Credit Agricole PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credit Agricole Bundle

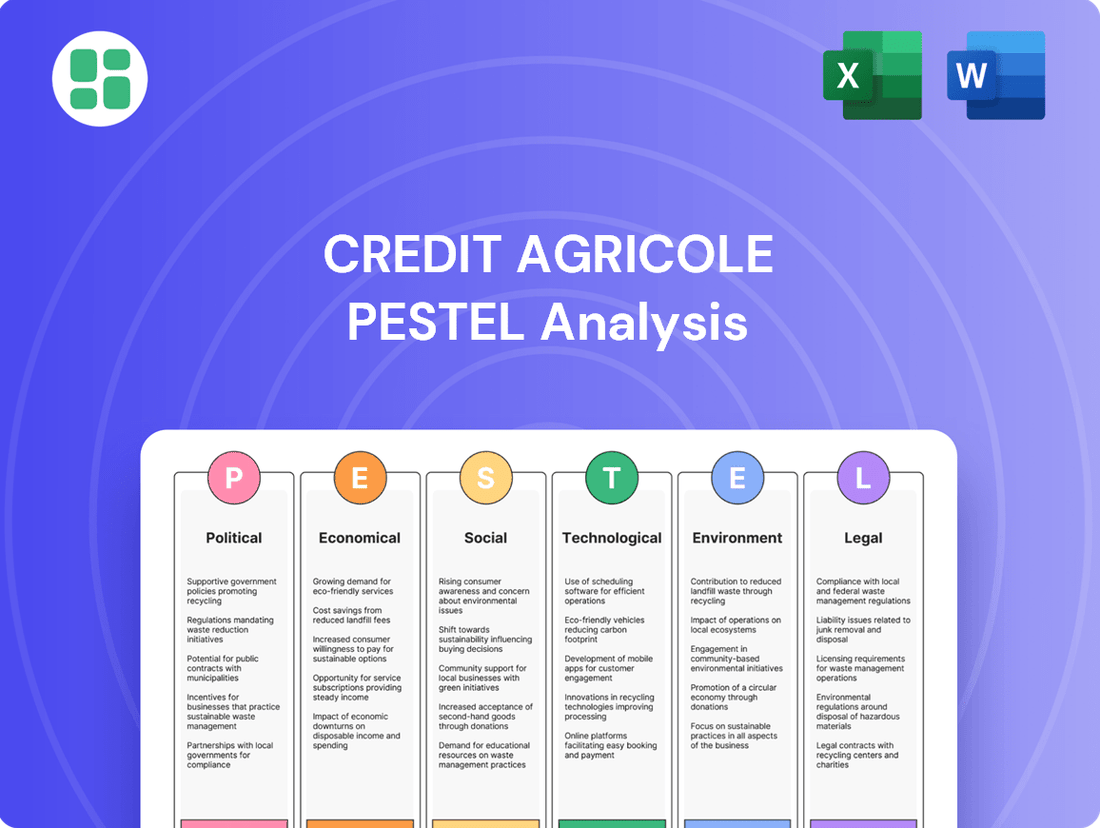

Navigate the complex external forces impacting Credit Agricole with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the financial landscape, and how these elements directly influence Credit Agricole's strategic direction and future growth. Gain the crucial intelligence needed to anticipate challenges and capitalize on opportunities.

Ready to unlock a deeper understanding of Credit Agricole's operating environment? Our PESTEL analysis provides expert insights into the social, technological, environmental, and legal factors that are critical for success in the banking sector. Equip yourself with actionable data to inform your investment decisions and strategic planning.

Don't get left behind in the rapidly evolving financial world. Our meticulously researched PESTEL analysis of Credit Agricole offers a clear roadmap of the external influences that matter most. Download the full report now to gain a competitive edge and make more informed, forward-thinking decisions.

Political factors

The stability of the French and European political landscape is a cornerstone for Crédit Agricole's operations. For instance, the French government's commitment to fiscal prudence, as evidenced by its budget deficit targets for 2024, aims to foster a predictable economic climate. Any significant shifts in this stability could directly impact investor confidence and the bank's strategic planning.

Political uncertainty can dampen both consumer and business sentiment, leading to reduced lending and investment activity. In 2024, European elections and potential government changes across key member states introduce a layer of this uncertainty, which financial institutions like Crédit Agricole must navigate by closely monitoring policy developments.

Crédit Agricole must remain agile in adapting to evolving government policies, especially those impacting the financial sector. For example, directives from the European Central Bank and national regulators, such as those concerning capital requirements or sustainable finance initiatives, necessitate ongoing adjustments to the group's operational framework and business strategies.

Crédit Agricole's operations are significantly shaped by the intricate web of EU and national banking regulations. For instance, the implementation of Capital Requirements Regulation (CRR III), which came into effect in early 2023, mandates higher capital buffers for banks, impacting lending capacity and profitability. This regulatory environment is dynamic, with upcoming legislation like the Digital Operational Resilience Act (DORA) set to impose stricter requirements on IT risk management and operational resilience by January 2025, directly affecting how Crédit Agricole manages its digital infrastructure and cybersecurity.

Global geopolitical tensions, such as ongoing conflicts and the rise of protectionist policies, directly impact Crédit Agricole's international operations. These shifts can disrupt supply chains, affect currency exchange rates, and lead to increased regulatory scrutiny in various markets where the bank has a presence.

For instance, the intensification of trade disputes between major economic blocs in 2024 and early 2025 could trigger market volatility, potentially impacting Crédit Agricole's corporate and investment banking revenues derived from cross-border transactions and international trade finance. The bank's exposure to regions experiencing heightened political instability requires constant vigilance.

Furthermore, the imposition of sanctions or sudden changes in international trade agreements can create significant headwinds for financial institutions. Crédit Agricole, with its broad international footprint, must actively manage these risks by diversifying its geographical exposure and adapting its strategies to navigate an increasingly complex and unpredictable global political landscape.

Government Fiscal and Monetary Policies

Government fiscal policies, encompassing taxation and public spending, directly shape the economic landscape for Crédit Agricole. For instance, changes in corporate tax rates or government investment programs can impact the bank's profitability and the demand for its services. The French government's commitment to fiscal consolidation, aiming to reduce its deficit, could influence public sector spending on infrastructure, potentially affecting project financing opportunities for banks.

Monetary policies enacted by the European Central Bank (ECB) are crucial for Crédit Agricole. Interest rate decisions, a primary tool of monetary policy, directly influence the bank's net interest income and its ability to offer competitive lending rates. As of mid-2025, the ECB's stance on interest rates, balancing inflation control with economic growth, will be a key determinant of the bank's lending margins and overall profitability. The outlook suggests a cautious approach to rate adjustments, with potential for slight reductions if inflation continues to moderate.

- Fiscal Policy Impact: French government initiatives to stimulate economic growth through targeted spending or tax incentives can boost business investment, thereby increasing demand for corporate loans and financial advisory services from Crédit Agricole.

- Monetary Policy Influence: The ECB's benchmark interest rates directly affect Crédit Agricole's cost of funding and the pricing of its loan products. A stable or slightly declining interest rate environment in 2025 would likely support the bank's net interest margin.

- Regulatory Environment: Beyond fiscal and monetary policy, banking regulations set by French and EU authorities significantly influence Crédit Agricole's operations, capital requirements, and risk management practices.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Efforts

Crédit Agricole, like all global financial institutions, operates within an increasingly rigorous framework of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These measures are designed to prevent illicit funds from entering the financial system and to disrupt the funding of terrorist activities. Staying compliant is not optional; it's a fundamental aspect of maintaining operational integrity and trust.

The evolving nature of financial crime necessitates continuous adaptation of AML/CTF policies. This includes enhanced due diligence on customers, robust transaction monitoring, and timely reporting of suspicious activities to authorities. Failure to meet these evolving standards can result in substantial financial penalties, severe reputational damage, and even operational restrictions.

In 2023, global AML/CTF enforcement actions continued to be significant. For instance, various financial institutions faced fines for compliance failures. The Financial Action Task Force (FATF) consistently updates its recommendations, impacting reporting requirements and customer verification processes worldwide. For 2024 and into 2025, expect continued scrutiny and potential new directives aimed at digital assets and emerging payment methods.

- Regulatory Scrutiny: Increased global focus on AML/CTF compliance by bodies like FATF and national regulators.

- Compliance Costs: Significant investment required in technology, personnel, and training to meet stringent due diligence and reporting obligations.

- Enforcement Actions: Potential for substantial fines and sanctions for non-compliance, as seen in numerous cases in 2023 and anticipated for 2024/2025.

- Reputational Risk: Non-compliance can severely damage a financial institution's reputation, impacting customer trust and market standing.

Political stability in France and the broader EU is crucial for Crédit Agricole's operational environment. Government fiscal policies, such as France's 2024 deficit reduction targets, aim to create economic predictability, though political shifts can impact investor confidence and strategic planning.

Evolving government regulations, including those from the European Central Bank on capital requirements and sustainable finance, necessitate ongoing adaptation by Crédit Agricole. For instance, the Digital Operational Resilience Act (DORA), effective January 2025, will impose stricter IT risk management standards.

Geopolitical tensions and protectionist policies, particularly trade disputes anticipated in 2024-2025, can disrupt international operations and currency exchange rates for Crédit Agricole. The bank must manage risks associated with regions experiencing political instability and adapt to changing trade agreements.

Monetary policy, especially the ECB's interest rate decisions, directly influences Crédit Agricole's net interest income and lending margins. The ECB's cautious approach to rate adjustments in mid-2025, balancing inflation and growth, will be a key factor for the bank's profitability.

What is included in the product

This Credit Agricole PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the banking giant.

It provides a comprehensive understanding of the external forces shaping Credit Agricole's strategic landscape, highlighting potential opportunities and challenges.

A PESTLE analysis for Crédit Agricole offers a structured approach to understanding external factors, acting as a pain point reliever by providing clarity and strategic direction amidst complex market dynamics.

Economic factors

The interest rate environment significantly shapes Crédit Agricole's Net Interest Margin (NIM). Central bank policies, particularly those from the European Central Bank (ECB), directly influence the cost of funds and the yield on assets.

While French banks, including Crédit Agricole, experienced a slower balance-sheet repricing in 2024, a projected stabilization or slight decline in interest rates for 2025 is expected to support a gradual recovery in NIM. This shift impacts both the bank's lending income and its deposit expenses.

For instance, if the ECB maintains its key interest rates around the levels seen in late 2024, Crédit Agricole's NIM could see a modest improvement as its lending portfolio reprices more favorably against its funding costs, potentially boosting profitability.

France's GDP growth is projected to be around 1.2% in 2024 and 1.4% in 2025, according to the Banque de France. This expansion directly fuels demand for Crédit Agricole's lending services, from mortgages to business financing. Stronger economic activity typically translates into higher loan origination volumes.

However, potential political instability, particularly concerning upcoming elections or shifts in government policy, could dampen business and consumer confidence. This uncertainty might lead to a cautious approach to borrowing, potentially delaying the anticipated rebound in lending volumes for 2025, especially in sectors sensitive to economic outlook.

Persistent inflation in 2024 and 2025 is a significant concern for Crédit Agricole, directly impacting its operating expenses. For instance, rising energy costs and wage inflation, common themes in the Eurozone throughout 2024, can push up the bank's cost-to-income ratio if not managed effectively. This ratio is a key indicator of a bank's efficiency, and an increase signals lower profitability relative to revenue.

Crédit Agricole, like many major European banks, faces the necessity of increasing spending on technology modernization and robust risk management frameworks. These investments are essential for competitiveness and regulatory compliance. However, the challenge lies in balancing these growth-oriented expenditures with the imperative of cost discipline. French banks, in particular, have been prioritizing cost containment measures to buffer against economic headwinds and maintain healthy profit margins.

For the fiscal year 2024, analysts project that operating expenses for major European banks could see an increase of 3-5% due to these inflationary pressures and investment needs. Crédit Agricole's ability to implement and adhere to effective cost containment strategies will be paramount in navigating this environment and ensuring sustained profitability. This focus on efficiency is a critical component of its strategic financial management.

Global Financial Market Stability

The stability of global financial markets is a critical factor for Crédit Agricole, directly impacting its corporate and investment banking, asset management, and capital markets operations. Market volatility, a persistent concern, can significantly sway trading revenues and the valuation of assets under management. For instance, in early 2024, heightened geopolitical tensions and inflation concerns contributed to increased choppiness in equity and bond markets, impacting investment banking deal flows.

French banks, including Crédit Agricole, often leverage diversified business models to buffer against these market fluctuations. This diversification allows them to draw strength from different revenue streams, even when specific market segments experience downturns. For example, while investment banking might see reduced activity during volatile periods, the bank's retail banking and insurance segments can offer a more stable income base.

- Market Volatility Impact: Increased volatility in global equity markets in Q1 2024, with indices like the S&P 500 experiencing swings of over 2%, directly affects trading revenues and asset valuations for financial institutions.

- Diversification Benefits: Crédit Agricole's broad exposure across retail banking, corporate and investment banking, and insurance aims to provide resilience, with its insurance division often demonstrating more stable performance during economic uncertainty.

- Interest Rate Sensitivity: Fluctuations in global interest rates, a key driver of market stability, influence bond portfolio valuations and the profitability of lending activities, a factor closely monitored by the bank throughout 2024.

- Geopolitical Risk: Ongoing geopolitical events in 2024 continue to introduce uncertainty into global financial markets, potentially disrupting cross-border investment and capital flows that are vital for Crédit Agricole's international operations.

Consumer Spending and Savings Behavior

Consumer spending and saving habits are crucial for Crédit Agricole's retail banking operations. Changes in how households manage their money directly affect loan demand and the bank's deposit base. For instance, during 2024, a key trend observed was a cautious approach to discretionary spending amidst persistent inflation, impacting credit card and personal loan volumes.

Household income and savings behavior are closely monitored. In the first half of 2025, data indicated a slight uptick in savings rates for some demographics, potentially driven by higher interest rates on savings accounts, which could influence the bank's funding costs and deposit mix. Conversely, rising costs for essential goods continued to pressure disposable income for many.

Consumer confidence and unemployment rates are significant indicators. As of mid-2025, consumer confidence surveys showed a mixed sentiment, with concerns about economic stability lingering. Unemployment rates remained relatively low in Crédit Agricole's core markets, supporting a baseline level of consumer spending, but the composition of employment and wage growth are key factors to watch.

The shift towards different deposit types also plays a role.

- Increased demand for high-yield savings accounts: Consumers sought better returns, leading to a shift from traditional checking accounts to more interest-bearing options in 2024 and early 2025.

- Impact on retail loan production: While savings increased, consumer appetite for new loans, particularly for large purchases like homes or vehicles, remained sensitive to interest rate environments and economic outlooks.

- Deposit mix evolution: Crédit Agricole observed a growing proportion of term deposits as consumers locked in higher rates, affecting the bank's liquidity management strategies.

- Consumer confidence fluctuations: Economic uncertainties in late 2024 and early 2025 led to periods of reduced spending and increased precautionary savings, directly impacting transaction volumes and credit growth.

Economic factors significantly influence Crédit Agricole's performance, particularly through interest rate dynamics and economic growth projections. The Banque de France forecasts French GDP growth at approximately 1.2% for 2024 and 1.4% for 2025, which directly supports demand for the bank's lending services. However, persistent inflation in 2024 and 2025 poses a challenge, potentially increasing operating expenses and impacting the bank's cost-to-income ratio if not managed effectively.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Crédit Agricole |

|---|---|---|---|

| French GDP Growth | ~1.2% | ~1.4% | Increased lending demand, higher loan volumes |

| Inflation Rate (Eurozone) | Elevated (e.g., 3-4%) | Moderating (e.g., 2-3%) | Higher operating costs, pressure on NIM if repricing lags |

| European Central Bank Key Interest Rates | Stabilizing/Slightly Decreasing | Stabilizing/Slightly Decreasing | Supports gradual NIM recovery, influences funding costs |

What You See Is What You Get

Credit Agricole PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Credit Agricole PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. Understand the external forces shaping its strategic landscape and future opportunities.

Sociological factors

Customer preferences are rapidly shifting, with digitalization at the forefront, demanding banking services that are both convenient and readily accessible. Crédit Agricole needs to consistently upgrade its digital offerings, including mobile apps and online portals, to keep pace with these evolving expectations and maintain its competitive edge in the European banking landscape. For instance, by the end of 2024, a significant portion of European banking transactions are expected to be conducted digitally, underscoring this trend.

Demographic shifts, particularly the aging population across Crédit Agricole's core European markets, significantly influence product demand. For instance, in France, the proportion of individuals aged 65 and over is projected to reach 27.7% by 2030, up from 21.4% in 2020. This necessitates a stronger focus on retirement planning, long-term care insurance, and wealth management services tailored to seniors.

The increasing life expectancy and the growing number of retirees create a sustained demand for financial products that offer stability and income generation. Crédit Agricole can capitalize on this by expanding its offerings in annuities, investment funds focused on capital preservation, and advisory services for estate planning. In 2024, European banks reported a noticeable uptick in demand for retirement-related products, with assets under management in pension funds growing by an estimated 5% year-on-year.

Societal emphasis on financial literacy and inclusion directly shapes Crédit Agricole's strategy, pushing the bank to actively educate its customer base and offer banking services that cater to a wider demographic. This focus is crucial as it aligns with broader goals of economic empowerment and reducing financial inequality.

Crédit Agricole's commitment to social responsibility is evident in its financial education programs and support for vulnerable customer segments. For instance, in 2023, the bank reported supporting over 1 million individuals through various financial well-being initiatives across its operations, demonstrating a tangible effort to foster financial inclusion.

Workforce Dynamics and Employee Expectations

Crédit Agricole, like many financial institutions, is navigating evolving workforce expectations. There's a growing demand for flexible work arrangements, with studies in 2024 indicating that a significant portion of the banking workforce prefers hybrid models. This shift necessitates adjustments in HR strategies to accommodate remote and flexible working, impacting office space utilization and management.

Furthermore, employees increasingly prioritize continuous skills development and career progression. Crédit Agricole's investment in training programs, particularly in areas like digital banking and data analytics, is vital for maintaining a competitive edge and ensuring employees remain adaptable. For instance, in 2023, the bank reported significant spend on upskilling initiatives, aiming to bridge the digital talent gap.

Diversity and inclusion are also paramount. Companies that foster inclusive environments often see higher employee engagement and better retention rates. Crédit Agricole's commitment to diversity, evident in its 2024 employee resource groups and gender parity targets, is crucial for attracting and retaining a broad talent pool, which directly influences operational efficiency and innovation.

- Workforce Expectations: A 2024 survey revealed that over 60% of financial services professionals in Europe desire hybrid work models.

- Skills Development: Crédit Agricole invested €150 million in employee training and development in 2023, focusing on digital transformation and cybersecurity skills.

- Diversity & Inclusion: The bank aims to achieve 40% female representation in senior management roles by 2025, up from 35% in 2023.

- Talent Retention: Investing in a supportive work environment and professional growth opportunities is key to reducing employee turnover, which can cost businesses up to 1.5 times an employee's annual salary.

Societal Expectations for Responsible Business Practices

Societal expectations are increasingly pushing businesses, including financial institutions like Crédit Agricole, towards more responsible practices, especially around Environmental, Social, and Governance (ESG) factors. This growing demand directly impacts how the bank is perceived and influences the trust stakeholders place in it.

Crédit Agricole's dedication to its 'Societal Project' and the integration of ESG criteria into its core operations are therefore crucial for maintaining public confidence and a strong reputation. For instance, in 2023, the bank reported that 34% of its new financing activities were aligned with ESG criteria, a figure it aims to increase.

- ESG Integration: Crédit Agricole is actively embedding ESG considerations into its lending and investment decisions, reflecting a broader societal shift.

- Stakeholder Trust: Meeting heightened expectations for corporate responsibility is vital for Crédit Agricole's long-term stakeholder relationships and brand image.

- Societal Project: The bank's stated commitment to a 'Societal Project' aims to align its business strategy with societal well-being and sustainability goals.

- Reputation Management: Proactive engagement with ESG issues helps Crédit Agricole mitigate reputational risks and enhance its standing in the community.

Societal expectations are increasingly pushing businesses, including financial institutions like Crédit Agricole, towards more responsible practices, especially around Environmental, Social, and Governance (ESG) factors. This growing demand directly impacts how the bank is perceived and influences the trust stakeholders place in it.

Crédit Agricole's dedication to its 'Societal Project' and the integration of ESG criteria into its core operations are therefore crucial for maintaining public confidence and a strong reputation. For instance, in 2023, the bank reported that 34% of its new financing activities were aligned with ESG criteria, a figure it aims to increase.

The bank's commitment to social responsibility is evident in its financial education programs and support for vulnerable customer segments, with over 1 million individuals reportedly supported through well-being initiatives in 2023.

| Societal Factor | Crédit Agricole Action/Focus | Relevant Data/Target |

|---|---|---|

| Financial Literacy & Inclusion | Educational programs, accessible services | Supported > 1 million individuals (2023) |

| Corporate Responsibility (ESG) | Integrating ESG into operations and financing | 34% of new financing aligned with ESG (2023) |

| Societal Project Alignment | Aligning business with societal well-being | Ongoing strategic focus |

| Stakeholder Trust & Reputation | Meeting expectations for responsible practices | Key driver for brand image |

Technological factors

Crédit Agricole is heavily invested in digital transformation, aiming to boost both client satisfaction and operational efficiency. This strategic push involves adopting cutting-edge technologies such as cloud computing, artificial intelligence (AI), and robotic process automation (RPA) to overhaul its IT infrastructure and streamline workflows.

By embracing these advancements, Crédit Agricole is modernizing its core systems, which is crucial for staying competitive in the rapidly evolving financial landscape. For instance, in 2023, the bank reported significant progress in its digital initiatives, with a notable increase in the use of AI-powered tools for customer service and risk management.

As financial services increasingly move online, Crédit Agricole faces significant technological challenges related to cybersecurity and data protection. The bank must invest heavily in advanced security systems to safeguard sensitive customer information and financial transactions from evolving cyber threats.

Compliance with regulations like the Digital Operational Resilience Act (DORA) is crucial, requiring robust frameworks for managing ICT risks and ensuring operational resilience. Reports from 2024 indicate a sharp rise in sophisticated cyberattacks targeting financial institutions, underscoring the urgency for enhanced protective measures.

Crédit Agricole is heavily investing in Artificial Intelligence (AI) and Machine Learning (ML) to boost its operations. These technologies are crucial for streamlining processes, offering tailored customer experiences, and strengthening fraud detection capabilities. The bank has actively developed AI-powered features and established an 'AI Factory' to efficiently implement these innovative solutions.

Fintech Competition and Collaboration

The financial technology (fintech) landscape is rapidly evolving, presenting Crédit Agricole with a dynamic mix of competitive pressures and collaborative avenues. The emergence of agile fintech firms is challenging traditional banking models, forcing established institutions to adapt and innovate. However, this also opens doors for strategic partnerships that can enhance service offerings and reach new customer segments.

Crédit Agricole is actively engaging with fintechs to foster innovation and expand its capabilities. For instance, its collaboration on the Optim Receivables and Supply Chain Finance platform exemplifies a strategic approach to leveraging fintech expertise. This type of partnership allows the bank to offer more sophisticated and efficient solutions to its clients, thereby strengthening its market position.

- Fintech Investment Growth: Global fintech investment reached over $100 billion in 2023, highlighting the sector's significant expansion and potential for disruption.

- Partnership Models: Crédit Agricole's engagement with fintechs ranges from direct investments to joint ventures and technology integrations, demonstrating a flexible approach to harnessing external innovation.

- Digital Transformation: The bank's commitment to digital transformation, partly driven by fintech competition, aims to improve customer experience and operational efficiency, with digital channels accounting for a growing percentage of customer interactions.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are being closely watched by Crédit Agricole as potential disruptors in traditional banking, even though widespread adoption is still in its early phases. The bank is actively exploring how these technologies can streamline operations, particularly in areas such as cross-border payments and the complex processes involved in trade finance. For instance, by the end of 2024, the global blockchain in banking market is projected to reach approximately $2.5 billion, indicating significant investment and development in this space.

Crédit Agricole's interest extends to asset tokenization, a process that could fundamentally change how financial assets are managed and traded. The bank's strategic exploration aims to leverage DLT for enhanced efficiency and robust security measures. By 2025, it's estimated that tokenized assets could represent a substantial portion of global financial markets, with some projections suggesting trillions of dollars in value, underscoring the transformative potential Crédit Agricole is keen to harness.

- Efficiency Gains: DLT can reduce transaction times and costs in areas like international payments, potentially cutting settlement times from days to minutes.

- Enhanced Security: The immutable and transparent nature of blockchain offers improved data integrity and reduced fraud risk in financial transactions.

- Trade Finance Innovation: Blockchain platforms are being developed to digitize and simplify the complex documentation and multi-party interactions in trade finance.

- Asset Tokenization: DLT enables the creation of digital representations of real-world assets, potentially increasing liquidity and accessibility for investors.

Crédit Agricole's technological strategy centers on digital transformation, leveraging AI, cloud, and RPA for efficiency and customer experience. The bank is actively exploring blockchain and DLT for streamlining payments and trade finance, with a keen eye on asset tokenization's potential to reshape financial markets by 2025.

| Technology Area | Crédit Agricole's Focus | Market Trend/Projection (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhancing customer service, risk management, fraud detection, and operational efficiency. Established an 'AI Factory' for rapid deployment. | AI in banking market projected to grow significantly, with increased adoption for personalized services and predictive analytics. |

| Cloud Computing | Modernizing IT infrastructure to support digital initiatives and improve scalability. | Continued migration of financial services to the cloud for agility and cost savings. |

| Blockchain & Distributed Ledger Technology (DLT) | Exploring for cross-border payments, trade finance simplification, and asset tokenization. | Global blockchain in banking market projected to reach ~$2.5 billion by end of 2024. Tokenized assets could represent trillions by 2025. |

| Cybersecurity | Heavy investment in advanced security systems to protect data and transactions against evolving threats. | Increased sophisticated cyberattacks targeting financial institutions, necessitating robust cybersecurity measures. Compliance with DORA is critical. |

Legal factors

The full implementation of Capital Requirements Regulation III (CRR III) starting January 1, 2025, will introduce more robust capital adequacy and risk management rules for European banks. Crédit Agricole needs to ensure its capital structure and risk assessment models align with these stricter mandates, which could influence how capital is deployed across its operations.

This regulatory shift is designed to bolster the resilience of the banking sector. For instance, CRR III aims to harmonize capital requirements across the EU, potentially leading to higher capital ratios for certain asset classes and requiring banks like Crédit Agricole to hold more capital against specific risks.

The Digital Operational Resilience Act (DORA), set to take effect on January 17, 2025, introduces stringent requirements for financial entities like Crédit Agricole regarding operational resilience. This includes mandatory, detailed reporting on cybersecurity measures and incident recovery plans, aiming to bolster the financial sector's ability to withstand and recover from digital disruptions.

Crédit Agricole is therefore compelled to significantly fortify its IT and cyber-risk resilience frameworks. This proactive adaptation is crucial for ensuring robust preparedness against potential digital threats and maintaining uninterrupted financial operations, thereby safeguarding overall financial stability.

Crédit Agricole must navigate a complex web of data privacy laws like the GDPR, which dictates how customer information is handled. Failure to comply can lead to severe penalties, as seen with other financial institutions facing multi-million euro fines. For instance, in early 2024, a major European bank was fined €30 million for inadequate data protection measures.

Anti-Money Laundering (AML) and Sanctions Compliance

Crédit Agricole is subject to stringent Anti-Money Laundering (AML) and sanctions regulations across various jurisdictions. The bank must continuously invest in advanced compliance technologies and thorough employee training to identify and prevent financial crimes. Failure to comply can result in significant fines and reputational damage, as seen with other major financial institutions facing penalties for inadequate AML controls. For instance, in 2023, several European banks faced increased scrutiny and fines related to AML shortcomings, highlighting the critical need for robust compliance frameworks.

Key aspects of Crédit Agricole's AML and sanctions compliance include:

- Customer Due Diligence (CDD): Implementing rigorous processes to verify customer identities and assess risks associated with their transactions.

- Transaction Monitoring: Utilizing sophisticated systems to detect suspicious activities and report them to relevant authorities.

- Sanctions Screening: Ensuring that no transactions or customers are linked to individuals or entities on international sanctions lists.

- Regulatory Reporting: Adhering to all mandatory reporting requirements for suspicious activities and transactions to national and international bodies.

Consumer Protection Laws and Conduct Regulations

Consumer protection laws and conduct regulations significantly shape Crédit Agricole's operations. For instance, the European Union's General Data Protection Regulation (GDPR), fully enforced since 2018, mandates strict data privacy for customers, impacting how the bank collects, stores, and uses client information. Failure to comply can result in substantial fines, as seen with various financial institutions facing penalties for data breaches or mishandling of personal data.

These regulations directly influence product design and marketing strategies, ensuring transparency and fairness in financial dealings. Crédit Agricole must navigate a complex web of rules, such as those governing fair lending practices and responsible investment advice, to maintain client trust and avoid costly legal battles or sanctions from regulatory bodies like the Autorité de Contrôle Prudentiel et de Résolution (ACPR) in France.

- Data Privacy: Adherence to GDPR is paramount, influencing how customer data is handled.

- Fair Practices: Regulations ensure transparency in product offerings and marketing.

- Consumer Trust: Compliance fosters trust and mitigates legal and reputational risks.

- Regulatory Oversight: Banks face scrutiny from bodies like the ACPR regarding conduct.

Crédit Agricole must adapt to evolving capital requirements, with CRR III, effective January 1, 2025, demanding stricter capital adequacy and risk management. Furthermore, the Digital Operational Resilience Act (DORA), starting January 17, 2025, mandates enhanced cybersecurity and incident recovery reporting, requiring significant investment in IT resilience. Compliance with data privacy laws like GDPR remains critical, with substantial fines for breaches, as evidenced by a €30 million penalty levied against a European bank in early 2024 for inadequate data protection.

Environmental factors

Crédit Agricole is actively pursuing carbon neutrality by 2050, a commitment reinforced by its membership in the Net Zero Banking Alliance. This strategic direction involves a tangible shift in its financing portfolio, specifically reducing exposure to fossil fuel industries and increasing investments in renewable and low-carbon energy projects. The bank has set concrete decarbonization targets for key sectors, integrating these climate-focused goals directly into its overarching '2025 Ambitions' strategic plan.

Crédit Agricole is well-positioned to capitalize on the surging demand for sustainable finance, a trend amplified by increasing investor and consumer awareness. In 2024, the global sustainable finance market is projected to reach trillions, with green lending a key component. The bank's commitment to financing climate transition projects, including renewable energy and biodiversity initiatives, directly addresses this growing market need.

Crédit Agricole faces growing demands for detailed ESG reporting, driven by regulators and investors. This means the bank must clearly communicate its environmental footprint and sustainability efforts, showing progress against its goals. For instance, the EU Taxonomy and the upcoming Corporate Sustainability Reporting Directive (CSRD) are setting new benchmarks for non-financial disclosures, impacting how financial institutions like Crédit Agricole operate and report.

Biodiversity Preservation and Natural Capital

Beyond the well-established focus on climate change, there's a significant and growing emphasis on biodiversity preservation and the direct impact of financial activities on natural capital. This shift recognizes that ecological health is intrinsically linked to long-term financial stability.

Crédit Agricole is actively integrating biodiversity considerations into its environmental policies and financing decisions. This proactive approach acknowledges the crucial interconnectedness between healthy ecosystems and a resilient financial sector.

For instance, in 2023, Crédit Agricole committed to aligning its financing and investment portfolios with the Taskforce on Nature-related Financial Disclosures (TNFD) recommendations, aiming to better understand and manage nature-related risks and opportunities. The bank is also a signatory to initiatives like the Finance for Biodiversity Pledge.

- Biodiversity Risk Assessment: Crédit Agricole is enhancing its methodologies to assess biodiversity risks within its lending and investment portfolios, particularly in sectors with high environmental impact.

- Sustainable Financing: The bank is increasing its financing for projects that demonstrably contribute to biodiversity conservation and the restoration of natural capital.

- TNFD Alignment: By aligning with TNFD, Crédit Agricole aims to improve transparency and disclosure of its nature-related dependencies, impacts, risks, and opportunities by 2025.

- Sectoral Engagement: Crédit Agricole is engaging with clients in sensitive sectors to encourage the adoption of biodiversity-positive practices.

Reputational Risk from Environmental Impact

Public scrutiny of environmental performance is a significant reputational risk for Crédit Agricole. Stakeholders, including customers and investors, increasingly expect robust sustainability practices. Failure to meet these expectations, such as through financing environmentally damaging projects, can lead to negative perceptions.

This can directly impact the bank's standing. For instance, a perceived lack of commitment to green finance could erode customer loyalty, making it harder to attract and retain clients who prioritize sustainability. Investor confidence may also waver, potentially affecting the bank's share price and access to capital.

- Reputational Damage: Negative press or public campaigns highlighting environmental concerns linked to Crédit Agricole's financing activities.

- Investor Relations: Difficulty attracting or retaining ESG-focused investors, potentially impacting cost of capital. For example, as of Q1 2024, sustainable investment funds saw continued inflows, underscoring investor demand for environmentally conscious portfolios.

- Talent Attraction: Challenges in recruiting and retaining top talent who are increasingly drawn to organizations with strong environmental credentials.

- Customer Loyalty: A decline in customer preference for Crédit Agricole if its environmental impact is viewed unfavorably compared to competitors.

Crédit Agricole is actively integrating biodiversity preservation into its strategy, aligning with the growing global recognition of nature's importance to financial stability. By committing to frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) and the Finance for Biodiversity Pledge, the bank aims to better manage nature-related risks and opportunities.

The bank is enhancing its assessment of biodiversity risks within its portfolios and increasing financing for projects that support conservation and ecosystem restoration. This proactive stance is crucial as regulators and investors increasingly demand transparency on environmental impacts, with initiatives like the EU Taxonomy and CSRD setting new disclosure standards.

Public perception regarding environmental performance poses a significant reputational risk, impacting customer loyalty and investor confidence. For instance, continued inflows into sustainable investment funds in early 2024 highlight investor preference for environmentally conscious portfolios, making strong environmental credentials vital for Crédit Agricole.

| Environmental Focus Area | Crédit Agricole's Action | 2024/2025 Relevance |

|---|---|---|

| Climate Transition Financing | Reducing fossil fuel exposure, increasing renewable energy investments | Aligned with growing green lending market, projected trillions in 2024 |

| ESG Reporting & Transparency | Meeting demands for detailed ESG disclosures (e.g., CSRD) | Essential for regulatory compliance and investor trust |

| Biodiversity Integration | Adopting TNFD recommendations, increasing biodiversity-positive financing | Addressing growing focus on nature-related financial risks and opportunities |

| Reputational Management | Prioritizing sustainability to maintain customer loyalty and investor appeal | Key for attracting ESG-focused investors and talent |

PESTLE Analysis Data Sources

Our Credit Agricole PESTLE analysis is meticulously crafted using data from reputable financial institutions like the IMF and World Bank, alongside official government reports and leading industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the bank.