CrossFirst Bankshares Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrossFirst Bankshares Bundle

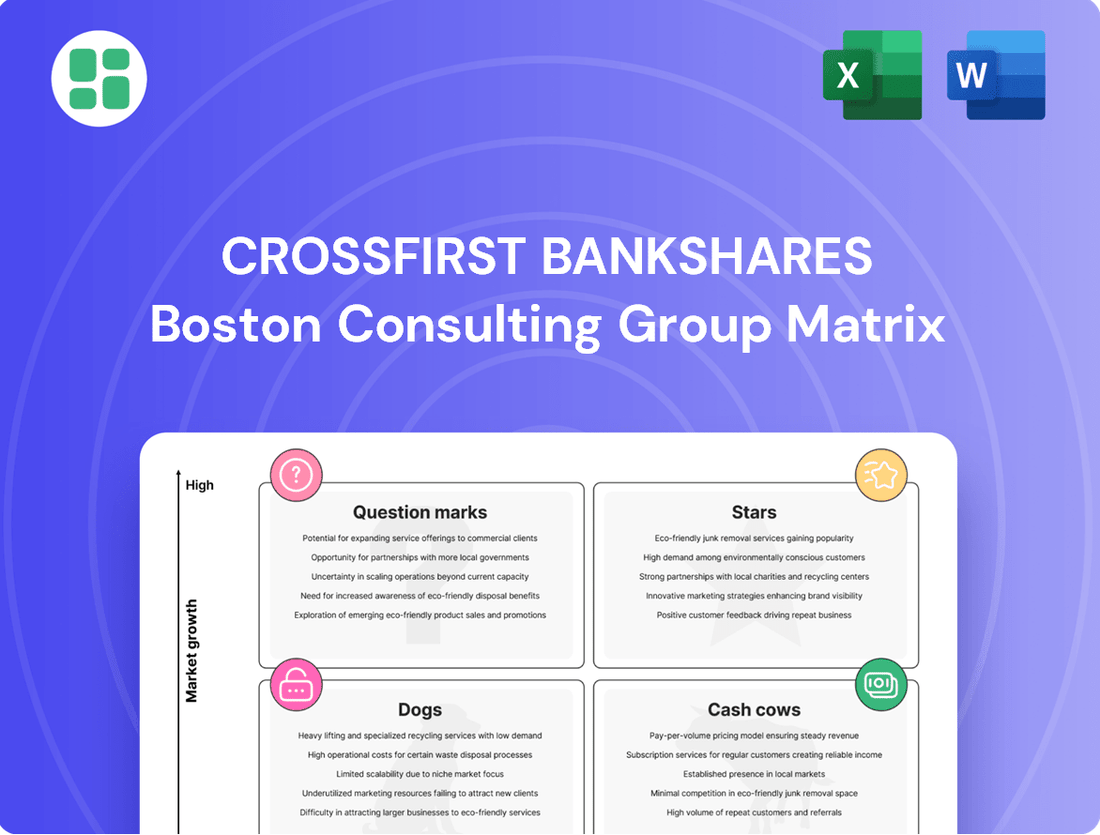

Curious about CrossFirst Bankshares' strategic positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders (Stars), steady income generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs). This snapshot is just the beginning of understanding their portfolio's health.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

CrossFirst Bank has strategically concentrated on commercial real estate (CRE) lending, and within its chosen growth markets, this sector is performing exceptionally well, positioning it as a star.

The bank's loan portfolio has experienced significant expansion, with CRE loans being a key driver of this growth. For instance, as of the first quarter of 2024, CrossFirst Bank reported a substantial increase in its commercial real estate loan balances, reflecting strong demand and successful execution in these target areas.

By channeling investments into CRE lending in these high-demand regions, CrossFirst Bank effectively leverages its established expertise. This focus not only aims to capture a larger market share but also to enhance profitability by capitalizing on favorable market conditions and client needs.

CrossFirst Bankshares demonstrates a robust commitment to commercial and industrial (C&I) lending, making it a cornerstone of their portfolio. This strategic focus allows them to cultivate deep expertise in specific industry segments.

By identifying and dominating niche C&I markets within its high-growth metropolitan areas, CrossFirst aims to capture significant market share. For instance, as of the first quarter of 2024, their commercial and industrial loan portfolio represented a substantial portion of their total loans, reflecting this strategic emphasis.

This specialization in particular industry verticals enables CrossFirst to offer highly tailored financial solutions and build stronger, more enduring client relationships. This approach is key to fostering a leading position within their chosen C&I segments.

Advanced Treasury Management Solutions are a key growth driver for CrossFirst Bankshares. As businesses prioritize efficient cash flow and financial operations, this segment is experiencing significant demand. CrossFirst's ability to innovate with technology and offer tailored services will be crucial for gaining market share.

This focus on advanced treasury management directly supports CrossFirst's strategic goal of increasing fee income. In 2024, the demand for such sophisticated financial tools is expected to remain strong, driven by economic uncertainties and the need for optimized liquidity management.

Wealth Management Services for High-Net-Worth Clients

Wealth management services for high-net-worth clients represent a key growth area for financial institutions. CrossFirst Bankshares is well-positioned to capitalize on this trend, leveraging its relationship-focused banking model. By enhancing its advisory capabilities and digital wealth platforms, CrossFirst can solidify its presence in this high-value market segment.

The demand for sophisticated wealth management is increasing, with the global high-net-worth individual (HNWI) population expected to grow. In 2023, the number of HNWIs worldwide reached over 22 million, controlling trillions in assets. CrossFirst's strategy to invest in personalized advisory services and advanced digital tools directly addresses the needs of this demographic.

- Growing HNWI Market: The global HNWI population saw a significant increase in 2023, indicating a robust market for wealth management.

- Relationship-Based Advantage: CrossFirst's established model of personalized client relationships is a strong asset in attracting and retaining high-net-worth clients.

- Digital Investment: Continued investment in digital platforms is crucial for delivering seamless and sophisticated wealth management solutions.

- Strategic Focus: Targeting the wealth management sector aligns with CrossFirst's strategy to expand its service offerings and capture a larger share of profitable markets.

Strategic Digital Banking Initiatives

CrossFirst Bankshares is actively enhancing its digital banking capabilities, recognizing the need to attract and retain clients in today's competitive landscape. These strategic investments aim to improve the client experience through user-friendly digital platforms.

The bank is focused on developing and aggressively marketing digital banking tools that are both feature-rich and easy to use. This proactive approach is designed to appeal to a growing segment of customers who prefer modern banking solutions.

By prioritizing these digital initiatives, CrossFirst Bankshares is positioning itself to capture market share. This strategy directly addresses evolving consumer preferences and the increasing demand for seamless digital banking services.

- Digital Investments: CrossFirst has been making strategic investments to bolster its digital platforms, aiming to improve client experience.

- User-Friendly Tools: The bank is developing and marketing highly user-friendly and feature-rich digital banking tools.

- Market Attraction: These digital advancements are crucial for attracting new clients in a rapidly evolving market.

- Market Share Growth: By catering to modern banking preferences, CrossFirst aims to gain market share.

CrossFirst Bank's commercial real estate (CRE) lending is a star performer, showing robust growth in key markets. As of the first quarter of 2024, CRE loans significantly contributed to the bank's overall loan portfolio expansion, reflecting strong market demand and the bank's expertise in this sector.

The bank's commercial and industrial (C&I) lending also shines as a star, with a strategic focus on niche markets within high-growth metropolitan areas. This specialization allows CrossFirst to capture substantial market share, as evidenced by the significant portion of their total loans represented by C&I lending in Q1 2024.

Advanced Treasury Management Solutions are a growing star for CrossFirst, driven by businesses' need for efficient cash flow management. The bank's investment in technology and tailored services positions it to gain market share in this crucial area, especially with continued strong demand in 2024.

Wealth management for high-net-worth clients is another star for CrossFirst, leveraging its relationship-focused model. With the global HNWI population growing, reaching over 22 million in 2023, CrossFirst's investment in advisory services and digital platforms targets this lucrative segment.

Digital banking capabilities are emerging as a star for CrossFirst, with strategic investments in user-friendly platforms to enhance client experience. This focus on modern banking solutions is crucial for attracting new clients and gaining market share in a competitive landscape.

| Business Unit | BCG Category | Key Growth Driver | 2024 Data Point |

|---|---|---|---|

| Commercial Real Estate Lending | Star | Strong market demand and bank expertise | Significant increase in CRE loan balances (Q1 2024) |

| Commercial & Industrial Lending | Star | Dominating niche markets in high-growth areas | Substantial portion of total loans (Q1 2024) |

| Advanced Treasury Management | Star | Demand for efficient cash flow and financial operations | Expected strong demand in 2024 |

| Wealth Management | Star | Growing HNWI population and relationship-based advantage | Global HNWI population over 22 million (2023) |

| Digital Banking | Star | Evolving consumer preferences and demand for seamless services | Strategic investments in user-friendly platforms |

What is included in the product

This BCG Matrix analysis for CrossFirst Bankshares offers strategic insights into its product portfolio, highlighting which units to invest in, hold, or divest.

The CrossFirst Bankshares BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of strategic uncertainty.

Cash Cows

CrossFirst Bankshares' core commercial deposit accounts are a prime example of a Cash Cow within the BCG Matrix. These accounts provide a consistent and cost-effective funding stream, essential for the bank's lending operations. In 2024, CrossFirst continued to leverage these stable deposits, which typically exhibit low growth but high profitability due to minimal marketing spend needed for retention.

Traditional commercial lending relationships are the bedrock of CrossFirst Bankshares' stable revenue. These long-standing connections, often with established businesses in mature markets, consistently generate interest income and boast high client retention. In 2023, CrossFirst reported that its commercial banking segment, which heavily relies on these relationships, continued to be a significant contributor to net interest income.

Basic treasury and payment processing services, including wire transfers, ACH, and bill pay, form a foundational revenue stream for CrossFirst Bankshares. These essential business services generate consistent fee income, acting as stable cash cows within the bank's portfolio.

These offerings are deeply embedded in client workflows, fostering strong retention and providing predictable, recurring revenue. In 2024, CrossFirst Bankshares reported significant fee income from these core treasury services, underscoring their role as reliable profit generators with manageable operational costs.

Residential Real Estate Loan Portfolio

While CrossFirst Bankshares emphasizes commercial lending, its residential real estate loan portfolio acts as a stable income generator. These loans, typically with lower risk profiles and predictable cash flows, contribute to the bank's overall financial health. In 2024, the bank reported that its residential mortgage originations remained a consistent part of its business, providing a foundational asset class.

This segment of the loan portfolio, when underwritten with stringent standards, offers reliable returns even in a mature market. The diversification benefit is significant, mitigating some of the volatility inherent in other lending areas. For instance, data from the Mortgage Bankers Association in late 2024 indicated continued demand for residential mortgages, suggesting a stable operating environment for such portfolios.

- Stable Income: Residential loans provide consistent interest payments, contributing to predictable revenue streams.

- Diversification: This loan type broadens the bank's overall credit exposure, reducing reliance on any single sector.

- Foundational Asset: A solid residential portfolio underpins the bank's lending activities and financial stability.

Established Private Banking Offerings

CrossFirst Bankshares' established private banking offerings are a prime example of a cash cow within its BCG Matrix. These services cater to affluent individuals, focusing on building deep, personalized relationships that foster loyalty and consistent revenue streams. This segment is characterized by its stability, contributing significantly to the bank's profitability without requiring substantial growth investments.

The private banking division leverages its mature client base to generate reliable fee income and substantial deposit balances. In 2023, CrossFirst Bankshares reported total revenue of $635.4 million, with a significant portion likely attributable to the stable, recurring income from these established client relationships. The low sensitivity of these relationships to market volatility means they provide a predictable income source, reducing the need for aggressive and costly marketing campaigns.

- Stable Fee Income: Private banking clients typically generate consistent fees from wealth management, trust services, and lending, providing a predictable revenue stream.

- Strong Deposit Base: Affluent clients maintain significant deposit balances, offering CrossFirst a cost-effective source of funding.

- Low Growth Investment: The mature nature of these relationships means less capital is needed for customer acquisition and product development compared to high-growth segments.

- Profitability Contribution: These services are highly profitable due to their low operating costs and stable revenue, underpinning the bank's overall financial health.

CrossFirst Bankshares' core commercial deposit accounts are a prime example of a Cash Cow within the BCG Matrix. These accounts provide a consistent and cost-effective funding stream, essential for the bank's lending operations. In 2024, CrossFirst continued to leverage these stable deposits, which typically exhibit low growth but high profitability due to minimal marketing spend needed for retention.

Traditional commercial lending relationships are the bedrock of CrossFirst Bankshares' stable revenue. These long-standing connections, often with established businesses in mature markets, consistently generate interest income and boast high client retention. In 2023, CrossFirst reported that its commercial banking segment, which heavily relies on these relationships, continued to be a significant contributor to net interest income.

Basic treasury and payment processing services, including wire transfers, ACH, and bill pay, form a foundational revenue stream for CrossFirst Bankshares. These essential business services generate consistent fee income, acting as stable cash cows within the bank's portfolio. These offerings are deeply embedded in client workflows, fostering strong retention and providing predictable, recurring revenue. In 2024, CrossFirst Bankshares reported significant fee income from these core treasury services, underscoring their role as reliable profit generators with manageable operational costs.

CrossFirst Bankshares' established private banking offerings are a prime example of a cash cow within its BCG Matrix. These services cater to affluent individuals, focusing on building deep, personalized relationships that foster loyalty and consistent revenue streams. In 2023, CrossFirst Bankshares reported total revenue of $635.4 million, with a significant portion likely attributable to the stable, recurring income from these established client relationships.

| Cash Cow Segment | Description | 2023/2024 Relevance |

| Commercial Deposit Accounts | Stable, cost-effective funding source. | Low growth, high profitability; minimal marketing spend. |

| Traditional Commercial Lending | Long-standing business relationships. | Consistent interest income, high client retention; significant contributor to net interest income in 2023. |

| Treasury & Payment Processing | Essential business services. | Consistent fee income, predictable recurring revenue; significant fee income reported in 2024. |

| Private Banking | Services for affluent individuals. | Deep relationships, consistent revenue; significant portion of $635.4 million total revenue in 2023. |

Delivered as Shown

CrossFirst Bankshares BCG Matrix

The BCG Matrix preview you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This report offers a comprehensive analysis of CrossFirst Bankshares' product portfolio, categorizing each business unit as a Star, Cash Cow, Question Mark, or Dog based on market share and growth rate. You can confidently expect the same professionally formatted and data-rich BCG Matrix report, ready for immediate strategic application and decision-making.

Dogs

Undifferentiated consumer checking accounts in today's market are often found in the Dogs quadrant of the BCG Matrix. This is because they operate in a highly competitive and commoditized space where differentiation is minimal. Consequently, these accounts typically struggle with low market share and limited growth prospects.

For banks like CrossFirst Bankshares, these accounts can become cash traps. They might generate very little revenue while demanding a significant portion of servicing resources, leading to a negative return on investment. In 2024, the average revenue per checking account for many community banks hovered around $100-$150 annually, a figure that is often outpaced by the operational costs associated with maintaining these basic, undifferentiated products.

CrossFirst Bankshares, despite its preference for a branch-light strategy, might have a few legacy branches or operational processes that aren't keeping pace. These could be considered its 'dogs' in the BCG Matrix. Think of them as older banking locations or systems that are costly to run but aren't bringing in much business, especially as more people bank online.

These underperforming branches may carry higher operating expenses compared to the income they generate. With the banking industry shifting towards digital channels, their potential for growth is quite limited. For instance, if a legacy branch’s operational cost is 15% of its revenue, and its customer acquisition cost is 20% higher than digital channels, it would likely fall into the dog category.

Certain niche deposit products, like some specialized escrow accounts or low-balance savings accounts, demand considerable administrative effort. These often require manual processing and dedicated customer support, leading to high operational costs. For instance, if a bank has a significant number of dormant checking accounts with balances under $100, the cost to maintain each account can easily exceed the meager interest earned.

These products can become resource drains if they don't bolster core funding or attract other profitable customer relationships. A prime example would be a legacy certificate of deposit (CD) product with a very low interest rate that few new customers are choosing, but existing ones are slow to mature. In 2024, financial institutions are increasingly reviewing such offerings, aiming to streamline operations and focus on products that contribute more meaningfully to their balance sheets.

Highly Competitive Small Business Lending (Generic)

Highly competitive small business lending can be a dog in the BCG matrix if a bank offers generic products without a distinct niche. This segment often faces low margins and intense competition, making it challenging to achieve significant market share or profitability. For instance, in 2024, the average interest rate for small business loans from traditional banks hovered around 11.07%, with many competing on price rather than value.

- Low Profitability: Generic small business loans often have thin profit margins due to high competition, potentially yielding only a 1-3% net interest margin.

- High Acquisition Costs: Acquiring new small business clients in a crowded market can be expensive, with marketing and sales expenses often outweighing the initial loan profits.

- Market Saturation: As of early 2024, over 30 million small businesses operate in the U.S., many seeking financing, but the market is flooded with lenders offering similar products.

- Lack of Differentiation: Without a unique value proposition, such as specialized industry expertise or faster approval times, these loans struggle to stand out and attract a loyal customer base.

Non-Strategic, Underperforming Loan Portfolios

Non-strategic, underperforming loan portfolios are essentially the ‘dogs’ in CrossFirst Bankshares’ BCG Matrix. These are segments of the bank’s lending business that consistently show poor results, such as high levels of non-performing assets (NPAs) or returns that simply don’t meet expectations. For instance, a portfolio focused on a sector that’s declining or one that’s outside the bank’s core competencies would fit this description. In 2023, many regional banks, including those with diverse loan books, experienced increased scrutiny on asset quality, with some reporting NPAs rising from below 1% to over 1.5% in specific commercial real estate sectors.

These ‘dog’ portfolios demand significant management time and resources. They often require higher provisions for credit losses, which directly impacts profitability. This diversion of capital and attention can hinder the bank’s ability to invest in and grow its more promising ‘star’ or ‘question mark’ segments. For example, if a bank has a significant portion of its capital tied up in a poorly performing legacy loan portfolio, it has less capacity to fund new, innovative lending initiatives or expand into higher-growth markets.

- High Non-Performing Assets (NPAs): Portfolios with NPAs significantly above the bank’s average, indicating a higher risk of default. For example, a specific commercial real estate loan segment might show NPAs exceeding 3% in 2024, compared to an overall bank average closer to 1%.

- Low or Negative Returns: Segments that generate returns insufficient to cover their cost of capital or risk, dragging down overall bank performance.

- Misalignment with Strategic Goals: Loan types or industries that are not part of CrossFirst Bankshares’ stated growth objectives or areas of expertise.

- Disproportionate Resource Allocation: Portfolios requiring extensive management oversight, workout efforts, and provisioning, diverting resources from more strategic initiatives.

Certain niche deposit products can fall into the Dogs quadrant if they require substantial administrative effort for minimal return. For example, dormant checking accounts with very low balances demand significant processing and support costs, often exceeding the meager interest earned.

These underperforming products can drain resources, hindering investment in more promising areas. A legacy certificate of deposit (CD) product with a low interest rate that few new customers choose, but existing ones are slow to mature, exemplifies this. In 2024, banks are actively streamlining such offerings to focus on more impactful products.

Highly competitive small business lending, when offered without a distinct niche, can also be a dog. These segments often face low margins and intense competition, making significant market share or profitability difficult. In 2024, average interest rates for small business loans from traditional banks hovered around 11.07%, with many competing primarily on price.

Non-strategic, underperforming loan portfolios are also considered dogs. These segments consistently show poor results, such as high non-performing assets (NPAs) or returns that don't meet expectations. For instance, a portfolio focused on a declining sector or one outside the bank’s core competencies would fit this description. In 2023, some regional banks saw NPAs rise in specific commercial real estate sectors.

| Product/Service Type | BCG Quadrant | Market Growth | Relative Market Share | Example Scenario |

|---|---|---|---|---|

| Undifferentiated Consumer Checking Accounts | Dog | Low | Low | Highly commoditized, minimal differentiation, low revenue per account. |

| Legacy Branch Operations | Dog | Low | Low | Costly to maintain, low customer traffic, declining relevance due to digital banking. |

| Niche Dormant Deposit Accounts | Dog | Low | Low | High administrative costs, minimal balances, low profitability despite customer numbers. |

| Generic Small Business Loans | Dog | Moderate | Low | Low net interest margins (1-3%), high acquisition costs, market saturation. |

| Underperforming Loan Portfolios (e.g., specific CRE sectors) | Dog | Low | Low | High NPAs (e.g., >3% in specific sectors in 2024), low returns, misaligned with strategy. |

Question Marks

The integration of First Busey's FirsTech payment technology solutions into CrossFirst Bankshares presents a classic BCG Matrix scenario. FirsTech operates in a high-growth market, positioning it as a potential "star" for CrossFirst. However, CrossFirst's current market share in these advanced payment solutions is notably low, suggesting it's still in the early stages of development within this segment.

Significant investment is anticipated to scale FirsTech's capabilities and effectively cross-sell these advanced services to CrossFirst's existing clientele, alongside efforts to penetrate new markets. This strategic move, while promising for long-term growth, introduces a degree of uncertainty regarding immediate returns, a characteristic often associated with "question marks" in the BCG matrix. For instance, the fintech payment sector saw substantial growth in 2024, with global transaction values projected to reach trillions, underscoring the market's potential.

CrossFirst Bankshares' merger with First Busey positions it for expansion into new geographic markets, notably Illinois and Florida. These states represent significant growth opportunities for the combined institution.

While these new territories offer high potential, CrossFirst's brand recognition and existing market share are currently minimal in Illinois and Florida. This presents a challenge for immediate market penetration.

Significant investment in marketing, talent acquisition, and tailored local strategies will be crucial for CrossFirst to establish a strong presence in these newly acquired markets. The success of this expansion remains an unfolding narrative.

The integration of AI and automation in financial advisory and back-office functions is a rapidly expanding technological area within banking. CrossFirst Bankshares, like many institutions, is likely evaluating or beginning to implement these advanced tools. While client adoption might currently be low, the potential for enhanced efficiency and innovative services is substantial.

These AI-driven initiatives demand considerable investment in research and development, alongside pilot programs. The immediate gains in market share from these efforts are uncertain, positioning them as potential question marks in a BCG matrix analysis, requiring careful strategic consideration for future growth.

ESG and Sustainable Finance Products

As environmental, social, and governance (ESG) considerations become increasingly important, the market for sustainable finance products and services is expanding rapidly. CrossFirst Bankshares' recent impact reports highlight a commitment to ESG initiatives, signaling a potential growth area for the company. While the overall market for sustainable finance is robust, CrossFirst's current market share within specialized ESG financing or advisory services is likely nascent. This suggests a strategic need for investment to effectively capitalize on future demand within this evolving sector.

The global sustainable finance market is projected to reach trillions of dollars in the coming years. For instance, sustainable debt issuance alone saw significant growth in 2023, with green, social, and sustainability bonds totaling over $1 trillion globally. This trend underscores the substantial opportunity for financial institutions to develop and offer tailored ESG-focused products.

- Market Growth: The global sustainable finance market is experiencing exponential growth, driven by investor demand and regulatory tailwinds.

- CrossFirst's Position: CrossFirst Bankshares has demonstrated a commitment to ESG principles, creating a foundation for developing sustainable finance offerings.

- Strategic Opportunity: Capturing a significant share of the ESG market will require strategic investment in specialized products and advisory services.

- Competitive Landscape: While the market is expanding, CrossFirst's current market share in niche ESG financing is likely low, necessitating proactive development.

Partnerships with Fintech Innovators

CrossFirst Bankshares' strategy to partner with fintech innovators positions them to explore potentially high-growth, specialized financial services. These collaborations, such as integrating blockchain for faster settlements or leveraging niche lending platforms, are crucial for accessing segments where traditional banks like CrossFirst currently hold a minimal market presence. For instance, the global fintech market was valued at approximately $111.8 billion in 2023 and is projected to grow significantly, indicating the vast opportunity in these emerging areas.

These fintech partnerships fall into the "Question Marks" category of the BCG Matrix, signifying their high potential reward coupled with substantial risk. CrossFirst's engagement in these ventures requires meticulous due diligence and a willingness to invest resources for successful scaling and integration. By strategically aligning with these innovators, CrossFirst aims to capture future market share in rapidly evolving financial technology landscapes.

- Exploring Blockchain: Partnerships can enable CrossFirst to explore blockchain for enhanced transaction security and efficiency, a market segment experiencing rapid technological advancement.

- Niche Lending Platforms: Collaborating with specialized lending platforms allows access to underserved markets and innovative credit scoring models, potentially driving new revenue streams.

- High Growth, High Risk: These ventures represent opportunities in rapidly expanding fintech sectors but also carry inherent risks requiring careful management and strategic investment.

- Market Share Expansion: By partnering, CrossFirst aims to build market share in cutting-edge financial services where its current footprint is limited, positioning for future growth.

CrossFirst Bankshares' ventures into emerging fintech sectors, such as blockchain integration for settlements and collaborations with niche lending platforms, represent classic "Question Marks" in the BCG Matrix. These areas offer significant growth potential, with the global fintech market valued at approximately $111.8 billion in 2023 and projected for substantial expansion. However, CrossFirst's current market share in these specialized segments is minimal, necessitating considerable investment and strategic focus to achieve success and build a competitive position.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| FirsTech Payment Solutions | High | Low | Question Mark | Requires significant investment to scale and gain market share. |

| Geographic Expansion (IL, FL) | High | Low | Question Mark | Needs substantial marketing and operational investment for penetration. |

| AI & Automation in Services | High | Low | Question Mark | Investment in R&D and pilot programs needed to prove market impact. |

| Fintech Partnerships (Blockchain, Niche Lending) | High | Low | Question Mark | High risk, high reward; requires careful due diligence and resource allocation for integration. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including CrossFirst Bankshares' financial statements, industry growth rates, and market share analysis, to accurately position each business segment.