Corsair Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsair Bundle

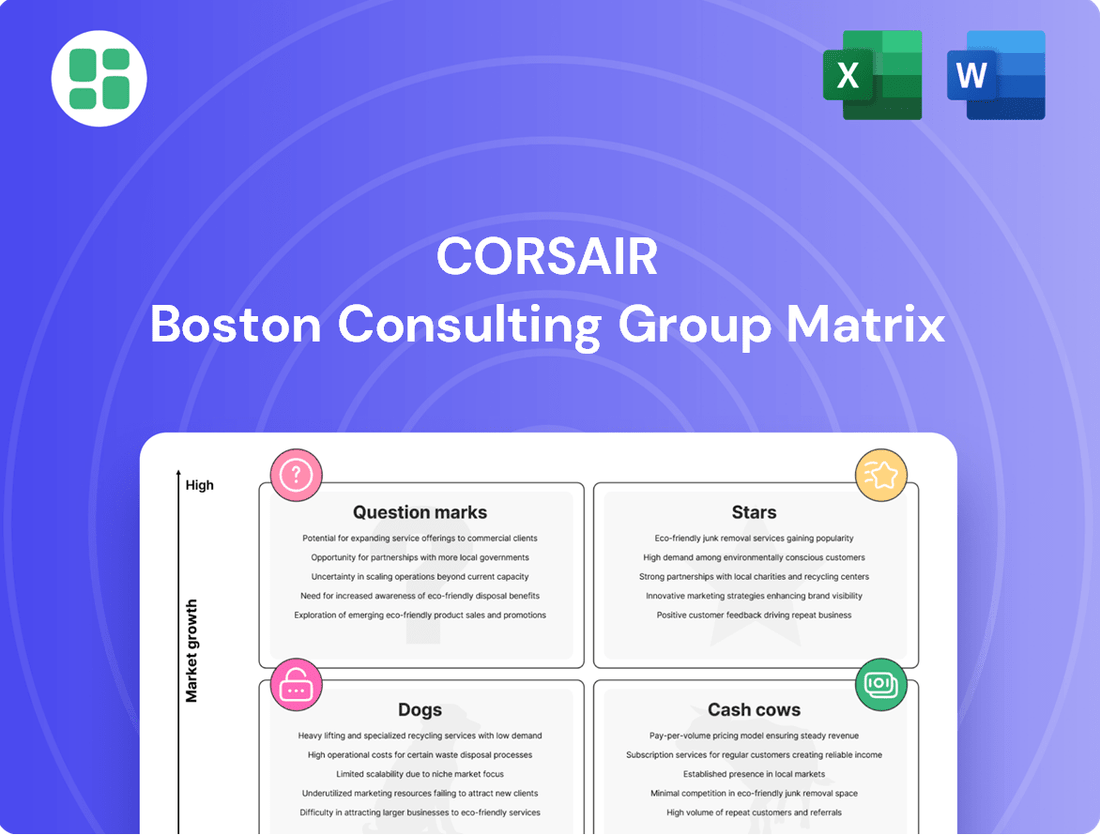

Curious about Corsair's product portfolio? This glimpse into their BCG Matrix highlights key areas of opportunity and potential challenges. Understand which products are driving growth and which might need a strategic rethink.

Dive deeper into Corsair's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Elgato, a key brand within Corsair, is a star in the BCG matrix, dominating the booming live streaming equipment market. This sector is anticipated to expand significantly, with projected Compound Annual Growth Rates (CAGRs) between 8.3% and 14.4% from 2025 through 2034. The strong performance in 2024 underscores this upward trend, driven by ongoing advancements in AI-enhanced broadcasting and the increasing popularity of portable streaming gear.

Elgato's established reputation among content creators solidifies its leadership in this dynamic, high-growth industry. The company's focus on innovation, particularly in areas like AI-powered broadcasting and user-friendly portable solutions, is expected to maintain its competitive edge and capture further market share as demand continues to rise.

The high-performance gaming peripherals market, including keyboards, mice, and headsets, is a dynamic sector with impressive growth projections. Analysts anticipate Compound Annual Growth Rates (CAGRs) between 6.88% and 11.1% from 2024 through 2029 or even 2034. This expansion is fueled by the surging popularity of esports and the continuous advancement of gaming technology, creating a strong demand for top-tier equipment.

Corsair stands as a significant force within this expanding market. The company is well-positioned to capitalize on this trend by offering a comprehensive range of high-performance keyboards, mice, and headsets. These products are specifically designed to meet the needs of competitive gamers who require precision, speed, and reliability in their equipment.

Corsair's Gamer and Creator Peripherals segment demonstrated notable year-over-year growth in 2024. This performance underscores the company's strong market acceptance and reinforces its leadership position. The robust growth in this segment suggests that Corsair's offerings are resonating well with consumers and effectively addressing the evolving demands of the gaming community.

DDR5 gaming memory represents a strong contender within Corsair's product portfolio. As a leading memory manufacturer, Corsair commanded a substantial 20.44% global market share as of November 2024. Although the broader PC components market experienced a slight slowdown in 2024, the demand for high-performance DDR5 memory, particularly within the gaming segment, continues to show resilience.

The ongoing transition to DDR5 technology, coupled with the anticipated refresh cycle for gaming PCs in 2024 and extending into 2025, positions Corsair's DDR5 gaming memory products favorably. This trend suggests sustained interest and purchasing activity from gaming enthusiasts seeking enhanced performance.

High-End Prebuilt Gaming PCs (Origin PC, Vengeance)

The high-end prebuilt gaming PC market, including Corsair's Origin PC and Vengeance brands, is a strong contender in the gaming hardware landscape. This segment benefits from the overall expansion of the gaming industry, with projections indicating a compound annual growth rate (CAGR) between 6.2% and 8.7% from 2025 to 2033. This growth is fueled by the demand for convenient, ready-to-use gaming solutions and the booming esports scene.

Corsair's presence in this market with Origin PC and Vengeance positions them to capitalize on this trend. These brands are known for delivering premium performance and superior build quality, appealing to gamers who prioritize a seamless, high-fidelity experience without the hassle of self-assembly. As the desire for powerful, plug-and-play gaming rigs continues to rise, Corsair's high-end prebuilt offerings are poised for sustained success.

- Market Growth: The prebuilt gaming PC market is expected to grow at a CAGR of 6.2% to 8.7% between 2025 and 2033.

- Key Drivers: Convenience of plug-and-play setups and the expansion of the esports industry are primary growth catalysts.

- Corsair's Position: Brands like Origin PC and Vengeance offer premium, high-performance systems catering to this demand.

- Consumer Trend: Gamers increasingly seek ready-to-use, top-tier gaming rigs, aligning with Corsair's product strategy.

Fanatec Sim Racing Products

Corsair's acquisition of Fanatec in 2024 marked a significant entry into the burgeoning sim racing market, a specialized segment of gaming known for its demand for realistic and immersive hardware. This strategic diversification allows Corsair to tap into a passionate community of enthusiasts who are typically willing to invest in high-quality equipment, enhancing Corsair's overall product ecosystem.

Fanatec, a leader in direct-drive wheelbases and advanced pedal sets, complements Corsair's existing gaming peripherals. The sim racing market, projected to see continued expansion, offers substantial growth potential for Fanatec's premium product lines under Corsair's broader reach and resources. For instance, the global esports market, which includes sim racing, was valued at approximately $1.1 billion in 2023 and is expected to grow, indicating a strong underlying demand for competitive gaming hardware.

- Market Entry: Corsair acquired Fanatec in 2024, entering the high-growth sim racing sector.

- Product Synergy: Fanatec's premium sim racing hardware complements Corsair's gaming peripherals.

- Growth Potential: The increasing popularity of sim racing suggests significant expansion opportunities for Fanatec under Corsair's ownership.

- Enthusiast Base: Sim racing attracts dedicated users willing to invest in top-tier equipment, a key demographic for premium brands.

Elgato's dominance in the live streaming equipment market, experiencing robust growth with CAGRs between 8.3% and 14.4% from 2025-2034, positions it as a star. This is further supported by its 2024 performance, driven by AI advancements and portable streaming gear popularity. Corsair's strong gaming peripherals segment, with projected CAGRs of 6.88% to 11.1% (2024-2029/2034), also shines. The DDR5 gaming memory market, where Corsair held 20.44% global share in November 2024, shows resilience despite broader market slowdowns, boosted by the DDR5 transition and PC refresh cycles.

| Product Category | Market Growth Projection (CAGR) | Corsair's Position/Key Factors | 2024 Data/Relevance |

| Live Streaming Equipment (Elgato) | 8.3% - 14.4% (2025-2034) | Dominant market share, strong brand reputation, innovation in AI and portable solutions. | Strong 2024 performance driven by AI broadcasting and portable gear. |

| Gaming Peripherals | 6.88% - 11.1% (2024-2029/2034) | Significant market presence, comprehensive product range meeting competitive gamer needs. | Notable year-over-year growth in 2024, indicating strong consumer acceptance. |

| DDR5 Gaming Memory | Resilient demand | 20.44% global market share (Nov 2024), leading memory manufacturer. | Benefiting from DDR5 transition and PC refresh cycles in 2024/2025. |

What is included in the product

Corsair's BCG Matrix analysis identifies key product lines, guiding investment in high-growth Stars and milking Cash Cows, while strategizing for Question Marks and divesting Dogs.

Clear visualization of business unit performance, eliminating confusion.

Cash Cows

Corsair's Power Supply Units (PSUs) are a prime example of a Cash Cow within their product portfolio. The company boasts a strong reputation for quality and reliability, consistently earning top rankings in the PSU market. This established trust translates into steady demand.

While the PSU market is mature, its essential nature for PC builds ensures a stable and consistent revenue stream. Corsair's diverse offerings, from high-efficiency to compact SFX models, appeal to a wide range of consumers, solidifying their sustained sales.

In 2024, the PC hardware market continued to show resilience, with PSUs being a foundational component. Corsair's commitment to high-wattage and efficient units, such as their RMx and HX series, has allowed them to maintain a significant market share, generating predictable and substantial cash flow for the company.

Corsair's PC cases are a classic Cash Cow, holding a robust position in the custom PC building market. This segment, while mature, sees consistent demand fueled by new PC builds and aesthetic preferences, rather than rapid technological disruption.

The company's broad selection of cases, catering to all budget levels, ensures predictable sales and a reliable revenue stream. This product line leverages strong brand loyalty, generating steady cash flow without demanding significant new capital outlays.

Corsair's liquid cooling solutions, encompassing both All-In-One (AIO) and custom loop systems, position them as a leading force in the PC thermal management sector. While the market for these products isn't seeing hyper-growth, it enjoys a steady demand driven by the ongoing need for effective cooling in high-performance gaming and workstation PCs. In 2024, the PC cooling market, including liquid cooling, continued to be a significant segment, with Corsair consistently capturing a substantial share due to its reputation for quality and innovation.

This segment acts as a Cash Cow for Corsair, generating consistent and reliable revenue. The necessity of efficient cooling for enthusiasts and the regular upgrade cycles within the PC hardware community ensure sustained sales. Corsair's commitment to advancing cooling technology, evident in their product launches throughout 2024, reinforces their market position and supports these predictable earnings.

Older Generation Gaming Peripherals

Corsair's older generation gaming peripherals, such as keyboards and mice, represent a classic Cash Cow. Despite the constant introduction of newer models, these established products maintain steady sales, driven by strong brand loyalty and attractive price points for budget-conscious gamers. This segment benefits from reduced marketing and research expenses, as the products are in a mature stage of their lifecycle.

These reliable performers generate consistent cash flow for Corsair. They efficiently utilize existing manufacturing infrastructure and distribution networks, allowing the company to capitalize on ongoing profitability without significant new investment. This strategy effectively 'milks' these mature products for sustained revenue.

- Mature Product Lifecycle: Older peripherals are in a stable, high-profit phase.

- Brand Recognition & Pricing: Established models appeal to value-seeking consumers.

- Reduced Investment Needs: Lower R&D and marketing costs compared to new products.

- Consistent Cash Flow: These products are reliable revenue generators for Corsair.

Legacy Memory Modules (DDR4)

Even as DDR5 technology advances, Corsair's DDR4 memory modules maintain a strong market presence. This is largely due to the substantial number of existing systems that are still compatible with DDR4. In 2024, the demand for DDR4 remains steady, primarily driven by PC upgrades and the construction of more budget-conscious builds.

This segment of Corsair's business operates in a mature market. While growth is modest, the demand is reliably consistent. Corsair benefits from established manufacturing processes and significant economies of scale for DDR4, which translates into healthy profit margins and a reliable source of cash flow.

- Market Share: Corsair continues to hold a notable share in the DDR4 market, serving a large installed base.

- Demand Drivers: Upgrades for existing DDR4 systems and new budget PC builds are key demand factors in 2024.

- Profitability: Mature production lines and economies of scale contribute to high profit margins for DDR4 modules.

- Cash Generation: The stable demand and efficient production make DDR4 a consistent cash cow for Corsair.

Corsair's established gaming peripherals, including keyboards and mice, are prime examples of Cash Cows. These products, while not at the forefront of technological innovation, benefit from strong brand recognition and a loyal customer base. Their mature lifecycle means reduced marketing and research and development costs, allowing them to generate consistent profits.

In 2024, the demand for these reliable peripherals remained robust, particularly among gamers seeking value. Corsair's ability to leverage existing manufacturing and distribution channels for these items ensures that they continue to be a steady source of cash flow, effectively 'milking' their established market position.

| Product Category | BCG Matrix Classification | 2024 Market Context | Key Characteristics | Financial Contribution |

| Gaming Keyboards & Mice (Older Models) | Cash Cow | Stable demand from value-conscious gamers and existing system upgrades. | High brand loyalty, mature product lifecycle, lower R&D/marketing spend. | Consistent, predictable cash flow generation. |

Full Transparency, Always

Corsair BCG Matrix

The Corsair BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive strategic tool is fully formatted and ready for immediate application in your business planning and analysis. You can trust that the professional design and insightful content you see here will be yours to utilize without any alterations or limitations.

Dogs

Corsair has historically discontinued product lines that no longer align with market demand or technological advancements. These often represent older generations of components or peripherals that have been superseded by newer, more efficient technologies. For example, the phasing out of certain DDR3 memory kits or older generation graphics card models would fall into this category.

Products in the Dogs quadrant of the BCG Matrix for Corsair typically exhibit low market share in mature or declining segments. These are often products that, while perhaps once popular, are now facing intense competition or have been made obsolete by innovation. Corsair's strategy here is to minimize investment and eventually divest or discontinue these offerings to free up capital.

In 2024, Corsair continued to manage its product portfolio by retiring less profitable lines. While specific financial figures for discontinued product lines are not publicly itemized, the company's overall focus on high-growth segments like gaming peripherals and high-performance PC components indicates a strategic shift away from legacy products. This aligns with industry trends where rapid technological evolution necessitates continuous portfolio optimization.

Niche or Underperforming Accessories represent products with limited market appeal and low sales volumes. These specialized items often struggle to gain traction, resulting in a minimal market share within their low-growth niches. For instance, if a company like Corsair were to have a highly specific gaming peripheral that only appealed to a tiny fraction of the market, it would likely fall into this category.

Continued investment in these underperforming accessories is generally not advisable, as the return on investment is typically very low. In 2024, many tech companies are focusing on streamlining their product lines to concentrate resources on more profitable areas. Products in this category might consume significant customer support resources without generating commensurate revenue, making them prime candidates for discontinuation or strategic divestiture to free up capital for more promising ventures.

Certain older PC component Stock Keeping Units (SKUs), such as specific power supply models like the Corsair CX450 (released in 2016) or memory kits like the Vengeance LPX DDR4 2400MHz 8GB, are being phased out. These products face declining demand as newer, higher-performing alternatives, like DDR5 memory and ATX 3.0 compatible power supplies, gain traction. For instance, the market share for DDR4 memory modules has been steadily decreasing, with DDR5 adoption accelerating throughout 2024.

Products with Limited Regional Appeal

Products with limited regional appeal often find themselves in the Dogs quadrant of the BCG Matrix. These items, perhaps designed for niche tastes or specific regulatory environments, struggle to gain broader market acceptance. For instance, a gaming peripheral tailored exclusively for the Japanese market's unique controller preferences might see minimal sales in North America or Europe, resulting in a low global market share.

The challenge with these products lies in their inability to scale. Despite initial development for a particular region, the cost of maintaining inventory, localized marketing campaigns, and ongoing support for a product with low overall sales volume can become a significant drain. Consider a scenario where a company invests heavily in adapting a product for a single country's unique power outlet standards and language support; if that market doesn't generate substantial revenue, the investment is unlikely to yield a positive return.

- Limited Market Penetration: Products developed for specific regional preferences, like a specialized PC cooling fan designed only for the humid Southeast Asian climate, often fail to capture a significant share in other, less niche markets.

- High Maintenance Costs: Maintaining inventory and localized marketing for products with low global sales, such as a unique keyboard layout popular only in a few Eastern European countries, can easily exceed the revenue generated. In 2024, companies reported that products with less than 1% global market share due to regional limitations often incurred 5-10% of their total portfolio maintenance costs.

- Low Growth Potential: These products typically exhibit minimal growth prospects as their appeal is inherently confined, making it difficult to justify further investment in expansion or feature development.

- Strategic Review Necessity: Products falling into this category require a thorough review, often leading to decisions about market exit or a significant re-evaluation of their place within the company's product portfolio to optimize resource allocation.

Initial Versions of Failed Ventures

Initial versions of failed ventures for Corsair, particularly those venturing into entirely new product categories outside their core PC component and gaming peripheral expertise, would be classified as Dogs. These could include early attempts at unrelated consumer electronics or software solutions that didn't connect with their established customer base. For example, if Corsair launched a line of smart home devices in the early 2010s that saw minimal adoption, these would represent Dog products.

These ventures often drain resources without generating substantial returns. Corsair’s significant investment in R&D and marketing for such products would have yielded low market penetration and negligible revenue. By 2024, a clear indicator of a Dog product would be its inability to contribute meaningfully to the company’s overall revenue growth, potentially showing a decline in sales year-over-year or remaining stagnant.

- Low Market Share: Products in the Dog quadrant typically hold a very small percentage of their respective markets.

- Low Growth Rate: The market for these products is either stagnant or declining, offering little opportunity for expansion.

- Resource Drain: Continued investment in R&D, marketing, and production for these items often results in a net loss.

Dogs in Corsair's BCG Matrix represent products with low market share in mature or declining markets. These are often older technologies or niche accessories that no longer align with current demand or competitive landscapes. Corsair's strategy is to minimize investment in these areas, focusing resources on more promising product categories.

In 2024, Corsair continued to streamline its portfolio, a common practice for tech companies facing rapid innovation. Products like older DDR4 memory kits or specific legacy power supply units (e.g., certain CX series models from 2016) are being phased out as newer standards like DDR5 and ATX 3.0 become prevalent. This strategic divestment of underperforming assets allows for greater capital allocation towards high-growth segments.

These products often suffer from limited regional appeal or are initial versions of ventures that failed to gain traction. For example, a specialized gaming peripheral designed for a very specific regional preference might see minimal sales globally, leading to high maintenance costs relative to revenue. By 2024, products with less than 1% global market share due to such limitations often represented a significant drain on resources.

The core characteristics of these Dog products include a minimal market share, a stagnant or declining market growth rate, and a tendency to consume resources without generating substantial returns. Companies like Corsair actively review these offerings, often leading to discontinuation to optimize their overall product portfolio and maximize efficiency.

Question Marks

Corsair's new AI-enhanced peripherals are positioned as question marks in the BCG matrix. This segment taps into the high-growth potential of intelligent gaming and creator gear, a market expected to see substantial expansion in the coming years. For instance, the global AI in gaming market was projected to reach USD 11.2 billion by 2024, indicating strong underlying demand for innovation.

While the market shows promise, Corsair's AI peripherals currently hold a low market share due to their novelty. Capturing significant market share will necessitate substantial investment in research and development, alongside aggressive marketing campaigns to educate consumers and build brand awareness. Success here could see these products transition into Stars.

The future profitability of these AI-enhanced peripherals remains uncertain but holds considerable promise. Corsair's strategic focus on integrating AI aligns with broader industry trends, and if they can effectively navigate the initial market development phase, these products could become significant revenue drivers.

Corsair's expansion into mobile gaming peripherals positions them in a rapidly growing sector. The global mobile gaming market generated an estimated $107.2 billion in revenue in 2023, and is projected to continue its upward trajectory, representing a significant opportunity for Corsair.

Currently, Corsair's footprint in dedicated mobile gaming peripherals appears minimal. This suggests a high-growth potential market where the company has a relatively low existing market share, a classic indicator for a Question Mark in the BCG matrix.

Developing competitive mobile gaming accessories requires considerable investment in research, development, and marketing. Successfully capturing market share here could transform these ventures into Stars, driving future revenue, but underinvestment or poor execution could relegate them to the Dogs category.

The burgeoning VR/AR gaming sector presents a classic Question Mark scenario for Corsair. While the integration of virtual and augmented reality into gaming is rapidly gaining traction, with the global VR/AR gaming market projected to reach over $30 billion by 2028, Corsair's direct product line in this specific niche is still developing. This means they are investing in a high-potential area but without a guaranteed return.

Corsair's position here reflects the inherent uncertainty of emerging technologies. Significant investment in research, development, and marketing of specialized VR/AR accessories is crucial to carve out a market share. The challenge lies in anticipating consumer adoption rates and technological advancements, making the future success of these products a question mark for now.

Advanced Professional Esports Equipment Beyond Peripherals

The global esports market is booming, projected to reach $2.72 billion in 2024, according to Newzoo. Corsair, while dominant in peripherals, has an opportunity to capture a larger share in specialized, high-performance esports hardware. This includes custom high-refresh rate monitors and advanced training simulation systems, areas where the company currently holds a low market share.

Expanding into these niche yet high-growth segments requires significant investment and strategic alliances. Corsair could leverage partnerships with esports organizations and venue operators to develop and deploy bespoke equipment. Such a move would position these new product lines as potential Stars within the BCG matrix, offering substantial future growth and market leadership.

- Market Opportunity: The esports hardware market is expanding rapidly, with professional teams and venues seeking cutting-edge, specialized equipment beyond standard peripherals.

- Corsair's Position: While strong in gaming peripherals, Corsair has a low market share in specialized esports hardware like custom monitors and training systems.

- Strategic Imperative: Significant investment and strategic partnerships are necessary to penetrate these specialized hardware markets effectively.

- Potential Outcome: Successful expansion into these areas could elevate these product lines to Stars in Corsair's portfolio, driving future growth and market dominance.

New Software Ecosystems and Services (e.g., iCUE expansions)

Corsair's iCUE software ecosystem is a key area for potential growth, particularly with expansions into premium services or subscription models aimed at content creators. This taps into a rapidly expanding digital services market.

While the software and services sector offers high growth potential, Corsair's current market share in this specific niche, beyond its hardware integration, is likely still developing. For instance, the global creator economy was projected to reach over $100 billion by 2023, highlighting the market opportunity.

Developing these premium software services requires substantial investment in research, development, and user acquisition. However, the potential returns are significant, offering a path to diversify Corsair's revenue streams away from a primary reliance on hardware sales.

- iCUE Software Expansion: Corsair is exploring premium software services and subscription models for content creators.

- Market Opportunity: The global creator economy is a large and growing market, exceeding $100 billion by 2023.

- Investment and Returns: Significant investment is needed for software development and user acquisition, with potentially high, albeit uncertain, returns.

- Revenue Diversification: Success in this area can reduce Corsair's dependence on hardware sales.

Corsair's new AI-enhanced peripherals are positioned as question marks in the BCG matrix. This segment taps into the high-growth potential of intelligent gaming and creator gear, a market expected to see substantial expansion in the coming years. For instance, the global AI in gaming market was projected to reach USD 11.2 billion by 2024, indicating strong underlying demand for innovation.

While the market shows promise, Corsair's AI peripherals currently hold a low market share due to their novelty. Capturing significant market share will necessitate substantial investment in research and development, alongside aggressive marketing campaigns to educate consumers and build brand awareness. Success here could see these products transition into Stars.

The future profitability of these AI-enhanced peripherals remains uncertain but holds considerable promise. Corsair's strategic focus on integrating AI aligns with broader industry trends, and if they can effectively navigate the initial market development phase, these products could become significant revenue drivers.

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of Corsair's financial disclosures, market research reports, and competitive performance data to accurately position each product.