CW Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CW Group Bundle

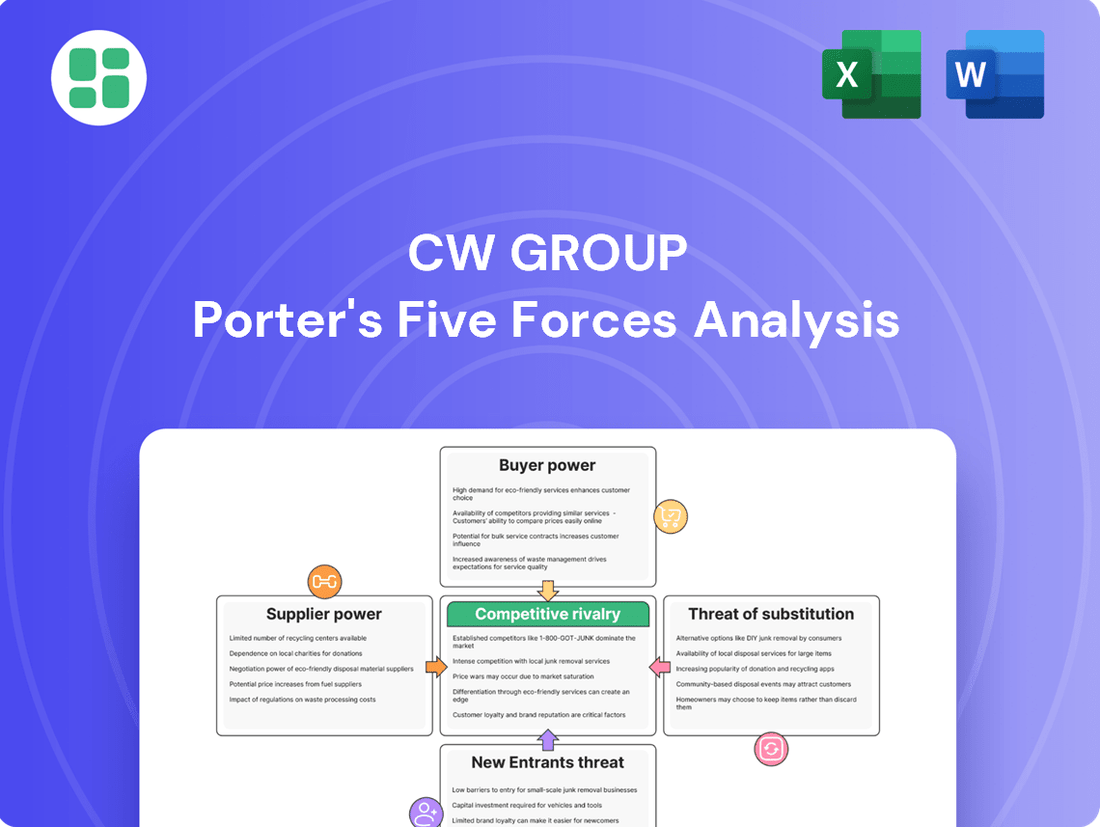

Understanding the competitive landscape for CW Group reveals a dynamic interplay of forces. From the bargaining power of buyers to the threat of new entrants, each element significantly shapes market strategy.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CW Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for CW Group is significantly shaped by the availability and uniqueness of the specialized metals and alloys essential for its industrial pipes and metalwork. When these critical materials are scarce or possess proprietary characteristics, suppliers gain considerable leverage to dictate pricing.

For instance, the global market for high-grade, corrosion-resistant steel alloys, crucial for CW Group's demanding applications, saw price increases of approximately 15-20% in early 2024 due to supply chain disruptions and increased demand from infrastructure projects. CW Group's reliance on these specific components means that any fluctuations in their supply or cost directly impacts the company's production expenses and, consequently, its profitability.

The concentration of suppliers for critical inputs, such as specialized welding consumables or high-grade steel, directly influences CW Group's bargaining power. If only a few major suppliers dominate these markets, they can dictate higher prices and less flexible contract terms, squeezing CW Group's margins. For instance, in 2024, the global welding consumables market saw significant consolidation, with the top five players accounting for over 60% of the market share, potentially increasing their leverage.

High switching costs significantly bolster supplier bargaining power. For CW Group, if changing suppliers necessitates costly re-tooling of manufacturing equipment or extensive re-certification of materials, suppliers gain leverage. For instance, in industries like aerospace or medical devices, where component precision and regulatory compliance are paramount, these switching costs can be exceptionally high, potentially running into millions of dollars per supplier change.

Forward Integration Threat

Suppliers might leverage forward integration by starting their own industrial pipe manufacturing or offering welding services directly. This would diminish CW Group's need for their raw materials and increase market competition.

While the specialized and capital-intensive nature of industrial pipe production could deter many raw material suppliers from this path, the threat remains a factor in assessing supplier power.

- Forward Integration Threat: Suppliers could enter CW Group's business by manufacturing pipes or offering welding services.

- Impact on Demand: This would reduce demand for CW Group's raw materials and heighten competition.

- Barrier to Entry: High capital requirements and specialized knowledge in pipe manufacturing may limit the feasibility of forward integration for many suppliers.

- Industry Data: For instance, the global industrial pipe market was valued at approximately $150 billion in 2023, indicating significant investment needed for entry.

Importance of Supplier's Business

The significance of CW Group's business to its suppliers directly influences the bargaining power of those suppliers. If CW Group constitutes only a minor fraction of a supplier's overall sales, the supplier may have less incentive to offer competitive pricing or prioritize CW Group's specific requests. For instance, if a key component supplier derives 95% of its revenue from other major clients, CW Group's business, representing just 5%, carries less weight in negotiations.

Conversely, if CW Group is a substantial customer, accounting for a significant portion of a supplier's revenue, this naturally grants CW Group greater leverage in securing favorable terms. This customer concentration can shift the power dynamic, making suppliers more amenable to meeting CW Group's demands to retain a valuable business relationship. By 2025, with ongoing global supply chain recalibrations, the importance of being a key customer will likely be amplified.

Global supply chain trends, including the increasing focus on resilience and the potential for disruptions, also impact supplier dynamics. Manufacturers are prioritizing supply chain stability, and suppliers who can demonstrate reliability and capacity may command stronger bargaining positions. For example, reports in late 2024 indicated that companies with diversified sourcing strategies were better positioned to navigate material shortages, suggesting that suppliers with robust operations will hold more sway.

- Customer Dependence: Suppliers with a high percentage of revenue tied to CW Group will have less power.

- Supplier Market Share: If CW Group is a small customer for a supplier, the supplier's power increases.

- Supply Chain Resilience: Suppliers demonstrating strong resilience in 2025 may exert greater influence.

- Global Sourcing Trends: Diversified sourcing by CW Group can mitigate supplier bargaining power.

The bargaining power of suppliers for CW Group is a critical factor in its operational costs and profitability. This power is amplified when suppliers offer unique or specialized materials, have concentrated market share, or when CW Group faces high switching costs. Conversely, CW Group's own importance as a customer and its diversified sourcing strategies can temper this power.

In 2024, the global market for specialized alloys saw price volatility, with some key inputs experiencing increases of up to 20% due to supply chain pressures. Furthermore, consolidation within the welding consumables sector, where the top five players held over 60% market share in 2024, indicates a strong supplier position in that segment.

| Factor | Impact on CW Group | 2024/2025 Relevance |

|---|---|---|

| Material Uniqueness/Scarcity | Increased costs, potential production delays | High-grade steel alloy prices rose 15-20% in early 2024. |

| Supplier Concentration | Higher prices, less favorable terms | Top 5 welding consumable suppliers held >60% market share in 2024. |

| Switching Costs | Supplier lock-in, higher costs to change providers | Re-tooling/certification can cost millions in specialized industries. |

| CW Group's Customer Importance | Less leverage if CW Group is a small client | A key customer relationship can secure better terms by 2025. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CW Group's specific industry position.

Effortlessly identify and address competitive threats with a dynamic Porter's Five Forces analysis, enabling proactive strategy adjustments and mitigating market pressures.

Customers Bargaining Power

CW Group's customer base is primarily composed of large, established entities within critical industries such as oil and gas, petrochemicals, pharmaceuticals, and water treatment. These significant industrial and infrastructure clients frequently procure goods and services in substantial volumes, thereby wielding considerable bargaining power.

This concentration of high-volume purchasing allows these customers to exert pressure on CW Group, often leading to demands for reduced pricing, enhanced service levels, or specifically tailored product offerings. For instance, in 2024, major players in the energy sector, facing their own market pressures, were observed negotiating more aggressively on supply contracts for specialized equipment, impacting margins for their suppliers.

The criticality of industrial pipes and metalwork for infrastructure projects means customers often have a fundamental need for these products. However, CW Group's ability to differentiate its offerings significantly impacts customer bargaining power. If CW Group provides highly specialized, custom-engineered solutions, customers are less likely to switch due to the unique fit and performance, thereby reducing their leverage.

Conversely, when CW Group offers more standardized or commodity-like metalwork, customers gain more power. This is because they have a wider array of alternative suppliers to choose from, leading to increased price sensitivity and a greater ability to negotiate terms. For instance, in 2024, the global industrial pipes market was valued at approximately $120 billion, with a substantial portion comprising standardized products where competition is more intense.

Customer switching costs for CW Group can significantly influence their bargaining power. When it's difficult or expensive for a customer to move to a competitor, CW Group has more leverage.

For instance, if CW Group provides highly integrated systems or is involved in long-term infrastructure projects, the costs of switching could be substantial. This might involve technical re-specifications, lengthy re-certification procedures, or potential project delays, all of which increase the customer's cost of changing suppliers.

Conversely, for less specialized services or individual components where switching is simpler and cheaper, customers will likely have stronger negotiation power. For example, in 2024, the average cost for a business to switch cloud service providers, a potentially comparable scenario for integrated systems, ranged from $1,000 to $5,000, but could escalate to tens of thousands for complex migrations.

Price Sensitivity

Customers in sectors like oil and gas, and petrochemicals, are acutely aware of market fluctuations and their own cost pressures. This means they are highly sensitive to price changes, often seeking the most competitive offers available.

This heightened price sensitivity directly impacts CW Group, pushing the company to adopt competitive pricing strategies and offer more adaptable contract terms to secure business. The constant drive for efficiency and cost reduction within these industrial markets further intensifies customer demands for lower prices.

- Price Sensitivity in Industrial Sectors: Industries such as oil and gas and petrochemicals exhibit significant price sensitivity due to their inherent market volatility and cost pressures.

- Impact on CW Group: This sensitivity necessitates competitive pricing and flexible contract terms from CW Group to remain attractive to its customer base.

- Amplifying Factors: The ongoing industry-wide emphasis on operational efficiency and cost reduction further amplifies customer demands for lower pricing.

- Market Dynamics: In 2024, many industrial commodity prices saw considerable swings, reinforcing the need for suppliers like CW Group to offer stable and competitive pricing structures.

Backward Integration Threat

The threat of backward integration by customers for CW Group is a significant consideration. Large clients, particularly in sectors like oil & gas or water treatment, might explore producing their own specialized industrial pipes or performing metalwork internally if CW Group's pricing becomes uncompetitive or service levels decline. This is especially true for routine maintenance or specific project requirements where in-house capabilities could be cost-effective.

While setting up such manufacturing is capital-intensive, the underlying threat remains. For instance, if the average cost of specialized industrial pipes for a large infrastructure project exceeds a certain threshold, a customer might re-evaluate the economics of in-house production. However, the increasing demand for sophisticated water treatment technologies and complex oil & gas infrastructure projects in 2024 and beyond may actually lessen the incentive for customers to invest in backward integration. These advanced solutions often require specialized expertise and technology that are difficult and costly to replicate internally, making it more strategic for them to rely on specialized suppliers like CW Group.

- Customer Backward Integration Risk: Large customers may consider producing specialized industrial pipes or conducting metalwork in-house for routine maintenance or specific projects.

- Cost & Reliability Drivers: The threat is amplified if CW Group's offerings become too expensive or unreliable for its clients.

- Mitigating Factors: The growing demand for advanced water treatment and oil & gas infrastructure solutions in 2024 may reduce customer incentive for backward integration due to the complexity and capital required.

CW Group's customers, particularly those in high-volume sectors like oil and gas, possess significant bargaining power. This leverage stems from their ability to negotiate pricing, demand enhanced services, and seek tailored product offerings due to their substantial procurement volumes. The criticality of CW Group's products for infrastructure projects means customers have a fundamental need, but this is tempered by the availability of alternative suppliers for standardized items, increasing price sensitivity.

Customer switching costs also play a crucial role; high integration or involvement in long-term projects increases these costs, thereby reducing customer leverage. Conversely, simpler component switching favors customers. The threat of backward integration, where clients produce items internally, is a constant consideration, though the increasing complexity of modern industrial solutions may limit this for some.

| Factor | Impact on CW Group | 2024 Context |

|---|---|---|

| Customer Volume | High volume buyers exert greater negotiation power. | Major energy sector players negotiated aggressively on supply contracts. |

| Product Differentiation | Specialized solutions reduce customer leverage; standardized items increase it. | The industrial pipes market ($120 billion in 2024) includes many standardized products. |

| Switching Costs | High integration/project involvement increases costs for customers to switch. | Switching cloud providers (analogous to integrated systems) can cost $1,000-$5,000+, higher for complex migrations. |

| Price Sensitivity | Customers in volatile sectors demand competitive pricing. | Industrial commodity prices saw significant swings in 2024. |

| Backward Integration Threat | Clients may produce items in-house if CW Group's pricing is uncompetitive. | Complex infrastructure projects in 2024 may reduce this incentive due to high capital requirements. |

Full Version Awaits

CW Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the CW Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering no surprises or placeholders. This in-depth analysis is ready for immediate download and use, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the CW Group's industry.

Rivalry Among Competitors

The industrial pipe and metal fabrication sectors are showing robust expansion. The global pipe market is anticipated to hit USD 153.71 billion by 2025, with an expected compound annual growth rate of 5.01% extending to 2035. Metal fabrication services are also witnessing substantial growth, which can ease competitive intensity by creating more opportunities for everyone involved.

While the overall market is growing, certain segments might expand at different rates. This disparity in growth can actually intensify rivalry within the slower-growing niches as companies vie for a larger share of limited opportunities.

The specialized industrial pipes and metalwork sector is characterized by a diverse competitive landscape. This includes large, established global manufacturers alongside numerous smaller, agile regional specialists, creating a dynamic environment where both scale and niche expertise are valued.

Competition isn't confined to direct rivals; companies offering adjacent or overlapping capabilities also exert pressure, forcing businesses to constantly adapt and differentiate their offerings. For instance, while some firms focus solely on high-alloy pipe fabrication, others might integrate welding and machining services, broadening the competitive set.

The sheer number of players often fuels intense price competition and drives a rapid pace of innovation as companies strive to gain market share. In 2024, reports indicated that the global industrial pipes market saw an average of 5-7 significant new product launches per quarter, a testament to this competitive drive.

CW Group's competitive rivalry is significantly shaped by its ability to differentiate its specialized industrial pipes and metalwork. For instance, securing certifications like ISO 9001:2015 for quality management systems can set CW Group apart, especially when targeting industries with stringent requirements, such as the aerospace sector, where precision and reliability are paramount. This differentiation strategy aims to move beyond simple price competition.

When CW Group can offer unique value, such as advanced material science applications in its pipes or highly specialized fabrication techniques for complex metal structures, it directly counters the commoditization of its offerings. This is crucial in markets like renewable energy infrastructure, where specialized components are essential and less susceptible to direct price comparisons with standard offerings. This focus on unique capabilities helps mitigate the intensity of price wars.

High Fixed Costs and Exit Barriers

CW Group operates in an industry characterized by substantial fixed costs. The manufacturing of specialized industrial pipes and comprehensive metalwork services demands significant capital outlays for advanced machinery, cutting-edge technology, and a highly skilled workforce. For instance, a new, state-of-the-art pipe extrusion line can easily cost millions of dollars, representing a major fixed asset.

These high fixed costs create a strong incentive for companies like CW Group to maintain high production volumes to spread the costs over a larger output. This can lead to intense price competition, especially when market demand softens, as firms strive to cover their overhead. In 2024, many industrial manufacturers faced this challenge as global demand saw fluctuations.

- High Capital Investment: Setting up specialized pipe manufacturing requires millions in machinery and technology.

- Capacity Utilization Pressure: Firms push for high output to cover fixed costs, potentially leading to oversupply.

- Price Competition: When demand dips, companies may lower prices to keep factories running, intensifying rivalry.

- Exit Barriers: Specialized assets and long-term commitments make it difficult and costly for companies to leave the market, even if unprofitable.

Technological Advancements

The metal fabrication and welding sectors are seeing significant shifts due to new technologies like automation, robotics, and AI. Fiber laser technology, for instance, is enhancing precision and speed in cutting and welding processes.

Companies that embrace these innovations can achieve greater efficiency and lower operational costs, directly impacting their competitiveness. For example, the global industrial robotics market was valued at approximately $51.2 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards automation.

CW Group needs to actively invest in and integrate these advanced technologies to keep pace. Failing to do so risks falling behind competitors who are already leveraging these advancements to improve quality and reduce turnaround times, potentially impacting market share.

- Automation and Robotics Adoption: Increased use of automated welding cells and robotic arms can boost throughput by up to 30% in some applications.

- AI in Quality Control: AI-powered visual inspection systems can identify defects with greater accuracy than human inspectors, reducing rework rates.

- Fiber Laser Technology: These lasers offer faster cutting speeds and higher precision compared to traditional methods, leading to material savings and improved part quality.

CW Group faces intense competition from a broad spectrum of players, from global giants to specialized regional firms. This rivalry is amplified by high fixed costs and the pressure to maintain high production volumes, often leading to price-sensitive markets. Companies that can effectively differentiate through quality, certifications, or unique fabrication techniques, and those that embrace technological advancements like automation and AI, are better positioned to thrive.

| Competitive Factor | Impact on CW Group | 2024 Data/Trend |

| Number of Competitors | High, ranging from large multinationals to niche specialists, increasing rivalry. | The industrial pipe sector alone features over 100 significant global manufacturers. |

| Price Competition | Intensified by high fixed costs and capacity utilization pressure. | Reports in 2024 indicated a 5-10% average price reduction in some industrial metal segments due to oversupply. |

| Technological Adoption | Crucial for efficiency and quality differentiation. | The industrial robotics market saw a 15% year-over-year growth in 2024, with adoption rates accelerating in metal fabrication. |

| Product Differentiation | Key to moving beyond price wars and securing premium markets. | Companies with specialized certifications (e.g., AS9100 for aerospace) command up to 15% higher margins. |

SSubstitutes Threaten

While metal pipes remain dominant due to their superior strength and reliability, especially in demanding high-pressure and high-temperature applications, alternative materials are increasingly presenting a viable threat. Plastic pipes, for instance, are gaining traction owing to their cost-effectiveness, lighter weight, and inherent resistance to corrosion, making them attractive for various plumbing and infrastructure projects. In 2023, the global plastic pipes market was valued at approximately $70 billion and is projected to grow substantially.

Composite pipes also represent a significant substitute, offering exceptional durability and resistance to corrosion and chemicals, which is crucial for industries dealing with aggressive substances. These materials are finding broader adoption across sectors like oil and gas, and chemical processing. The market for composite pipes is also expanding, with forecasts indicating continued growth driven by their performance advantages in specialized environments.

Emerging technologies like additive manufacturing, or metal 3D printing, and advanced robotics pose a significant threat of substitution to traditional metalwork services. These innovations allow for rapid prototyping and the creation of intricate designs previously impossible with conventional methods. For instance, the global metal 3D printing market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially, indicating increasing adoption.

These new technologies offer compelling advantages such as reduced material waste, potentially lowering costs, and faster production cycles. For example, some studies suggest additive manufacturing can reduce material waste by up to 90% compared to subtractive methods. CW Group must closely monitor the development and market penetration of these substitutes to understand their impact on demand for its core services.

The threat of substitutes for CW Group hinges on how well alternatives perform and how much they cost. For instance, in demanding sectors like oil and gas or pharmaceuticals, where safety and reliability are paramount, substitutes must meet stringent performance standards, including durability and corrosion resistance. In 2024, while established materials continue to dominate, emerging composite technologies are showing promise in specific applications, though often at a higher initial price point.

Customer Switching Costs to Substitutes

Customers often face significant costs when switching from CW Group's offerings to substitute products or services. These can include expenses related to redesigning existing infrastructure, the re-certification of new materials, or the retraining of personnel to operate new systems. For instance, in the highly regulated water treatment sector, the cost and time involved in re-certifying a new chemical supplier can be substantial, creating a strong deterrent to switching.

These switching costs act as a crucial barrier, protecting CW Group from direct competitive pressure from substitutes. For example, a utility company might incur millions in compliance and testing if they were to switch from a CW Group water treatment solution to a competitor's offering, even if the competitor's unit price was slightly lower. This inertia is a key factor in maintaining customer loyalty.

CW Group can strategically leverage these customer switching costs. By fostering deeper customer relationships and providing integrated solutions that are difficult to replicate piecemeal, CW Group can further solidify its market position. This approach makes it economically and operationally challenging for customers to consider alternatives, thereby enhancing customer retention.

- Redesigning Infrastructure: Costs associated with modifying or replacing existing equipment to accommodate a substitute product.

- Re-certifying Materials: Expenses incurred in the process of validating and approving new components or substances for use, particularly in regulated industries.

- Personnel Training: Investment in educating staff on the operation and maintenance of new substitute products or services.

- Integrated Solutions: CW Group's strategy to bundle products and services, increasing the complexity and cost of switching to a competitor.

Regulatory and Sustainability Drivers

Increasing environmental regulations and a growing emphasis on sustainability are significant factors that could encourage the use of alternative materials or processes. For example, the metal fabrication industry is seeing a push towards eco-friendly coating solutions, and the water treatment sector is developing more sustainable systems. These shifts could favor substitutes that better align with these evolving environmental demands.

CW Group must proactively ensure its products and services meet these increasing sustainability requirements. Failure to adapt could expose the company to a higher risk of substitution as customers increasingly prioritize environmentally conscious options. By 2024, reports indicated a substantial rise in corporate sustainability commitments, with over 90% of S&P 500 companies now publishing sustainability reports, highlighting the market's direction.

- Environmental Regulations: Stricter emission standards and waste disposal laws can increase the cost of traditional manufacturing processes, making substitutes more attractive.

- Consumer Demand: A growing segment of consumers and business clients actively seek out products with a lower environmental impact, driving innovation in substitute offerings.

- Technological Advancements: Innovations in material science and process engineering are continually creating viable and often more efficient alternatives to existing solutions.

The threat of substitutes for CW Group is moderate, influenced by the performance, cost, and customer switching costs associated with alternatives. While traditional metal pipes remain strong, plastic and composite pipes are gaining ground due to their cost-effectiveness and durability. Emerging technologies like additive manufacturing also present a substitution threat, though high switching costs for customers currently mitigate this risk.

| Substitute Type | Key Advantages | Market Trend (2023-2024) | Potential Impact on CW Group |

|---|---|---|---|

| Plastic Pipes | Cost-effectiveness, lightweight, corrosion resistance | Growing adoption in plumbing and infrastructure; global market ~$70 billion in 2023 | Increased competition in less demanding applications |

| Composite Pipes | High durability, chemical resistance | Expanding use in oil & gas, chemical processing | Threat in specialized, high-performance sectors |

| Additive Manufacturing (Metal 3D Printing) | Rapid prototyping, intricate designs, reduced waste | Market valued at ~$3.5 billion in 2023, with significant growth projected | Potential disruption for custom metalwork services |

Entrants Threaten

The manufacturing of specialized industrial pipes and comprehensive metalwork services necessitates a considerable outlay of capital for machinery, cutting-edge technology, and robust facilities. This significant financial hurdle acts as a potent deterrent for many prospective new competitors looking to enter the market.

Establishing advanced manufacturing plants, particularly those geared towards producing corrosion-resistant steel pipes or undertaking high-precision welding, requires substantial financial commitment. For instance, a state-of-the-art facility for producing specialized alloys could easily cost tens of millions of dollars in initial setup and ongoing technological upgrades, making it a challenging proposition for smaller players.

Success in CW Group's core markets, such as oil and gas, petrochemicals, and pharmaceuticals, hinges on highly specialized technical expertise and advanced manufacturing capabilities. New entrants face a significant hurdle in acquiring or developing this deep technical knowledge and the necessary skilled labor, which is a substantial barrier to entry.

The demand for skilled metal fabrication professionals, including certified welders and CNC machinists, remains robust. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 5% growth for welders, cutters, solderers, and brazers between 2022 and 2032, indicating a continued need for these specialized skills.

CW Group operates in sectors like pharmaceuticals, oil and gas, and water treatment, all of which are heavily regulated. New companies wanting to enter these markets must navigate a complex web of compliance requirements and obtain specific certifications. For instance, in the pharmaceutical sector, the U.S. Food and Drug Administration (FDA) approval process alone can take years and cost millions.

These stringent regulatory hurdles and the need for extensive product certifications and operational licenses significantly increase the upfront investment and time-to-market for potential new entrants. Demonstrating adherence to rigorous quality and safety standards, such as ISO certifications or specific environmental permits, is a substantial barrier. This makes it difficult and costly for newcomers to compete with established players like CW Group, who have already met these requirements.

Economies of Scale and Established Relationships

Economies of scale significantly deter new entrants for CW Group. Established players leverage their size for lower per-unit costs in manufacturing and sourcing, a level difficult for newcomers to match quickly. For instance, in 2024, major infrastructure suppliers often operate with production capacities that allow for substantial cost advantages, making it challenging for smaller, newer firms to compete on price.

Long-standing relationships with major clients in essential industries represent another formidable barrier. These established ties, built over years, often involve complex integration, trust, and specialized service agreements that are hard for new entrants to replicate. CW Group's deep connections within sectors like energy and utilities, solidified through consistent performance and tailored solutions, create a loyalty that new competitors must overcome.

- Economies of Scale: CW Group benefits from cost efficiencies in production and procurement, making it harder for new entrants to offer competitive pricing.

- Established Relationships: Long-term partnerships with key clients in critical infrastructure sectors create significant switching costs and loyalty.

- Market Penetration Difficulty: Newcomers face substantial hurdles in achieving the operational scale and client trust that CW Group already possesses.

Access to Distribution Channels and Raw Materials

Securing reliable access to specialized raw materials and establishing efficient distribution channels are critical hurdles for new entrants in the CW Group's industry. Existing players often benefit from established supply chain networks and long-term agreements with key suppliers, giving them a significant advantage. For instance, in 2024, many manufacturers reported increased lead times and price volatility for essential components, highlighting the difficulty for newcomers to secure consistent, cost-effective inputs.

New entrants would face substantial challenges in replicating these established relationships and securing the necessary volume of specialized raw materials at competitive prices. Furthermore, building out robust distribution networks to reach diverse customer bases across various industrial sectors requires significant capital investment and time. This can create a substantial barrier, as established companies already possess the infrastructure and market penetration needed to serve their clients efficiently.

- Supplier Relationships: Existing CW Group competitors have cultivated long-standing relationships with raw material suppliers, often securing preferential pricing and guaranteed supply.

- Distribution Networks: Established players have developed extensive logistics and distribution systems, enabling them to reach a wide customer base efficiently and cost-effectively.

- Economies of Scale: Larger, established companies can leverage economies of scale in both procurement of raw materials and distribution, further disadvantaging smaller new entrants.

- Market Access: Gaining access to key industrial sectors and securing contracts can be difficult without a proven track record and established brand recognition.

The threat of new entrants for CW Group is generally low due to significant capital requirements, specialized expertise, and regulatory hurdles. Building advanced manufacturing facilities for specialized pipes, for example, can cost tens of millions of dollars, a substantial barrier for potential competitors. Furthermore, the need for deep technical knowledge and skilled labor, such as certified welders, adds another layer of difficulty, with demand for these roles remaining strong in 2024.

Stringent regulations in sectors like pharmaceuticals and oil and gas, requiring extensive certifications and compliance, also deter new companies. For instance, FDA approval processes can be lengthy and costly. Economies of scale enjoyed by established players like CW Group, coupled with long-standing client relationships, create further challenges for newcomers aiming to compete on price and trust.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of advanced machinery and facilities. | Significant financial barrier. |

| Technical Expertise | Need for specialized knowledge and skilled labor. | Difficult to acquire or develop quickly. |

| Regulatory Compliance | Navigating complex rules and obtaining certifications. | Increases upfront investment and time-to-market. |

| Economies of Scale | Lower per-unit costs for established players. | Challenging to match pricing. |

| Customer Relationships | Established trust and loyalty with key clients. | Difficult for new entrants to replicate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, reputable industry research reports, and economic databases. This comprehensive approach ensures a thorough understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.