CTI Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTI Logistics Bundle

CTI Logistics faces a dynamic competitive landscape, with moderate bargaining power from both suppliers and buyers influencing its operations. The threat of new entrants is a key consideration, alongside the ever-present pressure from substitute services. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping CTI Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fuel suppliers hold significant bargaining power over CTI Logistics, as fuel is a major operational cost. In 2024, crude oil prices experienced considerable volatility, directly influencing diesel and gasoline costs for transport companies. For instance, fluctuations in global supply and demand, as seen with OPEC+ production decisions, can lead to price spikes that CTI Logistics must contend with, impacting their profitability if these costs cannot be fully passed on.

Vehicle manufacturers and lessors wield significant bargaining power over CTI Logistics. The immense capital investment and specialized engineering required for trucks, trailers, and other logistics assets mean CTI has limited alternatives for sourcing its fleet. For instance, a new semi-trailer truck can cost upwards of $150,000, and specialized vehicles like refrigerated units can easily exceed $200,000, making switching suppliers a costly proposition. This reliance, coupled with potential long lead times for new vehicle acquisition, particularly for custom specifications, allows these suppliers to dictate terms, impacting CTI's operational flexibility and cost structure.

The bargaining power of labor providers for CTI Logistics is a critical consideration. The availability of skilled drivers, warehouse staff, and logistics professionals directly impacts CTI's ability to operate efficiently. In 2024, Australia, like many developed nations, has faced ongoing challenges in securing sufficient skilled labor across various sectors, including transportation and logistics, which can amplify the power of these labor suppliers.

Recruitment agencies and labor unions can wield considerable influence, especially when specific logistics skills are scarce or in high demand. For instance, a shortage of qualified truck drivers in key Australian freight routes in 2024 could lead to increased wage demands. These negotiations over wages, benefits, and working conditions have a direct effect on CTI's overall cost structure and operational flexibility.

Technology and Software Vendors

Technology and software vendors, particularly those offering Transport Management Systems (TMS) and Warehouse Management Systems (WMS), are becoming increasingly influential suppliers for companies like CTI Logistics. These systems are critical for operational efficiency, real-time visibility, and seamless integration across the supply chain. The significant investment and integration effort required to implement these solutions often result in high switching costs for CTI Logistics, granting these vendors considerable bargaining power. This leverage can manifest in pricing negotiations, the terms of service agreements, and the pricing of future software upgrades.

The reliance on specialized software for core logistics functions means that disruptions or unfavorable terms from these vendors can have a substantial impact on CTI Logistics' operations. For instance, the global market for logistics software is projected to grow, with some estimates suggesting a compound annual growth rate of over 10% in the coming years, indicating increasing dependence and vendor power.

- High Switching Costs: Implementing and integrating new TMS/WMS solutions can cost millions and take years, locking in customers.

- Critical Functionality: These software systems are essential for CTI Logistics' efficiency, visibility, and customer service.

- Vendor Consolidation: A trend towards fewer, larger software providers can concentrate market power in the hands of a few vendors.

- Innovation Dependence: CTI Logistics relies on these vendors for ongoing technological advancements to remain competitive.

Real Estate and Warehouse Lessors

For CTI Logistics, securing strategically positioned and appropriate warehousing and distribution centers is absolutely critical to its operations. The lessors of these vital properties, particularly those located in prime industrial zones, hold considerable sway. They can dictate higher lease rates and enforce demanding contractual conditions.

The availability of suitable facilities in key logistical hubs is often limited, which directly amplifies the bargaining power of real estate suppliers. For instance, in 2024, industrial vacancy rates in major Australian logistics centers remained exceptionally low, often below 2%, putting upward pressure on rental prices for businesses like CTI Logistics.

- Landlords in prime industrial areas can leverage low vacancy rates to increase lease costs.

- Scarcity of specialized warehousing in key distribution hubs strengthens lessor negotiation power.

- CTI Logistics' reliance on these facilities makes them vulnerable to unfavorable lease terms.

The bargaining power of suppliers for CTI Logistics is substantial, impacting costs and operational flexibility. Key suppliers include fuel providers, vehicle manufacturers, labor, and technology vendors, all of whom can exert significant influence due to market dynamics and the critical nature of their offerings.

Fuel suppliers, particularly those providing diesel, hold considerable power. In 2024, global oil price volatility, influenced by factors like OPEC+ decisions, directly affected CTI's operating expenses. For example, a sustained increase in diesel prices can significantly erode profit margins if not passed on to customers.

Vehicle manufacturers and lessors also possess strong bargaining leverage. The high cost of acquiring and maintaining a logistics fleet, with new semi-trailer trucks costing over $150,000, creates high switching costs for CTI. This reliance, combined with potential long lead times for new vehicles, allows suppliers to dictate terms.

Labor providers, especially for skilled roles like truck drivers, have increasing power, particularly in 2024 due to a general shortage of qualified personnel in Australia. This scarcity can lead to higher wage demands and more stringent working condition negotiations, directly impacting CTI's labor costs.

Technology vendors for Transport Management Systems (TMS) and Warehouse Management Systems (WMS) are crucial. High implementation costs and the critical nature of these systems for operational efficiency give these suppliers significant power, often leading to vendor lock-in and substantial investment in upgrades.

| Supplier Category | Bargaining Power Factor | 2024 Impact Example |

|---|---|---|

| Fuel Suppliers | High dependence, price volatility | Diesel price fluctuations impacting operating costs |

| Vehicle Manufacturers | High capital cost, limited alternatives | New truck costs exceeding $150,000 |

| Labor Providers | Skilled labor shortage, union influence | Increased wage demands for truck drivers |

| Technology Vendors (TMS/WMS) | High switching costs, critical functionality | Vendor lock-in due to integration complexity |

What is included in the product

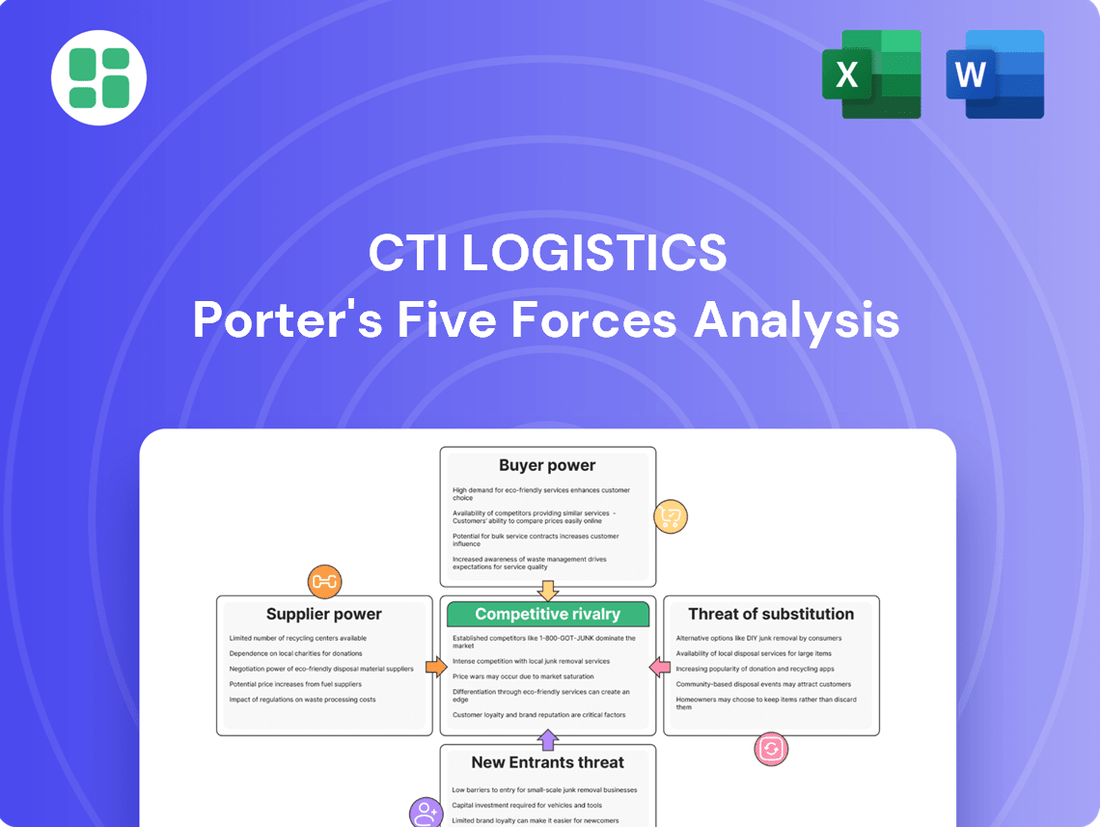

This Porter's Five Forces analysis for CTI Logistics dissects the industry's competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling targeted strategic adjustments.

Customers Bargaining Power

Clients who consistently ship large volumes or require intricate supply chain solutions often hold considerable sway over CTI Logistics. This scale allows them to negotiate for reduced rates, more favorable payment schedules, or even specialized service offerings, directly impacting CTI's pricing and service structure.

The threat of losing a major client, one that contributes a significant portion to CTI's overall revenue, amplifies the bargaining power of these large customers. For instance, if a top 10 client representing 5% of CTI's annual revenue were to shift providers, it would necessitate a substantial revenue replacement effort.

Customers, especially those operating in highly competitive sectors, often exhibit significant price sensitivity. This means they actively search for the most economical logistics solutions available. For CTI Logistics, this translates into a constant need to offer competitive pricing to attract and retain business.

The availability of viable alternatives significantly amplifies customer bargaining power. If CTI's service offerings are not perceived as unique or superior, clients can readily shift their business to competitors or even opt for managing their logistics internally. This dynamic pressures CTI to maintain a strong value proposition.

In 2024, the logistics industry continued to see intense competition, with many providers offering similar core services. This environment means that for a company like CTI Logistics, any perception of undifferentiated services directly empowers customers to demand lower prices or better terms. For instance, if a competitor offers a comparable delivery speed for 5% less, customers are likely to explore that option.

For many of CTI Logistics' standard transport and warehousing services, customers can switch providers with minimal cost or effort. This low barrier to entry for customers means they have significant leverage, as they can easily move to a competitor if pricing or service levels aren't satisfactory. For instance, a business needing general freight forwarding might find it straightforward to change from CTI Logistics to another provider in 2024, impacting CTI's ability to dictate terms.

Customer Knowledge and Transparency

Customers today are often highly informed, possessing detailed knowledge about prevailing market rates for logistics services, the latest technological advancements in the sector, and what competing companies offer. This deep understanding significantly shifts the balance of power towards them.

The logistics industry is experiencing a notable increase in transparency, largely driven by digital platforms. These tools allow customers to readily compare pricing structures and service quality across various providers, making it simpler to identify the best value. For example, in 2024, many freight marketplaces reported a surge in user activity as shippers sought to optimize their spend.

- Informed Negotiation: Customers' comprehensive grasp of market dynamics empowers them to negotiate more effectively with CTI Logistics, potentially driving down service prices.

- Price Sensitivity: Increased transparency highlights price differences, making customers more sensitive to cost and more likely to switch providers if CTI Logistics is not competitive.

- Demand for Value: Sophisticated customers expect not just a service, but a complete value proposition, including technological integration and efficient operations, which CTI Logistics must deliver to retain them.

Customer Industry Concentration

CTI Logistics' bargaining power of customers is influenced by industry concentration. If CTI serves a limited number of industries, key players within those sectors can wield considerable influence. For instance, a substantial revenue stream from a single industry, such as automotive manufacturing, would empower major automotive companies to negotiate more favorable terms.

This dependency can lead to pricing pressure and stricter service level agreements. In 2024, if CTI's top 5 clients represented over 60% of its revenue, this high concentration would significantly amplify customer bargaining power.

- Customer Concentration: CTI's reliance on a few key industries increases customer leverage.

- Pricing Pressure: Dominant players in concentrated industries can demand lower logistics costs.

- Service Demands: Major clients may dictate specific service requirements, impacting CTI's operational flexibility.

- Revenue Dependency: A high percentage of revenue from a small client base amplifies the impact of any single client's demands.

The bargaining power of CTI Logistics' customers is substantial, driven by market transparency and the availability of alternatives. In 2024, the logistics sector's competitive nature meant that customers could readily compare pricing and service levels, often switching providers with minimal friction. This environment forces CTI to maintain competitive pricing and a strong value proposition to retain its client base.

Large volume shippers and those requiring specialized services hold significant sway, able to negotiate for better rates and terms. The potential loss of a major client, which could represent a considerable portion of CTI's revenue, further amplifies these customers' leverage, creating pricing pressure and influencing service level agreements.

Customers' increased access to market information and technological tools in 2024 means they are well-equipped to negotiate favorable terms. This sophisticated customer base demands more than just basic transport, expecting integrated solutions and operational efficiency from logistics providers like CTI.

| Factor | Impact on CTI Logistics | 2024 Trend Example |

|---|---|---|

| Customer Volume & Specialization | High leverage for large or specialized clients | Clients needing refrigerated transport may negotiate premium rates |

| Price Sensitivity & Transparency | Drives demand for competitive pricing | Online freight marketplaces show average cost per mile |

| Availability of Alternatives | Low switching costs empower customers | A business can switch general freight carriers in days |

| Customer Concentration | Reliance on few clients increases their power | If 60% of revenue comes from top 5 clients, their demands are amplified |

What You See Is What You Get

CTI Logistics Porter's Five Forces Analysis

This preview shows the exact, comprehensive CTI Logistics Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape of the logistics industry. You'll gain deep insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within CTI Logistics' market. This professionally formatted document is ready for your immediate use, offering a complete and actionable strategic overview.

Rivalry Among Competitors

The logistics sector is crowded, featuring everyone from tiny local delivery services to massive global companies. CTI Logistics contends with a wide array of competitors, including those focusing on specific services and those offering a full suite of logistics solutions. This broad and varied competitive environment means CTI Logistics must continuously adapt to maintain its position.

The logistics sector often exhibits mature characteristics in many of its segments. This maturity means that growth for companies like CTI Logistics frequently stems from capturing market share from rivals rather than from an expanding overall market. This dynamic intensifies competitive rivalry, compelling businesses to prioritize innovation and operational efficiency to maintain their standing.

In 2024, the global logistics market is projected to reach approximately $10.6 trillion, demonstrating steady but not explosive growth. This maturity can translate into a zero-sum game where gains for one player often mean losses for another, further exacerbating competitive pressures and potentially leading to price wars that impact profitability.

While CTI Logistics aims for integrated solutions, the foundational transport and warehousing segments are often seen as basic commodities. This means that without distinct advantages, competition can easily devolve into price wars. For instance, in 2024, many smaller freight forwarders were observed competing primarily on cost for standard container shipping, impacting overall industry margins.

The real battle for CTI Logistics lies in how effectively it can set its services apart. Differentiation through advanced tracking technology, unwavering delivery reliability, or deep expertise in niche sectors like cold chain logistics can significantly reduce the pressure of direct price competition. Companies that successfully implement these strategies, such as those investing heavily in IoT for real-time shipment visibility, tend to command higher service fees.

High Fixed Costs and Exit Barriers

The logistics sector, including companies like CTI Logistics, is characterized by substantial fixed costs. Think about the massive investments required for fleets of trucks, expansive warehouse facilities, and sophisticated tracking and management technology. These aren't small, easily shed expenses.

These considerable fixed costs, coupled with assets that are often specialized and difficult to repurpose, erect significant barriers to exiting the industry. This means that even when market conditions are tough, companies are often compelled to remain operational and continue competing for business, rather than cutting their losses by shutting down.

Consequently, this situation intensifies competitive rivalry. Companies are less likely to exit during economic slowdowns, leading to a persistent struggle for market share among existing players. For instance, in 2023, the Australian logistics sector, a key market for CTI, saw continued investment in fleet upgrades and automation, underscoring these high fixed costs.

- High Capital Outlay: Significant investment in vehicles, warehouses, and technology is a hallmark of the logistics industry.

- Specialized Assets: Many assets in logistics are purpose-built, limiting resale value and increasing exit barriers.

- Intensified Competition: High fixed costs encourage existing firms to stay and compete aggressively, even in challenging economic periods.

Mergers, Acquisitions, and Strategic Alliances

The logistics industry is characterized by significant consolidation. In 2023, global M&A activity in the logistics sector reached approximately $70 billion, indicating a strong trend of larger companies acquiring smaller ones to expand their market share and operational capabilities. CTI Logistics faces intensified rivalry as competitors enhance their scale and service portfolios through these transactions.

Strategic alliances also play a crucial role in shaping competitive dynamics. By forming partnerships, logistics providers can offer more comprehensive end-to-end solutions, effectively pooling resources and expertise. This can create formidable competitors that are more integrated and efficient than standalone entities.

- Consolidation Impact: Competitors are actively merging or acquiring to gain market share and operational efficiencies, altering the competitive landscape.

- Strategic Alliances: Partnerships allow rivals to offer integrated services, increasing their competitive strength.

- Market Share Shifts: M&A activity can lead to rapid changes in market share, requiring CTI Logistics to adapt its strategies.

- Capability Enhancement: Acquisitions often serve to bolster specific capabilities, such as last-mile delivery or specialized freight handling, creating more formidable competitors.

The logistics sector is highly competitive, with numerous players ranging from small local operators to large global enterprises. CTI Logistics must contend with a diverse set of rivals, many of whom offer specialized services or comprehensive end-to-end solutions. This broad competitive field necessitates continuous adaptation and innovation for CTI Logistics to maintain its market standing.

The industry's maturity means that growth often comes from taking market share, intensifying rivalry. In 2024, the global logistics market is valued at approximately $10.6 trillion, indicating a stable but not rapidly expanding market. This can lead to a scenario where one company's gain is another's loss, potentially triggering price wars and impacting profitability across the board.

High fixed costs, such as those for fleets and warehouses, make exiting the industry difficult. This persistence of firms, even during downturns, fuels ongoing competition. For example, in 2023, Australian logistics firms continued investing in fleet upgrades, highlighting these substantial fixed costs and the resulting competitive pressure.

| Competitor Type | Key Characteristics | Impact on CTI Logistics |

|---|---|---|

| Global Integrators | Extensive networks, broad service offerings, economies of scale | Significant market share, ability to offer bundled solutions |

| Niche Specialists | Deep expertise in specific sectors (e.g., cold chain, hazardous materials) | Strong customer loyalty in their segments, potential for higher margins |

| Regional/Local Players | Agility, strong local knowledge, lower overheads | Price competitiveness in specific geographic areas, potential for disruption |

| Technology-Focused Startups | Innovative platforms, data analytics, last-mile solutions | Disruptive potential, focus on efficiency and customer experience |

SSubstitutes Threaten

Large manufacturers, retailers, and resource companies possess the potential to develop or enhance their own in-house logistics operations. This includes managing their own fleets and warehousing facilities, directly substituting the need to outsource to third-party providers like CTI Logistics.

For instance, in 2024, many large enterprises are re-evaluating their supply chain strategies, with a notable trend towards vertical integration to gain greater control and potentially reduce costs. Companies that previously relied heavily on external logistics providers are increasingly investing in their own infrastructure and personnel.

The decision to bring logistics in-house often stems from a desire for enhanced control over the supply chain, improved responsiveness to market changes, and the potential for long-term cost savings, especially for businesses with significant and consistent shipping volumes.

Digital freight platforms are emerging as a significant threat by directly connecting shippers with carriers, potentially bypassing traditional intermediaries like CTI Logistics. These online marketplaces offer greater transparency and efficiency, which can reduce the perceived need for established logistics providers. For instance, the global freight forwarding market, valued at approximately $230 billion in 2023, is increasingly seeing digital players capture market share by streamlining the booking and management process.

Customers can switch from CTI Logistics' road transport to alternatives like rail, sea, or air freight. This depends on factors such as the type of goods, how quickly they need to arrive, and the cost. For instance, in 2024, the demand for intermodal freight, combining road with rail or sea, continued to grow, especially for long-distance shipping, as companies sought cost efficiencies. This shift represents a significant substitution threat.

Advanced Manufacturing and Supply Chain Redesign

Innovations like additive manufacturing (3D printing) and the trend towards localized production present a significant threat by potentially reducing the need for extensive long-distance transport and large warehousing facilities. For instance, by 2024, the global 3D printing market was projected to reach over $60 billion, indicating substantial investment and adoption that could reshape traditional logistics demand.

Companies actively redesigning their supply chains for enhanced resilience and regionalization also diminish reliance on established, broad logistics networks. This strategic shift, driven by a desire to mitigate disruptions, can lead to a decreased volume of goods requiring traditional freight forwarding and warehousing services.

These evolving supply chain models represent a long-term substitution threat to CTI Logistics, as they fundamentally alter the demand for their core services. For example, a shift towards nearshoring or reshoring could see manufacturing operations move closer to end markets, bypassing traditional international shipping routes.

- Additive manufacturing adoption is growing, impacting demand for traditional logistics.

- Supply chain regionalization reduces reliance on long-haul transportation.

- Reshoring initiatives can bypass established logistics infrastructure.

- These trends collectively pose a long-term substitution threat to logistics providers.

Direct-to-Consumer (D2C) Models and E-commerce Fulfilment

The rise of direct-to-consumer (D2C) brands poses a significant threat of substitution for traditional logistics providers like CTI Logistics. Many D2C companies are opting to develop in-house last-mile delivery solutions or collaborate with niche e-commerce logistics specialists, effectively bypassing the need for general warehousing and distribution services. This trend allows brands to maintain greater control over the customer experience and can be more cost-effective for high-volume, specialized deliveries.

For instance, the e-commerce sector, a key area for fulfillment services, saw continued robust growth. In 2024, global e-commerce sales were projected to reach trillions, with a significant portion driven by D2C channels. This indicates a substantial market where alternative fulfillment models are actively being adopted, directly impacting the demand for services traditionally offered by companies like CTI.

- D2C Growth: Many emerging and established brands are investing in their own logistics infrastructure to manage the entire customer journey, from order to delivery.

- Specialized Providers: The market has seen an increase in logistics firms focusing exclusively on e-commerce, offering tailored solutions that may outperform generalist providers.

- Bypassing Traditional Models: D2C strategies often reduce reliance on large, centralized warehouses, favoring more agile, distributed fulfillment networks.

- Customer Experience Focus: Brands using D2C models prioritize a seamless delivery experience, leading them to seek out partners or build capabilities that directly align with their brand image.

The threat of substitutes for CTI Logistics is multifaceted, encompassing alternative transportation modes, technological advancements, and evolving business models. Customers can shift from road transport to rail, sea, or air freight, particularly for long-distance or time-sensitive shipments, with intermodal freight showing continued growth in 2024 for cost efficiencies.

Innovations like additive manufacturing and the trend towards localized production reduce the need for extensive long-distance transport, with the global 3D printing market projected to exceed $60 billion by 2024. Furthermore, the rise of direct-to-consumer (D2C) brands and digital freight platforms presents a significant challenge, as these entities often bypass traditional logistics providers by developing in-house solutions or utilizing more efficient online marketplaces.

| Substitute Category | Description | Impact on CTI Logistics | 2024 Trend/Data Point |

|---|---|---|---|

| Alternative Transport | Rail, sea, air freight, intermodal transport | Diversion of long-haul and time-sensitive freight | Growing demand for intermodal freight for cost efficiencies |

| Technological Innovation | Additive Manufacturing (3D Printing), Digital Freight Platforms | Reduced need for traditional transport and warehousing; disintermediation | Global 3D printing market projected >$60 billion; digital platforms streamlining booking |

| Evolving Business Models | In-house logistics, Direct-to-Consumer (D2C) fulfillment | Bypassing third-party providers, increased control over delivery | Continued robust growth in e-commerce, significant portion driven by D2C channels |

Entrants Threaten

The integrated logistics and transport sector demands significant upfront capital. Newcomers must invest heavily in a diverse fleet of vehicles, extensive warehousing infrastructure, and sophisticated technology to compete effectively. For instance, acquiring a modern, specialized freight truck can cost upwards of $150,000, and building a new distribution center can run into tens of millions of dollars. This substantial financial commitment acts as a significant deterrent for many potential entrants looking to challenge established players like CTI Logistics.

Established players like CTI Logistics leverage significant economies of scale, particularly in purchasing power for fuel and equipment, and operational efficiencies across their extensive logistics networks. This scale allows them to negotiate better rates and spread fixed costs over a larger volume, creating a substantial cost advantage.

New entrants face a steep challenge in matching these cost efficiencies. Without the established volume, they cannot achieve the same per-unit cost savings, making it difficult to compete on price against incumbents like CTI Logistics, which reported a revenue of AUD 335.3 million for the fiscal year ending June 30, 2023.

Furthermore, the network effects inherent in the logistics industry present another barrier. CTI Logistics' established network of depots, transportation assets, and customer relationships creates a powerful advantage. Newcomers lack this geographic reach and operational density, which are crucial for providing comprehensive and reliable logistics services.

The logistics sector faces significant regulatory burdens, encompassing licensing, stringent safety protocols, environmental standards, and labor regulations. These complex requirements can be a major deterrent and expense for potential new competitors seeking to enter the market.

For instance, in Australia, adherence to the National Heavy Vehicle Regulator's standards and various state-specific transport laws demands substantial investment in compliance and operational adjustments. New entrants must allocate considerable resources to understand and implement these rules, a process that can delay market entry and increase initial operating costs.

CTI Logistics, having operated within this framework for years, possesses well-developed compliance systems and expertise. This established infrastructure provides a distinct advantage over new players who must still build their understanding and processes to meet these demanding legal obligations.

Brand Reputation and Customer Relationships

Building trust and strong, long-term relationships with diverse industrial clients is a lengthy process that requires consistent, high-quality service delivery. CTI Logistics has cultivated an established brand reputation and secured existing customer contracts, creating a substantial hurdle for newcomers aiming to capture market share. This deep-seated loyalty means customers are often hesitant to move away from partners they know and trust.

For instance, in the competitive logistics sector, a strong brand can command a premium and reduce customer acquisition costs. A study by Accenture in 2024 indicated that 77% of consumers consider brand trust a key factor when making purchasing decisions. This highlights how CTI Logistics' established reputation directly deters new entrants by making it harder for them to gain initial customer confidence and secure vital contracts.

- Established Brand Equity: CTI Logistics benefits from years of reliable service, fostering a positive brand image that new competitors struggle to replicate quickly.

- Customer Inertia: Existing client relationships, often solidified through long-term contracts and proven performance, create a switching cost for customers, making them less likely to consider new providers.

- Service Reliability: The logistics industry demands a high degree of dependability; CTI Logistics' track record of consistent service delivery acts as a significant barrier to entry for less experienced or unproven new entrants.

Access to Talent and Specialized Expertise

New logistics companies often face significant hurdles in acquiring the necessary skilled labor. The industry demands professionals ranging from seasoned truck drivers and efficient warehouse supervisors to sophisticated supply chain analysts and IT experts. For instance, in 2024, the average annual salary for a truck driver in Australia, where CTI Logistics operates, was approximately AUD $70,000, highlighting the cost of securing essential personnel.

Attracting and retaining this specialized talent is a considerable expense and a major barrier for new entrants. Established players like CTI Logistics, with their existing teams and accumulated industry knowledge, possess a distinct advantage in human capital and operational know-how. This existing workforce is a critical asset, enabling smoother operations and faster adaptation to market demands.

- Talent Acquisition Costs: New entrants must invest heavily in recruitment, training, and competitive compensation packages to attract qualified drivers, managers, and analysts.

- Retention Challenges: High turnover rates in the logistics sector can further inflate costs for new businesses trying to build a stable and experienced team.

- CTI Logistics' Advantage: CTI Logistics benefits from an established talent pool, reducing onboarding time and costs, and leveraging existing expertise for operational efficiency.

The threat of new entrants in the integrated logistics and transport sector, impacting companies like CTI Logistics, is significantly mitigated by high capital requirements and substantial economies of scale enjoyed by incumbents. New players need to invest heavily in fleets, infrastructure, and technology, facing cost disadvantages due to lower initial volumes. For example, a new distribution center could easily cost tens of millions of dollars, a steep barrier for emerging businesses.

Furthermore, established brands and customer loyalty create a strong deterrent. Clients often prioritize reliability and established relationships, making it difficult for newcomers to gain traction. Regulatory compliance, a complex and costly undertaking, also favors established firms like CTI Logistics, which possess existing expertise and systems to navigate these requirements efficiently. The need for skilled labor, from drivers to analysts, further adds to the entry barriers, with average truck driver salaries in Australia around AUD $70,000 in 2024.

| Barrier Type | Impact on New Entrants | CTI Logistics Advantage |

|---|---|---|

| Capital Requirements | High upfront investment in assets and technology | Leverages existing infrastructure and purchasing power |

| Economies of Scale | Higher per-unit costs due to lower volume | Lower operating costs through bulk purchasing and network efficiency |

| Brand & Customer Loyalty | Difficulty in building trust and securing initial contracts | Established reputation and long-term client relationships |

| Regulatory Compliance | Significant costs and time for understanding and implementing rules | Existing compliance systems and industry expertise |

| Skilled Labor | High costs for recruitment, training, and retention | Established talent pool and operational know-how |

Porter's Five Forces Analysis Data Sources

Our CTI Logistics Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and government regulatory filings. These sources provide crucial insights into market structure, competitive intensity, and potential threats.