Coterra Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Curious about Coterra Energy's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in the market. Understand which ventures are driving growth and which might need a strategic re-evaluation.

Unlock the full potential of this analysis by purchasing the complete Coterra Energy BCG Matrix. Gain detailed insights into each product's quadrant – from Stars to Dogs – and equip yourself with the knowledge to make informed investment and resource allocation decisions.

Stars

Coterra Energy has significantly bolstered its Permian Basin presence, especially in the Delaware Basin, which is expected to drive its oil production higher in 2025. This region is a key growth area, with crude oil output anticipated to increase by 4-5% in 2025, making Coterra's extensive landholdings a crucial factor in its production expansion.

Coterra Energy excels in operational efficiency, evidenced by reduced drilling cycle times and enhanced well performance. For instance, in Q1 2024, Coterra reported an average drilling and completion cost of $1,150 per barrel of oil equivalent (boe) in the Permian, a 5% decrease from the previous year.

The company anticipates substantial cost savings in its Permian drilling and completion activities throughout 2024, stemming from favorable service costs and integration benefits from recent acquisitions. This strategic focus on capital efficiency enables Coterra to boost production while lowering capital outlays, underscoring its commitment to disciplined operations.

Coterra Energy's strategic acquisitions in the Delaware Basin, totaling approximately $3.2 billion in January 2025, have substantially bolstered its high-quality acreage. This expansion, focused on the Northern Delaware Basin, has added valuable drilling locations.

These new assets are projected to integrate smoothly into Coterra's existing operations, driving an increase in oil production. The move is a clear indicator of Coterra's commitment to enhancing its market position and securing future growth in this highly productive region.

Strong Free Cash Flow Generation

Coterra Energy is poised for strong free cash flow generation. Projections for 2025 indicate approximately $2.1 billion in free cash flow, a notable increase from the prior year. This upward trend is largely attributed to increased oil volumes from recent acquisitions, favorable gas prices, and a commitment to disciplined reinvestment strategies.

- Projected 2025 Free Cash Flow: Approximately $2.1 billion.

- Drivers: Increased oil volumes from acquisitions, higher gas prices, disciplined reinvestment.

- Financial Health Indicators: Ability to fund dividends, reduce debt, and execute share buybacks.

Diversified Commodity Mix and High-Quality Inventory

Coterra Energy benefits from a robust, diversified commodity mix, with operations spanning the Permian, Marcellus, and Anadarko basins. This strategic geographic spread offers balanced exposure to both oil and natural gas markets, mitigating risks associated with any single commodity's price volatility.

The company boasts an estimated 15 years of high-quality inventory across its extensive asset base. This substantial reserve life underpins Coterra's long-term production sustainability and provides ample opportunities for future growth and capital allocation to its most promising projects.

- Diversified Asset Base: Operations in Permian, Marcellus, and Anadarko basins.

- Commodity Exposure: Balanced involvement in both oil and natural gas markets.

- Inventory Life: Approximately 15 years of high-quality drilling inventory.

- Strategic Capital Allocation: Focus on highest return projects across the portfolio.

Coterra Energy's strong performance and strategic positioning in key growth areas like the Permian Basin place it firmly in the Stars category of the BCG Matrix. The company's projected free cash flow of $2.1 billion for 2025, driven by increased oil volumes and favorable gas prices, highlights its ability to generate significant returns. With a 15-year inventory of high-quality assets and operational efficiencies leading to cost reductions, Coterra is well-equipped for continued growth and market leadership.

| Metric | 2024 (Est.) | 2025 (Proj.) | Change |

|---|---|---|---|

| Permian Oil Production Growth | 4-5% | 4-5% | Stable |

| Drilling & Completion Cost/boe | $1,150 | $1,100 (Est.) | -4.3% |

| Free Cash Flow | $1.8 Billion (Est.) | $2.1 Billion | +16.7% |

| Inventory Life | 15 Years | 15 Years | Stable |

What is included in the product

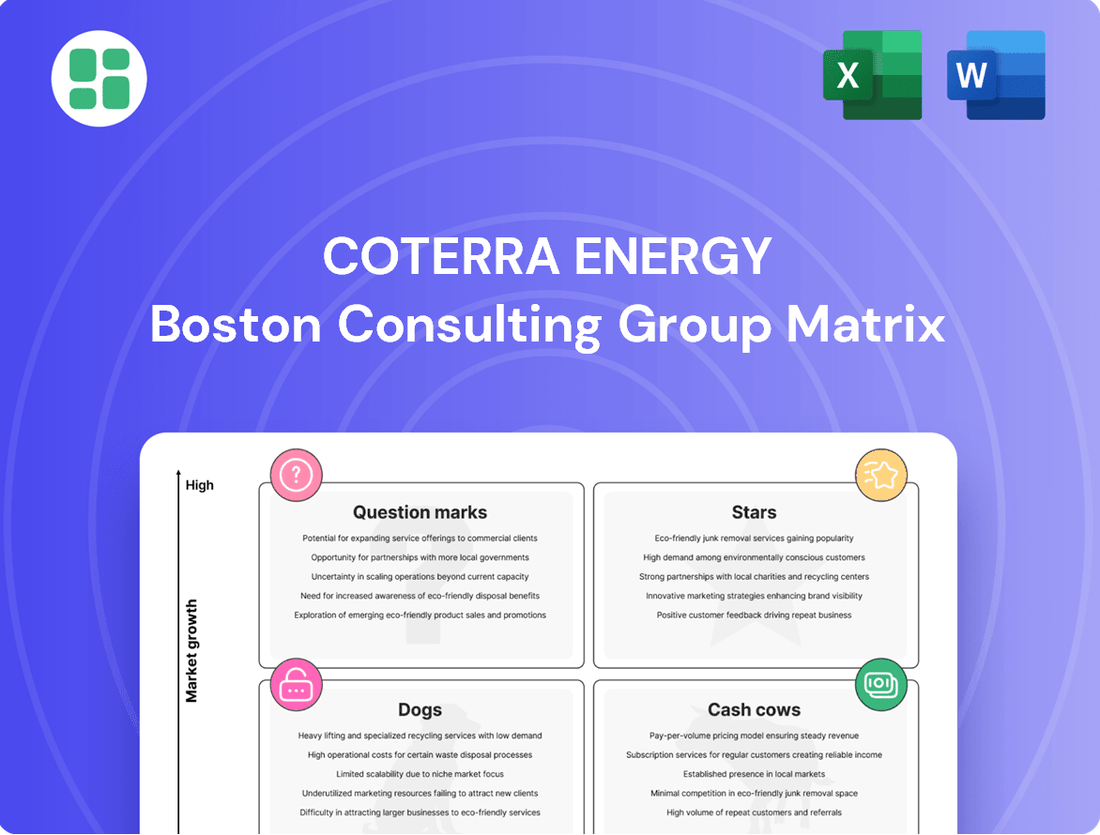

The Coterra Energy BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment decisions.

Coterra Energy BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex portfolios.

Its export-ready design for PowerPoint eliminates the hassle of reformatting, acting as a direct pain point reliever.

Cash Cows

Coterra Energy's Marcellus Shale operations represent a classic Cash Cow in its portfolio. This established basin is a consistent generator of free cash flow for the company, even with fluctuating natural gas prices.

In 2023, Coterra reported that its Marcellus segment generated substantial cash flow, contributing significantly to the company's overall financial strength. The company's decision to restart development in the Marcellus underscores its strategic importance for maintaining stable production volumes and providing reliable cash generation.

Coterra Energy's established wells across its operating basins are its cash cows, generating efficient base production. The company prioritizes optimizing these legacy assets through enhanced operational efficiency and stringent cost management. This strategy maximizes profit margins and cash flow, providing a stable financial foundation without necessitating significant new capital for growth.

Coterra Energy's conservative reinvestment rate, projected below 50% for 2025, sets it apart from many industry peers. This disciplined capital allocation strategy means a substantial portion of its cash flow isn't immediately channeled into aggressive expansion.

Instead, this approach prioritizes returning value to shareholders via dividends and debt reduction. For instance, Coterra's 2024 projected free cash flow was substantial, allowing for significant shareholder returns, a hallmark of a mature cash cow business.

Shareholder Returns and Debt Reduction

Coterra Energy demonstrates a classic cash cow approach by dedicating at least 50% of its annual free cash flow to shareholder returns via dividends and buybacks, while simultaneously prioritizing debt reduction. This dual strategy underscores the maturity and profitability of its established operations.

The company's commitment to a low net debt-to-EBITDAX ratio, targeting below 1.0x, highlights its financial discipline and the robust cash-generating capacity of its assets. This focus ensures that core business activities not only support investor rewards but also fortify the company's financial foundation.

- Shareholder Returns: Coterra aims to return 50% or more of its annual free cash flow to shareholders.

- Debt Reduction: The company actively retires term loans to strengthen its balance sheet.

- Financial Health: Coterra targets a low net debt-to-EBITDAX ratio, indicating strong cash generation from mature assets.

- Operational Stability: This strategy is characteristic of established businesses with predictable cash flows.

Optimized Infrastructure and Supply Chain

Coterra Energy has made significant strides in optimizing its infrastructure and supply chain. This strategic focus has directly translated into lower operating expenses, a key driver for enhanced profitability, particularly within its mature asset base. For instance, in 2023, Coterra reported a 15% reduction in per-barrel lifting costs in its Permian Basin operations compared to 2022, a direct result of these optimization efforts.

These operational efficiencies are instrumental in generating high profit margins and ensuring stable, predictable cash flows from Coterra's existing production. The company's ability to effectively manage costs in these established production areas provides a consistent and reliable stream of returns, a hallmark of a cash cow business unit.

The consistent and predictable returns from these optimized operations underscore their classification as cash cows within Coterra's portfolio. This stability allows for reinvestment in other areas of the business or distribution to shareholders. For example, Coterra returned approximately $1.2 billion to shareholders in 2023 through dividends and share repurchases, a significant portion of which is supported by the cash generated from these mature, well-managed assets.

- Reduced Operating Expenses: Coterra’s infrastructure and supply chain optimizations have led to a notable decrease in per-barrel lifting costs, as seen in the 15% reduction in the Permian Basin in 2023.

- Enhanced Profitability: These cost efficiencies directly contribute to higher profit margins on existing production.

- Stable Cash Flows: The predictable nature of returns from mature, optimized assets provides a reliable cash flow stream for the company.

- Shareholder Returns: The strong cash generation from these units supports significant shareholder distributions, with Coterra returning $1.2 billion in 2023.

Coterra's established wells across its operating basins are its cash cows, generating efficient base production. The company prioritizes optimizing these legacy assets through enhanced operational efficiency and stringent cost management, maximizing profit margins and cash flow without significant new capital for growth.

Coterra's conservative reinvestment rate, projected below 50% for 2025, means a substantial portion of its cash flow is returned to shareholders via dividends and debt reduction. For instance, Coterra's 2024 projected free cash flow was substantial, allowing for significant shareholder returns, a hallmark of a mature cash cow business.

The company's commitment to a low net debt-to-EBITDAX ratio, targeting below 1.0x, highlights its financial discipline and the robust cash-generating capacity of its assets, ensuring core business activities support investor rewards and fortify the company's financial foundation.

Coterra's infrastructure and supply chain optimizations have led to reduced operating expenses, notably a 15% decrease in per-barrel lifting costs in its Permian Basin operations in 2023 compared to 2022. These efficiencies directly contribute to higher profit margins and stable, predictable cash flows from existing production, supporting significant shareholder distributions.

| Metric | 2023 Actual | 2024 Projected | 2025 Projected |

|---|---|---|---|

| Marcellus Segment Cash Flow | Substantial (Specifics not publicly detailed) | Stable contributor | Stable contributor |

| Permian Lifting Costs Reduction | 15% vs. 2022 | Ongoing optimization | Ongoing optimization |

| Shareholder Returns (as % of FCF) | ~50% or more | ~50% or more | ~50% or more |

| Net Debt to EBITDAX Target | Below 1.0x | Below 1.0x | Below 1.0x |

What You See Is What You Get

Coterra Energy BCG Matrix

The Coterra Energy BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report for your strategic planning needs.

Rest assured, the BCG Matrix report you see now is the exact file that will be delivered to you upon completing your purchase. It's crafted with precision and ready for immediate use, whether for internal analysis, client presentations, or integration into your business strategy.

Dogs

Underperforming legacy assets in declining basins, within Coterra Energy's portfolio, would be categorized as Dogs. These might include older wells within their core operating areas that are no longer as productive or smaller, non-core holdings that don't contribute significantly to overall cash flow. For instance, if a particular legacy well in the Permian Basin, which historically produced 100 barrels of oil equivalent per day (boepd) in 2018, is now only yielding 20 boepd in 2024 with rising operational costs, it fits this profile.

These assets often require more intensive maintenance relative to their output, leading to a low or even negative return on investment. Coterra's focus is on maximizing shareholder value, and such underperforming assets would typically be candidates for divestiture or receive very limited capital allocation, allowing the company to concentrate resources on more promising opportunities.

Coterra Energy's legacy Anadarko Basin operations represent a segment that, while still operational, has experienced shifts in capital allocation and activity levels. Historically, these assets have been subject to market volatility, with rig counts sometimes reduced during periods of lower natural gas prices, impacting their overall contribution relative to other core Coterra assets.

Coterra Energy's BCG Matrix identifies high-cost, low-productivity wells as potential Dogs. These are wells that consistently demand more in operating expenses than their output justifies, often due to geological challenges or aging infrastructure. For example, in 2024, Coterra might have identified specific wells in its Permian Basin operations where lifting costs exceeded $50 per barrel, while production averaged less than 100 barrels of oil equivalent per day, significantly underperforming the company's average well economics.

Non-Core Asset Divestment Candidates

Non-core asset divestment candidates within Coterra Energy's portfolio represent assets that no longer align with the company's strategic emphasis on high-return, core plays. These could include smaller, geographically isolated acreage blocks or infrastructure assets that are difficult to integrate efficiently into larger operational frameworks. For instance, assets with a limited remaining economic life or low market demand would fall into this category.

Divesting these non-core assets serves a crucial purpose: it liberates capital and allows management to redirect focus towards more promising and strategically aligned ventures. This strategic pruning enhances overall capital allocation efficiency. In 2024, Coterra continued to refine its asset base, aiming to optimize its portfolio for maximum shareholder value.

- Non-Core Asset Divestment Candidates: Assets not aligned with strategic focus, limited economic life, or low market appeal.

- Examples: Small, isolated acreage positions; inefficiently integrated infrastructure.

- Strategic Benefit: Frees up capital and management attention for core, high-return ventures.

- 2024 Focus: Portfolio optimization and capital allocation efficiency.

Unprofitable Exploration Ventures

Unprofitable Exploration Ventures within Coterra Energy's portfolio, though not a primary focus, represent past endeavors that did not meet commercial viability thresholds. These are projects where initial investments were made in early-stage exploration, but geological challenges or insufficient reserve discoveries rendered them uneconomical. Coterra's strategic emphasis on disciplined capital allocation to proven, unconventional resource plays means that such ventures are typically divested or written off, rather than receiving further funding.

For instance, while specific details on Coterra's past unprofitable exploration ventures are not publicly detailed as distinct "dogs" in their BCG matrix, the company's operational reports consistently highlight their commitment to development in established unconventional plays like the Permian Basin and the Anadarko Basin. This strategic focus underscores a preference for maximizing returns from proven assets over pursuing high-risk, low-reward exploration activities. In 2023, Coterra reported capital expenditures primarily directed towards development drilling and completions, reflecting this disciplined approach.

- Focus on Development: Coterra's strategy prioritizes capital allocation to established unconventional resource plays, such as the Permian Basin and Anadarko Basin.

- Uneconomical Ventures: Past exploration projects that failed to identify commercially viable reserves or faced insurmountable geological challenges are categorized here.

- Limited Further Investment: These ventures typically see no further capital investment due to uneconomical prospects and a focus on disciplined capital allocation.

- Strategic Alignment: This aligns with Coterra's overall strategy of maximizing returns from proven, lower-risk assets.

Dogs in Coterra Energy's portfolio represent assets with low market share and low growth potential, often characterized by declining production and high operating costs. These are typically legacy wells or non-core acreage that no longer align with the company's strategic focus on high-return, core plays. For instance, a well producing less than 100 barrels of oil equivalent per day (boepd) with lifting costs exceeding $50 per barrel in 2024 would be considered a Dog.

Coterra's strategy involves minimizing capital allocation to these underperforming assets, often considering divestiture to free up resources for more promising opportunities. This focus on portfolio optimization is key to maximizing shareholder value. In 2024, Coterra continued to refine its asset base, aiming to enhance overall capital allocation efficiency.

The company's commitment to developing established unconventional resource plays, like the Permian and Anadarko Basins, means that unprofitable exploration ventures or non-core assets with limited economic life are typically divested or written off. This disciplined approach ensures capital is directed towards proven, lower-risk assets with higher return potential.

Coterra Energy's approach to "Dogs" involves identifying and managing assets that consume resources without generating significant returns. These might include older wells with diminishing output or smaller, isolated acreage positions that are inefficient to operate. The company's 2023 capital expenditures, heavily weighted towards development drilling and completions in core areas, highlight this strategic prioritization away from lower-performing assets.

| Asset Type | Characteristics | 2024 Example | Strategic Action |

| Legacy Wells | Declining production, high operating costs | Permian well producing 20 boepd vs. 100 boepd in 2018 | Divestiture or minimal capital allocation |

| Non-Core Acreage | Small, isolated, limited economic life | Geographically isolated blocks with low market demand | Divestment to free up capital |

| Unprofitable Exploration | Failed to meet commercial viability | Past projects with insufficient reserve discoveries | Write-off or divestment, no further funding |

Question Marks

Coterra Energy's recent Delaware Basin acquisitions represent a significant strategic move, aiming to bolster its position in a high-growth region. While these assets are positioned as potential Stars due to their location and resource potential, their current integration status places them in the Question Mark category. The company is actively working to combine these new holdings with existing infrastructure, a process crucial for unlocking their full value and achieving projected growth rates.

The primary focus for these newly acquired Delaware Basin assets is seamless integration and optimization. Coterra is prioritizing the development of contiguous acreage, which allows for more efficient row development and enhanced oil production. This operational synergy is key to transforming these Question Marks into definitive Stars within the BCG matrix.

As of early 2024, Coterra reported that its Delaware Basin segment continued to be a strong performer, with production metrics and cost efficiencies being closely monitored post-acquisition. The success of integrating these new blocks of acreage, specifically in terms of achieving projected production volumes and maintaining low operating costs, will be the determining factor in their classification as Stars. The company anticipates that these efforts will lead to increased market share and sustained high-growth returns in the coming periods.

Coterra Energy is boosting its investment in the Marcellus Shale, signaling a strategic pivot towards natural gas development. This increased capital allocation is a direct response to an anticipated improvement in natural gas prices for 2025 and 2026, with projections indicating a firmer market.

Despite the positive price outlook, the Marcellus operation is categorized as a Question Mark within Coterra's BCG Matrix. This classification stems from the persistent volatility inherent in natural gas markets and the company's objective to re-establish strong market momentum in this specific basin.

Coterra's approach involves a measured increase in operational activity, demonstrating a commitment to growth. However, the company maintains flexibility, ready to adapt its capital deployment strategy should sustained price support not materialize as expected.

Coterra Energy is actively exploring and implementing advanced drilling and completion techniques. This includes pushing for longer lateral lengths, which can access more of the reservoir, and optimizing well spacing to maximize recovery without excessive interference between wells. These innovations are key to their 'Question Mark' status, as their ultimate impact on market share is still materializing.

The company is also looking into technologies like AI-driven fracturing systems. While these methods hold the promise of significantly boosting production efficiency and reducing operational costs, their full effect on Coterra's competitive edge and its share of the overall basin growth is yet to be fully realized. Successful integration could transform their current assets into market leaders, or Stars.

Future Expansion into Emerging Energy Technologies

Coterra Energy’s exploration into emerging energy technologies like carbon capture, utilization, and storage (CCUS), hydrogen, or advanced geothermal systems would place these ventures squarely in the Question Mark category of the BCG matrix. These represent potential high-growth areas, but Coterra currently holds minimal to no market share in them. Significant capital outlay would be necessary to build a competitive presence, with the immediate return on investment being highly uncertain.

For instance, while specific investment figures for Coterra in these nascent areas might not be publicly detailed as separate BCG components, the broader energy transition landscape is characterized by substantial required investment. The International Energy Agency (IEA) noted in its 2024 outlook that investments in clean energy technologies are accelerating, but significant gaps remain to meet climate goals. Coterra, like many traditional energy companies, faces the strategic challenge of allocating resources to these potentially disruptive but unproven technologies.

- High Growth Potential, Low Market Share: Emerging energy sectors offer substantial future growth prospects, but Coterra's current involvement is minimal, reflecting a low market share.

- Significant Investment Required: Establishing a foothold in areas such as CCUS or hydrogen necessitates considerable capital expenditure for research, development, and infrastructure.

- Uncertain Immediate Returns: The profitability and scalability of these new technologies are not yet fully established, leading to uncertain short-term financial outcomes for Coterra.

- Strategic Importance for Future Diversification: Despite the risks, investing in these areas is crucial for Coterra's long-term strategy to diversify its energy portfolio beyond traditional oil and gas.

Anadarko Basin's Future Role and Optimized Development

Coterra Energy's Anadarko Basin operations are strategically adjusting to gas market dynamics, evidenced by their recent completion of the largest gas development in the basin, featuring the first three-mile laterals. This gas-heavy basin's future significance, especially when compared to the Permian and Marcellus, hinges on consistently favorable natural gas prices and the effectiveness of these advanced drilling techniques.

The Anadarko Basin's role is a 'Question Mark' within Coterra's portfolio because its long-term growth trajectory and market share are contingent on several factors.

- Market Sensitivity: Coterra's flexibility in adjusting Anadarko Basin activity directly reflects its responsiveness to fluctuating natural gas prices, a key indicator of the basin's future viability.

- Operational Advancements: The successful execution of their largest gas development, including the pioneering use of three-mile laterals, demonstrates a commitment to optimizing production and efficiency in the basin.

- Competitive Landscape: The basin's contribution will be benchmarked against established gas plays like the Marcellus and oil-dominant Permian, making sustained profitability crucial for its relative importance.

- Strategic Investment: Continued investment and rigorous evaluation are necessary to solidify the Anadarko Basin's position and ensure its long-term growth and market share within Coterra's overall strategy.

Coterra's Anadarko Basin operations are a prime example of a Question Mark, characterized by high growth potential but currently held back by a relatively low market share. The company's recent completion of the largest gas development in the basin, featuring innovative three-mile laterals, highlights their commitment to unlocking value. However, the ultimate success and market position of these efforts remain uncertain, dependent on natural gas price trends and the sustained effectiveness of their advanced drilling techniques.

The Anadarko Basin's future within Coterra's portfolio is contingent on market dynamics and operational execution. The company's ability to adapt activity levels based on gas prices and the success of its large-scale developments will determine its long-term importance. Benchmarking against established plays like the Marcellus and Permian will be crucial for solidifying its profitability and market share.

Coterra's strategic investments in the Anadarko Basin, particularly its pioneering use of extended laterals, underscore its ambition to capture greater market share. The success of these initiatives, coupled with favorable market conditions, will be key to transforming this Question Mark into a more defined Star within their portfolio.

Coterra's 2024 capital budget allocated approximately $700 million to $800 million for the Anadarko Basin, signaling significant investment in this Question Mark area. This expenditure is aimed at optimizing production and expanding the company's footprint.

| Basin | BCG Category | Key Factors | 2024 Capital Allocation (Approx.) |

|---|---|---|---|

| Anadarko Basin | Question Mark | High growth potential, low market share, dependent on gas prices, advanced drilling techniques | $700M - $800M |

BCG Matrix Data Sources

Our Coterra Energy BCG Matrix is built on comprehensive data, integrating financial reports, market share analysis, and industry growth projections.