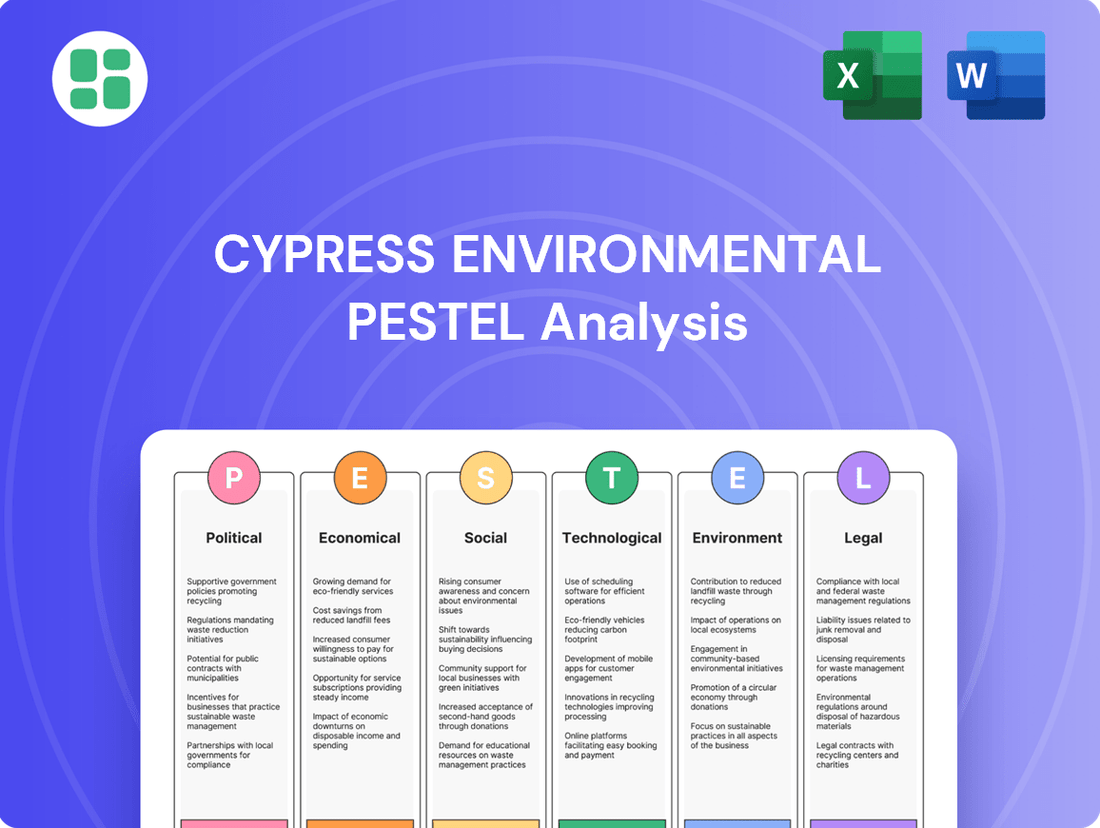

Cypress Environmental PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cypress Environmental Bundle

Navigate the complex external landscape affecting Cypress Environmental with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and societal trends are shaping opportunities and challenges. Gain a competitive edge by leveraging these crucial insights for your strategic planning. Download the full version now and unlock actionable intelligence.

Political factors

Government policies and initiatives play a crucial role in shaping the landscape for energy infrastructure development. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocates significant funding towards modernizing and expanding energy infrastructure, which could create opportunities for companies like Cypress Environmental Partners.

Regulatory streamlining for energy-related projects can accelerate development timelines. Conversely, stricter environmental regulations or permitting processes, while important for sustainability, can sometimes slow down the pace of new infrastructure construction, potentially impacting business pipelines.

In 2024, the U.S. Department of Energy continued to emphasize investments in clean energy transmission and grid modernization, signaling ongoing governmental support for a robust energy infrastructure. This focus on upgrading and expanding the grid, including pipelines, directly benefits companies involved in these sectors.

Changes in political administrations often bring about shifts in how environmental regulations are enforced and prioritized. For Cypress, which offers environmental solutions and compliance services, these changes can directly affect the demand for their offerings. For example, a new administration might relax regulations, potentially reducing the immediate need for certain environmental services, or conversely, tighten them, boosting demand.

The U.S. Environmental Protection Agency (EPA) plays a crucial role in setting and enforcing these standards. Recent political discussions, such as proposals to ease greenhouse gas emission standards for the power sector, illustrate how evolving political priorities can reshape the regulatory environment Cypress operates within. Such shifts can influence the market for pollution control technologies and environmental consulting services.

Global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to create significant volatility in energy supply chains and prices. This instability directly impacts Cypress Environmental's clients in the energy sector, influencing their operational costs and investment decisions. For instance, the average Brent crude oil price fluctuated significantly throughout 2024, impacting exploration and production budgets.

Political stability in key energy-producing regions, like parts of Africa and South America, directly affects investment in new infrastructure, which in turn shapes the demand for inspection and environmental services. Instability can delay or halt projects, reducing the need for these critical services. Conversely, stable regions may see increased infrastructure development, boosting demand.

The U.S. government's energy sovereignty initiatives and evolving policies on fossil fuels versus renewables are also highly relevant. Policies promoting domestic energy production, for example, could lead to increased drilling activity, necessitating more environmental compliance and inspection services. Conversely, a strong push towards renewable energy might shift demand towards different types of environmental consulting.

Trade Policies and Tariffs

Trade policies and tariffs represent a significant political factor for Cypress Environmental Partners. Tariffs on essential materials and equipment used in energy infrastructure projects directly influence operational costs for both Cypress and its clientele. For instance, increased tariffs on steel or specialized components could escalate project expenses, potentially impacting the economic feasibility of new developments or crucial maintenance work that relies on Cypress's expertise.

These trade dynamics can create volatility in supply chain costs. For example, in 2024, ongoing trade tensions between major economies led to fluctuating prices for imported industrial goods. This directly affects the cost of acquiring components for renewable energy installations or pollution control systems, areas where Cypress Environmental Partners operates. The unpredictability introduced by such policies necessitates robust risk management strategies for supply chain resilience.

- Tariff Impact: Increased tariffs on imported materials for energy infrastructure can raise project costs by an estimated 5-15% depending on the specific components and origin countries.

- Supply Chain Disruption: Trade disputes can lead to delays and increased shipping costs, potentially impacting project timelines and budgets for Cypress's clients.

- Policy Uncertainty: Shifting trade agreements and tariff schedules create an environment of uncertainty, making long-term financial planning for infrastructure projects more challenging.

Public Policy on ESG and Sustainability

Governments worldwide are intensifying their focus on Environmental, Social, and Governance (ESG) criteria and sustainability. This trend directly benefits companies like Cypress Environmental, particularly in areas such as water treatment and reducing environmental footprints, as it fuels demand for their specialized services.

Mandates and incentives are becoming more common. For instance, by the end of 2024, the European Union’s Corporate Sustainability Reporting Directive (CSRD) will require thousands more companies to report on their ESG performance, a move that is expected to boost the market for environmental consulting and compliance services. This creates significant new revenue opportunities for environmental service providers like Cypress.

- Increased Regulatory Pressure: Governments are enacting stricter environmental regulations, compelling businesses to invest in compliance and sustainable practices.

- Government Incentives: Tax credits and subsidies for green technologies and sustainable infrastructure projects are on the rise, making Cypress's solutions more financially attractive.

- Public Procurement Policies: Many governments are prioritizing suppliers with strong ESG credentials in their procurement processes, opening doors for environmentally conscious companies.

- International Agreements: Commitments like those stemming from COP28 in late 2023 continue to drive national policies towards decarbonization and environmental protection, directly impacting demand for environmental services.

Government policies significantly influence the energy sector, with initiatives like the Infrastructure Investment and Jobs Act driving investment in grid modernization. In 2024, the U.S. Department of Energy's continued focus on clean energy transmission directly supports companies involved in energy infrastructure. Evolving environmental regulations, such as proposed changes to greenhouse gas emission standards, directly shape the demand for Cypress Environmental's compliance and consulting services.

| Political Factor | Description | Impact on Cypress Environmental | Relevant Data/Trend |

| Government Spending on Infrastructure | Investment in energy transmission and grid modernization. | Increased demand for inspection, maintenance, and environmental services. | U.S. Infrastructure Investment and Jobs Act: $66 billion allocated for transmission and grid modernization. |

| Environmental Regulations | Stricter or relaxed emission standards and permitting processes. | Directly affects demand for pollution control, compliance, and consulting. | EPA proposals on emission standards can alter market needs for environmental solutions. |

| Energy Policy Shifts | Focus on fossil fuels vs. renewables. | Influences demand for services related to drilling activity or renewable energy projects. | Government initiatives promoting domestic energy production can boost demand for compliance services. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Cypress Environmental, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities for the company.

The Cypress Environmental PESTLE Analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during meetings and simplifying complex market dynamics for strategic decision-making.

Economic factors

Fluctuations in crude oil and natural gas prices significantly influence Cypress Environmental's clientele in the energy sector, directly affecting their profitability and investment strategies. For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, a level that generally supports continued investment in exploration and production, benefiting service providers like Cypress.

Sustained periods of lower oil prices, such as those seen in late 2023 where WTI crude dipped below $70 per barrel, can prompt energy companies to scale back capital expenditures on new projects or essential maintenance. This reduction in spending can consequently decrease the demand for Cypress's inspection and environmental services.

Conversely, periods of higher energy prices, like the spikes observed in mid-2024 pushing Brent above $85 per barrel, tend to stimulate increased activity within the energy industry. This heightened operational tempo often translates into greater demand for Cypress's specialized environmental compliance and inspection solutions as companies ramp up production and infrastructure projects.

The global economy is projected to grow by 2.7% in 2024, according to the World Bank, with emerging markets and developing economies expected to expand at a faster pace. This overall economic health directly impacts industrial activity, which in turn fuels demand for environmental services like those offered by Cypress Environmental. A growing industrial sector means more manufacturing, construction, and energy production, all of which create a need for pipeline integrity, non-destructive testing, and water treatment solutions.

In 2024, the U.S. industrial production index is anticipated to see moderate growth, reflecting a stable manufacturing and mining sector. This steady industrial output translates into consistent demand for Cypress's core services, particularly pipeline inspection and NDE, as businesses focus on maintaining operational efficiency and safety. Increased infrastructure spending, often a byproduct of economic expansion, also drives demand for environmental compliance and remediation services.

The energy sector's performance is a key indicator for Cypress, as oil and gas exploration and production activities are significant drivers of their business. While the energy landscape is evolving, continued investment in existing infrastructure and new projects, particularly in natural gas, will support demand for specialized inspection and maintenance services. For instance, the International Energy Agency forecasts continued global oil demand growth through 2025, which underpins the need for reliable pipeline management.

Investment in energy infrastructure is a significant economic factor for Cypress Environmental. The company's growth is tied to capital expenditure by energy firms on projects like pipelines, processing plants, and power generation. For instance, in 2024, global energy infrastructure investment was projected to reach $1.1 trillion, with a substantial portion allocated to traditional and renewable sources, creating demand for environmental services.

Inflation and Operational Costs

Inflationary pressures continue to impact Cypress Environmental Partners, directly affecting their operational costs. Rising prices for essential labor, raw materials, and critical equipment can significantly squeeze profit margins. For instance, the Producer Price Index (PPI) for construction materials saw a notable increase in late 2024, impacting companies like Cypress that rely on these inputs.

Effectively managing these escalating costs is paramount for Cypress Environmental in the current economic climate. This necessitates a strategic approach to resource allocation and careful consideration of pricing strategies to maintain profitability. The company's ability to adapt its pricing models in response to increased input costs will be a key determinant of its financial performance.

- Labor Costs: Wage growth in the environmental services sector has been a persistent factor, with average hourly earnings for waste management and remediation services showing a steady upward trend through early 2025.

- Material Costs: The cost of key materials, such as chemicals for water treatment and specialized equipment components, has experienced volatility, with some categories seeing year-over-year increases exceeding 5% by mid-2025.

- Equipment & Fuel: The price of industrial equipment and diesel fuel, critical for operations, has been influenced by global supply chain dynamics and energy market fluctuations, adding to overhead.

- Pricing Strategy: Cypress Environmental's ability to pass on increased costs through adjusted service pricing without significantly impacting client demand is a crucial balancing act.

Market Trends in Environmental Services

The environmental services market is experiencing robust growth, driven by increasing regulatory pressures and substantial infrastructure investments. For instance, the global environmental services market was valued at approximately $1.3 trillion in 2023 and is anticipated to reach over $2.1 trillion by 2030, exhibiting a compound annual growth rate (CAGR) of around 7.1%.

Within this expanding sector, specific segments like environmental inspection, water treatment, and waste disposal are showing particularly strong upward trajectories. The water treatment market alone is projected to grow significantly, with estimates suggesting it could reach over $150 billion globally by 2027, up from around $100 billion in 2022.

These trends present considerable opportunities for companies like Cypress Environmental to expand their service offerings and market reach. The increasing demand for compliance with environmental standards and the need for efficient resource management are key drivers fueling this expansion.

- Global Environmental Services Market: Projected to exceed $2.1 trillion by 2030.

- Water Treatment Market: Expected to reach over $150 billion by 2027.

- Key Growth Drivers: Tightening regulations and infrastructure investment.

- Impact on Cypress: Significant expansion potential due to industry tailwinds.

Economic factors significantly shape Cypress Environmental's operating landscape, with energy prices acting as a primary catalyst for client activity. For example, Brent crude oil prices in early 2024 around $80 per barrel generally supported client investment, while dips below $70 in late 2023 prompted spending cuts. Conversely, spikes above $85 in mid-2024 stimulated greater operational tempo, increasing demand for Cypress's services.

Global economic growth, projected at 2.7% for 2024 by the World Bank, directly influences industrial output and, consequently, the demand for environmental services. A robust industrial sector means more manufacturing and energy production, driving the need for pipeline integrity and water treatment solutions. Inflationary pressures, however, are a concern, with rising costs for labor and materials impacting operational margins. For instance, the Producer Price Index for construction materials saw a notable increase in late 2024.

The environmental services market itself is a strong growth area, expected to exceed $2.1 trillion by 2030. This expansion, fueled by regulatory demands and infrastructure investment, offers significant opportunities for Cypress. The water treatment market, in particular, is forecast to reach over $150 billion by 2027, highlighting a key segment for potential growth.

| Economic Factor | 2024/2025 Data Point | Impact on Cypress Environmental |

| Crude Oil Prices (Brent) | ~$80/barrel (early 2024), >$85/barrel (mid-2024) | Higher prices stimulate client investment and operational activity. |

| Global Economic Growth | 2.7% projected for 2024 (World Bank) | Drives industrial activity and demand for environmental services. |

| Inflation (PPI Construction Materials) | Notable increase late 2024 | Increases operational costs, potentially squeezing profit margins. |

| Environmental Services Market Growth | Projected >$2.1 trillion by 2030 | Indicates significant expansion opportunities for service providers. |

Same Document Delivered

Cypress Environmental PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cypress Environmental provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain actionable insights into the external forces shaping Cypress Environmental's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It's designed to equip you with a thorough understanding of the business environment.

Sociological factors

Public awareness of environmental issues, including climate change and pollution, is on the rise. This growing concern translates into increased pressure on companies, especially in the energy and industrial sectors, to implement greener operational practices. For instance, a 2024 survey indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions.

This societal shift directly benefits companies like Cypress, which provide solutions for environmental impact reduction and regulatory compliance. As regulatory bodies and the public demand greater accountability, the market for environmental consulting and services is expected to expand significantly, with projections showing a 6% annual growth rate for the environmental services sector through 2025.

Cypress Environmental Partners relies heavily on a skilled workforce for specialized services like pipeline inspection and non-destructive examination. The U.S. Bureau of Labor Statistics projected a 6% growth in the overall construction and extraction occupations between 2022 and 2032, indicating a need for skilled trades. However, a persistent shortage of qualified welders and inspectors, exacerbated by an aging workforce and insufficient training pipelines, could hinder Cypress's ability to meet demand and maintain service quality.

Cypress Environmental's operations are increasingly shaped by the growing demand for robust community engagement and a social license to operate, particularly for energy and industrial projects. This societal expectation means companies must actively involve local stakeholders and demonstrate responsible practices to gain and maintain public trust.

The energy sector, in particular, faces heightened scrutiny, driving a greater need for environmental compliance and mitigation services like those Cypress offers. For instance, in 2024, a significant portion of new energy infrastructure projects faced delays due to community opposition and environmental concerns, highlighting the critical nature of securing this social license early in the development process.

Health and Safety Standards

Societal expectations around health and safety are significantly shaping how companies like Cypress Environmental operate. There's a growing demand for stringent occupational health and safety (OHS) standards, not just within company walls but also in the field operations they manage. This trend directly influences Cypress's internal practices and the requirements they must meet for their clients.

Adherence to and proactive promotion of high safety standards are paramount for Cypress's reputation and the uninterrupted flow of its operations. This is particularly critical when working in environments that carry inherent risks. For instance, in 2024, workplace injuries in the environmental services sector can lead to significant operational downtime and financial penalties, underscoring the importance of robust safety protocols.

- Reputational Impact: Companies with strong safety records are viewed more favorably by clients, investors, and the public.

- Operational Continuity: Preventing accidents ensures that projects proceed without costly delays or shutdowns.

- Regulatory Compliance: Meeting or exceeding OHS standards avoids fines and legal repercussions.

- Employee Well-being: A safe working environment is crucial for employee morale and retention, which directly impacts productivity.

Demand for Sustainable Practices

Clients are increasingly scrutinizing the environmental footprint of their service providers, making sustainability a key factor in procurement. This trend is particularly evident in the environmental services sector, where companies like Cypress Environmental are expected to not only offer solutions but also embody sustainable practices themselves.

The demand for Corporate Social Responsibility (CSR) is translating into tangible purchasing power. For instance, a 2024 report indicated that over 60% of consumers consider a company's environmental commitment when making purchasing decisions, a figure that also influences business-to-business relationships.

- Growing Client Expectations: Businesses are actively seeking partners who align with their own sustainability goals, influencing contract awards.

- Market Differentiation: Demonstrating robust CSR initiatives can provide a competitive edge for environmental service providers.

- Enhanced Brand Reputation: Partnering with sustainable companies bolsters a client's own public image and commitment to environmental stewardship.

- Regulatory Alignment: Clients often prefer suppliers whose practices are already in line with or exceed current and anticipated environmental regulations.

Societal expectations regarding environmental stewardship and corporate responsibility are increasingly influencing business decisions. Consumers and business partners alike are prioritizing companies that demonstrate a commitment to sustainability, impacting purchasing power and market positioning. For example, a 2024 study revealed that 75% of consumers are more likely to buy from brands that actively support environmental causes.

The demand for transparency in environmental impact and ethical labor practices is also growing, pushing companies to adopt more rigorous reporting and compliance measures. This societal pressure directly benefits firms like Cypress Environmental, which offer services that help clients meet these evolving standards. The global market for environmental consulting services was valued at approximately $40 billion in 2024 and is projected to grow at a CAGR of 5.5% through 2028.

Furthermore, public perception and community acceptance, often termed the social license to operate, are critical for infrastructure projects, especially in the energy sector. Delays or cancellations due to community opposition can be costly; in 2023, an estimated $15 billion in planned energy projects faced significant delays attributed to social and environmental concerns.

| Sociological Factor | Impact on Cypress Environmental | Supporting Data (2024/2025) |

|---|---|---|

| Environmental Awareness | Increased demand for compliance and mitigation services. | 70% of consumers consider environmental impact in purchasing (2024 survey). |

| Skilled Labor Shortage | Potential for operational constraints and increased labor costs. | Projected 6% growth in construction/extraction jobs (2022-2032), but specific trades face shortages. |

| Social License to Operate | Necessity for proactive community engagement and risk management. | Energy projects in 2024 faced delays due to community opposition. |

| Health & Safety Expectations | Emphasis on robust OHS protocols for reputation and operational continuity. | Workplace injuries in environmental services can cause significant downtime and financial penalties. |

| Corporate Social Responsibility (CSR) | Requirement for providers to embody sustainable practices; influences client selection. | 60% of consumers consider environmental commitment in purchasing (2024 report). |

Technological factors

Continuous innovation in Non-Destructive Examination (NDE) technologies, like advanced ultrasonic testing and AI-powered analytics, directly influences Cypress Environmental's inspection services. These advancements allow for more precise and efficient assessments of pipeline and infrastructure integrity.

The adoption of cutting-edge NDE methods, such as digital radiography and machine learning for data interpretation, can significantly boost accuracy and safety in field operations. This technological edge is crucial for maintaining Cypress's competitive advantage in the environmental services sector.

Technological advancements are significantly reshaping water treatment and disposal. Innovations like zero-liquid discharge (ZLD) systems are gaining traction, aiming to eliminate liquid waste entirely. For instance, ZLD adoption is projected to grow substantially, with the global market expected to reach over $10 billion by 2027, driven by increasing water scarcity and regulatory pressures.

Advanced membrane filtration, including reverse osmosis and ultrafiltration, offers more efficient ways to purify water and recover valuable resources. Electrochemical treatment methods are also emerging as powerful tools for contaminant removal, often requiring less energy and fewer chemicals than traditional processes. These technologies directly benefit Cypress Environmental's water solutions by enhancing operational efficiency and enabling clients to comply with increasingly stringent environmental standards.

Robotics and automation are transforming pipeline inspection. In 2024, the global industrial robotics market was valued at approximately $50 billion, with significant growth projected in infrastructure services. Cypress can integrate these advanced tools, like AI-powered drones and robotic crawlers, to conduct more thorough inspections, identify potential issues earlier, and significantly reduce the time and cost associated with traditional methods.

This technological shift allows for improved data accuracy and real-time analysis, leading to proactive maintenance strategies. By adopting these automated solutions, Cypress can not only boost its operational efficiency but also enhance safety by minimizing human presence in potentially dangerous inspection sites, a key concern in the environmental services sector.

Data Analytics and Digitalization for Compliance

The integration of big data analytics, the Internet of Things (IoT), and digital platforms is revolutionizing environmental compliance. These technologies enable real-time monitoring of emissions, waste, and resource usage, providing immediate insights into operational performance and regulatory adherence. For instance, in 2024, companies leveraging IoT sensors reported a 15% reduction in compliance-related incidents due to proactive issue identification.

Cypress Environmental can significantly enhance its service offerings by adopting these digital tools. By implementing advanced analytics, Cypress can offer clients more sophisticated environmental management strategies, predicting potential compliance breaches before they occur and optimizing resource allocation. This proactive approach not only strengthens regulatory standing but also drives operational efficiencies, a key differentiator in the competitive environmental services market.

The benefits extend to improved data accuracy and accessibility, crucial for reporting and auditing. Digital platforms streamline the collection, storage, and analysis of environmental data, making it easier for both Cypress and its clients to meet stringent reporting requirements. This digital transformation is becoming a standard expectation for environmental consulting firms aiming to provide cutting-edge solutions.

Key applications for Cypress include:

- Real-time emissions monitoring using IoT sensors for immediate data capture and analysis.

- Predictive analytics to forecast potential environmental risks and compliance issues.

- Digital platforms for streamlined data management, reporting, and client collaboration.

- Enhanced operational efficiency through data-driven insights into resource consumption and waste management.

Emerging Environmental Monitoring Technologies

The development of new environmental monitoring technologies presents significant opportunities for Cypress. For instance, advancements in real-time methane detection using drones offer a more efficient and targeted approach to identifying emissions compared to traditional ground-based methods. In 2024, the global market for drone-based environmental monitoring was projected to reach over $2 billion, indicating substantial growth potential.

Furthermore, the proliferation of advanced sensor networks allows for granular data collection, enabling more precise and timely identification of environmental impacts. These systems can provide continuous, high-resolution data, which is crucial for proactive mitigation strategies and ensuring regulatory compliance. The global environmental sensors market is expected to grow at a CAGR of 7.5% from 2023 to 2030, reaching an estimated $4.8 billion by 2030, highlighting the increasing demand for such solutions.

These technological advancements can translate into new service offerings for Cypress, such as enhanced environmental impact assessments, real-time pollution tracking, and predictive analytics for environmental risk management. By integrating these cutting-edge tools, Cypress can offer clients more robust and data-driven solutions, strengthening its competitive position in the environmental services sector.

- Real-time Methane Detection: Drones equipped with advanced sensors can identify methane leaks with greater speed and accuracy than conventional methods.

- Advanced Sensor Networks: Deployment of sophisticated sensor arrays provides continuous, high-resolution data for precise environmental impact analysis.

- New Service Opportunities: These technologies enable Cypress to offer enhanced environmental assessments, real-time monitoring, and predictive risk management services.

Technological advancements in NDE, robotics, and data analytics are critical for Cypress Environmental. Innovations like AI-powered ultrasonic testing and robotic crawlers enhance inspection precision and efficiency, while IoT sensors and big data analytics enable real-time environmental compliance monitoring. These tools allow for proactive maintenance, improved safety, and more sophisticated environmental management strategies.

Legal factors

Cypress Environmental's operations are heavily influenced by stringent pipeline safety regulations, notably those set by the Pipeline and Hazardous Materials Safety Administration (PHMSA). These rules dictate critical aspects of their inspection and integrity services, ensuring the safe transport of hazardous materials.

Compliance with evolving standards, including mandates for advanced leak detection and repair technologies, is paramount for Cypress. For instance, PHMSA's Pipeline Inspection, Repair, and Maintenance (PIRM) program continually updates requirements, impacting the types of services Cypress must offer and the technology it employs. Failure to adhere to these regulations can result in significant fines and operational disruptions.

The Environmental Protection Agency (EPA) sets crucial standards for air emissions, water discharge, and waste management. These regulations directly shape the demand for Cypress Environmental's water treatment and environmental services, as clients must adhere to strict compliance requirements.

Updates to the Clean Air Act and Clean Water Act, including specific rules for industrial wastewater, can significantly alter client needs and, consequently, Cypress's service portfolio. For instance, stricter limits on per- and polyfluoroalkyl substances (PFAS) in water, which became a focus in 2024, directly increase the need for advanced treatment solutions.

In 2023, the EPA proposed stricter regulations for wastewater discharge from various industrial sectors, potentially increasing compliance costs for many of Cypress's clients. This creates opportunities for Cypress to offer enhanced treatment technologies and consulting services to meet these evolving environmental mandates.

Cypress Environmental's operations are heavily influenced by waste management and disposal laws, particularly those governing industrial waste from oil and natural gas activities. These regulations dictate how byproducts are treated, recovered, separated, and ultimately disposed of, forming the bedrock of Cypress's environmental services. Compliance with Environmental Protection Agency (EPA) Class II injection well regulations and stringent waste handling protocols is absolutely critical for their business model.

Occupational Safety and Health (OSHA) Standards

Cypress Environmental must adhere strictly to Occupational Safety and Health Administration (OSHA) standards, a critical legal factor given its work in high-risk industrial and energy environments. These regulations cover everything from employee training and personal protective equipment to hazard communication and emergency response procedures. Non-compliance can result in significant fines and operational disruptions.

For example, OSHA's Process Safety Management (PSM) standard (29 CFR 1910.119) is highly relevant for companies handling highly hazardous chemicals, requiring rigorous safety protocols. In 2023, OSHA reported issuing over 80,000 citations, with penalties often reaching tens of thousands of dollars per violation, underscoring the financial impact of regulatory adherence.

- OSHA Compliance Costs: Companies like Cypress face ongoing costs for safety training, equipment upgrades, and safety program management to meet OSHA requirements.

- Impact of Violations: In 2024, OSHA continued to focus on severe workplace hazards, with penalties for willful or repeated violations potentially reaching over $150,000 per incident.

- Industry-Specific Standards: Cypress must navigate specific OSHA standards tailored to the oil and gas, construction, and chemical processing industries it serves.

ESG Reporting and Disclosure Requirements

Legal mandates for ESG reporting are intensifying globally, pushing companies towards greater transparency. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in January 2024, requires a significant number of companies to report on sustainability matters, including environmental impact. This creates a substantial market for services that can accurately measure and validate environmental performance data.

Cypress Environmental is well-positioned to assist clients in navigating these complex and expanding disclosure requirements. By providing robust environmental data and validation, Cypress can help businesses meet the stringent demands of regulations like the CSRD and similar emerging frameworks in other jurisdictions. The growing need for auditable environmental data is a key legal driver for Cypress's service offerings.

The increasing focus on environmental accountability means that companies are legally obligated to demonstrate their commitment to sustainability. This legal pressure translates directly into a demand for specialized expertise in environmental assessment and reporting. Cypress's ability to offer validated environmental performance data directly addresses this critical legal factor.

Key legal drivers impacting ESG reporting include:

- Expanding Regulatory Landscape: Governments worldwide are implementing new laws and strengthening existing ones that mandate ESG disclosures.

- Increased Scrutiny of Environmental Claims: Regulatory bodies are paying closer attention to the accuracy and substantiation of environmental performance data reported by companies.

- Growing Investor and Stakeholder Expectations: While not strictly legal, legal frameworks often reflect and codify the growing expectations of investors and other stakeholders for transparent ESG information.

- International Harmonization Efforts: Initiatives like those by the International Sustainability Standards Board (ISSB) aim to create a global baseline for sustainability disclosures, influencing national legal requirements.

Legal factors significantly shape Cypress Environmental's operational landscape, from pipeline safety mandates to environmental compliance. Stringent regulations from agencies like PHMSA and EPA dictate service offerings and demand for specialized solutions, particularly in areas like PFAS remediation and industrial wastewater treatment. Failure to comply can lead to substantial financial penalties and operational disruptions, making adherence a core business imperative.

OSHA standards are critical, with significant fines for violations, as seen in the tens of thousands of dollars per incident in 2023. Furthermore, the global push for ESG reporting, exemplified by the EU's CSRD effective January 2024, creates a strong market for Cypress's data validation and environmental performance reporting services, directly driven by legal accountability and stakeholder expectations.

| Regulatory Area | Key Agency/Regulation | Impact on Cypress Environmental | Example Data/Trend |

|---|---|---|---|

| Pipeline Safety | PHMSA | Dictates inspection, integrity services, and technology adoption. | Ongoing updates to PIRM program requirements. |

| Environmental Protection | EPA (Clean Air/Water Acts, PFAS rules) | Shapes demand for water treatment and environmental services. | Increased focus on PFAS in water treatment, driving demand for advanced solutions. |

| Workplace Safety | OSHA | Mandates training, PPE, and hazard communication. | 2023 OSHA citations often reached tens of thousands of dollars per violation. |

| ESG Reporting | CSRD (EU), ISSB | Creates market for environmental data validation and reporting. | CSRD fully effective Jan 2024, increasing demand for auditable environmental data. |

Environmental factors

The intensifying global and national commitment to climate change mitigation, with many countries setting ambitious carbon emissions reduction targets, directly shapes investment flows into energy infrastructure and fuels the demand for specialized environmental services. For instance, the U.S. aims to cut greenhouse gas emissions by 50-52% from 2005 levels by 2030, a goal that necessitates significant shifts in energy production and consumption.

Consequently, clients within the energy sector are actively pursuing strategies and technologies to shrink their carbon footprint. This translates into a heightened demand for environmental solutions focused on methane detection and leak repair, alongside services promoting efficient water management, critical for sustainable energy operations.

Growing concerns over water scarcity and quality are significantly impacting industries, especially in areas with high energy and industrial activity. This trend is particularly relevant as we look towards 2024 and 2025, with projections indicating increased stress on freshwater resources globally.

These environmental pressures directly boost the demand for Cypress's specialized services in water treatment, recycling, and disposal. Companies are increasingly seeking solutions to safeguard drinking water supplies and improve their water usage efficiency, aligning perfectly with Cypress's offerings.

For instance, in 2023, the United Nations reported that over 2 billion people live in countries experiencing high water stress, a figure expected to rise. This escalating challenge underscores the critical need for advanced water management solutions that Cypress provides.

Environmental regulations concerning biodiversity and land use are increasingly influencing the development of energy projects. For instance, the U.S. Fish and Wildlife Service's efforts to protect endangered species, like the Northern Long-Eared Bat, can lead to project delays and require costly mitigation measures for infrastructure development across its habitat, which spans 37 states.

Cypress's expertise in conducting thorough environmental impact assessments and developing strategies to minimize ecological disruption becomes more valuable as these regulations tighten. This is particularly relevant as many clients face challenges in obtaining permits for new energy infrastructure, especially in areas with sensitive ecosystems.

The demand for sustainable land management practices is also growing, with initiatives like the Nature Conservancy's work on conservation easements impacting development potential. In 2023, over 17 million acres in the U.S. were protected through conservation easements, highlighting a significant trend in land use considerations for businesses.

Risk of Natural Disasters

The escalating frequency and severity of natural disasters like hurricanes and wildfires present a substantial threat to energy infrastructure. This necessitates enhanced inspection, maintenance, and emergency response services, areas where Cypress's integrity management expertise is crucial for damage assessment and mitigation.

For instance, the 2023 Atlantic hurricane season saw 20 named storms, underscoring the ongoing risk to coastal energy assets. Cypress's advanced inspection technologies, including drone-based assessments and non-destructive testing, are vital for ensuring the resilience of pipelines and facilities against these extreme weather events.

- Increased Infrastructure Vulnerability: Extreme weather events, such as those experienced in 2023 with multiple major hurricanes impacting the Gulf Coast, directly threaten the physical integrity of energy infrastructure, leading to potential service disruptions and costly repairs.

- Demand for Resilience Services: The heightened risk profile drives demand for specialized integrity management and inspection services that can proactively identify weaknesses and respond effectively to damage, positioning Cypress as a key service provider.

- Regulatory and Insurance Pressures: Following significant disaster events, regulatory bodies often impose stricter standards for infrastructure resilience, while insurers increase premiums for exposed assets, further incentivizing investments in robust integrity management solutions.

Circular Economy and Waste Minimization

The global push for a circular economy and waste minimization is a significant environmental factor impacting industries. This trend emphasizes reducing, reusing, and recycling materials, shifting away from linear "take-make-dispose" models. For companies like Cypress, this presents a clear opportunity to develop and implement advanced water recycling and resource recovery solutions.

Cypress can capitalize on this by offering technologies that transform waste streams into valuable resources. This aligns with growing regulatory pressures and consumer demand for sustainable business practices. For instance, the United Nations Environment Programme (UNEP) reported in 2024 that the global waste generation is projected to increase by 70% by 2050 if current trends continue, highlighting the urgency for innovative solutions.

- Circular Economy Growth: The global circular economy market is anticipated to reach $4.5 trillion by 2030, according to a recent report by Accenture.

- Water Reuse Potential: Advanced water recycling technologies can significantly reduce freshwater dependency, a critical concern as global water scarcity affects over 2 billion people.

- Resource Recovery Value: The recovery of valuable materials from waste streams, such as metals and nutrients, offers new revenue streams and reduces reliance on virgin resources.

- Regulatory Tailwinds: Stricter environmental regulations globally, including extended producer responsibility (EPR) schemes, incentivize waste reduction and recycling efforts.

The increasing focus on climate change mitigation and emissions reduction, exemplified by the U.S. goal to cut greenhouse gases by 50-52% from 2005 levels by 2030, drives demand for services like methane detection and leak repair. Growing water scarcity, with over 2 billion people facing high water stress according to the UN in 2023, also boosts demand for Cypress's water treatment and recycling solutions.

Stricter regulations on biodiversity and land use, such as U.S. Fish and Wildlife Service protections impacting 37 states, necessitate environmental impact assessments and mitigation strategies. The rising frequency of natural disasters, like the 20 named storms in the 2023 Atlantic hurricane season, increases the need for resilience services and advanced inspection technologies to protect energy infrastructure.

The global shift towards a circular economy, with the market projected to reach $4.5 trillion by 2030, creates opportunities for resource recovery and advanced water recycling solutions. This aligns with growing regulatory pressures and consumer demand for sustainable practices, especially as global waste generation is expected to rise significantly by 2050.

| Environmental Factor | Impact on Cypress | Supporting Data/Trend |

|---|---|---|

| Climate Change Mitigation | Increased demand for emissions reduction services (methane detection, leak repair). | U.S. target: 50-52% GHG reduction from 2005 levels by 2030. |

| Water Scarcity | Higher demand for water treatment, recycling, and disposal solutions. | Over 2 billion people in high water stress countries (UN, 2023). |

| Biodiversity & Land Use Regulations | Value of environmental impact assessments and mitigation strategies increases. | Northern Long-Eared Bat habitat spans 37 U.S. states, affecting infrastructure projects. |

| Extreme Weather Events | Demand for resilience, inspection, and emergency response services grows. | 2023 Atlantic hurricane season: 20 named storms. |

| Circular Economy | Opportunities in resource recovery and advanced water recycling. | Circular economy market projected to reach $4.5 trillion by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cypress draws from a robust blend of official government publications, environmental agency reports, and reputable industry analyses. We meticulously gather data on political stability, economic indicators, technological advancements, ecological policies, and social trends to provide a comprehensive overview.