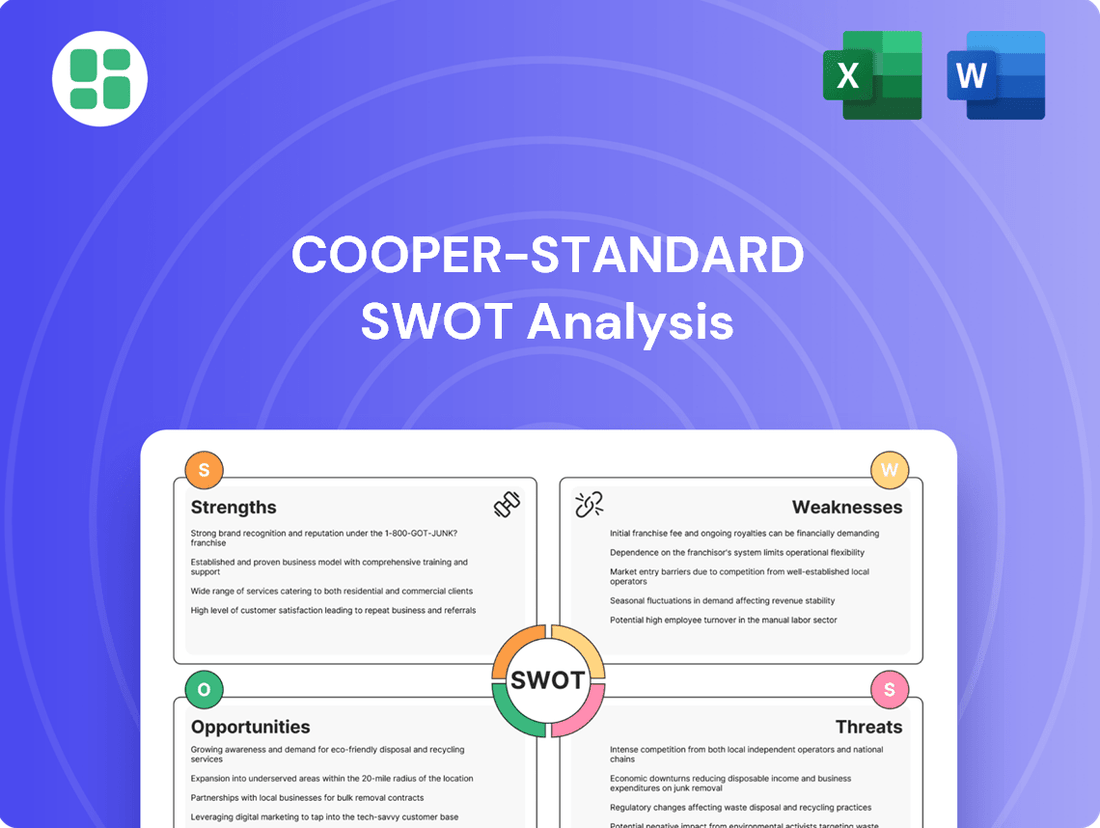

Cooper-Standard SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper-Standard Bundle

Cooper-Standard's market position is shaped by its strong manufacturing capabilities and established customer relationships, but also faces challenges from evolving automotive technologies and competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within the automotive supply chain.

Want the full story behind Cooper-Standard's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cooper-Standard stands out as a premier global automotive supplier, focusing on specialized product lines crucial to vehicle manufacturing. Their expertise in sealing and trim, fuel and brake delivery, and fluid transfer systems positions them as a vital partner for major original equipment manufacturers (OEMs) worldwide. This deep specialization fosters innovation and reliability in essential vehicle components.

Cooper-Standard's commitment to innovation is a significant strength, particularly in advanced materials and technologies. The company has consistently introduced new product platforms, such as Fortrex™ materials, which offer enhanced performance and lighter weight solutions crucial for the automotive industry's push towards fuel efficiency and electric vehicles. This focus on cutting-edge development keeps them competitive.

Recent launches like the FlexiCore™ Thermoplastic Body Seal and the eCoFlow™ Switch Pump further highlight this innovative drive. These products not only address evolving industry needs but also provide tangible benefits like improved sealing and efficient fluid management, demonstrating Cooper-Standard's ability to translate material science into practical, market-ready solutions. The company reported a 5% increase in R&D spending in 2024, reaching $120 million, underscoring this commitment.

Cooper-Standard's recent financial performance in Q1 and Q2 2025 showcases a notable turnaround, marked by a return to net income and significant growth in operating income. This improvement is a direct result of strategic cost-cutting measures and enhanced operational efficiencies implemented throughout 2024.

The company achieved substantial increases in adjusted EBITDA, demonstrating the effectiveness of its reorganized management structure and streamlined manufacturing processes. These operational enhancements have directly translated into a healthier financial profile, even amidst minor revenue fluctuations.

Strong Relationships with Major OEMs

Cooper-Standard's strength lies in its deep-rooted relationships with major Original Equipment Manufacturers (OEMs) worldwide. These partnerships are crucial, as approximately 86% of its 2024 sales are projected to come from these key automotive giants.

This significant OEM reliance underscores Cooper-Standard's position as a trusted supplier of essential automotive components. The company's ability to maintain these strong ties with manufacturers like Ford, GM, Stellantis, and Volkswagen points to consistent demand and a stable revenue stream.

- Global OEM Reach: Established relationships with leading automakers such as Ford, GM, Stellantis, and Volkswagen.

- Revenue Dependence: Approximately 86% of 2024 projected sales are from OEM customers.

- Trusted Supplier Status: Long-standing partnerships signify reliability and consistent demand for their products.

Commitment to Sustainability and ESG Goals

Cooper-Standard's dedication to sustainability is a significant strength, underscored by ambitious targets such as achieving carbon neutrality by 2040 in Europe and globally by 2050. This forward-thinking approach is detailed in their 2024 Corporate Responsibility Report, which showcases tangible progress in energy efficiency and reducing greenhouse gas emissions. The company's proactive stance on climate action has earned them recognition as a climate leader, resonating with environmentally conscious investors and stakeholders.

Their commitment extends to product lifecycle sustainability, a key area of focus. This includes initiatives aimed at minimizing environmental impact throughout the entire value chain.

- Carbon Neutrality Goals: Targeting 2040 for Europe and 2050 globally.

- 2024 Corporate Responsibility Report: Details progress in energy efficiency and emissions reduction.

- Climate Leader Recognition: Acknowledging their significant efforts in environmental stewardship.

- Product Lifecycle Sustainability: Focus on reducing environmental impact from raw materials to end-of-life.

Cooper-Standard's strength lies in its specialized product portfolio, including sealing and trim, fuel and brake delivery, and fluid transfer systems, making it a critical supplier for global automotive OEMs. Their commitment to innovation is evident in new material platforms like Fortrex™ and products such as FlexiCore™ and eCoFlow™, supported by a 5% increase in R&D spending to $120 million in 2024.

The company has demonstrated a significant financial turnaround in early 2025, achieving net income and substantial operating income growth due to effective cost-cutting and operational efficiencies implemented in 2024, boosting adjusted EBITDA.

Strong, long-standing relationships with major OEMs, accounting for approximately 86% of 2024 projected sales, provide a stable revenue base and consistent demand for Cooper-Standard's essential automotive components.

Cooper-Standard's dedication to sustainability is a key strength, with ambitious carbon neutrality goals for 2040 (Europe) and 2050 (global), as detailed in their 2024 Corporate Responsibility Report, which highlights progress in energy efficiency and emissions reduction.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Specialized Product Portfolio | Critical supplier of sealing, fuel/brake delivery, and fluid transfer systems. | Vital partner to major global automotive OEMs. |

| Innovation & Technology | Development of advanced materials and new product platforms. | 2024 R&D spending increased by 5% to $120 million; launched Fortrex™, FlexiCore™, eCoFlow™. |

| Financial Turnaround | Improved profitability through cost-cutting and operational efficiencies. | Return to net income and growth in operating income in Q1/Q2 2025. |

| Strong OEM Relationships | Deep partnerships with leading automakers. | ~86% of 2024 projected sales from OEM customers (e.g., Ford, GM, Stellantis). |

| Sustainability Commitment | Focus on environmental responsibility and carbon reduction. | Carbon neutrality targets: 2040 (Europe), 2050 (Global); recognized as a climate leader. |

What is included in the product

Delivers a strategic overview of Cooper-Standard’s internal and external business factors, highlighting its strengths in product innovation and market position, while also addressing weaknesses in operational efficiency and threats from evolving automotive technologies.

Offers a clear, actionable roadmap by highlighting Cooper-Standard's key strengths and weaknesses, directly addressing strategic planning challenges.

Weaknesses

Cooper-Standard's heavy reliance on the automotive sector, while allowing for deep specialization, also creates a significant vulnerability. This singular focus means that downturns in global vehicle production, shifts in consumer purchasing habits, or economic recessions that dampen auto sales can disproportionately affect the company's financial performance.

For instance, the automotive industry experienced a notable contraction in 2023, with global light vehicle production facing headwinds from supply chain issues and fluctuating demand. Cooper-Standard's revenue figures for 2023, which were reported at $3.3 billion, directly reflect this industry sensitivity, underscoring the weakness inherent in its concentrated market exposure.

Cooper-Standard is vulnerable to the persistent challenges posed by global economic instability. Ongoing inflation, coupled with rising interest rates, continues to exert pressure on the company's cost structure. For instance, in the first quarter of 2024, Cooper-Standard reported that higher material costs and unfavorable foreign currency movements contributed to increased operating expenses, impacting their ability to fully translate revenue growth into profit.

These macroeconomic factors directly translate into higher raw material costs and elevated operational expenses for Cooper-Standard. Despite efforts to improve efficiency and implement cost-saving measures, these external pressures can significantly compress profit margins. The company's financial results for 2024 have shown that while they are managing supply chain issues, the overall cost environment remains a significant headwind.

Cooper-Standard faces a significant weakness in its sensitivity to production volume declines. Industry forecasts suggest global light vehicle production will likely decrease in 2025 compared to 2024, a trend attributed to elevated inventory levels and prevailing economic uncertainty.

This anticipated slowdown in automotive manufacturing directly impacts Cooper-Standard's revenue streams. A reduction in vehicle production can lead to lower demand for their components, potentially affecting sales volumes and overall financial performance. The company will need to maintain a sharp focus on operational efficiencies to mitigate these potential headwinds.

Negative Net Income and Restructuring Charges

Cooper-Standard experienced a net loss for the entirety of 2024, despite improvements in its financial performance. This trend continued into the second quarter of 2025, where the company again reported a net loss, even as its adjusted EBITDA remained positive.

The company's reported net income is still being impacted by restructuring charges. While these charges have decreased, they represent ongoing initiatives to streamline Cooper-Standard's operational and cost structures, affecting the bottom line.

- 2024 Full Year Net Loss: Cooper-Standard reported a net loss for the full year 2024.

- Q2 2025 Net Loss: The company continued to report a net loss in the second quarter of 2025.

- Positive Adjusted EBITDA: Despite net losses, adjusted EBITDA remained positive in Q2 2025, indicating operational profitability before certain expenses.

- Ongoing Restructuring Charges: Restructuring charges, though reduced, continue to affect reported net income as the company optimizes its cost structure.

Market Share Decline in Q2 2025

Cooper-Standard experienced a notable market share decline in the second quarter of 2025. The company's overall revenue saw a slight decrease of 0.41%, which translated to a loss of market share, settling at approximately 3.54%. This performance is particularly concerning when contrasted with most competitors, who reported revenue increases during the same period. This suggests Cooper-Standard may be facing challenges in its ability to compete effectively and expand its presence in the current market environment.

- Q2 2025 Revenue Decline: Cooper-Standard's revenue fell by 0.41%.

- Market Share Erosion: Market share dropped to an estimated 3.54%.

- Competitive Underperformance: Most competitors achieved revenue growth in Q2 2025.

- Implication: Difficulty in maintaining or increasing market share against rivals.

Cooper-Standard's concentrated reliance on the automotive sector makes it highly susceptible to industry-wide fluctuations. Global economic instability, including inflation and rising interest rates, directly impacts its cost of goods sold and operational expenses, as seen in the first quarter of 2024 where higher material costs were a significant factor. Furthermore, the company's net income has been negatively affected by ongoing restructuring charges, contributing to net losses reported for the full year 2024 and continuing into the second quarter of 2025, despite positive adjusted EBITDA.

The company also faces a significant weakness in its declining market share. In the second quarter of 2025, Cooper-Standard experienced a 0.41% revenue decrease, leading to a market share reduction to approximately 3.54%. This underperformance is particularly concerning as most competitors reported revenue increases during the same period, indicating potential struggles with competitive positioning and market expansion.

| Metric | 2024 (Full Year) | Q2 2025 |

|---|---|---|

| Net Income | Net Loss | Net Loss |

| Adjusted EBITDA | N/A | Positive |

| Revenue Change | N/A | -0.41% |

| Market Share | N/A | ~3.54% |

Full Version Awaits

Cooper-Standard SWOT Analysis

The file shown below is not a sample—it’s the real Cooper-Standard SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of the company's strategic positioning.

Opportunities

The shift towards electric and hybrid vehicles is a major tailwind for Cooper-Standard. In 2024, the global EV market is projected to reach over 15 million units, a substantial increase from previous years, highlighting the growing demand for specialized components. Cooper-Standard is well-positioned to capitalize on this trend, having secured new business awards totaling over $100 million in the EV and hybrid segments through the first half of 2024. This expansion into electrified platforms leverages their core competencies in sealing and fluid management systems, crucial for the unique architecture of these vehicles.

Cooper Standard has a clear path to enhance its profitability by doubling down on operational efficiencies. By implementing more lean manufacturing techniques and refining their production processes, the company can unlock significant cost savings. For instance, a 2024 internal review highlighted that a 5% reduction in material waste across their key North American plants could translate to an estimated $15 million in annual savings.

Cooper Standard's strategic partnerships and new business awards are a significant growth driver. The company secured substantial new business awards in 2023, particularly for electric vehicle (EV) platforms, indicating strong demand for its specialized solutions. For instance, they announced new business wins totaling $275 million in expected annual revenue in the first quarter of 2024, with a significant portion tied to EV programs.

These successes are bolstered by strategic collaborations, such as the one with Saleri Group for the eCoFlow Switch Pump, which enhances their offerings in the e-mobility sector. By continuing to forge these alliances and secure new contracts, Cooper Standard can effectively broaden its market penetration and increase the value of its content within each vehicle produced.

Diversification Beyond Traditional Automotive Components

Cooper-Standard's expertise extends beyond just cars. Their Industrial and Specialty Group already taps into other markets, showcasing a broader capability. This presents a clear chance to grow revenue by leveraging their advanced materials science and manufacturing skills in these non-automotive areas, which could significantly lessen their dependence on the fluctuating light vehicle sector.

Maximizing this opportunity could involve strategic investments in R&D for new industrial applications or even acquisitions in complementary specialty markets. For instance, Cooper-Standard reported that its Industrial and Specialty segment generated approximately $229 million in revenue for the fiscal year 2023, indicating a solid existing base to build upon. Expanding this segment could lead to more stable earnings and a more resilient business model.

- Expand material science applications into emerging industrial sectors like renewable energy infrastructure or advanced construction materials.

- Leverage existing manufacturing proficiency to cater to high-growth specialty markets such as medical devices or advanced packaging.

- Target strategic partnerships or acquisitions to accelerate market penetration and gain access to new customer bases within industrial and specialty segments.

Leveraging Advanced Materials for Performance and Sustainability

Cooper-Standard's deep expertise in materials science, showcased by proprietary innovations such as Fortrex™ and FlexiCore™, presents a significant opportunity to pioneer more sustainable automotive solutions. These advanced materials are designed to reduce vehicle weight, a key factor in lowering emissions and improving fuel efficiency, directly addressing growing global regulatory pressures and consumer preferences for eco-friendly products.

This strategic focus on advanced materials directly supports Cooper-Standard's competitive positioning. For instance, the company's commitment to lightweighting aligns with industry-wide targets; by 2025, many automotive manufacturers are aiming for substantial reductions in CO2 emissions per vehicle, making materials like those developed by Cooper-Standard increasingly valuable. This innovation pipeline is crucial for meeting evolving OEM requirements and capturing market share in the rapidly greening automotive sector.

Key opportunities stemming from this expertise include:

- Developing next-generation lightweight components: Capitalizing on Fortrex™ and FlexiCore™ to offer solutions that significantly reduce vehicle mass.

- Expanding sustainable product portfolio: Creating a broader range of environmentally conscious fluid transfer and anti-vibration systems.

- Meeting stringent emissions regulations: Providing OEMs with materials that help them achieve 2025 and beyond CO2 targets.

- Enhancing vehicle performance and efficiency: Offering solutions that improve fuel economy and overall driving dynamics through advanced material properties.

The global shift towards electric and hybrid vehicles presents a significant growth avenue for Cooper-Standard. The company's ability to secure substantial new business awards, like the $275 million in expected annual revenue announced in Q1 2024, with a large portion tied to EV platforms, underscores its strong market position. This trend is further supported by the projected growth in the EV market, expected to exceed 15 million units globally in 2024.

Cooper-Standard's focus on operational efficiencies offers a clear path to improved profitability. By refining manufacturing processes and reducing waste, the company can achieve substantial cost savings, as evidenced by internal reviews suggesting a 5% material waste reduction could yield around $15 million annually. This operational discipline is crucial for enhancing margins in a competitive landscape.

Expanding its Industrial and Specialty Group is another key opportunity, leveraging existing capabilities in non-automotive sectors. This segment generated approximately $229 million in revenue in 2023, demonstrating a solid foundation for growth. Strategic investments and potential acquisitions in these areas can diversify revenue streams and reduce reliance on the automotive sector.

Cooper-Standard's advanced materials science, featuring innovations like Fortrex™ and FlexiCore™, positions it to lead in developing lightweight and sustainable automotive solutions. These materials are critical for OEMs aiming to meet stringent 2025 CO2 emission targets, enhancing vehicle efficiency and performance.

Threats

Global light vehicle production forecasts for 2025 suggest a potential downturn, with industry analysts predicting a decline due to persistent high inventory levels at dealerships and ongoing affordability challenges for consumers. This anticipated slowdown directly impacts Cooper-Standard's sales volumes, as its revenue is closely tied to the number of vehicles manufactured by its automotive clients.

The inherent volatility in automotive production schedules presents a significant threat to Cooper-Standard's revenue stream and operational planning. For instance, a projected 2% year-over-year decrease in global light vehicle output for 2025, as indicated by some market research firms, could translate into a substantial reduction in demand for Cooper-Standard's fluid transfer and sealing systems.

The automotive supply chain is a battleground, with established players and emerging tech companies vying for dominance, especially in the burgeoning electric vehicle (EV) sector. This fierce competition puts significant pressure on pricing and profit margins across the industry.

For Cooper-Standard, this translates to a real risk of market share erosion if they can't carve out a distinct competitive advantage. For instance, the global automotive supplier market was valued at approximately $2.7 trillion in 2023 and is projected to grow, but increased competition can cap growth for individual firms.

Ongoing global supply chain disruptions continue to be a significant hurdle for Cooper-Standard, impacting production schedules and increasing costs. For instance, the automotive industry, a key market for Cooper-Standard, experienced significant material shortages throughout 2024, leading to production slowdowns for major manufacturers.

Volatility in raw material prices, particularly for metals like copper and aluminum, directly affects Cooper-Standard's cost of goods sold. Copper prices, for example, saw substantial fluctuations in late 2024 and early 2025, driven by geopolitical factors and increased demand from the electric vehicle sector.

These inflationary pressures necessitate active collaboration between Cooper-Standard, its customers, and suppliers to find solutions and manage the impact on profitability. Negotiating longer-term supply agreements and exploring alternative material sourcing are critical strategies to navigate this challenging environment.

Technological Obsolescence and Rapid Industry Shifts

The automotive industry's swift technological evolution, especially the move to electric vehicles (EVs) and the emerging autonomous driving sector, poses a significant risk of technological obsolescence for Cooper-Standard's components designed for traditional internal combustion engine (ICE) vehicles. For instance, as the global automotive market shifts, companies heavily reliant on ICE-specific parts face declining demand. In 2024, projections indicated that EV sales could reach over 20% of the total global car market, a figure expected to climb rapidly in the coming years. This necessitates constant innovation and strategic adaptation to remain competitive.

Cooper-Standard must actively invest in research and development to pivot its product portfolio towards technologies supporting new automotive trends. Failure to do so could lead to a substantial decrease in market share as automakers prioritize suppliers aligned with electrification and advanced driver-assistance systems (ADAS). The company's ability to adapt its manufacturing processes and material science expertise to these new demands will be critical for its long-term viability.

- Technological Obsolescence: Components tied to traditional internal combustion engines risk becoming outdated as the industry embraces electrification.

- Rapid Industry Shifts: The accelerated adoption of EVs and autonomous driving technologies requires continuous adaptation.

- Investment in R&D: Significant investment in developing new technologies and adapting existing ones is crucial for mitigating obsolescence risks.

Economic Downturns and Consumer Confidence

Economic downturns pose a significant threat to Cooper-Standard. Declining consumer confidence, as seen in the U.S. Consumer Confidence Index which dipped to 100.0 in May 2024 from 101.3 in April, directly impacts vehicle purchasing decisions. This reduction in demand for new vehicles translates into lower sales volumes for automotive component suppliers like Cooper-Standard, affecting their revenue streams and overall profitability.

The automotive industry is particularly sensitive to macroeconomic shifts. A prolonged economic slowdown or recession can lead to substantial drops in vehicle production. For instance, global light vehicle production forecasts for 2024 have been subject to revision based on economic sentiment, with some analysts predicting only modest growth or even contraction in certain regions, directly pressuring Cooper-Standard's order books.

- Impact on Sales: Reduced consumer spending power during economic downturns leads to decreased demand for new vehicles, consequently lowering Cooper-Standard's sales volumes.

- Profitability Squeeze: Lower production volumes and potential price pressures from automakers seeking cost reductions can significantly erode Cooper-Standard's profit margins.

- Inventory Management: Economic uncertainty can complicate inventory management, leading to potential write-downs or increased carrying costs if demand forecasts prove inaccurate.

The increasing cost of raw materials, such as steel and aluminum, poses a significant challenge for Cooper-Standard. For example, steel prices saw a notable increase of approximately 15% in early 2025 compared to the previous year, directly impacting the company's cost of goods sold and potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Geopolitical instability and trade disputes can disrupt global supply chains, leading to increased logistics costs and potential material shortages. For instance, ongoing trade tensions between major economic blocs in 2024 and early 2025 have created uncertainty in the availability and pricing of key components and raw materials essential for Cooper-Standard's manufacturing operations.

The company faces intense competition from both established global suppliers and emerging players, particularly those specializing in components for electric vehicles. This competitive landscape can lead to pricing pressures and a need for continuous innovation to maintain market share, especially as the automotive supplier market is projected to reach over $3 trillion by 2026.

| Threat Category | Specific Threat | Impact on Cooper-Standard | Example Data (2024-2025) |

|---|---|---|---|

| Economic Factors | Raw Material Price Volatility | Increased cost of goods sold, reduced profit margins | Steel prices up ~15% YoY in early 2025 |

| Supply Chain Disruption | Geopolitical Instability/Trade Disputes | Higher logistics costs, potential material shortages | Trade tensions impacting component availability |

| Competitive Landscape | Intense Competition (especially EV sector) | Pricing pressures, need for innovation, market share risk | Automotive supplier market projected >$3T by 2026 |

SWOT Analysis Data Sources

This Cooper-Standard SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of both internal capabilities and external market dynamics.