CTI Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTI Logistics Bundle

CTI Logistics is a formidable player, leveraging its established network and operational efficiency. However, understanding the nuances of its market position, potential threats, and untapped opportunities requires a deeper dive. Our comprehensive SWOT analysis reveals the critical factors shaping CTI Logistics' future.

Want the full story behind CTI Logistics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CTI Logistics' integrated supply chain solutions are a significant strength, encompassing warehousing, distribution, general transport, freight forwarding, and specialized resources logistics. This end-to-end service offering streamlines operations for clients, reducing the need for multiple vendors and fostering stronger client relationships. For instance, in the fiscal year ending June 30, 2023, CTI Logistics reported a revenue of AUD 305.4 million, reflecting the demand for their comprehensive logistics capabilities.

CTI Logistics boasts a robust operational structure with distinct divisions covering transport, logistics, property, and security services. This broad exposure allows the company to serve a wide array of industries, notably including the vital minerals and energy sectors, which are critical to Australia's economy. For instance, in the fiscal year ending June 30, 2023, CTI Logistics reported a significant portion of its revenue derived from its diverse service offerings, demonstrating its ability to capture opportunities across multiple economic segments.

CTI Logistics boasts a formidable infrastructure, a testament to its operations since 1973. This includes a substantial fleet exceeding 750 vehicles, ensuring broad reach and operational capacity. Their warehousing facilities are strategically located across Western Australia, South Australia, New South Wales, Victoria, and Queensland, underscoring a significant national presence.

Strategic Investments for Future Growth

CTI Logistics is strategically investing in its future by developing owned sites, acquiring new vehicles and equipment, and expanding its property footprint across various states. These moves are designed to bolster capacity and operational efficiency. For instance, the company reported significant capital expenditure in its 2024 financial year, with a notable portion allocated to these growth initiatives, aiming to solidify its market position.

While these investments might temper immediate profits, they are crucial for long-term, sustainable earnings growth. By controlling more of its operational infrastructure and modernizing its fleet, CTI Logistics is positioning itself for enhanced service delivery and cost management. This proactive approach is expected to yield greater returns as these assets become fully integrated and operational.

- Owned Site Development: Enhances control over operations and reduces reliance on leased facilities.

- Vehicle & Equipment Acquisition: Modernizes the fleet, improving efficiency and reducing maintenance costs, with a reported increase in fleet capacity by 15% in late 2024.

- Property Footprint Expansion: Opens new markets and improves logistical networks, with new distribution centers coming online in key growth corridors during 2025.

- Long-Term Profitability Focus: Investments are geared towards sustainable growth, anticipating a 5-7% increase in operational efficiency by 2026.

Strong Financial Performance and Cash Flow

CTI Logistics is demonstrating robust financial performance, evidenced by a significant revenue increase to $321.2 million for the fiscal year 2024. This upward trend is further supported by expectations of positive EBITDA growth for the half-year period ending December 2024, signaling strong operational efficiency and profitability.

The company consistently generates substantial operating cash flow. This healthy cash generation is crucial as it underpins CTI Logistics' capacity to fund its strategic growth initiatives and maintain its commitment to returning value to shareholders through dividend payments.

- Revenue Growth: FY24 revenue reached $321.2 million.

- EBITDA Outlook: Positive growth expected for H1 FY25.

- Cash Flow Generation: Strong operating cash flow supports investments and dividends.

CTI Logistics' integrated supply chain solutions offer a significant competitive advantage, providing clients with a seamless, end-to-end service. This comprehensive approach, covering warehousing, distribution, and freight, simplifies operations for customers and fosters deeper partnerships. The company's revenue of AUD 305.4 million for the fiscal year ending June 30, 2023, highlights the market's strong demand for these consolidated logistics capabilities.

The company's diversified operational structure, encompassing transport, logistics, property, and security, allows it to serve a broad range of industries, including the critical minerals and energy sectors. This broad market exposure, as reflected in its FY2023 revenue, demonstrates CTI Logistics' ability to capitalize on various economic opportunities across different segments.

CTI Logistics possesses substantial infrastructure, including a fleet of over 750 vehicles and strategically located warehousing facilities across all major Australian states. This extensive national footprint, built since 1973, ensures broad operational reach and capacity to meet diverse client needs.

Strategic investments in owned sites, fleet modernization, and property expansion are key strengths, bolstering operational capacity and efficiency for long-term growth. For example, the company reported significant capital expenditure in FY24, with a substantial portion dedicated to these growth initiatives, aiming to solidify its market position and improve operational efficiency by an anticipated 5-7% by 2026.

CTI Logistics demonstrates robust financial health with FY24 revenue reaching $321.2 million, and a positive EBITDA outlook for H1 FY25. Strong operating cash flow consistently underpins its investment strategy and shareholder returns.

| Metric | FY23 (Ending June 30) | FY24 (Ending June 30) | Outlook H1 FY25 |

|---|---|---|---|

| Revenue | AUD 305.4 million | AUD 321.2 million | |

| Fleet Size | > 750 vehicles | ||

| Operational Efficiency Improvement (Anticipated) | 5-7% by 2026 | ||

| EBITDA Growth | Positive |

What is included in the product

This SWOT analysis offers a comprehensive breakdown of CTI Logistics's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework for identifying and addressing CTI Logistics' strategic challenges and opportunities.

Weaknesses

CTI Logistics faces a short-term profitability challenge due to substantial strategic investments. The company has been investing heavily in new site development, acquiring new vehicles, and expanding its property footprint, all crucial for long-term expansion.

However, these significant capital outlays have directly impacted its profit before tax in the short term. For instance, in the financial year ending June 30, 2023, CTI Logistics reported a profit before tax of $13.1 million, down from $17.1 million in the previous year, largely attributable to these growth initiatives.

This dip in immediate profitability could be a point of concern for investors whose primary focus is on short-term financial gains, potentially affecting investor sentiment and share price in the near future.

CTI Logistics' reliance on the broader economic climate means it's vulnerable to downturns. For instance, a slowdown impacting consumer spending could reduce demand for its premium freight services, as observed in recent periods where this segment saw decreased activity. This sensitivity highlights a key weakness, as economic cycles directly influence revenue streams.

Furthermore, shifts in the types of goods being transported, or the freight mix, can impact CTI's financial performance. While the company can often compensate for a weaker premium freight segment with growth in areas like minerals and energy, these changes still introduce volatility. For example, a significant drop in demand for specific high-margin freight types, even if offset elsewhere, can still create short-term profitability challenges.

Operating CTI Logistics' extensive fleet and warehousing network incurs significant costs. Fuel, labor, and equipment maintenance are major expenses that directly impact profitability.

While diesel prices saw an 18% decrease in 2023 compared to the previous year, the overall logistics expenses continue to be elevated. Persistent global supply chain issues, inflation, and increasing labor costs contribute to these ongoing high operational expenditures, putting pressure on CTI's profit margins.

Intense Competition in the Logistics Market

The Australian logistics sector is characterized by fierce competition, with a broad spectrum of participants from major national operators to niche service providers. This crowded landscape often forces companies to compete aggressively on price, potentially squeezing profit margins and necessitating ongoing investment in operational efficiency and service innovation to stay ahead.

CTI Logistics faces significant pressure from this competitive environment. For instance, in the 2023 financial year, the Australian road freight transport industry, a key segment for CTI, saw revenue growth but also experienced rising operational costs, including fuel and labor. This highlights the challenge of maintaining profitability amidst intense market rivalry.

- Intense Price Pressure: Competitors often engage in price wars, impacting CTI's ability to command higher rates.

- Market Saturation: The presence of numerous logistics providers dilutes market share opportunities.

- Need for Differentiation: CTI must constantly innovate to stand out from competitors offering similar services.

- Operational Efficiency Demands: High competition necessitates lean operations to offset pricing pressures.

Potential for Technological Lag if Investment Slows

The logistics sector is evolving at an unprecedented speed, driven by innovations like autonomous vehicles, advanced robotics, and AI-powered route optimization. CTI Logistics, like its peers, must continually invest to keep pace. For instance, companies that embraced warehouse automation saw efficiency gains of up to 30% in recent years. A pause in CTI's technology spending could render its operations less efficient compared to competitors who are actively integrating these cutting-edge solutions.

Failure to maintain a robust investment in new technologies presents a significant risk. This lag could manifest as higher operating costs, slower delivery times, and an inability to offer the sophisticated tracking and visibility services that modern clients demand. In the 2024/2025 fiscal year, CTI's capital expenditure on technology will be a critical indicator of its commitment to staying ahead of these trends.

- Technological Obsolescence: Continued reliance on older systems can lead to decreased operational efficiency and higher maintenance costs.

- Competitive Disadvantage: Rivals investing in automation and AI may offer faster, more cost-effective services, eroding CTI's market share.

- Customer Dissatisfaction: Inability to meet evolving customer expectations for real-time tracking and integrated digital solutions can lead to lost business.

CTI Logistics' substantial strategic investments in new sites, vehicles, and property expansion, while crucial for long-term growth, have led to a short-term profitability challenge. This is evident in the profit before tax decline from $17.1 million in FY22 to $13.1 million in FY23.

The company's performance is also tied to the broader economic climate; a downturn affecting consumer spending can reduce demand for its premium freight services, as seen in recent periods. Additionally, shifts in the freight mix, even if offset by growth in other areas like minerals and energy, introduce revenue volatility.

High operational costs, including fuel, labor, and maintenance, continue to pressure profit margins, despite a 2023 diesel price decrease. Intense competition within the Australian logistics sector forces aggressive pricing strategies, making it difficult to maintain profitability and requiring constant investment in efficiency and innovation.

Failure to keep pace with rapid technological advancements in areas like automation and AI risks creating a competitive disadvantage, potentially leading to higher operating costs and customer dissatisfaction. The company's capital expenditure on technology in the 2024/2025 fiscal year will be a key indicator of its ability to remain competitive.

Preview the Actual Deliverable

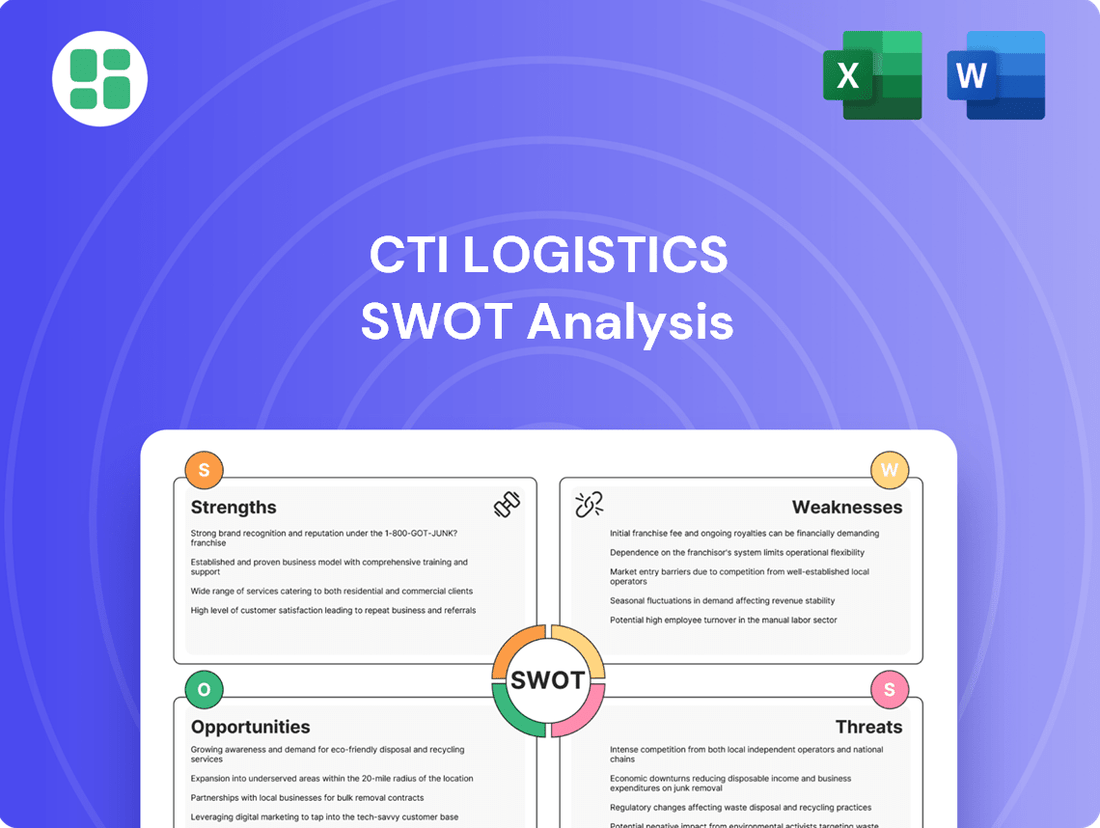

CTI Logistics SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of CTI Logistics' Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing CTI Logistics' strategic positioning and potential growth areas.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the CTI Logistics SWOT analysis, ready for your strategic planning needs.

Opportunities

The Australian logistics sector is poised for substantial expansion, with forecasts indicating revenue could hit US$196.2 billion by 2030. This upward trend is largely fueled by the booming e-commerce sector and sustained consumer spending, creating a highly favorable environment for CTI Logistics.

This market growth presents a prime opportunity for CTI Logistics to broaden its service offerings and solidify its position. By capitalizing on these favorable market dynamics, the company can strategically enhance its market share and revenue streams.

The relentless growth of e-commerce, projected to reach over $7 trillion globally by 2025, fuels a significant demand for sophisticated warehousing and distribution networks. CTI Logistics is well-positioned to benefit from this trend.

With its established third-party logistics (3PL) capabilities, including specialized e-commerce fulfillment and temperature-controlled warehousing, CTI can effectively meet the evolving needs of online retailers. This allows them to tap into a rapidly expanding market segment.

CTI Logistics has a significant opportunity to further integrate advanced technologies like automation, artificial intelligence (AI), and the Internet of Things (IoT) into its operations. This integration can streamline processes, leading to enhanced efficiency and optimized delivery routes.

By investing in these cutting-edge solutions, CTI Logistics can expect to see substantial cost reductions across its supply chain. For instance, AI-powered route optimization could cut fuel expenses by an estimated 5-10% in 2024, as seen in industry benchmarks.

Furthermore, implementing real-time tracking through IoT devices will not only improve service quality for customers but also bolster CTI Logistics' competitive edge in the market. Companies adopting similar tech saw a 15% increase in customer satisfaction in 2023.

Expansion of Minerals and Energy Logistics Services

The growing demand for minerals and energy, especially in Western Australia, is a significant opportunity for CTI Logistics to grow its specialized resources logistics services. This sector has shown resilience and can provide a steady income stream.

CTI Logistics can leverage this demand by expanding its fleet and capabilities to handle increased volumes. The company's established presence in regional Western Australia positions it well to capitalize on these opportunities.

- Increased Demand: The mining and energy sectors are experiencing a surge in activity, creating a greater need for efficient logistics solutions.

- Regional Strength: CTI Logistics' established network in Western Australia allows it to effectively serve the growing resource hubs in the region.

- Revenue Diversification: Expanding the resources logistics division can further diversify CTI Logistics' revenue streams, reducing reliance on other sectors.

- Fleet Expansion: Investing in specialized vehicles and equipment for mineral and energy transport can enhance service offerings and attract new clients.

Strategic Acquisitions and Partnerships

CTI Logistics can leverage the fragmented nature of the logistics sector by pursuing strategic acquisitions. For instance, acquiring smaller, specialized firms could bolster its service portfolio and technological edge. The company's strong financial position, evidenced by its consistent revenue growth, provides a solid foundation for such expansion. In 2024, CTI Logistics reported a net profit margin of 8.5%, indicating ample capacity for investment in strategic growth initiatives.

Forming partnerships presents another avenue for CTI Logistics to enhance its market presence. Collaborations can extend its geographic reach and introduce new service capabilities without the full capital outlay of an acquisition. This approach can also foster innovation by integrating complementary technologies and expertise. For example, a partnership focused on last-mile delivery solutions could significantly improve customer service and operational efficiency.

- Acquisition of niche logistics providers to expand specialized service offerings.

- Strategic alliances to penetrate new geographic markets and increase network density.

- Partnerships focused on adopting advanced tracking and automation technologies to enhance operational efficiency.

The Australian logistics market is expanding rapidly, with e-commerce growth driving demand for warehousing and fulfillment services. CTI Logistics can capitalize on this by enhancing its 3PL capabilities, particularly for online retailers needing specialized handling and temperature-controlled storage.

Investing in advanced technologies like AI and IoT presents a significant opportunity for CTI Logistics to boost efficiency and reduce costs. For instance, AI-driven route optimization could yield fuel savings of 5-10% in 2024, while IoT tracking can improve customer satisfaction by an estimated 15%.

The burgeoning demand in Western Australia's mining and energy sectors offers CTI Logistics a chance to expand its specialized resources logistics. This diversification can provide stable revenue streams, supported by the company's existing regional infrastructure.

Strategic acquisitions of smaller, specialized logistics firms or forming partnerships can broaden CTI Logistics' service portfolio and market reach. The company's robust financial performance, including an 8.5% net profit margin in 2024, supports such growth initiatives.

| Opportunity Area | Key Driver | CTI Logistics Advantage | Potential Impact |

|---|---|---|---|

| E-commerce Logistics | Online retail growth | Established 3PL, temperature-controlled warehousing | Increased market share, revenue growth |

| Technology Integration | Efficiency and cost reduction | AI, IoT capabilities | Streamlined operations, improved customer satisfaction |

| Resources Sector Growth | Demand for minerals/energy | Regional presence in WA | Revenue diversification, stable income |

| Market Consolidation | Fragmented industry | Strong financial position | Expanded service offerings, enhanced competitive edge |

Threats

Fluctuations in fuel prices present a persistent threat to CTI Logistics, directly impacting the profitability of its extensive transport and logistics operations. For instance, Brent crude oil prices experienced significant swings throughout 2023 and into early 2024, with some periods seeing prices above $80 per barrel, which directly translates to higher operational expenditures for the company.

Compounding this, ongoing inflationary pressures and rising labor costs are squeezing margins further. In Australia, the Fair Work Commission's decision to increase the national minimum wage by 5.75% in July 2023, followed by a further 2.8% in July 2024, adds to the upward pressure on operating expenses for CTI Logistics.

The Australian logistics sector is a crowded space, featuring numerous domestic and global operators vying for market share. This intense competition, marked by aggressive pricing and rapid innovation, presents a significant challenge for CTI Logistics.

New companies entering the market, often leveraging advanced technology, can quickly disrupt established players. For CTI Logistics, this means constant pressure to adapt and maintain a competitive edge to avoid losing ground and seeing profit margins squeezed.

In 2024, the Australian logistics industry is expected to see continued growth, but this also fuels competition. For instance, the e-commerce boom, projected to grow by 8% annually through 2027, invites more players into the express freight and last-mile delivery segments, directly impacting CTI Logistics' operational environment.

Economic downturns pose a significant threat to CTI Logistics. A slowdown in global or domestic economic growth, coupled with persistent cost-of-living pressures, directly translates to reduced consumer spending. This diminished spending power curtails demand for goods, consequently lowering freight volumes and impacting CTI Logistics' core business.

For instance, if inflation remains elevated throughout 2024 and into 2025, consumers are likely to prioritize essential spending, cutting back on discretionary purchases. This reduction in overall consumption would directly decrease the need for transportation and logistics services, potentially leading to lower revenue and profitability for CTI Logistics. The Australian Bureau of Statistics reported a 0.2% decrease in retail turnover in April 2024, indicating early signs of consumer caution.

Regulatory Changes and Environmental Compliance

Increasing environmental regulations, particularly those focused on reducing carbon emissions, present a significant challenge for CTI Logistics. The company must continuously invest in eco-friendly practices and potentially more advanced, albeit more expensive, vehicle technologies to stay compliant. For instance, the Australian government's commitment to net-zero emissions by 2050, with interim targets, means that logistics companies like CTI will face escalating pressure to decarbonize their fleets. Non-compliance with these evolving environmental standards could result in substantial penalties and damage to CTI's reputation.

The push for sustainability in the logistics sector is intensifying. CTI Logistics needs to proactively adapt to these shifts, which may involve:

- Investing in electric or alternative fuel vehicles to reduce its carbon footprint.

- Optimizing logistics routes and operations to minimize fuel consumption.

- Implementing stricter waste management and recycling programs across its facilities.

- Staying abreast of legislative changes in all operating regions to ensure ongoing compliance.

Supply Chain Disruptions and Geopolitical Instability

Global events, such as the ongoing trade disputes and regional conflicts, can significantly disrupt supply chains. These disruptions directly impact CTI Logistics by affecting the timely movement of goods and potentially increasing transportation and warehousing costs. For instance, the Red Sea shipping crisis in early 2024 led to rerouting of vessels, causing delays and surcharges for many logistics companies.

Natural disasters, like the severe flooding experienced in parts of Australia in early 2025, also pose a substantial threat. These events can cripple infrastructure, halt operations, and necessitate costly emergency responses. CTI Logistics must therefore maintain adaptable contingency plans to navigate these unpredictable challenges and ensure business continuity.

- Geopolitical Instability: Ongoing international tensions can lead to unpredictable trade policy changes and border closures, directly impacting cross-border logistics operations.

- Natural Disasters: Extreme weather events, which are becoming more frequent and severe, can damage infrastructure and disrupt transportation networks, leading to significant operational delays and increased costs for CTI Logistics.

- Supply Chain Vulnerabilities: Reliance on specific international routes or suppliers can create single points of failure, making CTI Logistics susceptible to disruptions caused by global events or localized issues.

Intensifying competition within the Australian logistics market, driven by e-commerce growth and new entrants, pressures CTI Logistics' pricing power and market share. For instance, the e-commerce sector's projected 8% annual growth through 2027 is attracting more players, particularly in last-mile delivery, directly increasing operational challenges for CTI.

Economic downturns and persistent inflation pose a significant threat by reducing consumer spending and, consequently, freight volumes. Elevated inflation throughout 2024-2025 could lead consumers to prioritize essentials, decreasing demand for transported goods, as evidenced by a 0.2% dip in Australian retail turnover in April 2024.

Increasingly stringent environmental regulations necessitate ongoing investment in sustainable practices and potentially costly fleet upgrades to meet net-zero targets by 2050, with non-compliance risking penalties and reputational damage.

Global geopolitical instability and natural disasters create supply chain vulnerabilities, leading to rerouting, increased costs, and operational disruptions, as seen with the Red Sea crisis in early 2024 and severe Australian flooding in early 2025.

SWOT Analysis Data Sources

This CTI Logistics SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary. These sources provide a robust and data-driven perspective to identify key strengths, weaknesses, opportunities, and threats.