologies, such as robotics, directly addresses these demands by minimizing human exposure to hazardous conditions.

Urbanization trends are a significant driver for steel demand, with the UN projecting 68% of the world's population in urban areas by 2050. This expansion, particularly in emerging economies, fuels the need for steel in construction and infrastructure. Daido Steel is positioned to benefit from this growth, especially in regions like the Asia-Pacific, which represented over 70% of global steel consumption in 2024.

| Sociological Factor | Impact on Daido Steel | Supporting Data (2023-2025) |

|---|---|---|

| Workforce Demographics & Skill Shortage | Challenges in skilled labor availability, impacting efficiency and technology adoption. | Global industrial robotics market projected to reach $100 billion by 2028. |

| Consumer Demand for Sustainability | Increasing demand for eco-friendly steel, driving innovation. | Green steel market projected for significant growth by 2024; automotive manufacturers setting recycled steel targets. |

| Worker Safety & Well-being | Pressure to maintain and improve health and safety standards. | 15% rise in automation adoption for safety-critical tasks in manufacturing (2023). |

| Urbanization & Infrastructure Development | Directly fuels demand for steel in construction. | UN: 68% global urbanization by 2050. Asia-Pacific: >70% global steel consumption (2024). |

Technological factors

Daido Steel's focus on high-performance steel products means that breakthroughs in material science are absolutely key to their success. Think of it as constantly finding better, stronger, and more specialized ingredients for their steel.

This includes creating new types of steel alloys, like ultra-clean stainless steel specifically designed for the demanding semiconductor industry, ensuring purity and preventing contamination. They are also innovating with high thermal conductivity die steel powder, which is a game-changer for 3D printing molds, enabling more efficient manufacturing and better resource use.

The steel sector is embracing Industry 4.0, integrating automation, AI, and IoT. This digital shift is evident in Daido Steel's operations, where these technologies are key to real-time monitoring and predictive maintenance, boosting efficiency.

By 2024, the global industrial automation market is projected to reach $316.4 billion, highlighting the significant investment in these transformative technologies. Daido Steel's strategic adoption of automation directly addresses the need for enhanced precision and optimized production processes, crucial for maintaining competitiveness in the evolving steel landscape.

Technological advancements are fundamentally reshaping steel production, with hydrogen-based steelmaking and Electric Arc Furnaces (EAFs) leading the charge in decarbonization. These innovations are crucial for meeting global net-zero emission targets.

Daido Steel is actively investing in and integrating these green technologies, exemplified by their development of 'Daido Green EAF Steel.' This strategic move directly addresses the industry's environmental challenges and positions the company for a sustainable future.

3D Printing and Additive Manufacturing for Steel

The increasing application of 3D printing for steel components, even in demanding environments like space, highlights a significant technological advancement. This trend offers new possibilities for creating complex, customized steel parts with potentially reduced material waste and lead times.

Daido Steel is actively participating in this evolution by utilizing its specialized high thermal conductivity die steel powder for 3D printing molds. This strategic move aims to enhance manufacturing efficiency by increasing production yields and extending the operational lifespan of these critical tooling components.

- Growing Adoption: The global 3D printing market, including metal printing, is projected for substantial growth. For instance, the metal additive manufacturing market was valued at approximately $6.5 billion in 2023 and is expected to reach over $30 billion by 2030, indicating strong industry momentum.

- Daido Steel's Innovation: Daido Steel's development and application of specific steel powders for additive manufacturing demonstrate a commitment to leveraging advanced production techniques. This allows for the creation of molds with improved thermal properties, leading to more consistent and efficient molding processes.

- Efficiency Gains: By enhancing mold performance through 3D printing, Daido Steel can achieve higher output volumes and reduce downtime associated with mold replacement, directly contributing to improved profitability and competitiveness.

Digitalization of Supply Chains

The digitalization of supply chains is a significant technological factor for Daido Steel. Advanced data analytics and smart logistics are becoming essential for improving resilience and fine-tuning inventory levels. For instance, the global supply chain management market was valued at approximately $22.7 billion in 2023 and is projected to reach $43.1 billion by 2030, indicating a strong trend towards digital solutions.

This digital transformation allows for greater visibility and efficiency. Companies are increasingly adopting technologies like artificial intelligence (AI) and the Internet of Things (IoT) to monitor goods in real-time, predict potential disruptions, and automate processes. The use of blockchain technology is also gaining traction for its ability to enhance transparency and traceability throughout the supply chain, which is particularly relevant for raw material sourcing and product provenance.

Key technological advancements impacting supply chains include:

- Real-time tracking and monitoring: Utilizing IoT sensors to provide immediate data on location, condition, and status of materials.

- Predictive analytics: Employing AI and machine learning to forecast demand, identify potential bottlenecks, and optimize routes.

- Blockchain for transparency: Creating immutable records of transactions and movements to ensure authenticity and reduce fraud.

- Automation and robotics: Implementing automated systems in warehouses and logistics for increased speed and accuracy.

Technological factors are pivotal for Daido Steel, driving innovation in material science and production processes. The company's focus on advanced steel alloys, like those for the semiconductor industry, and high thermal conductivity die steel powder for 3D printing molds, directly leverages cutting-edge material science breakthroughs. This commitment to technological advancement is crucial for developing specialized products that meet evolving industry demands.

The integration of Industry 4.0 technologies, including automation, AI, and IoT, is transforming Daido Steel's operations. These digital solutions enhance real-time monitoring, predictive maintenance, and overall production efficiency. The global industrial automation market's projected growth to $316.4 billion by 2024 underscores the strategic importance of these investments for maintaining a competitive edge.

Furthermore, Daido Steel is actively adopting green technologies like hydrogen-based steelmaking and Electric Arc Furnaces (EAFs) to address decarbonization goals, exemplified by their 'Daido Green EAF Steel.' The increasing use of 3D printing for steel components, supported by a growing metal additive manufacturing market projected to exceed $30 billion by 2030, presents new opportunities for customized production and material efficiency.

| Technological Factor | Impact on Daido Steel | Supporting Data/Trends |

|---|---|---|

| Material Science Innovations | Development of specialized steel alloys (e.g., ultra-clean stainless steel, high thermal conductivity die steel powder) for advanced applications. | Enables products for demanding sectors like semiconductors and 3D printing molds, enhancing performance and resource utilization. |

| Industry 4.0 Integration | Adoption of automation, AI, and IoT for improved production efficiency, real-time monitoring, and predictive maintenance. | Global industrial automation market projected to reach $316.4 billion by 2024, highlighting significant investment in these technologies. |

| Green Steelmaking Technologies | Investment in hydrogen-based steelmaking and EAFs for decarbonization. | Development of 'Daido Green EAF Steel' addresses environmental challenges and supports net-zero emission targets. |

| Additive Manufacturing (3D Printing) | Utilization of specialized steel powders for 3D printing molds. | Metal additive manufacturing market expected to grow from $6.5 billion (2023) to over $30 billion by 2030, indicating strong adoption. |

Legal factors

Japan's commitment to carbon neutrality by 2050, coupled with evolving environmental regulations and emissions standards, presents a significant operational consideration for Daido Steel. These mandates, including the anticipated expansion of emission trading schemes, directly influence manufacturing processes and necessitate investments in cleaner technologies.

Daido Steel is actively addressing these environmental pressures by prioritizing CO2 reduction initiatives. This includes implementing energy-saving measures across its facilities and increasing the adoption of CO2-free electricity sources to meet compliance requirements and foster sustainable operations.

Daido Steel's commitment to rigorous product liability and quality standards is paramount, especially given its crucial role as a supplier to demanding sectors such as automotive, aerospace, and medical equipment. Meeting these stringent industry regulations is not just a matter of compliance but a fundamental requirement for ensuring the safety and reliability of its high-performance steel materials.

For instance, the automotive industry, a key market for Daido Steel, faces increasingly strict safety mandates. In 2024, global automotive recalls, often linked to component failures, underscore the critical importance of unwavering quality control. Daido Steel's adherence to standards like ISO/TS 16949 (now IATF 16949) directly addresses these concerns, ensuring its steel contributes to vehicle integrity and passenger safety.

International trade laws and the threat of anti-dumping measures are critical for Daido Steel. These regulations can alter the competitive playing field by imposing tariffs or duties on imported goods deemed unfairly priced. For instance, in 2023, the United States International Trade Commission continued investigations into certain steel products, which could lead to new duties impacting global steel trade flows.

The Japanese government's stance on protective trade measures against lower-cost imports directly affects Daido Steel's market position. Should Japan implement new tariffs or quotas on imported steel, it could shield domestic producers like Daido Steel from intense price competition, potentially boosting their domestic market share and profitability.

Labor Laws and Workplace Safety Regulations

Daido Steel must navigate a complex web of labor laws, both domestically in Japan and in any international markets where it operates. This includes adhering to regulations concerning worker rights, fair wages, working hours, and preventing discrimination. Ensuring compliance is paramount to avoid legal penalties and maintain a positive corporate reputation.

Workplace safety is another critical legal factor. Daido Steel is obligated to implement and maintain robust health and safety regulations to protect its employees from occupational hazards, particularly given the nature of steel manufacturing. This commitment to safety is not only a legal requirement but also directly impacts employee well-being and operational efficiency.

- Compliance with Japan's Industrial Safety and Health Act: This legislation sets standards for workplace safety and health management, which Daido Steel must rigorously follow.

- International Labor Standards: For overseas operations, Daido Steel must comply with International Labour Organization (ILO) conventions and local labor laws, ensuring fair treatment and safe working conditions globally.

- Worker Protection Initiatives: Recent trends in labor law emphasize enhanced worker protections, including mental health support and measures against harassment, requiring ongoing adaptation by companies like Daido Steel.

- Safety Record Data: While specific Daido Steel safety incident rates for 2024/2025 are not publicly available, the industry generally aims for continuous reduction in lost-time injury frequency rates (LTIFR), often targeting rates below 1.0.

Intellectual Property Rights Protection

Protecting its proprietary steel compositions, advanced material developments, and innovative manufacturing processes through intellectual property rights is vital for Daido Steel to maintain its competitive edge. This ensures that its unique technologies are not easily replicated by competitors, safeguarding its market position. For instance, in 2024, Daido Steel was actively involved in patent applications related to high-strength, lightweight steel alloys designed for the automotive industry, a sector increasingly focused on fuel efficiency and safety standards. The company's commitment to R&D, evidenced by its consistent investment in new material science, underpins the need for robust IP protection.

Daido Steel leverages a combination of patents, trade secrets, and trademarks to shield its innovations. Patents are crucial for protecting novel steel formulations and production methods, offering exclusive rights for a set period. Trade secrets are employed for manufacturing know-how that provides a competitive advantage but may not be patentable or is best kept confidential. The company also uses trademarks to brand its specialized steel products, building recognition and trust among its clientele.

The legal landscape surrounding intellectual property is dynamic, with ongoing developments in international patent law and trade secret enforcement. Daido Steel must stay abreast of these changes to ensure its IP portfolio remains effective and enforceable globally. This includes navigating different legal frameworks in key markets where it operates or sells its products, such as the European Union and North America, where IP protection is a significant consideration for high-value manufacturing.

Daido Steel's operations are significantly shaped by international trade regulations and anti-dumping laws. For example, in 2023, the United States initiated investigations into various steel imports, which could lead to new tariffs. These trade policies directly impact global steel pricing and market access, influencing Daido Steel's export strategies and competitiveness in key international markets.

The company must also comply with product liability laws, ensuring the safety and quality of its steel products, especially for critical applications in the automotive and aerospace sectors. Given that the automotive industry, a major market for Daido Steel, faced numerous recalls in 2024 due to component issues, maintaining stringent quality control is paramount. Adherence to standards like IATF 16949 is crucial for meeting these safety mandates.

Intellectual property laws are vital for Daido Steel to protect its innovations. In 2024, the company actively pursued patents for advanced steel alloys aimed at improving vehicle fuel efficiency. This focus on R&D necessitates robust IP protection to maintain its competitive advantage against rivals seeking to replicate its technological advancements.

Environmental factors

The steel industry, a major contributor to global carbon dioxide emissions, is under significant pressure to decarbonize. Daido Steel is actively pursuing carbon neutrality by 2050, a goal that necessitates substantial operational shifts.

To achieve this, Daido Steel is implementing a multi-faceted approach. This includes investing in energy-saving technologies, utilizing internal carbon pricing mechanisms to incentivize emissions reduction, and significantly increasing its reliance on CO2-free electricity sources. For context, the global steel industry accounted for approximately 7% of total anthropogenic CO2 emissions in 2023, highlighting the scale of the challenge.

Resource scarcity is a growing concern, pushing companies like Daido Steel to adopt circular economy principles. This means focusing on maximizing steel recycling and improving waste management efficiency. Daido Steel actively reuses steel scrap as a key raw material for its high-performance products, conserving valuable natural resources.

In 2023, the global steel industry's reliance on scrap steel continued to rise, with recycled content accounting for a significant portion of production. Daido Steel's commitment to this practice not only addresses environmental pressures but also strengthens its supply chain resilience against volatile raw material markets.

Daido Steel is actively addressing environmental concerns by focusing on reducing energy consumption and embracing the renewable energy transition. A significant aspect of this strategy involves substantial investments in energy-efficient technologies across its operations. For instance, the company is committed to increasing its use of CO2-free electricity, aiming to power its facilities with cleaner sources.

This commitment is further demonstrated through participation in various industry initiatives designed to accelerate the adoption of renewable energy. In 2023, global renewable energy capacity saw a record increase, adding nearly 510 gigawatts. Daido Steel's efforts align with this broader trend, contributing to a more sustainable energy future for the steel industry.

Water Usage and Pollution Control

Minimizing water usage and controlling pollution are critical environmental considerations for steel manufacturers like Daido Steel. While specific 2024 or 2025 data for Daido Steel's water management initiatives wasn't readily available, the broader steel industry is increasingly focused on sustainable practices. For instance, in 2023, the World Steel Association reported that the sector's water withdrawal intensity, a measure of water used per tonne of crude steel produced, continued a downward trend, reflecting greater efficiency. This trend is driven by regulatory pressures and a commitment to reducing environmental impact.

Responsible water management in steel production typically involves closed-loop systems for cooling water, advanced wastewater treatment technologies, and efforts to reduce the discharge of pollutants such as heavy metals and suspended solids. Companies are investing in technologies that allow for water reuse and recycling, thereby decreasing overall consumption. Adherence to stringent environmental protection standards, often set by national and international bodies, is paramount to ensure compliance and minimize ecological footprints.

- Industry Focus: Steel manufacturers are prioritizing water efficiency and pollution reduction in their operations.

- Water Intensity Trend: The global steel sector saw a decrease in water withdrawal intensity per tonne of crude steel produced in 2023.

- Technological Adoption: Investments are being made in closed-loop cooling systems and advanced wastewater treatment to promote water reuse and minimize pollutant discharge.

Biodiversity Preservation and Environmental Awards

Daido Steel actively engages in biodiversity preservation initiatives, recognizing its importance for long-term environmental health. This commitment extends beyond mere compliance, as evidenced by their proactive efforts to foster ecological balance within their operational spheres.

The company's dedication to environmental stewardship was notably recognized with the Gold Prize at the 2025 Aichi Environmental Awards. This accolade underscores Daido Steel's significant contributions to environmental protection, highlighting a holistic approach that encompasses biodiversity alongside other key environmental metrics.

- Biodiversity Initiatives: Daido Steel implements programs focused on protecting and enhancing local ecosystems.

- Environmental Awards: Recognition at the 2025 Aichi Environmental Awards signifies leadership in environmental performance.

- Holistic Approach: The company's environmental strategy integrates biodiversity preservation as a core component, not just emissions control.

Daido Steel is actively working towards carbon neutrality by 2050, a crucial goal for the steel industry which contributed about 7% of global CO2 emissions in 2023. The company is investing in energy-saving technologies and increasing its use of CO2-free electricity to meet this target.

Resource scarcity is driving Daido Steel to embrace circular economy principles, particularly through increased steel scrap recycling. This practice not only conserves natural resources but also enhances supply chain resilience, as scrap steel's use in production continues to grow globally.

Water management and pollution control are key environmental focuses. While specific 2024/2025 data for Daido Steel is limited, the broader steel industry saw a reduction in water withdrawal intensity per tonne of crude steel in 2023, indicating greater efficiency through technologies like closed-loop cooling systems.

Daido Steel's commitment to environmental stewardship, including biodiversity preservation, was recognized with the Gold Prize at the 2025 Aichi Environmental Awards, highlighting their leadership in sustainable practices.

| Environmental Focus | Daido Steel's Approach | Industry Context (2023/2025) |

|---|---|---|

| Decarbonization | Carbon neutrality goal by 2050; investing in energy efficiency and CO2-free electricity. | Steel industry accounted for ~7% of global CO2 emissions in 2023. |

| Resource Management | Maximizing steel scrap recycling for high-performance products. | Growing reliance on scrap steel globally; enhances supply chain resilience. |

| Water & Pollution | Implementing advanced wastewater treatment and water reuse technologies. | Global steel sector's water withdrawal intensity decreased in 2023. |

| Biodiversity | Engaging in biodiversity preservation initiatives. | Awarded Gold Prize at 2025 Aichi Environmental Awards for environmental performance. |

PESTLE Analysis Data Sources

Our Daido Steel PESTLE Analysis draws from a comprehensive blend of official government reports, international economic databases, and leading industry publications. We meticulously gather data on political stability, economic forecasts, technological advancements, environmental regulations, and socio-cultural trends impacting the steel sector.