Cypress Environmental Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cypress Environmental Bundle

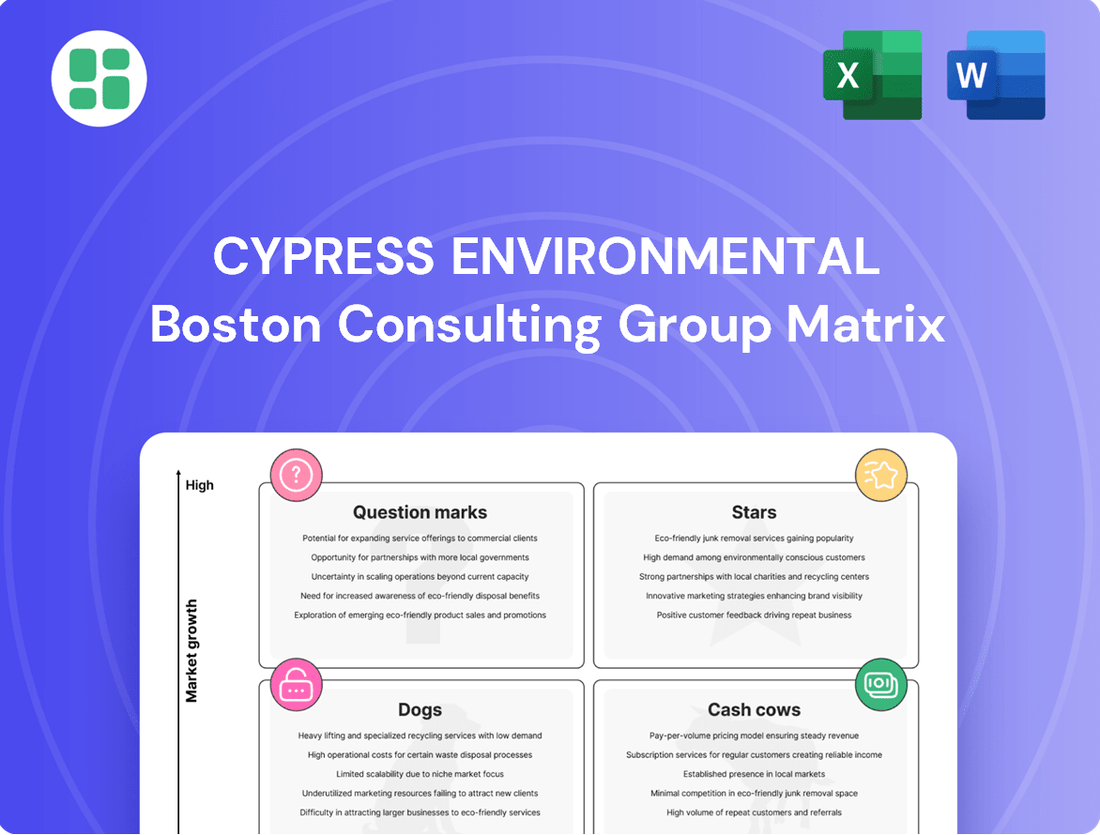

Understand Cypress Environmental's strategic positioning with our insightful BCG Matrix preview. See how its products stack up as Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into market share and growth potential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Cypress Environmental's advanced NDE services, leveraging digital radiography, ultrasonic testing, and AI analytics, are positioned as a Star in the BCG matrix. This segment benefits from the robust growth anticipated in the global NDT and inspection market, which is expected to reach $10.36 billion by 2025, growing at a CAGR of 7.8% from $9.61 billion in 2024.

The oil and gas sector, a significant consumer of NDE, is a key driver for this expansion. Specifically, the NDT market within oil and gas is projected to grow at a 7.3% CAGR between 2024 and 2028, fueled by the increasing adoption of AI and machine learning technologies.

Cypress Environmental is well-positioned in the robotics and automation sector for inspection services, particularly for difficult pipeline settings. This technological adoption is a significant growth driver.

The market for pipe inspection systems is growing robustly, projected to achieve a compound annual growth rate of 6.2% between 2025 and 2033. This expansion is driven by the increasing need for pipeline integrity monitoring and the integration of advanced technologies like robotic crawlers and AI-powered diagnostics.

By actively pursuing and scaling these technological advancements, Cypress Environmental can solidify a leading position in this expanding market, leveraging innovation to enhance its service offerings and competitive advantage.

Pipeline Integrity Management Solutions are a significant area for Cypress, fitting into the Stars quadrant due to high growth potential. The global market is expected to expand from $2.27 billion in 2024 to $2.98 billion by 2030, a compound annual growth rate of 4.7%.

This growth is fueled by the critical need for safe and dependable pipeline operations, making advanced solutions like in-line inspection tools and real-time monitoring essential. Cypress is well-positioned to capitalize on this demand, especially with the increasing adoption of AI and IoT in these services.

Specialized Industrial Water Treatment

Cypress Environmental's specialized industrial water treatment, focusing on complex wastewater, positions it as a potential Star within the BCG matrix. This segment thrives on high-growth niches demanding sophisticated, tailored solutions.

The U.S. water and wastewater treatment market, particularly its industrial component, is a significant growth area. Projections indicate a compound annual growth rate (CAGR) of 6.80% for the period spanning 2025 to 2034. This expansion is fueled by increasing industrial activity and more stringent environmental mandates.

Cypress's expertise in handling challenging waste streams through innovative technologies is key. By securing a substantial market share in these expanding, specialized segments, the company can solidify its Star status.

- Market Growth: U.S. industrial water treatment market projected to grow at a 6.80% CAGR from 2025-2034.

- Key Drivers: Rising industrialization and stricter environmental regulations are primary growth catalysts.

- Cypress's Advantage: Specialization in difficult-to-treat wastewater streams with advanced technologies.

- Strategic Positioning: High market share in growing, niche industrial wastewater segments.

Environmental Compliance & Consulting

Cypress Environmental's focus on environmental compliance and consulting positions it well within the BCG matrix, potentially as a star. As regulations tighten, particularly in energy and industry, these services are crucial for clients. This area represents a high-growth, high-market share opportunity for Cypress, reflecting the increasing demand for expert guidance in navigating complex environmental rules.

While not a distinct segment, Cypress's commitment to helping clients meet stringent regulations is a key differentiator. The global environmental consulting market was valued at approximately $40 billion in 2023 and is projected to grow significantly. This growth is driven by increasing environmental awareness and stricter government mandates worldwide.

- Growing Regulatory Landscape: Environmental regulations are becoming more complex and demanding across various industries.

- Expert Consulting Demand: Businesses require specialized knowledge to ensure compliance and mitigate environmental risks.

- Market Growth: The environmental consulting sector is experiencing robust growth, indicating strong demand for these services.

- Cypress's Strategic Alignment: Cypress's core mission directly addresses this market need, positioning it for success.

Cypress Environmental's advanced NDE services, leveraging digital radiography, ultrasonic testing, and AI analytics, are positioned as a Star in the BCG matrix. This segment benefits from the robust growth anticipated in the global NDT and inspection market, which is expected to reach $10.36 billion by 2025, growing at a CAGR of 7.8% from $9.61 billion in 2024. The oil and gas sector, a significant consumer of NDE, is a key driver for this expansion. Specifically, the NDT market within oil and gas is projected to grow at a 7.3% CAGR between 2024 and 2028, fueled by the increasing adoption of AI and machine learning technologies.

Pipeline Integrity Management Solutions are a significant area for Cypress, fitting into the Stars quadrant due to high growth potential. The global market is expected to expand from $2.27 billion in 2024 to $2.98 billion by 2030, a compound annual growth rate of 4.7%. This growth is fueled by the critical need for safe and dependable pipeline operations, making advanced solutions like in-line inspection tools and real-time monitoring essential. Cypress is well-positioned to capitalize on this demand, especially with the increasing adoption of AI and IoT in these services.

Cypress Environmental's specialized industrial water treatment, focusing on complex wastewater, positions it as a potential Star within the BCG matrix. This segment thrives on high-growth niches demanding sophisticated, tailored solutions. The U.S. water and wastewater treatment market, particularly its industrial component, is a significant growth area. Projections indicate a compound annual growth rate (CAGR) of 6.80% for the period spanning 2025 to 2034. This expansion is fueled by increasing industrial activity and more stringent environmental mandates.

Cypress Environmental's focus on environmental compliance and consulting positions it well within the BCG matrix, potentially as a star. As regulations tighten, particularly in energy and industry, these services are crucial for clients. The global environmental consulting market was valued at approximately $40 billion in 2023 and is projected to grow significantly, driven by increasing environmental awareness and stricter government mandates worldwide.

| Segment | BCG Quadrant | Market Size (2024) | Projected CAGR (approx.) | Key Drivers |

|---|---|---|---|---|

| Advanced NDE Services | Star | NDT & Inspection: $9.61 billion | NDT & Inspection: 7.8% (to 2025) Oil & Gas NDT: 7.3% (to 2028) |

AI integration, Oil & Gas demand, Robotics adoption |

| Pipeline Integrity Management | Star | $2.27 billion | 4.7% (to 2030) | Safety regulations, Advanced inspection tools, AI/IoT adoption |

| Specialized Industrial Water Treatment | Star | U.S. Industrial Water Market: Size not specified for 2024 | 6.80% (U.S. Industrial Water, 2025-2034) | Industrial growth, Environmental regulations, Complex wastewater needs |

| Environmental Compliance & Consulting | Star | Global Environmental Consulting: ~$40 billion (2023) | Significant growth (specific CAGR not provided for 2024+) | Stricter regulations, Environmental awareness, Risk mitigation |

What is included in the product

The Cypress Environmental BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers insights into which units Cypress Environmental should invest in, hold, or divest to optimize its portfolio.

Visualizes business units to quickly identify areas needing strategic attention.

Cash Cows

Cypress Environmental's routine pipeline inspection services, encompassing basic integrity assessments and routine checks, likely function as Cash Cows within the BCG Matrix. These are foundational services, critical for ongoing operations and regulatory compliance in a well-established industry, consistently generating revenue with minimal need for further capital infusion.

The pipeline testing and inspection services market, projected to reach approximately $15 billion globally by 2028, exhibits steady growth driven by the essential nature of routine maintenance. This segment ensures a stable demand for established players like Cypress, solidifying their position as reliable revenue generators.

Standard NDE for existing infrastructure is a cornerstone for Cypress Environmental, holding a strong market share in a stable, mature segment. These essential services ensure the integrity of aging energy assets, generating consistent cash flow through well-established practices and enduring client partnerships.

The oil and gas sector, in particular, demonstrates persistent demand for NDT. For instance, the global NDT market was valued at approximately USD 7.5 billion in 2023 and is projected to grow steadily, underscoring the ongoing need for fault detection and material integrity assessments of existing infrastructure.

Cypress Environmental's nine water treatment facilities with EPA Class II injection wells in the Bakken shale region of North Dakota are a prime example of a Cash Cow. These operations are vital for managing waste from oil and gas extraction in a mature production area.

The Bakken shale region, a significant oil-producing area, relies heavily on these disposal facilities. In 2023, North Dakota's oil production averaged around 1.1 million barrels per day, underscoring the consistent demand for wastewater management services.

With substantial fixed costs already invested in this infrastructure, higher utilization directly translates to enhanced operating cash flow. Cypress Environmental benefits from economies of scale, as increased throughput requires minimal additional capital expenditure, solidifying its Cash Cow status.

Hydrostatic Testing and Chemical Cleaning

Hydrostatic testing and chemical cleaning services, offered by Pipeline and Process Services (PPS), are likely positioned as Cash Cows within Cypress Environmental's BCG Matrix. These are essential, recurring maintenance tasks for operational pipelines, generating consistent revenue due to high demand. The aging infrastructure trend, with a significant portion of U.S. oil and gas pipelines exceeding 50 years of age, underpins this steady demand.

- High Volume, Low Growth: These services represent a mature market with stable, predictable demand, characteristic of Cash Cows.

- Critical Infrastructure Maintenance: Essential for pipeline integrity and safety, ensuring ongoing need for providers.

- Aging Infrastructure Driver: The increasing age of existing pipeline networks fuels consistent demand for these services.

- Revenue Stability: PPS's expertise in these established procedures provides a reliable income stream for Cypress Environmental.

In-Line Inspection Support Services

In-line inspection support services, including tool run support and pig tracking, are vital, recurring components of pipeline maintenance. These services are foundational, enabling pipeline operators to gauge internal conditions and proactively address potential problems. This consistent demand translates into a stable revenue stream for Cypress Environmental.

The market for these inspection services is substantial, fueled by stringent regulatory requirements and the ongoing necessity for pipeline asset monitoring. In 2024, the global pipeline inspection market was valued at approximately $8.5 billion, with in-line inspection accounting for a significant share. Cypress's established presence in this sector positions it well to capitalize on this ongoing need.

- Consistent Revenue: The recurring nature of in-line inspection support and pig tracking provides a predictable revenue base for Cypress Environmental.

- Regulatory Driven Demand: Compliance with safety and environmental regulations mandates regular pipeline inspections, ensuring sustained demand for these services.

- Market Size: The global pipeline inspection market's significant valuation underscores the opportunity for established service providers like Cypress.

- Essential Service: These services are critical for pipeline operators to maintain asset integrity and prevent costly failures.

Cypress Environmental's water treatment facilities, particularly those in the Bakken shale region, function as strong Cash Cows. These facilities are essential for managing produced water from oil and gas operations, a consistent need in a mature production area. In 2023, North Dakota's oil output averaged about 1.1 million barrels daily, highlighting the ongoing demand for these services and ensuring stable revenue generation for Cypress.

The company's routine pipeline inspection and integrity assessment services also represent Cash Cows. These are foundational services in a stable, mature market, critical for regulatory compliance and asset longevity. The global pipeline inspection market was valued at approximately $8.5 billion in 2024, with a significant portion dedicated to these essential checks, providing a predictable income stream.

| Service Segment | BCG Matrix Classification | Market Characteristic | 2024 Market Value (USD Billions) | Cypress Environmental's Role |

| Water Treatment Facilities (Bakken) | Cash Cow | Mature, Stable Demand | N/A (Region Specific) | Essential Waste Management |

| Routine Pipeline Inspection | Cash Cow | Mature, Steady Growth | ~8.5 (Global Pipeline Inspection) | Foundational Integrity Services |

What You See Is What You Get

Cypress Environmental BCG Matrix

The comprehensive BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises—just a professionally designed strategic tool ready for immediate application in your environmental business planning. You can confidently use this preview as a direct representation of the high-quality, analysis-ready report that will be delivered to you instantly after your transaction, empowering your decision-making processes.

Dogs

Outdated inspection methodologies, such as manual visual checks or reliance on paper-based reporting, are prime examples of Dogs in the environmental services sector. These methods struggle to compete with advancements like drone-based inspections or AI-powered data analysis, leading to a diminished market share. For instance, while the global drone inspection market was valued at approximately $2.5 billion in 2023, services still relying on older techniques see declining demand.

Assets like water disposal facilities in regions with significantly declining oil and gas output, or those relying on outdated, costly treatment methods, would fall into the Dogs category of the BCG Matrix. These operations are likely to experience low volumes and slim profit margins.

Such underperforming assets could become cash drains, requiring ongoing maintenance and operational expenses without generating enough revenue to offset these costs. For instance, a disposal well in a basin with a 30% year-over-year production decline might struggle to attract sufficient business to cover its operating budget.

The company's pre-packaged restructuring efforts likely aim to divest these problematic, low-return assets. This strategic move is designed to free up capital and management focus from liabilities that offer little prospect of future growth or profitability.

Non-strategic, low-volume ancillary services within Cypress Environmental's BCG Matrix represent those smaller, less impactful offerings that don't fit the company's main goals. These might be services Cypress provides but aren't a core part of its business or don't have a significant customer base.

These types of services typically have a very small slice of the market and aren't expected to grow much. For instance, if Cypress Environmental offered a niche consulting service in 2024 that only accounted for 0.5% of its total revenue and had a projected annual growth rate of less than 2%, it would likely fall into this category.

The concern with these ancillary services is that they can divert valuable management time and company resources. Despite their low contribution to profits or strategic direction, they still require operational support, potentially hindering the focus on more profitable or growth-oriented core services.

Services in Highly Fragmented, Price-Sensitive Niches

Segments where Cypress Environmental operates in highly fragmented and price-sensitive niche markets can be categorized as Dogs in the BCG Matrix. These are areas where the company doesn't possess a clear advantage and struggles to capture substantial market share. The low growth and low profitability in these niches make it challenging to achieve economies of scale or see meaningful returns on investment.

For instance, consider the specialized industrial cleaning services market for a specific type of manufacturing equipment. If this market is characterized by numerous small competitors, intense price competition, and limited technological differentiation, Cypress might find itself in a Dog position. In 2024, such niche markets often see profit margins below 5%, significantly impacting overall company profitability.

- Low Market Share: Cypress struggles to gain a significant foothold in these highly competitive niche markets.

- Low Profitability: Price sensitivity and lack of differentiation lead to slim profit margins, often below industry averages.

- Limited Growth Potential: The niche itself may not be expanding, or Cypress's offerings are not compelling enough to drive growth.

- Resource Drain: Continued investment in these areas may divert resources from more promising business units.

Legacy Services Not Integrated with Core Offerings

Legacy Services Not Integrated with Core Offerings represent Cypress Environmental's Dogs in the BCG Matrix. These are services that are remnants of past acquisitions or historical operations, which haven't been effectively woven into the company's current core offerings. This lack of integration means they often lack synergy with the main business.

These isolated services typically hold a low market share and experience minimal growth. Consequently, they can function inefficiently, potentially diverting valuable resources and management attention away from more promising and synergistic areas of Cypress Environmental's business. For instance, if a historical environmental testing service acquired in 2018 has seen its market shrink by 5% annually since 2020 due to new technologies, and Cypress’s current market share in that niche is only 2%, it would likely be classified as a Dog.

- Low Market Share: These services often represent a small fraction of the overall market they operate in.

- Low Growth Prospects: The market for these legacy services is typically stagnant or declining.

- Lack of Synergy: They do not complement or benefit from Cypress Environmental's core business activities.

- Resource Drain: Continued investment in these services may yield diminishing returns and detract from more profitable ventures.

Dogs in Cypress Environmental's BCG Matrix represent services with low market share and low growth potential, often requiring significant investment without promising returns. These segments, such as outdated inspection methods or non-strategic ancillary services, can drain resources and management focus. For example, a legacy environmental testing service acquired in 2018, with a 5% annual market decline since 2020 and a 2% market share for Cypress, exemplifies a Dog.

| Category | Description | Example | Market Share | Growth Rate | Profitability |

|---|---|---|---|---|---|

| Dogs | Low market share, low growth, low profitability | Outdated manual inspection services | < 5% | < 2% | Low (< 5%) |

| Dogs | Non-strategic, low-volume ancillary services | Niche consulting service | 0.5% of total revenue | < 2% | Negligible |

| Dogs | Highly fragmented, price-sensitive niche markets | Specialized industrial cleaning for specific equipment | Low | Low | Low (< 5%) |

Question Marks

AI-powered predictive maintenance and data analytics for pipeline integrity and environmental compliance are emerging as significant Question Marks for Cypress Environmental. This sector is experiencing rapid growth, fueled by technological leaps in non-destructive testing (NDT) and overall pipeline management.

Cypress is likely navigating this nascent, high-potential market with a relatively small footprint, necessitating considerable investment to carve out a leadership position. For instance, the global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach over $28 billion by 2028, indicating substantial growth potential.

Expanding environmental services to the booming renewable energy sector, such as inspections for wind, solar, or geothermal infrastructure, presents a classic Question Mark opportunity for Cypress Environmental. This segment is experiencing rapid growth, with the global renewable energy market valued at over $1.3 trillion in 2023 and projected to reach $1.9 trillion by 2030, according to various market analyses.

However, Cypress's current operational focus remains predominantly on traditional energy sources. To capitalize on this high-growth renewable market, the company would need to invest in developing new expertise, acquiring relevant certifications, and undertaking significant market entry initiatives, which could entail substantial upfront costs and a period of lower returns.

Investing in advanced water recycling and reuse technologies presents a significant growth avenue for Cypress Environmental, particularly within the industrial and municipal sectors. This focus aligns with the U.S. water and wastewater treatment market's increasing emphasis on water conservation and reuse, a trend projected to continue expanding.

While Cypress might currently hold a modest market share in these specialized, capital-intensive areas, the potential for high growth is substantial if they can successfully innovate and deploy these solutions. The U.S. market for water and wastewater treatment is expected to reach approximately $125 billion by 2027, with recycling and reuse technologies being a key driver of this growth.

Geographical Expansion into New High-Growth Regions

Expanding Cypress Environmental's core inspection or water services into new, high-growth geographical regions where the company currently has a minimal footprint would place these ventures in the Question Mark category of the BCG Matrix. These markets, while promising significant upside, typically present substantial hurdles.

These new territories often exhibit robust economic growth, indicating strong demand for environmental services. For instance, emerging markets in Southeast Asia saw their environmental services sector grow by an estimated 7-9% annually leading up to 2024, driven by increased industrialization and stricter regulations. However, entering these regions necessitates considerable upfront investment in infrastructure, talent acquisition, and navigating local regulatory landscapes. Competition from established local players and other international firms is also a significant factor, potentially leading to lower initial market share and profitability until critical mass is achieved.

- High Growth Potential: Markets with rapidly developing economies and increasing environmental awareness offer substantial revenue opportunities.

- Intense Competition: Established local and international competitors may already have a strong foothold, requiring aggressive strategies to gain market share.

- Substantial Upfront Investment: Significant capital is needed for market entry, including setting up operations, marketing, and talent development.

- Uncertain Market Share: The success of gaining a significant market share is not guaranteed, making these ventures high-risk, high-reward propositions.

Innovative Sensor and IoT-Based Monitoring Systems

Developing and integrating advanced sensor and IoT-based monitoring systems for real-time asset integrity and environmental tracking places Cypress squarely in the Question Mark quadrant of the BCG Matrix. This area represents a high-growth market driven by the increasing demand for predictive maintenance and environmental compliance in infrastructure management.

Cypress's involvement here signifies a strategic bet on a rapidly evolving technological landscape. The company would need substantial investment in research and development to stay ahead of innovation curves and to foster market adoption of these sophisticated systems. For instance, the global IoT in infrastructure market was projected to reach USD 35.8 billion in 2023 and is expected to grow at a CAGR of 15.2% from 2024 to 2030, indicating significant potential but also intense competition.

- High Growth Potential: The increasing need for real-time data in infrastructure management fuels rapid expansion in this sector.

- Significant Investment Required: Substantial R&D funding is necessary to develop cutting-edge sensor technology and robust IoT platforms.

- Market Adoption Challenges: Educating the market and demonstrating the ROI of these new systems are crucial for gaining traction.

- Competitive Landscape: Established tech giants and specialized startups are actively vying for market share in this dynamic space.

AI-powered predictive maintenance and data analytics for pipeline integrity and environmental compliance represent significant Question Marks for Cypress Environmental. This sector is experiencing rapid growth, with the global predictive maintenance market valued at approximately $6.9 billion in 2023 and projected to exceed $28 billion by 2028.

Expanding environmental services to the booming renewable energy sector, such as inspections for wind, solar, or geothermal infrastructure, is another classic Question Mark. The global renewable energy market was valued at over $1.3 trillion in 2023, with projected growth to $1.9 trillion by 2030.

Investing in advanced water recycling and reuse technologies also falls into the Question Mark category, aligning with the U.S. water and wastewater treatment market's focus on conservation, a sector expected to reach approximately $125 billion by 2027.

Developing and integrating advanced sensor and IoT-based monitoring systems for real-time asset integrity and environmental tracking is a high-growth area. The global IoT in infrastructure market was projected at USD 35.8 billion in 2023, with an expected CAGR of 15.2% from 2024 to 2030.

| Opportunity Area | Market Growth Potential | Cypress's Current Position | Investment Need | Key Challenges |

|---|---|---|---|---|

| AI Predictive Maintenance | High (Global market ~$6.9B in 2023, projected >$28B by 2028) | Nascent, small footprint | Significant R&D, market entry | Technological adoption, competition |

| Renewable Energy Services | High (Global market >$1.3T in 2023, projected $1.9T by 2030) | Minimal current focus | New expertise, certifications, market entry | Shifting operational focus, upfront costs |

| Water Recycling Technologies | High (U.S. market ~$125B by 2027, reuse a key driver) | Modest market share in specialized areas | Innovation, deployment, capital investment | Capital intensity, scaling solutions |

| IoT Monitoring Systems | High (Global IoT in infra market ~$35.8B in 2023, 15.2% CAGR 2024-2030) | Strategic bet on evolving tech | Substantial R&D, market education | Rapid innovation, market adoption, competition |

BCG Matrix Data Sources

Our Environmental BCG Matrix leverages data from company sustainability reports, regulatory filings, and independent environmental impact assessments to provide a comprehensive view of market positions.