CrossFirst Bankshares PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossFirst Bankshares Bundle

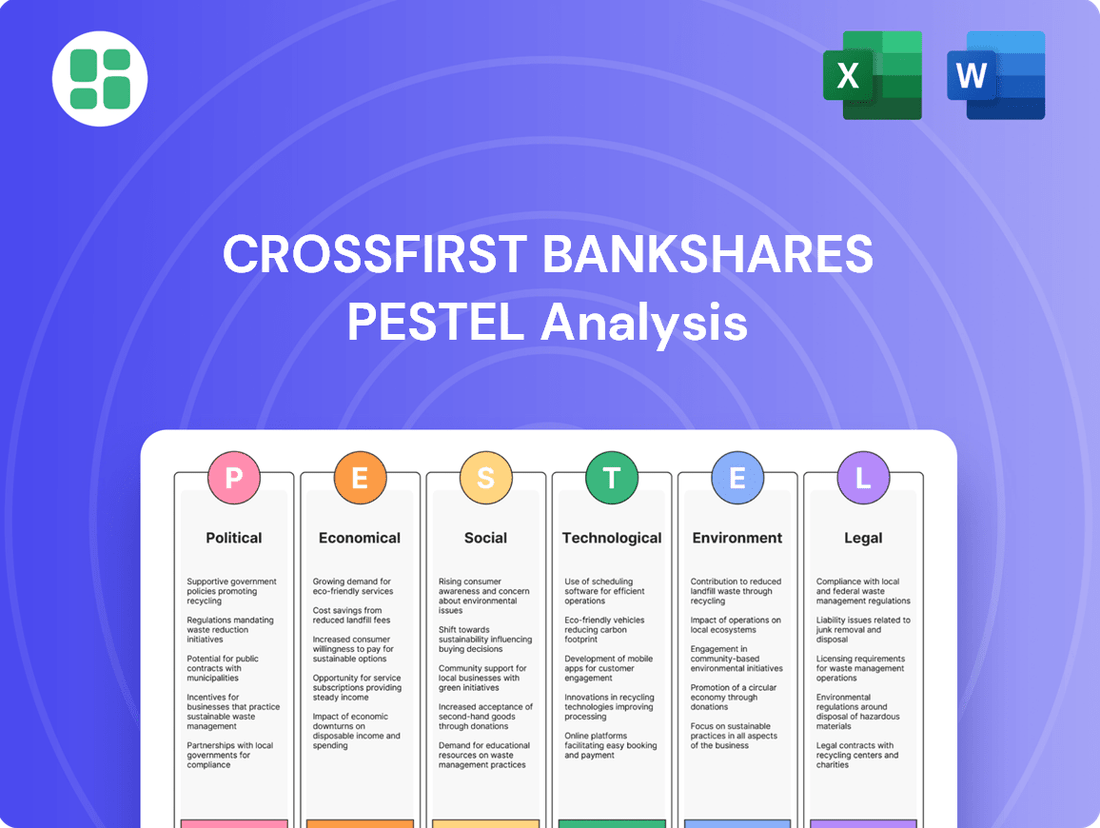

Unlock the critical external factors influencing CrossFirst Bankshares's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the banking landscape and impacting the company's strategic decisions. Gain a competitive edge by leveraging these expert insights to refine your investment strategy or business planning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The merger of CrossFirst Bankshares with First Busey Corporation will place the combined entity under the purview of a potentially altered regulatory framework. As of early 2025, the banking sector anticipates shifts influenced by the current administration, with a general leaning towards deregulation, though substantial policy changes typically unfold gradually.

The Federal Reserve's monetary policy is a significant political factor. Anticipated gradual interest rate reductions in 2025 will directly influence CrossFirst Bankshares' net interest income and the demand for loans. The speed and magnitude of these cuts are key to understanding the bank's future profitability and how it will adjust its lending strategies.

Regulators are increasingly scrutinizing non-financial risks, such as cybersecurity and data privacy, impacting financial institutions like CrossFirst Bankshares. For instance, the U.S. Securities and Exchange Commission (SEC) proposed new rules in 2023 mandating extensive disclosures on cyber risks and incidents, with final rules expected in 2024.

CrossFirst must enhance its governance, risk management, and compliance frameworks to meet these elevated supervisory expectations. Failure to do so could lead to penalties and reputational damage, especially as data breaches continue to rise; in 2023, the average cost of a data breach reached $4.45 million globally, according to IBM's Cost of a Data Breach Report.

Potential for State-Level Regulatory Divergence

CrossFirst Bankshares operates in states with varying regulatory landscapes. For instance, while federal banking laws apply nationwide, individual states can implement their own rules regarding lending practices, consumer protection, and capital requirements. This potential for state-level regulatory divergence means CrossFirst Bank, with its presence in Kansas, Missouri, Oklahoma, Texas, Arizona, Colorado, and New Mexico, might face a patchwork of compliance obligations.

This fragmentation can increase operational complexity and costs. For example, a new consumer protection law enacted in Texas, which differs from similar legislation in Arizona, would require separate compliance strategies and potentially different technology solutions. As of late 2024, several states have been actively reviewing or proposing new financial regulations, particularly around digital banking services and data privacy, which could further complicate multi-state operations for institutions like CrossFirst Bank.

- Regulatory Fragmentation: Banks face potential complexities from differing state-level regulations on top of federal rules.

- Operational Costs: Compliance with varied state requirements can lead to increased operational expenses and administrative burdens.

- Geographic Impact: CrossFirst Bank's multi-state footprint (KS, MO, OK, TX, AZ, CO, NM) makes it particularly susceptible to these divergences.

- Emerging Trends: States are increasingly focusing on digital finance and data privacy, creating new compliance challenges.

Geopolitical Climate and Trade Policies

The evolving geopolitical landscape and shifts in global trade policies, including potential tariff adjustments, can introduce significant economic uncertainty. While CrossFirst Bankshares has a primarily domestic focus, these international developments can indirectly affect the banking sector by influencing overall business and consumer confidence. This, in turn, can impact loan demand and investment appetite, creating a less predictable operating environment.

For instance, the International Monetary Fund (IMF) projected in April 2024 that global growth would remain at 3.2% for both 2024 and 2025, a figure unchanged from their previous outlook. However, they also noted that risks to this forecast remain tilted to the downside, with geopolitical factors and trade fragmentation being key concerns. Such broader economic headwinds, even if not directly targeting CrossFirst, can dampen the confidence of their commercial clients and individual depositors, potentially leading to slower credit growth or increased caution in lending.

- Global Growth Forecast: IMF projects 3.2% global growth for 2024 and 2025, with risks leaning negative due to geopolitical tensions.

- Trade Policy Impact: Changes in tariffs and trade agreements can create economic volatility, affecting business investment and consumer spending, indirectly impacting banks.

- Confidence Sensitivity: The banking sector is sensitive to shifts in business and consumer confidence, which are significantly influenced by geopolitical stability and trade relations.

- Domestic vs. International Exposure: While CrossFirst's direct international exposure may be limited, the indirect effects of global economic uncertainty on the domestic market are a key consideration.

The political climate significantly influences banking regulations, with potential shifts in oversight expected in 2025. The Federal Reserve's monetary policy, including anticipated gradual interest rate reductions, will directly impact CrossFirst Bankshares' profitability and lending strategies.

Increased scrutiny on non-financial risks like cybersecurity, evidenced by SEC proposals, necessitates robust governance and compliance frameworks for banks like CrossFirst. Failure to adapt could result in penalties, especially given the rising costs of data breaches, which averaged $4.45 million globally in 2023.

CrossFirst's multi-state operations in Kansas, Missouri, Oklahoma, Texas, Arizona, Colorado, and New Mexico expose it to a patchwork of state-specific regulations, particularly concerning digital banking and data privacy, which are seeing increased legislative attention in 2024.

Geopolitical instability and trade policy shifts, as highlighted by the IMF's 2024-2025 global growth forecast of 3.2% with downside risks, can indirectly affect CrossFirst by influencing domestic business and consumer confidence, thereby impacting loan demand.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CrossFirst Bankshares, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the bank's strategic landscape, aiding in identifying opportunities and mitigating risks.

A concise PESTLE analysis for CrossFirst Bankshares that highlights key external factors impacting the financial sector, enabling proactive strategy development and risk mitigation.

Economic factors

The anticipated shift towards lower interest rates in 2025 presents a significant challenge for the U.S. banking sector, as net interest income is projected to decline. Deposit costs, however, are likely to stay high, creating a squeeze on profitability. For CrossFirst Bankshares, successfully navigating this environment will hinge on its adeptness in managing its asset and liability structure, especially its portfolio of variable-rate loans and its ability to control funding expenses.

Economic forecasts for 2025 anticipate a slowdown in GDP growth, which is likely to temper overall loan demand. However, a potential decrease in interest rates could stimulate mortgage demand. For instance, the Federal Reserve's projections in late 2024 indicated a potential easing of monetary policy, which historically correlates with increased mortgage activity.

CrossFirst Bankshares must maintain vigilant oversight of credit quality. Industry-wide, segments like commercial real estate and credit cards have experienced rising net charge-offs and nonperforming loans. Data from the FDIC in Q3 2024 showed a notable uptick in nonperforming assets for regional banks, highlighting this trend.

Persistent inflation continues to put pressure on consumers, potentially slowing the growth of credit card debt and auto loans. This trend could directly impact CrossFirst Bankshares' consumer lending portfolios, as individuals may become more cautious with their borrowing.

The overall health of consumer spending, a key driver for banking services, is closely tied to inflation and employment figures. For instance, if inflation remains elevated, consumers might reduce discretionary spending, which in turn could lessen demand for services like new account openings or loan applications at CrossFirst.

Competition in the Banking Sector

The banking sector is a hotbed of competition, with traditional banks battling not only each other but also nimble fintech companies. This rivalry is particularly fierce when it comes to attracting deposits and offering cutting-edge digital services. For instance, in early 2024, the average national savings account yield hovered around 4.35%, a figure that fintechs often aim to beat with more aggressive rates.

CrossFirst Bankshares, operating as a regional bank, must capitalize on its growing scale and a broader suite of financial products to stand out. This means using its expanded reach to secure deposits and cultivate deeper client relationships in a crowded marketplace. The ability to offer more integrated digital banking solutions alongside personalized service will be crucial for winning and retaining customers.

- Increased Competition: Banks face pressure from both established players and agile fintechs, especially on deposit pricing and digital user experience.

- Fintech Impact: Fintechs have driven innovation, forcing traditional banks to enhance their digital offerings and customer service models to remain competitive.

- Deposit Rate Wars: The need to attract and retain deposits leads to competitive interest rate offerings, impacting banks' net interest margins.

- Scale and Diversification: For regional banks like CrossFirst, leveraging increased scale and a diversified product set is vital for competing effectively against larger institutions and fintech disruptors.

Economic Growth and Business Investment

While the U.S. economy is projected for a soft landing, a slowdown in consumer spending and subdued business investment could temper overall economic expansion. This moderation directly impacts CrossFirst Bankshares, as its commercial lending operations are closely linked to the financial well-being and expansion plans of businesses. A stable or growing economic climate is therefore crucial for the performance of CrossFirst's primary business segments.

Weak business investment can lead to reduced demand for commercial loans, affecting CrossFirst's net interest income. For instance, the U.S. Bureau of Economic Analysis reported that real private nonresidential fixed investment, a key indicator of business investment, saw a modest increase in early 2024, but the pace of growth is being watched closely for signs of a sustained slowdown.

- Economic Growth Outlook: Projections for U.S. GDP growth in 2024 and 2025 indicate a moderating but positive trend, with potential headwinds from consumer behavior and business capital expenditures.

- Consumer Spending Impact: A decline in consumer spending can indirectly affect businesses that rely on consumer demand, leading them to postpone or reduce investment and borrowing.

- Business Investment Trends: Data from sources like the Federal Reserve's Beige Book often highlight regional business sentiment regarding investment, with reports in late 2023 and early 2024 indicating cautious optimism but also concerns about future demand and interest rates.

- CrossFirst's Lending Focus: As a commercial bank, CrossFirst's loan portfolio is heavily influenced by the capital needs and economic outlook of its business clients, making it sensitive to fluctuations in business investment.

Economic factors present a mixed outlook for CrossFirst Bankshares in 2024-2025. While a potential easing of interest rates could boost mortgage demand, overall GDP growth moderation may temper loan demand. Persistent inflation continues to strain consumer spending, impacting credit card and auto loan portfolios.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on CrossFirst |

|---|---|---|---|

| GDP Growth (U.S.) | ~2.0% - 2.5% | ~1.5% - 2.0% | Slower growth may reduce overall loan demand. |

| Inflation Rate (U.S.) | ~3.0% - 3.5% | ~2.5% - 3.0% | High inflation pressures consumer spending, affecting loan growth. |

| Federal Funds Rate (End of Year) | ~4.75% - 5.00% | ~4.00% - 4.50% | Lower rates could compress net interest margins but boost mortgage activity. |

Full Version Awaits

CrossFirst Bankshares PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CrossFirst Bankshares covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external forces shaping CrossFirst Bankshares' strategic landscape.

Sociological factors

Customer preferences are rapidly shifting towards digital banking, with a significant portion of consumers, especially millennials and Gen Z, favoring mobile-first experiences over traditional branch visits. This trend is underscored by data showing a substantial increase in mobile banking app usage; for instance, in 2024, over 70% of banking interactions for many institutions were conducted digitally. CrossFirst Bankshares needs to prioritize ongoing investment in intuitive mobile applications and robust online platforms to meet these evolving customer demands and ensure a seamless, engaging digital experience.

Customers today are actively seeking financial services that feel custom-made, a shift fueled by the growing availability of data that allows for deeper understanding of individual needs. This demand for hyper-personalization means banks need to move beyond one-size-fits-all approaches.

CrossFirst Bankshares' strategy of nurturing strong client relationships directly addresses this sociological trend. By focusing on personalized solutions, they are positioning themselves to meet this evolving customer expectation, which is a significant driver in the banking sector.

To effectively cater to this, CrossFirst will likely need to invest in advanced data analytics and artificial intelligence. These technologies are crucial for understanding customer behavior, predicting needs, and ultimately delivering customized financial products and communication, a trend observed across the financial industry in 2024 and projected to intensify through 2025.

Despite the rise of digital financial tools, a substantial demand for personalized financial advice persists. Younger generations, in particular, are increasingly seeking guidance from non-traditional channels such as social media influencers and online forums, highlighting a gap in accessible, trusted advice.

CrossFirst Bankshares can leverage this trend by positioning itself as a primary source for financial education and expert consultation. By integrating educational resources and personalized advisory services with its banking offerings, CrossFirst can build trust and cater to the evolving needs of its customer base, especially those new to financial planning.

For instance, a 2024 survey indicated that over 40% of Gen Z adults view social media as a primary source for financial information, underscoring the need for banks to provide engaging and reliable content. CrossFirst's strategic focus on advisory services could capture this demographic, potentially increasing customer acquisition and loyalty.

Demographic Shifts and Regional Growth

CrossFirst Bank operates in several dynamic markets across the Midwest and Southwest, regions witnessing significant demographic transformations. For instance, states like Texas, a key market for CrossFirst, saw an estimated net migration of over 300,000 people in 2023, primarily young professionals and families, according to the U.S. Census Bureau. This influx presents both opportunities and challenges for tailoring financial products and services.

Understanding the evolving needs of these growing regional populations, particularly professionals and small to medium-sized businesses, is crucial for CrossFirst Bank's strategic planning. A deeper dive into the financial behaviors and preferences of these demographics will inform service innovation and market penetration strategies. For example, a rising demand for digital banking solutions and specialized lending for expanding businesses in these areas is anticipated.

- Midwest & Southwest Growth: CrossFirst's operational footprint includes states like Kansas, Missouri, Oklahoma, Arizona, and Texas, all experiencing population growth.

- Professional Influx: Emerging sectors in these regions are attracting a skilled workforce, increasing the demand for sophisticated financial services.

- Business Expansion: The demographic shifts are fueling entrepreneurship and business growth, creating a need for tailored commercial banking solutions.

- Digital Adoption: Younger demographics and tech-savvy professionals are driving higher adoption rates for digital banking platforms.

Trust and Relationship Banking

Despite the increasing prevalence of digital banking platforms, a significant portion of consumers still prioritize trust when selecting a financial institution. This is particularly true for more intricate financial needs such as wealth management and commercial lending, where personal relationships and perceived reliability are paramount. For instance, a 2024 survey indicated that over 60% of small business owners still prefer face-to-face interactions for critical financial decisions.

CrossFirst Bankshares strategically leverages its focus on building robust client relationships and its private banking services as a core competitive advantage. This approach directly addresses the enduring need for trust, aiming to cultivate deep-seated loyalty among its customer base. The bank's commitment to personalized service aims to differentiate it in a market often characterized by transactional digital interactions.

The emphasis on relationship banking can translate into tangible benefits. For example, banks with strong client relationships often experience higher customer retention rates and a greater share of wallet from their existing clients. In 2023, community banks with a strong relationship-based model reported an average net interest margin that was 25 basis points higher than their more transaction-focused counterparts.

- Customer Trust: Remains a primary driver for financial service selection, especially for complex needs.

- Relationship Banking: CrossFirst's strategy to build strong client connections is a key differentiator.

- Private Banking: Enhances trust and loyalty by offering personalized financial solutions.

- Market Trend: While digital banking grows, personal interaction is still valued for critical financial decisions.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on ethical practices and corporate social responsibility. Consumers, particularly younger demographics, are increasingly scrutinizing a bank's impact on communities and the environment. For example, a 2024 study revealed that 55% of consumers consider a company's social responsibility when making purchasing decisions, including financial services.

CrossFirst Bankshares' commitment to community engagement and its focus on supporting local businesses align with these shifting societal values. By actively participating in and contributing to the well-being of the communities it serves, CrossFirst can foster goodwill and build a reputation for responsible corporate citizenship, a factor that increasingly influences customer loyalty and brand perception.

The bank’s strategic approach to relationship banking, which emphasizes personalized service and understanding individual client needs, also resonates with a societal desire for more human-centric interactions in an increasingly digitized world. This focus on building genuine connections can differentiate CrossFirst in a competitive market where transactional relationships are common.

Furthermore, the increasing demand for financial literacy and accessible financial education presents an opportunity. By providing resources and guidance, CrossFirst can empower individuals and small businesses, thereby strengthening its community ties and attracting clients who value such support. This proactive approach to financial empowerment is becoming a key societal expectation for financial institutions.

Technological factors

The banking sector's digital transformation is accelerating, with AI and automation becoming crucial for efficiency. CrossFirst Bankshares must prioritize investments in digital infrastructure to enhance operations like transaction processing and fraud detection. For instance, in 2024, many banks reported significant cost savings through AI-driven automation, with some seeing up to a 20% reduction in operational expenses.

The increasing digitization of financial services, including those offered by CrossFirst Bankshares, significantly escalates the risk of cyberattacks, ransomware, and data breaches. In 2023, the financial sector experienced a notable rise in cyber threats, with reports indicating a substantial increase in the average cost of a data breach, reaching millions of dollars globally. This necessitates that CrossFirst invests heavily in advanced cybersecurity frameworks, robust encryption technologies, and comprehensive employee training to safeguard sensitive customer information and preserve customer trust.

The integration of AI and machine learning is a significant technological factor reshaping the banking landscape. These advancements are powering everything from customer service chatbots to sophisticated risk assessment and fraud detection systems. For instance, in 2024, many financial institutions are investing heavily in AI to enhance customer experience and operational efficiency.

CrossFirst Bankshares can harness these powerful tools to offer hyper-personalized services, leading to improved customer engagement and loyalty. Furthermore, AI-driven predictive analytics can significantly bolster financial forecasting accuracy and strengthen fraud prevention measures, ensuring a more secure and robust operational framework for the bank.

Open Banking and API Integration

Open banking, driven by Application Programming Interfaces (APIs), is rapidly expanding, granting third-party providers access to customer financial data for integrated services. This trend is projected to see significant growth, with the global open banking market expected to reach approximately $40 billion by 2026, up from an estimated $13.6 billion in 2021, representing a CAGR of over 24%. CrossFirst Bankshares can capitalize on this by developing or integrating with platforms that leverage APIs to offer novel revenue streams, improve customer financial transparency, and seamlessly connect with other financial management tools.

The strategic adoption of APIs by CrossFirst could unlock several key benefits:

- New Revenue Streams: Offering data-driven insights or specialized financial products through API partnerships.

- Enhanced Customer Experience: Providing customers with a consolidated view of their finances and easier access to third-party financial applications.

- Operational Efficiency: Streamlining internal processes and data sharing through secure API integrations.

- Competitive Advantage: Staying ahead by offering innovative, digitally-enabled financial solutions that meet evolving customer expectations.

Cloud Computing Adoption

Banks are increasingly moving to cloud platforms to manage data and improve how they operate. This shift allows for flexible and safe environments for sophisticated data analysis and artificial intelligence. For CrossFirst Bankshares, adopting hybrid and multi-cloud approaches can boost its operational flexibility, data processing power, and overall infrastructure upgrades. In 2024, cloud spending by financial services firms was projected to reach over $100 billion globally, highlighting the significant industry trend towards cloud adoption for enhanced efficiency and innovation.

The strategic use of cloud computing by financial institutions like CrossFirst enables them to scale resources up or down as needed, which is crucial for handling fluctuating customer demands and data volumes. This adaptability is key to maintaining a competitive edge in a rapidly evolving digital landscape. A significant portion of banks are actively pursuing cloud migration, with estimates suggesting that by the end of 2025, over 70% of financial institutions will have adopted at least one cloud-based service for core banking functions.

- Enhanced Data Analytics: Cloud platforms provide the infrastructure for advanced analytics, allowing for deeper insights into customer behavior and market trends.

- Operational Agility: Hybrid and multi-cloud strategies offer flexibility, enabling quicker deployment of new services and adaptation to market changes.

- Cost Efficiency: Migrating to the cloud can reduce capital expenditure on physical infrastructure and optimize operational costs.

- Security and Compliance: Reputable cloud providers offer robust security measures and compliance certifications, crucial for the highly regulated banking sector.

Technological advancements are rapidly reshaping banking, with AI and automation driving efficiency. CrossFirst Bankshares must invest in digital infrastructure to improve operations, as many banks saw significant cost savings from AI in 2024. Cybersecurity is paramount due to increased digitization, with the financial sector facing rising cyber threats and substantial data breach costs.

AI and machine learning are key, powering customer service and risk assessment. CrossFirst can leverage AI for personalized services and improved fraud detection. Open banking, facilitated by APIs, is growing, with the market expected to reach $40 billion by 2026, offering CrossFirst new revenue and customer engagement opportunities.

Cloud adoption is a major trend; by the end of 2025, over 70% of financial institutions are expected to use cloud services for core functions. This shift enhances data analytics, operational agility, cost efficiency, and security for banks like CrossFirst, enabling them to scale and innovate effectively.

| Technological Factor | Impact on CrossFirst Bankshares | Key Data/Trend (2024-2025) |

| AI & Automation | Improved operational efficiency, cost savings, enhanced customer service, better fraud detection. | Banks reported up to 20% operational cost reduction via AI automation in 2024. |

| Cybersecurity | Increased risk of breaches, need for robust investment in security measures. | Average cost of data breach in finance sector rose significantly in 2023. |

| Open Banking (APIs) | New revenue streams, enhanced customer experience, operational efficiency, competitive advantage. | Global open banking market projected to reach $40 billion by 2026. |

| Cloud Computing | Enhanced data analytics, operational agility, cost efficiency, improved security. | Over 70% of financial institutions expected to adopt cloud services for core functions by end of 2025. |

Legal factors

CrossFirst Bankshares, operating as a bank holding company, navigates a stringent regulatory landscape. This includes federal oversight from bodies like the Federal Reserve and state-level regulations, all demanding strict adherence to capital adequacy ratios, liquidity management, and rigorous stress testing protocols. For instance, the Federal Reserve's Comprehensive Capital Analysis and Review (CCAR) process, which intensified in recent years, requires banks to demonstrate resilience under adverse economic scenarios.

The persistent emphasis by regulators on supervisory issues and the successful remediation of any identified deficiencies underscores the need for CrossFirst to maintain continuous, adaptive compliance. As of the latest available data, banking institutions are investing significantly in compliance technology and personnel to manage these evolving requirements, with industry-wide spending on regulatory compliance projected to remain substantial through 2025.

Regulatory scrutiny on Anti-Money Laundering (AML) and Know Your Customer (KYC) processes continues to be a significant concern for financial institutions. Banks like CrossFirst are compelled to invest in and refine their transaction monitoring and reporting systems to meet these evolving demands. For instance, the Financial Crimes Enforcement Network (FinCEN) in the US regularly updates its guidance, impacting how financial institutions identify and report suspicious activities.

To maintain compliance and mitigate risks, CrossFirst must bolster its customer due diligence procedures. This includes leveraging advanced technologies, often referred to as RegTech, to facilitate real-time detection of potentially illicit transactions. The adoption of such solutions is crucial for banks aiming to proactively identify and report suspicious activities, thereby safeguarding their operations and reputation.

CrossFirst Bankshares, like all financial institutions, must navigate a complex web of evolving data privacy and consumer protection laws. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) set high bars for how customer data is collected, processed, and stored. For instance, the CCPA, which went into effect in 2020 and saw significant amendments in 2023, grants consumers rights regarding their personal information, impacting how banks like CrossFirst manage customer relationships and data sharing. Failure to comply can result in substantial penalties, underscoring the need for robust data governance, including strong encryption and secure storage practices, particularly as digital banking services expand.

Merger and Acquisition Regulatory Approvals

The merger between CrossFirst Bankshares and First Busey Corporation, completed in the first quarter of 2024, necessitated extensive regulatory approvals, notably from the Federal Reserve and state banking authorities. This process underscores the stringent oversight governing the banking sector, ensuring financial stability and fair competition.

Future strategic initiatives, including potential acquisitions or significant operational changes by the newly combined entity, will continue to face scrutiny. Regulatory bodies will assess these moves for their impact on market concentration, consumer protection, and overall financial system health. Antitrust considerations remain paramount, particularly in evaluating whether any combination could lead to reduced competition or monopolistic practices within specific geographic or product markets.

- Federal Reserve Approval: Crucial for banking mergers, ensuring compliance with capital requirements and safe, sound banking practices.

- Antitrust Review: Assesses the competitive impact of mergers, preventing undue market power concentration.

- State Banking Authority Approvals: Required for mergers involving state-chartered banks, ensuring adherence to state-specific regulations.

Legal Challenges and Litigation Risks

The financial services sector, including institutions like CrossFirst Bankshares, is susceptible to rising civil litigation. This often stems from issues such as alleged fraud, mismanagement of assets, and breaches of consumer protection laws. For instance, in 2023, the U.S. saw a notable increase in class-action lawsuits targeting financial institutions for various alleged malpractices.

CrossFirst must remain vigilant regarding potential legal hurdles, especially as it integrates emerging technologies like artificial intelligence into its operations, such as in lending decisions. Ensuring strict adherence to fair lending practices and robust data privacy protocols is paramount to mitigate these risks and avoid costly litigation.

The regulatory landscape continues to evolve, presenting ongoing compliance burdens. For example, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations designed to protect consumers, and non-compliance can result in significant penalties. CrossFirst's legal strategy must proactively address these evolving requirements.

Specifically, the bank should focus on:

- Proactive compliance with evolving consumer protection regulations.

- Developing clear legal frameworks for the use of AI in financial decision-making.

- Strengthening internal controls to prevent fraud and asset mismanagement claims.

- Monitoring and responding to trends in financial services litigation.

CrossFirst Bankshares operates under a rigorous legal framework shaped by federal and state banking regulations, demanding strict adherence to capital adequacy, liquidity, and consumer protection laws. The merger with First Busey in Q1 2024 required extensive regulatory approvals, highlighting the sector's oversight. Continued scrutiny on Anti-Money Laundering (AML) and Know Your Customer (KYC) processes necessitates ongoing investment in compliance technology, with industry spending on regulatory compliance projected to remain high through 2025.

Environmental factors

Regulators and investors are escalating demands for transparency in environmental, social, and governance (ESG) practices, with new reporting mandates anticipated in 2025. This shift means CrossFirst Bankshares must embed sustainability throughout its operations and bolster its ESG data collection and reporting mechanisms to align with these developing standards.

Customers and investors are increasingly showing a preference for financial products that are both sustainable and ethical. This trend is fueling a significant expansion in the market for investments focused on environmental, social, and governance (ESG) criteria, as well as green loans. For example, global sustainable investment assets reached an estimated $37.2 trillion in early 2024, demonstrating the scale of this shift.

CrossFirst Bankshares has a clear opportunity to tap into this growing demand. By offering sustainable financing options and investment products, the bank can attract clients who are environmentally conscious and position itself favorably within current market trends. This strategic move could enhance customer loyalty and open up new revenue streams.

Financial institutions like CrossFirst Bankshares are increasingly tasked with managing climate-related financial risks. This includes understanding how physical events, such as severe weather, and transition risks, like new environmental regulations, could impact their operations and loan portfolios.

For instance, the U.S. banking sector saw over $100 billion in insured losses from natural catastrophes in 2023, a figure expected to rise. CrossFirst must evaluate its exposure to these evolving physical risks, potentially impacting collateral values and borrower repayment capacity.

Furthermore, the transition to a lower-carbon economy presents risks and opportunities. CrossFirst needs to assess how changing energy policies and consumer preferences might affect industries it lends to, requiring proactive portfolio adjustments and risk mitigation strategies to navigate this evolving landscape.

Operational Environmental Footprint

Financial institutions like CrossFirst Bankshares are increasingly expected to minimize their environmental impact. This involves adopting greener operational practices, such as reducing paper consumption through digital banking solutions and optimizing energy usage across their facilities. For instance, by promoting paperless statements and investing in energy-efficient technologies, CrossFirst can significantly lower its operational footprint.

Enhancing sustainability initiatives is becoming a key differentiator. CrossFirst can further this by expanding its digital banking services, making it easier for customers to access accounts and conduct transactions online, thereby reducing the need for physical paper. Exploring energy-efficient upgrades for its branches and data centers is another crucial step in this direction.

- Digital Transformation: Promoting paperless transactions and electronic statements directly reduces paper waste.

- Energy Efficiency: Optimizing energy consumption in branches and data centers lowers carbon emissions.

- Sustainable Operations: Implementing eco-friendly practices across all business functions demonstrates corporate responsibility.

- Customer Engagement: Encouraging digital adoption benefits both the bank's footprint and customer convenience.

Reputational Risk from Environmental Performance

Public perception of financial institutions is increasingly linked to their environmental stewardship. CrossFirst Bankshares' proactive engagement with Environmental, Social, and Governance (ESG) principles is crucial for maintaining a positive corporate reputation. This commitment, demonstrated through transparent reporting on its environmental impact, can significantly boost brand image and attract a growing segment of socially responsible investors.

Furthermore, strong environmental performance fosters deeper community relationships. As of early 2024, a significant majority of consumers indicate that a company's environmental practices influence their purchasing decisions, with many willing to pay a premium for sustainable products and services. CrossFirst's alignment with these values can translate into enhanced customer loyalty and a stronger social license to operate.

Key aspects of CrossFirst's environmental performance influencing reputation include:

- Energy Consumption and Emissions: Tracking and reducing energy use in operations, particularly in data centers and branches, directly impacts its carbon footprint.

- Waste Management and Recycling: Implementing robust recycling programs and minimizing waste generation in all facilities.

- Sustainable Lending Practices: Evaluating and potentially limiting financing for projects with significant negative environmental impacts, aligning with a greener economy.

- Climate Risk Disclosure: Providing clear and comprehensive information regarding the bank's exposure to and management of climate-related financial risks.

Environmental regulations are tightening, requiring financial institutions like CrossFirst Bankshares to adapt their operations and reporting. For instance, new mandates expected in 2025 will likely necessitate enhanced ESG data collection and transparency.

Climate-related financial risks, both physical and transitional, are becoming more prominent. The U.S. banking sector experienced over $100 billion in insured losses from natural catastrophes in 2023, underscoring the need for CrossFirst to assess portfolio exposure to such events.

Consumer and investor preferences are shifting towards sustainable finance, with global sustainable investment assets estimated at $37.2 trillion by early 2024. CrossFirst can leverage this by offering green loans and ESG-focused investment products.

CrossFirst Bankshares can improve its environmental footprint by promoting digital banking solutions to reduce paper consumption and investing in energy-efficient technologies for its facilities. For example, expanding paperless statements and optimizing data center energy usage are key strategies.

| Environmental Factor | Impact on CrossFirst Bankshares | Data/Trend (2024-2025) |

|---|---|---|

| Regulatory Scrutiny | Increased compliance costs and reporting requirements for ESG. | Anticipated new ESG reporting mandates in 2025. |

| Climate Risk Exposure | Potential asset devaluation and loan default risks from extreme weather. | U.S. insured catastrophe losses exceeded $100 billion in 2023. |

| Market Demand for Sustainability | Opportunity to attract capital and customers through green finance. | Global sustainable investment assets reached $37.2 trillion (early 2024). |

| Operational Footprint | Need to reduce carbon emissions through efficiency and digital adoption. | Growing consumer preference for eco-friendly business practices. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CrossFirst Bankshares is meticulously crafted using data from reputable financial news outlets, regulatory filings from the SEC, and reports from leading economic research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.