Crayon Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crayon Group Bundle

The Crayon Group's SWOT analysis reveals a strong brand presence and a loyal customer base, but also highlights potential challenges in adapting to evolving digital landscapes. Understanding these dynamics is crucial for navigating the competitive market.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Crayon Group's global presence is a significant strength, enabling them to serve clients across numerous markets. This broad reach allows for diversified revenue streams and the ability to capitalize on varying regional IT demands. For instance, in 2023, Crayon reported revenue growth in both established markets like Europe and emerging regions, demonstrating the effectiveness of their international strategy.

Crayon Group's core strength lies in its deep specialization in software and cloud asset management. This focus directly addresses a critical business need for optimizing technology spending and gaining control over complex IT environments. By concentrating on this niche, Crayon cultivates unparalleled expertise, enabling them to deliver highly sought-after services in a rapidly expanding market.

This specialization translates into tangible benefits for clients, including enhanced operational efficiency and significant reductions in IT asset expenditures. For instance, in 2024, organizations globally continued to grapple with escalating cloud costs, with many reporting overspending due to a lack of visibility and management, highlighting the crucial value of Crayon's specialized offerings.

Crayon Group's comprehensive service portfolio extends well beyond traditional asset management, encompassing critical areas like cloud migration, advanced data analytics, artificial intelligence, and robust cybersecurity solutions. This broad offering allows them to address a wide spectrum of client requirements, supporting businesses throughout their entire digital transformation lifecycle.

This integrated approach not only positions Crayon as a holistic IT solutions provider but also creates significant opportunities for cross-selling services. By acting as a single point of contact for diverse IT needs, Crayon strengthens client relationships and enhances customer loyalty, as evidenced by their reported 90% customer retention rate in Q4 2024 for clients utilizing multiple service lines.

Focus on Cost Optimization and ROI

Crayon Group's core strength lies in its dedication to cost optimization and demonstrating a clear return on investment (ROI) for its clients. This focus is particularly resonant in the current economic climate, where businesses are aggressively seeking ways to enhance efficiency and manage expenditures. By proving tangible financial benefits, Crayon solidifies its client relationships and attracts new business.

This emphasis on value translates into practical advantages for clients looking to maximize their technology spend.

- Cost Reduction: Crayon helps clients identify and eliminate unnecessary software and cloud spending, a critical area for many businesses.

- ROI Demonstration: The company's ability to quantify the financial returns of its services provides a compelling reason for clients to engage and continue their partnership.

- Market Attractiveness: In a landscape prioritizing fiscal prudence, Crayon's value proposition of optimizing technology investments is a significant competitive advantage.

Strategic Partnerships and Vendor Relationships

Crayon Group's strategic partnerships with key technology vendors like Microsoft, AWS, and Google Cloud form a cornerstone of its operational strength. These relationships are vital, granting Crayon access to cutting-edge software and cloud services, which are essential for delivering its core value proposition. For instance, Crayon's status as a Microsoft Cloud Solution Provider (CSP) allows it to offer Microsoft's extensive suite of cloud products, a significant portion of its revenue. In 2023, Microsoft Azure revenue alone saw substantial growth, underscoring the importance of such vendor alliances.

These strong vendor relationships translate into tangible benefits for Crayon, including preferential pricing and collaborative go-to-market strategies. This access enables Crayon to provide its clients with competitive pricing and to leverage vendor marketing and sales resources for co-selling initiatives. The company's ability to tap into these resources directly impacts its market reach and sales effectiveness, helping it secure new business and expand existing client relationships.

The direct result of these collaborations is Crayon's capacity to offer advanced, integrated solutions that meet evolving market demands. By staying at the forefront of technological advancements through its vendor ties, Crayon maintains a significant competitive advantage. This allows the company to act as a trusted advisor, guiding clients through complex cloud transformations and software licensing, which is particularly relevant in the rapidly changing landscape of digital services throughout 2024 and into 2025.

- Microsoft Partnership: Crayon's deep integration with Microsoft's cloud offerings, including Azure and Microsoft 365, is a primary revenue driver.

- AWS and Google Cloud Alliances: Collaborations with Amazon Web Services and Google Cloud Platform diversify Crayon's portfolio and broaden its market appeal.

- Preferential Terms: Vendor partnerships often result in favorable pricing and support structures, enhancing Crayon's cost-efficiency and service delivery.

- Co-selling Opportunities: Joint sales and marketing efforts with vendors amplify Crayon's market presence and accelerate customer acquisition.

Crayon Group's expertise in software and cloud asset management is a key strength, allowing them to help businesses optimize their IT spending and gain control over complex technology environments. This specialization is highly valued, especially as companies face increasing cloud costs, with many reporting overspending in 2024 due to a lack of visibility and management.

Their comprehensive service portfolio, including cloud migration, data analytics, AI, and cybersecurity, positions them as a complete IT solutions provider. This broad offering fosters strong client relationships and loyalty, evidenced by a reported 90% customer retention rate in Q4 2024 for clients using multiple services.

Crayon's commitment to demonstrating clear return on investment (ROI) is a significant advantage, particularly in the current economic climate where fiscal prudence is paramount. Their ability to quantify the financial benefits of their services solidifies client partnerships and attracts new business.

Strategic partnerships with major technology vendors like Microsoft, AWS, and Google Cloud are foundational to Crayon's success. These alliances grant access to cutting-edge technologies and preferential terms, enabling them to offer competitive pricing and advanced solutions. For instance, Crayon's role as a Microsoft Cloud Solution Provider is a substantial revenue contributor, with Microsoft Azure revenue showing significant growth in 2023.

| Strength Area | Description | Impact | Supporting Data (2023-2024) |

|---|---|---|---|

| Specialization | Software and cloud asset management expertise | Optimized IT spending, enhanced control | Cloud cost overruns reported by many companies in 2024 |

| Service Portfolio | Broad IT solutions (cloud migration, AI, cybersecurity) | Holistic client support, increased loyalty | 90% customer retention rate (Q4 2024) for multi-service clients |

| Value Proposition | Focus on cost optimization and ROI | Strong client relationships, competitive advantage | High demand for efficiency and expenditure management |

| Vendor Partnerships | Microsoft, AWS, Google Cloud alliances | Access to technology, preferential terms, revenue growth | Microsoft Azure revenue growth in 2023; CSP status a key driver |

What is included in the product

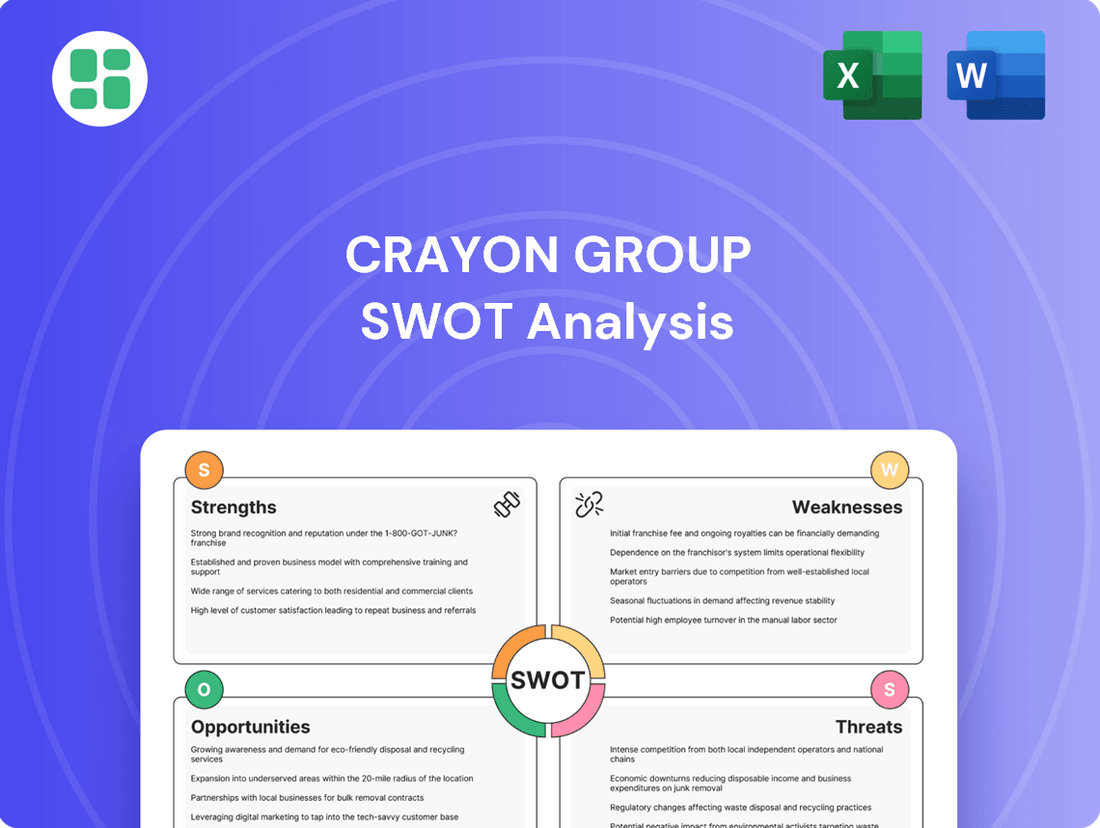

Analyzes Crayon Group’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap by identifying and addressing key competitive advantages and potential threats.

Weaknesses

Crayon's reliance on a concentrated vendor ecosystem, particularly for software licensing and cloud services, presents a notable weakness. A significant portion of their revenue is tied to the success and strategic decisions of major players like Microsoft and AWS. For instance, as of their Q1 2024 report, a substantial majority of their cloud resale revenue was generated through Microsoft's Azure platform, highlighting this concentration.

Should these key vendors alter their partnership terms, pricing structures, or introduce direct-to-customer competing solutions, Crayon's service portfolio and profitability could face considerable disruption. This dependency inherently limits Crayon's agility in responding to market shifts if a primary vendor pivots its strategy, potentially impacting their ability to offer competitive and diverse solutions.

Crayon Group operates within the fiercely competitive IT services sector, a landscape populated by established global giants, agile niche specialists, and increasingly capable in-house IT departments. This crowded marketplace exerts significant pressure on pricing strategies and profit margins, making it difficult to stand out purely on cost advantages.

For instance, the global IT services market was valued at approximately $1.3 trillion in 2023 and is projected to grow to over $2 trillion by 2028, indicating substantial market opportunity but also intense rivalry. Crayon must therefore prioritize continuous innovation in its service offerings and client engagement models to maintain its differentiation and secure market share against a multitude of competitors.

Crayon Group, as a knowledge-based service firm, faces significant hurdles in attracting and keeping top-tier IT talent, especially those with expertise in AI, cybersecurity, and cloud architecture. The intense global competition for these specialized skills drives up recruitment costs and complicates retention efforts.

The ongoing scarcity of these in-demand professionals means Crayon must invest heavily in competitive compensation and benefits packages to secure and retain them. For instance, reports from 2024 indicate a persistent deficit in cybersecurity professionals, with some estimates suggesting millions of unfilled roles globally, directly impacting companies like Crayon.

High employee turnover is a tangible risk, potentially disrupting project continuity and negatively affecting the quality of services delivered to clients. This can erode client trust and damage Crayon's reputation in a market where consistent, high-quality delivery is paramount.

Scalability of Consulting Services

Crayon Group's consulting and asset management services, while highly valuable, face inherent scalability challenges. Unlike software-as-a-service models that can often scale with minimal marginal cost, Crayon's growth is directly tied to increasing its pool of specialized consultants and asset managers. This reliance on human capital can create a bottleneck, limiting the pace of expansion. For instance, if Crayon aims for the kind of exponential growth seen in pure tech product companies, it must proportionally increase its headcount of highly skilled professionals, which is a more complex and time-consuming process.

This constraint on scalability can be a significant weakness. Crayon's business model requires significant investment in training and retaining top talent. As of their latest reports, the company has been actively hiring, but the demand for specialized cloud economics expertise means that rapid scaling necessitates a continuous and substantial recruitment effort. This contrasts with software companies where a single code update can serve millions of new users with little additional personnel cost.

The implications of this weakness are clear:

- Personnel Dependency: Growth is directly proportional to the number of skilled employees, unlike software products.

- Recruitment Challenges: Finding and onboarding specialized talent in cloud economics is a continuous hurdle.

- Slower Exponential Growth: The service-based nature limits the potential for hyper-growth experienced by pure product companies.

Perception as a Cost Reducer vs. Innovator

Crayon Group's expertise in optimizing software licensing and cloud spend, while a significant strength, can inadvertently position them as primarily a cost-reduction specialist. This perception might overshadow their capabilities in driving innovation and digital transformation. For instance, while Crayon reported a 15% increase in cloud revenue in their Q1 2024 results, the market may still associate them more with efficiency gains than with pioneering new technological solutions.

This focus on cost optimization could potentially hinder Crayon's ability to attract and secure high-value projects centered on cutting-edge technology and digital disruption. Companies seeking transformative solutions might overlook Crayon if they believe the firm's primary focus is on reducing existing expenses. Effectively communicating their broader innovation capabilities, beyond cost savings, is therefore critical for their strategic positioning in the evolving tech landscape.

- Perception Gap: Crayon's strength in cost management might lead to a perception of being a cost reducer rather than an innovation driver.

- Impact on Projects: This perception could limit opportunities for securing transformative, innovation-focused digital projects.

- Strategic Imperative: Balancing the narrative to highlight innovation alongside cost optimization is crucial for Crayon's future growth and market appeal.

Crayon's reliance on a concentrated vendor ecosystem, particularly for software licensing and cloud services, presents a notable weakness. A significant portion of their revenue is tied to the success and strategic decisions of major players like Microsoft and AWS. For instance, as of their Q1 2024 report, a substantial majority of their cloud resale revenue was generated through Microsoft's Azure platform, highlighting this concentration.

Should these key vendors alter their partnership terms, pricing structures, or introduce direct-to-customer competing solutions, Crayon's service portfolio and profitability could face considerable disruption. This dependency inherently limits Crayon's agility in responding to market shifts if a primary vendor pivots its strategy, potentially impacting their ability to offer competitive and diverse solutions.

Crayon Group operates within the fiercely competitive IT services sector, a landscape populated by established global giants, agile niche specialists, and increasingly capable in-house IT departments. This crowded marketplace exerts significant pressure on pricing strategies and profit margins, making it difficult to stand out purely on cost advantages. For instance, the global IT services market was valued at approximately $1.3 trillion in 2023 and is projected to grow to over $2 trillion by 2028, indicating substantial market opportunity but also intense rivalry.

Crayon Group, as a knowledge-based service firm, faces significant hurdles in attracting and keeping top-tier IT talent, especially those with expertise in AI, cybersecurity, and cloud architecture. The intense global competition for these specialized skills drives up recruitment costs and complicates retention efforts. The ongoing scarcity of these in-demand professionals means Crayon must invest heavily in competitive compensation and benefits packages to secure and retain them. For instance, reports from 2024 indicate a persistent deficit in cybersecurity professionals, with some estimates suggesting millions of unfilled roles globally, directly impacting companies like Crayon.

Crayon Group's consulting and asset management services, while highly valuable, face inherent scalability challenges. Unlike software-as-a-service models that can often scale with minimal marginal cost, Crayon's growth is directly tied to increasing its pool of specialized consultants and asset managers. This reliance on human capital can create a bottleneck, limiting the pace of expansion. For instance, if Crayon aims for the kind of exponential growth seen in pure tech product companies, it must proportionally increase its headcount of highly skilled professionals, which is a more complex and time-consuming process.

Crayon Group's expertise in optimizing software licensing and cloud spend, while a significant strength, can inadvertently position them as primarily a cost-reduction specialist. This perception might overshadow their capabilities in driving innovation and digital transformation. For instance, while Crayon reported a 15% increase in cloud revenue in their Q1 2024 results, the market may still associate them more with efficiency gains than with pioneering new technological solutions.

Same Document Delivered

Crayon Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the Crayon Group's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is designed to inform strategic decision-making.

Opportunities

The relentless expansion of cloud computing and the widespread adoption of Software-as-a-Service (SaaS) applications represent a significant growth avenue for Crayon. Many businesses are finding it challenging to effectively manage and optimize their cloud expenditures and SaaS subscriptions, highlighting a clear market demand for Crayon's specialized offerings.

This increasing reliance on cloud infrastructure and SaaS solutions is a powerful tailwind. For instance, Gartner projected that worldwide end-user spending on public cloud services would reach $679 billion in 2024, a substantial increase from $632 billion in 2023, underscoring the vast and growing market Crayon operates within.

Crayon Group is well-positioned to capitalize on the burgeoning demand for Artificial Intelligence, advanced data analytics, and robust cybersecurity solutions. These rapidly evolving fields represent significant growth opportunities, allowing Crayon to expand its service portfolio and deepen its expertise.

By integrating these technologies, Crayon can offer more comprehensive and integrated solutions to its clients, thereby capturing new market segments. For instance, the global AI market was projected to reach over $500 billion in 2024, showcasing the immense potential for companies like Crayon to leverage this trend.

This strategic expansion ensures Crayon remains at the forefront of technological innovation, enabling it to attract new clients and strengthen relationships with existing ones by addressing their evolving digital transformation needs.

Crayon Group's global footprint, while extensive, still offers significant opportunities in emerging economies and under-penetrated markets. Regions like Southeast Asia and parts of Africa are experiencing rapid digital transformation and a growing demand for cloud solutions, presenting fertile ground for Crayon's expertise in IT optimization and software asset management. For instance, the global cloud computing market is projected to reach $1.3 trillion by 2025, with emerging markets expected to be key growth drivers.

Increased Focus on Digital Transformation Initiatives

The global push for digital transformation is a significant tailwind for Crayon Group. Businesses worldwide are actively modernizing their IT systems, migrating to cloud environments, and harnessing data analytics for better decision-making. This ongoing shift creates substantial demand for Crayon's core competencies in cloud solutions and software asset management.

Crayon's expertise in cloud migration and optimization directly addresses the critical needs of companies navigating this complex landscape. As enterprises increasingly rely on cloud-native applications and data-driven strategies, Crayon is well-positioned to be a key enabler of their digital ambitions.

- Digital Transformation Spending: Global IT spending on digital transformation initiatives was projected to reach over $2.3 trillion in 2023, with continued strong growth expected through 2025, according to IDC.

- Cloud Adoption: Gartner predicted that worldwide end-user spending on public cloud services would grow by 20.4% to reach $678.8 billion in 2024, up from $562 billion in 2023.

- Crayon's Role: Crayon's services are essential for businesses seeking to leverage these digital trends efficiently and cost-effectively.

Strategic Acquisitions and Partnerships

Crayon Group can significantly expand its capabilities and market presence by strategically acquiring smaller companies that possess specialized expertise or cutting-edge technology. This approach allows for the rapid integration of new services and the penetration of niche markets. For instance, acquiring a firm with advanced AI-driven analytics could enhance Crayon's cloud optimization offerings.

Forming strategic alliances with key technology providers and businesses offering complementary services presents another avenue for growth. These partnerships can unlock new sales channels and enrich Crayon's value proposition by offering more comprehensive solutions to clients. A collaboration with a leading cybersecurity firm, for example, could bolster Crayon's security consulting services.

Mergers and acquisitions (M&A), alongside strategic partnerships, are powerful catalysts for accelerating growth and solidifying competitive advantages. Crayon's proactive approach in this area, demonstrated by its continued investment in acquisitions, positions it well to capitalize on market opportunities. In 2023, Crayon completed several acquisitions, including that of CloudFirst, a Dutch cloud consultancy firm, which expanded its footprint in the Benelux region.

- Acquire niche technology firms to enhance specialized service offerings.

- Forge partnerships with complementary service providers to broaden market reach.

- Leverage M&A and partnerships to accelerate growth and gain competitive edge.

- Integrate new capabilities through strategic acquisitions, such as AI analytics or cybersecurity expertise.

Crayon Group is poised to capitalize on the increasing demand for AI, advanced analytics, and cybersecurity solutions, expanding its service portfolio and deepening its expertise. The global AI market was projected to exceed $500 billion in 2024, presenting significant growth potential. By integrating these technologies, Crayon can offer more comprehensive solutions, capturing new market segments and addressing evolving client needs.

Threats

Economic slowdowns, like the potential for a mild recession in some regions during 2024-2025, can significantly curb IT budgets. This means clients might delay or cancel projects, directly impacting Crayon Group's revenue streams.

While Crayon's cost optimization services could see a boost as companies seek efficiency, this might not offset the loss from deferred strategic IT investments. For instance, a 5% contraction in global IT spending, as some analysts projected for 2024, could translate to substantial revenue headwinds.

The IT sector is characterized by relentless innovation, with emerging technologies like AI and cloud computing constantly reshaping the landscape. Crayon Group, to maintain its competitive edge, must dedicate significant resources to R&D and upskilling its workforce to integrate these advancements. For instance, the global cloud computing market was valued at approximately $800 billion in 2023 and is projected to grow substantially, highlighting the imperative for Crayon to stay ahead of this curve.

Failure to adapt to disruptive technological shifts, such as the increasing adoption of serverless architectures or advanced data analytics platforms, could lead to a decline in Crayon's service relevance and market share. Companies that don't pivot quickly risk becoming outdated, as seen with legacy software providers struggling against agile, cloud-native solutions. This necessitates a proactive approach to identifying and capitalizing on new technological paradigms.

Hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are expanding their own consulting and optimization services. This directly challenges Crayon’s core business. For instance, Microsoft’s FY23 revenue reached $211.9 billion, with significant growth in its cloud segment, indicating their increasing capacity to offer integrated services.

While Crayon thrives on its partnerships with these very hyperscalers, their growing direct service offerings pose a threat. As hyperscalers enhance their capabilities, some clients may find it more efficient to engage directly, bypassing intermediaries like Crayon for certain cloud management and optimization needs.

This intensified competition creates a complex landscape where Crayon must continually differentiate its value proposition. The ability of hyperscalers to bundle services could put pressure on Crayon's margins and market share, especially for less complex client engagements.

Data Security Breaches and Compliance Risks

Crayon Group, as an IT consulting firm, faces considerable threats from data security breaches and compliance risks. A significant breach could not only lead to substantial financial penalties but also irreparably harm its reputation and client relationships. For instance, the average cost of a data breach in 2024 reached $4.73 million, highlighting the financial implications.

Failure to adhere to stringent data privacy regulations like GDPR or CCPA presents another critical threat. Non-compliance can result in hefty fines; GDPR violations can incur penalties up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates continuous investment in robust security infrastructure and compliance protocols.

- Reputational Damage: A single security incident can erode years of built trust with clients.

- Financial Penalties: Non-compliance with data privacy laws can lead to significant fines, impacting profitability.

- Client Attrition: Loss of client confidence due to security failures can result in a substantial loss of business.

Pricing Pressure and Commoditization of Services

As cloud and asset management services mature, there's a growing risk of commoditization. This means clients may increasingly view these offerings as interchangeable, focusing primarily on price. For Crayon Group, this translates into significant pricing pressure, potentially impacting their ability to maintain current service margins.

The trend towards standardization in cloud solutions means that many foundational services are becoming readily available from multiple providers. This makes it easier for customers to shop around based on cost alone, potentially eroding Crayon's competitive advantage if differentiation isn't clearly articulated. For instance, reports in late 2024 indicated that the average cost of cloud infrastructure management services saw a slight decline year-over-year as more providers entered the market.

- Increased Price Sensitivity: Clients may prioritize the lowest cost over nuanced service offerings, especially for basic cloud management.

- Margin Squeeze: Intense competition on price could directly reduce Crayon's profitability per service.

- Need for Differentiation: Crayon must emphasize unique value-added services, such as specialized optimization or advanced security, to counter commoditization.

Intensified competition from hyperscalers like Microsoft Azure and AWS, who are increasingly offering their own consulting services, poses a direct threat. As these giants expand their capabilities, clients may opt for direct engagement, potentially bypassing intermediaries like Crayon for certain cloud management needs.

The IT sector's rapid evolution demands constant adaptation to new technologies such as AI and serverless architectures. Failure to invest heavily in R&D and workforce upskilling could render Crayon's offerings less relevant, impacting market share against more agile competitors.

Data security breaches and non-compliance with evolving privacy regulations like GDPR represent significant financial and reputational risks. The average cost of a data breach in 2024 was approximately $4.73 million, underscoring the potential financial fallout.

The increasing commoditization of cloud and asset management services leads to greater price sensitivity among clients. This trend could squeeze Crayon's margins, as customers may prioritize cost over specialized value-added services.

| Threat Category | Specific Risk | Impact Example (2024-2025 Projection) | Mitigation Focus |

| Competitive Landscape | Hyperscaler Direct Services | Microsoft FY23 Cloud Revenue: $211.9B+ | Emphasize unique value-add, specialized expertise |

| Technological Disruption | Rapid Tech Evolution (AI, Serverless) | Global Cloud Market: $800B (2023) | Continuous R&D, workforce upskilling |

| Security & Compliance | Data Breaches, Privacy Violations | Avg. Data Breach Cost (2024): $4.73M | Robust security infrastructure, compliance protocols |

| Market Dynamics | Commoditization & Price Pressure | Slight decline in cloud infra. management service costs (late 2024) | Differentiate through specialized optimization, advanced security |

SWOT Analysis Data Sources

This SWOT analysis draws from Crayon Group's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a robust and actionable strategic overview.