Crayon Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crayon Group Bundle

The Crayon Group operates in a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for strategic success.

This brief overview only scratches the surface of the forces impacting Crayon Group. Unlock the full Porter's Five Forces Analysis to explore Crayon Group’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with actionable insights.

Suppliers Bargaining Power

Crayon Group's reliance on a small number of hyperscale cloud providers like Microsoft, AWS, and Google Cloud significantly amplifies supplier bargaining power. These giants control the essential infrastructure Crayon needs, giving them considerable leverage. For instance, in 2024, the global cloud infrastructure market was dominated by these three, with AWS holding approximately 31% market share, Azure around 24%, and Google Cloud at 11%, illustrating their concentrated market control.

The software and cloud platforms from key suppliers are absolutely critical for Crayon's core operations, forming the backbone of their cloud migration, data analytics, and AI service offerings. Without these foundational technologies, Crayon simply couldn't deliver the specialized solutions their clients expect.

This deep reliance on a limited number of technology providers significantly amplifies the bargaining power of these suppliers. For instance, major cloud providers like Microsoft Azure and Amazon Web Services (AWS) hold substantial sway, as Crayon's ability to serve its customers is directly tied to its access and pricing for these essential platforms.

Crayon Group's reliance on key technology vendors like Microsoft and AWS means that switching primary partners involves significant hurdles. Consider the substantial investment in retraining Crayon's technical staff on new platforms and the complex process of re-architecting existing solutions to be compatible with alternative vendors. This operational disruption, coupled with the potential for client data migration complexities, creates high switching costs, thereby enhancing the bargaining power of these suppliers.

Supplier Differentiation and Forward Integration

Major software and cloud providers are increasingly differentiating their offerings through continuous innovation and the development of unique features. For instance, Microsoft's Azure and Amazon Web Services (AWS) consistently roll out new services and capabilities, making their platforms more comprehensive and potentially reducing the need for third-party optimization specialists. This ongoing innovation allows them to command higher prices and exert greater influence over their partners and customers.

The potential for these suppliers to engage in forward integration, such as offering their own consulting and managed services, further strengthens their bargaining power. By directly providing services that were once the domain of intermediaries like Crayon, these vendors can capture more of the value chain. For example, many cloud providers now offer advanced analytics, security, and migration services directly, which can bypass the need for external expertise.

Crayon's core value proposition often centers on navigating and optimizing these complex, evolving supplier ecosystems. However, as suppliers enhance their direct service capabilities, the leverage shifts. In 2024, the trend of hyperscalers expanding their professional services arms continued, aiming to solidify customer relationships and capture a larger share of the IT spend. This strategic move by suppliers directly impacts the intermediary's ability to negotiate terms and maintain margins.

- Supplier Innovation: Major cloud providers like Microsoft and AWS are constantly introducing new, specialized services, increasing their platform's inherent value and reducing reliance on intermediaries.

- Forward Integration Threat: The expansion of direct consulting and managed services by software vendors poses a significant risk, potentially disintermediating partners.

- Pricing Leverage: Enhanced product differentiation and direct service offerings empower suppliers to dictate terms and pricing more effectively in 2024.

- Evolving Value Proposition: Intermediaries like Crayon must continually adapt their offerings to remain essential in an environment where suppliers are increasingly capable of serving end-customers directly.

Threat of Direct Sales by Suppliers

Hyperscale cloud providers like Microsoft, Amazon Web Services (AWS), and Google Cloud are expanding their own consulting and professional services divisions. This presents a direct competitive threat to Crayon Group, as these giants can bypass channel partners and engage enterprise clients directly. For instance, AWS's Professional Services organization offers a wide range of cloud adoption and modernization services, directly competing with Crayon's core offerings.

This ability for suppliers to directly serve end customers significantly enhances their bargaining power. It means they can capture the full value chain, from infrastructure provision to implementation and ongoing management, potentially squeezing out intermediaries like Crayon. In 2024, the continued growth of cloud services, with the global cloud computing market projected to reach over $1 trillion, underscores the scale of this potential direct competition.

- Direct Competition: Hyperscalers are building robust internal consulting arms, directly challenging Crayon's market position.

- Supplier Power: The ability of cloud providers to go direct to enterprise clients grants them considerable leverage.

- Market Growth: The expanding cloud market amplifies the potential impact of direct sales by suppliers.

Crayon Group's significant reliance on a few major cloud providers, such as Microsoft Azure and AWS, gives these suppliers substantial bargaining power. Their control over critical infrastructure and software platforms means Crayon's operations are deeply intertwined with their offerings. In 2024, these hyperscalers continued to dominate the cloud market, with AWS and Microsoft Azure holding a combined market share exceeding 55% of the global cloud infrastructure services market, highlighting their concentrated influence.

The high switching costs associated with migrating between cloud platforms, including retraining staff and re-architecting solutions, further solidify supplier leverage. Moreover, these providers are increasingly innovating and expanding their own direct professional services, posing a competitive threat by potentially disintermediating Crayon and capturing more of the value chain. This trend is evident in the continued growth of the global cloud market, which was projected to exceed $1 trillion in 2024, indicating the vast revenue potential suppliers can tap into directly.

| Supplier | 2024 Market Share (Cloud Infrastructure) | Key Services for Crayon | Potential for Forward Integration |

|---|---|---|---|

| Amazon Web Services (AWS) | ~31% | Cloud Computing, Data Analytics, AI | High (Professional Services) |

| Microsoft Azure | ~24% | Cloud Computing, Software Platforms, AI | High (Consulting Services) |

| Google Cloud | ~11% | Cloud Computing, Data Analytics | Moderate (Professional Services) |

What is included in the product

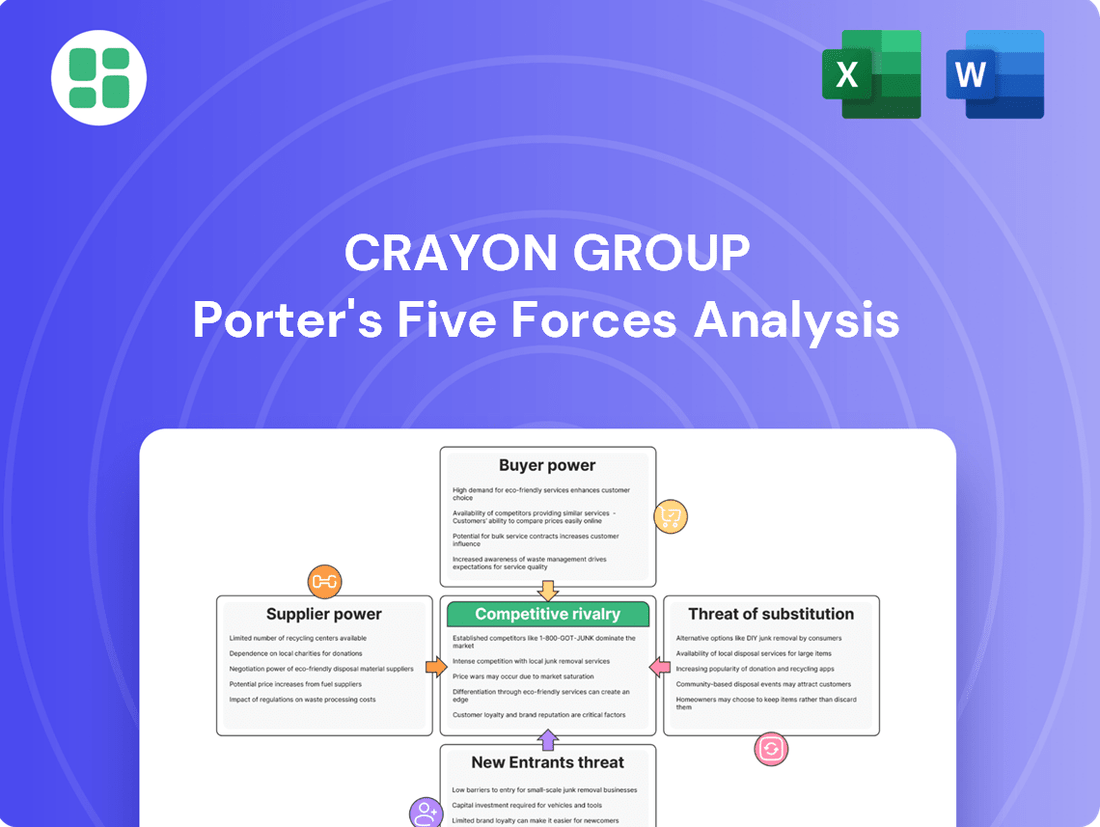

Analyzes the competitive landscape for Crayon Group by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its market.

Instantly identify and address competitive threats with a clear, actionable framework for understanding industry dynamics.

Customers Bargaining Power

Customers, especially large businesses and government bodies, are increasingly prioritizing cloud cost optimization, often referred to as FinOps. They want to see a clear return on their IT investments, which naturally makes them more sensitive to pricing and more inclined to negotiate service terms. This focus on value and efficiency significantly boosts their bargaining power.

Deloitte's projections indicate that companies adopting FinOps practices are likely to achieve substantial cost savings, with some estimates pointing to significant percentages in 2025. This growing emphasis on measurable value and cost reduction empowers customers to demand better pricing and more favorable contract conditions from service providers like Crayon Group.

The IT consulting and cloud services sector is incredibly crowded, with many firms offering comparable services in areas like software and cloud asset management, cloud migration, and cybersecurity. This means customers aren't tied to a single provider and can easily switch if they're not satisfied or find a better deal elsewhere.

Customers can choose from a vast selection of providers, ranging from massive global consultancies like Accenture and Deloitte, which reported revenues of $62.1 billion and $64.9 billion respectively in fiscal year 2023, to niche, specialized local players. This wide availability of options directly amplifies the bargaining power of customers.

Customer switching costs for IT consulting services, particularly those involving cloud integration, are a significant factor in the bargaining power of customers. While transitioning to a new IT consulting partner can incur expenses related to knowledge transfer, data migration, and re-integrating systems, the growing modularity of cloud services and the increasing standardization across major cloud platforms are actively lowering these barriers. For instance, companies leveraging platforms like AWS or Azure often find that core functionalities can be replicated with relative ease by competing providers, diminishing the lock-in effect.

In 2024, the IT consulting market saw continued emphasis on flexible, cloud-native solutions. Many clients are adopting multi-cloud strategies, which inherently reduces dependence on a single provider and makes switching easier. If a client experiences dissatisfaction with service quality or pricing from their current IT consulting firm, the ability to migrate less deeply embedded services to a competitor, especially for standardized tasks like cloud infrastructure management or application development, becomes a more viable option.

Customer Size and Concentration

Crayon Group's customer base includes both public sector entities and large enterprise clients, many of whom possess substantial purchasing power. This concentration of significant buyers allows them to negotiate for customized solutions and more favorable pricing, thereby increasing their bargaining leverage.

While Crayon also caters to a broader market of smaller clients, the influence of these larger customers is a key factor in the bargaining power of customers. For instance, in 2024, enterprise agreements represented a significant portion of Crayon's revenue, underscoring the importance of these client relationships.

- Customer Concentration: A notable percentage of Crayon's revenue in 2024 was derived from its largest clients, granting these customers considerable sway in negotiations.

- Public Sector Influence: Public sector contracts often involve large volumes and stringent requirements, giving these clients significant bargaining power.

- Demand for Customization: Large clients frequently require tailored solutions, which can increase the costs for Crayon and empower customers to demand better terms.

- Switching Costs: For large enterprises deeply integrated with Crayon's services, the cost of switching to a competitor can be high, paradoxically giving Crayon some leverage, but the initial negotiation power remains with the customer.

Threat of In-House IT Capabilities

Many businesses are building their own IT teams, capable of handling some cloud and software management. This reduces their reliance on external providers like Crayon, especially for basic tasks. For instance, a 2024 survey found that 65% of mid-sized enterprises reported having a dedicated cloud management team, up from 40% in 2022.

The extent to which customers can bring IT functions in-house often hinges on the complexity and specialization required. If a company has the internal expertise for advanced areas like AI-driven cloud optimization or complex software licensing, their bargaining power increases significantly.

- Internal IT Capabilities: Organizations increasingly invest in in-house IT to manage routine cloud operations and software asset management.

- Specialization Gap: The need for specialized skills, such as in AI or complex multi-cloud environments, often limits the extent to which IT functions can be fully internalized.

- Scalability Needs: The ability of internal IT to scale resources up or down rapidly remains a key factor in outsourcing decisions for many firms.

- Cost-Benefit Analysis: Companies continuously evaluate the cost-effectiveness of maintaining specialized IT functions internally versus outsourcing to specialized providers.

Customers, especially large enterprises and public sector organizations, hold significant bargaining power due to their focus on cloud cost optimization and demand for demonstrable ROI. This is amplified by the highly competitive IT consulting market, where numerous providers offer similar services, making client switching relatively easy. As of 2024, many clients are adopting multi-cloud strategies, further reducing their reliance on any single vendor and strengthening their negotiation position.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Customer Focus on Cost Optimization (FinOps) | Increases bargaining power | Growing adoption of FinOps practices expected to yield substantial cost savings for businesses in 2025. |

| Market Competition | Increases bargaining power | IT consulting sector characterized by many firms offering comparable cloud and software asset management services. |

| Customer Switching Costs | Generally decreases bargaining power (but decreasing overall) | Increasing modularity of cloud services and standardization across platforms are lowering barriers to switching. |

| Customer Concentration (Large Clients) | Increases bargaining power | A significant portion of Crayon's 2024 revenue derived from key clients, granting them substantial negotiation leverage. |

| Internal IT Capabilities | Increases bargaining power | 65% of mid-sized enterprises in a 2024 survey reported having dedicated cloud management teams, reducing reliance on external providers. |

Preview Before You Purchase

Crayon Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the Crayon Group, offering a detailed examination of competitive forces within their industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and no hidden surprises. You can confidently acquire this professionally formatted analysis, ready for immediate application in your strategic planning.

Rivalry Among Competitors

Crayon Group operates in a market characterized by a high number of competitors, making competitive rivalry a significant force. This fragmentation means Crayon faces pressure not only from global IT giants like Accenture and IBM Global Services but also from numerous specialized firms. For instance, companies like Snow Software and Bechtle, alongside a vast array of cloud consulting specialists, all vie for market share.

The software asset management (SAM) market is experiencing significant expansion, with projections indicating a rise to $4.36 billion by 2025 and $8.93 billion by 2029. This rapid growth, largely propelled by cloud-based solutions, inherently intensifies competitive rivalry as more players are drawn to this lucrative sector.

Further underscoring the market's attractiveness, global spending on public cloud services is anticipated to surpass $720 billion in 2025. This substantial investment in cloud infrastructure not only fuels demand for SAM but also encourages existing competitors to innovate and expand their offerings, thereby heightening the competitive landscape.

The IT services and cloud consulting landscape is buzzing with merger and acquisition (M&A) activity. Companies are actively consolidating to bolster their service portfolios, capture greater market share, and streamline their operations. This trend is reshaping the competitive dynamics of the industry, as larger, more integrated players emerge.

A prime example of this consolidation is SoftwareOne's acquisition of Crayon Group, a deal that was finalized in July 2025, following its announcement in December 2024. This strategic move has created a formidable competitor with a significantly expanded global reach and a more comprehensive suite of offerings, directly intensifying rivalry within the sector.

Differentiation and Specialization

Competitors in the cloud solutions market actively differentiate themselves by cultivating specialized expertise. This often involves focusing on niche areas such as FinOps for cost management, deep proficiency in specific hyperscaler platforms like AWS, Azure, or Google Cloud, robust cybersecurity offerings, and cutting-edge artificial intelligence capabilities.

Crayon Group, for instance, highlights its customer-centric methodology, a commitment to continuous innovation, and its proven ability to optimize complex IT estates for its clients. This focus on delivering unique value propositions is absolutely critical for standing out and succeeding in such a dynamic and crowded competitive environment.

- Specialized Expertise: Competitors focus on areas like FinOps, AWS, Azure, Google Cloud, cybersecurity, and AI.

- Crayon's Approach: Emphasizes customer-centricity, innovation, and IT estate optimization.

- Value Proposition: Offering distinct and valuable solutions is key to competitive advantage.

Service Quality and Reputation

Crayon Group's competitive rivalry is significantly influenced by service quality and reputation. A strong track record of delivering excellent service, building trust, and achieving tangible results is crucial for keeping existing clients and attracting new ones. For instance, Crayon highlights its numerous Microsoft Partner awards and success stories to differentiate itself in a highly competitive IT services landscape.

Companies in this sector often rely on their established reputation as a key differentiator. This includes showcasing client testimonials, case studies demonstrating successful outcomes, and industry recognition. Maintaining consistently high service quality is therefore not just a goal, but a necessity for sustained competitive advantage.

- Reputation as a Differentiator: Crayon leverages its history of successful client engagements and partner recognitions, such as Microsoft Partner awards, to build trust and attract new business.

- Client Retention Drivers: Proven results and a reputation for high-quality service are key factors in retaining existing clients, reducing churn, and securing recurring revenue streams.

- Market Standing: In a crowded market, a strong service quality reputation allows companies like Crayon to stand out and command a premium, influencing client acquisition rates.

- Sustained Advantage: Continuous delivery of superior service is essential for maintaining a competitive edge and preventing rivals from eroding market share through better client experiences.

The competitive rivalry within the IT services and cloud consulting sector, where Crayon Group operates, is exceptionally intense. This is driven by a market characterized by numerous players, ranging from global IT behemoths to specialized niche providers, all vying for market share in a rapidly expanding sector. The increasing global investment in cloud services, projected to exceed $720 billion in 2025, further fuels this competition by attracting more participants and encouraging existing ones to innovate aggressively.

| Competitor Type | Examples | Key Differentiators |

|---|---|---|

| Global IT Giants | Accenture, IBM Global Services | Broad service portfolios, extensive global reach |

| Specialized SAM/Cloud Firms | Snow Software, Bechtle | Niche expertise (e.g., FinOps), specific hyperscaler focus |

| Emerging Cloud Specialists | Various cloud consulting firms | Agility, focus on specific cloud technologies (AWS, Azure, GCP) |

SSubstitutes Threaten

The rise of robust internal IT departments presents a significant threat of substitution for Crayon Group. Organizations increasingly opt to build or enhance their in-house capabilities for managing software, cloud infrastructure, data analytics, and cybersecurity. This internal development bypasses the need for external specialized services.

For instance, a 2024 survey indicated that 65% of large enterprises are investing heavily in upskilling their IT teams to handle complex cloud migrations and data management independently. This trend directly substitutes the core offerings of companies like Crayon, particularly for businesses with substantial existing IT talent and financial resources.

The increasing availability of off-the-shelf software and automated tools presents a significant threat of substitutes for Crayon Group’s services. These solutions, designed for software asset management (SAM) and cloud cost optimization, offer organizations a more accessible and potentially less expensive way to gain visibility and basic control over their IT spending.

For instance, the SAM market alone was projected to reach $4.1 billion in 2023, with many vendors offering automated discovery and reporting features. This accessibility means companies might opt for these tools to handle simpler SAM needs, thereby reducing their reliance on specialized consulting firms like Crayon for foundational management tasks.

The rapid advancement of AI and automation technologies presents a significant threat of substitutes for traditional IT consulting services. For instance, AI-powered platforms can now automate complex data analysis and asset tracking, tasks that previously required dedicated human consultants. This trend is expected to accelerate, with AI streamlining consulting processes by handling repetitive tasks more efficiently.

Direct Engagement with Hyperscale Providers

Clients increasingly have the option to bypass intermediaries like Crayon and engage directly with hyperscale cloud providers such as Microsoft Azure, Amazon Web Services (AWS), and Google Cloud. This direct engagement leverages the providers' extensive professional services arms for cloud strategy and optimization.

While Crayon often collaborates with these major players, the ability for large enterprises to go direct presents a significant substitute threat. For instance, in 2024, AWS's professional services revenue continued to grow, indicating a strong in-house capability that clients can tap into.

- Direct Engagement: Large enterprises can directly access cloud providers' professional services for cloud strategy and optimization.

- Hyperscaler Capabilities: Major providers like Microsoft, AWS, and Google Cloud offer robust in-house expertise.

- Cost and Control: Direct engagement can sometimes offer perceived cost savings and greater control for very large clients.

- Market Trend: The growing scale of hyperscalers' professional services divisions in 2024 signifies an increasing capacity to serve clients directly.

General Business Consulting Firms

Traditional management consulting firms, particularly those bolstering their digital and technology capabilities, present a significant threat of substitution for Crayon Group. These established players can offer broader strategic advice that touches upon technology, potentially encroaching on Crayon's specialized IT asset management domain. For instance, in 2024, major consulting firms continued to invest heavily in their technology practices, with many reporting double-digit growth in these areas, reflecting a strong market demand for integrated IT and business strategy services.

While these general consulting firms may not possess Crayon's granular expertise in specific IT asset management niches, their ability to provide holistic, enterprise-wide solutions can be attractive to clients seeking comprehensive digital transformation. This broad-stroke approach can serve as a substitute for Crayon's more focused offerings, especially when clients prioritize overarching business strategy over specialized IT asset optimization. Reports from 2024 indicated that the global management consulting market reached over $300 billion, with technology consulting being a significant growth driver within that figure.

- Broader Strategic Scope: General consulting firms offer integrated business and technology strategy, potentially overshadowing specialized IT asset management.

- Digital Transformation Focus: Many large consultancies are heavily investing in and promoting their digital transformation services, which can encompass IT asset considerations.

- Market Size and Investment: The significant size of the management consulting market and its strong growth in technology services indicate a competitive landscape for specialized IT firms.

- Client Preference for Integration: Some clients may prefer a single provider for all their strategic and technological needs, creating a substitute for Crayon's niche services.

The threat of substitutes for Crayon Group is significant, stemming from both internal capabilities and readily available external solutions. Organizations are increasingly building in-house IT expertise, particularly in cloud management and data analytics, which directly replaces the need for external consultants. For instance, a 2024 survey revealed that 65% of large enterprises are enhancing their IT teams for independent cloud migration and data management.

Furthermore, the proliferation of off-the-shelf software and AI-driven automation tools offers a simpler and often more cost-effective alternative for tasks like software asset management and cloud cost optimization. The SAM market, projected to reach $4.1 billion in 2023, exemplifies this with many vendors providing automated discovery features that can handle basic SAM needs.

Clients also have the option to engage directly with hyperscale cloud providers like AWS, Azure, and Google Cloud, whose professional services arms are expanding. AWS's continued revenue growth in professional services in 2024 highlights this trend, allowing large enterprises to bypass intermediaries for cloud strategy and optimization.

Finally, traditional management consulting firms, by bolstering their technology practices, offer a broader strategic approach that can substitute Crayon's specialized IT asset management services. The global management consulting market, exceeding $300 billion in 2024 with significant growth in technology services, underscores the competitive pressure from these integrated solution providers.

Entrants Threaten

Launching a comprehensive IT consulting and services firm akin to Crayon, encompassing areas like cloud, data, AI, and cybersecurity, demands significant capital. This includes investments in cutting-edge technology, robust infrastructure, and establishing a worldwide operational footprint. For instance, a firm aiming for global reach in 2024 would likely need to allocate hundreds of millions of dollars for acquisitions, talent development, and market expansion.

The need for specialized expertise and talent acquisition presents a significant barrier to entry for new companies looking to compete with Crayon Group. Crayon's core services, including cloud asset management, FinOps, and advanced AI consulting, require a workforce possessing highly niche skills, industry-recognized certifications, and substantial practical experience. For instance, in 2024, the global demand for cloud architects and FinOps specialists continued to outpace supply, with reported salary increases of up to 15% for these roles.

New entrants would face considerable challenges in attracting and retaining this caliber of talent, as established players like Crayon have already built strong employer brands and competitive compensation packages. The cost and time investment in training and upskilling employees to meet these specialized demands are substantial, making it difficult for newcomers to quickly build a capable team. This talent gap acts as a powerful deterrent, protecting Crayon's market position by raising the bar for potential competitors.

Crayon Group has cultivated a robust brand reputation and nurtured enduring client relationships, serving a wide array of organizations from large enterprises to public sector bodies in 46 nations. This deep-seated trust and market credibility present a significant hurdle for any new competitor attempting to establish a foothold.

Regulatory and Compliance Hurdles

The IT services and cloud sector, where Crayon Group operates, presents substantial regulatory and compliance barriers for potential new entrants. Navigating diverse international data privacy laws, such as the EU's General Data Protection Regulation (GDPR), and other sector-specific compliance mandates requires significant upfront investment in legal expertise and robust infrastructure. For instance, in 2024, companies expanding into new markets often face escalating compliance costs, with some estimates suggesting that meeting GDPR requirements alone can cost small to medium-sized businesses tens of thousands of euros annually.

These complexities create a high barrier to entry.

- Significant Legal Investment: New players must allocate substantial capital towards establishing legal and compliance departments, ensuring adherence to varying international regulations.

- Data Privacy Compliance: Laws like GDPR mandate stringent data handling and privacy protocols, demanding specialized knowledge and technological solutions.

- Ongoing Compliance Costs: Beyond initial setup, continuous monitoring and adaptation to evolving regulatory landscapes incur ongoing operational expenses, deterring less capitalized entrants.

- Reputational Risk: Non-compliance can lead to severe penalties and damage a company's reputation, making it a critical consideration for any new entrant.

Partnership Ecosystems with Hyperscalers

Crayon Group's formidable threat of new entrants is significantly mitigated by its deeply entrenched partnership ecosystems with hyperscale cloud providers such as Microsoft, AWS, and Google Cloud. These alliances are not merely transactional; they represent strategic integrations essential for Crayon's service delivery capabilities and broad market access. For instance, Microsoft's Cloud Solution Provider (CSP) program, a key pillar for Crayon, offers preferential terms and direct access to Azure services, a complex relationship that takes years to cultivate.

New competitors face a daunting barrier in replicating these established, often exclusive, relationships. Building trust and achieving preferred partner status with these tech giants requires substantial investment, proven expertise, and a track record of successful collaboration, which new entrants lack. This makes it exceptionally difficult for them to quickly establish the foundational elements necessary to compete effectively in the cloud solutions market.

- Deeply Integrated Partnerships: Crayon benefits from established, strategic alliances with hyperscalers like Microsoft, AWS, and Google Cloud, crucial for service delivery and market penetration.

- High Barrier to Entry: New entrants would struggle to rapidly forge similar strategic alliances and achieve preferred partner status, a process that typically takes years of proven performance.

- Exclusive Program Access: Crayon's participation in programs like Microsoft's Cloud Solution Provider (CSP) offers preferential terms and direct service access that are difficult for newcomers to replicate.

The threat of new entrants for Crayon Group is considerably low due to the immense capital required to establish a comparable IT consulting and services firm. This includes substantial investments in technology, infrastructure, and global operations, with new global players in 2024 needing hundreds of millions for expansion and talent. Furthermore, the need for highly specialized talent in areas like cloud management and AI presents a significant hurdle, as demand for these skills in 2024 continued to outstrip supply, driving up salary costs by up to 15% for key roles.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Crayon Group is built upon a robust foundation of data, including Crayon's annual reports, investor presentations, and public financial filings. We also leverage industry-specific market research reports and data from reputable financial information providers.