CSPC Pharmaceutical Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSPC Pharmaceutical Group Bundle

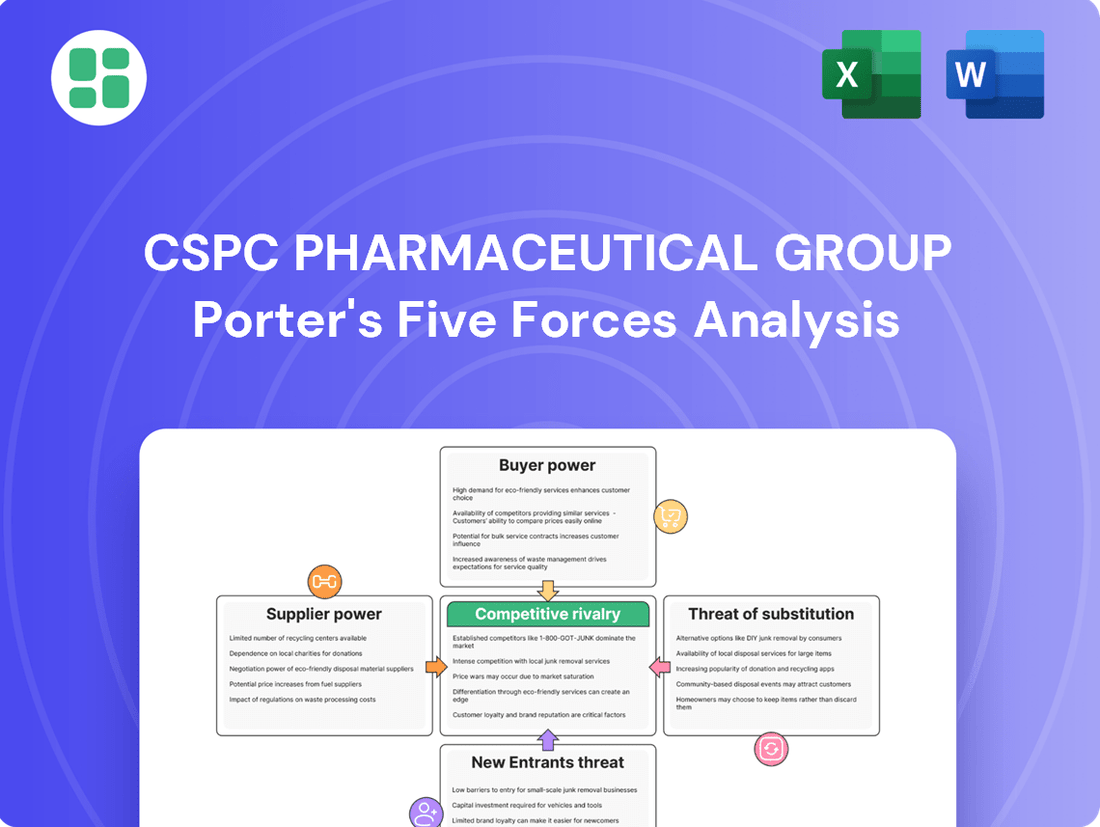

CSPC Pharmaceutical Group navigates a dynamic landscape shaped by intense rivalry and the ever-present threat of new entrants in the pharmaceutical sector. Understanding the bargaining power of both buyers and suppliers is crucial for strategic positioning. The availability of substitute products also presents a significant challenge.

The complete report reveals the real forces shaping CSPC Pharmaceutical Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CSPC Pharmaceutical Group, like many in its industry, depends on a global network for specialized raw materials and Active Pharmaceutical Ingredients (APIs). The suppliers of these critical components can wield significant bargaining power, particularly when dealing with patented or intricate intermediates that have limited alternative sourcing options.

This supplier leverage is amplified by factors like geopolitical shifts and evolving trade regulations. For instance, China's strategic focus on decreasing its dependence on specific foreign imports can directly impact the availability and pricing of essential inputs, thereby strengthening the negotiating position of certain suppliers for key components.

Suppliers of high-tech manufacturing equipment for pharmaceuticals wield considerable influence over CSPC Pharmaceutical Group. The specialized nature and substantial investment required for this machinery, coupled with a limited vendor pool, mean CSPC faces high switching costs. These costs extend beyond mere equipment replacement to include critical re-validation processes, extensive staff retraining, and the potential for significant production downtime, reinforcing supplier leverage.

The pharmaceutical sector's reliance on advanced research and development means suppliers of novel technologies, research tools, and intellectual property hold significant sway. Companies offering specialized R&D services, especially those leveraging cutting-edge platforms like AI for drug discovery, can command premium pricing. This is evident in collaborations such as CSPC's partnership with AstraZeneca, which utilizes AI to enhance research, underscoring the substantial leverage these specialized R&D partners possess.

Skilled Labor and Scientific Talent

The availability of highly skilled researchers, chemists, clinical trial experts, and specialized manufacturing personnel is absolutely critical for pharmaceutical companies like CSPC. A shortage of this specialized talent, whether in China or globally, can significantly drive up labor costs. This directly impacts CSPC's ability to recruit and retain the best minds, thereby reducing its bargaining power in the labor market.

To counter this, CSPC must focus on offering competitive compensation packages and robust professional development opportunities. Investing in attracting and retaining top-tier scientific and technical staff is paramount for maintaining innovation and operational efficiency. For instance, in 2023, the average salary for R&D scientists in China saw a notable increase, reflecting the growing demand for specialized skills.

- Talent Scarcity Impact: A tight labor market for skilled pharmaceutical professionals can lead to higher recruitment costs and increased employee turnover for CSPC.

- Competitive Compensation: Offering attractive salaries, bonuses, and benefits is essential for securing and retaining top scientific and technical talent.

- Investment in Development: Continuous training and career advancement programs are key to keeping skilled employees engaged and motivated.

- Global Talent Pool: CSPC's ability to tap into a global talent pool can mitigate regional shortages and enhance its recruitment capabilities.

Logistics and Distribution Networks

Efficient logistics and distribution are crucial for CSPC Pharmaceutical Group to ensure its products reach patients and healthcare providers promptly. While the market for logistics services in China is competitive, providers with established, extensive networks, especially those capable of handling specialized requirements like cold chain transport for sensitive medications, can hold significant bargaining power. For instance, in 2024, the pharmaceutical logistics market in China was valued at approximately RMB 200 billion, with a projected compound annual growth rate of over 15% in the coming years, indicating a growing demand for specialized services.

Disruptions, whether global or domestic, can further amplify the leverage of logistics providers. Events like port congestion or fluctuations in fuel prices can impact delivery timelines and costs, giving well-positioned logistics partners more influence. The increasing complexity of pharmaceutical supply chains, driven by regulatory changes and the need for temperature-controlled shipments, means that companies like CSPC must carefully manage relationships with these critical service providers.

- Network Reach: Logistics providers with comprehensive coverage across China's vast geographical landscape and international routes possess greater leverage.

- Specialized Capabilities: Companies offering advanced cold chain logistics, essential for many pharmaceuticals, can command stronger terms.

- Supply Chain Resilience: In periods of instability, logistics firms that can guarantee reliable delivery gain increased bargaining power.

Suppliers of specialized raw materials and Active Pharmaceutical Ingredients (APIs) hold significant bargaining power over CSPC Pharmaceutical Group, especially for patented or complex intermediates with limited alternative sources. This leverage is heightened by geopolitical shifts and China's efforts to reduce reliance on foreign imports, impacting the availability and pricing of essential inputs.

Providers of high-tech pharmaceutical manufacturing equipment and specialized R&D services, including AI platforms, also exert considerable influence due to high switching costs and the proprietary nature of their offerings. CSPC's engagement with partners like AstraZeneca highlights the substantial leverage these R&D collaborators possess.

The bargaining power of suppliers is a critical factor for CSPC Pharmaceutical Group, influencing costs and operational efficiency. Key areas of supplier influence include specialized raw materials, advanced manufacturing equipment, and R&D services.

| Factor | Impact on CSPC | Example/Data Point (2024) |

| Raw Materials/APIs | Higher input costs, potential supply disruptions | China's push for self-sufficiency in key APIs can strengthen domestic supplier positions. |

| Manufacturing Equipment | Significant capital expenditure, high switching costs | Limited vendors for specialized equipment necessitate strong supplier relationships. |

| R&D Services/Technology | Premium pricing for cutting-edge solutions | AI in drug discovery partnerships command higher fees, as seen with collaborations like CSPC's with AstraZeneca. |

What is included in the product

Analyzes the competitive intensity and profitability potential for CSPC Pharmaceutical Group by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for CSPC Pharmaceutical Group.

Customers Bargaining Power

The Chinese government's centralized volume-based procurement (VBP) program significantly amplifies customer bargaining power for pharmaceutical companies like CSPC. This program mandates substantial price reductions in exchange for guaranteed large-scale sales, directly squeezing revenue and profit margins for suppliers.

CSPC Pharmaceutical Group's financial performance in 2024 reflected this pressure, with reported revenue declines partially attributed to the stringent price controls imposed by the VBP system. This centralized approach consolidates purchasing power, allowing the government to negotiate highly favorable terms.

Hospitals and healthcare institutions are significant buyers of finished pharmaceutical products, and their bargaining power is particularly strong when dealing with generic or less specialized drugs. Their purchasing choices are significantly shaped by Value-Based Purchasing (VBP) results, formulary lists, and overall cost-effectiveness assessments. For instance, in 2024, the increased adoption of VBP models across many markets means that hospitals can negotiate more aggressively based on demonstrated patient outcomes and cost savings for specific treatments.

The emphasis on quality assurance for VBP-contracted medicines further bolsters the leverage of these institutional purchasers. They can demand stricter adherence to quality standards and may favor suppliers who can consistently meet or exceed these benchmarks, potentially leading to price concessions or preferred supplier status.

Large pharmaceutical wholesalers and distributors hold significant sway by consolidating demand from a vast number of smaller healthcare providers, effectively acting as gatekeepers to market access for companies like CSPC Pharmaceutical Group. Their extensive networks are crucial for widespread product distribution, granting them leverage in negotiations, especially when alternative distribution channels are less efficient or established. For instance, in 2024, major pharmaceutical distributors in China, such as Sinopharm and Shanghai Pharma, managed a substantial portion of the country's drug supply chain, underscoring their critical role and bargaining power.

Insurance Providers and Reimbursement Lists

In China, the National Healthcare Security Administration (NHSA) wields significant power through its National Reimbursement Drug List (NRDL). Inclusion on this list is paramount for market access and sales volume for pharmaceutical companies like CSPC Pharmaceutical Group.

While the NRDL saw an expansion in late 2024 to incorporate more innovative therapies, the NHSA continues to exert pricing pressure. This is to ensure both patient affordability and the long-term financial sustainability of the Basic Medical Insurance fund.

This dynamic places considerable bargaining power in the hands of customers, represented by the NHSA, as drug pricing negotiations are a critical hurdle for market penetration and revenue generation.

- NRDL Inclusion: Essential for market access and sales in China.

- Pricing Pressure: NHSA mandates affordability and fund sustainability.

- Customer Power: NHSA's role significantly impacts drug pricing and market strategy.

Patient and Physician Influence (Indirect)

While patients and individual physicians don't directly negotiate prices with CSPC Pharmaceutical Group, their influence is significant. Physician prescribing habits and patient demand for specific treatments indirectly shape market dynamics. For instance, in 2024, the demand for innovative oncology drugs, often driven by physician recommendation and patient advocacy, allowed manufacturers to maintain stronger pricing power, even within evolving reimbursement landscapes.

The willingness of patients to pay, or their ability to access drugs through commercial insurance with manageable co-pays, also plays a crucial role. This is particularly true for drugs offering significant therapeutic advantages or addressing unmet medical needs. Brand consciousness among educated consumers can further shift demand towards specific products, providing a degree of leverage against price pressures from large purchasing groups.

- Physician Recommendations: Doctors' prescribing patterns directly impact which drugs gain market share, influencing CSPC's sales volume and pricing flexibility.

- Patient Demand: Patient awareness and desire for specific treatments, especially for chronic or serious conditions, can create a pull effect that offsets some buyer power.

- Brand Loyalty: In 2024, continued patient and physician trust in established brands, particularly for chronic disease management, contributed to stable demand and pricing for certain CSPC products.

The bargaining power of customers for CSPC Pharmaceutical Group is substantial, primarily driven by China's centralized volume-based procurement (VBP) program. This system forces significant price reductions in exchange for guaranteed large sales volumes, directly impacting CSPC's revenue and profit margins. In 2024, CSPC's financial reports indicated revenue pressures partly due to these stringent VBP price controls.

Hospitals and healthcare institutions, as major buyers, leverage VBP results and cost-effectiveness assessments to negotiate aggressively, especially for generics. The National Healthcare Security Administration (NHSA) also exerts considerable power through the National Reimbursement Drug List (NRDL), making inclusion critical for market access and sales. While the NRDL expanded in late 2024, the NHSA continues to push for affordability and fund sustainability, intensifying pricing negotiations.

| Customer Segment | Key Bargaining Levers | Impact on CSPC |

|---|---|---|

| Government (VBP/NHSA) | Centralized purchasing, price negotiation, NRDL inclusion | Significant price pressure, reduced revenue per unit |

| Hospitals/Institutions | VBP outcomes, formulary control, cost-effectiveness | Demand for lower prices, preferred supplier status |

| Wholesalers/Distributors | Network control, consolidated demand | Negotiating power on distribution margins and terms |

Preview the Actual Deliverable

CSPC Pharmaceutical Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details how CSPC Pharmaceutical Group's competitive landscape is shaped by the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The Chinese pharmaceutical landscape is intensely competitive, with a vast array of domestic companies and a growing presence of international giants. CSPC Pharmaceutical Group navigates this crowded space, particularly in high-demand areas like oncology and cardiovascular treatments. This fierce rivalry directly impacts pricing strategies and the imperative for robust product innovation and differentiation.

China's Volume-Based Procurement (VBP) policy has significantly ramped up price wars, especially for generic medications. This forces companies to bid very low to win contracts, squeezing profit margins. For instance, in the latest VBP rounds, average price reductions for selected drugs have exceeded 50%, impacting overall industry profitability.

CSPC Pharmaceutical Group experienced this directly, with its 2024 financial results showing revenue and profit declines partially attributed to the intense price competition within these VBP tenders. The need to offer deeply discounted prices to secure market share in these government-led procurement programs creates a challenging environment for maintaining healthy margins.

The pharmaceutical industry's competitive landscape is increasingly defined by innovation, with a clear shift from generic drugs to novel, patent-protected therapies. This trend necessitates substantial investment in research and development (R&D). For instance, by the end of 2023, global pharmaceutical R&D spending was projected to exceed $240 billion, underscoring the industry's commitment to discovering new treatments.

Chinese pharmaceutical firms are making significant strides in drug development, evidenced by a notable rise in new drug approvals and a growing presence in the global R&D pipeline. In 2023 alone, Chinese companies filed a record number of Investigational New Drug (IND) applications in the US, signaling their expanding capabilities.

CSPC Pharmaceutical Group's dedication to R&D, particularly its investment in an AI-driven drug discovery platform, is paramount to its ability to compete effectively. This focus on cutting-edge technology allows CSPC to accelerate the identification and development of innovative drugs, a critical factor in maintaining market share and driving future growth in this dynamic sector.

Product Differentiation and Therapeutic Areas

CSPC Pharmaceutical Group strategically targets key therapeutic areas such as cardiovascular, oncology, and neurology to distinguish its product offerings. This focus allows for specialized development and marketing efforts.

Despite this focus, the pharmaceutical landscape is marked by fierce competition, particularly within specific drug classes. For instance, in oncology, the development of Antibody-Drug Conjugates (ADCs) and bispecific antibodies sees numerous companies vying for market share with similar treatment approaches.

CSPC's success hinges on its ability to achieve genuine product differentiation. This can be accomplished through demonstrating superior efficacy, an improved safety profile, or introducing novel mechanisms of action that offer distinct advantages over existing therapies.

- Therapeutic Area Focus: CSPC concentrates on cardiovascular, oncology, and neurology, aiming for specialized differentiation.

- Intense Competition: High rivalry exists within specific drug classes, such as ADCs and bispecific antibodies in oncology, with many firms developing comparable treatments.

- Differentiation Drivers: Superior efficacy, enhanced safety, and novel mechanisms of action are critical for CSPC to stand out.

- Market Dynamics: The pharmaceutical industry's competitive nature demands continuous innovation to capture and maintain market position.

Strategic Partnerships and Global Expansion

The pharmaceutical landscape is defined by intense competition, with companies actively pursuing strategic partnerships and global expansion to secure market share. CSPC Pharmaceutical Group's collaboration with AstraZeneca, for instance, highlights a common industry strategy to combine strengths and access new markets. This trend is evident as many pharmaceutical giants, including those in China, are increasingly looking beyond domestic borders for growth opportunities.

In 2024, the global pharmaceutical market continued its trajectory of consolidation and strategic alliances. CSPC's international expansion efforts are a direct response to this dynamic, aiming to leverage complementary expertise and tap into diverse patient populations. Companies are realizing that innovation and market reach are often best achieved through joint ventures and licensing agreements, rather than solely relying on internal R&D.

- CSPC's Partnership Strategy: CSPC has actively pursued collaborations, such as its deal with AstraZeneca, to enhance its product pipeline and market access.

- Global Market Penetration: The company's international expansion is a key pillar in its strategy to compete on a global scale, mirroring broader industry trends.

- Industry Trend: Strategic partnerships and international expansion are critical for pharmaceutical firms to navigate complex regulatory environments and capitalize on emerging markets.

- Competitive Necessity: To maintain a competitive edge, companies like CSPC must engage in these alliances and global outreach initiatives to foster innovation and diversify revenue streams.

The competitive rivalry within the pharmaceutical sector, particularly for CSPC Pharmaceutical Group, is defined by intense price pressures stemming from China's Volume-Based Procurement (VBP) policy, which has led to significant price reductions, impacting profitability. This environment necessitates a strong focus on innovation and product differentiation, as companies like CSPC invest heavily in R&D to develop novel therapies and improve existing ones. Strategic partnerships and global expansion are also crucial tactics employed by CSPC and its peers to navigate this competitive landscape and secure market share.

| Metric | CSPC Pharmaceutical Group (2023/2024 Estimates) | Industry Average (2023/2024 Estimates) |

|---|---|---|

| R&D Investment as % of Revenue | Approx. 15-18% | Approx. 10-15% |

| Impact of VBP on Revenue | Significant pressure, contributing to revenue fluctuations | Widespread impact across generic drug portfolios |

| New Drug Approvals (Domestic/International) | Growing pipeline, with key approvals anticipated | Steady increase driven by innovation |

| Partnerships/Licensing Deals | Active engagement (e.g., AstraZeneca collaboration) | Increasing trend for market access and pipeline expansion |

SSubstitutes Threaten

The most significant threat to CSPC Pharmaceutical Group comes from generic drugs and biosimilars. Once a drug's patent expires, other companies can produce cheaper versions, directly impacting CSPC's sales and profit margins.

In 2023, China's volume-based procurement (VBP) program intensified this threat. This system encourages bulk purchasing of drugs, often favoring lower-priced generics and biosimilars, thereby accelerating the substitution process for originator products.

In China, Traditional Chinese Medicine (TCM) and alternative therapies pose a significant threat of substitutes for Western pharmaceutical products, often supported by cultural preference and government initiatives. For instance, in 2023, the Chinese government continued to invest heavily in TCM research and development, with the TCM industry's output value projected to reach over 1.2 trillion yuan, demonstrating its substantial market presence and influence.

While TCM may not directly replace CSPC's offerings for critical illnesses, it can divert demand for certain chronic conditions or less severe ailments. This substitution can impact the market share and revenue streams for CSPC's product lines that cater to these less acute health needs, requiring strategic consideration of this alternative market.

Lifestyle changes and preventive care present a significant threat of substitutes for pharmaceutical companies like CSPC Pharmaceutical Group. For chronic conditions such as heart disease or diabetes, adopting healthier diets and increasing physical activity can delay or even negate the need for certain medications. For example, studies consistently show that regular exercise can significantly reduce the risk of developing type 2 diabetes, a condition heavily reliant on pharmaceutical treatments.

Public health initiatives focused on promoting wellness and disease prevention can further exacerbate this threat. As more individuals embrace preventive strategies, the overall demand for prescription drugs may decrease. This trend could impact CSPC's market share, particularly for treatments targeting lifestyle-related illnesses.

Newer Generation Drugs or Different Drug Classes

The threat of substitutes for CSPC Pharmaceutical Group is significantly influenced by advancements in medical science, particularly the emergence of newer generation drugs or entirely different drug classes. These innovations can offer enhanced efficacy, reduced side effects, or novel mechanisms of action for treating the same conditions currently addressed by CSPC's products.

For instance, the development of groundbreaking gene therapies or advanced biologics could potentially render existing small molecule drugs obsolete if they provide a more effective or curative treatment pathway. This constant wave of innovation creates a persistent substitution threat, as patients and healthcare providers may opt for these newer, potentially superior alternatives.

- Innovation in drug classes: New therapies like gene editing or advanced immunotherapy can offer curative potential, directly challenging traditional drug treatments.

- Efficacy and safety profiles: Drugs with demonstrably better outcomes and fewer adverse effects naturally attract patients and prescribers, increasing substitution risk.

- Market adoption rates: For example, the rapid uptake of mRNA vaccines in 2021-2022 demonstrated how quickly a new drug class can disrupt established markets, a trend that continues to influence pharmaceutical R&D and competitive landscapes.

Non-Pharmaceutical Interventions and Medical Devices

Non-pharmaceutical interventions, including surgical procedures, medical devices, and physical therapy, present a significant threat of substitutes for CSPC Pharmaceutical Group. These alternatives can offer comparable or even superior outcomes for certain conditions, thereby reducing patient and physician reliance on drug-based treatments. For instance, advancements in minimally invasive surgery or wearable medical devices can provide effective management for chronic diseases that were previously managed primarily with pharmaceuticals.

The market for medical devices is substantial and growing, directly impacting the pharmaceutical sector. In 2024, the global medical device market was valued at approximately $600 billion, with projections indicating continued expansion. This growth is fueled by technological innovation and an aging global population, both of which increase demand for alternative treatment modalities.

Consider these specific examples of how non-pharmaceutical interventions act as substitutes:

- Cardiovascular Devices: Pacemakers, implantable cardioverter-defibrillators (ICDs), and angioplasty balloons offer alternatives to certain cardiovascular medications, reducing the need for long-term drug therapy for rhythm disorders and blockages.

- Diabetes Management: Continuous glucose monitoring (CGM) systems and insulin pumps provide sophisticated alternatives to oral medications and traditional insulin injections, offering better control and convenience for many patients. As of 2023, the global CGM market alone was valued at over $7 billion.

- Orthopedic Solutions: Joint replacements and advanced physical therapy techniques can significantly alleviate pain and improve mobility for conditions like arthritis, often reducing the need for pain management drugs or anti-inflammatory medications.

The threat of substitutes for CSPC Pharmaceutical Group is multifaceted, encompassing everything from generic and biosimilar versions of their patented drugs to alternative therapies and lifestyle changes. The increasing prevalence of China's volume-based procurement (VBP) program, which favors lower-cost generics, directly amplifies this substitution risk for CSPC's originator products.

Furthermore, the robust growth and cultural acceptance of Traditional Chinese Medicine (TCM) in China, with its industry output valued at over 1.2 trillion yuan in 2023, presents a significant alternative for certain conditions, potentially diverting market share from CSPC's offerings.

Advancements in medical science, leading to novel drug classes like gene therapies, and non-pharmaceutical interventions such as medical devices and surgical procedures, also pose substantial threats. The global medical device market's value, estimated at around $600 billion in 2024, highlights the significant market share these alternatives can capture.

| Threat Category | Key Substitutes | Impact on CSPC | Supporting Data/Trend |

|---|---|---|---|

| Generic & Biosimilar Drugs | Cheaper versions of patented drugs | Reduced sales and profit margins | China's VBP program favors lower-priced generics. |

| Alternative Therapies | Traditional Chinese Medicine (TCM) | Market share diversion for certain conditions | TCM industry output > 1.2 trillion yuan (2023). |

| Lifestyle & Prevention | Healthy diet, exercise | Decreased demand for certain medications | Studies show exercise reduces type 2 diabetes risk. |

| Medical Innovations | Gene therapies, advanced biologics | Obsolescence of existing drug classes | New therapies offer curative potential. |

| Non-Pharmaceutical Interventions | Medical devices, surgery, physical therapy | Reduced reliance on drug treatments | Global medical device market ~ $600 billion (2024). |

Entrants Threaten

The pharmaceutical sector inherently requires substantial upfront investment. Developing new drugs involves years of costly research and development, rigorous clinical trials, and building advanced manufacturing capabilities. For instance, in 2024, the average cost to bring a new drug to market remained in the billions of dollars, a figure that naturally discourages smaller players.

This immense capital outlay acts as a significant barrier, effectively deterring many potential new entrants from challenging established companies like CSPC Pharmaceutical Group. CSPC’s commitment to innovation, evidenced by its substantial R&D expenditures, highlights the industry's capital-intensive nature.

The pharmaceutical industry, including players like CSPC Pharmaceutical Group, faces formidable barriers to entry due to strict regulatory hurdles. Developing and launching new drugs requires extensive, multi-phase clinical trials that can take years and cost hundreds of millions of dollars. Furthermore, adherence to Good Manufacturing Practices (GMP) is non-negotiable, demanding significant investment in quality control and production facilities.

In China, while the National Medical Products Administration (NMPA) has made efforts to expedite certain approval pathways, the overall process remains complex and demanding. For instance, in 2023, the NMPA continued to refine its review processes, but the time and resources needed for compliance and successful drug approval represent a substantial deterrent for potential new entrants seeking to compete with established companies like CSPC.

Established pharmaceutical giants like CSPC Pharmaceutical Group benefit significantly from their extensive patent portfolios. These patents act as formidable barriers, protecting their innovative drug formulations and preventing new entrants from easily replicating their success. For instance, in 2024, the global pharmaceutical market continued to see substantial R&D investment, with companies like CSPC leveraging intellectual property to maintain market share.

New companies entering the market must either invest heavily in discovering and patenting entirely novel compounds, a process that can take years and billions of dollars, or wait for existing patents to expire. This waiting period can be lengthy, significantly delaying market entry and revenue generation for potential competitors.

Established Distribution Channels and Brand Loyalty

New entrants into the pharmaceutical market, particularly within China, face significant hurdles in replicating the extensive distribution networks and deep-rooted brand loyalty that established players like CSPC Pharmaceutical Group command. Building these channels from scratch requires substantial investment and time, often proving prohibitive for newcomers.

CSPC Pharmaceutical Group boasts a formidable presence, with established relationships across China's vast healthcare system, including hospitals, clinics, and pharmacies. This network is crucial for ensuring product availability and efficient market penetration, a significant barrier for any aspiring competitor.

While the Volume-Based Purchasing (VBP) policy can impact loyalty to specific drugs, the overall reputation and trust built by CSPC over years of operation remain powerful assets. This company loyalty translates into a more stable customer base and easier acceptance of new products within their portfolio.

- Established Distribution Network: CSPC's reach across China's healthcare providers is a significant advantage, making it difficult for new entrants to match market access.

- Brand Reputation and Trust: Years of operation have fostered trust among healthcare professionals and patients, a valuable intangible asset that new companies must painstakingly build.

- Challenges for New Entrants: Overcoming these established relationships and brand loyalty requires substantial resources and a long-term strategic commitment, acting as a deterrent to new competition.

Access to Specialized Expertise and Talent Pool

The pharmaceutical sector demands highly specialized scientific, medical, and regulatory knowledge. New entrants face significant hurdles in acquiring and retaining the necessary talent, often finding themselves outbid by established companies with existing R&D infrastructure and experienced teams. For instance, as of early 2024, the global demand for skilled pharmaceutical researchers and regulatory affairs specialists continued to outpace supply, driving up compensation packages.

CSPC Pharmaceutical Group, like other major players, benefits from its established reputation, which aids in attracting top-tier scientific and managerial talent. This deep pool of expertise is crucial for navigating the complex drug development and approval processes. In 2023, CSPC reported significant investment in R&D personnel, underscoring the importance of this specialized workforce in maintaining its competitive edge.

- High barriers to entry due to specialized talent requirements.

- Established firms like CSPC possess deep talent pools and R&D teams.

- Competition for skilled pharmaceutical professionals remains intense.

The threat of new entrants for CSPC Pharmaceutical Group is generally low due to several significant barriers. The immense capital required for research, development, and regulatory compliance, often running into billions of dollars by 2024, makes it difficult for smaller companies to enter. Furthermore, established players like CSPC benefit from strong patent protection, extensive distribution networks, and deep-rooted brand loyalty, all of which are time-consuming and expensive to replicate.

The pharmaceutical industry's stringent regulatory environment, demanding years of clinical trials and adherence to Good Manufacturing Practices, acts as a substantial deterrent. New entrants must navigate complex approval processes, such as those overseen by China's NMPA, which, despite efforts to streamline, remain resource-intensive. This complexity, coupled with the need for specialized scientific and medical expertise, further limits the pool of potential new competitors.

CSPC Pharmaceutical Group's established distribution channels and brand reputation in China's healthcare system are critical advantages. Building comparable relationships with hospitals and clinics requires significant time and investment, presenting a formidable challenge for any newcomer. The intense competition for specialized talent in the pharmaceutical sector also favors established firms with existing R&D infrastructure and experienced teams.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CSPC Pharmaceutical Group is built upon a robust foundation of data, including their annual reports, publicly available financial statements, and regulatory filings with relevant health authorities.

We also incorporate insights from reputable industry research reports, market intelligence platforms, and analyses from financial institutions to provide a comprehensive understanding of the competitive landscape.