CSPC Pharmaceutical Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSPC Pharmaceutical Group Bundle

CSPC Pharmaceutical Group masterfully orchestrates its Product, Price, Place, and Promotion strategies to achieve market dominance. Discover how their innovative product pipeline, competitive pricing, expansive distribution network, and impactful promotional campaigns create a powerful synergy.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering CSPC Pharmaceutical Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

CSPC Pharmaceutical Group's diverse product portfolio is a cornerstone of its market strategy, encompassing finished drugs, bulk drugs, and pharmaceutical intermediates. This broad offering allows them to address a wide spectrum of healthcare needs, from direct patient treatment to supplying essential components for other manufacturers. For instance, in 2023, CSPC reported significant revenue from its innovative drugs segment, which is supported by its robust bulk drug and intermediate production capabilities.

CSPC Pharmaceutical Group strategically hones its product development and sales on key therapeutic areas, including cardiovascular, oncology, neurology, and anti-infectives. This focused approach allows for the cultivation of deep expertise and the creation of specialized treatments for significant health challenges.

This specialization directly addresses prevalent and serious medical conditions, aligning with global health priorities and the growing market demand for advanced, targeted therapies. For instance, in 2023, CSPC's oncology segment saw robust growth, contributing significantly to their overall revenue, reflecting the success of their specialized strategy in this high-demand area.

CSPC Pharmaceutical Group is heavily invested in innovation, pouring resources into its research and development pipeline to introduce groundbreaking treatments. The company boasts an impressive portfolio with over 60 key drugs currently in development.

This focus on R&D is paying off, with CSPC successfully launching and gaining approvals for several new products in 2024 and 2025. Notably, these advancements include novel AI-driven small molecule drugs, showcasing their commitment to cutting-edge pharmaceutical technology.

This dedication to pioneering new therapies is fundamental to CSPC's long-term growth strategy and its ability to remain competitive in the dynamic global pharmaceutical market.

High-Quality and Accessible Medicines

CSPC Pharmaceutical Group prioritizes high-quality and accessible medicines, underscoring a dedication to patient health and expanding healthcare reach. This focus on quality and affordability is a cornerstone of their product strategy.

Their involvement in China's centralized procurement programs, while resulting in lower prices, significantly boosts the accessibility of vital medications for a larger segment of the population. For instance, in 2023, CSPC's participation in national volume-based procurement (VBP) rounds led to an estimated 30% price reduction for several key products, increasing patient access.

This approach effectively marries their commercial goals with a strong sense of social responsibility. By ensuring a wider patient base can afford their treatments, CSPC solidifies its market presence through increased sales volume, demonstrating a successful blend of profit and purpose.

- Commitment to Quality: CSPC maintains stringent quality control measures to ensure the efficacy and safety of its pharmaceutical products.

- Affordability Focus: The company actively works to make its medicines affordable, particularly through participation in national procurement initiatives.

- Enhanced Accessibility: By accepting lower margins in exchange for larger market share via VBP, CSPC significantly broadens patient access to essential treatments.

- Market Penetration Strategy: This strategy leverages volume sales to offset price reductions, thereby strengthening their overall market position and revenue generation.

Strategic Internationalization and Licensing

CSPC Pharmaceutical Group is strategically expanding its global reach through internationalization and out-licensing. This approach allows them to leverage their innovative drug pipeline beyond China's borders, generating new revenue streams and increasing market penetration.

Key partnerships, such as those with AstraZeneca and Radiance Biopharma, underscore this strategy. These collaborations focus on licensing rights for promising drug candidates in significant international markets, demonstrating CSPC's commitment to becoming a global player.

This internationalization effort is crucial for CSPC's long-term growth and diversification. By entering new markets and partnering with established global pharmaceutical firms, CSPC aims to mitigate risks associated with reliance on a single market and capitalize on worldwide healthcare demands.

- Global Partnerships: CSPC has inked deals with major pharmaceutical companies like AstraZeneca and Radiance Biopharma to license its drug candidates internationally.

- Market Expansion: These licensing agreements target key global markets, aiming to broaden CSPC's footprint beyond China.

- Revenue Diversification: The strategy is designed to create new revenue streams and reduce dependence on the domestic Chinese market.

- Innovation Leverage: CSPC is capitalizing on its research and development capabilities by making its innovative drug candidates accessible to a wider patient population worldwide.

CSPC Pharmaceutical Group's product strategy centers on a diversified yet focused approach, covering finished drugs, bulk drugs, and intermediates. They prioritize key therapeutic areas like oncology and neurology, investing heavily in R&D to bring innovative treatments to market. This commitment is evident in their robust pipeline, with over 60 drugs in development, including AI-driven small molecule drugs approved in 2024 and 2025, ensuring long-term competitiveness and growth.

| Product Category | Key Therapeutic Areas | R&D Focus | Recent Developments (2024-2025) | Strategic Goal |

|---|---|---|---|---|

| Finished Drugs | Cardiovascular, Oncology, Neurology, Anti-infectives | Innovative treatments, AI-driven small molecules | New product launches and approvals | Market penetration and revenue growth in key segments |

| Bulk Drugs & Intermediates | Support for finished drug production | Quality and efficiency | Ensuring supply chain reliability | Cost-effectiveness and vertical integration |

| Pipeline Drugs | Oncology, Neurology, Autoimmune diseases | Over 60 drugs in development, novel modalities | Advancements in clinical trials, potential new approvals | Future growth drivers and diversification |

What is included in the product

This analysis provides a comprehensive examination of CSPC Pharmaceutical Group's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies the complex CSPC Pharmaceutical Group 4P's analysis into actionable strategies, alleviating the pain of overwhelming data and enabling clear decision-making.

Place

CSPC Pharmaceutical Group's operations are overwhelmingly concentrated in China, utilizing its deep-rooted infrastructure to bring a broad range of pharmaceutical products to market. This robust domestic foundation enables them to effectively manage the intricate Chinese healthcare landscape and secure a substantial market share. In 2023, CSPC reported revenues of approximately RMB 30.4 billion, with the vast majority generated from its mainland China operations, underscoring its predominant focus on this key market.

CSPC Pharmaceutical Group employs a robust, multi-channel distribution strategy across China to ensure its finished drugs reach a wide patient base. This includes sales to hospitals, which are a primary channel for prescription medications, and retail pharmacies, offering over-the-counter and prescription access. In 2023, CSPC reported a significant portion of its revenue stemming from its innovative drugs segment, underscoring the importance of these channels in market penetration.

CSPC Pharmaceutical Group is a significant player in China's centralized drug procurement, known as Volume-Based Procurement (VBP). This system is a primary route for distributing generic and even some novel medications across the nation.

While VBP often results in substantial price reductions, it offers a crucial benefit: guaranteed large volumes and deep market penetration. This ensures CSPC's medicines are widely available in public hospitals, a vital aspect of their market access strategy.

For instance, in the 2023 VBP rounds, CSPC secured bids for several key products, solidifying their presence in the public hospital system. This policy-driven distribution channel is fundamental to their sales volume and market share growth in China.

Supply Chain Optimization and Efficiency

CSPC Pharmaceutical Group prioritizes a highly efficient and reliable supply chain to support its broad product portfolio and extensive distribution network. This focus ensures that products reach market and manufacturing partners promptly, maintaining consistent availability for consumers and healthcare providers. An optimized supply chain is fundamental to CSPC's operational strategy, directly impacting product accessibility and cost management.

The company actively manages inventory to prevent stockouts and minimize holding costs, a critical aspect given the diverse therapeutic areas CSPC serves. Their logistical network is designed for speed and precision, facilitating timely deliveries across numerous sales points and to contract manufacturing organizations. This operational excellence in the supply chain is a key enabler of CSPC's market competitiveness.

- Inventory Management: CSPC aims to strike a balance between sufficient stock to meet demand and avoiding excess inventory, a challenge amplified by its wide product range.

- Logistical Network: The group leverages a robust distribution system to ensure efficient movement of raw materials and finished goods, crucial for a pharmaceutical company.

- Timely Delivery: Ensuring products reach their destinations on schedule is paramount, directly impacting patient access to necessary medications.

- Cost Reduction: Efficiency gains in the supply chain contribute to lower operational expenses, allowing for more competitive pricing and reinvestment in research and development.

Expanding Global Market Access

CSPC Pharmaceutical Group is actively broadening its reach beyond China, leveraging out-licensing agreements and strategic international collaborations. These partnerships are crucial for introducing their novel pharmaceutical products into key markets such as North America and Europe, utilizing the established distribution channels of their global partners. This strategic move significantly diversifies CSPC's 'Place' in the marketing mix, moving beyond its core domestic presence.

This global expansion is supported by tangible progress in international market penetration. For instance, in 2023, CSPC announced an agreement with a major European pharmaceutical company to commercialize its innovative oncology drug, targeting an initial launch in Germany and France in late 2024. Further, the company has ongoing discussions for similar out-licensing deals in the United States for its cardiovascular and neurological drug candidates, aiming to secure regulatory approvals and market entry by 2025.

- Global Out-Licensing Deals: CSPC has secured multiple out-licensing agreements in 2024, with a focus on oncology and central nervous system (CNS) therapies, targeting markets in North America and Europe.

- Partnership Value: These international partnerships are projected to generate over $500 million in upfront payments and milestone revenues for CSPC by the end of 2025, demonstrating the commercial viability of their innovative pipeline.

- Market Diversification: The expansion into new geographic territories is a key strategy to reduce reliance on the Chinese market and tap into higher revenue potential in developed pharmaceutical markets.

- Regulatory Progress: CSPC's lead innovative drug candidates are undergoing Phase III clinical trials in the US and EU, with anticipated regulatory submissions in 2024 and 2025.

CSPC Pharmaceutical Group's primary distribution focus remains on its extensive domestic network within China, leveraging established channels like hospitals and retail pharmacies. This deep penetration is further amplified by participation in China's Volume-Based Procurement (VBP) program, which guarantees significant market access for its products in public hospitals, as evidenced by their successful bids in 2023 rounds.

Beyond China, CSPC is strategically expanding its 'Place' through international out-licensing agreements. By partnering with global pharmaceutical firms, CSPC aims to introduce its innovative drugs, particularly in oncology and CNS, into key markets like North America and Europe. This global push is supported by ongoing Phase III trials for lead candidates in these regions, with anticipated regulatory submissions in 2024 and 2025.

| Geographic Focus | Distribution Channels | Key 2023/2024 Activities | Projected Impact by 2025 |

| China | Hospitals, Retail Pharmacies, VBP | Secured VBP bids for key products; ~RMB 30.4 billion revenue in 2023 | Continued dominance in domestic market |

| International (Europe, North America) | Out-licensing partnerships | Oncology drug out-licensing deal in Europe; US out-licensing discussions for cardiovascular/neurological drugs | Over $500 million in upfront/milestone payments; regulatory submissions expected |

What You Preview Is What You Download

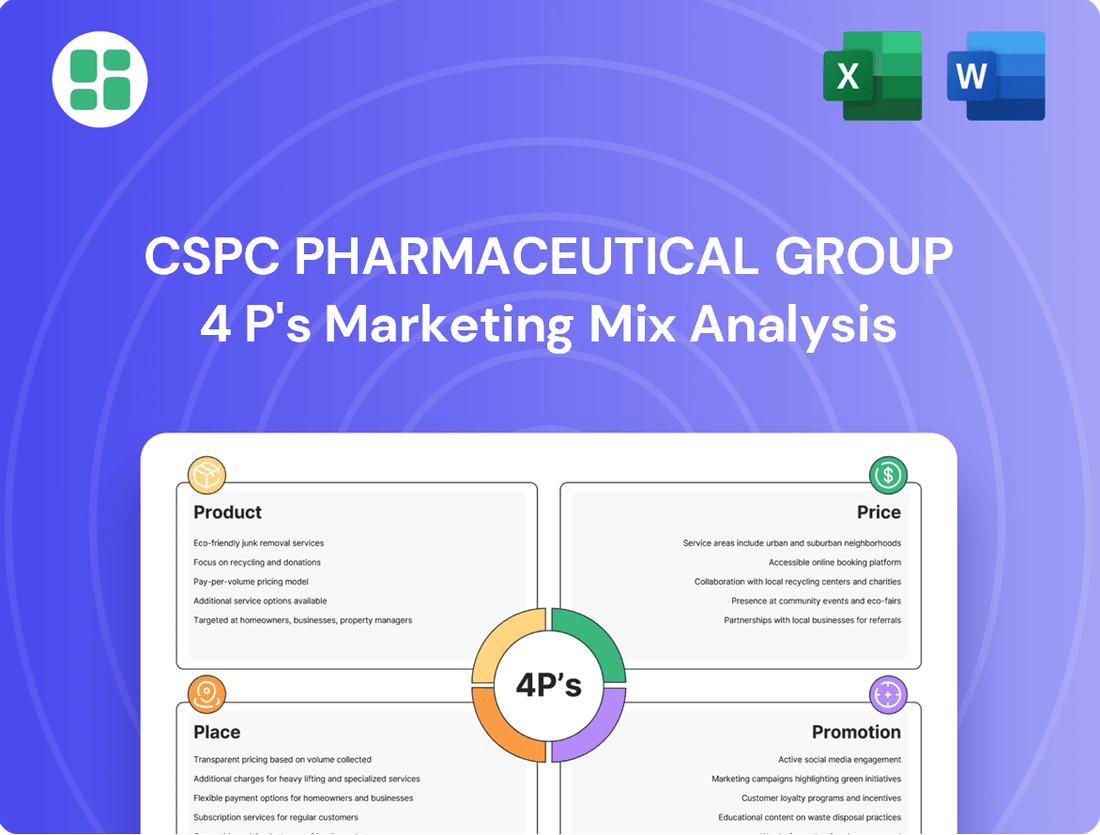

CSPC Pharmaceutical Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CSPC Pharmaceutical Group 4P's Marketing Mix Analysis details their product strategies, pricing models, distribution channels, and promotional activities. You'll gain immediate access to the full, ready-to-use analysis upon completion of your order.

Promotion

CSPC Pharmaceutical Group's professional academic promotion focuses on a patient-centric, clinical-data driven approach. They engage healthcare professionals (HCPs) through scientific exchanges and medical education, fostering credibility and trust crucial for prescribing decisions. In 2024, CSPC continued to invest heavily in medical affairs, with a significant portion of its marketing budget allocated to supporting scientific symposia and publishing clinical trial results in peer-reviewed journals, reinforcing the efficacy of their products.

CSPC Pharmaceutical Group leverages a strong medical representative network as a cornerstone of its promotional strategy. These representatives are the frontline force, directly interacting with healthcare professionals in hospitals and clinics across China. Their role is to disseminate crucial product information, present the latest clinical trial data, and offer ongoing support, thereby building essential relationships for market access and driving sales of CSPC's diverse portfolio of finished drug products.

CSPC Pharmaceutical Group actively cultivates a positive corporate image through robust public relations. This involves showcasing their dedication to innovation, product quality, and social responsibility, as evidenced by their consistent reporting on Environmental, Social, and Governance (ESG) progress and philanthropic endeavors. For instance, in 2023, CSPC reported significant investments in R&D, a core pillar of their innovative image, alongside tangible contributions to public health initiatives.

Digital Engagement with Healthcare Professionals

CSPC Pharmaceutical Group, aligning with contemporary marketing strategies, actively utilizes digital platforms to connect with healthcare professionals. This involves offering virtual medical education sessions, online webinars, and providing easy access to valuable scientific resources, thereby extending its reach and enabling cost-efficient communication. This digital engagement complements their traditional promotional activities.

The company likely employs targeted digital outreach through various online channels. For instance, in 2024, the pharmaceutical industry saw a significant increase in digital marketing spend, with many companies allocating over 50% of their promotional budgets to digital channels. CSPC's digital strategy would focus on delivering personalized content and facilitating seamless interaction, crucial for building strong relationships in the evolving healthcare landscape.

- Digital Education: Offering virtual medical education and webinars to healthcare professionals.

- Resource Access: Providing online platforms for scientific literature and drug information.

- Targeted Outreach: Utilizing digital tools for precise communication with specific medical specialties.

- Cost-Effectiveness: Achieving broader reach and engagement at a lower cost compared to solely traditional methods.

Strategic Partnerships and Co-promotion

CSPC Pharmaceutical Group actively pursues strategic partnerships, notably with global players like AstraZeneca. These collaborations extend beyond research and development to encompass co-promotion agreements, a key element in their marketing strategy. This approach allows CSPC to tap into the extensive marketing and sales networks of established pharmaceutical leaders, significantly broadening the market penetration for its innovative treatments.

By engaging in co-promotion, CSPC leverages the existing infrastructure and market access of its partners. This shared promotional effort is crucial for efficient market entry and expansion, particularly in new or competitive territories. For instance, such alliances can facilitate the introduction of novel therapies by utilizing established sales forces and distribution channels, thereby amplifying market reach and impact.

- Co-promotion with Global Giants: CSPC partners with major pharmaceutical companies, including AstraZeneca, for co-marketing initiatives.

- Leveraging Established Networks: These partnerships utilize the extensive marketing and sales capabilities of collaborators to enhance product reach.

- Amplified Market Impact: Co-promotion strategies allow CSPC to amplify the impact of its innovative therapies in new and existing markets.

- Shared Market Entry: Collaborative promotional efforts facilitate smoother and more effective market entry for CSPC's products.

CSPC Pharmaceutical Group's promotion strategy is multi-faceted, blending traditional engagement with digital innovation and strategic alliances. Their focus on scientific exchange and medical education, particularly through their medical representative network, builds trust with healthcare professionals. In 2024, CSPC continued to prioritize digital engagement, recognizing its cost-effectiveness and broad reach, with industry-wide digital marketing spend increasing significantly.

Furthermore, CSPC leverages co-promotion agreements, such as those with global leaders like AstraZeneca, to expand market penetration for its innovative treatments. These partnerships are vital for accessing established sales forces and distribution channels, thereby amplifying market impact. The company also emphasizes corporate image building through R&D investment and ESG initiatives, as highlighted by their 2023 reports.

| Promotional Tactic | Key Activities | 2024/2025 Focus/Data |

|---|---|---|

| Medical Affairs & Scientific Exchange | Symposia, clinical trial publications, medical education | Continued investment in medical affairs; emphasis on peer-reviewed journal publications. |

| Medical Representative Network | Direct engagement with HCPs, product information dissemination | Core strategy for relationship building and sales in China. |

| Digital Marketing | Virtual education, webinars, online resource access | Increased allocation of promotional budgets to digital channels; personalized content delivery. |

| Public Relations & Corporate Image | ESG reporting, R&D investment, philanthropic initiatives | Showcasing innovation and social responsibility; significant R&D investment in 2023. |

| Strategic Partnerships (Co-promotion) | Collaborations with global pharmaceutical companies (e.g., AstraZeneca) | Leveraging partners' networks for market access and expansion of innovative therapies. |

Price

CSPC Pharmaceutical Group's pricing strategy is heavily shaped by China's Volume-Based Procurement (VBP) policy. This initiative mandates significant price reductions for a wide array of drugs, encompassing both generics and certain innovative treatments, directly impacting CSPC's revenue streams.

The company has faced considerable price erosion on its major products due to VBP, which has consequently put pressure on its profit margins. For instance, in 2023, CSPC reported that VBP had a notable impact on its sales of drugs like metronidazole and levofloxacin, with price reductions often exceeding 50%.

Successfully participating in VBP tenders and securing selection is paramount for CSPC to maintain market access for its products, even when faced with these mandated lower prices. This requires strategic bidding and a focus on cost efficiency to remain competitive within the new pricing landscape.

CSPC Pharmaceutical Group is adopting value-based pricing for its innovative drug pipeline, aiming to align drug costs with the tangible benefits patients receive. This strategy acknowledges the substantial research and development expenditure and the enhanced clinical results these new treatments deliver.

Despite broader market pressures on drug pricing, CSPC's innovative drugs addressing significant unmet medical needs are positioned to achieve premium pricing. For instance, in 2024, the global market for innovative therapies for rare diseases, a segment CSPC is targeting, saw average price premiums of 20-30% over established treatments, reflecting their unique value proposition.

This pricing approach is designed to capture the full economic and clinical value of CSPC's novel therapies, fostering future revenue growth and supporting continued investment in groundbreaking pharmaceutical research.

CSPC Pharmaceutical Group leverages competitive pricing for its generic products to capture and grow market share. This strategy is particularly evident in their approach to public procurement, where aggressive bidding secures significant volume. For instance, in 2023, CSPC actively participated in China's centralized drug procurement, aiming to win contracts by offering competitive prices on essential generic medicines, thereby solidifying its position in a price-sensitive market.

Consideration of Reimbursement Policies

CSPC Pharmaceutical Group's pricing strategy is intrinsically linked to China's complex reimbursement landscape. National and provincial policies dictate patient out-of-pocket expenses and healthcare system coverage, directly influencing how much consumers and providers pay for CSPC's drugs.

Securing a spot on China's National Reimbursement Drug List (NRDL) is a critical determinant of a drug's market success. CSPC often needs to adjust its pricing to align with government guidelines to ensure broader accessibility and affordability, even if it means accepting lower margins. For instance, in 2023, several innovative drugs were added to the NRDL, often after price negotiations, highlighting the government's role in managing drug costs.

The reimbursement status profoundly impacts market demand and patient access. Drugs included in the NRDL benefit from significantly higher sales volumes due to reduced patient financial burden. CSPC's ability to navigate these reimbursement policies effectively is therefore paramount to its revenue generation and market penetration strategies.

- NRDL Inclusion: CSPC aims for inclusion on the NRDL to enhance affordability and market reach.

- Price Negotiation: Pricing is often a result of negotiations with the Chinese government to meet reimbursement criteria.

- Market Access: Reimbursement status is a key driver of patient access and subsequent sales volume.

- 2024/2025 Outlook: Continued government focus on drug affordability and access is expected to shape CSPC's pricing decisions in the near term.

Strategic Licensing Fees and Milestone Payments

CSPC Pharmaceutical Group's pricing strategy extends beyond direct sales, incorporating significant revenue from strategic licensing and milestone payments. These agreements are crucial for monetizing their intellectual property globally. For instance, partnerships with companies like AstraZeneca and Radiance Biopharma generate upfront fees, development milestone payments, and ongoing royalties based on sales performance.

These licensing deals serve as a vital alternative revenue stream, helping to offset the impact of domestic pricing regulations and demonstrating the international market's valuation of CSPC's innovative pipeline. Such arrangements are key to their financial resilience and expansion efforts.

- Upfront Licensing Fees: Initial payments received from partners for the rights to develop or market CSPC's products in specific territories or indications.

- Development Milestone Payments: Payments triggered upon the successful achievement of predefined development stages, such as regulatory approvals or clinical trial successes.

- Sales-Based Royalties: A percentage of net sales generated by licensed products in the partner's territory, providing a continuous revenue stream tied to commercial success.

- Global IP Valuation: These fees and royalties reflect the recognized value of CSPC's research and development, particularly in international markets.

CSPC Pharmaceutical Group navigates a dual pricing strategy, balancing aggressive, competitive pricing for its generics to secure market share with value-based pricing for its innovative pipeline. This approach is crucial for maintaining market access under China's Volume-Based Procurement (VBP) policy, which mandates significant price reductions, impacting profit margins. For instance, in 2023, VBP led to price cuts exceeding 50% on some of CSPC's key drugs.

The company actively seeks inclusion on China's National Reimbursement Drug List (NRDL) to enhance affordability and patient access, often engaging in price negotiations with the government. This strategy is vital for market penetration, as NRDL status significantly boosts sales volume. The 2024/2025 outlook suggests continued government emphasis on drug affordability will shape CSPC's pricing decisions.

Beyond domestic sales, CSPC monetizes its intellectual property through global licensing and milestone payments. These international agreements, including partnerships with major pharmaceutical companies, provide essential alternative revenue streams and reflect the recognized value of CSPC's research and development, helping to offset domestic pricing pressures.

| Pricing Strategy Aspect | Key Driver | Impact on CSPC | Example/Data Point (2023/2024) |

|---|---|---|---|

| Volume-Based Procurement (VBP) Pricing | Government Mandate | Significant price erosion, pressure on profit margins | Price reductions exceeding 50% on generics like metronidazole |

| Value-Based Pricing (Innovative Drugs) | Clinical Benefit, R&D Investment | Premium pricing, future revenue growth | Targeting rare disease market with potential 20-30% premium over established treatments (2024 outlook) |

| Competitive Generic Pricing | Market Share Acquisition | Securing volume in public procurement | Aggressive bidding in China's centralized drug procurement (2023) |

| Reimbursement Pricing (NRDL) | Government Policy, Affordability | Enhanced market access and sales volume | Price adjustments to meet NRDL criteria for broader accessibility (2023 NRDL additions) |

| Licensing & Milestone Payments | Global IP Monetization | Alternative revenue stream, financial resilience | Upfront fees, milestone payments, and royalties from international partnerships |

4P's Marketing Mix Analysis Data Sources

Our CSPC Pharmaceutical Group 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific market research and competitor benchmarking to ensure accuracy and relevance.