Corsair SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsair Bundle

Corsair's strong brand loyalty and diverse product portfolio are significant strengths, but they face intense competition and evolving technological landscapes. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Corsair's market position, potential threats, and avenues for growth? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

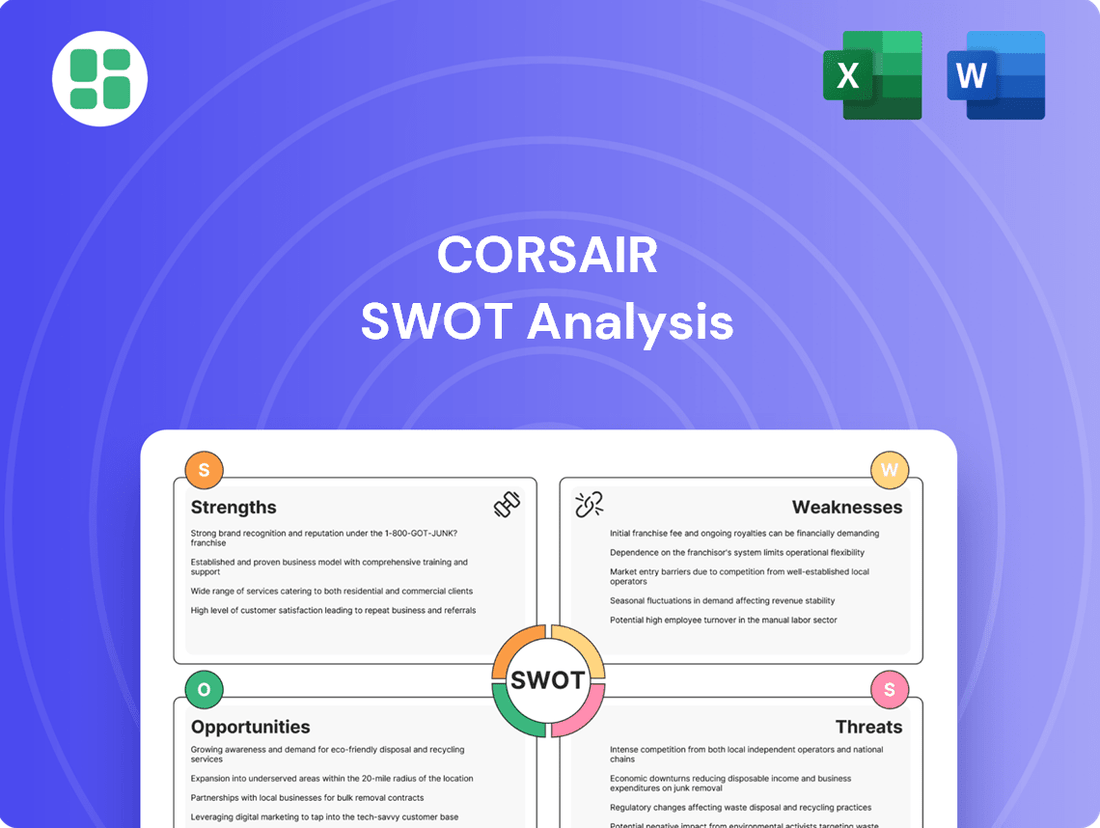

Strengths

Corsair boasts an incredibly diverse product lineup, spanning essential PC components like memory and power supplies to high-demand gaming peripherals such as keyboards, mice, and headsets. This comprehensive offering also extends to specialized areas like streaming equipment and fully assembled gaming PCs, effectively capturing a broad spectrum of the gaming and content creation market.

This wide-ranging portfolio significantly mitigates the company's dependence on any single product category, providing a more stable revenue stream. For instance, in Q1 2024, Corsair reported net revenue of $321.6 million, with their components and systems segment contributing $163.3 million and their peripherals and systems segment contributing $158.3 million, showcasing a balanced performance across divisions.

Strategic acquisitions have been instrumental in bolstering Corsair's ecosystem and market penetration. The integration of brands like Elgato, SCUF Gaming, Drop, and Fanatec has not only expanded their product offerings but also deepened their engagement with core enthusiast communities, further solidifying their position in the gaming and tech accessory landscape.

Corsair has cultivated a powerful brand identity over more than twenty years, becoming synonymous with quality and performance in the competitive gaming and PC enthusiast sectors. This long-standing reputation has translated into a deeply loyal customer base that trusts the brand's commitment to excellence.

The company's dedication to high-performance products has fostered genuine authenticity, creating a passionate community around its offerings. This strong brand equity is a significant asset, driving repeat purchases and positive word-of-mouth referrals.

Corsair's market leadership in key product categories within the U.S. underscores this loyalty; for instance, in Q1 2024, their PC components and peripherals segment continued to show robust consumer preference, with several product lines holding over 25% market share.

Corsair's dedication to innovation is evident in its consistent investment in research and development, fueling the launch of cutting-edge products. This commitment led to the introduction of the VIRTUOSO MAX headset and the HXi Series power supplies, alongside new GPU-optimized cases, demonstrating their drive to stay ahead in the competitive tech market.

Furthermore, Corsair is actively integrating artificial intelligence into its offerings, as seen with Elgato's AI Prompter and AiCoustic tools. This strategic move positions the company at the forefront of technological advancements, anticipating and shaping future market demands.

Strategic Acquisitions and Ecosystem Integration

Corsair's strategic acquisitions have significantly broadened its market reach and diversified its revenue base. By integrating complementary brands such as Elgato, known for its streaming equipment, SCUF Gaming for performance controllers, Drop for mechanical keyboards, and Fanatec for sim racing peripherals, Corsair has effectively expanded its product portfolio.

This approach fosters a more cohesive ecosystem, enabling Corsair to offer end-to-end solutions that enhance overall customer value. For instance, a gamer can now outfit their entire setup, from PC components to peripherals and streaming gear, all under the Corsair umbrella, creating a sticky customer relationship.

- Market Expansion: Acquisitions like Elgato and SCUF Gaming have opened new customer segments in streaming and competitive gaming.

- Revenue Diversification: Corsair's revenue streams are less reliant on PC components alone, now including accessories and specialized gaming equipment.

- Ecosystem Synergy: Integration allows for cross-promotional opportunities and bundled offerings, increasing average revenue per user.

- Brand Portfolio Growth: The company has successfully integrated several reputable brands, strengthening its overall market position.

Adaptable Supply Chain and Tariff Mitigation

Corsair has shown impressive adaptability in managing its supply chain, particularly in response to trade tensions. By actively reducing its dependence on China for goods destined for the U.S. market, the company has strategically diversified its production base to other Southeast Asian countries. This proactive approach is crucial for mitigating the impact of tariffs and ensuring consistent product availability for its customers.

This supply chain flexibility directly translates into cost efficiency and resilience. For example, in recent years, many electronics manufacturers have faced increased costs due to tariffs. Corsair's ability to shift production allows it to absorb some of these cost pressures, maintaining competitive pricing. This strategic move also safeguards against potential disruptions, ensuring that Corsair can continue to deliver its gaming peripherals and components even when global trade landscapes are uncertain.

- Supply Chain Diversification: Corsair has strategically moved production away from China to other Southeast Asian locations.

- Tariff Mitigation: This shift helps to offset the financial impact of tariffs on U.S. imports.

- Product Availability: The adaptability ensures that Corsair's products remain accessible to consumers despite trade uncertainties.

- Cost Efficiency: By managing production locations effectively, Corsair can maintain competitive pricing and operational costs.

Corsair's extensive product range, covering everything from core PC components to gaming peripherals and streaming gear, provides significant market breadth. This diversification, evidenced by Q1 2024 net revenue of $321.6 million split almost evenly between components and peripherals, reduces reliance on any single product line.

Strategic acquisitions, such as Elgato and SCUF Gaming, have broadened Corsair's reach and diversified revenue streams, creating a more robust ecosystem. This integration allows for cross-promotional opportunities and bundled offerings, enhancing customer value and brand loyalty.

The company's strong brand equity, built over two decades, is a key strength, fostering a loyal customer base that values quality and performance. This brand recognition is reflected in market leadership, with several product lines holding over 25% market share in the U.S. as of Q1 2024.

Corsair's commitment to innovation, including AI integration with tools like Elgato's AI Prompter, positions it at the forefront of technological advancements. This focus on R&D fuels the launch of cutting-edge products, ensuring continued relevance in the fast-evolving tech market.

What is included in the product

Analyzes Corsair’s competitive position through key internal and external factors, highlighting its strong brand and product portfolio against market challenges and evolving consumer demands.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Corsair's significant reliance on the PC gaming market presents a notable weakness. A substantial portion of its revenue, especially from Gaming Components and Systems, is directly linked to the ebb and flow of PC building and upgrading trends.

This dependence was evident in 2024, as the company saw a downturn in this segment. Factors like the normalization of demand post-pandemic and delays in key graphics card releases contributed to reduced sales, impacting Corsair's overall financial performance.

Corsair has faced a challenging financial period, reporting net losses for 2022, 2023, and projecting a significant net loss for 2024. Despite some positive movement in gross margins within specific product categories, the company continues to grapple with overall margin pressures. This persistent profitability challenge means Corsair has yet to fully regain consistent financial health following the surge in demand experienced during the peak gaming boom.

Corsair operates in a gaming hardware market characterized by intense competition and fragmentation, featuring a multitude of global and local manufacturers vying for consumer attention. This crowded landscape presents a significant challenge for market share expansion.

Some market observers suggest Corsair's brand perception might not carry the same weight as certain rivals, particularly those originating from the Asia-Pacific region. This perceived gap in brand strength, coupled with potentially less aggressive pricing strategies compared to some competitors, could impede Corsair's ability to capture a larger portion of the market in the coming years.

High Debt Levels Relative to EBITDA

Corsair's financial structure reveals significant leverage, with its debt load presenting a substantial multiple against its Last Twelve Months (LTM) EBITDA. This high degree of financial risk could become particularly problematic if the company faces economic downturns or if its earnings growth falters unexpectedly.

For instance, data as of early 2024 indicated a debt-to-EBITDA ratio that warrants careful monitoring. This leverage means that a larger portion of operating income is dedicated to servicing debt, potentially limiting financial flexibility for investments or shareholder returns.

- High Debt-to-EBITDA Ratio: Corsair's debt levels are notably high when compared to its earnings before interest, taxes, depreciation, and amortization.

- Financial Risk Exposure: This leverage amplifies the company's vulnerability to market slowdowns and potential dips in profitability.

- Limited Financial Flexibility: A significant portion of operating income is allocated to debt servicing, potentially constraining capital for growth initiatives.

Potential for Diminishing Returns from Acquisitions

Corsair's growth has often been fueled by acquisitions, but there's a concern that the benefits from recent deals might be leveling off. Some analysts point to modest revenue growth alongside these acquisitions, questioning if they're truly creating a lasting competitive advantage or substantially boosting profit margins. The real test will be how effectively Corsair integrates these acquired businesses and unlocks their long-term value.

For instance, while Corsair acquired brands like Elgato and SCUF Gaming, the integration process is key to realizing synergistic benefits. Without seamless integration, the potential for diminishing returns on these investments increases. The company's ability to translate these acquisitions into tangible improvements in market share and profitability will be closely watched in the coming fiscal years, especially as the gaming and PC component markets evolve.

- Integration Challenges: Successfully merging new companies into Corsair's existing structure is vital for realizing acquisition benefits.

- Margin Improvement: The extent to which recent acquisitions contribute to higher profit margins remains a key performance indicator.

- Competitive Edge: The sustainability of the competitive advantage gained from these acquisitions needs to be demonstrated through market performance.

Corsair's significant reliance on the PC gaming market makes it vulnerable to industry fluctuations. For example, in 2024, the company experienced a slowdown in its Gaming Components and Systems segment due to normalized post-pandemic demand and delayed graphics card releases, impacting overall sales.

The company has struggled with profitability, reporting net losses for 2022, 2023, and projecting a significant net loss for 2024. Despite some gross margin improvements in certain product lines, persistent margin pressures hinder Corsair's return to consistent financial health.

Corsair faces intense competition in a fragmented gaming hardware market, making it challenging to expand market share. Additionally, its brand perception may not be as strong as some Asia-Pacific rivals, and its pricing strategies might be less aggressive, potentially limiting its ability to capture more of the market.

Corsair's substantial debt load, with a high debt-to-EBITDA ratio as of early 2024, poses a significant financial risk. This leverage means a larger portion of operating income is used for debt servicing, which could restrict financial flexibility for investments or shareholder returns, especially during economic downturns.

Full Version Awaits

Corsair SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Corsair's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Corsair SWOT analysis, ready for your strategic planning.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, giving you immediate access to valuable insights.

Opportunities

The upcoming launch of new high-performance graphics processing units (GPUs), like NVIDIA's anticipated RTX 50 series, is poised to invigorate the PC market. This refresh cycle, expected to gain significant momentum throughout 2025, should translate into a substantial increase in demand for PC components and complete system builds.

This presents a prime opportunity for Corsair, particularly within its Gaming Components and Systems division. A strong GPU launch can directly boost sales of power supplies, memory, cooling solutions, and cases, all key products for Corsair. For instance, the gaming PC market saw a notable uptick in component sales during previous GPU upgrade cycles, and the 2025 refresh is widely expected to follow suit, potentially driving double-digit growth in this segment for Corsair.

Corsair's Gamer and Creator Peripherals segment is a significant growth engine, consistently delivering year-over-year revenue increases and healthier gross margins than its components business. This trend highlights a strategic shift towards higher-value, consumer-facing products.

The company's ongoing investment in innovation within this space, encompassing everything from advanced streaming gear to emerging markets like sim racing peripherals, presents a clear path for continued expansion. For instance, Corsair's Q1 2024 earnings reported a substantial uptick in their gaming and streaming product lines, reflecting strong consumer demand for these specialized items.

Corsair can capitalize on the growing virtual reality (VR) and augmented reality (AR) markets by developing specialized peripherals, such as high-performance headsets and controllers. The cloud gaming sector also presents a significant opportunity for Corsair to integrate its components and software solutions, enhancing the user experience for a broader audience.

The company's strategic focus on AI integration across its product ecosystem, from gaming mice to PC components, can create smarter, more responsive user experiences. This AI push, combined with expansion into non-China Asian markets like Japan and South Korea, where gaming and tech adoption are high, offers substantial avenues for revenue growth and market share expansion in the 2024-2025 period.

Strategic Partnerships and Customization Offerings

Corsair's strategic partnerships with major gaming franchises, such as Call of Duty and the highly anticipated Starfield, are a significant opportunity. These collaborations allow for the creation of branded product lines, directly tapping into established fan bases and ensuring sustained demand for peripherals and components. This not only boosts sales but also significantly enhances Corsair's brand visibility within the core gaming community.

Furthermore, Corsair's investment in expanding its custom labs platforms presents a compelling opportunity. This caters directly to the growing consumer preference for personalization, enabling gamers to customize their peripherals. For example, the ability to select specific keycaps, switches, and even RGB lighting profiles allows users to create truly unique gaming setups, fostering brand loyalty and potentially commanding premium pricing.

These initiatives are crucial in the competitive gaming hardware market. In 2024, the global gaming market was projected to reach over $200 billion, with a significant portion driven by PC gaming hardware and accessories. Corsair's ability to leverage these partnerships and customization options positions them to capture a larger share of this lucrative market.

- Franchise Collaborations: Partnerships with titles like Call of Duty and Starfield drive demand for co-branded products.

- Customization Growth: Expanding custom labs platforms meets the increasing consumer desire for personalized gaming peripherals.

- Market Penetration: These strategies are vital for capturing market share in the rapidly growing global gaming industry, which saw significant growth in 2024.

Growing Esports and Content Creation Ecosystems

The esports and content creation industries are booming, presenting significant opportunities. The global esports audience reached over 570 million viewers in 2023, a number projected to grow substantially. This expanding viewership directly translates to increased demand for the high-performance peripherals, streaming gear from Elgato, and specialized controllers from SCUF Gaming that Corsair offers.

Corsair is strategically positioned to capitalize on these trends.

- Expanding Audience: The global esports audience is projected to reach 640 million by 2025, up from 570 million in 2023.

- Streaming Growth: Streaming platforms continue to experience robust user engagement, driving demand for creator tools.

- Brand Synergy: Corsair's Elgato and SCUF Gaming brands align perfectly with the needs of this growing ecosystem.

Corsair can leverage the anticipated 2025 GPU refresh cycle to boost sales of its PC components and systems, capitalizing on increased demand for high-performance hardware.

The company's focus on its Gamer and Creator Peripherals segment, which has shown consistent year-over-year revenue growth and higher margins, offers a strong avenue for continued expansion through innovation in areas like streaming gear and sim racing.

Strategic partnerships with major gaming franchises and the expansion of custom labs platforms cater to consumer demand for branded and personalized products, enhancing brand loyalty and market penetration in the lucrative global gaming market.

The booming esports and content creation industries present a significant opportunity for Corsair, with growing audiences driving demand for its high-performance peripherals and creator tools from brands like Elgato and SCUF Gaming.

| Opportunity Area | Key Driver | Corsair Brand/Product Relevance | 2024-2025 Data Point |

| PC Component Sales | New High-Performance GPUs (e.g., RTX 50 Series) | Power Supplies, Memory, Cooling, Cases | PC gaming hardware market projected to continue significant growth in 2024-2025. |

| Peripherals & Creator Gear | Esports & Content Creation Boom | Elgato Streaming Gear, SCUF Gaming Controllers | Global esports audience projected to reach 640 million by 2025. |

| Personalization | Consumer Demand for Customization | Custom Labs Platforms (Keycaps, Switches) | Growing trend in gaming accessory market for personalized options. |

| Brand Engagement | Gaming Franchise Partnerships | Co-branded Peripherals and Components | Partnerships with titles like Call of Duty and Starfield drive direct sales. |

Threats

Corsair faces a fiercely competitive landscape in gaming hardware, where established brands and emerging players constantly battle for consumer attention. This dynamic environment often translates into significant pricing pressure, particularly from competitors in the Asia-Pacific (APAC) region known for their aggressive cost structures. For instance, in 2024, the global gaming peripherals market, a key segment for Corsair, was projected to reach over $12 billion, highlighting the sheer volume of competition and the constant need to differentiate beyond price.

Global economic downturns and persistent inflation pose a significant threat to Corsair. During economic instability, consumers tend to cut back on discretionary spending, which directly impacts purchases of premium gaming peripherals and high-performance PC components. For instance, during periods of economic uncertainty, sales of enthusiast-level hardware can see a noticeable dip as consumers prioritize essential goods over luxury tech upgrades.

Global supply chain vulnerabilities remain a significant concern for Corsair. Events like the ongoing disruptions in the Red Sea have driven up freight costs, impacting delivery times and increasing operational expenses. For instance, shipping costs from Asia to Europe saw substantial increases throughout late 2023 and early 2024 due to these geopolitical tensions.

Furthermore, persistent trade tensions and the potential for new tariffs between major economic blocs present a continuous threat to Corsair's profitability. These factors can directly affect the cost of components and finished goods, squeezing profit margins if not effectively managed through pricing adjustments or sourcing strategies.

Rapid Technological Obsolescence and Innovation Pace

The gaming industry's relentless technological evolution poses a significant threat to Corsair. Products can become outdated swiftly, necessitating ongoing, substantial investments in research and development to stay competitive. For instance, the shift towards higher refresh rate monitors and more powerful graphics cards means that even recent product lines can quickly feel underpowered.

Corsair's ability to innovate at a rapid pace and accurately anticipate future technological trends is crucial. A misstep in predicting the next generation of gaming hardware or software could lead to a substantial loss of market share. In 2024, the increasing demand for AI-powered gaming experiences and cloud-based gaming infrastructure highlights the need for adaptable product roadmaps.

- Rapid R&D Investment: Corsair must continually allocate significant capital to R&D to keep pace with technological advancements in areas like PC components, peripherals, and streaming gear.

- Market Share Risk: Failure to innovate quickly or accurately forecast next-gen trends, such as the integration of advanced AI in gaming, could cede market share to more agile competitors.

- Product Lifecycle Management: The swift obsolescence of technology requires efficient product lifecycle management to minimize inventory risk and ensure new offerings meet current demand.

Brand Perception and Marketing Challenges

Corsair's brand perception, while generally positive among enthusiasts, may not resonate as broadly as some top-tier competitors. The company's marketing strategy leans heavily on organic growth and endorsements from professional gamers and streamers. A potential vulnerability arises if these key influencers shift their allegiances or if Corsair fails to secure new, high-profile partnerships, which could directly impact its market standing and sales in a sector heavily influenced by online personalities.

For instance, while specific endorsement values are proprietary, the esports and streaming market saw significant growth, with top streamers earning millions annually in 2024. A decline in Corsair's visibility through these channels could mean missing out on crucial consumer touchpoints.

- Brand Perception Gap: Corsair's brand recognition might lag behind industry leaders in broader consumer segments.

- Influencer Dependency: Heavy reliance on pro-player and streamer endorsements creates a risk if these relationships weaken.

- Marketing Reach: A lack of diverse or high-impact marketing campaigns could limit reach beyond its core enthusiast base.

Corsair faces intense competition from both established brands and new entrants, leading to pricing pressures, especially from cost-competitive APAC manufacturers. The global gaming peripherals market, valued at over $12 billion in 2024, exemplifies this crowded space. Economic downturns and inflation also threaten sales as consumers reduce discretionary spending on premium gaming gear. Supply chain disruptions, such as those impacting Red Sea shipping, continue to increase freight costs and delivery times, affecting operational expenses throughout late 2023 and early 2024.

Trade tensions and potential tariffs between major economies can escalate component and finished goods costs, impacting Corsair's profit margins. The rapid pace of technological advancement in gaming requires substantial, ongoing R&D investment to prevent product obsolescence. Failure to innovate or accurately predict future trends, like AI integration in gaming, risks significant market share loss, as seen in the evolving demand for AI-powered gaming experiences in 2024.

Corsair's brand perception, while strong with enthusiasts, may not match that of some top competitors. A reliance on endorsements from professional gamers and streamers presents a vulnerability if these partnerships falter or if new, high-profile collaborations are not secured, potentially impacting sales in a market heavily influenced by online personalities. Top streamers earned millions in 2024, underscoring the importance of visibility through these channels.

| Threat Category | Specific Threat | Impact on Corsair | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Aggressive pricing from APAC competitors | Reduced profit margins, market share erosion | Global gaming peripherals market projected > $12 billion in 2024 |

| Economic Factors | Global economic downturns, inflation | Decreased discretionary spending on premium gaming products | Consumer spending on electronics sensitive to economic sentiment |

| Supply Chain | Geopolitical disruptions (e.g., Red Sea) | Increased freight costs, delivery delays, higher operational expenses | Shipping costs saw substantial increases late 2023-early 2024 |

| Trade Policy | Trade tensions, potential tariffs | Increased cost of goods, squeezed profit margins | Ongoing trade dialogues impact global component sourcing |

| Technological Change | Rapid product obsolescence, need for constant R&D | Risk of losing market share to faster innovators | Demand for AI-powered gaming and cloud gaming infrastructure growing |

| Brand & Marketing | Dependency on influencer endorsements | Potential loss of visibility and sales if influencer relationships weaken | Top streamers earned millions annually in 2024 |

SWOT Analysis Data Sources

This Corsair SWOT analysis is built upon a foundation of credible data, including their latest financial filings, comprehensive market research reports, and expert analyses of the gaming and PC component industries.