Corsair Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsair Bundle

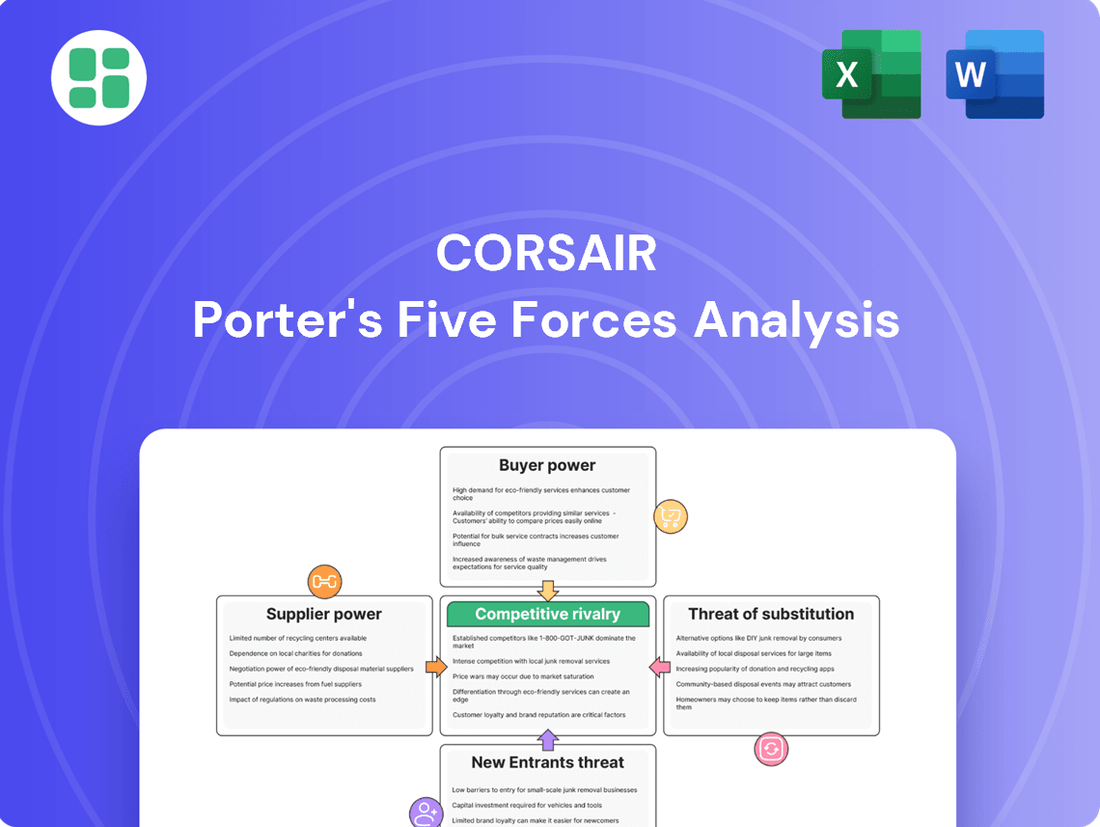

Corsair operates in a dynamic market, facing intense competition and evolving customer demands. Understanding the interplay of supplier power, buyer bargaining, and the threat of substitutes is crucial for their success.

The complete report reveals the real forces shaping Corsair’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Corsair's reliance on a limited number of key component suppliers, such as those providing DRAM, NAND flash, and GPU chipsets, grants these suppliers considerable bargaining power. This concentration means Corsair has fewer alternative sources for essential parts, particularly when demand surges or supply chains face disruptions. For instance, in early 2024, the global semiconductor shortage continued to impact component availability and pricing, directly affecting companies like Corsair that depend on a few major chip manufacturers.

Corsair faces significant supplier bargaining power when it comes to highly integrated or proprietary components. Switching these specialized parts often necessitates costly product redesigns and extensive re-qualification processes, which can take months. For instance, in 2024, the semiconductor industry continued to experience lead times for certain advanced chips, making it difficult and expensive for companies like Corsair to quickly change their component suppliers without substantial disruption and investment.

Suppliers possessing proprietary technology, such as patents for advanced cooling solutions or unique component designs, can significantly enhance their bargaining power. This exclusivity makes it difficult for Corsair to find readily available substitutes, potentially forcing them to accept higher prices or less favorable contract terms. For instance, a supplier holding a patent on a specific type of high-speed memory module essential for premium gaming PCs could dictate terms, impacting Corsair's production costs and product pricing.

Impact of global supply chain disruptions

Global supply chain disruptions, like those experienced in 2021-2022, significantly bolster supplier bargaining power. When external factors such as geopolitical tensions or natural disasters interrupt production, suppliers who can still deliver critical components gain leverage. This can force companies like Corsair to accept higher prices or face production delays, impacting their ability to launch new products on time.

The impact of these disruptions is substantial. For instance, the semiconductor shortage, which began in late 2020 and continued through much of 2022, saw lead times for certain chips extend to over a year. This scarcity meant suppliers could dictate terms, leading to increased component costs for electronics manufacturers. Corsair, heavily reliant on these components for its gaming peripherals and PC parts, would have faced these challenges directly.

- Increased Component Costs: Suppliers can command premium prices due to limited availability.

- Extended Lead Times: Delays in receiving essential parts can halt production.

- Reduced Product Availability: Shortages can lead to stockouts and lost sales opportunities for Corsair.

- Shift in Negotiation Power: Suppliers gain the upper hand in price and delivery negotiations.

Supplier's ability to forward integrate

A key supplier's ability to forward integrate, meaning they could start producing PC components or peripherals themselves, significantly boosts their bargaining power over Corsair. This threat can pressure Corsair to secure favorable terms and maintain strong supplier relationships to prevent direct competition from its own suppliers.

While not a frequent occurrence for highly specialized component manufacturers, the potential for a supplier to enter Corsair's market directly can influence pricing negotiations and supply contract stipulations. For instance, in 2024, the semiconductor industry, a crucial supplier base for PC components, continued to see consolidation and strategic investments, increasing the potential for some larger players to explore adjacent market opportunities.

- Supplier Capability: The technical expertise and financial resources a supplier possesses to enter Corsair's product lines.

- Market Incentives: The profitability and growth potential a supplier sees in the PC component or peripheral market.

- Corsair's Response: Maintaining strong partnerships and potentially diversifying suppliers to mitigate the risk of forward integration.

Corsair's bargaining power with suppliers is significantly influenced by the concentration of key component manufacturers. For instance, in 2024, the market for high-performance GPUs and essential chipsets remained dominated by a few major players, allowing them to dictate terms and pricing to downstream manufacturers like Corsair.

The specialized nature of many components, such as advanced cooling systems or proprietary circuit designs, further amplifies supplier leverage. Corsair's need for these unique parts, coupled with the high cost and time involved in re-qualifying alternative suppliers, means it has limited options to switch, especially when facing extended lead times, as seen with certain semiconductor components throughout 2024.

Suppliers with unique intellectual property, like patented technologies for memory modules or advanced thermal management, hold considerable sway. This exclusivity restricts Corsair's ability to find readily available substitutes, potentially forcing acceptance of higher prices or less favorable contract terms, a dynamic prevalent in the high-margin PC component sector.

Global supply chain volatility, a recurring theme in 2024, strengthens supplier bargaining power. Disruptions stemming from geopolitical events or production bottlenecks empower suppliers who can maintain consistent delivery, enabling them to command premium prices and stricter contract conditions from companies like Corsair.

| Supplier Characteristic | Impact on Corsair | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Dominance of a few GPU and chipset manufacturers in 2024. |

| Component Specificity | High switching costs empower specialized suppliers. | Proprietary cooling tech or unique memory designs. |

| Proprietary Technology | Patented components restrict substitute options. | Patents on high-speed memory modules impacting premium PC builds. |

| Supply Chain Disruptions | Scarcity grants power to reliable suppliers. | Continued semiconductor lead times affecting component availability. |

What is included in the product

Corsair's Five Forces analysis meticulously examines the competitive intensity within the PC components and gaming peripherals market, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players to inform strategic decisions.

Effortlessly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model that visually highlights areas of strategic vulnerability.

Customers Bargaining Power

Customers in the PC gaming and enthusiast market, where Corsair primarily operates, exhibit significant price sensitivity. This is particularly true for standardized components like RAM or power supplies, where performance differences can be marginal between brands.

The proliferation of competitors offering comparable products allows consumers to readily switch based on price. For instance, in 2024, the average price for a 32GB DDR5 RAM kit from major brands fluctuated, with Corsair often facing pressure to match lower-priced offerings from less premium brands.

This intense price competition directly impacts Corsair's ability to command premium pricing and can lead to reduced profit margins if they are forced to lower prices to remain competitive.

The market for PC components, gaming peripherals, and streaming equipment is incredibly crowded. In 2024, consumers could easily find comparable products from dozens of brands. This abundance of choice means if Corsair's offerings aren't perfectly aligned with customer desires regarding price, features, or quality, switching to a competitor is remarkably simple.

This widespread availability directly erodes Corsair's ability to dictate prices. When customers have many similar options, they are less likely to pay a premium, forcing Corsair to remain competitive on price to maintain market share.

For many of Corsair's products, like gaming peripherals, the cost and effort for a customer to switch to a competitor are quite low. This means a gamer can easily swap out a Corsair keyboard for one from Razer or Logitech with little trouble or expense. In 2024, the consumer electronics market, especially for PC components and accessories, is characterized by widespread availability and a plethora of brands, further reducing the perceived switching cost.

Access to comprehensive product information and reviews

Modern consumers are incredibly well-informed, thanks to readily available online reviews, detailed product benchmarks, and extensive comparison websites. This transparency significantly shifts the power dynamic, enabling customers to make highly informed purchasing decisions. For Corsair, this means increased pressure to consistently deliver competitive products and uphold rigorous quality and performance standards, as information asymmetry now heavily favors the buyer.

This heightened customer awareness directly impacts Corsair's pricing strategies and product development cycles. With easy access to competitor data and user feedback, customers can quickly identify value propositions and potential shortcomings. For instance, a study in late 2023 indicated that over 80% of consumers consult online reviews before making a significant purchase, a trend that continues to grow.

- Informed Decisions: Consumers leverage online resources to compare specifications, read user experiences, and view independent benchmarks, leading to more discerning purchasing choices.

- Price Sensitivity: Easy access to pricing information across multiple retailers and direct comparisons with competitors makes customers more sensitive to price differences.

- Quality Expectations: A wealth of user-generated content and expert reviews sets high expectations for product quality, durability, and performance, forcing companies like Corsair to maintain stringent quality control.

- Brand Loyalty Impact: While brand loyalty exists, it is increasingly challenged by the ability of customers to find better alternatives or value propositions through readily available information.

Influence of large retailers and distributors

Corsair's reliance on large retailers and distributors grants these entities significant leverage. Their substantial order volumes and direct connection to end consumers mean they can negotiate for lower prices or preferential terms, directly affecting Corsair's profit margins.

These powerful intermediaries can also dictate product placement, marketing support, and even influence product development by providing feedback on consumer demand. For instance, major electronics retailers often demand co-op advertising funds or charge slotting fees, further pressuring manufacturers like Corsair.

- Significant Order Volumes: Large retailers like Amazon, Best Buy, and Newegg account for a substantial portion of Corsair's sales, giving them considerable sway in negotiations.

- Channel Control: These distributors control access to a vast customer base, making it difficult for Corsair to bypass them without significant investment.

- Pricing Pressure: Retailers can demand discounts, impacting Corsair's gross margins, which stood at 23.4% in Q1 2024.

- Promotional Demands: Corsair often needs to allocate marketing budgets for in-store promotions or online advertising managed by these large partners.

Customers in Corsair's market possess substantial bargaining power due to high price sensitivity and easy access to information. The abundance of competing brands offering similar products means consumers can readily switch, forcing Corsair to maintain competitive pricing and potentially impacting profit margins. This dynamic is amplified by the ease with which customers can compare products and prices online, setting high expectations for quality and value.

| Factor | Impact on Corsair | Supporting Data (2024) |

|---|---|---|

| Price Sensitivity | Reduces pricing flexibility, pressures margins | Average DDR5 RAM kit prices saw fluctuations, with Corsair facing downward price pressure. |

| Availability of Substitutes | Increases switching likelihood, erodes pricing power | Dozens of brands offered comparable PC components and peripherals in 2024. |

| Low Switching Costs | Facilitates easy customer movement between brands | Minimal cost or effort for consumers to switch gaming peripherals. |

| Informed Consumers | Demands higher quality and value, impacts brand loyalty | Over 80% of consumers consulted online reviews before major purchases (late 2023 trend). |

Full Version Awaits

Corsair Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Corsair meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The PC gaming and enthusiast market is incredibly crowded. This means Corsair faces a lot of direct competition across its product lines, from memory modules to gaming peripherals. For instance, in the memory market, companies like G.Skill, Crucial, and Kingston are major players, each offering a wide range of enthusiast-grade DDR5 modules as of mid-2024.

This fragmentation forces intense competition, driving aggressive marketing and price wars. Brands constantly innovate and offer promotions to capture market share. In 2024, we've seen many companies in this space, including Razer and Logitech for peripherals, and NZXT for PC cases, all vying for the attention of gamers and PC builders.

Competitors in the PC component and gaming peripheral market, including those facing Corsair, are locked in a fierce product differentiation and innovation race. This means companies are constantly trying to make their offerings stand out through unique features, superior performance, and appealing designs. For instance, in 2024, we've seen continued advancements in RGB lighting synchronization across components and peripherals, a key area for differentiation.

Corsair, like its rivals, must pour significant resources into research and development to introduce cutting-edge technologies and novel features. This investment is crucial for maintaining a competitive edge. The market for high-performance PC hardware is particularly dynamic; for example, the introduction of new GPU architectures often triggers a wave of innovation in cooling solutions and power supplies from various manufacturers, including Corsair.

The rapid pace of technological change shortens product lifecycles considerably, intensifying the pressure to innovate. What is considered state-of-the-art today can become outdated quickly. This relentless cycle means that companies must not only keep up but also anticipate future trends to avoid falling behind in this highly competitive arena.

Corsair operates in a market where aggressive pricing and frequent promotions are common due to intense competition and a customer base sensitive to cost. This dynamic forces companies to constantly adjust their pricing to remain competitive, which can significantly squeeze profit margins for everyone involved, including Corsair.

For instance, in the PC components market, brands often engage in price matching and offer discounts during major sales events like Black Friday. In 2023, the average selling price for high-end gaming GPUs saw considerable fluctuations, with some models experiencing price drops of over 15% to clear inventory and attract buyers, directly impacting profitability for manufacturers like Corsair.

Strong brand loyalty and ecosystem lock-in

Corsair faces intense rivalry, with some competitors leveraging strong brand loyalty and integrated ecosystems. While individual component switches are easy, a cohesive setup can create significant lock-in. For instance, Razer's Synapse software connects its peripherals, creating a unified user experience that can deter customers from switching to other brands. Corsair actively works to build its own ecosystem through products like iCUE software, which controls lighting, cooling, and peripherals, aiming to foster similar customer retention.

This competitive dynamic means Corsair must continuously innovate to offer compelling reasons for customers to choose and stay with its brand. The challenge lies in convincing users to invest in a Corsair ecosystem when established rivals already have dedicated followings. As of early 2024, Corsair's gaming peripherals and components business, a key area for ecosystem development, has shown resilience, though market share shifts are common. For example, in the PC component market, brands like ASUS and MSI have long-standing reputations that contribute to customer loyalty.

- Brand Loyalty Challenges: Competitors with established, loyal customer bases present a significant hurdle for Corsair's ecosystem expansion.

- Ecosystem Integration: The success of integrated software and hardware platforms, like Razer's Synapse, highlights the importance of seamless user experiences in retaining customers.

- Corsair's Strategy: Corsair aims to counter this by developing its own robust ecosystem, exemplified by the iCUE software, to enhance user engagement and reduce switching incentives.

- Market Dynamics: The PC hardware market, where Corsair operates, is characterized by rapid technological advancements and fierce competition, requiring constant product development and marketing efforts to maintain relevance and customer preference.

Marketing and distribution channel intensity

Competitors intensely battle for prominent placement in physical retail stores and high visibility on e-commerce platforms. This struggle extends to capturing consumer attention through aggressive marketing campaigns. For instance, in 2024, the gaming peripherals market saw significant marketing spend from major players like Logitech and Razer, directly impacting Corsair's need to maintain brand presence.

Corsair must allocate substantial resources to marketing, brand building, and nurturing strong channel partner relationships. This investment is crucial for ensuring its diverse product range, from PC components to gaming gear, effectively reaches its intended consumer base. The ongoing competition for mindshare and market share remains a significant challenge.

- Retail Shelf Space: Competitors actively seek prime locations in electronics stores and major retailers, influencing consumer purchasing decisions.

- E-commerce Visibility: Dominating search results and product placement on platforms like Amazon and Newegg is a constant battle.

- Marketing Spend: Significant budgets are dedicated to digital advertising, influencer collaborations, and sponsorships to cut through the noise.

- Channel Relationships: Maintaining strong ties with distributors and retailers is vital for consistent product availability and promotional support.

Corsair faces intense rivalry in the PC gaming and enthusiast market, a sector characterized by numerous direct competitors across its product lines, from memory modules to gaming peripherals. This crowded landscape necessitates continuous innovation and aggressive marketing to capture and retain market share, with companies like G.Skill, Crucial, Kingston, Razer, Logitech, and NZXT being prominent rivals as of mid-2024.

The competition extends to product differentiation, with companies like Corsair investing heavily in R&D to offer unique features and superior performance, as seen in the advancements in RGB lighting synchronization in 2024. Furthermore, pricing strategies are highly competitive, with frequent promotions and price matching common, particularly during major sales events, impacting profit margins for all players.

Corsair also contends with rivals who have built strong brand loyalty and integrated ecosystems, such as Razer's Synapse software, which can create customer lock-in. To counter this, Corsair actively develops its own ecosystem, like the iCUE software, to foster user engagement and retention, a critical strategy in a market where technological advancements rapidly shorten product lifecycles.

Securing prominent retail shelf space and high visibility on e-commerce platforms is another battleground, requiring significant marketing spend and strong channel partner relationships to ensure product reach and brand presence. The market's dynamic nature, driven by rapid technological change and fierce competition, demands constant adaptation and strategic investment from Corsair to maintain its competitive edge.

SSubstitutes Threaten

The increasing prevalence of cloud gaming services like Xbox Cloud Gaming and NVIDIA GeForce Now presents a significant threat of substitution for Corsair. These platforms allow users to stream games directly to less powerful devices, potentially reducing the demand for high-end PCs and the components Corsair specializes in, such as powerful graphics cards and processors.

For instance, by mid-2024, services like Xbox Cloud Gaming were expanding their reach, offering a library of hundreds of titles playable on smartphones, tablets, and lower-spec PCs. This accessibility directly challenges the necessity for consumers to invest in expensive, custom-built gaming rigs that often feature Corsair's premium components, thereby impacting the upgrade cycle for PC hardware.

This shift could lead to a gradual decline in consumer spending on dedicated gaming hardware, as the performance bottleneck moves from local hardware to internet connectivity. Consequently, Corsair might see a dampening effect on the demand for its high-performance memory, power supplies, and cooling solutions, as the perceived value of top-tier PC builds diminishes in favor of accessible streaming options.

Consumers today have an incredibly diverse range of entertainment options that can pull them away from PC gaming. This includes everything from dedicated gaming consoles like the PlayStation 5 and Xbox Series X, to the ever-growing mobile gaming market, and even immersive virtual reality experiences that don't require a PC. In 2024, the global gaming market, encompassing all these segments, is projected to reach over $200 billion, highlighting the sheer scale of competition for consumer attention and spending.

If these alternative entertainment forms become more attractive, perhaps through lower price points, greater convenience, or more compelling content, they directly threaten Corsair's core business. For instance, a surge in the popularity of cloud gaming services accessible on any device could reduce the perceived need for high-end PC hardware. This diversion of discretionary income and leisure time represents a significant substitute threat that Corsair must continually monitor and address.

The rise of integrated all-in-one computing solutions presents a significant threat to Corsair. These solutions, often sleek laptops or compact desktops, bundle all necessary components, reducing the need for separate purchases of items like cases, power supplies, and memory modules that form a core part of Corsair's product line. For instance, the global laptop market is projected to reach over $140 billion by 2025, highlighting the scale of this integrated segment.

This convenience factor directly challenges the DIY PC building market, a key demographic for Corsair. Consumers opting for these pre-integrated systems may forgo the customization and upgradeability that enthusiasts value, thereby diminishing demand for individual Corsair components. This trend is further amplified as manufacturers continually improve the performance and portability of these all-in-one options.

Generic or lower-cost peripheral alternatives

Generic or lower-cost peripheral alternatives present a significant threat, especially for basic items like keyboards, mice, and headsets. Consumers can readily find unbranded or store-brand options that perform essential functions at a fraction of the price. For instance, while Corsair might offer a high-performance gaming mouse for $80, a functional, albeit less feature-rich, alternative can be found for as little as $15 from various online retailers.

This availability of budget options directly impacts Corsair's entry-level and mid-range product lines. These alternatives, while lacking the advanced features and brand cachet of Corsair products, satisfy the needs of many price-sensitive consumers. In 2024, the market for budget peripherals remained robust, with many consumers prioritizing affordability for everyday computing tasks rather than specialized gaming performance.

This competitive pressure forces Corsair to continually justify its premium pricing strategy. The brand must clearly articulate the value proposition of its higher-priced peripherals, highlighting superior build quality, advanced features, and enhanced performance. Without this clear differentiation, consumers may opt for cheaper substitutes, eroding Corsair's market share in segments where performance differences are less critical.

- Threat: Generic/Lower-Cost Peripherals

- Impact on Corsair: Pressure on entry-level/mid-range sales.

- Consumer Behavior: Budget-consciousness drives demand for alternatives.

- Corsair's Response: Need to emphasize premium value and differentiation.

Upgradable components vs. full system replacement

The threat of substitution for Corsair's components extends beyond alternative brands to the fundamental choice between upgrading existing systems and purchasing entirely new ones. If the cost or effort associated with swapping out individual parts, like a graphics card or RAM, becomes prohibitive, consumers may bypass this process altogether. This is particularly relevant in the gaming PC market, where the rapid pace of technological advancement can make a full system upgrade more appealing than piecemeal component replacements.

This shift in consumer behavior directly impacts Corsair. Instead of selling a new power supply or memory kit, the company could lose the entire sale if a customer opts for a pre-built gaming rig or the latest gaming console. For instance, in 2024, the average price of a new, high-end gaming PC often exceeded $2,000, a figure that could be comparable to or even less than the cumulative cost of multiple high-performance component upgrades over a few years, making the complete system replacement a more attractive substitute.

- Component Upgrade Cost vs. Full System Replacement: Consumers weigh the expense and complexity of upgrading individual parts against the total cost and convenience of a new system.

- Technological Obsolescence: Rapid advancements in computing power can make older systems significantly underperform, pushing consumers towards complete overhauls rather than incremental upgrades.

- Pre-built Systems and Consoles: The availability and competitive pricing of pre-built PCs and gaming consoles present a direct substitute for consumers seeking immediate performance gains without the hassle of component selection and installation.

- Market Trends: In 2024, the gaming console market continued to see strong demand, offering a seamless, albeit less customizable, alternative to PC gaming for many consumers.

Cloud gaming platforms and the increasing power of mobile devices present significant substitutes for traditional PC gaming hardware, a core market for Corsair. Services like Xbox Cloud Gaming and NVIDIA GeForce Now allow users to play high-fidelity games on less powerful hardware, reducing the need for expensive components like high-end GPUs and CPUs. This trend, gaining traction throughout 2024, directly challenges the demand for Corsair's premium PC components.

The growing popularity of gaming consoles and the continued strength of the mobile gaming sector also divert consumer spending and leisure time away from PC gaming. In 2024, the global gaming market was valued at over $200 billion, with consoles and mobile games representing substantial portions of this revenue. This broad entertainment landscape means Corsair's specialized PC hardware competes not just with other PC brands, but with entirely different gaming ecosystems.

Furthermore, the convenience of integrated computing solutions, such as high-performance laptops and all-in-one PCs, offers an alternative to the DIY PC building market that Corsair serves. Consumers seeking a plug-and-play experience may bypass the need for individual components like cases, power supplies, and cooling systems, which are key product categories for Corsair. The global laptop market's projected growth to over $140 billion by 2025 underscores the scale of this integrated alternative.

The availability of generic or lower-cost peripherals also poses a threat, particularly for entry-level and mid-range products. While Corsair focuses on premium features and performance, budget-conscious consumers can find functional alternatives for essential items like mice, keyboards, and headsets. The robust market for budget peripherals in 2024 indicates a segment where price is a primary driver, potentially impacting Corsair's market share if value differentiation is not clearly communicated.

Entrants Threaten

The PC components and peripherals market demands significant upfront investment. Think research and development, setting up or contracting manufacturing, stocking inventory, and building out distribution channels worldwide. For example, developing a new high-performance graphics card can cost tens of millions of dollars, making it a formidable hurdle for newcomers.

These substantial capital requirements act as a strong deterrent, effectively blocking many aspiring companies from entering the space. Corsair, with its established operations and market presence, benefits immensely from this high barrier, as it has already made these necessary investments.

Corsair, a dominant force in PC components and peripherals, benefits immensely from its strong brand recognition and deeply ingrained customer loyalty. This is a significant barrier for any potential new entrant aiming to disrupt the market.

Newcomers face the arduous task of building trust and replicating the loyalty Corsair enjoys, a loyalty often forged through years of delivering reliable, high-performance products. For instance, Corsair's gaming peripherals often receive top ratings, fostering repeat purchases and brand advocacy.

The challenge for new entrants lies not just in product quality but in overcoming the established reputation and emotional connection consumers have with brands like Corsair. This brand equity represents a formidable hurdle, making it difficult for new players to gain immediate traction and market share.

Corsair has cultivated deep-seated relationships with a vast network of global retailers, distributors, and prominent e-commerce platforms. Newcomers attempting to enter the market would struggle immensely to secure favorable shelf space and negotiate crucial distribution agreements necessary to reach their intended customer base efficiently.

These well-established channels and the loyalty Corsair commands from its partners represent a significant hurdle. For instance, in 2024, Corsair's extensive retail presence across major electronics chains and online marketplaces provided them with unparalleled market access, a position new entrants would find exceedingly difficult and costly to replicate.

Economies of scale for established players

Established companies like Corsair leverage significant economies of scale in their operations. This advantage translates into lower per-unit costs for manufacturing and procurement, as well as more substantial budgets for marketing and research and development. For instance, in 2023, Corsair's revenue reached $1.4 billion, enabling them to spread fixed costs over a larger production volume compared to a hypothetical new entrant.

New companies entering the market face a considerable challenge in matching these cost efficiencies. Operating at a smaller scale, they are unlikely to achieve the same level of purchasing power or production optimization. This inherent cost disadvantage makes it difficult for new entrants to compete on price or offer a comparable range of features from the outset, acting as a substantial barrier.

- Economies of Scale: Corsair benefits from lower production costs due to high-volume manufacturing.

- Procurement Power: Larger order volumes allow Corsair to negotiate better prices with suppliers.

- Marketing & R&D Investment: Significant revenue enables greater spending on brand building and product innovation.

- Competitive Pricing: Lower costs allow established players to offer more competitive prices, pressuring new entrants.

Intellectual property and technological complexity

The development of high-performance gaming gear, like that offered by Corsair, frequently involves intricate engineering and patented technologies. For instance, advanced cooling solutions or unique peripheral designs can be protected by intellectual property, making it difficult for newcomers to replicate without significant investment or licensing agreements. This high barrier to entry, stemming from the need for substantial R&D expenditure and potentially costly patent acquisition, serves as a protective shield for established companies.

New entrants face a steep climb, needing to commit considerable resources to research and development to create products that can compete with existing offerings. Alternatively, they might need to license proprietary technologies, which adds another layer of expense and complexity. This technological and intellectual property hurdle directly impacts the threat of new entrants in the high-performance gaming hardware market.

- R&D Investment: Developing cutting-edge gaming peripherals requires substantial upfront investment in research and development.

- Proprietary Technology: Companies like Corsair often protect their innovations through patents, creating a barrier for competitors.

- Licensing Costs: New entrants may need to license existing technologies, adding significant costs and time to market entry.

- Technological Complexity: The inherent complexity of high-performance components makes replication and innovation challenging for new players.

The threat of new entrants for Corsair is moderate. While the PC components and peripherals market requires significant capital for R&D, manufacturing, and distribution, established brands like Corsair benefit from strong brand loyalty and extensive distribution networks. For instance, in 2024, Corsair's established retail partnerships provided unparalleled market access, a difficult position for newcomers to replicate.

New companies must overcome substantial capital requirements, technological complexity, and the need to build brand trust, which can take years and significant investment. Corsair's 2023 revenue of $1.4 billion highlights its ability to leverage economies of scale, making it challenging for smaller, new entrants to compete on cost.

Intellectual property protection, such as patents on unique designs or cooling technologies, further erects barriers. New entrants might need to invest heavily in their own R&D or incur licensing costs, adding to the already high cost of market entry.

| Factor | Impact on New Entrants | Corsair's Advantage |

|---|---|---|

| Capital Requirements | High | Established infrastructure and investment capacity |

| Brand Loyalty & Reputation | Low (initially) | Strong customer trust and recognition |

| Distribution Channels | Challenging to establish | Extensive global retail and online presence |

| Economies of Scale | Disadvantageous | Lower per-unit costs and higher R&D/marketing budgets |

| Intellectual Property | Barrier to replication | Patented technologies and proprietary designs |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Corsair leverages data from company annual reports, investor presentations, and market research firms specializing in the PC hardware and gaming peripherals sectors. We also incorporate insights from industry trade publications and competitor websites to understand the competitive landscape.