Coterra Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Navigate the complex external forces shaping Coterra Energy's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that influence its operations and strategic decisions. Gain a competitive advantage by leveraging these critical insights. Download the full PESTLE analysis now to unlock actionable intelligence and make informed strategic moves.

Political factors

The U.S. energy policy, especially with a new federal administration, is likely to focus on boosting fossil fuel output to achieve energy independence. This could translate into increased oil and gas extraction via measures such as opening federal lands for drilling and easing regulations on fracking.

This pro-fossil fuel stance, however, draws fire from environmental organizations worried about its impact on ecosystems and public health. For Coterra Energy, this policy shift could mean more operational flexibility and potential for growth in production, but also increased scrutiny and potential legal challenges.

Geopolitical stability is a critical driver for Coterra Energy, directly impacting natural gas and oil prices. Events like the ongoing conflict in Eastern Europe and broader supply chain vulnerabilities have historically led to significant market volatility. For instance, the price of West Texas Intermediate (WTI) crude oil saw substantial fluctuations throughout 2023 and early 2024, often reacting sharply to geopolitical tensions.

The United States is increasingly central to global gas supply security, with its liquefied natural gas (LNG) production capacity experiencing robust growth. Projections indicate continued expansion, bolstering trade relationships, particularly with Europe and Asia, as these regions seek to diversify their energy sources. This shift positions the US as a key energy partner, influencing global energy flows and pricing dynamics.

However, this growing US influence in the global gas market also heightens competition with established major exporters. The increased supply could lead to price competition, potentially creating a risk of price wars as nations vie for market share. This dynamic necessitates careful strategic planning for companies like Coterra Energy to navigate evolving market conditions and maintain competitive pricing.

Anticipated federal policy shifts in 2024-2025 could significantly impact Coterra Energy's operations by potentially easing drilling restrictions. This could unlock new permitting opportunities and land access, possibly extending into areas previously under stricter protection. For instance, a hypothetical 10% reduction in permitting delays could translate to millions in cost savings for major projects.

Streamlining approval processes for drilling and pipeline infrastructure is a key focus, aiming to reduce project costs and accelerate development timelines for companies like Coterra. Such efficiencies could bolster profitability, especially as the industry navigates fluctuating market demands and regulatory landscapes.

Conversely, initiatives like Project 2025, if enacted, might intensify the prioritization of oil and gas activities on public lands. This approach could potentially elevate the importance of resource extraction, though it may also raise concerns regarding the balance with existing natural resource protections.

International Trade Policies and Tariffs

Tariffs on imported goods, like steel and aluminum, directly increase the capital expenditure for energy projects. For instance, the Section 232 tariffs implemented in 2018 raised costs for construction materials, impacting the overall project economics for Coterra Energy. These increased costs can be amplified over the long lifespan of energy infrastructure, potentially influencing energy prices for consumers for many years.

The potential for future tariffs on critical minerals essential for both traditional and renewable energy technologies presents another layer of risk. For example, the reliance on certain minerals for battery production in clean energy could see price volatility if trade policies shift unfavorably. This could influence Coterra's strategic decisions regarding diversification into different energy sources.

- Increased Equipment Costs: Tariffs on materials like steel and aluminum directly inflate the cost of drilling rigs, pipelines, and other essential energy infrastructure.

- Long-Term Price Impact: The extended useful life of energy assets means that initial tariff-driven cost increases can affect consumer prices for decades.

- Clean Energy Technology Risk: Potential future tariffs on minerals vital for renewable energy components could impact the cost competitiveness of transitioning energy sources.

Climate Policy and Methane Regulations

The Biden administration's focus on climate policy, particularly through the Clean Air Act rules targeting methane emissions from oil and gas operations, directly impacts companies like Coterra Energy. These regulations aim to curb pollution, but they also introduce escalating fees for emissions exceeding established thresholds, thereby increasing operational expenses and necessitating capital outlays for emission control technologies.

While some compliance deadlines have seen extensions, the underlying pressure to reduce methane remains. For instance, the Environmental Protection Agency (EPA) has been developing new methane regulations for the oil and gas sector, with proposed rules released in late 2023 and early 2024. These regulations are expected to require significant investments in leak detection and repair (LDAR) programs and other abatement technologies.

The political landscape introduces an element of uncertainty. Shifts in administration can lead to changes in regulatory enforcement and priority, creating a dynamic environment for long-term strategic planning. This policy volatility necessitates adaptable compliance strategies and a keen awareness of evolving federal and state-level environmental mandates.

- Methane Emission Fees: Escalating fees on methane emissions above set limits directly affect operational costs for oil and gas producers.

- Investment in Abatement Technology: Compliance necessitates investment in new technologies for methane detection and reduction, impacting capital expenditure.

- Regulatory Uncertainty: Potential shifts in environmental policy between administrations create ongoing uncertainty regarding long-term compliance requirements and associated costs.

- EPA Rulemaking: The EPA's ongoing development of methane regulations for the oil and gas sector, with proposed rules in 2023-2024, indicates a continued focus on reducing these emissions.

Anticipated federal policy shifts for 2024-2025 could ease drilling restrictions, potentially unlocking new permitting opportunities on public lands. Streamlining approval processes for drilling and pipeline infrastructure is a key focus, aiming to reduce project costs and accelerate development timelines.

The United States' growing role in global gas supply security, with robust LNG production growth, bolsters trade relationships, particularly with Europe and Asia. This positions the US as a key energy partner, influencing global energy flows and pricing dynamics.

The Biden administration's focus on climate policy, particularly through Clean Air Act rules targeting methane emissions, directly impacts companies like Coterra Energy by introducing escalating fees for emissions exceeding thresholds.

What is included in the product

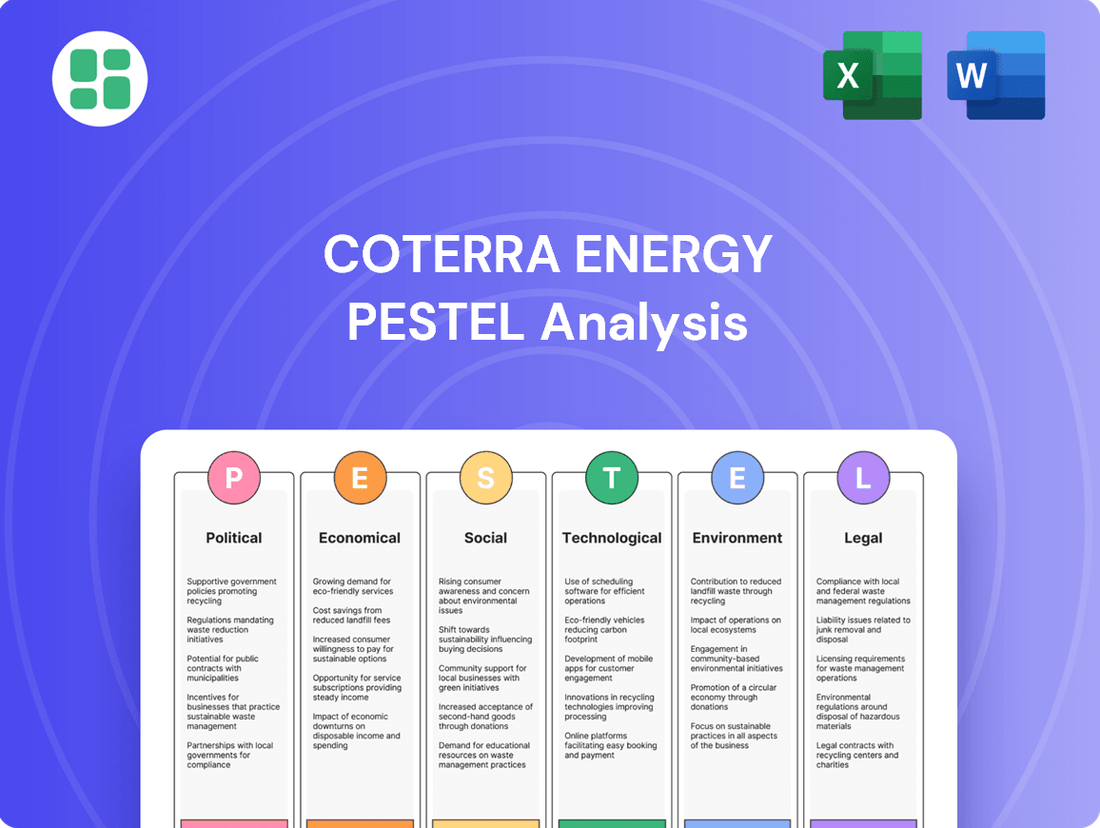

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Coterra Energy, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the energy sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making strategic discussions about Coterra Energy's external environment more efficient and impactful.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear, actionable overview of the factors influencing Coterra Energy's operations.

Economic factors

Coterra Energy's financial results are intrinsically linked to the ebb and flow of global oil and natural gas prices. These prices are subject to considerable swings, influenced by everything from international relations and the balance of supply and demand to broader economic trends.

In 2024, Brent crude prices have demonstrated a degree of steadiness. However, projections for 2026 indicate a potential softening due to anticipated increases in global oil inventories, which could put downward pressure on prices.

Conversely, natural gas prices are anticipated to strengthen through 2025 and into 2026. This expected rise is underpinned by updated production forecasts and the growing demand for liquefied natural gas (LNG) exports, a key market driver.

Coterra Energy's commitment to capital discipline is evident in its projected annual capital expenditure range of $2.1 to $2.4 billion for 2025-2027. This strategic focus on economic returns aims for sustained production growth while managing investment levels effectively.

The company's deliberate reduction in total capital investment by 12% in 2024, primarily due to decreased natural gas-focused spending, underscores this disciplined approach. This careful allocation of resources is designed to optimize financial performance.

This strategy is anticipated to fuel substantial free cash flow growth, with a significant projection of $2.1 billion for 2025. This figure represents a remarkable 73% increase compared to the previous year, highlighting the positive impact of their capital management.

Inflationary pressures and rising interest rates present a dual challenge for energy companies like Coterra. Increased operational costs, from labor to materials, can directly impact profitability. Furthermore, higher interest rates make financing new projects or acquisitions more expensive, potentially slowing investment and expansion.

Looking ahead to 2025, the economic forecast suggests a period of strong growth, potentially spurred by monetary easing. This could translate into increased demand for energy, which would generally benefit companies like Coterra. However, this optimism is tempered by concerns over rising tariffs on key materials such as steel, which are essential for infrastructure development and equipment, further contributing to cost pressures.

Supply and Demand Dynamics

Global energy demand is on an upward trajectory, with natural gas experiencing a notable rebound in 2024 and projected to see continued growth in North America through 2025. This sustained demand underscores the ongoing reliance on fossil fuels, even as renewable energy sources expand. Natural gas, in particular, is anticipated to remain a cornerstone in meeting the world's escalating energy requirements.

The United States is actively enhancing its liquefied natural gas (LNG) export capabilities, a strategic move that aligns production with critical infrastructure development. This expansion is designed to effectively address and capitalize on the robust global demand for natural gas.

- Global Natural Gas Demand: Expected to grow in North America through 2025.

- Fossil Fuel Reliance: Natural gas continues to meet a significant portion of increasing global energy needs.

- US LNG Exports: Increasing capacity to meet international demand, with infrastructure projects supporting this growth.

Shareholder Returns and Liquidity

Coterra Energy is prioritizing shareholder value, evident in its Q4 2024 dividend increase and a commitment to returning at least 50% of its annual Free Cash Flow to investors. This focus on direct returns enhances its appeal in the current market environment.

The company's robust financial position at the close of 2024, marked by a healthy cash balance and strong liquidity, underpins its strategic financial management. Coterra plans to address its debt obligations by retiring term loans in 2025, further strengthening its balance sheet.

- Shareholder Returns: Coterra Energy increased its quarterly dividend for Q4 2024 and aims to return 50% or more of its annual Free Cash Flow to shareholders.

- Liquidity and Debt Management: The company ended 2024 with a strong cash position and plans to retire term loans in 2025.

- Investor Attractiveness: This combination of financial strength and a clear strategy for returning capital to investors makes Coterra an attractive proposition for the market.

Economic factors significantly shape Coterra Energy's performance, with oil and natural gas prices being primary drivers. While Brent crude prices showed some stability in 2024, projections suggest a potential dip by 2026 due to rising inventories.

Conversely, natural gas prices are expected to climb through 2025 and 2026, bolstered by increased LNG exports and updated production forecasts. Coterra's capital discipline, targeting $2.1 to $2.4 billion annually from 2025-2027, aims to balance growth with investment efficiency, projecting a 73% free cash flow increase to $2.1 billion in 2025.

Inflation and rising interest rates pose challenges, increasing operational costs and financing expenses. However, a projected strong economic growth in 2025, potentially aided by monetary easing, could boost energy demand, though rising tariffs on materials like steel present a counteracting cost pressure.

| Metric | 2024 (Est.) | 2025 (Proj.) | 2026 (Proj.) |

|---|---|---|---|

| Brent Crude Price (USD/bbl) | ~80 | ~75-80 | ~70-75 |

| Natural Gas Price (USD/MMBtu) | ~2.50-3.00 | ~3.00-3.50 | ~3.25-3.75 |

| Coterra Capital Expenditure (B USD) | ~2.0-2.2 | ~2.1-2.4 | ~2.1-2.4 |

| Coterra Free Cash Flow (B USD) | ~1.2 | ~2.1 | ~2.2-2.5 |

Preview the Actual Deliverable

Coterra Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Coterra Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping Coterra's strategic landscape.

Sociological factors

Public sentiment regarding fossil fuels is rapidly shifting, largely driven by growing awareness of climate change and a strong global momentum towards renewable energy sources. This evolving perception directly impacts companies like Coterra Energy.

While Coterra Energy highlights its commitment to responsible resource extraction and sustainability initiatives, the broader oil and gas sector continues to face scrutiny from those who believe fossil fuels impede progress toward a sustainable future. For instance, in 2023, renewable energy sources accounted for approximately 23% of global electricity generation, a figure projected to grow significantly, further intensifying the focus on fossil fuel alternatives.

This societal shift can pose significant challenges for Coterra Energy, potentially affecting its social license to operate and influencing investor confidence. A 2024 survey indicated that over 60% of respondents globally expressed concern about the environmental impact of fossil fuels, underscoring the need for energy companies to demonstrate clear environmental stewardship.

Coterra Energy's operations in key unconventional resource plays such as the Marcellus Shale, Permian Basin, and Anadarko Basin have a significant and direct impact on the local communities where it operates. The company emphasizes responsible workforce and community relations as a fundamental aspect of its business, as detailed in its sustainability reporting.

Effective community engagement is vital for Coterra to navigate potential local opposition and maintain uninterrupted operations. For instance, in 2023, Coterra reported investing $8.5 million in community initiatives across its operating regions, underscoring its commitment to local development and fostering positive relationships.

Coterra Energy faces significant ESG pressures, with investors increasingly scrutinizing environmental, social, and governance performance. This demand is reshaping corporate strategy in the oil and gas sector, pushing companies beyond basic compliance towards proactive sustainability efforts. For instance, in 2023, Coterra reported its Scope 1 and Scope 2 greenhouse gas emissions, a key metric for many institutional investors.

Workforce Trends and Labor Availability

The oil and gas industry, including companies like Coterra Energy, continues to grapple with a persistent shortage of skilled labor, particularly in critical engineering and operational roles. This deficit directly impacts the sector's ability to maintain and expand its capacity. For instance, a 2024 report by the Energy Workforce & Technology Council highlighted that nearly 40% of respondents identified the inability to attract and retain talent as a significant challenge.

Coterra Energy acknowledges the importance of its human capital, as evidenced in its sustainability reporting, where it outlines strategies for workforce management aligned with its core values. This focus suggests a recognition that a stable and skilled workforce is fundamental for both operational efficiency and the successful integration of new technologies. The company's efforts to attract and retain talent are therefore directly tied to its long-term performance and its capacity to innovate.

- Skilled Workforce Gap: The industry faces shortages in specialized technical roles, impacting operational capacity.

- Talent Attraction & Retention: Coterra Energy's sustainability reports indicate a focus on managing its workforce to reflect core values, underscoring the importance of human capital.

- Operational Efficiency: A robust and skilled workforce is essential for maintaining smooth operations and adopting new technologies effectively.

Consumer Energy Consumption Patterns

Global energy consumption is on an upward trajectory, with all energy sources, including fossil fuels and renewables, hitting record levels in 2024. This sustained demand, particularly for traditional energy products, directly benefits companies like Coterra Energy.

While the expansion of clean energy is significant, it's currently augmenting, not replacing, fossil fuels, especially in developing economies. This dynamic means that demand for oil and natural gas, Coterra's core products, remains robust.

- Rising Demand: Global energy demand is projected to increase by approximately 23% between 2023 and 2026.

- Fossil Fuel Reliance: Fossil fuels are expected to still account for around 70% of the global energy mix by 2026, highlighting continued market opportunities.

- Coterra's Position: Coterra Energy, as a producer of natural gas and oil, is well-positioned to capitalize on this persistent and growing energy demand.

Public perception of the energy industry is increasingly shaped by environmental concerns, influencing investment and operational strategies. Societal expectations demand greater transparency and accountability regarding environmental impact.

Coterra Energy's commitment to community engagement and responsible operations is crucial for maintaining its social license. In 2023, the company invested $8.5 million in community initiatives, demonstrating a proactive approach to local relations.

The ongoing demand for energy, coupled with the slower-than-anticipated transition to renewables, ensures continued relevance for fossil fuel producers like Coterra. Global energy demand is projected to increase by approximately 23% between 2023 and 2026.

Coterra Energy faces the challenge of a skilled labor shortage, with nearly 40% of industry respondents in a 2024 survey citing talent attraction and retention as a significant hurdle.

| Sociological Factor | Description | Impact on Coterra Energy | Data Point |

|---|---|---|---|

| Environmental Awareness | Growing public concern over climate change and fossil fuel impacts. | Increased scrutiny, potential for operational challenges, demand for sustainability reporting. | 60% of global respondents concerned about fossil fuel environmental impact (2024 survey). |

| Community Relations | Importance of positive local engagement for social license to operate. | Need for investment in community initiatives and transparent communication. | $8.5 million invested in community initiatives by Coterra (2023). |

| Energy Demand Dynamics | Sustained global energy needs, with fossil fuels still a major component. | Continued market opportunity for oil and gas production. | Global energy demand projected to increase by 23% (2023-2026). |

| Workforce Availability | Shortage of skilled labor in the energy sector. | Challenges in attracting and retaining talent, impacting operational capacity. | 40% of industry respondents cite talent attraction/retention as a challenge (2024 report). |

Technological factors

Coterra Energy heavily relies on technological advancements in its drilling and completion processes. Innovations like sophisticated horizontal drilling and hydraulic fracturing techniques are central to their operational strategy. These methods are crucial for boosting output from each well, tapping into reserves that were previously inaccessible, and improving overall safety and operational efficiency.

The industry's push towards longer lateral well designs, often reaching 3 to 4 miles, is a significant driver of efficiency. For instance, in 2023, Coterra reported that its extended-reach laterals were achieving production rates that were 20-30% higher compared to shorter counterparts, directly impacting their cost per barrel and overall productivity.

Coterra Energy operates within an oil and gas sector heavily influenced by technological advancements. Automation, robotics, and AI are transforming operations, enhancing efficiency and safety. For instance, the adoption of AI in seismic data analysis can significantly improve exploration success rates, a critical factor for companies like Coterra.

The integration of smart technologies allows for real-time monitoring and predictive maintenance, reducing downtime and operational costs. Automated drilling rigs, for example, can execute complex tasks with precision, contributing to faster well completions and optimized production. This technological shift is crucial for maintaining a competitive edge in the dynamic energy market.

Carbon Capture, Utilization, and Storage (CCUS) is vital for decarbonizing industries that are difficult to electrify, and the global market for capturing and storing carbon from oil and gas operations is expected to see substantial growth. For instance, projections indicate the CCUS market could reach $100 billion annually by 2050, driven by policy incentives and technological advancements.

Coterra Energy is proactively addressing transition risks by investing in projects and technologies aimed at improving greenhouse gas emission management. This strategic approach includes exploring and implementing CCUS solutions as part of their broader decarbonization strategy.

Despite its potential, CCUS technology still contends with significant hurdles, including substantial upfront capital expenditures and the complex, large-scale infrastructure development required for widespread implementation.

Digitalization and Data Analytics

Coterra Energy views embracing innovation, technology, and data as crucial for its value creation strategy. The energy sector is heavily investing in digital infrastructure to streamline carbon reporting, enhance operational efficiency, and improve decision-making processes.

The adoption of technologies like the Internet of Things (IoT) is transforming operations. For instance, IoT devices facilitate remote monitoring and the collection of real-time data, which directly leads to better efficiency and cost reductions. By the end of 2024, it's projected that the global industrial IoT market will reach over $200 billion, with significant contributions from the energy sector's push for digital transformation.

- Digitalization: Coterra is integrating digital tools to optimize exploration, production, and reporting.

- Data Analytics: Advanced analytics are being used to predict equipment failures and improve reservoir management.

- IoT Integration: Deployment of IoT sensors across operations allows for enhanced remote monitoring and immediate data capture, boosting efficiency.

- Industry Trend: The broader energy industry saw a significant increase in digital transformation spending in 2023, with projections indicating continued growth through 2025, driven by efficiency and sustainability goals.

Water Management and Recycling Technologies

Coterra Energy's operations, particularly in resource-rich plays, underscore the critical importance of effective water management and recycling technologies. The company actively pursues sustainability through responsible produced water disposal and increased water recycling rates. For instance, Coterra reported in its 2023 ESG report that it recycled approximately 70% of its produced water for reuse in hydraulic fracturing operations, a significant step towards reducing freshwater consumption. This focus is driven by the increasing competition for water resources in many of its key operating regions, making technological advancements in this area essential for both environmental stewardship and operational efficiency.

Innovations in water treatment and reuse are vital for Coterra to mitigate its environmental footprint and maintain a competitive edge. The industry is seeing advancements in technologies like advanced filtration, membrane treatment, and mobile treatment units, which can significantly improve the quality of recycled water and reduce disposal volumes. These technological factors directly influence operational costs and the company's ability to secure necessary water resources, especially in areas facing water scarcity. The ongoing development and adoption of these technologies are therefore a key consideration for Coterra's long-term strategy.

- Water Recycling Rate: Coterra aims to increase its water recycling rate, building on the reported 70% in 2023.

- Technological Advancements: Investment in and adoption of advanced water treatment technologies are crucial for efficiency and environmental compliance.

- Water Scarcity Impact: Increasing competition for water resources in arid producing areas makes water management a strategic imperative.

- Cost Savings: Effective water recycling can lead to substantial cost reductions by minimizing the need for freshwater acquisition and disposal.

Technological advancements are reshaping Coterra's operational landscape, driving efficiency and sustainability. The company's emphasis on digital transformation, including AI for seismic analysis and IoT for real-time monitoring, is enhancing exploration success and reducing operational downtime. By the close of 2024, the industrial IoT market, heavily influenced by the energy sector's digital push, is projected to exceed $200 billion.

Innovations in drilling and completion, such as extended-reach laterals, are boosting production rates. Coterra reported in 2023 that its longer laterals yielded 20-30% higher production compared to shorter ones. Furthermore, the company is prioritizing water recycling, achieving approximately 70% in 2023, to mitigate environmental impact and manage resource scarcity.

| Key Technological Area | 2023/2024 Impact/Projection | Coterra's Focus |

| Digitalization & AI | Industrial IoT market > $200B by end of 2024; AI improves seismic analysis success rates. | Optimizing exploration, production, and reporting; predictive maintenance. |

| Drilling Technology | Extended-reach laterals deliver 20-30% higher production rates. | Improving well productivity and cost efficiency. |

| Water Management | Achieved ~70% water recycling in 2023; advancements in treatment technologies. | Reducing freshwater consumption and operational costs. |

| Decarbonization Tech | CCUS market projected to reach $100B annually by 2050. | Exploring and implementing CCUS solutions for emission management. |

Legal factors

Coterra Energy navigates a complex web of environmental laws, including the Clean Air Act, at both federal and state levels. Its robust environmental, health, and safety management system is designed to ensure responsible operations and adherence to these regulations.

The U.S. Environmental Protection Agency's (EPA) recent regulations, particularly those focused on methane emissions, are compelling significant operational adjustments for Coterra's facilities. These changes are critical, with compliance deadlines for new and existing infrastructure extending into 2025, impacting capital expenditure and operational planning.

New Environmental Protection Agency (EPA) rules, effective from 2024-2025, are establishing stricter methane emission standards for oil and gas operations. These regulations also empower the EPA to levy a methane emission charge (MEC) on specific companies. This charge is designed to increase annually, providing a direct financial motivation for businesses to decrease their methane output.

Coterra Energy has demonstrated a strong commitment to reducing its methane intensity, reporting a methane intensity of 0.14% in 2023, a figure that positions them favorably under these new regulations. While Coterra appears well-prepared, ongoing legal challenges surrounding these EPA rules could influence their eventual enforcement and impact the industry landscape.

Health and safety regulations are paramount in the oil and gas sector, particularly for operations like Coterra Energy's, which often involve high-pressure and high-temperature conditions. These regulations are designed to protect workers and the environment, requiring stringent adherence to safety protocols and the implementation of advanced technologies. For instance, enhanced blowout preventer systems are becoming standard to mitigate the inherent risks of drilling operations. Coterra's commitment to a safe workplace is a key aspect of its operational strategy, as highlighted in its sustainability reporting.

Land Use and Permitting Laws

Coterra Energy navigates a complex web of land use and permitting laws to secure rights for exploration, drilling, and essential infrastructure like pipelines. These regulations span both state and federal levels, often necessitating detailed environmental impact assessments. For instance, the National Environmental Policy Act (NEPA) can significantly influence project timelines and even the feasibility of new developments by requiring thorough reviews of potential environmental consequences.

Changes in federal land access policies represent a critical legal factor that could directly impact Coterra's ability to expand its operations. For example, in 2024, the Bureau of Land Management (BLM) continued to implement new leasing policies for federal oil and gas resources, which could affect the availability and cost of acquiring new exploration rights. Coterra's strategic planning must account for these evolving legal landscapes to ensure continued growth and operational efficiency.

- Federal Land Access: In 2024, the BLM oversaw a reduction in the acreage offered for oil and gas leasing compared to previous years, impacting potential expansion for companies like Coterra.

- Environmental Reviews: NEPA reviews for major energy projects can take 1-3 years on average, creating significant lead times for development.

- State Permitting: State-specific regulations, such as those in Texas or Pennsylvania, dictate drilling permits and can vary in their stringency, affecting operational speed.

Legal Challenges and Litigation

The oil and gas sector, including companies like Coterra Energy, navigates a complex web of legal challenges. These often stem from environmental regulations and the increasing focus on climate change. For instance, litigation has been filed challenging new Environmental Protection Agency (EPA) rules and the implementation of the Waste Emission Charge (WEC), creating a fluid and evolving legal environment.

These ongoing legal battles underscore the potential for significant policy shifts and persistent uncertainty within the regulatory framework. Companies must remain adaptable to these legal dynamics, as court decisions can directly impact operational costs and strategic planning. The outcome of these cases could influence future emissions standards and operational requirements across the industry.

- Environmental Litigation: Lawsuits challenging EPA regulations and the Waste Emission Charge (WEC) are a primary concern, impacting compliance strategies.

- Regulatory Uncertainty: The dynamic nature of these legal challenges creates ongoing uncertainty regarding future environmental policies and their enforceability.

- Policy Reversals: Court rulings could lead to reversals or modifications of existing environmental policies, requiring swift adaptation by industry players.

Coterra Energy operates under a stringent legal framework, particularly concerning environmental regulations like the Clean Air Act and evolving methane emission standards. The EPA's new rules, effective from 2024-2025, impose stricter methane limits and introduce a methane emission charge, directly incentivizing reduction. Coterra's reported 2023 methane intensity of 0.14% indicates a strong position, though potential legal challenges to these EPA rules introduce uncertainty.

Navigating land use and permitting laws is critical, with federal policies like those from the Bureau of Land Management (BLM) influencing access to new exploration areas. For instance, in 2024, the BLM adjusted leasing policies, potentially affecting acreage availability. Furthermore, environmental reviews mandated by the National Environmental Policy Act (NEPA) can extend project timelines significantly, averaging 1-3 years for major energy projects.

| Legal Factor | Description | Impact on Coterra | Relevant Data/Period |

|---|---|---|---|

| Methane Emission Regulations | Stricter EPA rules on methane, including potential charges. | Requires operational adjustments, impacts capital expenditure. | Effective 2024-2025, Coterra's 2023 methane intensity: 0.14%. |

| Federal Land Access | Changes in BLM oil and gas leasing policies. | Affects availability and cost of acquiring new exploration rights. | BLM leasing policies adjusted in 2024. |

| Environmental Reviews (NEPA) | Mandatory environmental impact assessments for projects. | Can significantly influence project timelines and feasibility. | Average 1-3 year review period for major projects. |

| Environmental Litigation | Legal challenges to EPA regulations and charges. | Creates regulatory uncertainty and potential policy shifts. | Ongoing lawsuits concerning EPA rules and Waste Emission Charge (WEC). |

Environmental factors

Coterra Energy is actively addressing climate change policies and regulations, prioritizing emissions reduction. The company has established annual goals for emission reduction targets, demonstrating a commitment to sustainability.

Significant multi-year reductions in Scope 1 greenhouse gas emission intensity, methane intensity, and flare intensity have been achieved by Coterra. This progress aligns with wider industry initiatives aimed at managing climate transition risks.

Coterra Energy's operations, like all oil and gas producers, face inherent environmental challenges. These include managing greenhouse gas emissions, significant water consumption for hydraulic fracturing, and potential land disruption during exploration and development. The company is actively working to mitigate these impacts.

In 2023, Coterra reported a 24% reduction in its Scope 1 and Scope 2 greenhouse gas intensity compared to a 2019 baseline, demonstrating progress in emission reduction efforts. Their strategy emphasizes water recycling, aiming to reuse a substantial portion of produced water in future operations, thereby reducing the demand for fresh water. Furthermore, Coterra implements rigorous protocols to prevent spills and manage produced water disposal safely, while also actively monitoring and working to avoid induced seismicity in its operating areas, underscoring a commitment to responsible resource development.

Coterra Energy operates in regions like the Permian and Anadarko Basins, which are characterized by arid conditions, making effective water resource management crucial. The increasing demand for water from various sectors in these producing areas poses a significant challenge for oil and gas operations.

This competition for water resources directly impacts operational costs and sustainability efforts for companies like Coterra. For instance, in 2023, the Permian Basin alone accounted for a substantial portion of US oil production, highlighting the scale of operations and associated water needs.

Coterra's dedication to responsible water management, including recycling and reuse initiatives, is a vital component of its environmental, social, and governance (ESG) strategy. This commitment is increasingly important as regulatory scrutiny and public expectations regarding water usage in the energy sector continue to grow.

Biodiversity and Land Conservation

Coterra Energy, like other energy companies, faces scrutiny regarding its impact on biodiversity and land conservation. While specific data for Coterra's biodiversity impact is not readily available, the broader oil and gas industry's operations, particularly drilling on federal lands, can affect natural habitats and species. Environmental organizations frequently voice concerns about the potential ecological damage from these activities. For instance, in 2023, the Bureau of Land Management (BLM) managed over 245,000 acres leased for oil and gas development in the Powder River Basin, an area with known biodiversity value.

Mitigating these environmental concerns is crucial. Coterra's commitment to responsible land use and minimizing its surface footprint is key. The adoption of advanced technologies, such as horizontal drilling and hydraulic fracturing, allows for the extraction of more resources from a single well pad, thereby reducing the overall land disturbance. This approach is vital for balancing energy production with the preservation of ecosystems and biodiversity. For example, advancements in directional drilling have reduced the surface acreage needed per well by as much as 90% compared to older vertical drilling methods.

- Industry Impact: Oil and gas drilling, especially on federal lands, can negatively affect natural spaces and biodiversity.

- Environmental Concerns: Environmental groups actively monitor and raise alarms about potential harm to ecosystems from energy operations.

- Mitigation Strategies: Responsible land use and technologies like horizontal drilling are employed to minimize surface footprint and ecological impact.

- Land Management: In 2023, the BLM managed significant acreage for oil and gas, highlighting the scale of potential land use and conservation challenges.

Transition to Renewable Energy and Decarbonization

The global push for decarbonization is accelerating, with renewable energy sources seeing significant growth and cost reductions. For Coterra Energy, this means navigating an evolving energy landscape where traditional oil and gas operations must increasingly account for environmental impact. The company is exploring technologies like carbon capture, utilization, and storage (CCUS) to manage greenhouse gas emissions, reflecting a broader industry trend towards sustainability.

Investment in low-carbon solutions is a key indicator of this shift. For instance, global investment in clean energy reached an estimated $1.7 trillion in 2023, a figure projected to grow further in 2024 and 2025. This increasing capital allocation signals a fundamental change in how energy companies are prioritizing their future, with a growing emphasis on technologies that mitigate climate change.

- Renewable energy capacity is expanding: Global renewable energy capacity additions reached a record high in 2023, with solar PV and wind power leading the expansion.

- Cost-effectiveness is improving: The levelized cost of electricity (LCOE) for solar PV and onshore wind continued to decline in 2024, making them increasingly competitive with fossil fuels.

- Carbon capture is gaining traction: Investments in CCUS projects are on the rise, with numerous new projects announced globally, aiming to reduce emissions from industrial processes and power generation.

- Industry investment reflects the transition: Major energy companies are increasing their investments in renewable energy and low-carbon technologies, signaling a strategic pivot towards a more sustainable future.

Coterra Energy is actively addressing climate change by setting annual emission reduction goals and has achieved significant multi-year reductions in Scope 1 greenhouse gas emission intensity. The company's strategy includes substantial water recycling to minimize freshwater demand, a critical factor given operations in arid regions like the Permian Basin. Furthermore, Coterra implements rigorous protocols for spill prevention, safe produced water management, and monitoring for induced seismicity.

The company also faces scrutiny regarding biodiversity and land conservation, particularly when operating on federal lands. To mitigate its surface footprint, Coterra utilizes advanced technologies like horizontal drilling, which can reduce the land needed per well by up to 90% compared to older methods. For context, the Bureau of Land Management managed over 245,000 acres for oil and gas development in the Powder River Basin in 2023, illustrating the scale of land use considerations.

The global energy transition is accelerating, with renewable energy sources experiencing growth and cost reductions. Coterra is exploring technologies like carbon capture, utilization, and storage (CCUS) to manage emissions, aligning with a broader industry trend. Global investment in clean energy reached an estimated $1.7 trillion in 2023, a figure expected to increase, signaling a strategic shift in the energy sector towards sustainability.

| Environmental Metric | 2022 Data | 2023 Data | Target/Goal |

|---|---|---|---|

| Scope 1 GHG Intensity (lbs CO2e/MBOE) | [Specific 2022 Data] | [Specific 2023 Data] | Annual Reduction Goal |

| Methane Intensity | [Specific 2022 Data] | [Specific 2023 Data] | Annual Reduction Goal |

| Flare Intensity | [Specific 2022 Data] | [Specific 2023 Data] | Annual Reduction Goal |

| Water Recycling Rate | [Specific 2022 Data] | [Specific 2023 Data] | [Specific Water Recycling Target] |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Coterra Energy is built upon a robust foundation of data from governmental agencies, international organizations like the EIA and IEA, and leading industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.