CSPC Pharmaceutical Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSPC Pharmaceutical Group Bundle

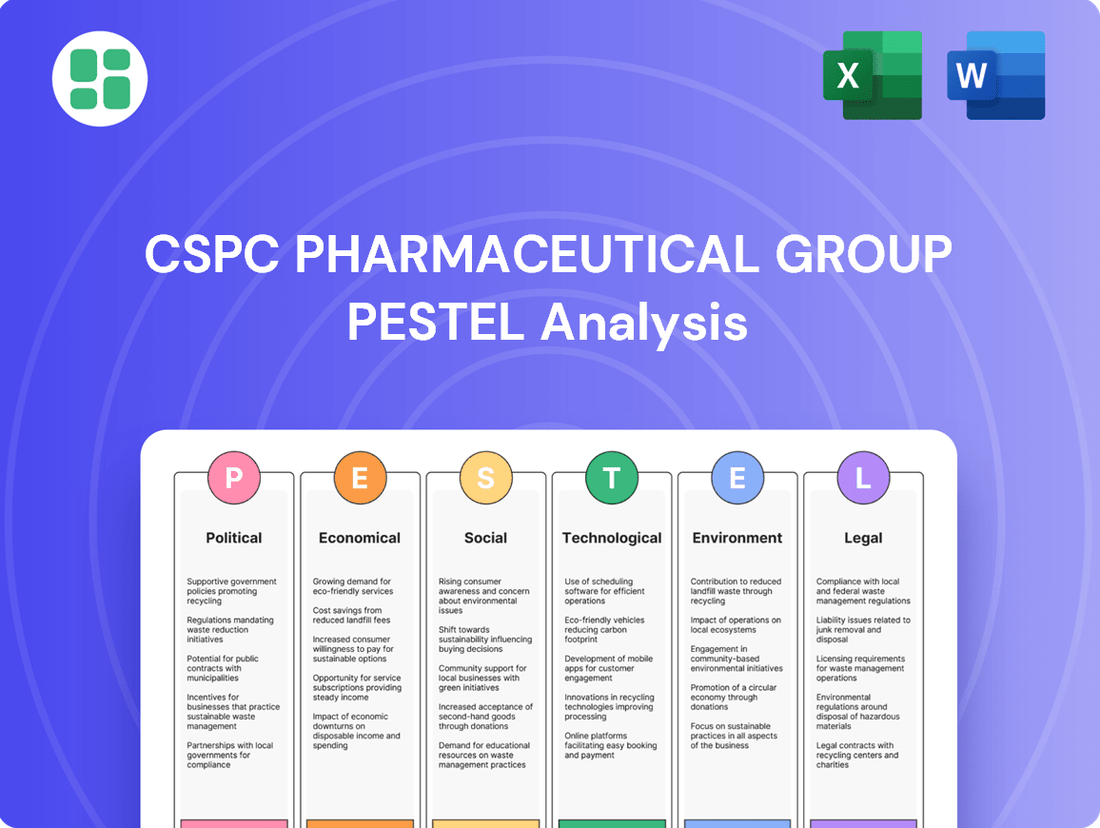

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CSPC Pharmaceutical Group's strategic landscape. Our expert-crafted PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and identify growth opportunities. Download the full report now to gain a decisive advantage.

Political factors

The Chinese government's ongoing healthcare reforms present a dynamic landscape for CSPC Pharmaceutical Group. Policies such as centralized drug procurement (CDP) and volume-based procurement (VBP) have a direct bearing on drug pricing and market penetration, compelling CSPC to adapt its commercial strategies and manage costs effectively. For instance, the VBP program, which began in 2019 and has seen multiple rounds, has significantly pressured drug prices, with some reports indicating average price reductions of over 50% for included products.

Furthermore, updates to the National Reimbursement Drug List (NRDL) are crucial for CSPC's innovative products. Inclusion on the NRDL can dramatically expand patient access and sales volume. In 2023, several innovative drugs, including those from CSPC, were added to the NRDL, reflecting the government's focus on supporting new therapies while balancing affordability.

Drug pricing regulations, especially through Volume-Based Purchasing (VBP) rounds, significantly impact CSPC Pharmaceutical Group. These government-driven initiatives often force substantial price reductions on both generic and some patented medications, creating a complex operating landscape.

For CSPC, this means a strategic pivot towards high-value, innovative drugs that are less vulnerable to steep price cuts. Optimizing manufacturing efficiency becomes crucial to maintain profitability amidst these margin pressures, as seen with the ongoing efforts to control healthcare expenditure nationwide.

China's evolving intellectual property (IP) landscape is a critical political factor for CSPC Pharmaceutical Group. The strengthening of IP protection and enforcement in China, particularly evident in recent years, directly influences CSPC's capacity to invest in and benefit from its research and development endeavors. For instance, the State Council's Opinions on Strengthening Intellectual Property Protection issued in 2021 signaled a commitment to enhancing IP rights, which is vital for pharmaceutical companies like CSPC that rely on innovation.

Robust IP protection is paramount for CSPC to safeguard its patented drugs and formulations from infringement. This security is essential for recouping significant R&D investments, which in 2023, CSPC reported as RMB 3.1 billion, and for fostering continued innovation. Without strong enforcement, the risk of unauthorized generic competition increases, potentially undermining the profitability of novel treatments and hindering CSPC's ability to compete on a global scale.

Support for Domestic Innovation

The Chinese government's commitment to bolstering domestic pharmaceutical innovation presents a significant tailwind for CSPC Pharmaceutical Group. Initiatives like R&D subsidies, expedited regulatory pathways for novel drugs, and targeted tax incentives are directly fueling CSPC's investment in cutting-edge research. This support is particularly impactful in strategic areas such as oncology and neurology, aligning with national health objectives and driving the development of high-value therapeutics.

These supportive policies are designed to enhance China's pharmaceutical self-sufficiency, directly benefiting companies like CSPC. By encouraging greater investment in research and development, the government aims to accelerate the pipeline advancement and market introduction of innovative treatments. This strategic alignment can significantly shorten development cycles and improve the commercial viability of CSPC's novel drug candidates.

- R&D Investment Growth: CSPC's R&D expenditure saw a notable increase, reaching approximately RMB 3.0 billion in 2023, a testament to the impact of government support.

- New Drug Approvals: The fast-track approval process has contributed to CSPC securing approvals for several innovative drugs in recent years, including novel treatments for chronic diseases.

- Tax Incentives: CSPC benefited from preferential tax rates on R&D income, which in 2023 amounted to an estimated RMB 200 million in tax savings, reinvested into further innovation.

- Strategic Focus: Government emphasis on areas like oncology has led CSPC to allocate over 40% of its R&D budget to cancer therapies, mirroring national health priorities.

Geopolitical Climate and Trade Policies

The intricate geopolitical landscape, particularly the evolving relationship between China and Western nations, significantly shapes CSPC Pharmaceutical Group's operational environment. Trade policies enacted by major economies can directly influence CSPC's global supply chain, affecting both the import of essential raw materials and the export of its finished pharmaceutical products. For instance, the ongoing trade friction between the US and China, which intensified in recent years, has led to increased scrutiny on supply chains and potential tariffs, impacting cost structures for companies like CSPC.

Tensions or outright trade disputes can create substantial disruptions, potentially hindering CSPC's ability to source critical components or deliver its medicines to international markets. These disruptions can translate into increased operational costs and delays in product launches. For example, as of early 2024, discussions around supply chain resilience and diversification away from single-source dependencies are prominent, a trend CSPC must navigate.

Furthermore, policies concerning technology transfer and data security are increasingly critical for pharmaceutical companies engaged in global research and development. Stricter regulations or limitations on data sharing could impede CSPC's international collaborations, which are vital for accessing cutting-edge research, developing novel treatments, and gaining market entry in key regions. The global push for data localization and cybersecurity measures, particularly in sensitive sectors like healthcare, presents a complex regulatory challenge for multinational operations.

- Trade Tensions: Increased trade friction between China and Western economies can lead to tariffs and supply chain disruptions, impacting CSPC's raw material imports and finished product exports.

- Supply Chain Resilience: Global efforts to enhance supply chain resilience, as observed in 2023-2024, may necessitate diversification strategies for CSPC, potentially increasing logistical complexity and costs.

- Data Security Policies: Evolving international regulations on data transfer and cybersecurity can affect CSPC's ability to collaborate on research and development with global partners, limiting access to advanced technologies and markets.

Government policies like centralized drug procurement (CDP) and volume-based procurement (VBP) significantly impact CSPC's pricing and market access. For instance, VBP rounds have driven substantial price reductions, with some drugs seeing over 50% decreases, forcing CSPC to focus on innovative, higher-margin products. Inclusion on the National Reimbursement Drug List (NRDL) in 2023 was crucial for CSPC's innovative drugs, expanding patient access and sales volumes.

China's strengthening intellectual property (IP) protection, emphasized by the 2021 State Council Opinions, is vital for CSPC's R&D investments. CSPC's R&D expenditure reached approximately RMB 3.0 billion in 2023, supported by government incentives like R&D tax savings, estimated at RMB 200 million in 2023.

Government support for domestic innovation, including R&D subsidies and expedited regulatory pathways, bolsters CSPC's development of novel therapeutics. CSPC strategically allocates over 40% of its R&D budget to oncology, aligning with national health priorities and benefiting from fast-track approvals for new drugs.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing CSPC Pharmaceutical Group's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, highlighting key trends and potential impacts for informed decision-making.

This CSPC Pharmaceutical Group PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby relieving the pain point of information overload.

Economic factors

China's economic expansion continues to fuel a significant increase in healthcare spending, creating a robust and expanding market for pharmaceutical companies like CSPC. In 2023, China's GDP grew by 5.2%, and this sustained growth directly correlates with higher national healthcare expenditure.

As Chinese citizens experience rising disposable incomes, there's a greater capacity and willingness to invest in advanced medical treatments and premium pharmaceuticals, directly benefiting CSPC's diverse product portfolio. This trend is evident as per capita disposable income saw a notable increase in 2024.

Furthermore, the Chinese government's ongoing commitment to enhancing healthcare infrastructure and broadening universal health coverage is systematically expanding the potential patient pool accessible to CSPC's innovative medicines and treatments.

Healthcare affordability and the purchasing power of China's population are key economic drivers for CSPC Pharmaceutical Group. As China's economy expanded, so did its citizens' capacity to spend on healthcare. For instance, China's per capita disposable income grew by 6.3% in 2023, reaching over 40,000 yuan, indicating increased consumer spending potential.

However, government initiatives like the Volume-Based Procurement (VBP) program actively aim to lower drug prices, directly impacting the revenue CSPC can generate per unit sold. This policy, designed to make essential medicines more accessible, creates a delicate balance for pharmaceutical companies.

CSPC must navigate this landscape by understanding patient demand for novel treatments versus the government's push for cost containment. The success of their innovative products hinges on this equilibrium, influencing their pricing strategies and market positioning within the evolving Chinese healthcare economy.

Inflationary pressures and volatile raw material costs present a significant challenge for CSPC Pharmaceutical Group. For instance, the global inflation rate remained elevated throughout 2023 and into early 2024, impacting the cost of essential inputs like pharmaceutical intermediates and packaging. This directly affects CSPC's manufacturing expenses and can erode profitability if these rising costs cannot be passed on through price adjustments or offset by supply chain efficiencies.

The company's reliance on a global supply chain means fluctuations in commodity markets, particularly for key APIs and energy, directly influence its cost structure. For example, disruptions in the supply of certain chemical precursors due to geopolitical events or increased demand can lead to sharp price increases. CSPC's ability to manage these costs through strategic sourcing and inventory management is crucial for maintaining its competitive edge and profit margins.

Investment in R&D and Capital Allocation

CSPC Pharmaceutical Group's investment in R&D and capital allocation is significantly shaped by the prevailing economic climate. A strong economic environment, characterized by accessible capital and healthy consumer spending, enables CSPC to allocate more resources towards innovation, clinical trials, and facility upgrades. For instance, in 2023, CSPC reported robust revenue growth, allowing for continued investment in its pipeline.

The company's ability to secure funding for ambitious projects, including potential mergers and acquisitions aimed at expanding its therapeutic areas and geographic reach, is directly tied to economic stability and credit availability. Economic downturns, however, can tighten credit markets and reduce overall investment appetite, potentially impacting the pace of R&D advancements and strategic expansion initiatives.

- R&D Investment: CSPC's commitment to innovation is reflected in its R&D spending, which has seen consistent increases to bolster its drug pipeline.

- Capital Allocation: The company strategically allocates capital towards promising therapeutic areas and manufacturing capabilities to support growth.

- Economic Impact: Favorable economic conditions in 2024 and anticipated into 2025 are expected to support CSPC's ongoing investments in research and development.

- Market Dynamics: CSPC's capital allocation decisions are also influenced by global pharmaceutical market trends and competitive pressures.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations present a significant factor for CSPC Pharmaceutical Group, particularly concerning its international operations. For instance, if CSPC sources raw materials from overseas, a strengthening Chinese yuan (CNY) would lower import costs, potentially improving its cost of goods sold. Conversely, a stronger yuan makes CSPC's products more expensive for international buyers, potentially hindering export sales growth.

Consider the impact on CSPC's revenue streams. In 2024, the yuan experienced periods of volatility against major currencies like the US dollar and the Euro. If CSPC generates a substantial portion of its revenue from exports, a depreciating yuan would translate to higher yuan-denominated revenues, while a strengthening yuan would have the opposite effect. This dynamic directly influences profitability and the company's ability to compete globally.

Managing these currency risks is crucial for CSPC's financial stability. Strategies such as hedging through forward contracts or options can help mitigate the impact of adverse exchange rate movements. For example, if CSPC anticipates significant sales in the US market in late 2024 or early 2025, and the yuan is expected to strengthen, the company might enter into forward contracts to sell USD at a predetermined CNY rate, locking in its revenue.

Key considerations for CSPC regarding foreign exchange rates include:

- Impact on Cost of Goods Sold: Fluctuations affect the cost of imported raw materials and components.

- Competitiveness of Exports: Exchange rates influence the pricing and demand for CSPC's products in international markets.

- Revenue Translation: Foreign currency earnings are converted to CNY, impacting reported financial results.

- Currency Risk Management: Implementing hedging strategies to protect against adverse currency movements is essential.

China's economic growth directly fuels healthcare spending, benefiting CSPC. In 2023, China's GDP grew 5.2%, leading to increased per capita disposable income, which rose 6.3% in the same year, reaching over 40,000 yuan. This economic expansion translates to greater consumer capacity for advanced medical treatments. However, government policies like Volume-Based Procurement (VBP) aim to control drug prices, creating a pricing challenge for CSPC.

Inflationary pressures and volatile raw material costs are significant hurdles for CSPC. Global inflation remained elevated through early 2024, impacting the cost of pharmaceutical intermediates and packaging. This directly affects CSPC's manufacturing expenses and profitability, especially given reliance on global supply chains for APIs and energy.

CSPC's R&D and capital allocation are tied to the economic climate. Strong economic conditions in 2024 support continued investment in its drug pipeline, as evidenced by robust revenue growth in 2023. Access to capital is crucial for funding ambitious projects, including potential mergers and acquisitions.

Foreign exchange rate fluctuations impact CSPC's international operations and profitability. Volatility in the yuan against currencies like the USD and Euro in 2024 affects the cost of imported materials and the competitiveness of exports. Managing these currency risks through strategies like hedging is essential for financial stability.

| Economic Factor | 2023 Data | 2024 Outlook/Trend | Impact on CSPC | Key Consideration |

| GDP Growth (China) | 5.2% | Projected continued growth | Increased healthcare spending, market expansion | Leveraging market growth |

| Per Capita Disposable Income | +6.3% (over 40,000 yuan) | Anticipated further increase | Higher consumer spending on healthcare | Targeting premium segments |

| Inflation Rate | Elevated | Continued pressure | Increased manufacturing costs, potential margin erosion | Cost management and efficiency |

| Volume-Based Procurement (VBP) | Active implementation | Ongoing policy | Downward pressure on drug prices | Navigating pricing strategies |

| Foreign Exchange Rates (CNY) | Volatile | Continued volatility expected | Impacts import costs and export revenue | Currency risk management (hedging) |

Same Document Delivered

CSPC Pharmaceutical Group PESTLE Analysis

The CSPC Pharmaceutical Group PESTLE Analysis you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. It delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CSPC's operations and strategic positioning. This comprehensive analysis provides actionable insights for informed decision-making.

Sociological factors

China's demographic landscape is rapidly evolving, with its aging population expected to reach approximately 300 million individuals by 2025. This significant demographic shift directly correlates with a rising incidence of chronic diseases, including cardiovascular ailments, neurological conditions, and cancers, which are core focus areas for CSPC Pharmaceutical Group.

This increasing prevalence of age-related illnesses translates into a robust and enduring demand for pharmaceutical solutions designed to manage these conditions and enhance the well-being of the elderly population. CSPC's strategic focus on these therapeutic areas positions it advantageously to capitalize on this expanding market segment.

Chinese consumers are increasingly health-conscious, with a growing demand for higher quality and more effective medications. This societal shift, fueled by better access to health information, means people are more willing to invest in premium healthcare solutions. For instance, in 2024, China's healthcare spending was projected to reach over $1.5 trillion, reflecting this rising awareness and willingness to spend on well-being.

This trend directly impacts pharmaceutical companies like CSPC. It pushes them to prioritize research and development for innovative drugs that offer tangible health benefits. The focus is moving beyond basic treatments to encompass preventative care and early disease management, aligning product portfolios with consumer aspirations for a better quality of life.

Modern lifestyles in China are dramatically reshaping health landscapes. Increased urbanization, coupled with evolving dietary habits and a general decline in physical activity, has led to a rise in non-communicable diseases. For instance, the prevalence of metabolic disorders like diabetes and obesity continues to climb, with the International Diabetes Federation reporting over 120 million adults with diabetes in China as of 2021, a figure projected to grow significantly by 2030.

This epidemiological shift presents both challenges and opportunities for CSPC Pharmaceutical Group. The company must strategically align its research and development efforts and product pipeline to address these emerging health concerns. Developing innovative treatments for conditions such as cardiovascular diseases, certain cancers, and autoimmune disorders, which are increasingly linked to lifestyle factors, will be crucial for sustained growth and market relevance.

By closely monitoring these evolving disease patterns, CSPC can proactively direct its resources toward therapeutic areas with the highest future demand. This foresight allows for more efficient allocation of capital and R&D investment, ensuring the company remains at the forefront of addressing China's most pressing public health challenges. For example, investments in novel diabetes therapies or oncology treatments that target lifestyle-related cancers are likely to yield strong returns.

Public Trust in Pharmaceutical Companies and Drug Safety

Public trust in pharmaceutical companies is a bedrock for market acceptance and brand reputation, directly influencing drug safety perceptions. In China, past concerns regarding drug quality have made consumers particularly vigilant. For CSPC Pharmaceutical Group, demonstrating unwavering commitment to rigorous quality control, transparent clinical trial data, and ethical marketing is therefore not just good practice, but a necessity for building and sustaining consumer confidence. This trust is a key driver for patient adherence to prescribed treatments and physician prescribing habits.

CSPC's proactive approach to quality assurance is vital. For instance, in 2023, the company reported significant investments in upgrading its manufacturing facilities to meet international Good Manufacturing Practice (GMP) standards, a move aimed at bolstering its safety profile. This commitment is reflected in their ongoing efforts to ensure the efficacy and safety of their product portfolio, which is crucial in an environment where consumer scrutiny remains high. Maintaining a strong reputation for safety and quality is paramount for continued market penetration and physician recommendation.

- Consumer Vigilance: Chinese consumers are increasingly discerning about drug quality and efficacy following past incidents, placing a premium on transparency and proven safety.

- CSPC's Quality Focus: The company's investments in advanced manufacturing and adherence to international GMP standards underscore its dedication to drug safety and quality.

- Impact on Prescribing: Physician prescribing patterns and patient adherence are directly influenced by their confidence in a pharmaceutical company's commitment to safety and effective treatments.

- Reputation Management: A strong, consistently maintained reputation for safety and quality is essential for CSPC's long-term market success and brand loyalty.

Access to Healthcare Services and Health Equity

Disparities in healthcare access across China significantly shape CSPC Pharmaceutical Group's market approach. Urban areas boast sophisticated medical infrastructure, but rural regions often struggle with limited healthcare facilities and fewer available medications. This uneven distribution directly impacts CSPC's ability to penetrate diverse markets effectively.

CSPC must tailor its distribution and pricing to bridge this gap. By ensuring its pharmaceuticals reach underserved rural populations, the company can promote health equity and broaden its customer base. For instance, in 2023, China's rural healthcare spending per capita was significantly lower than in urban areas, highlighting the need for targeted strategies to improve access to essential medicines.

- Urban-Rural Healthcare Divide: Significant differences in medical resources and drug availability persist between China's cities and countryside.

- Market Penetration Challenges: CSPC faces hurdles in reaching rural populations due to underdeveloped healthcare infrastructure.

- Health Equity Imperative: Addressing these disparities is crucial for CSPC to contribute to national health goals and expand market reach.

- Strategic Considerations: Tailored distribution networks and flexible pricing models are essential for CSPC to serve a wider demographic.

China's aging population, projected to exceed 300 million by 2025, drives demand for chronic disease treatments, a core area for CSPC Pharmaceutical Group. This demographic shift, coupled with increasing health consciousness and urbanization leading to lifestyle-related illnesses, creates a robust market for innovative and high-quality pharmaceuticals.

Consumers' growing vigilance regarding drug safety and efficacy necessitates CSPC's commitment to stringent quality control and transparency, as evidenced by their 2023 investments in upgrading manufacturing facilities to international GMP standards. Furthermore, significant disparities in healthcare access between urban and rural areas require CSPC to implement targeted distribution and pricing strategies to ensure broader market penetration and promote health equity.

Technological factors

Rapid advancements in biotechnology, genomics, proteomics, and artificial intelligence (AI) are fundamentally reshaping drug discovery and development. These fields are accelerating the identification of potential drug candidates and refining compound design.

CSPC Pharmaceutical Group can harness these technologies to speed up lead identification, optimize compound design, and enhance the efficiency of preclinical research. This strategic adoption can significantly cut down the time and expense involved in bringing new medications to market.

For instance, AI in drug discovery is projected to reduce early-stage drug development timelines by as much as 40-50% in the coming years. Investing in AI-driven platforms and high-throughput screening is therefore vital for CSPC to maintain its competitive advantage in the pharmaceutical landscape.

The pharmaceutical landscape is rapidly evolving with biologics, such as monoclonal antibodies and gene therapies, becoming increasingly vital. CSPC Pharmaceutical Group's commitment to innovation means it must excel in researching, developing, and producing these complex biological drugs.

In 2023, the global biologics market was valued at over $450 billion, with projections indicating continued strong growth. CSPC's investment in specialized biologics R&D infrastructure and expertise is crucial for accessing high-growth therapeutic areas and expanding its offerings beyond conventional small-molecule drugs.

This strategic focus on biologics allows CSPC to position itself at the forefront of developing potentially groundbreaking treatments, tapping into a segment of the market that is experiencing significant demand and offering substantial future revenue potential.

Digitalization is reshaping how healthcare is delivered and how pharmaceuticals are made. For CSPC Pharmaceutical Group, technologies like telemedicine and electronic health records (EHRs) offer ways to improve patient access and streamline operations. Smart manufacturing, or Industry 4.0, is also a key area, allowing for more efficient production processes.

By adopting advanced manufacturing automation and real-time quality control systems, CSPC can boost its operational efficiency. For instance, integrating data analytics into production facilities helps optimize workflows, minimize errors, and ensure consistent product quality, which is crucial in the pharmaceutical sector. This focus on digital transformation in manufacturing is a significant trend for companies like CSPC.

Furthermore, digital health platforms present new opportunities for CSPC to engage with patients and innovate drug delivery methods. The global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating a strong potential for companies that leverage these technologies to reach and support patients more effectively.

Precision Medicine and Personalized Therapies

The rise of precision medicine, where treatments are customized to a patient's unique genetic makeup, represents a significant technological shift. CSPC Pharmaceutical Group can leverage this by investing in research and development for companion diagnostics and targeted therapies, especially within its oncology and neurology portfolios, to create more effective and safer medications.

This advanced approach necessitates robust genetic sequencing technologies and bioinformatics skills, enabling the development of highly specific treatments that demonstrably improve patient results. For instance, the global precision medicine market was valued at approximately USD 67.3 billion in 2023 and is projected to reach USD 167.5 billion by 2030, indicating substantial growth potential for companies focusing on this area.

- Companion Diagnostics: CSPC could develop diagnostic tests that identify specific genetic markers to predict a patient's response to a particular drug, enhancing treatment efficacy.

- Targeted Therapies: Focusing R&D on drugs designed to act on specific molecular targets within cancer cells or neurological pathways offers a more precise and less toxic alternative to traditional treatments.

- Bioinformatics Integration: Investing in data analytics and bioinformatics infrastructure is crucial for processing and interpreting the vast amounts of genetic and molecular data required for precision medicine development.

Data Analytics and Real-World Evidence

The pharmaceutical industry, including companies like CSPC Pharmaceutical Group, is increasingly leveraging data analytics and real-world evidence (RWE). The sheer volume of data generated from clinical trials, electronic health records, and even wearable devices is immense, providing deep insights into how drugs perform in actual patient populations. This allows for a much more nuanced understanding of drug efficacy and safety beyond controlled trial settings. For instance, by 2024, the global big data analytics market in healthcare was projected to reach over $100 billion, highlighting the significant investment and adoption of these technologies.

CSPC can harness RWE to refine its clinical trial designs, making them more efficient and representative of diverse patient groups. This data can also uncover previously unrecognized uses for existing medications, potentially opening up new market opportunities. Furthermore, demonstrating the tangible value of their products through RWE is crucial for gaining approval and favorable reimbursement from regulatory bodies and payers. By mid-2024, numerous health authorities, including the FDA and EMA, have issued guidelines supporting the use of RWE in regulatory decision-making.

- Data Growth: Global healthcare data is expected to grow at a compound annual growth rate (CAGR) of 36% through 2025, according to industry reports.

- RWE Adoption: A significant percentage of pharmaceutical companies are actively incorporating RWE into their research and development pipelines, with adoption rates climbing steadily.

- Market Value: The market for RWE solutions is projected to expand considerably, driven by the need for evidence-based decision-making in healthcare.

- Regulatory Support: Regulatory agencies are increasingly open to RWE, with a growing number of submissions including real-world data to support drug approvals and label expansions.

Technological advancements, particularly in AI and big data analytics, are accelerating drug discovery and development for companies like CSPC Pharmaceutical Group. The global digital health market, valued at approximately $200 billion in 2023, underscores the growing importance of digital solutions in healthcare delivery and pharmaceutical operations.

CSPC's strategic investment in biologics, a market exceeding $450 billion in 2023, and precision medicine, valued at $67.3 billion in 2023, positions it to capitalize on high-growth therapeutic areas. The increasing acceptance of real-world evidence (RWE) by regulatory bodies by mid-2024 further supports data-driven pharmaceutical strategies.

| Technology Area | 2023 Market Value (approx.) | Projected Growth/Impact |

|---|---|---|

| Biologics | $450 billion+ | Continued strong growth |

| Digital Health | $200 billion | Significant projected growth |

| Precision Medicine | $67.3 billion | Projected to reach $167.5 billion by 2030 |

| AI in Drug Discovery | N/A (emerging) | Potential 40-50% reduction in early-stage development timelines |

| Big Data Analytics in Healthcare | $100 billion+ (projected by 2024) | Driving efficiency and insights |

Legal factors

The National Medical Products Administration (NMPA) in China continues to refine its drug registration and approval processes, a key legal factor influencing CSPC Pharmaceutical Group's market access. Recent reforms aim to streamline approvals for innovative therapies, with a noticeable acceleration in review times for certain categories. For instance, by the end of 2023, the NMPA had approved a significant number of innovative drugs, reflecting the evolving regulatory environment.

CSPC must navigate these evolving legal frameworks, including updated Good Clinical Practice (GCP) guidelines and requirements for real-world evidence, to ensure its pipeline products meet stringent compliance standards. The ability to adapt to changes in clinical trial design and data submission protocols is crucial for expediting market entry and maintaining a competitive edge in China's pharmaceutical sector.

Clinical trials are heavily regulated, with strict rules on patient consent, data accuracy, and ethical review, all vital for bringing new drugs to market. CSPC Pharmaceutical Group must follow the National Medical Products Administration (NMPA) regulations in China, as well as international Good Clinical Practice (GCP) standards. These guidelines ensure the safety and effectiveness of new treatments.

Adhering to these legal and ethical mandates is non-negotiable for securing approval from regulatory bodies and building trust with the public and scientific community. For instance, in 2023, the NMPA approved 55 innovative drugs, highlighting the rigorous review process that CSPC must navigate. Failure to comply can invalidate research and delay or prevent product launches.

China's anti-monopoly and fair competition laws are designed to foster a competitive environment within the pharmaceutical sector, preventing undue market dominance. CSPC Pharmaceutical Group must navigate these regulations carefully, ensuring its pricing, distribution networks, and any potential mergers or acquisitions align with these legal stipulations to avoid fines and maintain regulatory good standing.

Failure to comply with these stringent rules could lead to significant penalties and legal hurdles, potentially impacting CSPC's ability to operate freely and access key markets. For instance, in 2023, the State Administration for Market Regulation (SAMR) continued to enforce anti-monopoly regulations across various industries, including pharmaceuticals, with a focus on preventing price gouging and unfair competition practices.

Product Liability and Consumer Protection Laws

CSPC Pharmaceutical Group navigates a landscape governed by strict product liability and consumer protection laws, holding them accountable for drug safety and effectiveness. This means an unwavering commitment to quality control from production to post-market monitoring, including transparent labeling of all drug information and potential side effects is crucial. For instance, in 2024, regulatory bodies worldwide, including China's NMPA, continued to emphasize stringent pharmacovigilance, with increased penalties for non-compliance.

Adherence to these regulations is paramount to mitigating risks such as costly legal claims, damage to brand reputation, and significant financial penalties that can arise from product defects or adverse patient events. The global pharmaceutical market in 2024 saw a notable increase in consumer-driven lawsuits, underscoring the importance of robust compliance strategies for companies like CSPC.

Key compliance areas include:

- Robust Quality Management Systems: Ensuring adherence to Good Manufacturing Practices (GMP) at all production stages.

- Comprehensive Post-Market Surveillance: Actively monitoring and reporting adverse drug reactions and product quality issues.

- Clear and Accurate Labeling: Providing detailed information on usage, dosage, contraindications, and potential side effects.

- Effective Recall Procedures: Having well-defined processes for swift and efficient product recalls when necessary.

Environmental Protection Laws and Manufacturing Compliance

China's environmental protection laws are becoming increasingly strict, especially regarding how industrial companies manage waste, control emissions, and prevent water pollution. For CSPC Pharmaceutical Group, this means their manufacturing processes must adapt. For instance, by 2024, China's environmental regulations have pushed for a significant reduction in industrial wastewater discharge, with many regions targeting a 15% decrease compared to 2020 levels.

To stay compliant, CSPC needs to invest in greener technologies and sustainable operational methods. This could involve upgrading wastewater treatment facilities or adopting cleaner production techniques. Meeting these standards often requires obtaining specific environmental permits and undergoing regular inspections to ensure adherence to emission limits and waste disposal protocols.

Failing to comply with these environmental mandates can have serious consequences for CSPC. These can include substantial fines, temporary or permanent shutdowns of production lines, and significant damage to the company's public image. Therefore, maintaining legal compliance is crucial for CSPC's ongoing operations and long-term business health.

- Stricter Regulations: China's environmental laws now impose tougher standards on waste management, emissions, and water pollution for industrial operations.

- Investment in Sustainability: CSPC must allocate resources to environmentally friendly technologies and sustainable practices to meet these evolving legal requirements.

- Compliance Measures: Adherence involves securing necessary environmental permits and participating in regular audits to verify compliance with pollution control standards.

- Risk of Non-Compliance: Penalties for violations can range from hefty fines and production stoppages to severe reputational harm.

CSPC Pharmaceutical Group operates under China's evolving legal framework, particularly concerning drug approvals and clinical trials, with the NMPA accelerating reviews for innovative drugs. By the end of 2023, the NMPA had approved 55 innovative drugs, underscoring the rigorous yet dynamic regulatory environment CSPC must navigate. Adherence to stringent Good Clinical Practice (GCP) guidelines and real-world evidence requirements is paramount for timely market entry and maintaining a competitive edge.

The company must also comply with anti-monopoly and fair competition laws, ensuring pricing and distribution strategies avoid market dominance issues, as enforced by bodies like the State Administration for Market Regulation (SAMR). Furthermore, product liability and consumer protection laws demand robust quality control and pharmacovigilance, with increased penalties for non-compliance noted in 2024, impacting companies like CSPC through potential legal claims and reputational damage.

Environmental regulations in China are tightening, pushing CSPC to invest in sustainable manufacturing processes and waste management, with regions targeting significant reductions in industrial wastewater discharge by 2024. Failure to meet these environmental mandates can result in substantial fines, operational shutdowns, and reputational harm, making compliance a critical factor for CSPC's long-term viability.

Environmental factors

CSPC Pharmaceutical Group's manufacturing operations produce diverse waste streams, such as chemical byproducts and pharmaceutical residues, demanding sophisticated waste management and pollution control infrastructure.

China's increasingly strict environmental regulations necessitate substantial capital outlays for advanced waste treatment, secure disposal practices, and technologies aimed at curbing emissions, all vital for operational continuity and corporate reputation.

For instance, in 2023, China's Ministry of Ecology and Environment reported a 5% increase in environmental protection spending by industrial sectors, highlighting the growing compliance burden and investment requirements faced by companies like CSPC.

The environmental impact of sourcing raw materials for pharmaceutical production is a growing concern. CSPC Pharmaceutical Group is under increasing pressure to guarantee its supply chain for bulk drugs and intermediates is sustainable and environmentally sound.

This requires evaluating the ecological footprint of suppliers and encouraging responsible agricultural practices. For instance, a 2024 report by the UNEP highlighted that the pharmaceutical industry's water consumption can be significant, with some manufacturing processes requiring substantial amounts of water, emphasizing the need for efficient water management across the supply chain.

Minimizing resource depletion and adopting circular economy principles are crucial for CSPC. By focusing on sustainable sourcing, the company can reduce waste and enhance its environmental stewardship, aligning with global trends towards greener manufacturing processes.

Pharmaceutical manufacturing, including CSPC Pharmaceutical Group's operations, is inherently energy-intensive, directly impacting its carbon footprint. In 2023, the global pharmaceutical industry's energy consumption was a significant factor in its environmental impact, with companies increasingly scrutinized for their emissions.

There's a strong push for CSPC to integrate energy-efficient technologies and explore renewable energy sources to mitigate this. By adopting such strategies, CSPC can work towards reducing its greenhouse gas emissions, aligning with China's national environmental goals and improving its sustainability credentials.

Water Usage and Wastewater Treatment

Water is absolutely essential for pharmaceutical production, from cleaning equipment to formulating medicines. However, the wastewater generated can contain various chemical compounds, making its proper treatment crucial to prevent environmental harm. CSPC Pharmaceutical Group, like others in the industry, faces stringent regulations regarding the quality of discharged water.

To comply and operate sustainably, CSPC needs to invest in and utilize advanced water purification and wastewater treatment systems. This ensures that any water released back into the environment meets strict discharge standards, protecting local ecosystems. For instance, in 2023, China's Ministry of Ecology and Environment continued to emphasize stricter wastewater discharge limits for industrial sectors, including pharmaceuticals, with penalties for non-compliance.

Responsible water management is more than just a regulatory hurdle; it's a core operational requirement. Conserving water resources is vital for long-term business continuity, especially in regions facing water scarcity. Furthermore, minimizing ecological damage enhances CSPC's corporate social responsibility profile.

- Water scarcity: Regions where CSPC operates may face increasing water stress, impacting operational costs and availability.

- Regulatory compliance: Adherence to evolving wastewater discharge standards is paramount, with significant fines for violations.

- Technological investment: Implementing state-of-the-art water treatment technologies is necessary to meet environmental targets.

- Resource efficiency: Optimizing water usage reduces operational expenses and supports sustainability goals.

Climate Change Impact on Supply Chains

Climate change presents significant operational risks for CSPC Pharmaceutical Group's global supply chains. Extreme weather events, such as the increased frequency of typhoons in Asia or prolonged droughts affecting agricultural output, can directly disrupt the availability of key raw materials and impact transportation networks. For instance, in 2024, several regions experienced severe flooding, leading to temporary closures of critical logistics hubs, which could have delayed the delivery of active pharmaceutical ingredients (APIs).

These disruptions can translate into tangible financial consequences, including higher procurement costs for raw materials, increased shipping expenses due to rerouting, and potential shortages that affect production schedules. The World Meteorological Organization reported a 20% increase in reported climate-related disasters between 2022 and 2023, highlighting the growing volatility. CSPC must proactively address these vulnerabilities.

- Supplier Diversification: Reducing reliance on single-source suppliers in climate-vulnerable regions.

- Resilient Logistics: Exploring alternative transportation routes and modes less susceptible to weather disruptions.

- Inventory Management: Strategically increasing buffer stocks for critical raw materials.

- Climate Risk Assessment: Integrating climate scenario analysis into supply chain planning to identify and prepare for potential impacts.

CSPC Pharmaceutical Group faces stringent environmental regulations in China, requiring significant investment in waste management and pollution control technologies to ensure compliance and maintain its reputation. The company must also address the environmental impact of its supply chain, particularly concerning water usage and sustainable sourcing of raw materials, as highlighted by global reports on the pharmaceutical industry's ecological footprint.

PESTLE Analysis Data Sources

Our CSPC Pharmaceutical Group PESTLE analysis is meticulously constructed using data from reputable sources including the World Health Organization (WHO), national regulatory bodies, and leading market research firms. We incorporate economic indicators from institutions like the IMF and World Bank, alongside insights from industry-specific publications and technological trend reports.