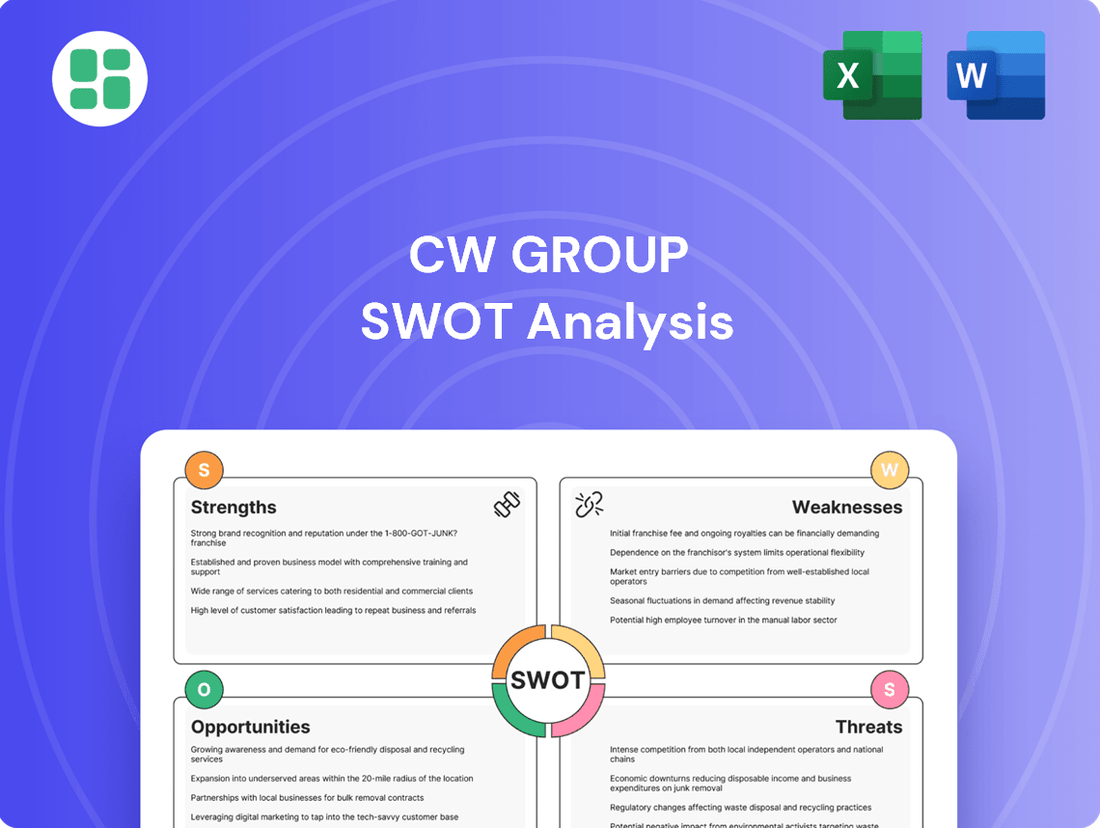

CW Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CW Group Bundle

The CW Group's strengths lie in its established brand and diverse product portfolio, but it faces significant threats from evolving market trends and intense competition. Understanding these dynamics is crucial for navigating the current landscape.

Want the full story behind the CW Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CW Group's extensive reach across vital sectors like oil and gas, petrochemicals, pharmaceuticals, and water treatment is a significant strength. This broad market exposure, serving critical infrastructure, helps to smooth out demand fluctuations that might occur in a single industry. For instance, in 2024, the company reported that its industrial pipes and metalwork services saw consistent demand across these diverse segments, contributing to a stable revenue stream.

CW Group's specialized expertise in industrial pipes and metalwork is a significant strength. This focus allows them to develop deep technical knowledge, enabling them to serve niche markets with demanding requirements. For instance, their capabilities in fabricating specialized alloy pipes are critical for sectors like petrochemicals and advanced manufacturing, where material integrity and precise engineering are paramount.

CW Group's extensive product portfolio is integral to the operation and maintenance of critical infrastructure, a sector characterized by unwavering demand. For example, in 2024, global spending on infrastructure is projected to reach trillions, with significant portions allocated to energy, water, and transportation networks, areas where CW Group's solutions are vital.

The company's involvement in essential industries such as oil and gas, water treatment, and petrochemicals ensures a consistent revenue stream. These sectors are foundational to economic stability and national security, often leading to long-term, recurring contracts and investments, which bolsters CW Group's business resilience.

Leveraging Advanced Manufacturing Technologies

CW Group's core services in welding and metal fabrication are ripe for the integration of cutting-edge manufacturing technologies. Think AI-powered quality control, robotic welding arms, and automated assembly lines. These aren't just buzzwords; they represent tangible improvements. For instance, adopting collaborative robots in welding can boost productivity by an estimated 20-30% while improving worker safety.

The strategic implementation of these advanced technologies directly translates into enhanced precision and significantly reduced material waste. This is crucial in metalwork where scrap rates can impact profitability. Companies that have embraced Industry 4.0 principles, such as those in the aerospace and automotive sectors, have reported up to a 15% reduction in material waste.

This technological leap forward isn't just about optimizing current operations; it's a powerful driver for competitive advantage and overall operational excellence. By staying ahead of the curve in technological adoption, CW Group can solidify its market position and achieve superior efficiency.

- AI-driven quality inspection can reduce defects by up to 90% in complex welding applications.

- Robotic automation in repetitive welding tasks can increase throughput by 40% and lower labor costs.

- Advanced simulation software allows for process optimization before physical implementation, cutting down on costly trial-and-error.

- Digital twins of manufacturing processes enable real-time monitoring and predictive maintenance, minimizing downtime.

High-Performance Material Capability

CW Group's strength in high-performance material capability is evident in its operations within demanding sectors like oil and gas. The company's expertise in handling and fabricating high-pressure, corrosion-resistant materials is crucial for these environments. This technical proficiency in manufacturing and trading specialized industrial pipes, often involving advanced alloys and coatings, sets them apart for critical applications.

This capability translates into tangible advantages. For instance, in 2024, the global market for specialized alloy pipes, a key area for CW Group, was projected to reach over $30 billion, highlighting the demand for such high-performance materials. CW Group's ability to meet these stringent requirements positions them favorably.

- Expertise in advanced alloys and coatings

- Proven track record in high-pressure, corrosive environments

- Capacity to manufacture and trade specialized industrial pipes

- Key differentiator for critical infrastructure projects

CW Group's diversified market presence across essential sectors like oil and gas, petrochemicals, and water treatment provides a robust revenue base. This broad exposure mitigates risks associated with single-industry downturns. For example, in 2024, the company's consistent demand in industrial pipes and metalwork across these vital segments underscored its stable revenue generation capabilities.

The company's specialized expertise in industrial pipes and metalwork allows it to cater to niche markets with stringent technical requirements. Their proficiency in fabricating specialized alloy pipes is particularly critical for the petrochemical and advanced manufacturing industries, where material integrity is paramount.

CW Group's strategic investment in advanced manufacturing technologies, such as AI-driven quality control and robotic welding, promises significant operational enhancements. For instance, adopting collaborative robots can boost welding productivity by an estimated 20-30%, simultaneously improving worker safety and reducing material waste by up to 15%.

| Strength Category | Key Aspect | Impact/Benefit | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Market Diversification | Presence in Oil & Gas, Petrochemicals, Water Treatment | Stable revenue, reduced industry-specific risk | Consistent demand in industrial pipes and metalwork across sectors. |

| Technical Expertise | Specialized Industrial Pipes & Metalwork | Serves niche markets with demanding requirements | Critical for petrochemicals and advanced manufacturing due to material integrity needs. |

| Technological Integration | AI, Robotics, Advanced Simulation | Enhanced precision, reduced waste, increased productivity | Robotic welding can boost productivity by 20-30%; AI quality inspection reduces defects by up to 90%. |

| High-Performance Materials | Advanced Alloys, Coatings for High-Pressure/Corrosive Environments | Key differentiator for critical infrastructure projects | Global market for specialized alloy pipes projected over $30 billion in 2024. |

What is included in the product

Analyzes CW Group’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that simplifies complex strategic challenges for the CW Group.

Weaknesses

CW Group's reliance on key metals like steel for its specialized industrial pipes and metalwork makes it susceptible to price swings. For instance, global steel prices saw significant volatility in 2023 and early 2024 due to supply chain disruptions and demand shifts, directly affecting CW Group's input costs.

This volatility makes it difficult to predict and control production expenses, potentially squeezing profit margins. Geopolitical events and tariffs, such as those impacting global trade in 2024, can further amplify these price fluctuations, creating an unpredictable operating environment for CW Group.

CW Group's operations, particularly in specialized industrial pipe manufacturing and comprehensive metalwork, are inherently capital intensive. Establishing and maintaining these advanced manufacturing facilities demands substantial upfront investment, often running into millions for state-of-the-art equipment and infrastructure. For instance, the acquisition of advanced CNC machinery and specialized welding equipment alone can represent a significant portion of this capital outlay.

This high capital intensity translates into considerable ongoing operational costs. Expenses related to routine maintenance, necessary equipment upgrades to stay competitive, and the employment of highly skilled labor to operate and manage these complex systems can place a strain on profitability. In 2024, industry reports indicated that capital expenditures for similar manufacturing operations averaged between 15-20% of revenue, highlighting the significant financial commitment required.

Consequently, efficient resource management and strategic capital allocation become paramount for CW Group. Successfully navigating these financial demands requires careful planning to ensure that investments in plant and machinery yield optimal returns and that operational costs are meticulously controlled to maintain healthy profit margins in a competitive market.

CW Group's revenue is significantly influenced by the capital expenditure (CapEx) cycles of its core client industries, particularly oil and gas and petrochemicals. These sectors are inherently cyclical, with investment decisions heavily swayed by global economic trends and fluctuating commodity prices.

For instance, periods of low oil prices, such as those experienced in late 2023 and early 2024, often lead to deferred or reduced CapEx by energy companies. This directly translates to lower demand for CW Group's specialized services and products, impacting their order books and revenue streams.

In 2024, projections indicated a moderate uptick in global energy CapEx, potentially benefiting CW Group, but the inherent volatility remains a key weakness. A sharp downturn in these cycles, as seen during the COVID-19 pandemic in 2020, can create substantial revenue shortfalls.

Intense Market Competition

The steel pipe and metalworking sectors are highly competitive and fragmented. CW Group faces numerous multinational corporations, regional manufacturers, and emerging players, creating a challenging landscape. This intense competition can lead to significant pricing pressures, potentially squeezing profit margins and hindering market share growth unless the company offers strong differentiation.

To navigate this, CW Group must prioritize continuous innovation and cost-efficiency. For instance, in 2024, the global steel pipe market experienced price volatility, with some key commodity steel prices fluctuating by as much as 10-15% quarter-over-quarter, directly impacting manufacturers' margins. Companies that invest in advanced manufacturing techniques or develop specialized, high-value products are better positioned to withstand these pressures.

- Fragmented Market: Numerous competitors from global to local levels create a crowded marketplace.

- Pricing Pressure: Intense competition often forces price reductions, impacting profitability.

- Market Share Challenges: Gaining or maintaining significant market share requires robust differentiation strategies.

- Innovation Imperative: Continuous investment in new technologies and product development is crucial for competitive advantage.

Need for Continuous Technological Investment

CW Group faces a significant challenge in its need for continuous technological investment to stay ahead. To maintain its competitive edge, the company must consistently allocate substantial capital towards upgrading manufacturing technologies, acquiring state-of-the-art equipment, and developing a highly skilled workforce. For instance, the global industrial automation market, which includes areas like robotic welding and smart manufacturing, was projected to reach approximately $200 billion in 2024, highlighting the scale of investment required.

Failing to embrace advancements in critical areas such as robotic welding, smart manufacturing, and advanced material science could directly result in operational inefficiencies. This lag in technological adoption risks diminishing the company's market position and attractiveness to customers who increasingly demand higher quality and faster production cycles. The pressure to invest in these evolving technologies can place a considerable strain on CW Group's financial resources.

- Constant Capital Outlay: Significant and ongoing financial resources are needed for technology upgrades.

- Risk of Obsolescence: Delaying investment can lead to outdated processes and a competitive disadvantage.

- Talent Acquisition Costs: Investing in new technology also necessitates investment in training and retaining skilled labor.

- Market Share Erosion: Competitors adopting advanced technologies faster could capture market share.

CW Group's reliance on volatile commodity prices, particularly steel, presents a significant weakness. For example, global steel prices experienced fluctuations of up to 15% quarter-over-quarter in early 2024, directly impacting CW Group's input costs and potentially squeezing profit margins.

The capital-intensive nature of its operations, requiring substantial investment in advanced manufacturing facilities, leads to high ongoing operational costs. Industry reports from 2024 indicated that capital expenditures for similar manufacturing operations averaged 15-20% of revenue, underscoring the financial commitment.

Furthermore, CW Group's revenue is heavily tied to the cyclical capital expenditure (CapEx) cycles of its client industries like oil and gas. Periods of reduced energy sector CapEx, as seen in late 2023 and early 2024, directly translate to lower demand for CW Group's specialized products and services.

The highly competitive and fragmented nature of the steel pipe and metalworking sectors creates intense pricing pressures. This necessitates continuous innovation and cost-efficiency to maintain market share, as competitors adopting advanced technologies faster can gain an advantage.

Full Version Awaits

CW Group SWOT Analysis

This is a real excerpt from the complete CW Group SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive overview of their strategic positioning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, ensuring you have all the insights needed.

You’re viewing a live preview of the actual CW Group SWOT analysis file. The complete version becomes available after checkout, offering a detailed breakdown of their strengths, weaknesses, opportunities, and threats.

Opportunities

The global petrochemical market is on a significant growth trajectory, with projections indicating a compound annual growth rate (CAGR) of around 4% through 2028. This expansion is largely fueled by the escalating demand for plastics across diverse sectors, including essential packaging, lightweight automotive components, and everyday consumer goods. This burgeoning demand for plastic production directly translates into a heightened need for robust and advanced petrochemical infrastructure, presenting a prime opportunity for CW Group's expertise in specialized pipes and metalwork solutions.

Global spending on water infrastructure is on the rise, projected to reach approximately $1 trillion annually by 2025. This surge is driven by the escalating need for clean water, rapid urbanization, and heightened environmental awareness. For CW Group, this translates into a significant opportunity to provide essential pipes and metalwork services for both new water system developments and the crucial upgrades of existing infrastructure.

The global energy transition presents a significant opportunity for CW Group to expand into new energy infrastructure, particularly in areas like hydrogen transport and Carbon Capture, Utilization, and Storage (CCUS). The demand for specialized pipelines in these sectors is rapidly growing as nations aim for decarbonization targets. For instance, the global CCUS market is projected to reach approximately $60 billion by 2030, with significant investment flowing into new infrastructure development.

CW Group's established expertise in industrial piping positions it well to capitalize on this trend. These emerging markets require high-strength, corrosion-resistant line pipes, a niche where CW Group can leverage its manufacturing capabilities and technical know-how. The International Energy Agency (IEA) reported in 2024 that hydrogen infrastructure investment alone could reach hundreds of billions of dollars globally in the coming decade, creating substantial demand for specialized pipe solutions.

Adoption of Advanced Manufacturing and Automation

The metal fabrication and welding industries are seeing a significant push towards advanced manufacturing, including automation and AI. This trend, often referred to as Industry 4.0, presents a prime opportunity for CW Group to boost its operational effectiveness. For instance, reports from the Association for Manufacturing Technology (AMT) indicated that new orders for manufacturing technology surged by 18.8% in the first quarter of 2024 compared to the same period in 2023, highlighting the industry's investment in these areas.

By integrating these cutting-edge technologies, CW Group can achieve notable improvements. This includes not only enhancing the precision and consistency of its production output but also driving down operational expenses through optimized processes and reduced waste. Furthermore, embracing automation and AI can unlock the potential to develop and deliver more sophisticated, value-added solutions to its customer base.

- Increased Production Efficiency: Automation can lead to faster cycle times and higher throughput.

- Improved Quality Control: AI-powered systems can detect defects with greater accuracy than traditional methods.

- Cost Reduction: Automation can lower labor costs and minimize material waste.

- Innovation in Offerings: Advanced manufacturing allows for the creation of more complex and customized products.

Strategic Partnerships and Market Consolidation

The industrial manufacturing landscape is intensely competitive, often driving companies to form strategic alliances or pursue mergers and acquisitions. CW Group has a significant opportunity to leverage these trends by seeking partnerships that could broaden its service portfolio, unlock entry into previously inaccessible markets, or facilitate the acquisition of crucial, complementary technologies. Such moves would not only bolster its competitive standing but also unlock substantial economies of scale.

Consider the potential impact of consolidation. In 2024, the global mergers and acquisitions market, particularly within industrial sectors, demonstrated robust activity, with notable deals aimed at achieving greater market share and operational efficiencies. For instance, the machinery manufacturing segment saw several key acquisitions designed to integrate advanced automation capabilities, a trend CW Group could emulate. By strategically acquiring or partnering with firms possessing specialized expertise or established market presence, CW Group can accelerate its growth trajectory and enhance its value proposition.

- Expand Service Offerings: Acquire or partner with companies providing niche industrial services to create a more comprehensive solution set.

- Market Access: Forge alliances with regional players to gain immediate entry into new geographic markets.

- Technology Acquisition: Purchase or license advanced manufacturing technologies to enhance production capabilities and product innovation.

- Economies of Scale: Consolidate operations through mergers to reduce costs and improve overall profitability.

The global petrochemical market's projected 4% CAGR through 2028, driven by plastic demand, offers CW Group a chance to supply specialized pipes for this growing sector. Similarly, the $1 trillion annual global water infrastructure spending by 2025, fueled by urbanization and environmental needs, creates a significant opportunity for CW Group's pipe and metalwork services in upgrading and developing water systems.

The energy transition, particularly in hydrogen transport and CCUS, presents a substantial growth area. The CCUS market is expected to reach $60 billion by 2030, with hydrogen infrastructure investment potentially reaching hundreds of billions of dollars globally in the next decade, as noted by the IEA in 2024. CW Group can leverage its expertise in high-strength, corrosion-resistant line pipes for these emerging energy needs.

Embracing Industry 4.0, with manufacturing technology orders up 18.8% in Q1 2024 per AMT, allows CW Group to boost efficiency and reduce costs through automation and AI. Strategic partnerships and M&A are also key opportunities, as seen in the robust industrial M&A market in 2024, enabling CW Group to expand services, gain market access, and acquire advanced technologies.

Threats

The oil and gas sector, a key market for CW Group, is currently experiencing significant price volatility. For instance, Brent crude oil prices have fluctuated considerably, trading between $75 and $90 per barrel in early 2024, impacting investment decisions. This instability, coupled with the global drive towards renewable energy sources, often prompts oil and gas companies to adopt a more cautious approach to capital expenditures.

This conservative spending trend can directly translate into reduced demand for new pipeline construction and industrial equipment, services that CW Group provides. In 2023, global capital expenditure in the oil and gas sector saw a moderate increase, but projections for 2024 suggest a more restrained growth, with some analysts forecasting a potential plateau or even a slight decline in certain segments due to energy transition pressures.

Manufacturers like CW Group are grappling with escalating raw material costs. For instance, steel prices, a key input for industrial pipes, saw significant fluctuations throughout 2024, with some benchmarks experiencing double-digit percentage increases at various points. This volatility directly impacts production expenses.

Adding to the pressure are trade tariffs. The imposition of tariffs on imported steel and other essential components in late 2023 and early 2024 has further inflated procurement costs for many industrial manufacturers. This creates a challenging environment for maintaining competitive pricing and protecting profit margins.

CW Group faces increasing pressure from stricter environmental regulations globally, a trend amplified by a growing consumer and investor focus on sustainability. For instance, the EU's Green Deal initiatives and similar policies in other major markets are setting higher standards for emissions, waste management, and resource efficiency.

Meeting these evolving environmental standards could necessitate substantial capital expenditures for CW Group. Investments in cleaner production technologies, sustainable sourcing of raw materials, and advanced waste treatment systems are likely required, potentially impacting operational costs and profit margins in the short to medium term.

Supply Chain Disruptions

CW Group, like many in its sector, faces ongoing threats from supply chain disruptions. Geopolitical tensions, extreme weather events, and economic volatility continue to pose risks to the seamless flow of goods and materials. These factors can significantly affect the timely procurement of essential raw materials and components, directly impacting production schedules and increasing operational costs. For instance, the ongoing semiconductor shortage, which began impacting various industries in 2020 and persisted through 2024, highlights the vulnerability of global supply chains to single-source dependencies and unexpected demand surges.

These disruptions can translate into production delays, escalating logistics expenses, and a diminished capacity to fulfill customer orders promptly. The ripple effect can damage client relationships and market reputation. In 2024, the Red Sea shipping crisis, stemming from regional conflicts, forced many companies to reroute vessels, adding significant transit time and cost, a challenge CW Group would need to navigate.

- Geopolitical Instability: Ongoing conflicts and trade disputes can interrupt shipping routes and access to key manufacturing regions.

- Logistical Bottlenecks: Port congestion and a shortage of shipping containers, issues that saw significant impact in 2023 and continued to be a concern in early 2024, can cause delays and increase freight costs.

- Raw Material Volatility: Fluctuations in the availability and price of essential raw materials, influenced by global demand and production capacities, present a constant challenge.

Intensified Competition and Pricing Pressure

The industrial pipes and metal fabrication sectors are highly competitive, with numerous global and regional manufacturers vying for market share. This intense rivalry often translates into aggressive pricing tactics. For CW Group, this means constant pressure on profit margins, making it difficult to sustain profitability and growth.

In 2024, the global industrial pipes market saw significant pricing fluctuations due to raw material cost volatility and increased supply chain competition. For instance, the average price of carbon steel pipes experienced a notable increase in early 2024 before stabilizing, impacting manufacturers' ability to maintain consistent pricing strategies. This environment necessitates continuous efficiency improvements and strategic cost management for CW Group to remain competitive.

- Intense Rivalry: Established global corporations and agile regional players compete fiercely in the industrial pipes and metal fabrication markets.

- Pricing Pressure: Aggressive pricing strategies by competitors directly challenge CW Group's ability to maintain healthy profit margins.

- Market Share Erosion: Sustained pricing pressure can lead to a gradual loss of market share if CW Group cannot effectively counter competitor strategies.

- Operational Efficiency: The need to offset pricing pressure requires CW Group to focus on optimizing its production processes and supply chain management.

CW Group faces significant threats from the volatile oil and gas market, where price fluctuations and the global shift to renewables dampen capital expenditure, directly impacting demand for its core services. Escalating raw material costs, particularly for steel, coupled with the impact of trade tariffs imposed in late 2023 and early 2024, are squeezing profit margins and challenging competitive pricing. Furthermore, increasingly stringent environmental regulations necessitate costly investments in cleaner technologies, potentially increasing operational expenses.

Supply chain disruptions, exacerbated by geopolitical events like the Red Sea crisis in early 2024, and persistent logistical bottlenecks continue to pose risks to timely delivery and increase freight costs. Intense market competition, characterized by aggressive pricing strategies from both global and regional players, puts constant pressure on CW Group's profitability and market share. The need to adapt to these evolving market dynamics requires a strong focus on operational efficiency and strategic cost management.

| Threat Category | Specific Threat | Impact on CW Group | Relevant Data/Context (2023-2024) |

|---|---|---|---|

| Market Volatility | Oil & Gas Capex Reduction | Reduced demand for pipelines and equipment | Brent crude prices fluctuated $75-$90/barrel (early 2024); restrained growth in oil & gas capex projected for 2024. |

| Cost Pressures | Raw Material Price Increases | Higher production expenses, reduced margins | Steel prices saw double-digit percentage increases at various points in 2024. |

| Regulatory Environment | Stricter Environmental Standards | Increased investment in compliance, higher operational costs | EU Green Deal and similar global policies driving demand for cleaner technologies. |

| Supply Chain Issues | Geopolitical & Logistical Disruptions | Production delays, increased freight costs, delivery challenges | Red Sea shipping crisis (early 2024) forced rerouting; port congestion and container shortages persisted from 2023. |

| Competitive Landscape | Intense Market Rivalry & Pricing Pressure | Threat to profit margins and market share | Global industrial pipes market experienced significant pricing fluctuations in 2024 due to material costs and competition. |

SWOT Analysis Data Sources

This CW Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry forecasts. These sources provide the reliable, data-driven insights necessary for a thorough and accurate strategic assessment.