CTI Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTI Logistics Bundle

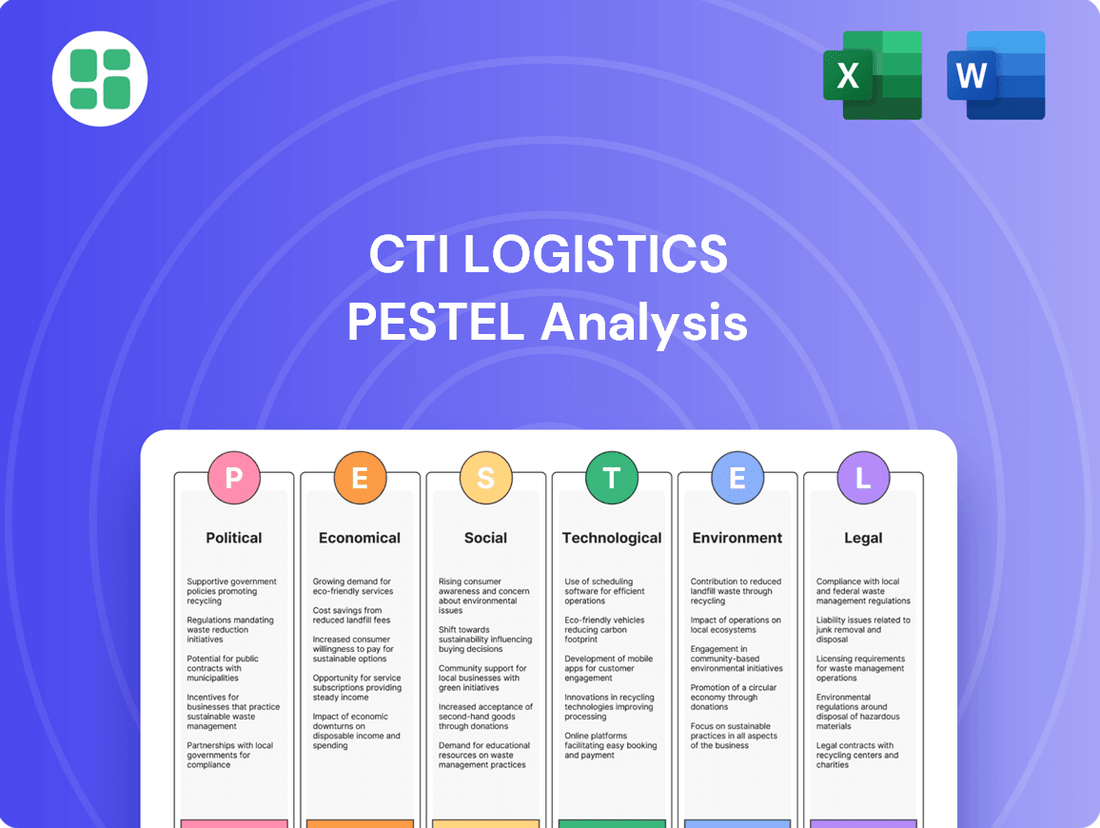

Navigate the complex external landscape impacting CTI Logistics with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the company's operational environment. This ready-to-use analysis provides critical insights for strategic planning and competitive advantage. Download the full version now to unlock actionable intelligence and make informed decisions.

Political factors

Government investment in transport infrastructure directly impacts CTI Logistics' operational efficiency and expansion. Significant spending on projects like the Heavy Vehicle Road Reform (HVRR) from 2024 aims to improve road networks, potentially reducing transit times and operational costs.

Changes in international trade policies significantly impact CTI Logistics by altering freight volumes and preferred routes. For example, the Australia-India Economic Cooperation and Trade Agreement (ECTA), which came into effect in late 2022, is projected to boost bilateral trade, potentially creating new opportunities for freight forwarders like CTI. Australia's exports to India were valued at AUD 14.5 billion in 2022-23, and this agreement aims to further expand those figures.

CTI Logistics faces a dynamic regulatory landscape in Australia. The stringency and complexity of transport and logistics regulations, covering road use, safety, and cross-border movements, directly impact the company's compliance burden and operational expenses. For instance, ongoing updates to the Australian Dangerous Goods (ADG) Code necessitate continuous adaptation.

New legislation, such as the anticipated Transport Security Amendment (Security of Australia's Transport Sector) Bill 2024, will further shape operational requirements. These legislative changes often demand investment in new training, technology, and process adjustments to ensure full compliance, potentially affecting CTI's cost structure and service delivery timelines.

Labor Laws and Industrial Relations

Government legislation significantly shapes labor dynamics for CTI Logistics. New laws, like the Fair Work Legislation Amendment (Closing Loopholes No 2) Bill 2024, which took effect in July 2024, directly impact how transport and logistics companies manage their workforce. These changes can alter operational costs and employment strategies.

The Closing Loopholes No 2 Bill introduced specific regulations for 'regulated workers' in the road transport sector. This means CTI Logistics must adapt its employment practices to comply with updated rules regarding minimum wages, working conditions, and contractor classifications. Such adjustments are crucial for maintaining compliance and managing labor expenses effectively.

- New legislation impacts road transport workers' classifications and entitlements.

- Compliance with updated labor laws can affect CTI Logistics' operational costs.

- Changes may necessitate adjustments in employment contracts and wage structures.

Geopolitical Stability and Supply Chain Resilience

Global and regional geopolitical stability directly impacts the predictability of supply chains, a critical factor for CTI Logistics in delivering integrated solutions. Unforeseen conflicts or trade disputes can disrupt shipping routes and increase operational costs. For instance, ongoing geopolitical tensions in the Asia-Pacific region continue to pose risks to maritime trade, a significant component of global logistics.

The Australian logistics sector, including companies like CTI Logistics, is increasingly prioritizing supply chain resilience. This focus is driven by a combination of geopolitical risks, the escalating impacts of climate change, and the potential for natural disasters. Building robust supply chains involves diversifying sourcing locations and investing in stronger infrastructure to mitigate potential disruptions. By 2025, this strategic shift is expected to be a defining characteristic of the industry’s adaptation to an uncertain global environment.

- Geopolitical Stability: Fluctuations in global political landscapes directly affect international trade flows and transportation costs, influencing CTI Logistics' operational efficiency.

- Supply Chain Diversification: Australian logistics firms are actively seeking to diversify their sourcing and transport networks to reduce reliance on single points of failure, a trend expected to accelerate towards 2025.

- Climate Change Impact: The increasing frequency and intensity of extreme weather events necessitate investments in climate-resilient infrastructure and contingency planning within the logistics sector.

Government investment in transport infrastructure, such as the Heavy Vehicle Road Reform (HVRR) initiated in 2024, directly enhances CTI Logistics' operational efficiency by improving road networks. Changes in international trade policies, like the Australia-India ECTA effective late 2022, are projected to boost bilateral trade, potentially increasing freight volumes for CTI, with Australia's exports to India reaching AUD 14.5 billion in 2022-23.

The regulatory environment presents ongoing compliance challenges for CTI Logistics, with updates to codes like the Australian Dangerous Goods (ADG) Code impacting operational expenses. Furthermore, new legislation, including the Transport Security Amendment (Security of Australia's Transport Sector) Bill 2024, necessitates investment in technology and process adjustments.

Labor laws, such as the Fair Work Legislation Amendment (Closing Loopholes No 2) Bill 2024 effective July 2024, directly influence CTI Logistics' workforce management and operational costs by introducing new regulations for 'regulated workers' in the road transport sector.

Geopolitical stability directly impacts supply chain predictability, with ongoing tensions in the Asia-Pacific region posing risks to maritime trade. By 2025, the logistics sector, including CTI, is expected to prioritize supply chain resilience through diversification and infrastructure investment to mitigate disruptions from geopolitical risks and climate change.

What is included in the product

This CTI Logistics PESTLE analysis examines the critical external forces impacting the company's operations and strategic direction across Political, Economic, Social, Technological, Environmental, and Legal domains.

It provides a comprehensive overview of how these macro-environmental factors present both challenges and opportunities for CTI Logistics, enabling informed strategic decision-making.

A concise, actionable summary of CTI Logistics' PESTLE analysis, providing immediate clarity on external factors impacting operations and strategic decision-making.

Economic factors

Australia's economic growth trajectory significantly impacts CTI Logistics. A forecasted slowdown to 1.2% in FY2025, with only modest improvement anticipated for FY2026, signals a potentially subdued demand for logistics services. This economic environment suggests that businesses like CTI may face continued cost pressures and a more uncertain market landscape.

Consumer spending patterns are intrinsically linked to economic health and, consequently, to the demand for logistics. When economic growth falters, consumers tend to reduce discretionary spending, which can dampen the volume of goods requiring warehousing, distribution, and freight services. This directly affects CTI's operational capacity and revenue streams.

Inflationary pressures continue to be a significant concern for CTI Logistics, impacting profitability through increased fuel, labor, and operational expenses. While diesel prices experienced a decline from their 2023 peaks, the broader logistics sector still grapples with elevated costs. For instance, global inflation and persistent supply chain issues, coupled with a tight labor market, kept overall logistics expenses high throughout 2024.

These persistent cost pressures necessitate proactive margin improvement strategies for CTI Logistics. Businesses in the logistics sector are increasingly focused on optimizing routes, enhancing fuel efficiency, and negotiating better terms with suppliers to mitigate the impact of rising operational expenditures. The need to adapt to these economic realities is paramount for maintaining competitive pricing and profitability.

Fluctuations in interest rates directly affect CTI Logistics' borrowing costs. For example, if the Reserve Bank of Australia (RBA) raises its cash rate, CTI's loans for fleet upgrades or new technology become more expensive. This can slow down investment in crucial areas like electric vehicles or advanced tracking systems, impacting long-term efficiency and sustainability goals.

Higher interest rates in 2024 and early 2025 could make capital expenditure decisions more challenging for CTI. For instance, a 1% increase in interest rates on a $50 million investment could add $500,000 annually to financing costs. This increased expense might lead CTI to delay or scale back investments in future-proof assets, potentially affecting its competitive edge.

E-commerce Growth and Demand for Last-Mile Delivery

The burgeoning e-commerce landscape is a primary driver for the logistics sector, particularly for last-mile delivery services. As online shopping becomes more ingrained in consumer habits, the need for efficient and speedy delivery to the customer's doorstep intensifies.

Australia's e-commerce market is projected to experience robust growth, with an estimated increase of 10.3% in 2024. This surge directly translates into heightened demand for sophisticated logistics operations that can meet evolving consumer expectations for speed and flexibility.

Logistics providers like CTI Logistics must therefore adapt to these market dynamics by:

- Investing in technology: To optimize delivery routes and improve tracking capabilities.

- Expanding urban infrastructure: Establishing more urban distribution centers to facilitate quicker last-mile handoffs.

- Offering diversified delivery options: Catering to customer preferences for same-day or scheduled deliveries.

- Enhancing operational efficiency: Streamlining processes to reduce delivery times and costs in a competitive market.

Industry Competition and Profit Margins

The Australian logistics sector is highly competitive, which directly impacts CTI Logistics' ability to maintain healthy profit margins. Intense rivalry means that companies often have to keep prices low to attract and retain customers.

For example, the road freight forwarding industry, a key segment for CTI Logistics, operates with notoriously thin profit margins. Data from 2024 indicates that average profit margins in this specific sector hover around a mere 3.9%. This low margin environment means that even small shifts in operational costs or pricing can significantly affect profitability.

The pressure to remain competitive can lead to several outcomes:

- Price Wars: Competitors may engage in aggressive pricing strategies to gain market share, squeezing margins for all players.

- Increased Operational Costs: To differentiate or maintain service levels, companies might invest more in technology or infrastructure, further pressuring margins if not offset by efficiency gains.

- Consolidation: The challenging margin environment can drive consolidation within the industry as smaller, less efficient players are acquired or exit the market.

Australia's economic outlook for FY2025 suggests a subdued growth rate of 1.2%, with only a slight improvement expected in FY2026. This slower economic pace will likely translate into reduced demand for logistics services, potentially impacting CTI Logistics' revenue and increasing cost pressures. Consumer spending, closely tied to economic health, will also be a key factor, with any downturn directly affecting the volume of goods needing transport and storage.

Inflationary pressures remain a significant concern for CTI Logistics, driving up operational costs for fuel, labor, and supplies throughout 2024 and into early 2025. While diesel prices have seen some moderation from 2023 highs, the overall logistics sector continues to grapple with elevated expenses due to persistent supply chain issues and a tight labor market. These ongoing cost challenges necessitate a strong focus on efficiency and cost management for CTI.

Interest rate fluctuations directly influence CTI Logistics' financing costs for capital investments. For instance, a higher interest rate environment in 2024-2025 could increase the cost of borrowing for fleet upgrades or technology investments, potentially slowing down strategic expansion or efficiency improvements. This makes careful financial planning and investment appraisal crucial for CTI.

The e-commerce boom continues to be a major growth driver for logistics, with Australia's market projected to grow by 10.3% in 2024. This surge in online retail directly fuels demand for last-mile delivery and efficient warehousing solutions, areas where CTI Logistics can capitalize. Adapting to evolving consumer expectations for faster and more flexible delivery options is key for CTI to thrive in this dynamic market.

What You See Is What You Get

CTI Logistics PESTLE Analysis

The CTI Logistics PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CTI Logistics. You'll gain a strategic understanding of the external forces shaping the company's operational landscape.

Sociological factors

Consumers increasingly demand speed and transparency in deliveries. In 2024, a significant portion of online shoppers, around 60%, indicated that same-day or next-day delivery is a key factor in their purchasing decisions. This growing expectation necessitates that logistics companies like CTI Logistics enhance their operational efficiency and technological capabilities to meet these evolving needs.

The push for sustainability is also a major driver of consumer behavior in logistics. By 2025, it's projected that over 70% of consumers will actively choose brands offering carbon-neutral shipping options. CTI Logistics must therefore continue to invest in greener fleet technologies and optimize routing to align with these environmentally conscious consumer preferences and maintain a competitive edge.

The availability of skilled drivers and logistics professionals presents a significant sociological challenge for CTI Logistics and the broader Australian transport sector. A persistent shortage of qualified personnel directly impacts operational capacity and efficiency.

Australia's logistics industry is grappling with acute workforce shortages, with reports indicating a deficit of thousands of drivers. This scarcity compels companies like CTI Logistics to significantly invest in robust training and upskilling programs to develop new talent and retain existing employees. Focusing on fostering positive company cultures is also paramount for talent retention in this competitive landscape.

The ongoing trend of urbanization is significantly reshaping logistics demands. As more people flock to major cities, the need for streamlined urban logistics and efficient last-mile delivery becomes paramount. This concentration of population directly fuels the demand for services that CTI Logistics provides, especially in densely populated areas.

This increasing urban population concentration, with cities like Sydney and Melbourne experiencing steady growth, necessitates strategic placement of warehousing facilities closer to end consumers. CTI Logistics must adapt by optimizing its distribution networks within these urban corridors to ensure timely and cost-effective deliveries, directly impacting its operational strategies for 2024 and beyond.

Health and Safety Standards

Societal expectations and a growing regulatory emphasis on occupational health and safety significantly shape how transport and warehousing companies like CTI Logistics operate. This means CTI Logistics must continuously invest in safety protocols and initiatives to meet these evolving standards.

CTI Logistics actively incorporates staff wellbeing and safety into its Environmental, Social, and Governance (ESG) strategy. This commitment is not just about compliance but also about fostering a responsible corporate image and attracting talent. For instance, in their 2023 Sustainability Report, CTI Logistics highlighted a reduction in lost time injuries by 15% compared to the previous year, demonstrating a tangible focus on safety performance.

- Regulatory Compliance: Adherence to stringent health and safety regulations in Australia, such as those mandated by Safe Work Australia, is paramount.

- Investment in Safety: CTI Logistics' ongoing investment in training, equipment, and safe work procedures directly addresses societal demands for worker protection.

- ESG Integration: Prioritizing employee safety is a key component of their ESG framework, influencing operational decisions and stakeholder perception.

- Performance Metrics: Tracking and reporting on safety incidents, like the aforementioned 15% reduction in lost time injuries in 2023, showcases their commitment to improvement.

Social Responsibility and ESG Focus

There's a noticeable shift in how society views businesses, with a growing expectation for companies to be good corporate citizens. This means paying close attention to Environmental, Social, and Governance, or ESG, principles. For CTI Logistics, this focus directly impacts how the public perceives the company and shapes its day-to-day operations.

CTI Logistics is actively addressing these societal expectations by prioritizing ESG. This includes making sure its employees are well and safe, and working towards reducing its carbon footprint. These efforts are crucial for aligning the company with what people increasingly expect from responsible businesses.

- Employee Wellbeing and Safety: CTI Logistics reported a lost time injury frequency rate (LTIFR) of 1.33 in FY23, demonstrating a commitment to workplace safety.

- Environmental Initiatives: The company is exploring opportunities to reduce its carbon emissions, a key concern for environmentally conscious stakeholders.

- Community Engagement: While specific community investment figures for 2024/2025 are still emerging, a strong ESG focus often correlates with increased local support and positive brand association.

Societal expectations for faster and more transparent deliveries are high, with around 60% of online shoppers in 2024 prioritizing same-day or next-day options. This consumer demand requires CTI Logistics to continually enhance its operational speed and technological infrastructure. Furthermore, a strong emphasis on sustainability means over 70% of consumers by 2025 are expected to favor carbon-neutral shipping, pushing CTI Logistics to invest in greener fleet technologies and optimized routing.

Workforce availability remains a critical sociological factor, with Australia facing a significant shortage of qualified drivers. This scarcity directly impacts operational capacity and efficiency for companies like CTI Logistics. The company's commitment to employee safety is evident, with a 15% reduction in lost time injuries reported in 2023, a key metric in their ESG strategy.

| Sociological Factor | Impact on CTI Logistics | 2024/2025 Data/Trend |

|---|---|---|

| Consumer Delivery Expectations | Need for speed and transparency | 60% of shoppers prioritize same-day/next-day delivery (2024) |

| Sustainability Demand | Preference for eco-friendly options | 70%+ consumers to favor carbon-neutral shipping (projected 2025) |

| Workforce Shortages | Operational capacity and efficiency constraints | Thousands of drivers needed in Australian logistics sector |

| Workplace Safety & ESG | Reputation, talent attraction, compliance | 15% reduction in lost time injuries (FY23), LTIFR of 1.33 (FY23) |

Technological factors

CTI Logistics is navigating an era of rapid digital transformation, particularly in how freight and logistics operations are managed. The industry's embrace of automated warehouse systems and digital freight platforms is a key driver of efficiency. For CTI, this means leveraging technologies like artificial intelligence and robotics to refine inventory management, minimize errors, and improve overall decision-making processes.

Technological advancements in real-time tracking and data analytics are revolutionizing supply chain management. The proliferation of the Internet of Things (IoT) devices allows for continuous data flow, offering unparalleled visibility into inventory and shipments. For CTI Logistics, this means a significant opportunity to enhance operational efficiency and customer service.

By integrating IoT sensors and advanced analytics platforms, CTI Logistics can achieve granular real-time visibility across its entire network. This capability directly translates to improved inventory accuracy, which is crucial for optimizing stock levels and reducing holding costs. In 2024, the global IoT in logistics market was valued at approximately USD 25 billion, with projections indicating substantial growth, underscoring the strategic importance of these technologies.

Enhanced visibility empowers CTI Logistics to provide customers with precise, up-to-the-minute tracking information, thereby boosting customer satisfaction and trust. Furthermore, real-time data allows for proactive identification and mitigation of potential disruptions, such as delays or route changes, enabling a more resilient and responsive supply chain. Companies that effectively leverage these solutions often see a reduction in transit times and a decrease in lost or damaged goods.

Artificial Intelligence (AI) and machine learning are fundamentally reshaping the logistics sector. Companies are leveraging these technologies for advanced predictive analytics, allowing for more accurate demand forecasting and dynamic route optimization. For instance, in 2024, many logistics firms reported significant reductions in fuel costs, often upwards of 10-15%, thanks to AI-powered route planning that accounts for real-time traffic and weather conditions.

These advancements empower businesses to make smarter decisions regarding inventory management, pricing strategies, and the efficient allocation of resources like vehicles and personnel. By anticipating demand fluctuations with greater precision, businesses can minimize stockouts and overstocking, thereby improving overall operational efficiency and significantly cutting costs. This data-driven approach is becoming a critical differentiator in the competitive logistics landscape.

Sustainable Technology Adoption

The transport sector is increasingly embracing sustainable technologies, with electric vehicles (EVs) and hydrogen fuel cells gaining traction. This shift aims to reduce the environmental impact of logistics operations.

While the adoption of electric heavy vehicles in Australia has been gradual, there's a clear push from both government and industry to invest in compliant fleets and sustainable practices. For instance, the Australian government has set targets to reduce emissions, indirectly encouraging logistics companies to explore greener options.

- Growing EV Market Share: Global EV sales are projected to reach significant figures, influencing the commercial vehicle sector.

- Government Incentives: Many countries, including Australia, are implementing policies and subsidies to encourage the adoption of low-emission transport.

- Fleet Modernization: Logistics companies are evaluating the total cost of ownership for EVs, considering fuel savings and maintenance advantages.

- Hydrogen Fuel Cell Development: While still in earlier stages for heavy transport, hydrogen technology offers a promising zero-emission alternative.

Cybersecurity and Data Protection

The increasing digitization of logistics operations for companies like CTI Logistics amplifies the critical need for advanced cybersecurity and stringent data protection. As more data moves online, the risk of breaches grows, demanding significant investment in safeguarding sensitive information.

New legislative frameworks, such as the proposed Transport Security Amendment (Security of Australia's Transport Sector) Bill 2024, underscore this trend by introducing mandatory reporting for cybersecurity incidents. This legislation directly impacts how logistics firms must manage and respond to digital threats, necessitating proactive security strategies.

- Increased reliance on digital platforms: Logistics firms are adopting cloud-based systems and IoT devices, expanding their digital footprint and potential vulnerabilities.

- Mandatory incident reporting: Legislation like the Transport Security Amendment (Security of Australia's Transport Sector) Bill 2024 will require timely reporting of cyber breaches, impacting operational continuity and reputation.

- Data privacy compliance: Adhering to evolving data protection regulations is paramount to avoid penalties and maintain customer trust.

- Growing threat landscape: Sophisticated cyberattacks targeting critical infrastructure, including logistics networks, are becoming more prevalent, demanding continuous security upgrades.

Technological advancements are a significant factor for CTI Logistics, driving efficiency and customer service through automation and data. The increasing adoption of AI and IoT in logistics is transforming operations, with the global IoT in logistics market valued at approximately USD 25 billion in 2024, projected for substantial growth.

AI and machine learning enable predictive analytics for better demand forecasting and route optimization, with many logistics firms reporting fuel cost reductions of 10-15% in 2024 due to AI-powered route planning. This data-driven approach is crucial for competitive advantage and cost reduction.

The push towards sustainable transport, including electric vehicles (EVs), is also a key technological trend. While EV adoption in Australian heavy transport is gradual, government incentives and fleet modernization efforts are encouraging greener logistics solutions, with ongoing development in hydrogen fuel cell technology.

Furthermore, the increased digitization necessitates robust cybersecurity measures. Legislation like the Transport Security Amendment (Security of Australia's Transport Sector) Bill 2024 mandates reporting of cyber incidents, highlighting the growing threat landscape and the need for proactive security strategies to protect sensitive data and maintain operational continuity.

Legal factors

CTI Logistics must navigate a complex web of national and state-specific transport regulations. Key among these are reforms impacting heavy vehicles and driver fatigue management, which are crucial for efficient and compliant operations.

The Heavy Vehicle Road Reform (HVRR), set to roll out from 2024, introduces national service-level standards for roads. This initiative will likely reshape CTI Logistics' operational strategies and necessitate adjustments to ensure ongoing compliance with evolving infrastructure and usage requirements.

Mandatory climate and emissions reporting is becoming a significant legal factor for logistics companies. Legislation enacted in early 2024, taking effect in January 2025, will compel businesses like CTI Logistics to transparently disclose their carbon footprint. This means meticulously tracking and reporting Scope 1, 2, and ultimately Scope 3 emissions.

These new reporting requirements will directly impact CTI Logistics' operational decisions and strategic investments. The need to quantify and report emissions will likely drive a greater focus on adopting greener practices and investing in more sustainable logistics solutions to meet regulatory demands and stakeholder expectations.

CTI Logistics must strictly adhere to Workplace Health and Safety (WHS) laws to protect its workforce and mitigate risks in its warehousing and transportation operations. These regulations, which are continually updated, mandate specific safety protocols, employee training standards, and equipment specifications, directly impacting operational expenses and the company's approach to risk management.

For instance, in Australia, the model WHS Act requires employers to ensure, so far as is reasonably practicable, the health and safety of workers. This includes providing safe work systems, adequate training, and necessary personal protective equipment, all of which contribute to CTI's compliance costs and operational efficiency.

Data Privacy and Security Regulations

CTI Logistics operates in a landscape increasingly shaped by data privacy and security regulations. With the ongoing digitalization of its operations, the company must meticulously adhere to laws like the GDPR and similar frameworks globally, ensuring the protection of sensitive customer and internal operational data. Failure to comply can result in significant fines, as seen with data breaches leading to penalties in the millions for companies across various sectors.

Furthermore, recent amendments to transport security legislation are placing a greater legal onus on logistics providers. These changes introduce mandatory reporting requirements for cybersecurity incidents, highlighting the critical need for CTI Logistics to implement and maintain robust data protection measures. For instance, a 2024 report indicated a 30% rise in reported cyberattacks targeting the logistics sector, underscoring the escalating legal risks.

- Data Privacy Compliance: Adherence to GDPR and similar global regulations is paramount for protecting customer and operational data.

- Cybersecurity Reporting: New transport security legislation mandates reporting of cybersecurity incidents, increasing legal accountability.

- Incident Response: The imperative for robust data protection is amplified by the growing threat landscape and potential for significant penalties.

Contract and Consumer Protection Laws

CTI Logistics' diverse operations, from freight forwarding to warehousing and distribution, are deeply intertwined with contract and consumer protection laws. These legal frameworks dictate the terms of service level agreements, define liability in case of loss or damage, and establish processes for resolving disputes. Ensuring clarity in contracts and respecting consumer rights is paramount for CTI Logistics to maintain trust and operational integrity.

For instance, Australian consumer law, particularly the Australian Consumer Law (ACL), imposes significant obligations on businesses like CTI Logistics. The ACL provides consumers with guarantees regarding the quality and safety of services. A breach of these guarantees can lead to remedies such as refunds or compensation. In 2023, the Australian Competition and Consumer Commission (ACCC) reported ongoing enforcement actions related to unfair contract terms and misleading or deceptive conduct in the services sector, highlighting the regulatory scrutiny CTI Logistics faces.

- Contractual Clarity: CTI Logistics must ensure all service agreements clearly outline responsibilities, pricing, and performance standards to comply with contract law.

- Consumer Rights Adherence: Adherence to consumer protection laws, such as the ACL, is critical to avoid penalties and maintain customer satisfaction across all service offerings.

- Liability Management: Understanding and managing liability as defined by contracts and consumer laws is essential, especially in logistics where goods are in transit and storage.

- Dispute Resolution Mechanisms: Establishing fair and transparent dispute resolution processes is a legal requirement and vital for customer retention.

CTI Logistics faces evolving legal mandates concerning environmental impact and reporting. Legislation effective January 2025 requires detailed disclosure of carbon emissions, including Scope 1, 2, and 3. This will necessitate enhanced data collection and reporting capabilities, impacting operational strategies and potential investments in sustainability initiatives.

Workplace Health and Safety (WHS) laws remain a significant legal factor, demanding strict adherence to safety protocols and training for CTI Logistics' workforce. The Australian model WHS Act, for example, places a duty of care on employers to ensure a safe working environment, directly influencing operational costs and risk management practices.

Data privacy and cybersecurity regulations are increasingly stringent, requiring CTI Logistics to protect sensitive customer and operational data. The rise in cyberattacks targeting the logistics sector, with a reported 30% increase in 2024, amplifies the legal imperative for robust data protection measures and incident reporting.

Contract and consumer protection laws, such as Australia's ACL, govern CTI Logistics' service agreements and customer interactions. Ensuring contractual clarity and adhering to consumer guarantees is crucial to avoid penalties and maintain customer trust, especially given ongoing enforcement actions by bodies like the ACCC.

Environmental factors

Australia's commitment to reducing greenhouse gas emissions by 43% by 2030 places significant pressure on CTI Logistics. As a logistics company, its operations are inherently tied to carbon emissions.

The transport sector is a major contributor to emissions, and the current slow adoption of electric heavy vehicles presents a challenge for CTI Logistics. This necessitates urgent innovation to meet net-zero objectives.

The push for greater fuel efficiency and the adoption of alternative fuels are significant environmental factors impacting CTI Logistics. Companies are increasingly investing in greener fleets, including Battery Electric Vehicles (BEVs) and hydrogen fuel cell technology, to reduce their carbon footprint. For instance, by early 2025, many global logistics firms aim to have at least 15% of their light-duty vehicle fleet be electric, a trend CTI Logistics will likely mirror.

CTI Logistics is increasingly focused on integrating circular economy principles to reduce waste and enhance resource efficiency within its operations. This involves exploring eco-friendly packaging solutions and optimizing reverse logistics for product refurbishment and recycling, aiming to lessen the environmental footprint of transportation services.

The push towards a circular economy in logistics is driven by growing regulatory pressures and consumer demand for sustainable practices. For instance, in 2024, the European Union's Packaging and Packaging Waste Regulation aims to significantly reduce packaging waste, pushing companies like CTI Logistics to adopt more sustainable materials and reuse models.

By embracing circular supply chain strategies, CTI Logistics can not only minimize its environmental impact but also unlock cost savings through reduced material consumption and waste disposal fees. This proactive approach aligns with global sustainability goals and positions the company for long-term resilience in a resource-constrained world.

Sustainable Warehousing and Infrastructure

The environmental footprint of warehousing and logistics infrastructure is increasingly under scrutiny, driving a significant shift towards sustainable practices. This includes the adoption of green warehousing, which focuses on minimizing energy consumption and waste. For instance, many companies are investing in solar panel installations on warehouse roofs and upgrading to more energy-efficient lighting and HVAC systems. These initiatives are not just about environmental responsibility; they also offer tangible cost savings through reduced utility bills.

Companies are actively seeking certifications like Green Star or LEED to validate their sustainability efforts. In 2024, the Australian logistics sector, for example, saw a notable increase in warehouse developments targeting these green building standards. This trend is expected to accelerate as regulatory pressures and customer demand for eco-friendly supply chains intensify through 2025.

- Solar Panel Adoption: Warehouses are increasingly equipped with solar panels to offset energy costs and reduce reliance on fossil fuels.

- Energy Efficiency Upgrades: Investments in LED lighting, smart climate control, and improved insulation are becoming standard to lower operational energy use.

- Green Certifications: Pursuing certifications like Green Star or LEED demonstrates a commitment to environmental performance and can enhance brand reputation.

- Waste Reduction Programs: Implementing comprehensive recycling and waste management strategies within warehousing operations is a key focus.

Climate Change Adaptation and Resilience

Climate change presents significant hurdles for supply chain continuity. Extreme weather events, such as the record-breaking heatwaves and severe flooding experienced globally in 2024, directly impact CTI Logistics' ability to operate efficiently and predictably.

To counter these environmental risks, logistics firms are increasingly investing in resilience. This includes diversifying their supplier base to avoid over-reliance on single regions vulnerable to climate impacts, and reinforcing critical infrastructure like warehouses and transportation hubs against potential damage from natural disasters. For instance, many are exploring distributed warehousing models to reduce the impact of localized disruptions.

- Increased frequency of extreme weather events: Reports indicate a continued rise in the occurrence and intensity of events like hurricanes and droughts, directly affecting transportation routes and delivery times.

- Supply chain diversification: Companies are actively seeking alternative sourcing locations and transportation modes to mitigate risks associated with climate-vulnerable areas.

- Infrastructure hardening: Investments are being made in making warehouses and distribution centers more resistant to flooding, high winds, and other climate-related threats.

- Adaptation strategy development: CTI Logistics, like its peers, is likely developing dynamic routing and contingency plans to navigate disruptions caused by evolving environmental conditions.

Australia's commitment to a 43% emissions reduction by 2030 significantly impacts CTI Logistics, as transport is a major emissions source. The slow adoption of electric heavy vehicles presents a challenge, requiring urgent innovation for net-zero goals.

The drive for fuel efficiency and alternative fuels is key, with many logistics firms aiming for at least 15% of their light-duty fleets to be electric by early 2025. CTI Logistics is also embracing circular economy principles, focusing on eco-friendly packaging and optimizing reverse logistics to reduce waste and enhance resource efficiency.

Green warehousing, including solar panel installations and energy-efficient upgrades, is becoming standard to lower operational energy use and utility bills. Many companies are pursuing certifications like Green Star or LEED, with a notable increase in Australian logistics sector developments targeting these standards in 2024.

Climate change poses risks to supply chain continuity, with extreme weather events in 2024 impacting operations. Logistics firms are investing in resilience through supplier diversification and infrastructure hardening, with distributed warehousing models being explored to mitigate localized disruptions.

PESTLE Analysis Data Sources

Our CTI Logistics PESTLE Analysis is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry research firms. We ensure every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.