Crayon Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crayon Group Bundle

Navigate the complex external forces impacting Crayon Group with our comprehensive PESTLE analysis. Uncover how political shifts, economic volatility, and technological advancements are shaping the company's landscape. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Government initiatives to digitize public services, particularly in areas like healthcare and defense, are accelerating cloud adoption. For instance, the US government's Federal Cloud Computing Strategy, updated in 2024, continues to push agencies towards cloud-first approaches, aiming to improve efficiency and security. This trend creates substantial opportunities for companies like Crayon Group, which specialize in managing and migrating complex IT assets to the cloud.

Many of these government cloud adoption policies come with stringent compliance requirements, such as FedRAMP in the United States or the NIS Directive in Europe. Crayon Group's expertise in cloud asset management and migration allows them to assist clients in navigating these complex regulatory landscapes, ensuring adherence to specific frameworks and security protocols. This specialized knowledge is a key differentiator in securing lucrative public sector contracts.

The sheer scale of public sector IT spending offers a pathway to stable, large-scale contracts. In 2024, global government spending on cloud services was projected to reach over $150 billion, with significant portions allocated to modernization efforts. Crayon Group is well-positioned to capture a share of this spending by providing end-to-end solutions for cloud migration, optimization, and management, thereby securing predictable revenue streams.

Geopolitical shifts, such as the ongoing trade tensions between major economic blocs and regional conflicts, directly affect Crayon Group's ability to operate seamlessly across borders. For instance, the evolving regulatory landscape around technology and data privacy in regions like the EU and Asia necessitates constant adaptation in service delivery models. The company's strategic focus on maintaining a robust presence in over 90 countries, as of early 2024, serves as a critical buffer against localized geopolitical instability, allowing it to leverage diverse markets and mitigate risks stemming from any single region's challenges.

Governments worldwide are significantly increasing their focus on national cybersecurity resilience and the protection of critical infrastructure. This heightened attention directly boosts the demand for specialized cybersecurity services, such as those offered by Crayon Group. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) has been actively promoting its Shields Up initiative, urging organizations to bolster their defenses against potential cyber threats, especially in light of ongoing geopolitical tensions.

Stricter regulations concerning data breaches and cybersecurity standards are being enacted globally. In the EU, the General Data Protection Regulation (GDPR) continues to set a high bar, with ongoing enforcement actions. Similarly, in 2024, many countries are updating their national cybersecurity laws to mandate more robust data protection measures, compelling businesses to invest heavily in advanced security solutions. This regulatory environment makes Crayon's expertise in compliance and advanced cybersecurity highly valuable.

Intellectual Property Protection Laws

The strength and enforcement of intellectual property (IP) laws globally directly impact Crayon Group's core business of software licensing and asset management. Jurisdictions with robust IP protection foster an environment where software vendors can confidently license their products, which is crucial for Crayon's operations. For instance, in 2024, countries with strong IP regimes, like those in the EU and North America, typically see lower rates of software piracy, estimated to be around 20-25% compared to higher rates in other regions. This directly supports Crayon's mission to ensure legitimate software usage and optimize client investments.

Weak enforcement of IP rights presents a significant challenge. Piracy can undermine vendor relationships and create an uneven playing field, potentially impacting Crayon's ability to secure favorable licensing agreements. Reports from 2024 indicate that global software piracy rates remained a concern, costing industries billions annually. Crayon's focus on compliance and asset management helps clients navigate these risks, ensuring they meet vendor requirements and avoid legal repercussions.

- Global software piracy rates in 2024 hovered around 23%, representing a significant financial loss for software vendors.

- Countries with strong IP protection laws, such as the United States and Germany, typically exhibit lower software piracy rates, benefiting companies like Crayon.

- Crayon's services are designed to mitigate risks associated with IP infringement, ensuring clients maintain compliant software estates.

- Changes in IP legislation, such as new enforcement measures or intellectual property treaties, can alter the operational landscape for software asset management firms.

Government Incentives for Digital Transformation

Governments worldwide are actively promoting digital transformation through various financial incentives. For instance, the United States' CHIPS and Science Act of 2022, while focused on semiconductor manufacturing, signals a broader trend of government investment in technological advancement that can indirectly benefit digital transformation efforts. Similarly, many European nations offer grants and tax credits for cloud adoption and AI integration, making these technologies more accessible for businesses. These programs directly reduce the financial burden for Crayon's prospective clients, thereby boosting the demand for their specialized consulting and implementation services. Crayon is well-positioned to guide clients in navigating and maximizing the benefits of these government-backed initiatives.

These incentives can significantly impact the market for digital transformation services:

- Stimulated Demand: Lowering cost barriers encourages more businesses to invest in cloud, AI, and other digital solutions.

- Competitive Advantage: Companies utilizing these incentives can adopt advanced technologies faster, gaining a competitive edge.

- Crayon's Role: Crayon can act as a key enabler, helping clients identify and apply for relevant government programs.

- Market Growth: The availability of such support is projected to drive substantial growth in the digital transformation market, with global spending expected to reach trillions by 2025.

Government regulations and policies play a crucial role in shaping the digital landscape Crayon Group operates within. Initiatives promoting cloud adoption, like the US Federal Cloud Computing Strategy, directly fuel demand for Crayon's services. Conversely, stringent compliance requirements, such as FedRAMP, necessitate specialized expertise that Crayon provides, turning regulatory hurdles into business opportunities.

Geopolitical shifts and national security concerns also significantly influence Crayon's operations. Heightened focus on cybersecurity resilience, exemplified by initiatives like CISA's Shields Up, creates demand for advanced security solutions. Crayon's global presence across over 90 countries in early 2024 helps mitigate risks associated with localized geopolitical instability.

Intellectual property (IP) laws are fundamental to Crayon's software licensing and asset management business. Strong IP protection, prevalent in regions like the EU and North America, fosters a healthier market environment, with global software piracy rates around 23% in 2024. Crayon's focus on compliance helps clients navigate these IP landscapes effectively.

What is included in the product

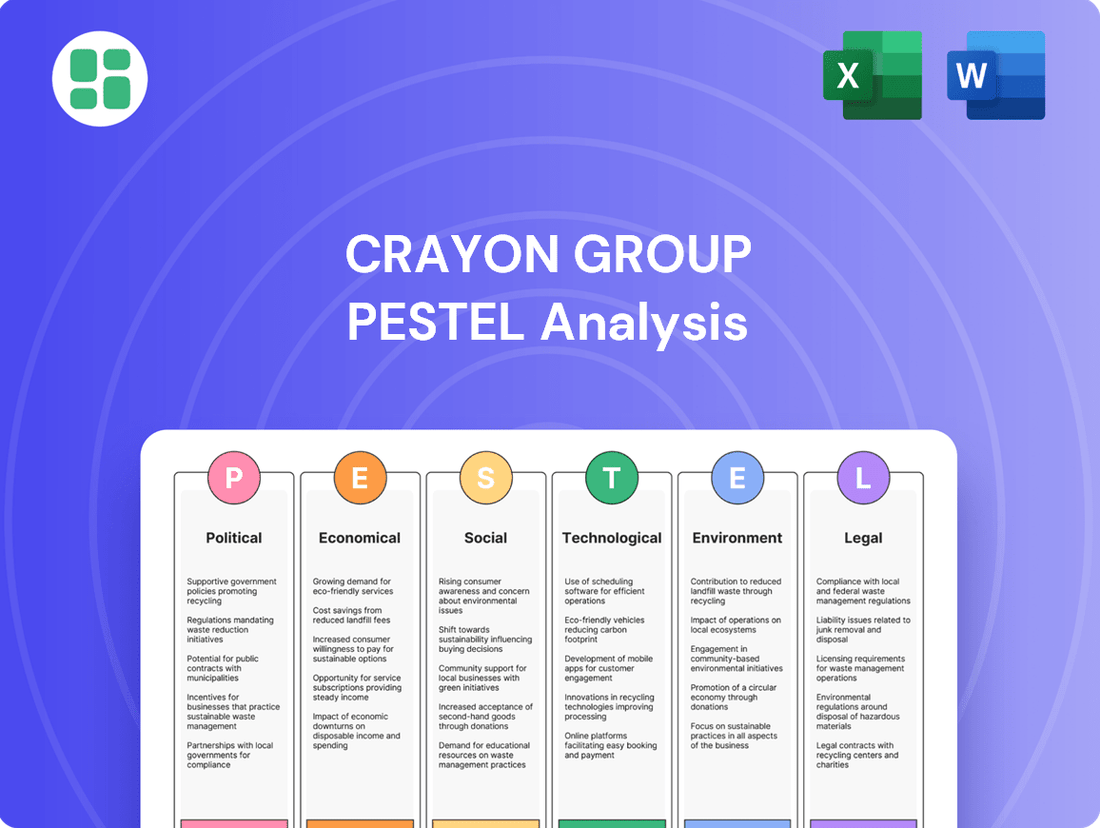

This PESTLE analysis delves into the external macro-environmental forces impacting the Crayon Group, examining Political, Economic, Social, Technological, Environmental, and Legal factors. It provides a comprehensive overview of how these elements shape the company's operational landscape and strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for the Crayon Group.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the external landscape impacting Crayon Group's strategy.

Economic factors

The global economy's trajectory is a critical factor for Crayon Group, as robust growth typically fuels increased IT investment. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for 2024, a figure that, if realized, could translate into higher client spending on cloud services and digital transformation initiatives that Crayon facilitates.

However, recessionary risks loom large, potentially impacting Crayon's revenue streams. Signs of slowing growth in major economies, such as a projected 1.5% GDP growth for the Eurozone in 2024, could prompt businesses to defer or reduce IT expenditures. This economic uncertainty necessitates Crayon's strategic focus on adaptable service models and cost-optimization solutions for its clients.

Rising inflation, with global consumer price index (CPI) averaging around 5.9% in 2024 according to IMF projections, directly impacts Crayon Group's operating expenses. This surge in costs, from employee compensation to essential software licenses and hardware procurement, can squeeze profit margins if not meticulously managed through strategic pricing adjustments and cost optimization initiatives.

Furthermore, the ongoing trend of elevated interest rates, with many central banks maintaining benchmark rates in the 4-5% range through early 2025, presents a challenge for Crayon's clients. Increased borrowing costs can deter businesses from undertaking significant IT investments, such as large-scale cloud migrations or the adoption of new enterprise software, potentially dampening demand for Crayon's services.

To navigate these economic headwinds, Crayon Group must proactively manage its pricing strategies to reflect increased operational costs while remaining competitive. Simultaneously, a focus on efficient cost management across its supply chain and internal operations is crucial to protect profitability in a fluctuating economic landscape.

Crayon Group, as a global entity, faces significant exposure to currency exchange rate volatility. Fluctuations between the currencies of its operating regions and its reporting currency, likely USD or EUR, directly impact the reported financial results. For instance, if the Norwegian Krone, Crayon's home currency, strengthens significantly against the US Dollar, the company's USD-denominated revenues would translate into fewer Krones, potentially affecting profitability.

In 2023, the Euro experienced notable fluctuations against the US Dollar, trading in a range that could have impacted companies with substantial European operations. Similarly, the Norwegian Krone's performance against major currencies is a key consideration for Crayon. For example, a significant appreciation of the Krone in 2024 could reduce the reported value of Crayon's earnings generated in less appreciating currencies.

To navigate this, Crayon Group likely employs sophisticated hedging strategies, such as forward contracts or options, to lock in exchange rates for anticipated transactions. Geographical diversification across various currency zones also serves as a natural hedge, reducing the overall impact of any single currency's adverse movement on the company's consolidated financial performance.

Client IT Budget Allocation Trends

Client IT budget allocation is increasingly favoring cloud services, data analytics, artificial intelligence, and cybersecurity, which directly benefits Crayon Group. Organizations are prioritizing operational efficiency and digital innovation, aligning their spending with Crayon's core competencies.

For instance, Gartner projected worldwide IT spending to reach $5.1 trillion in 2024, an increase of 6.8% from 2023, with cloud services and data analytics being significant growth drivers. This trend necessitates Crayon's continuous adaptation of its services to mirror these evolving client spending priorities.

- Cloud Services Dominance: IT budgets are heavily skewed towards cloud infrastructure and Software as a Service (SaaS) solutions.

- Data-Driven Investments: Significant allocations are directed towards data analytics and business intelligence platforms to extract actionable insights.

- AI and Automation Focus: Artificial intelligence and automation technologies are receiving substantial budget increases for efficiency gains.

- Cybersecurity Imperative: Cybersecurity remains a top priority, with budgets consistently rising to address evolving threats.

Competitive Landscape and Pricing Pressure

The IT consulting and services sector is a crowded arena, featuring a multitude of global giants and nimble local competitors, all vying for market share. This intense rivalry naturally translates into significant pricing pressure, a reality that directly impacts the profitability and margins of companies like Crayon Group.

To navigate this challenging environment and sustain its competitive advantage, Crayon Group must focus on distinct strategies. Differentiation is key, achieved through cultivating specialized expertise in niche areas, offering superior value-added services that go beyond standard offerings, and nurturing robust, long-term relationships with its clientele. These elements are crucial for standing out in a saturated market.

- Market Saturation: The global IT services market, valued at approximately $1.3 trillion in 2024, is characterized by a high number of players, leading to increased competition.

- Pricing Sensitivity: Reports from 2024 indicate that clients in the IT consulting space are increasingly price-sensitive, with average project margins potentially compressed by 5-10% due to competitive bidding.

- Differentiation Strategies: Crayon Group's success hinges on its ability to offer unique value propositions, such as advanced cloud migration expertise or specialized cybersecurity solutions, which command premium pricing.

- Client Retention: Maintaining strong client relationships is vital, as the cost of acquiring new clients can be significantly higher than retaining existing ones, especially in a competitive landscape.

Global economic growth significantly influences Crayon Group's business, with projections for 2024 indicating a 3.2% global growth rate according to the IMF. However, potential recessionary pressures, such as the Eurozone's anticipated 1.5% GDP growth in 2024, could lead clients to scale back IT investments. Inflation, with global CPI averaging 5.9% in 2024, increases Crayon's operational costs, necessitating careful pricing and cost management.

Elevated interest rates, with central banks maintaining rates around 4-5% into early 2025, can also deter client IT spending. Crayon Group must navigate currency volatility, a factor highlighted by the Euro's fluctuations against the US Dollar in 2023, by employing hedging strategies and geographical diversification. Client IT budgets are increasingly prioritizing cloud services, data analytics, and AI, areas where Crayon Group excels, as evidenced by a projected 6.8% increase in worldwide IT spending to $5.1 trillion in 2024.

The IT services market, valued at approximately $1.3 trillion in 2024, is highly competitive, with clients showing increased price sensitivity. Crayon Group's success depends on differentiation through specialized expertise and strong client relationships to maintain margins in this saturated environment.

| Economic Factor | 2024 Projection/Status | Impact on Crayon Group | Mitigation Strategy |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Higher IT spending potential | Focus on value-added services |

| Eurozone GDP Growth | 1.5% | Potential reduction in IT investment | Offer cost-optimization solutions |

| Global Inflation (CPI) | 5.9% (IMF) | Increased operating costs | Strategic pricing, cost management |

| Interest Rates | 4-5% range (early 2025) | Deters client IT investment | Highlight ROI of IT projects |

| Worldwide IT Spending | $5.1 trillion (6.8% increase) | Increased demand for cloud, data, AI | Align services with client priorities |

What You See Is What You Get

Crayon Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Crayon Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. Gain actionable insights into the strategic landscape surrounding the Crayon Group.

Sociological factors

Societal acceptance of digital transformation is accelerating, making it a necessity for businesses across all sectors. This growing demand directly fuels the need for Crayon Group's expertise in cloud migration, AI, and data analytics. For instance, a 2024 report indicated that over 70% of global enterprises were actively engaged in digital transformation initiatives, highlighting a substantial market expansion.

As companies increasingly understand the critical importance of updating their IT infrastructure and operational processes, the market for services that facilitate this modernization is booming. This societal and business imperative to digitize is a core growth engine for Crayon Group, as businesses seek partners to navigate this complex landscape effectively.

The IT workforce faces a persistent skills gap, especially in high-demand areas like cloud computing, data analytics, and cybersecurity. This shortage directly benefits Crayon Group, as businesses struggling to find in-house talent turn to specialized managed services and consulting firms to bridge these critical gaps. For instance, a 2024 report indicated that over 70% of IT leaders surveyed experienced difficulties in hiring qualified cybersecurity professionals, underscoring the market need for external expertise.

Companies are increasingly outsourcing IT functions to external partners like Crayon to overcome the scarcity of skilled personnel. This trend is driven by the rapid evolution of technology, making it challenging for organizations to keep their internal teams up-to-date with the latest competencies. Crayon's strategic focus on developing and certifying its own workforce ensures it can meet this growing demand for specialized IT skills, providing a competitive edge in the market.

The shift towards remote and hybrid work, significantly boosted since 2020, has dramatically increased the need for cloud services and robust IT infrastructure. This trend is a major driver for companies like Crayon Group, whose cloud asset management and cybersecurity solutions are essential for businesses navigating these flexible work arrangements.

By mid-2024, surveys indicated that a significant percentage of the global workforce continued to operate in hybrid or fully remote models, underscoring the sustained demand for digital collaboration tools and secure remote access. Crayon Group's ability to optimize cloud spending and enhance security posture directly addresses the operational challenges and opportunities presented by this evolving work landscape.

Data Privacy Concerns and Public Trust

Growing public awareness around data privacy significantly impacts how companies like Crayon Group operate. As individuals become more vigilant about their personal information, businesses are increasingly prioritizing robust data handling practices. This heightened concern directly fuels the demand for Crayon's expertise in cybersecurity and data governance, as clients aim to secure customer trust and adhere to stringent regulations. For instance, a 2024 survey indicated that over 70% of consumers are more likely to do business with companies that demonstrate strong data privacy measures.

The societal expectation for secure data management creates a direct market opportunity for Crayon. Businesses are actively seeking solutions to safeguard sensitive information, not only to comply with laws but also to build and maintain customer loyalty. This trend is underscored by the increasing number of data breaches reported globally, with the average cost of a data breach reaching $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

- Increased Demand for Data Security: Societal emphasis on data privacy drives client needs for Crayon's cybersecurity solutions.

- Reputation as a Key Differentiator: A strong track record in data security is crucial for Crayon to build and maintain public trust.

- Regulatory Compliance: Evolving data protection laws, such as GDPR and CCPA, necessitate sophisticated data governance services, which Crayon provides.

- Consumer Trust: Businesses are investing more in data protection to foster consumer confidence, directly benefiting Crayon's service offerings.

Demand for Sustainable and Ethical Technology

Societal expectations are increasingly pushing businesses towards sustainable and ethical technology practices. Consumers and clients alike are demanding that companies minimize their environmental impact and ensure responsible use of technology, particularly in areas like artificial intelligence. This shift directly influences how businesses select their IT partners.

Clients are actively seeking IT providers, such as Crayon Group, who can demonstrate a commitment to green IT and ethical AI. This includes helping clients optimize their technology resource utilization, thereby reducing their overall carbon footprint. For instance, a growing number of enterprises are setting ambitious sustainability targets; a 2024 report indicated that over 60% of large corporations have publicly stated net-zero commitments, which often translate to scrutinizing their IT supply chains.

Crayon Group can capitalize on this trend by positioning itself as a frontrunner in sustainable IT solutions and responsible AI. This involves offering services that facilitate energy efficiency in cloud computing and data management, alongside robust frameworks for ethical AI development and deployment. The market for green IT services is projected to grow significantly, with some analysts forecasting a compound annual growth rate of over 20% between 2024 and 2028.

- Growing Client Demand: Over 60% of large corporations had net-zero commitments by 2024, driving demand for sustainable IT.

- Focus on Carbon Footprint: Clients are prioritizing IT partners who help reduce their technology's environmental impact.

- Ethical AI Imperative: The responsible deployment of AI is a key concern for businesses, influencing technology partner selection.

- Market Opportunity: The green IT services market is experiencing rapid growth, with significant expansion expected in the coming years.

The increasing societal acceptance of digital transformation, coupled with a persistent IT skills gap, creates a fertile ground for Crayon Group's specialized services. Businesses are actively seeking external expertise to navigate complex cloud migrations, AI implementation, and cybersecurity challenges. This demand is amplified by the sustained shift to hybrid work models, which necessitates robust cloud infrastructure and secure remote access solutions. For instance, a 2024 survey revealed that over 70% of IT leaders struggled to hire qualified cybersecurity professionals, directly benefiting firms like Crayon that offer managed services.

Public concern over data privacy is a significant driver, pushing companies to invest heavily in data protection and governance. Consumers are increasingly choosing businesses that demonstrate strong data privacy measures, with over 70% of consumers in a 2024 study indicating this preference. This societal expectation translates into a direct market opportunity for Crayon's cybersecurity and data governance offerings, especially as the average cost of a data breach reached $4.45 million in 2024.

Furthermore, a growing societal emphasis on sustainability and ethical technology practices is influencing business decisions. Over 60% of large corporations had net-zero commitments by 2024, prompting them to scrutinize their IT supply chains and seek partners who can help reduce their environmental impact. Crayon Group is well-positioned to capitalize on this by offering green IT solutions and frameworks for responsible AI deployment, tapping into a market segment projected for over 20% annual growth between 2024 and 2028.

| Sociological Factor | Impact on Crayon Group | Supporting Data (2024/2025) |

|---|---|---|

| Digital Transformation Adoption | Increased demand for cloud, AI, and data analytics services. | >70% of global enterprises engaged in digital transformation initiatives. |

| IT Skills Gap | Growth in demand for outsourced IT and consulting services. | >70% of IT leaders reported difficulty hiring cybersecurity professionals. |

| Remote/Hybrid Work Trends | Elevated need for cloud services and secure IT infrastructure. | Significant percentage of global workforce operating in hybrid/remote models. |

| Data Privacy Concerns | Increased demand for cybersecurity and data governance solutions. | >70% of consumers favor companies with strong data privacy; average data breach cost $4.45 million. |

| Sustainability & Ethical Tech | Demand for green IT and responsible AI services. | >60% of large corporations have net-zero commitments; green IT market growth projected >20% annually (2024-2028). |

Technological factors

The relentless evolution of cloud computing, encompassing new services, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) models, along with the rise of hybrid and multi-cloud strategies, profoundly shapes Crayon Group's operations. Staying ahead of these changes is crucial for Crayon to guide clients effectively in selecting the best cloud strategies, managing costs, and planning migrations.

This dynamic technological environment constantly generates opportunities for Crayon to introduce innovative service offerings, capitalizing on the increasing demand for cloud expertise. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, highlighting the significant growth potential for companies like Crayon that facilitate cloud adoption and management.

The rapid advancement of Artificial Intelligence (AI) and Machine Learning (ML) presents a significant growth avenue for Crayon Group. These technologies are transforming industries by enabling sophisticated data analytics and intelligent automation, areas where Crayon can offer substantial client value.

Crayon's role involves guiding clients in harnessing AI for enhanced business insights, streamlined operations, and fostering innovation. This necessitates deep expertise in developing AI strategies, preparing data effectively, and successfully deploying AI models, positioning AI as a critical driver for Crayon's future expansion.

Cyber threats are becoming more sophisticated, demanding constant upgrades to defense mechanisms. Crayon Group's cybersecurity offerings must adapt quickly to shield clients from emerging vulnerabilities, ransomware attacks, and persistent threats.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the critical need for robust protection. Crayon's ability to innovate in areas like AI-driven threat detection and zero-trust architecture is paramount for maintaining client confidence and its market position.

Big Data Analytics and Business Intelligence

The sheer volume of data being generated globally fuels the demand for Crayon Group's expertise in data analytics and business intelligence. Businesses are increasingly reliant on understanding this data to make informed decisions. For instance, in 2024, the global big data market was projected to reach over $229 billion, highlighting the critical need for companies to leverage this information effectively.

Advancements in technologies for data collection, storage, processing, and visualization are continuously enhancing business intelligence capabilities. Crayon Group thrives by helping clients navigate these evolving tools, transforming raw data into strategic assets. Their proficiency spans a wide array of data platforms, enabling sophisticated analysis and actionable insights.

- Growing Data Volumes: Global data creation is expected to reach 295 zettabytes by 2025, a significant increase from previous years.

- Demand for Insights: Businesses are investing heavily in analytics to gain a competitive edge.

- Technological Evolution: Cloud computing and AI are key enablers for advanced big data analytics.

- Crayon's Role: The company provides the necessary expertise to harness these technologies for client success.

Software Licensing Models and Optimization Tools

The landscape of software licensing is constantly shifting, moving beyond traditional perpetual licenses to embrace subscription-based and consumption-based models. This evolution directly shapes the demand for Crayon Group's core expertise in Software Asset Management (SAM). For instance, the increasing adoption of cloud services and SaaS platforms means clients need sophisticated tools to track usage and manage entitlements effectively, a key area where Crayon excels.

Crayon Group capitalizes on these trends by offering advanced SAM tools and methodologies. These solutions are designed to help businesses navigate the complexities of modern software agreements, ensuring compliance and identifying opportunities for cost optimization. The ongoing shift towards flexible licensing models means that proactive management is no longer optional, but a necessity for controlling software spend.

The dynamic nature of software licensing, including the rise of usage-based pricing, creates a continuous need for Crayon's specialized services. As of late 2024, many organizations are still grappling with the financial implications of these new models, leading to a sustained demand for expert guidance. This presents a significant opportunity for Crayon to demonstrate its value in optimizing software investments.

- Complexity of Licensing: The transition to subscription and consumption-based models introduces intricate tracking and management requirements.

- Crayon's SAM Solutions: Advanced tools and methodologies are employed by Crayon to optimize software investments and ensure compliance.

- Cost Optimization: Effective SAM practices, facilitated by Crayon, are crucial for reducing software expenditure in evolving licensing environments.

- Ongoing Demand: New licensing trends, such as pay-as-you-go cloud services, fuel a persistent need for Crayon's specialized SAM expertise.

The rapid advancement of Artificial Intelligence (AI) and Machine Learning (ML) presents a significant growth avenue for Crayon Group, transforming industries through sophisticated data analytics and intelligent automation. By guiding clients in harnessing AI for enhanced business insights and streamlined operations, Crayon positions itself at the forefront of innovation, with the global AI market expected to grow substantially in the coming years.

Legal factors

Global and regional data protection laws, like GDPR in Europe and CCPA in California, place stringent demands on how businesses handle personal data. Crayon Group's services are designed to help clients meet these requirements, offering expertise and tools to navigate these intricate legal landscapes.

Ensuring client compliance with these evolving regulations is paramount. Crayon Group provides consulting and technical solutions to manage data securely and ethically, a critical offering given the increasing focus on data privacy worldwide.

The financial implications of non-compliance are substantial. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the importance of robust data protection strategies that Crayon Group helps facilitate.

Software vendors are increasingly proactive in conducting audits to verify licensing compliance, with non-compliance often leading to significant financial penalties and legal entanglements. For instance, a major software company's audit of a large enterprise in 2024 uncovered a shortfall of over $5 million in licensing for a single product suite.

Crayon Group's Software Asset Management (SAM) services are designed to mitigate these risks by ensuring clients maintain accurate licensing records, optimize software utilization to avoid overspending, and are prepared for vendor audits. This proactive approach helps clients avoid unexpected costs and legal challenges, solidifying Crayon's role as a vital partner in managing software assets.

Governments worldwide are strengthening cybersecurity regulations, with many mandating specific protective measures and imposing strict timelines for reporting data breaches. For instance, the European Union's General Data Protection Regulation (GDPR) requires organizations to report personal data breaches within 72 hours of becoming aware of them, and similar regulations are emerging globally. Crayon Group's expertise in cybersecurity and incident response directly assists clients in navigating these complex legal landscapes, thereby mitigating their risk of substantial fines and reputational damage. Staying abreast of these rapidly evolving legal mandates is crucial for Crayon to ensure its service portfolio remains relevant and effective in the 2024-2025 period.

Antitrust and Competition Laws in the Tech Sector

Antitrust and competition laws are increasingly shaping the tech landscape, directly impacting Crayon Group's operational environment. Regulators worldwide, including the European Commission and the U.S. Department of Justice, are intensifying scrutiny of dominant tech firms, which could affect Crayon's strategic alliances with key cloud providers and software vendors. For instance, ongoing investigations into potential monopolistic practices by major cloud players might lead to new regulations impacting reseller agreements or pricing models.

These evolving legal frameworks can significantly alter how Crayon operates. Changes in competition laws could necessitate adjustments to pricing strategies for software licenses or cloud services, potentially affecting market access for Crayon's offerings. Furthermore, shifts in these regulations might redefine the competitive dynamics within the broader IT services sector, requiring Crayon to remain agile in its business strategy to navigate these changes effectively.

- Increased regulatory focus: In 2024, the EU's Digital Markets Act (DMA) continues to impose obligations on large online platforms, potentially influencing how Crayon partners with these entities.

- Impact on partnerships: Stricter antitrust enforcement could lead to mandated changes in how major cloud providers structure their partner programs, affecting Crayon's access to certain services or preferential terms.

- Pricing and market access: New competition laws might introduce regulations on bundling or exclusive deals, which could alter Crayon's ability to offer competitive pricing and reach specific market segments.

- Strategic adaptation: Crayon must proactively monitor antitrust developments globally to adapt its partnership strategies and service offerings, ensuring continued compliance and competitive positioning.

International Trade Laws and Sanctions

International trade laws, including tariffs and economic sanctions, significantly impact Crayon Group's global operations. For instance, the ongoing trade tensions between major economies can lead to increased import duties, affecting the cost of goods and services Crayon may procure or deliver. Compliance with these evolving regulations is paramount, as violations can result in substantial fines and reputational damage.

Crayon Group must diligently navigate a complex web of international trade restrictions to ensure its business activities remain legitimate. This includes understanding and adhering to sanctions imposed by bodies like the United Nations, the European Union, and individual nations. Failure to comply could jeopardize client relationships and market access in affected regions.

- Tariffs: In 2024, global trade protectionism saw a rise, with some countries implementing new tariffs on technology components, potentially increasing operational costs for Crayon.

- Sanctions: As of mid-2025, numerous countries remain subject to various economic sanctions, requiring Crayon to conduct thorough due diligence on all international clients and partners.

- Compliance Costs: Companies like Crayon often allocate significant resources to legal and compliance departments to monitor and adapt to changing international trade laws.

- Market Access: Sanctions can directly restrict Crayon's ability to operate in or serve clients within targeted countries, impacting revenue streams.

The legal landscape for technology and data services is dynamic, with significant implications for Crayon Group. Data protection laws like GDPR and CCPA continue to evolve, demanding robust compliance measures. Software licensing audits are also a persistent risk, with non-compliance leading to substantial financial penalties, as highlighted by a 2024 audit revealing over $5 million in underlicensing for a single product suite.

Environmental factors

Growing environmental consciousness and a strong emphasis on corporate social responsibility are fueling a significant demand for sustainable IT solutions. Businesses are actively seeking ways to minimize their ecological footprint, particularly within their IT operations.

Clients are increasingly focused on reducing the energy consumption of their data centers and overall IT infrastructure. This push for efficiency is driven by both cost savings and a genuine commitment to environmental stewardship.

Crayon Group is well-positioned to capitalize on this trend by offering services that optimize cloud resource utilization for greater efficiency. Furthermore, promoting responsible e-waste management is a key area where Crayon can provide valuable solutions, aligning with client sustainability goals.

Data centers are massive energy consumers, directly impacting carbon footprints. In 2023, global data center energy consumption was estimated to be around 1.5% of total global electricity usage, contributing significantly to greenhouse gas emissions.

Crayon Group's cloud optimization services are crucial here. By guiding clients toward more energy-efficient public cloud providers or helping them fine-tune their current IT infrastructure, Crayon directly addresses this environmental challenge. This focus on efficiency helps businesses meet their sustainability targets.

The drive for greener IT is escalating, with many organizations actively seeking ways to reduce their environmental impact. Crayon's expertise in optimizing cloud usage offers a tangible solution for businesses aiming to lower their energy consumption and associated emissions, a trend expected to intensify through 2025.

Global e-waste regulations are tightening, with many countries implementing stricter rules for the disposal and recycling of electronic equipment. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive continues to evolve, pushing for higher collection and recycling rates. In 2023, the global e-waste generated reached an estimated 62 million metric tons, highlighting the scale of the challenge.

Crayon Group, as an IT solutions provider, is well-positioned to guide clients through these complex e-waste landscapes. By offering expertise in IT asset disposition (ITAD) and advising on sustainable hardware lifecycle management, Crayon helps businesses ensure compliance with these growing environmental mandates. This includes facilitating responsible recycling and promoting a circular economy model for IT assets, potentially reducing disposal costs for clients.

Climate Change Policies and Carbon Footprint Reduction

Government policies increasingly target climate change, influencing IT investment. For instance, many nations are implementing or strengthening carbon taxes and emission reduction targets, which directly impact the operational costs and strategic choices for IT infrastructure. Crayon Group can assist clients in navigating these evolving regulations by helping them understand and mitigate their IT carbon footprint.

Cloud migration and optimization are key strategies Crayon Group employs to reduce a client's IT carbon footprint. By moving to more energy-efficient cloud environments and optimizing resource utilization, Crayon helps clients achieve sustainability goals and comply with environmental mandates. This proactive approach positions Crayon as a valuable partner in corporate environmental strategies.

- Global carbon pricing initiatives are expanding, with over 70 countries and regions now having some form of carbon pricing as of early 2024.

- The IT sector's energy consumption is significant, with data centers alone accounting for an estimated 1-1.5% of global electricity usage.

- Crayon's cloud optimization services can lead to an average reduction of 20-30% in energy consumption for IT workloads.

- Many large enterprises are setting ambitious net-zero targets, with IT sustainability becoming a critical component of these commitments.

Corporate Social Responsibility (CSR) and ESG Reporting

The increasing demand for Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting significantly influences vendor selection. Clients are now scrutinizing their partners' sustainability practices, making it crucial for companies like Crayon Group to align with these evolving expectations.

Crayon Group's own environmental footprint and its capacity to support clients in meeting their ESG objectives represent a key competitive advantage. Demonstrating a genuine commitment to environmental responsibility is no longer optional but a fundamental requirement for sustained business success.

For instance, a growing number of institutional investors are prioritizing ESG factors. In 2024, it's estimated that over $3.7 trillion in assets under management in the US alone were allocated to strategies that consider ESG criteria, highlighting the financial imperative of sustainability.

- Client Scrutiny: Businesses are increasingly evaluating vendors based on their environmental and social impact, with sustainability metrics becoming a standard part of procurement processes.

- Competitive Edge: Crayon Group's ability to showcase strong ESG performance and provide solutions that help clients achieve their sustainability goals can differentiate it in the market.

- Market Trends: The global ESG investing market is projected to reach $50 trillion by 2025, underscoring the significant financial and reputational benefits of robust ESG reporting and practices.

- Risk Mitigation: Proactive environmental stewardship can help mitigate regulatory risks and enhance brand reputation, which are critical for long-term viability.

The increasing focus on environmental sustainability is a major driver for IT solutions. Businesses are actively seeking ways to reduce their carbon footprint, particularly in areas like data center energy consumption and e-waste management. Crayon Group's expertise in cloud optimization and responsible IT asset disposition directly addresses these critical environmental concerns, aligning with client sustainability objectives and growing regulatory pressures.

| Environmental Factor | Impact on IT Sector | Crayon Group's Role | Relevant Data (2023-2025) |

| Climate Change & Carbon Emissions | Increased demand for energy-efficient IT; scrutiny of data center energy usage. | Offers cloud optimization to reduce IT energy consumption and carbon footprint. | Global data center energy consumption estimated at 1.5% of global electricity in 2023. Carbon pricing initiatives in over 70 countries by early 2024. |

| E-Waste Management | Stricter regulations on electronic waste disposal and recycling. | Provides IT asset disposition (ITAD) and lifecycle management advice. | Global e-waste reached 62 million metric tons in 2023; EU's WEEE directive continues to evolve. |

| Corporate Social Responsibility (CSR) & ESG | Clients evaluate vendors on sustainability practices; investors favor ESG-compliant companies. | Helps clients meet ESG goals and demonstrates Crayon's own commitment. | US ESG-focused AUM estimated over $3.7 trillion in 2024; global ESG market projected to reach $50 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government reports, international organizations like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting your industry.