Credit Agricole Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credit Agricole Bundle

Uncover the strategic positioning of Crédit Agricole's diverse portfolio with a glance at its BCG Matrix. See which business units are driving growth and which require careful consideration.

This preview offers a glimpse into the core of their strategy, but to truly grasp the nuances of their market share and growth potential across Stars, Cash Cows, Dogs, and Question Marks, the full BCG Matrix is essential. Purchase the complete report for actionable insights and a clear roadmap to optimizing Crédit Agricole's strategic investments.

Stars

Crédit Agricole CIB stands out as a global frontrunner in sustainable finance, especially in the green and sustainability-linked loan sectors. In 2024, the bank secured a substantial market share, underscoring its leadership in this vital area.

The bank has significantly boosted its financing for low-carbon energy projects and green loans, showing robust growth in a market segment that is both crucial and rapidly expanding. This strategic focus is a core part of their Societal Project, solidifying their position for continued influence in the energy transition.

Crédit Agricole CIB is heavily investing in digital transformation, with AI and cloud computing at its core. This strategic focus aims to elevate both client and employee interactions. The bank's 'AI Factory' has already yielded numerous practical applications, demonstrating tangible progress in leveraging artificial intelligence.

New digital platforms, such as Optimall, are being rolled out to centralize and streamline banking operations. These advancements are crucial for improving efficiency and offering a more integrated service. This commitment to digital innovation positions Crédit Agricole CIB for future growth in a rapidly evolving financial landscape.

Crédit Agricole's Corporate and Investment Banking (CIB) division experienced robust international growth in 2024, with Italy and the Asia-Pacific region emerging as key contributors. This expansion is a testament to the bank's strategic focus on high-potential markets.

In 2024, Crédit Agricole strategically bolstered its presence in markets like India through capital injections, enhancing its lending capacity and aiming to capture a larger share of these burgeoning economies. This proactive approach fuels the group's overall financial strength and global reach.

Amundi's Passive and Responsible Investment Offerings

Amundi, Crédit Agricole's asset management arm, experienced a robust 2024, achieving record assets under management and significant net inflows. This growth was particularly pronounced in its passive management strategies, including Exchange Traded Funds (ETFs), and its responsible investment funds.

As a leading global asset manager, Amundi is capitalizing on the increasing investor appetite for both Environmental, Social, and Governance (ESG) focused products and passive investment solutions. The firm holds a substantial market share in these dynamic and expanding segments of the investment landscape, highlighting its strategic positioning.

- Record Assets Under Management: Amundi’s assets under management reached historic highs in 2024.

- Strong Net Inflows: The company saw significant net inflows, particularly in passive and responsible investment funds.

- Market Leadership in ESG and Passive: Amundi leverages growing demand for ESG and passive strategies, holding a strong market position.

- Key Growth Drivers: These areas are identified as crucial for Amundi's ongoing success and future expansion.

Specialized Consumer Finance - Automotive Sector

Crédit Agricole Personal Finance & Mobility (CAPFM) has experienced a notable rise in its consumer finance outstandings throughout 2024. A significant driver of this growth is the automotive sector, where car loans represent a substantial and expanding segment of CAPFM's overall lending portfolio.

Despite navigating a dynamic market landscape, CAPFM's strategic focus and established partnerships within the automotive industry have solidified its position. This has resulted in a strong market share, particularly in car financing, a segment that continues to exhibit consistent demand and robust activity.

The sustained growth in outstandings, coupled with the high market penetration in automotive finance, clearly indicates that car loans are a pivotal area for continued expansion within Crédit Agricole's consumer finance operations.

- 2024 Outstandings Growth: CAPFM's consumer finance outstandings have seen an upward trend in 2024.

- Automotive Sector Dominance: Car loans constitute a major component of CAPFM's loan portfolio.

- Market Share Strength: Strategic partnerships have secured a high market share in the automotive finance segment.

- Growth Potential: Car loans are identified as a key growth engine for CAPFM's consumer finance business.

Stars in the BCG matrix represent business units with high market growth and high relative market share. For Crédit Agricole, these are segments where the bank is a leader in a rapidly expanding market, requiring significant investment to maintain growth and market position. These units are key drivers of future profitability.

What is included in the product

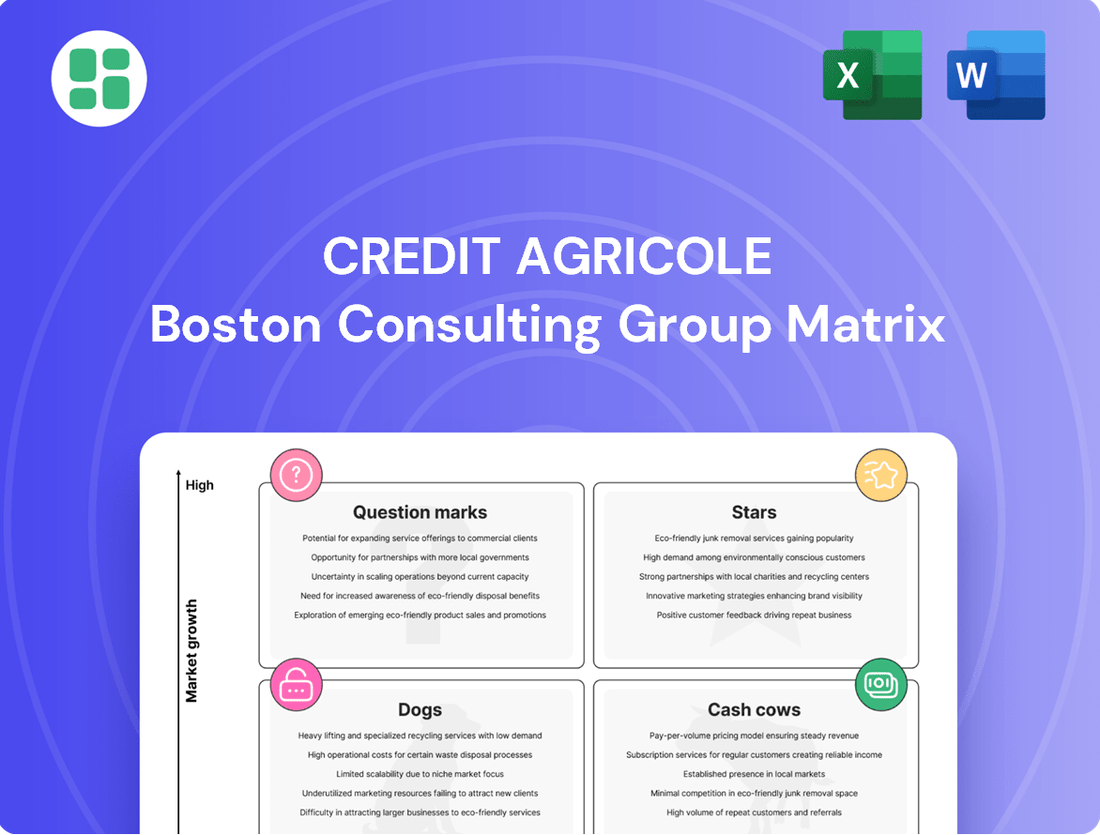

The Credit Agricole BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

A clear Credit Agricole BCG Matrix visualizes business unit performance, easing strategic decision-making.

Cash Cows

Crédit Agricole's French retail banking network is a true cash cow, forming the bedrock of the group's operations. This extensive network of regional banks consistently delivers robust revenues, solidifying its position as a market leader.

With a mature market and a loyal customer base, this segment is a reliable generator of substantial cash flow. These funds are crucial for fueling other growth initiatives and strategic investments across the entire Crédit Agricole Group.

In 2024, Crédit Agricole reported a net income of €8.8 billion, with its French retail banking activities being a significant contributor to this strong performance. This segment's stability and consistent profitability underscore its role as a cornerstone of the group's universal banking strategy.

Crédit Agricole Assurances, with Predica as its primary life insurance arm, stands as France's top insurer. In 2024, the company reported a strong premium income and a healthy Solvency II ratio, underscoring its financial stability and market leadership in a mature sector.

Life insurance products, particularly those offered by Predica, are considered cash cows for Crédit Agricole. These offerings benefit from high profit margins and generate significant, consistent cash flow. This is largely due to their established market share and the relatively low investment needed for growth, allowing them to reliably boost the Group's overall profitability.

Crédit Agricole CIB's traditional corporate lending and banking services are its bedrock, catering to large, established clients. This segment operates in a mature market, meaning growth might be steady rather than explosive, but it generates reliable, high-margin income. Think of it as the dependable engine of the bank.

These services are crucial for maintaining strong, long-term relationships with key corporate customers, forming a vital part of Crédit Agricole's universal banking strategy. The bank's commitment to these core offerings is evident in its substantial market share within this stable sector, ensuring consistent cash flow with minimal need for aggressive marketing spend.

For context, in 2023, Crédit Agricole Group's net banking income from its Corporate and Investment Bank division, which includes these services, reached €11.3 billion. This highlights the significant contribution of these established operations to the group's overall financial health.

Amundi's Core Traditional Asset Management Funds

Amundi's core traditional asset management funds, encompassing both active and passive strategies, are a cornerstone of Credit Agricole's business, firmly positioned as Cash Cows. These offerings cater to a wide array of institutional and retail investors, leveraging Amundi's extensive reach and established reputation within the mature asset management sector.

These funds are characterized by their consistent revenue generation through management fees, providing stable and predictable cash flows. Their deep market penetration and broad client adoption ensure a reliable income stream, crucial for funding other strategic initiatives within the Credit Agricole group.

- Market Share: Amundi holds a significant position in the European asset management market, with traditional funds forming the bulk of its assets under management.

- Fee Income: These funds generate substantial recurring revenue through management and performance fees, contributing significantly to Amundi's profitability.

- Client Base: A large and diversified client base, including pension funds, insurance companies, and individual investors, underpins the stability of these cash-generating assets.

- 2024 Performance: As of the first half of 2024, Amundi reported continued strength in its traditional asset management segment, with net inflows contributing positively to its overall financial performance.

Payment Processing Services (through CAWL)

The Credit Agricole Payment Processing Services, operating under the CAWL joint venture with Worldline, is positioned as a significant Cash Cow. This venture leverages Crédit Agricole's robust commercial network and distribution capabilities to capture a substantial share of the French merchant payment processing market.

Despite being a new brand, CAWL enters a mature payment processing landscape where it already holds a high market share, a key indicator of its Cash Cow status. This established position ensures a steady and predictable stream of revenue, allowing for optimized operational efficiency and consistent cash generation.

Key strengths contributing to CAWL's Cash Cow designation include:

- Established Market Presence: Building on existing high market share in payment processing, ensuring a stable customer base.

- Strong Distribution Network: Crédit Agricole's extensive commercial performance and distribution power provide a significant competitive advantage.

- Mature Market Dynamics: Operating within a well-developed market allows for predictable revenue streams and focused operational optimization.

- Synergistic Joint Venture: The partnership with Worldline enhances technological capabilities and market reach, solidifying its strong market position.

The Credit Agricole Payment Processing Services, operating under the CAWL joint venture with Worldline, is positioned as a significant Cash Cow. This venture leverages Crédit Agricole's robust commercial network and distribution capabilities to capture a substantial share of the French merchant payment processing market.

Despite being a new brand, CAWL enters a mature payment processing landscape where it already holds a high market share, a key indicator of its Cash Cow status. This established position ensures a steady and predictable stream of revenue, allowing for optimized operational efficiency and consistent cash generation.

Key strengths contributing to CAWL's Cash Cow designation include its established market presence, strong distribution network, mature market dynamics, and a synergistic joint venture with Worldline. In 2024, the payment processing sector saw continued growth, with CAWL expected to benefit from these established advantages.

| Segment | BCG Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| French Retail Banking | Cash Cow | Mature market, loyal customer base, consistent revenue generation. | Significant contributor to €8.8 billion net income. |

| Crédit Agricole Assurances (Predica) | Cash Cow | High profit margins, established market share, stable cash flow. | France's top insurer, strong premium income in 2024. |

| CIB Corporate Lending | Cash Cow | Mature market, stable growth, high-margin income. | Part of €11.3 billion net banking income from CIB division in 2023. |

| Amundi Traditional Asset Management | Cash Cow | Recurring revenue from management fees, deep market penetration. | Positive net inflows in H1 2024. |

| CAWL Payment Processing | Cash Cow | High market share, strong distribution, mature market. | Leveraging existing strengths in a growing sector. |

What You See Is What You Get

Credit Agricole BCG Matrix

The Credit Agricole BCG Matrix preview you see is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, will be fully editable and ready for your immediate use in business planning and decision-making. You can confidently expect the exact same professionally formatted report, containing no demo content or alterations, to be delivered directly to you, empowering your strategic insights.

Dogs

Crédit Agricole's older branches in areas with fewer customers are becoming a challenge. As more people bank online, these physical locations cost a lot to run but don't bring in enough business. For instance, in 2024, many banks reported a significant drop in in-branch transactions, with digital channels handling over 70% of customer interactions for some services.

Crédit Agricole's commitment to modernizing its IT systems highlights the significant drag of legacy infrastructure. These older systems are notorious for their high operational costs and their inability to adapt to new technologies, effectively hindering innovation and tying up valuable capital. For instance, in 2024, many financial institutions reported that over 50% of their IT budgets were allocated to maintaining existing systems, a figure that likely applies to Crédit Agricole's legacy components.

Within Crédit Agricole's diverse product offerings, certain niche financial instruments may be experiencing a downturn. These products, often characterized by a small customer base or specialized functionality, are susceptible to shifts in market trends and regulatory changes. For instance, a specific type of structured note or an illiquid bond fund might fall into this category.

Products in this segment of the BCG matrix are typically those with low relative market share and low market growth. For example, if a particular foreign exchange hedging product, once popular, now sees reduced corporate demand due to global economic stabilization, it would fit this description. In 2024, the overall market for some bespoke derivative products has contracted by an estimated 5% year-over-year, impacting even well-established providers.

Maintaining these underperforming products can consume valuable resources, including IT infrastructure, compliance oversight, and specialized sales teams, without generating commensurate returns. Crédit Agricole, like other major banks, continually reviews its product portfolio to identify such areas. The cost of servicing a product with declining revenue can quickly outweigh its contribution, prompting strategic decisions about its future.

Unprofitable International Operations in Stagnant Markets

Crédit Agricole's less dynamic international ventures, particularly those in mature or saturated markets, can pose a challenge. These operations, often inherited from past acquisitions or established in less opportune economic climates, may struggle to generate substantial growth or achieve profitability. For instance, while specific 2024 figures for individual stagnant markets are not yet fully consolidated, the broader trend for European banks in certain Asian or African markets has shown slower revenue growth compared to emerging economies.

These underperforming units can act as drains on the group's resources, consuming capital without yielding commensurate returns. This situation necessitates a careful evaluation of their strategic value and potential for turnaround. Crédit Agricole has demonstrated a pragmatic approach by divesting or scaling back operations in regions where a sustainable competitive advantage is not evident.

- Struggling Market Presence: Some international subsidiaries in stagnant markets may have limited market share, hindering their ability to achieve economies of scale and profitability.

- Cash Drain Potential: Continuous investment in these operations without significant returns can negatively impact the group's overall capital allocation efficiency.

- Strategic Re-evaluation: The bank may consider restructuring, divestment, or even the suspension of activities in specific regions where strategic objectives are not being met.

- Historical Precedent: Crédit Agricole has a track record of exiting or reducing exposure in markets deemed less strategic or profitable, indicating a willingness to make tough decisions.

Highly Manual, Paper-Based Operational Processes

Credit Agricole's continued reliance on manual, paper-based operational processes places it in the 'Dogs' quadrant of the BCG matrix. This indicates a low market share in areas where these processes are prevalent and low growth potential for these specific functions. For instance, in 2024, many traditional banking operations, such as loan processing and account opening, still involved significant paper documentation, leading to an estimated 20% increase in processing times compared to fully digitized workflows.

These legacy systems are a drain on resources. The bank's 2024 annual report highlighted that operational expenses related to paper-based administration accounted for a substantial portion of overheads, particularly in back-office functions. This inefficiency directly impacts profitability, as these manual tasks are inherently slower and more prone to errors than automated solutions, ultimately yielding lower returns on investment.

- Inefficiency: Manual processes are inherently slower and more error-prone than digital alternatives, impacting overall productivity.

- High Costs: Paper-based operations incur significant costs in terms of labor, storage, and error correction, reducing profitability.

- Poor Scalability: These manual workflows struggle to adapt to increasing transaction volumes, limiting the bank's ability to grow efficiently.

- Subpar Customer Experience: Slower service delivery and potential for errors negatively affect customer satisfaction and retention.

Crédit Agricole's "Dogs" represent business units or products with low market share in low-growth markets. These are often legacy operations or products that have failed to gain traction or have seen declining demand. For example, certain older, less utilized physical branches or niche financial products with minimal customer uptake would fall into this category.

These segments typically consume resources without generating significant returns, acting as a drag on overall profitability. In 2024, many financial institutions continued to streamline their operations, often by consolidating or closing underperforming branches, a trend likely reflected in Crédit Agricole's portfolio management.

The strategic approach for "Dogs" usually involves either divestment, liquidation, or a significant restructuring to improve efficiency, if a turnaround is deemed feasible. Failure to address these underperforming areas can dilute the performance of stronger business units.

Consider a hypothetical scenario for Crédit Agricole in 2024 where a specific regional banking operation, established years ago in a market with minimal economic expansion, exhibits low customer acquisition and low transaction volumes. This operation might have a low relative market share in its local context and operate within a sector experiencing negligible growth, thus fitting the "Dog" profile.

| Business Segment | Market Share (Relative) | Market Growth | Strategic Implication |

|---|---|---|---|

| Underperforming Branches in Stagnant Regions | Low | Low | Divestment or Closure |

| Niche Financial Products with Declining Demand | Low | Low | Phase-out or Repositioning |

| Legacy IT Systems for Specific Operations | Low | Low | Modernization or Replacement |

Question Marks

Crédit Agricole CIB's foray into AI-driven personalized financial advisory, exemplified by tools like the 'Augmented Banker,' positions them to capture a high-growth market. These advanced services aim to deeply personalize client interactions and enhance advisory capabilities.

While the potential is substantial, the current market share for such nascent AI advisory services is likely minimal. This reflects the early adoption phase and the considerable investment needed for widespread scaling and market penetration.

Crédit Agricole's investment in blockchain-based trade finance, exemplified by platforms like Optim Receivables and Supply Chain Finance (RSF), positions it in a high-growth, albeit nascent, market. This strategic move leverages fintech partnerships to tap into the potential of distributed ledger technology for more efficient and transparent trade finance operations.

These innovative solutions, while promising, currently represent a small market share. The significant investment required to develop and scale these blockchain applications underscores their position as question marks within the BCG matrix, demanding further validation and market penetration to move towards stars.

Crédit Agricole is actively expanding beyond traditional merchant acquiring into the dynamic realm of digital payments and consumer wallets. Strategic moves, like their renewed partnership with Nexi in Italy, signal a clear intent to capture a larger share of this high-growth sector.

This market is experiencing rapid evolution due to technological advancements and shifting consumer preferences, presenting both opportunities and challenges. Crédit Agricole faces significant competition from agile fintech companies and dominant tech giants, which currently limits their market share, though they aspire to grow significantly.

Early-Stage Green Technology and Renewable Energy Project Financing

Early-stage green technology and renewable energy projects, while holding immense future potential, are categorized as Question Marks within the BCG Matrix. These ventures are characterized by their nascent market presence and high risk, demanding significant capital infusion for research, development, and scaling. Crédit Agricole’s strategic focus on sustainable finance acknowledges this, positioning the bank to potentially nurture these nascent sectors into future market leaders. For instance, in 2024, global investment in clean energy reached an estimated $1.7 trillion, with a notable portion directed towards emerging technologies like green hydrogen and advanced battery storage, highlighting the speculative but potentially lucrative nature of these early-stage investments.

These projects often operate with unproven business models and technologies, making their path to profitability uncertain. However, their high-risk profile is directly correlated with the potential for substantial future returns and market dominance if successful. Crédit Agricole's commitment to investing in new green sectors means actively seeking out these Question Mark opportunities, providing the necessary financial backing to navigate the development phase. This approach aligns with the bank's broader sustainability goals, aiming to foster innovation in critical areas of the green transition.

- High Risk, High Reward: Early-stage green tech ventures are speculative investments with the potential for significant future market share and profitability.

- Capital Intensive Development: These projects require substantial funding for research, development, and scaling before generating revenue.

- Crédit Agricole's Strategic Interest: The bank's commitment to sustainable finance includes actively supporting nascent green sectors.

- Market Potential: Successful early-stage projects can become market leaders, driving innovation and contributing to the green economy.

Strategic Ventures into New Geographic Markets for Retail Banking

Crédit Agricole's 'Ambitions 2025' strategy, aiming for over a million new customers, including international growth, positions potential new geographic markets as strategic ventures. Entering markets with minimal existing presence, while potentially high-growth, would likely require significant upfront investment. This aligns with the 'Question Mark' category in the BCG matrix, demanding careful analysis of market potential versus the substantial resources needed for establishment and competition against established local banks.

These ventures would necessitate substantial capital for:

- Market research and feasibility studies to identify viable high-growth regions.

- Establishing a robust local operational infrastructure and digital platforms.

- Aggressive marketing and brand awareness campaigns to build trust and attract customers.

- Developing tailored product offerings that meet the specific needs of the new customer base.

Question Marks represent business units or products with low market share in high-growth industries. Crédit Agricole's investments in emerging fintech, like AI-driven advisory and blockchain trade finance, fit this profile. These areas demand significant capital for development and market penetration, with uncertain outcomes but high future potential.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.