Coterra Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coterra Energy Bundle

Coterra Energy navigates a complex energy landscape, shaped by the bargaining power of suppliers and the intense rivalry among established players. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis reveals the real forces shaping Coterra Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, including companies like Coterra Energy, heavily depends on a limited number of specialized firms for critical services such as drilling, completion, and ongoing maintenance. When these service providers are few and possess unique expertise or technology, their ability to dictate terms and prices to energy producers increases significantly.

The bargaining power of these concentrated service providers can be particularly pronounced when Coterra requires advanced or niche solutions that only a handful of companies can offer. This dynamic can lead to higher operational costs for Coterra if these suppliers can effectively leverage their market position.

Industry trends toward consolidation among oilfield service companies, a pattern observed in recent years, further amplify the bargaining power of the remaining, larger entities. For instance, major players in the oilfield services market have seen significant revenue growth, with some reporting double-digit percentage increases in revenue in 2023, indicating their strengthening market control.

The upstream oil and gas sector, including companies like Coterra Energy, often grapples with a shortage of skilled professionals. This scarcity impacts areas like geoscientists and experienced construction crews, making it harder for companies to find the talent they need.

This limited supply of qualified workers significantly boosts the bargaining power of labor suppliers. As exploration and production (E&P) companies vie for a finite pool of talent, they often face rising labor costs, directly affecting their operational expenses and profitability.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported that demand for petroleum engineers remained strong, with projected job growth of 5% from 2022 to 2032, indicating continued competition for specialized roles.

Coterra Energy's operational costs are significantly impacted by the bargaining power of its suppliers, particularly for essential raw materials like steel used in pipelines and well casings, as well as specialized chemicals vital for hydraulic fracturing operations. Fluctuations in the prices of these commodities, or any disruptions within their respective supply chains, can directly translate into increased expenses for Coterra, thereby amplifying supplier leverage.

Specialized Technology and Intellectual Property

Suppliers offering specialized technology and intellectual property, such as proprietary drilling techniques or advanced seismic imaging, wield considerable bargaining power. The substantial investment required for developing these innovations, coupled with the competitive edge they provide, makes them indispensable. Coterra Energy's operational efficiency is directly tied to the performance of these specialized suppliers, increasing their leverage.

- High R&D Costs: Developing cutting-edge oil and gas technologies often involves multi-million dollar research and development expenditures, limiting the number of viable suppliers.

- Competitive Advantage: Proprietary technologies can significantly reduce extraction costs or increase recovery rates, offering a distinct advantage that Coterra seeks.

- Supplier Dependence: Coterra's reliance on these specialized inputs means that disruptions or price increases from these suppliers can critically impact its production and profitability.

- Limited Alternatives: The unique nature of these technologies often means there are few, if any, direct substitutes, further strengthening supplier power.

Midstream Infrastructure Providers

Coterra Energy, while managing some of its own gathering systems for natural gas and saltwater disposal, still depends on external midstream infrastructure providers for crucial transportation to reach end markets. This reliance means that the bargaining power of these third-party pipeline companies can significantly influence Coterra's operational costs and, consequently, its profitability. In 2024, the energy sector saw continued investment in midstream infrastructure, yet localized constraints in pipeline capacity, particularly for certain natural gas liquids, remained a factor. When pipeline capacity is tight, or when only a few providers control access to key markets, these midstream companies are in a stronger position to negotiate higher transportation fees.

The concentration of midstream providers in specific basins can exacerbate this bargaining power. If Coterra has limited options for transporting its products, the existing providers can leverage this situation to their advantage, potentially increasing their fees. This dynamic directly impacts Coterra's cost of production and its ability to compete effectively in the market. For instance, regions with robust but consolidated midstream networks often present higher transportation expenses for producers.

- Dependence on Third-Party Infrastructure: Coterra relies on external midstream companies for transporting natural gas and saltwater disposal to end markets, creating a reliance that can shift bargaining power.

- Impact of Pipeline Capacity Constraints: When pipeline capacity is limited, midstream providers can command higher fees, directly affecting Coterra's profitability and operational efficiency.

- Concentration of Providers: A concentrated market of midstream transportation providers can empower them to negotiate more favorable terms, increasing costs for Coterra.

- 2024 Market Dynamics: While midstream investment continued in 2024, localized capacity issues and regional provider concentration remained relevant factors influencing transportation costs for energy producers like Coterra.

The bargaining power of suppliers for Coterra Energy is significant due to the specialized nature of oilfield services and the concentration of providers. Companies offering unique technologies or expertise, such as advanced drilling techniques, can command higher prices because Coterra's operational efficiency is directly tied to their capabilities. This reliance is amplified when few alternatives exist, as seen with the high R&D costs associated with developing these innovations.

Labor shortages in skilled areas like geoscientists and experienced crews also increase supplier leverage, as Coterra must compete for a limited pool of talent, driving up labor costs. For example, the U.S. Bureau of Labor Statistics projected a 5% job growth for petroleum engineers between 2022 and 2032, indicating continued demand and potential wage pressures in 2024.

Furthermore, Coterra's dependence on third-party midstream infrastructure for transportation means that concentrated pipeline providers can dictate terms, especially when capacity is constrained. In 2024, localized pipeline capacity issues continued to empower midstream companies in certain regions, directly impacting Coterra's transportation expenses and overall profitability.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Coterra Energy | 2024 Context/Data Point |

|---|---|---|---|

| Oilfield Services (Drilling, Completion) | Concentration of specialized firms, unique technology, high R&D costs | Increased operational costs, potential delays if services are unavailable | Major oilfield service providers reported double-digit revenue growth in 2023, indicating strengthening market control. |

| Skilled Labor | Shortage of qualified professionals (geoscientists, engineers) | Higher labor costs, competition for talent | U.S. Bureau of Labor Statistics projected 5% job growth for petroleum engineers (2022-2032), signaling continued demand. |

| Raw Materials (Steel, Chemicals) | Price volatility, supply chain disruptions | Increased cost of goods, potential impact on project timelines | Global steel prices experienced fluctuations in early 2024, influenced by manufacturing demand and geopolitical factors. |

| Midstream Infrastructure (Pipelines) | Concentration of providers, limited pipeline capacity | Higher transportation fees, reduced profitability, market access challenges | Localized pipeline capacity constraints persisted in 2024 in key basins, empowering midstream operators. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Coterra Energy's position in the oil and gas industry.

Instantly understand strategic pressure with a powerful spider/radar chart visualizing Coterra Energy's competitive landscape.

No macros or complex code—easy to use even for non-finance professionals to grasp Coterra Energy's competitive forces.

Customers Bargaining Power

Coterra Energy serves a wide array of customers, including industrial users, local distribution companies, and major energy firms. This broad customer base, with no single entity dominating purchases, inherently limits the bargaining power of any individual buyer. For instance, in 2024, industrial consumption represented a significant portion of natural gas demand, but it was spread across numerous sectors, preventing any one industrial segment from wielding substantial leverage over Coterra.

The commodity nature of oil, natural gas, and natural gas liquids means Coterra's products are largely interchangeable. This makes it easy for customers to switch suppliers based on price, significantly limiting Coterra's pricing power. For instance, in early 2024, fluctuations in global oil prices, like West Texas Intermediate (WTI) trading around $75-$80 per barrel, directly influence customer purchasing decisions for Coterra's output.

While the energy market can appear fragmented, large-volume buyers like major energy companies or utility consortia wield significant bargaining power over Coterra Energy. These entities can negotiate more favorable pricing and contract terms due to the substantial quantities of oil and gas they procure. For instance, in 2023, the top 10 global utilities accounted for over 40% of electricity generation, demonstrating the concentrated purchasing power that can be leveraged.

Influence of Spot vs. Long-Term Contracts

Coterra Energy's customer bargaining power is significantly influenced by the mix of spot market sales versus long-term contracts. When the energy market is oversupplied, customers gain considerable leverage, particularly in spot market transactions, allowing them to negotiate more favorable pricing.

Conversely, long-term contracts offer Coterra a degree of price stability and predictable demand. However, these contracts can also limit the company's ability to capitalize on upward price swings during periods of high demand, as the contracted prices remain fixed. This dynamic directly impacts Coterra's revenue and profitability, as the proportion of sales made under each type of agreement shifts with market conditions.

- Spot Market Influence: In a market with abundant supply, customers can easily switch suppliers for immediate needs, driving down prices and increasing their bargaining power.

- Long-Term Contract Trade-offs: While long-term contracts provide revenue predictability for Coterra, they can cap potential profits if market prices surge beyond the contracted rate.

- Customer Leverage: For example, during periods of lower natural gas prices, such as the average Henry Hub spot price in early 2024 which hovered around $2.00-$2.50 per MMBtu, customers have greater flexibility to demand concessions.

- Contractual Stability vs. Market Volatility: Coterra's strategy to balance these contract types aims to mitigate the impact of extreme price volatility on its financial performance.

Customer Integration and Downstream Capabilities

Coterra Energy's customers, especially large industrial users and major energy companies, can exert significant bargaining power if they possess their own production or integrated downstream operations. This vertical integration means they are less reliant on Coterra as a sole supplier, allowing them to negotiate more favorable terms. For instance, a refiner with its own upstream assets might reduce purchases from Coterra if its internal production costs are lower.

This customer integration directly impacts Coterra's pricing power and sales volume. When customers can substitute Coterra's products with their own internal supply or alternative sources, their willingness to accept higher prices diminishes. This dynamic is particularly relevant in the oil and gas sector where many large players operate across the entire value chain.

- Customer Integration: Major energy companies often have integrated operations, reducing their dependence on external suppliers like Coterra.

- Downstream Capabilities: Possessing refining or distribution assets allows customers to process or move products themselves, strengthening their bargaining position.

- Reduced Dependence: Customers with internal production can absorb price increases or seek alternative suppliers more readily, limiting Coterra's pricing flexibility.

- Impact on Coterra: This integration can lead to lower margins and increased pressure on Coterra to offer competitive pricing and reliable supply.

Coterra Energy faces moderate customer bargaining power. While its diverse customer base, including industrial users and utilities, prevents any single buyer from dominating, the commodity nature of its products means customers can easily switch suppliers based on price. For example, in early 2024, the price of natural gas at the Henry Hub fluctuated, impacting customer purchasing decisions.

Large-volume buyers, such as major energy firms or utility consortia, do possess significant leverage due to the substantial quantities they purchase. These entities can negotiate more favorable terms, especially in a market with ample supply. The balance between spot market sales and long-term contracts also plays a crucial role in shaping customer power.

| Factor | Impact on Coterra | Example (2024 Data) |

| Customer Base Diversity | Lowers individual customer leverage | Industrial consumption spread across multiple sectors |

| Product Interchangeability | Increases customer ability to switch suppliers | WTI crude oil prices influencing purchasing decisions |

| Large-Volume Buyers | Increases customer bargaining power | Top 10 global utilities' significant share of electricity generation |

| Spot vs. Contract Sales | Customer leverage higher in spot markets during oversupply | Henry Hub spot prices around $2.00-$2.50 per MMBtu in early 2024 |

Preview the Actual Deliverable

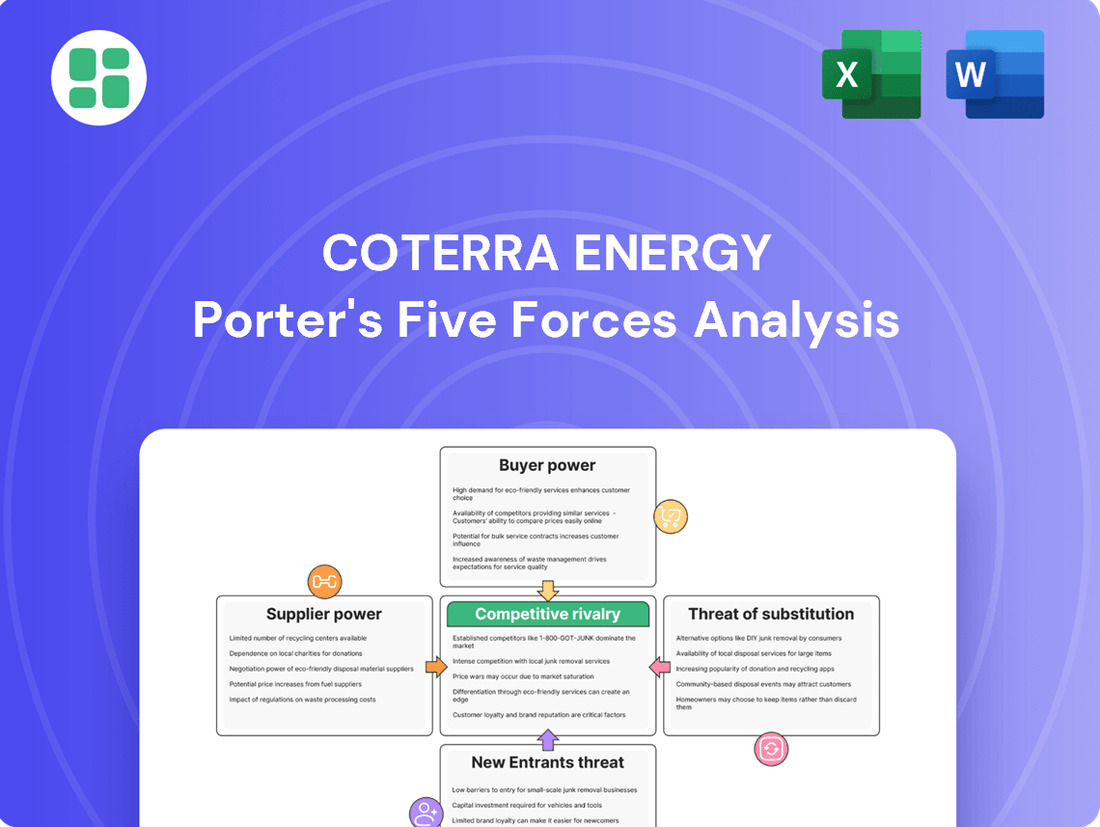

Coterra Energy Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Coterra Energy Porter's Five Forces Analysis details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector.

Rivalry Among Competitors

Coterra Energy operates within intensely competitive unconventional resource plays, including the Permian Basin, Marcellus Shale, and Anadarko Basin. These regions are populated by a significant number of other exploration and production (E&P) companies, creating a crowded marketplace.

This high density of competitors, particularly in more established basins, directly fuels price-based rivalry. For instance, in 2024, the Permian Basin alone saw production exceeding 6 million barrels of oil per day, with numerous operators vying for market share and favorable pricing.

In the oil and gas sector, where products are largely undifferentiated commodities like crude oil and natural gas, competitive rivalry intensely focuses on price. This means companies are constantly vying to offer the lowest prices to attract customers, directly impacting profit margins.

The inherent volatility of commodity prices significantly shapes competitive dynamics. For instance, in 2024, West Texas Intermediate (WTI) crude oil prices have seen fluctuations, trading in a range that impacts the profitability of producers. When prices dip, companies may increase production to maintain sales volume and market share, even if it means lower per-unit profit, leading to more aggressive competition.

Conversely, during periods of high price volatility, companies might adopt more disciplined capital allocation strategies. This involves prioritizing cash flow preservation and reducing capital expenditures to weather potential downturns, rather than engaging in a price war that could deplete reserves and financial strength.

The U.S. upstream oil and gas sector has been a hotbed of merger and acquisition (M&A) activity, driving significant consolidation. This trend has seen larger, well-capitalized companies acquire smaller ones, creating more dominant players. For instance, in 2023, major deals like ExxonMobil's acquisition of Pioneer Natural Resources for $60 billion and Chevron's $53 billion deal for Hess Corporation reshaped the competitive landscape.

This wave of consolidation intensifies rivalry for mid-sized companies such as Coterra Energy. As larger entities absorb competitors, they benefit from enhanced economies of scale, greater bargaining power with suppliers, and increased market share. This can put pressure on Coterra to maintain its competitive edge and operational efficiency to avoid being disadvantaged by these larger, more formidable rivals.

Operational Efficiency and Cost Structure

Companies that can operate more efficiently and manage their costs effectively, like Coterra Energy, often have a significant advantage in the energy sector. This focus on disciplined capital allocation and reducing well costs directly translates into a stronger competitive position. Coterra's commitment to these principles helps them maintain profitability even when commodity prices are lower, which is a key differentiator in this industry.

For instance, Coterra reported a total capital expenditure of $1.1 billion in 2023, a figure demonstrating their focused approach to investment. Their efforts in well cost reduction are crucial; in the Permian Basin, they achieved average well costs of approximately $7.8 million in 2023, down from previous years. This cost efficiency allows them to generate free cash flow even in fluctuating market conditions.

- Lower operating costs provide a buffer against commodity price volatility.

- Capital efficiency, seen in disciplined spending and well cost reductions, enhances profitability.

- Coterra's 2023 capital expenditure of $1.1 billion reflects their strategic cost management.

- Achieving average Permian well costs around $7.8 million in 2023 highlights their operational improvements.

Asset Quality and Inventory Depth

Competitive rivalry in the energy sector is heavily influenced by the quality and depth of a company's asset base. Access to high-quality, long-life reserves and a robust inventory of future drilling locations are paramount for maintaining a sustained competitive edge. Companies with superior reserves can operate more efficiently and profitably over the long term, giving them an advantage in a capital-intensive industry.

Coterra Energy's strategy of maintaining a diversified portfolio across multiple basins directly addresses this competitive pressure. This diversification not only spreads operational risk but also ensures a consistent supply of future development opportunities. As of their 2023 reporting, Coterra highlighted an estimated 15 years of high-quality inventory, a significant factor in its ability to navigate market fluctuations and sustain production levels.

- Asset Quality: Coterra's focus on acquiring and developing premium reserves, characterized by lower extraction costs and longer economic lives, directly impacts its competitive standing.

- Inventory Depth: An extensive inventory of undeveloped locations allows for flexible capital allocation and provides a clear runway for future growth, a key differentiator among peers.

- Basin Diversification: Operating in multiple, distinct geological basins, such as the Permian, Marcellus, and Anadarko, reduces reliance on any single region and mitigates localized operational or regulatory risks.

- Long-Term Viability: The estimated 15-year inventory of high-quality drilling locations underscores Coterra's commitment to long-term operational planning and its capacity to generate sustained cash flows.

Competitive rivalry is intense in the oil and gas sector, especially in key basins like the Permian, where production exceeded 6 million barrels per day in 2024, with numerous operators vying for market share. As a commodity market, competition often centers on price, directly impacting profit margins for companies like Coterra. The sector is also experiencing significant consolidation, with major acquisitions in 2023 reshaping the competitive landscape and putting pressure on mid-sized players to maintain efficiency.

| Metric | Coterra Energy (2023/2024 Estimates) | Industry Context |

|---|---|---|

| Permian Basin Production | N/A (Company Specific) | >6 million bpd (2024) |

| Capital Expenditure | $1.1 billion (2023) | Reflects disciplined spending |

| Permian Well Costs | ~$7.8 million (2023) | Demonstrates cost efficiency |

| Inventory Life | 15 years (estimated) | Key for sustained operations |

SSubstitutes Threaten

The accelerating global shift towards renewable energy sources like solar and wind power presents a substantial long-term threat to Coterra Energy's core business. As these cleaner alternatives become more cost-competitive and widely adopted, demand for natural gas and oil is likely to diminish. In 2024, for instance, renewable energy sources are projected to account for a significant portion of new electricity generation capacity globally, directly impacting the market for fossil fuels.

The increasing adoption of electric vehicles (EVs) poses a significant threat to Coterra Energy by directly impacting the demand for crude oil. As more consumers switch to EVs, the reliance on gasoline, a primary derivative of crude oil, diminishes. This shift could lead to a structural decline in demand for Coterra's core product.

In 2024, EV sales continued their upward trajectory, accounting for a notable percentage of new vehicle registrations globally. For instance, by the end of 2024, it's projected that EVs will represent over 20% of all new car sales in major markets like Europe and China, a substantial increase from previous years. This growing market share directly translates to reduced gasoline consumption, a critical factor for Coterra's oil business segment.

While the complete displacement of oil demand by EVs will be a gradual process, the accelerating pace of EV adoption presents a clear and present danger. Coterra must consider that a sustained increase in EV market penetration could fundamentally alter the long-term demand outlook for crude oil, potentially impacting pricing and overall revenue for its oil operations.

Advancements in energy efficiency are a significant threat to Coterra Energy. For instance, in 2024, the International Energy Agency (IEA) reported that global energy efficiency improvements are on track to save the equivalent of the entire energy demand of the European Union. This reduction in overall energy consumption directly lowers the demand for oil and natural gas, Coterra's core products.

These continuous improvements across industrial, commercial, and residential sectors act as a persistent substitute. As buildings become better insulated and appliances more efficient, the need for heating and cooling decreases, impacting demand for natural gas. Similarly, more fuel-efficient vehicles reduce the consumption of gasoline and diesel, affecting oil demand.

Policy and Regulatory Push for Decarbonization

Global and national policies are increasingly pushing for decarbonization, creating a significant threat from substitutes for companies like Coterra Energy. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, places a price on carbon emissions for imported goods, making fossil fuels less competitive. Similarly, the Inflation Reduction Act in the United States offers substantial tax credits for renewable energy projects, accelerating the adoption of alternatives.

These regulatory shifts directly favor substitutes by making them more economically viable and attractive. Countries are setting ambitious emissions reduction targets, such as the United States aiming for a 50-52% reduction from 2005 levels by 2030, which necessitates a move away from traditional energy sources. This policy-driven environment elevates the threat of substitutes by actively discouraging fossil fuel consumption and promoting cleaner energy alternatives.

- Carbon Pricing Mechanisms: Policies like carbon taxes and cap-and-trade systems, as seen in California's cap-and-trade program, increase the cost of carbon-intensive energy.

- Emissions Regulations: Stricter standards on greenhouse gas emissions from power plants and vehicles, such as those proposed by the EPA in 2023, directly impact fossil fuel demand.

- Incentives for Renewables: Tax credits and subsidies for solar, wind, and other renewable energy sources, like the 2024 extension of the Investment Tax Credit (ITC) for solar power, make substitutes more competitive.

- International Agreements: Commitments under the Paris Agreement drive national policies that favor decarbonization and, consequently, substitutes for fossil fuels.

Alternative Fuels and Technologies

The threat of substitutes for Coterra Energy, particularly concerning alternative fuels and technologies, is a growing concern. While not yet a dominant force, innovations in areas like green hydrogen production and advanced battery storage are steadily advancing. These emerging technologies represent potential long-term challenges to the demand for traditional hydrocarbon fuels.

The energy sector is witnessing significant investment in these alternatives. For instance, global investment in clean energy technologies, including renewables and storage, reached an estimated $1.7 trillion in 2023, according to the International Energy Agency. This substantial capital flow fuels research and development, accelerating the viability and adoption of these substitutes.

- Hydrogen Economy Growth: Projections suggest the global hydrogen market could reach $2.5 trillion by 2050, driven by decarbonization efforts.

- Battery Storage Deployment: The global energy storage market is expected to grow significantly, with battery storage capacity projected to increase by over 500 GW by 2030.

- EV Adoption Rates: Electric vehicle sales continue to climb, with global sales accounting for approximately 14% of the total car market in 2023, impacting gasoline and diesel demand.

The threat of substitutes for Coterra Energy is multifaceted, encompassing the rise of renewable energy, electric vehicles, and advancements in energy efficiency. These alternatives directly challenge the demand for Coterra's core products: oil and natural gas. The accelerating global transition to cleaner energy sources, coupled with supportive government policies and technological innovation, intensifies this threat.

In 2024, the energy landscape continued to shift, with renewables like solar and wind capturing a larger share of new capacity. Electric vehicle adoption also saw sustained growth, impacting gasoline demand. Furthermore, energy efficiency measures are reducing overall consumption across sectors, collectively diminishing the market for fossil fuels.

| Substitute Category | Key Trend | Impact on Coterra | 2024 Data/Projection |

|---|---|---|---|

| Renewable Energy | Increasing cost-competitiveness and adoption | Reduces demand for natural gas and oil in power generation | Renewables projected to account for a significant portion of new global electricity capacity |

| Electric Vehicles (EVs) | Rapidly growing market share | Directly reduces demand for gasoline and diesel | EVs expected to represent over 20% of new car sales in major markets by year-end 2024 |

| Energy Efficiency | Continuous improvements across sectors | Lowers overall energy consumption, impacting demand for all fossil fuels | Global energy efficiency gains on track to save energy equivalent to the EU's total demand |

Entrants Threaten

The exploration, development, and production of oil and natural gas demand enormous upfront capital. Coterra Energy, like its peers, faces this barrier, as significant investments are needed for land acquisition, drilling rigs, pipelines, and advanced extraction technologies. For instance, a single shale well can cost millions to drill and complete, creating a formidable hurdle for newcomers.

The availability of high-quality, commercially viable unconventional resource plays presents a significant barrier to entry. Established companies like Coterra Energy often hold extensive acreage positions, effectively controlling access to these valuable assets. For instance, as of the first quarter of 2024, Coterra reported a substantial leasehold position in the Permian Basin, a highly sought-after unconventional resource play.

The oil and gas sector faces substantial regulatory and environmental hurdles that act as a significant deterrent to new entrants. Companies must navigate a complex web of permits, stringent environmental standards, and rigorous safety protocols. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce strict methane emission regulations, impacting operational costs and requiring advanced compliance technologies, which can be prohibitively expensive for startups.

Technological Complexity and Expertise

The threat of new entrants into the oil and gas sector, particularly in complex unconventional resource plays like those Coterra Energy operates in, is significantly mitigated by high technological complexity and the need for specialized expertise. Success hinges on advanced geological understanding, mastery of sophisticated drilling techniques such as horizontal drilling and hydraulic fracturing, and deep operational know-how. Newcomers often struggle to replicate the accumulated technical acumen and experienced workforce that established players like Coterra possess.

This technical barrier is substantial. For instance, the capital expenditure for a single unconventional well pad can easily reach tens of millions of dollars, with the technology and expertise required to maximize recovery being a critical differentiator. In 2024, the industry continued to see significant investment in advanced seismic imaging and data analytics, further raising the bar for entry. Companies that cannot afford or access these cutting-edge technologies or the skilled personnel to operate them will find it exceedingly difficult to compete effectively against incumbents with proven track records and optimized processes.

- High Capital Investment: Unconventional drilling requires substantial upfront capital for specialized equipment and technology.

- Specialized Skill Sets: Expertise in geology, reservoir engineering, and advanced drilling techniques is paramount.

- Operational Experience: Proven ability to manage complex operations and optimize production is a key advantage for incumbents.

- Technological Advancement: Continuous investment in R&D and adoption of new technologies creates a moving target for potential entrants.

Established Infrastructure and Supply Chains

Established energy exploration and production (E&P) companies, like Coterra Energy, benefit significantly from their existing infrastructure and deeply entrenched supply chains. These established players have cultivated long-standing relationships with crucial service providers, ensuring preferential access and potentially better pricing for drilling, completion, and transportation services. For instance, in 2024, the cost of oilfield services saw fluctuations, with some key inputs experiencing price increases, making it harder for newcomers to secure competitive rates without established partnerships.

New entrants face a substantial hurdle in replicating this integrated network. They would need to invest heavily in building their own pipeline access, storage facilities, and logistics capabilities, or negotiate new, likely less favorable, terms with existing providers. This upfront capital expenditure and the time required to forge these essential connections represent a significant barrier to entry, increasing the overall cost and operational complexity for any company aiming to compete in the E&P sector.

Consider the following points regarding established infrastructure:

- Existing E&P companies benefit from established relationships with service providers, access to pipeline networks, and integrated supply chains.

- New entrants would need to build these relationships and infrastructure from scratch, adding to costs and operational complexities.

- In 2024, the average cost for a horizontal well completion in the Permian Basin, a key region for many E&P companies, could range from $5 million to $9 million, a figure that would be significantly inflated for a new entrant lacking established service contracts.

The significant capital required for exploration, drilling, and infrastructure development acts as a major deterrent for new companies entering the oil and gas sector. Coterra Energy, like its peers, benefits from its established financial capacity to undertake these high-cost ventures. For instance, the average cost to drill and complete a horizontal well in the Permian Basin in 2024 could range from $5 million to $9 million, a substantial barrier for potential entrants lacking access to similar funding.

Access to high-quality reserves and the technical expertise to exploit them efficiently are critical. Coterra’s extensive acreage in prime unconventional plays, such as the Permian Basin, limits the availability of prime locations for newcomers. Furthermore, mastering advanced techniques like horizontal drilling and hydraulic fracturing, coupled with deep operational knowledge, presents a steep learning curve and requires significant investment in specialized talent and technology, which many new entrants may not possess.

Regulatory compliance and environmental standards add another layer of complexity and cost. Navigating permits, emissions regulations, and safety protocols demands substantial resources and specialized knowledge. For example, the U.S. EPA’s continued enforcement of methane emission rules in 2024 necessitates investment in advanced compliance technologies, potentially doubling the operational burden for startups compared to established players with existing systems.

Established players like Coterra leverage existing infrastructure and supply chains, securing competitive advantages in service costs and logistics. New entrants must either build this infrastructure or negotiate less favorable terms with service providers. In 2024, the cost of oilfield services experienced volatility, making it harder for new companies without established relationships to secure essential resources at competitive rates.

| Barrier | Description | 2024 Impact Example |

| Capital Intensity | High upfront investment for exploration, drilling, and infrastructure. | Permian Basin horizontal well completion: $5M - $9M |

| Resource Access & Expertise | Control of prime acreage and specialized technical knowledge. | Coterra's extensive Permian leasehold |

| Regulatory & Environmental | Complex compliance with permits, emissions, and safety standards. | Methane emission regulations requiring advanced compliance tech |

| Infrastructure & Supply Chain | Existing pipelines, service contracts, and logistics networks. | Fluctuating oilfield service costs impacting new entrants |

Porter's Five Forces Analysis Data Sources

Our Coterra Energy Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Coterra's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific data from reputable sources like the EIA and market research firms to provide a robust competitive landscape.