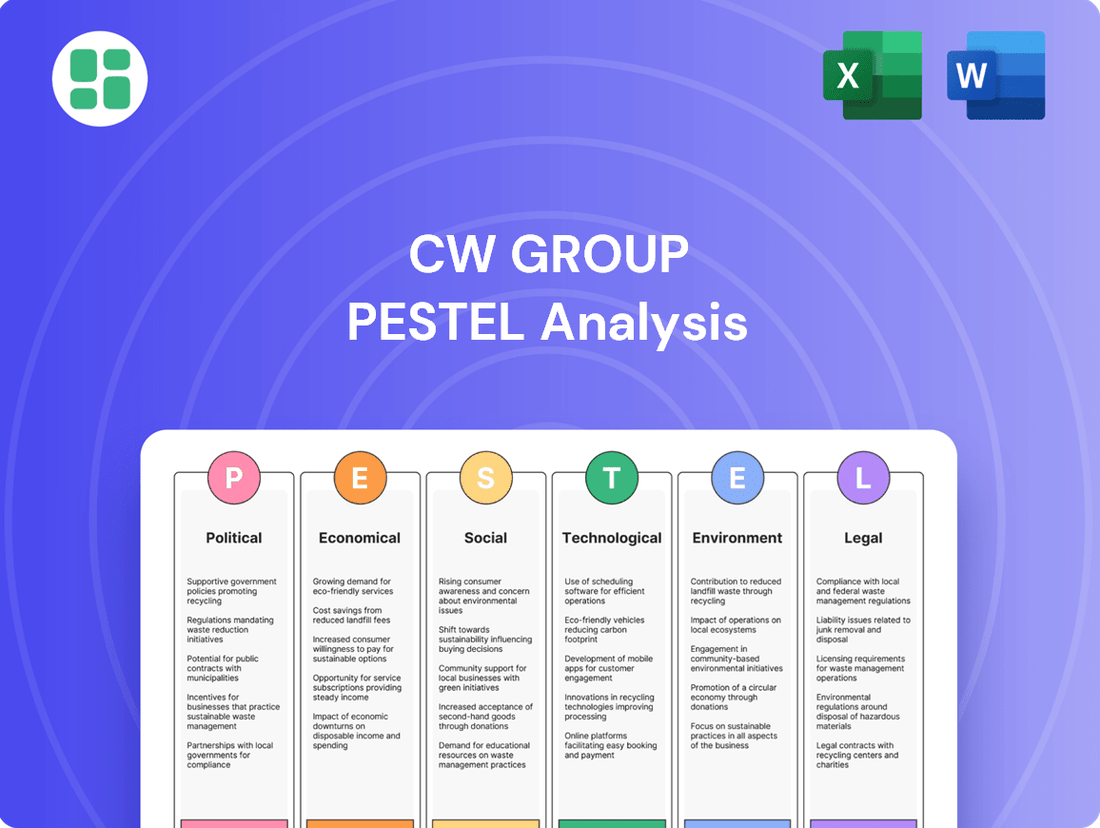

CW Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CW Group Bundle

Navigate the complex external forces shaping CW Group's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Equip yourself with actionable intelligence to refine your strategies and secure a competitive advantage. Download the full PESTLE analysis now and gain the insights you need to thrive.

Political factors

Government investment in critical infrastructure, particularly in sectors like oil and gas, water treatment, and petrochemicals, significantly influences the demand for CW Group's specialized industrial pipes and welding services. These public spending initiatives directly translate into project pipelines that require robust material and fabrication solutions.

Policies such as the U.S. Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) are injecting substantial capital into water and wastewater infrastructure upgrades. These laws are set to channel billions of dollars through 2026, presenting considerable growth opportunities for companies like CW Group that cater to these essential projects.

Global trade policies, including tariffs and protectionist measures, significantly impact CW Group's operational costs and market access. For instance, the imposition of tariffs on key raw materials like steel or copper can directly increase production expenses. The ongoing trend of rising tariffs, observed throughout 2024 and projected into 2025, necessitates robust supply chain diversification strategies to hedge against potential disruptions and maintain competitive pricing in international arenas.

Stricter environmental regulations are a significant political factor for CW Group. For instance, new methane emission standards for oil and gas operations, and evolving PFAS regulations in water treatment, are increasing compliance costs for many industries. These regulations, however, also create opportunities by driving demand for advanced, compliant industrial solutions that CW Group can provide.

The U.S. Environmental Protection Agency's (EPA) continued focus on environmental justice and emission reduction targets, particularly looking towards 2027, will directly shape the operational requirements for the industries CW Group serves. This means companies will need to invest in cleaner technologies and processes, presenting a market for CW Group's expertise and offerings.

Geopolitical Stability and Supply Chain Resilience

Geopolitical instability continues to pose significant risks to global supply chains, impacting the availability and cost of essential materials. For instance, ongoing conflicts in Eastern Europe and the Middle East have led to increased shipping costs and delays, with the Baltic Dry Index experiencing notable volatility throughout 2024. Businesses are actively seeking to mitigate these disruptions.

In response, a growing emphasis on reshoring and nearshoring is evident as companies aim to build more resilient supply networks. A 2024 survey indicated that over 60% of manufacturers are actively exploring or implementing strategies to diversify their supplier base away from single-source dependencies. This strategic shift will necessitate adjustments in CW Group's sourcing and logistics planning for 2025 to ensure continuity and manage costs effectively.

- Increased shipping costs: Freight rates on key East-West routes saw a 25% average increase in the first half of 2024 compared to the previous year.

- Supplier diversification: 70% of companies surveyed in late 2024 reported having at least one alternative supplier for critical components.

- Reshoring initiatives: Investments in domestic manufacturing capacity in North America and Europe are projected to grow by 15% in 2025.

- Impact on raw material pricing: Volatility in energy prices, directly linked to geopolitical events, has caused fluctuations of up to 10% in the cost of petrochemical-based raw materials throughout 2024.

Industry-Specific Regulatory Changes

Regulatory shifts in sectors like oil and gas, petrochemicals, and pharmaceuticals significantly shape the demand for specialized piping and related services. For instance, evolving safety and operational efficiency standards in the oil and gas industry, particularly concerning offshore operations, can necessitate upgrades to existing infrastructure, driving demand for corrosion-resistant and high-pressure piping solutions. The pharmaceutical sector, in particular, is experiencing a regulatory push towards continuous manufacturing processes, which requires different piping configurations and stringent quality assurance protocols compared to traditional batch manufacturing.

These industry-specific regulations have a direct impact on CW Group's business. For example, stricter environmental regulations in the petrochemical industry, such as those limiting emissions or mandating the use of specific materials for transporting hazardous chemicals, could increase the need for advanced piping systems. As of early 2025, several regions are implementing updated guidelines for pipeline integrity management, requiring more frequent inspections and the replacement of older, potentially less robust, piping, which directly benefits specialized pipe suppliers.

- Pharmaceuticals: Increased regulatory emphasis on continuous manufacturing and enhanced quality assurance drives demand for specialized, high-purity piping systems.

- Oil & Gas: Evolving safety and operational efficiency standards, especially for offshore and deepwater exploration, require advanced, corrosion-resistant piping.

- Petrochemicals: Stricter environmental regulations concerning emissions and hazardous material transport necessitate the use of specialized, compliant piping materials and designs.

- Regulatory Updates: Ongoing implementation of updated pipeline integrity management guidelines globally is spurring the replacement of older infrastructure, creating opportunities for specialized pipe providers.

Government investment in critical infrastructure, such as the U.S. Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA), is a significant driver for CW Group, injecting billions into water and wastewater upgrades through 2026. These policies directly boost demand for specialized industrial pipes and welding services, creating substantial growth opportunities.

Global trade policies, including tariffs, directly impact CW Group's costs and market access. The trend of rising tariffs observed in 2024 and projected into 2025 necessitates supply chain diversification to manage expenses and maintain competitiveness.

Stricter environmental regulations, like new methane emission standards and evolving PFAS rules, increase compliance costs but also create demand for advanced, compliant solutions that CW Group can provide.

Geopolitical instability and reshoring initiatives are reshaping supply chains, with over 60% of manufacturers exploring supplier diversification in 2024, requiring strategic sourcing adjustments for CW Group in 2025.

| Political Factor | Impact on CW Group | Key Data/Trend (2024-2025) |

|---|---|---|

| Infrastructure Spending | Increased demand for pipes and welding services | BIL & IRA channeling billions into water/wastewater upgrades through 2026. |

| Trade Policies (Tariffs) | Higher raw material costs, reduced market access | Rising tariffs in 2024-2025 necessitate supply chain diversification. |

| Environmental Regulations | Increased compliance costs, demand for advanced solutions | New methane and PFAS regulations drive need for compliant piping. |

| Geopolitics & Reshoring | Supply chain volatility, focus on diversified sourcing | 60%+ manufacturers exploring supplier diversification in 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the CW Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the CW Group's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured overview of the CW Group's operating environment.

Economic factors

Global economic growth directly influences demand for CW Group's offerings. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that underpins the purchasing power of industries reliant on CW Group's solutions.

Industrial output in key sectors like oil and gas, petrochemicals, pharmaceuticals, and water treatment is a critical driver. Despite some petrochemical sectors experiencing overcapacity, the overall industrial landscape continues to expand, with global industrial production expected to see modest growth in 2024-2025, signaling sustained demand.

Fluctuations in commodity prices, especially for steel and metals, directly impact CW Group's manufacturing expenses and profit margins. For instance, the global steel market experienced price volatility throughout 2023, with benchmarks like the TSI US Hot-Rolled Coil (HRC) price seeing significant swings, which would have directly influenced CW Group's input costs.

The steel pipe market is expected to see growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% from 2024 to 2029, fueled by infrastructure and energy sector demand. However, anticipated increases in raw material costs, potentially driven by supply chain pressures and global demand, are expected for 2024 and 2025, posing a challenge for manufacturers like CW Group.

Investment levels in key end-use industries directly influence demand for industrial pipes and welding services. For instance, substantial capital expenditures in the oil and gas sector, projected to reach over $600 billion globally in 2024, often translate into significant opportunities for pipe manufacturers and service providers.

The petrochemical industry is a major driver, with ongoing expansion projects worldwide. In 2024, global petrochemical investments are estimated to be in the tens of billions, particularly in regions like Asia and the Middle East, fueling demand for specialized piping solutions.

Furthermore, the pharmaceutical sector continues its robust investment in new facilities and capacity expansions, with global pharmaceutical market growth expected to continue steadily through 2025, supporting the need for high-quality, corrosion-resistant piping.

Significant focus is also being placed on water infrastructure upgrades. In the United States alone, the Bipartisan Infrastructure Law allocates billions towards water system improvements, creating a strong pipeline of projects requiring extensive piping and welding expertise through 2025 and beyond.

Inflation and Interest Rates

Rising inflation is a significant concern, with global inflation rates showing varied trends. For instance, the US experienced a Consumer Price Index (CPI) increase of 3.4% year-over-year in April 2024, impacting operational costs like labor and energy for CW Group. This necessitates a strong focus on operational efficiencies and cost control measures to safeguard profit margins.

Higher interest rates, a common response to inflation, directly affect CW Group's capital expenditure plans and the financing capabilities of its clients. The US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, making borrowing more expensive. This economic climate pushes companies to strategically manage their debt and explore financing alternatives.

- Inflationary Pressures: Global inflation, exemplified by the US CPI at 3.4% (April 2024), increases input costs for CW Group.

- Interest Rate Impact: Elevated interest rates, such as the Fed's 5.25%-5.50% range, raise the cost of capital for both CW Group and its clients.

- Strategic Responses: Companies are prioritizing efficiency and cost management to mitigate margin erosion caused by these economic factors.

- Client Financing Challenges: Higher borrowing costs can constrain infrastructure project financing for CW Group's clientele.

Supply Chain Costs and Efficiency

The cost and efficiency of global supply chains remain a critical factor for CW Group, directly impacting their ability to source materials and deliver products competitively. Geopolitical events and ongoing logistical challenges continue to exert pressure on transportation costs. For instance, the Drewry World Container Index saw fluctuations throughout 2024, with some periods experiencing significant year-on-year increases in shipping rates, impacting overall supply chain expenses.

Businesses are increasingly focusing on supply chain agility and resilience to mitigate risks and control costs. This involves diversifying sourcing locations and investing in technology to improve visibility and responsiveness. A report from McKinsey in late 2024 highlighted that companies with more resilient supply chains were better positioned to navigate disruptions and maintain profitability compared to their less prepared counterparts.

- Logistics Costs: Global freight rates, while volatile, have shown an upward trend in certain corridors due to capacity constraints and increased demand in 2024.

- Geopolitical Impact: Regional conflicts and trade policy shifts continue to create uncertainty, leading to longer lead times and higher insurance costs for certain goods.

- Resilience Investments: Companies are allocating more capital towards dual-sourcing strategies and advanced tracking systems to enhance supply chain predictability.

- Efficiency Gains: Automation and digital transformation within warehouses and transportation networks are key areas for cost reduction and improved delivery times.

Global economic growth remains a primary driver for CW Group, with the IMF projecting 3.2% global growth for 2024. This growth underpins demand across key sectors like oil and gas, petrochemicals, pharmaceuticals, and water treatment, all significant consumers of industrial pipes and welding services.

Inflationary pressures, evidenced by the US CPI at 3.4% year-over-year in April 2024, directly impact CW Group's operational costs, necessitating a strong focus on efficiency. Coupled with elevated interest rates, such as the US Federal Reserve's 5.25%-5.50% range, these factors increase the cost of capital for both the company and its clients, potentially constraining project financing.

Supply chain dynamics, including fluctuating freight rates and geopolitical uncertainties, continue to influence logistics costs and lead times. Companies are investing in resilience, with McKinsey reporting that agile supply chains better navigate disruptions, a trend CW Group must also consider for cost management and delivery reliability.

| Economic Factor | 2024 Projection/Data | Impact on CW Group | Mitigation Strategy |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Drives demand for industrial products | Focus on growing end-markets |

| US Inflation (CPI) | 3.4% (April 2024) | Increases operational and material costs | Enhance operational efficiency, cost control |

| US Interest Rates | 5.25%-5.50% (through mid-2024) | Raises cost of capital for company and clients | Strategic debt management, explore financing options |

| Steel Market Volatility | Price swings in 2023 | Affects raw material input costs | Secure favorable supplier contracts, explore hedging |

Preview the Actual Deliverable

CW Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the CW Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. The detailed breakdown within this document will equip you with a thorough understanding of the external forces shaping the CW Group's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. Gain valuable insights into opportunities and threats by exploring the in-depth analysis presented here.

Sociological factors

The availability of skilled labor for specialized industrial processes, such as welding and metalwork, is a significant concern for companies like CW Group. A projected shortage of welders in the coming years, with estimates suggesting a need for tens of thousands more welders than available by 2024-2025, directly impacts operational capacity and project timelines.

These labor shortages are a powerful catalyst for accelerating the adoption of automation and advanced manufacturing technologies within the metalworking industry. CW Group may need to strategically invest in and embrace these automated solutions to mitigate the risks associated with a shrinking pool of qualified manual labor, ensuring continued productivity and competitiveness.

Societal expectations are increasingly prioritizing workplace safety and employee well-being across industries. This heightened awareness directly impacts sectors like oil and gas and pharmaceuticals, where rigorous safety protocols are paramount. For CW Group, this translates into a growing demand for piping systems and welding services that not only perform reliably but also adhere to the most stringent safety standards, ensuring compliance and mitigating risks for their clients.

Societal expectations for corporate social responsibility are intensifying, with consumers and investors increasingly prioritizing ethical business practices. This trend directly impacts companies like CW Group, pushing them to demonstrate genuine commitment to sustainability and fair labor in their supply chains.

By 2024, a significant majority of consumers, around 70%, indicated they would pay more for products from brands that are committed to positive social and environmental impact. This growing consumer demand translates into direct pressure on CW Group to ensure its sourcing is ethical and its operations contribute positively to the communities it serves.

Furthermore, institutional investors are increasingly integrating ESG (Environmental, Social, and Governance) factors into their decision-making. In 2025, ESG-focused funds are projected to manage trillions of dollars globally, meaning CW Group's ability to showcase robust community engagement and sustainable practices will be crucial for attracting and retaining investment capital.

Demographic Shifts and Urbanization

Global demographic shifts, with a projected population increase to 8.5 billion by 2030, are significantly amplified by rapid urbanization. This trend is particularly pronounced in the Asia Pacific region, where an estimated 60% of the world's urban population is expected to reside by 2030. Such concentrated growth fuels an insatiable demand for robust infrastructure, including advanced water treatment facilities and reliable energy supply networks. These essential services directly translate into sustained demand for industrial pipes, a core product for CW Group.

The increasing concentration of people in urban centers necessitates substantial investment in infrastructure upgrades and expansions. For instance, cities in developing nations are experiencing unprecedented growth, requiring new pipe systems for potable water, wastewater management, and energy distribution. This ongoing development cycle provides a consistent market for CW Group's specialized piping solutions, ensuring long-term revenue streams.

- Urban Population Growth: The global urban population is projected to reach 68% by 2050, up from 57% in 2023.

- Asia Pacific Dominance: This region is expected to account for the majority of urban population growth in the coming decades.

- Infrastructure Demand: Urbanization directly drives demand for water, sanitation, and energy infrastructure, all reliant on industrial piping.

- CW Group's Market Position: The company is well-positioned to capitalize on this sustained demand for critical infrastructure components.

Public Perception and Industry Reputation

Public perception of industries like oil and gas and petrochemicals, particularly regarding their environmental footprint, can significantly influence investment decisions and the intensity of regulatory scrutiny. For CW Group, maintaining a strong reputation for quality and adherence to stringent compliance standards within these sensitive sectors is paramount for its continued success and operational stability.

For instance, a 2024 survey indicated that 65% of consumers are more likely to support businesses demonstrating strong environmental responsibility. This sentiment directly impacts industries perceived as high-impact. CW Group's commitment to sustainability, evidenced by its 2024 initiatives aimed at reducing emissions by 15% across its operations, is therefore a critical factor in shaping its public image and mitigating potential regulatory headwinds.

- Industry Reputation: CW Group's standing in sectors with high environmental scrutiny is directly tied to public trust.

- Consumer Sentiment: Growing consumer preference for eco-conscious brands, as highlighted by a 2024 survey showing 65% favoring responsible businesses, pressures industries like oil and gas.

- Regulatory Impact: Positive public perception can translate into reduced regulatory pressure, while negative views can lead to stricter oversight and compliance costs.

- Investment Attraction: A strong reputation for quality and environmental stewardship is increasingly vital for attracting investment in 2024 and beyond.

Societal trends are increasingly emphasizing sustainability and ethical sourcing, with a 2024 survey revealing that approximately 70% of consumers are willing to pay more for products from environmentally and socially responsible brands. This consumer preference directly influences companies like CW Group, necessitating a strong commitment to ethical supply chains and community engagement to attract and retain customers.

Institutional investors are also prioritizing Environmental, Social, and Governance (ESG) factors, with ESG-focused funds projected to manage trillions of dollars globally by 2025. CW Group's ability to demonstrate robust community involvement and sustainable practices is therefore crucial for securing investment capital and maintaining a positive market valuation.

| Societal Factor | Impact on CW Group | Supporting Data (2024-2025) |

|---|---|---|

| Consumer Demand for Sustainability | Increased pressure for ethical sourcing and operations. | 70% of consumers willing to pay more for responsible brands (2024). |

| Investor ESG Focus | Need for demonstrable community engagement and sustainability. | Trillions of dollars in AUM for ESG funds projected by 2025. |

| Workplace Safety Expectations | Demand for high-safety piping systems and welding services. | Growing emphasis on stringent safety standards across industries. |

Technological factors

CW Group is positioned to benefit from the increasing integration of automation and smart manufacturing technologies. The adoption of advanced robotics, AI, and the Internet of Things (IoT) is fundamentally reshaping metal fabrication, driving significant improvements in efficiency, precision, and quality control. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, with automation in manufacturing expected to add trillions to the global economy by 2030.

By strategically implementing robotic welding systems, CW Group can achieve higher throughput and consistent weld quality, reducing labor costs and improving worker safety. Furthermore, the application of AI-driven quality control systems can identify defects earlier and more accurately than traditional methods, minimizing waste and rework. Predictive maintenance, powered by IoT sensors and AI analytics, will allow CW Group to anticipate equipment failures, scheduling maintenance proactively and minimizing costly downtime, thereby enhancing operational reliability and reducing overall maintenance expenses.

Innovations in materials science, like advanced composites and high-strength alloys, are creating more durable and specialized pipes. For instance, the global advanced composites market was valued at approximately $50 billion in 2023 and is projected to grow significantly. CW Group can leverage these material advancements to develop pipes with enhanced performance characteristics, meeting the evolving demands of industries such as aerospace and renewable energy.

New fabrication techniques, including fiber laser cutting and additive manufacturing (3D printing), are also transforming the manufacturing landscape. The global 3D printing market reached over $20 billion in 2023, with significant growth expected in industrial applications. CW Group’s adoption of these technologies could lead to more efficient production, reduced waste, and the creation of custom-designed pipe solutions for complex projects, potentially improving lead times and cost-effectiveness.

CW Group's operations are significantly impacted by the accelerating trend of digital transformation and advanced data analytics. The integration of digital tools across its supply chain and manufacturing processes, a move mirrored by many in the industry, is crucial for enhancing visibility and efficiency. For instance, the pharmaceutical sector is increasingly leveraging digital twins to optimize production, a technology with direct applicability to improving CW Group's service delivery and operational oversight.

The ability to monitor operations in real-time through data analytics is transforming decision-making. Companies that effectively harness this capability can identify bottlenecks and inefficiencies much faster. By 2024, the global market for big data and business analytics solutions was projected to reach hundreds of billions of dollars, underscoring the widespread adoption and recognized value of these technologies in driving business performance.

Additive Manufacturing (3D Printing)

Additive manufacturing, or 3D printing, is increasingly influencing the industrial landscape, offering novel solutions for component production. CW Group can leverage this technology for creating custom pipe joints and on-demand spare parts, significantly reducing material waste and accelerating prototyping cycles. While not yet mainstream for large-scale pipe manufacturing, its application in specialized components and repair services, especially in hard-to-reach areas like remote or offshore sites, presents a distinct advantage.

The global 3D printing market is projected to reach substantial figures, with some estimates suggesting it could exceed $50 billion by 2027, highlighting its growing economic significance. For CW Group, this translates to potential cost savings and enhanced operational flexibility.

- Reduced Lead Times: 3D printing allows for the rapid production of custom parts, cutting down on traditional manufacturing and delivery times.

- Material Efficiency: Additive processes use only the material needed, minimizing waste compared to subtractive methods.

- Customization Capabilities: The technology enables the creation of highly specific, bespoke components tailored to unique project requirements.

- On-Demand Production: Facilitates the creation of spare parts as needed, reducing the need for extensive inventory.

Emerging Technologies in Client Sectors

Technological advancements are reshaping CW Group's client sectors, directly influencing demand for its specialized piping and metalwork. For instance, the pharmaceutical industry's pivot towards personalized medicine necessitates highly specialized, often smaller-scale, and more intricate fabrication for advanced treatment delivery systems. This evolution requires CW Group to maintain agility in its manufacturing processes and material handling.

The global energy transition is another significant technological driver. The burgeoning hydrogen economy, for example, is creating substantial demand for infrastructure capable of safely transporting and storing hydrogen. CW Group's expertise in high-pressure piping and specialized alloys positions it to capitalize on this trend, with projections indicating significant growth in hydrogen infrastructure investment through 2030.

Key technological factors impacting CW Group include:

- Advancements in materials science: Development of new alloys with enhanced corrosion resistance and high-temperature capabilities, crucial for sectors like advanced energy and aerospace.

- Digitalization and automation: Increased adoption of AI and robotics in manufacturing processes, leading to greater precision, efficiency, and reduced lead times for complex projects.

- Growth of the hydrogen economy: Significant investment in hydrogen production, storage, and transportation infrastructure, creating new markets for specialized piping solutions. For example, the International Energy Agency (IEA) reported in 2024 that global hydrogen investments were projected to reach over $300 billion by 2030.

- Biotechnology and personalized medicine: Demand for highly specialized, sterile, and precisely engineered components for advanced pharmaceutical manufacturing and medical device production.

Technological advancements are fundamentally reshaping CW Group's operational landscape, driving efficiency and opening new market opportunities. The increasing adoption of automation and AI in manufacturing, projected to add trillions to the global economy by 2030, allows for enhanced precision and reduced costs. Innovations in materials science, with markets like advanced composites valued at approximately $50 billion in 2023, enable the creation of higher-performance products. Furthermore, new fabrication techniques such as 3D printing, a market exceeding $20 billion in 2023, offer customization and material efficiency.

The digital transformation trend, underscored by a global big data market worth hundreds of billions in 2024, empowers real-time operational monitoring and improved decision-making for CW Group. Additive manufacturing, with market projections potentially exceeding $50 billion by 2027, provides advantages in producing custom parts and reducing waste. These technological shifts are crucial for CW Group to meet evolving client demands, particularly in sectors like the burgeoning hydrogen economy, where infrastructure investment is projected to exceed $300 billion by 2030.

Key technological factors impacting CW Group include advancements in materials science for enhanced product capabilities, the integration of AI and robotics for greater manufacturing efficiency, and the growth of specialized markets like the hydrogen economy and biotechnology. These trends necessitate agility and innovation in production processes and material handling to maintain a competitive edge.

Legal factors

Stringent environmental laws, covering emissions, waste management, and hazardous substances, significantly influence CW Group's manufacturing and its clients' operations. For instance, the U.S. Environmental Protection Agency (EPA) has been tightening regulations, with proposed methane emission standards for the oil and gas sector and ongoing efforts to regulate per- and polyfluoroalkyl substances (PFAS), impacting material sourcing and product lifecycle management.

Occupational Health and Safety (OHS) regulations are critical for CW Group, especially in its industrial manufacturing and metalwork sectors. These laws dictate stringent safety protocols to safeguard employees, preventing accidents and ensuring a healthy working environment. For instance, in 2023, the US Bureau of Labor Statistics reported over 2.8 million nonfatal workplace injuries and illnesses across private industry, highlighting the importance of robust OHS compliance.

CW Group's adherence to these evolving standards is not just about worker well-being but also about maintaining operational continuity and its licenses to operate. Failure to comply can result in significant fines and operational shutdowns. The UK's Health and Safety Executive (HSE) actively enforces regulations, with penalties for non-compliance potentially reaching millions of pounds, as seen in cases involving severe safety breaches.

Regulations surrounding product quality, performance, and liability are particularly strict in sectors where CW Group operates, such as oil and gas, pharmaceuticals, and water treatment. For instance, in the oil and gas industry, standards like API (American Petroleum Institute) specifications are critical for equipment used in exploration and production. Failure to meet these can result in significant penalties and operational shutdowns.

CW Group must consistently adhere to these rigorous industry standards and certifications to guarantee the safety and dependability of its offerings. In 2024, the global market for water treatment chemicals alone was valued at approximately $45 billion, with quality and safety certifications being paramount for market access and customer trust.

International Trade Laws and Sanctions

International trade laws, including sanctions and export controls, significantly impact CW Group's global operations. These regulations dictate the flow of goods and services, affecting CW Group's ability to source raw materials from international suppliers and to export its finished products to various markets. Navigating these complex legal frameworks is crucial for maintaining supply chain integrity and market access.

Geopolitical shifts are increasingly influencing trade policies, leading to more frequent and stringent sanctions and export controls. For instance, the ongoing geopolitical tensions in Eastern Europe have resulted in extensive sanctions regimes impacting numerous industries. In 2024, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures, underscoring the need for businesses like CW Group to adapt their strategies to comply with evolving international legal landscapes.

- Sanctions Compliance: CW Group must ensure strict adherence to all applicable sanctions, which can restrict trade with specific countries, entities, or individuals.

- Export Controls: Understanding and complying with export control regulations is vital to prevent unauthorized transfer of sensitive technologies or goods.

- Trade Agreements: CW Group benefits from favorable trade agreements but is also vulnerable to changes or disruptions in these pacts.

- Geopolitical Risk: Increased geopolitical instability necessitates proactive risk assessment and contingency planning for supply chain resilience.

Labor and Employment Laws

Labor and employment laws significantly shape CW Group's operational landscape. Regulations concerning minimum wages, overtime, workplace safety, and collective bargaining directly influence labor costs and employee relations. For instance, in 2024, many regions saw adjustments to minimum wage laws, with some countries increasing them by as much as 10-15%, potentially impacting CW Group's payroll expenses.

Staying compliant with these evolving employment regulations is crucial for CW Group's ability to attract and retain a skilled workforce. Failure to adhere to labor laws can result in fines, legal disputes, and damage to the company's reputation, hindering talent acquisition efforts. The International Labour Organization (ILO) reported in late 2024 that labor law enforcement remains a challenge in many sectors, underscoring the need for robust internal compliance mechanisms.

- Minimum Wage Adjustments: Many countries implemented or proposed minimum wage increases in 2024, impacting labor costs for companies like CW Group.

- Workplace Safety Standards: Ongoing scrutiny of workplace safety regulations requires continuous investment in training and equipment to prevent accidents and ensure compliance.

- Labor Relations: Laws governing unionization and collective bargaining can affect CW Group's ability to manage employee relations and negotiate contracts.

- Talent Retention: Adherence to fair employment practices and competitive compensation, often dictated by labor laws, is vital for retaining valuable employees amidst a competitive job market.

CW Group operates within a complex web of legal frameworks that demand constant vigilance and adaptation. Environmental regulations, such as those from the EPA concerning emissions and PFAS, directly impact manufacturing processes and material sourcing. Similarly, stringent Occupational Health and Safety (OHS) laws, evidenced by the 2.8 million nonfatal workplace injuries reported in the US in 2023, necessitate robust safety protocols to avoid significant penalties and operational disruptions.

Product quality and performance standards, like API specifications in the oil and gas sector, are paramount for market access and customer trust, especially in a global water treatment chemical market valued at approximately $45 billion in 2024. Furthermore, international trade laws, including sanctions and export controls, are increasingly influenced by geopolitical shifts, as highlighted by the WTO's report of rising trade-restrictive measures in 2024, requiring CW Group to maintain agile supply chain strategies.

| Regulatory Area | Key Impact on CW Group | Relevant 2023/2024 Data Point |

|---|---|---|

| Environmental Compliance | Manufacturing processes, material sourcing, waste management | US EPA tightening methane emission standards; PFAS regulation focus |

| Occupational Health & Safety (OHS) | Employee safety protocols, operational continuity | 2.8 million nonfatal workplace injuries in US private industry (2023) |

| Product Quality & Liability | Market access, customer trust, operational permits | Global water treatment chemical market valued at ~$45 billion (2024) |

| International Trade & Sanctions | Supply chain integrity, market access, export/import operations | WTO reported increase in trade-restrictive measures (2024) |

Environmental factors

Global and national climate policies, like the EU's Green Deal and the US Inflation Reduction Act, are significantly reshaping manufacturing and energy. These initiatives push for reduced carbon emissions and a transition to a low-carbon economy, directly impacting industries. For instance, the EU aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels.

CW Group, operating within this evolving landscape, likely faces increasing pressure to integrate greener production techniques. This could involve adopting more energy-efficient machinery, sourcing sustainable materials, and investing in renewable energy for its operations to align with mandated carbon reduction goals.

The financial implications are substantial, with companies like CW Group needing to allocate capital towards sustainability initiatives. For example, the global renewable energy market was valued at over $1.3 trillion in 2023 and is projected to grow significantly, indicating investment opportunities and potential cost savings for businesses that adapt.

Growing global water scarcity, exacerbated by climate change, is a significant environmental factor. By 2025, projections indicate that over two-thirds of the world's population could face water shortages, making efficient water management critical. This trend directly fuels demand for advanced water treatment technologies and infrastructure, a core area for CW Group.

CW Group's strategic focus on water treatment solutions positions it to capitalize on this increasing demand. The company's investments in sustainable water infrastructure align with governmental and societal priorities to address resource depletion. This environmental imperative translates into a robust market opportunity for CW Group's expertise in water purification and distribution systems.

Stricter waste management regulations are increasingly shaping industries, driving a significant shift towards circular economy principles. This means more emphasis on recycling and reusing materials throughout the production process. For instance, the stainless steel pipe sector is actively integrating recycled content, with some manufacturers aiming for over 80% recycled material in their products by 2025 to meet environmental targets and reduce reliance on virgin resources.

Pollution Control and Emissions

Stricter regulations on industrial pollution, encompassing both air and water emissions, are compelling companies like CW Group to invest significantly in advanced control technologies and cleaner manufacturing processes. This trend is particularly evident as industries CW Group serves, such as oil and gas, confront increasingly stringent methane emission standards. For instance, the U.S. Environmental Protection Agency (EPA) finalized new rules in December 2023 targeting methane emissions from oil and natural gas facilities, aiming to cut emissions by 75% by 2030 compared to 2019 levels.

These evolving environmental mandates directly impact operational costs and strategic planning for businesses. CW Group's clients in the energy sector, for example, are under pressure to adopt technologies that reduce greenhouse gas output. The International Energy Agency (IEA) reported in its 2024 Oil and Gas Industry report that investments in methane abatement technologies are projected to reach $100 billion globally by 2030, highlighting the scale of this transition.

- Regulatory Pressure: New environmental laws require substantial capital expenditure for pollution abatement.

- Technological Investment: Companies must adopt cleaner technologies to meet emission targets, especially for methane.

- Industry Impact: The oil and gas sector, a key market for CW Group, faces significant compliance costs and operational shifts.

- Global Trends: International bodies like the IEA project massive global investment in methane reduction technologies.

Sustainability in Client Industries

The oil and gas, petrochemicals, and pharmaceutical industries are increasingly prioritizing sustainability. This means clients are actively seeking suppliers who demonstrate strong environmentally responsible practices. For CW Group, highlighting solutions that boost energy efficiency or champion green chemistry principles becomes a significant competitive differentiator.

For instance, the global sustainable chemicals market was valued at approximately $100 billion in 2023 and is projected to grow substantially in the coming years. Companies within these sectors are under pressure from regulators and consumers alike to reduce their environmental footprint.

- Growing Demand for Green Solutions: Clients in key sectors are actively seeking suppliers with demonstrable commitments to environmental stewardship.

- Competitive Advantage: Offering sustainable products and services, such as those focused on energy efficiency or sustainable chemistry, positions CW Group favorably against competitors.

- Market Trends: The global market for sustainable chemicals is expanding rapidly, indicating a strong commercial opportunity for suppliers aligned with these values.

- Regulatory and Consumer Pressure: Environmental regulations and consumer expectations are driving the adoption of sustainable practices across client industries.

Growing global water scarcity, exacerbated by climate change, is a significant environmental factor. By 2025, projections indicate that over two-thirds of the world's population could face water shortages, making efficient water management critical. This trend directly fuels demand for advanced water treatment technologies and infrastructure, a core area for CW Group.

CW Group's strategic focus on water treatment solutions positions it to capitalize on this increasing demand. The company's investments in sustainable water infrastructure align with governmental and societal priorities to address resource depletion. This environmental imperative translates into a robust market opportunity for CW Group's expertise in water purification and distribution systems.

Stricter waste management regulations are increasingly shaping industries, driving a significant shift towards circular economy principles. This means more emphasis on recycling and reusing materials throughout the production process. For instance, the stainless steel pipe sector is actively integrating recycled content, with some manufacturers aiming for over 80% recycled material in their products by 2025 to meet environmental targets and reduce reliance on virgin resources.

Stricter regulations on industrial pollution, encompassing both air and water emissions, are compelling companies like CW Group to invest significantly in advanced control technologies and cleaner manufacturing processes. This trend is particularly evident as industries CW Group serves, such as oil and gas, confront increasingly stringent methane emission standards. For instance, the U.S. Environmental Protection Agency (EPA) finalized new rules in December 2023 targeting methane emissions from oil and natural gas facilities, aiming to cut emissions by 75% by 2030 compared to 2019 levels.

| Environmental Factor | Impact on CW Group | Market Opportunity/Challenge | Relevant Data/Targets |

|---|---|---|---|

| Climate Change & Emissions | Need to adopt greener production, energy efficiency | Demand for renewable energy solutions, carbon capture technology | EU Green Deal: 55% emissions cut by 2030; Global renewable energy market >$1.3T in 2023 |

| Water Scarcity | Increased demand for water treatment and management solutions | Growth in water purification and distribution systems market | 2/3 world population facing water shortages by 2025 |

| Waste Management & Circular Economy | Pressure to use recycled materials, reduce waste | Opportunity in developing sustainable material solutions | Stainless steel pipe sector aiming for >80% recycled content by 2025 |

| Industrial Pollution Regulations | Investment in advanced control technologies, cleaner processes | Compliance costs, but also market for emission reduction solutions | EPA methane rules: 75% cut by 2030 (vs 2019); IEA projects $100B investment in methane abatement by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government publications, international organizations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting your business.