Cooper-Standard Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper-Standard Bundle

Cooper-Standard operates in a competitive automotive supply landscape, where buyer power and the threat of substitutes significantly shape its market. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Cooper-Standard’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive industry, including companies like Cooper-Standard, grapples with the increasing cost of raw materials such as rubber, plastics, and metals. These price hikes, coupled with persistent supply chain disruptions, put pressure on manufacturers.

For specialized components within sealing and fluid transfer systems, a limited number of suppliers for critical, high-performance materials can significantly amplify their bargaining power. This scarcity allows these suppliers to dictate terms and pricing more effectively.

Cooper-Standard faces significant supplier bargaining power due to high switching costs in the automotive sector. For specialized components, OEMs demand rigorous adherence to precise specifications and extensive validation processes for any new supplier or material. This makes it both difficult and financially prohibitive for automakers to switch from established, qualified suppliers.

This intricate qualification process means that Cooper-Standard often finds itself dependent on its current, validated suppliers. Consequently, these suppliers are in a stronger position to negotiate terms, as the cost and time involved in Cooper-Standard finding and integrating a replacement are substantial. For instance, in 2024, the automotive industry continued to grapple with supply chain disruptions, further amplifying the leverage of reliable, pre-qualified component providers.

While uncommon, the possibility of major raw material or sub-component suppliers moving into manufacturing Cooper-Standard’s finished products, known as forward integration, can grant them a degree of leverage. This threat, though often theoretical, adds a layer of supplier bargaining power.

However, the substantial capital outlay and specialized expertise needed to produce Cooper-Standard's advanced automotive components create significant barriers to entry for most suppliers considering such a move. For instance, the automotive supply chain often involves highly engineered parts, with suppliers needing to meet rigorous quality and performance standards, making direct integration into Cooper-Standard's core business a formidable challenge.

Uniqueness of Supplier Inputs

The uniqueness of supplier inputs significantly impacts Cooper-Standard's bargaining power. When suppliers offer highly specialized materials or proprietary technologies, their leverage increases. For example, exclusive access to advanced polymers or specific rubber compounds crucial for sophisticated sealing and fluid transfer systems can limit Cooper-Standard's options, thereby strengthening the supplier's position.

This reliance on a few select providers for critical components means Cooper-Standard has fewer viable alternatives. In 2024, the automotive industry continued to see consolidation among specialized material suppliers, particularly for advanced composites and high-performance elastomers. This trend exacerbates the bargaining power of these unique suppliers.

- Limited Alternatives: Cooper-Standard faces reduced choices when suppliers control unique or patented materials.

- Increased Supplier Leverage: Suppliers of proprietary technologies can command higher prices or more favorable terms.

- Industry Trends: Consolidation in specialized material supply chains in 2024 has amplified the power of unique input providers.

- Impact on Costs: Dependence on unique inputs can lead to higher raw material costs for Cooper-Standard.

Impact of Supplier Inputs on Cooper-Standard’s Cost and Differentiation

The cost of raw materials and components is a major driver of Cooper-Standard's expenses. For instance, in the first quarter of 2024, Cooper-Standard reported that raw material costs, particularly for rubber and plastics, represented a significant portion of their Cost of Goods Sold. This makes suppliers of these essential inputs quite influential.

Moreover, the quality and innovation from suppliers directly impact Cooper-Standard's product differentiation. Meeting OEM demands for performance and sustainability often relies on advanced materials and components. Suppliers who can consistently deliver cutting-edge solutions, like lightweight composites or advanced sealing technologies, possess considerable leverage.

- Raw Material Costs: In Q1 2024, Cooper-Standard's Cost of Goods Sold was impacted by fluctuations in key commodity prices, giving suppliers of these materials significant bargaining power.

- Supplier Innovation: The ability of suppliers to provide advanced materials that meet stringent OEM performance and sustainability standards enhances their leverage.

- Critical Input Dependence: Cooper-Standard's reliance on specific, high-value inputs from certain suppliers means these suppliers can exert considerable influence over pricing and terms.

Cooper-Standard's bargaining power with suppliers is significantly influenced by the concentration of suppliers for critical, specialized components. When only a few suppliers can provide these high-performance materials, their leverage increases, allowing them to dictate terms and prices more effectively.

The automotive industry's reliance on specialized inputs, coupled with high switching costs for OEMs due to rigorous validation processes, further strengthens supplier positions. This dependence means Cooper-Standard often faces limited alternatives, particularly for proprietary technologies or unique materials, as seen with the consolidation trend among specialized material suppliers in 2024.

The bargaining power of suppliers is also amplified by the critical nature of their inputs to Cooper-Standard's product quality and innovation, especially as OEMs demand advanced materials for performance and sustainability. For instance, raw material costs, particularly for rubber and plastics, represented a significant portion of Cooper-Standard's Cost of Goods Sold in Q1 2024, highlighting supplier influence.

| Factor | Impact on Cooper-Standard | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High for specialized components | Consolidation in specialized material supply chains |

| Switching Costs | Significant due to OEM validation | Reinforces dependence on qualified suppliers |

| Input Uniqueness | Increases supplier leverage for proprietary tech | Advanced polymers and elastomers crucial for performance |

| Raw Material Costs | Major component of COGS | Q1 2024 COGS impacted by rubber/plastic prices |

What is included in the product

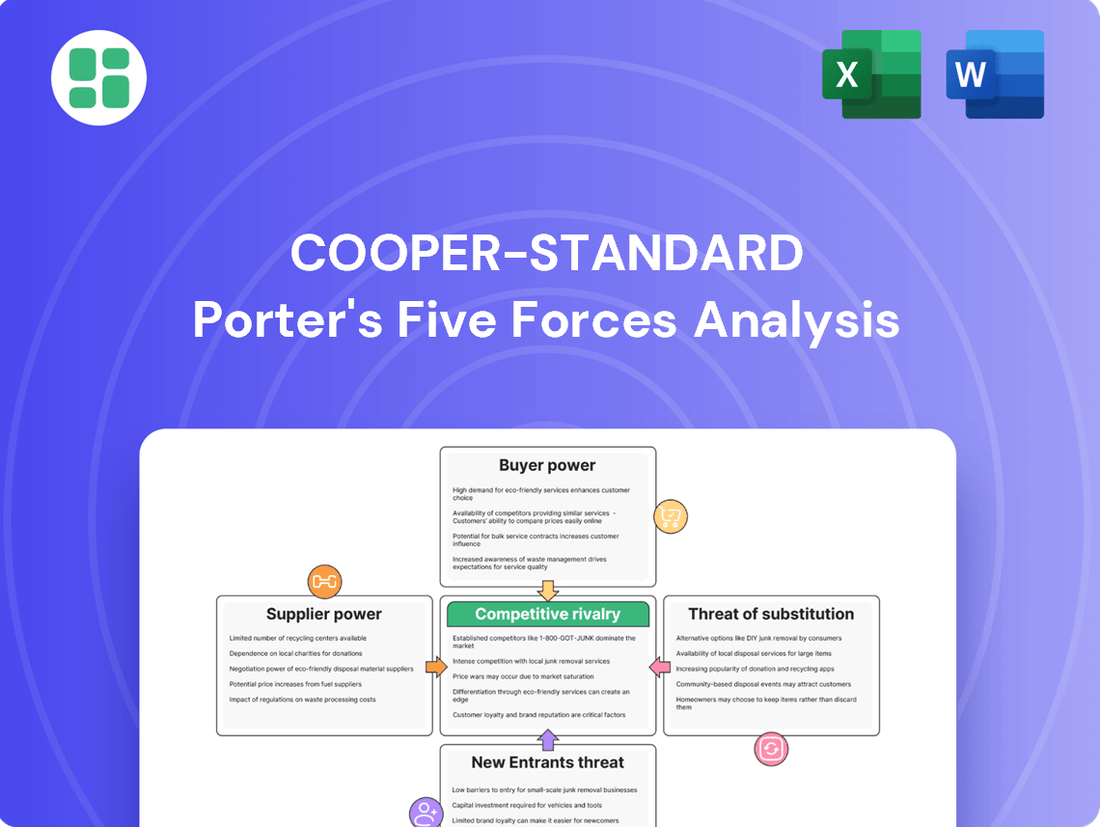

This analysis unpacks the competitive forces impacting Cooper-Standard, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the automotive supplier market.

Instantly visualize the competitive landscape for Cooper-Standard, simplifying complex industry dynamics for strategic clarity.

Customers Bargaining Power

Cooper-Standard's customer base is highly concentrated, with major automotive Original Equipment Manufacturers (OEMs) like Ford, General Motors, Stellantis, Volkswagen, and Toyota forming the core of its business. These large global players represent a significant portion of Cooper-Standard's sales, granting them considerable leverage due to their substantial order volumes.

The automotive industry's current slowdown significantly amplifies customer bargaining power for suppliers like Cooper-Standard. With global light vehicle production projected to remain flat or decline slightly in 2025, original equipment manufacturers (OEMs) are under immense pressure to control costs.

This market environment directly translates into heightened price sensitivity from customers. OEMs, facing their own economic headwinds, are increasingly leveraging their purchasing volume to negotiate more favorable terms and demand cost reductions from their supply chain partners.

The automotive industry's reliance on standardized components means original equipment manufacturers (OEMs) can often source parts from numerous qualified suppliers. This availability allows them to foster competition among suppliers like Cooper-Standard, driving down prices and improving terms.

OEMs frequently adopt dual-sourcing or multi-sourcing strategies for critical components. For example, in 2024, many major automakers secured supply contracts with at least two significant providers for key parts like seating systems and chassis components, directly reducing their dependence on any single vendor and strengthening their bargaining power.

Threat of Backward Integration by Customers

Large Original Equipment Manufacturers (OEMs) in the automotive sector, like General Motors or Ford, often have substantial financial resources and the technical expertise to consider producing certain parts themselves. For instance, if a supplier's pricing becomes uncompetitive, an OEM might explore bringing the production of a high-volume component, such as a specific type of seating foam or a plastic interior trim piece, in-house.

This capability, even if not fully realized, acts as a powerful lever for OEMs during price negotiations. The mere possibility that a major customer could decide to manufacture a component internally puts pressure on suppliers like Cooper-Standard to maintain competitive pricing and efficient operations. In 2024, the automotive industry continued to see cost-saving initiatives across the board, making this threat particularly relevant.

- OEMs' Financial Muscle: Major automotive OEMs in 2024 commanded billions in revenue, providing the capital for potential in-house manufacturing investments.

- Technical Know-how: Established OEMs possess advanced engineering and manufacturing knowledge, reducing the learning curve for producing certain components.

- Strategic Component Focus: The threat is most potent for high-volume, standardized, or strategically important parts where in-house production offers clear cost or control advantages.

- Supplier Pricing Pressure: The latent threat of backward integration forces suppliers to remain highly competitive on price and quality to retain business.

Importance of Cooper-Standard's Products to OEM's Final Product

The bargaining power of customers, specifically Original Equipment Manufacturers (OEMs) in the automotive sector, is a critical factor for Cooper-Standard. While Cooper-Standard's fluid carrying and sealing systems are vital for vehicle performance, noise reduction, and fuel efficiency, their contribution to the overall vehicle cost is relatively minor. For instance, in 2024, the average cost of a new vehicle in the US hovered around $47,000, with component costs varying significantly, but Cooper-Standard's specific product lines likely represent a single-digit percentage of this total.

This low percentage of total vehicle cost means OEMs are often less sensitive to minor price fluctuations from Cooper-Standard. Their primary focus tends to be on managing the vast and complex automotive supply chain for overall cost efficiency and ensuring timely delivery of all components, rather than negotiating aggressively on individual, smaller-value parts. This dynamic can limit Cooper-Standard's ability to pass on significant cost increases directly to the OEMs.

Key considerations regarding OEM bargaining power include:

- Component Cost Proportion: Cooper-Standard's products, while critical, typically form a small fraction of the total manufacturing cost of a vehicle, reducing OEM price sensitivity.

- OEM Focus on Total Cost: OEMs prioritize overall supply chain efficiency and timely delivery, often outweighing the impact of individual component price variations.

- Switching Costs for OEMs: While OEMs can switch suppliers, the process involves significant engineering, testing, and validation, creating a degree of inertia that can temper immediate price pressure.

- Volume Purchasing Power: Large OEMs purchase in massive volumes, giving them considerable leverage in price negotiations with their suppliers.

The bargaining power of Cooper-Standard's customers, primarily major automotive OEMs, is substantial due to their concentrated purchasing volume and the industry's competitive landscape. In 2024, these OEMs, representing a significant portion of Cooper-Standard's revenue, leveraged their size to negotiate favorable terms, especially amidst a projected flat to slightly declining global light vehicle production for 2025. The availability of multiple qualified suppliers for standardized components further empowers these customers to foster competition and drive down prices.

The threat of backward integration, where OEMs might produce certain components in-house, also serves as a potent bargaining tool. With substantial financial resources and technical expertise, major automakers like Ford and General Motors, which generated billions in revenue in 2024, can explore bringing high-volume parts production in-house if supplier pricing becomes uncompetitive. This capability, even if not fully exercised, compels suppliers like Cooper-Standard to maintain aggressive pricing and operational efficiency.

Despite the critical nature of Cooper-Standard's fluid carrying and sealing systems, their relatively small proportion of the total vehicle cost, estimated to be a single-digit percentage of a new vehicle's average price of around $47,000 in the US in 2024, limits the OEMs' sensitivity to minor price increases. OEMs tend to focus on overall supply chain efficiency rather than aggressively negotiating individual component prices, though switching costs for these large buyers can introduce some inertia against immediate price pressure.

| Factor | Impact on Cooper-Standard | 2024/2025 Context |

| Customer Concentration | High leverage for major OEMs | Core customer base includes Ford, GM, Stellantis, VW, Toyota |

| Industry Production Trends | Increased price sensitivity from OEMs | Projected flat to slight decline in global light vehicle production for 2025 |

| Component Standardization | Enables supplier competition | Many parts are standardized, allowing for multi-sourcing |

| Backward Integration Threat | Pressure to maintain competitive pricing | OEMs possess financial and technical capacity for in-house production |

| Component Cost Proportion | Reduced OEM price sensitivity | Cooper-Standard's products likely < 10% of total vehicle cost |

What You See Is What You Get

Cooper-Standard Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Cooper-Standard, providing a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted and insightful analysis you will receive immediately after purchase, ensuring no surprises or missing sections.

Rivalry Among Competitors

Cooper-Standard faces intense competition within the mature automotive supply segments it serves, particularly in sealing, trim, and fluid transfer systems. This crowded landscape means companies must constantly innovate and maintain cost efficiencies to capture market share.

Key global rivals such as Henniges Automotive, Toyoda Gosei, Standard Profil, Lear Corporation, Magna, and Valeo are well-established players, each with significant manufacturing capabilities and extensive product portfolios. Their presence intensifies the rivalry, putting pressure on Cooper-Standard's pricing and profitability.

For instance, the global automotive sealing systems market, a core area for Cooper-Standard, was valued at approximately $35 billion in 2023 and is projected to grow modestly. This growth, while positive, is spread across numerous suppliers, highlighting the competitive intensity for market share gains.

The automotive sector is experiencing sluggish expansion, with global light vehicle production forecasts for 2025 indicating only minor growth, potentially even a slight contraction. This subdued market environment naturally amplifies the competitive pressures among established manufacturers and suppliers like Cooper-Standard.

When the overall industry pie isn't growing much, companies are forced to fight harder for every slice. This means increased price competition and a greater focus on retaining existing customers, putting pressure on profit margins for all involved.

Furthermore, the presence of excess production capacity across the industry exacerbates this rivalry. Manufacturers may operate plants at less than optimal utilization, leading them to push for higher volumes through aggressive pricing or incentives, further intensifying the competitive landscape for component suppliers.

Cooper-Standard operates in an industry where substantial upfront investment in advanced manufacturing equipment, research and development, and maintaining a global production network results in very high fixed costs. For instance, the automotive component sector often requires specialized, automated machinery that represents millions in capital expenditure.

These high fixed costs, coupled with assets that are difficult to repurpose and deeply entrenched relationships with major automakers, erect significant barriers to exiting the market. Companies must continue operating and competing intensely, even when demand falters, to spread these fixed costs over production volume, making the industry particularly susceptible to intense rivalry.

Product Differentiation and Innovation

Cooper-Standard focuses on innovation with offerings like its Fortrex™ advanced rubber material and eCoFlow™ switch pump technology designed for electric vehicles. However, achieving meaningful differentiation in the highly commoditized automotive component sector remains a significant challenge.

Competitors are also making substantial investments in research and development, introducing their own advanced materials and innovative solutions. This creates an ongoing innovation race where securing new business awards and maintaining market share depend on staying ahead in technological advancements.

- Innovation Focus: Cooper-Standard's development of Fortrex™ materials and eCoFlow™ technology highlights its commitment to innovation, particularly for EV applications.

- Commoditization Challenge: The automotive component market's inherent commoditization makes it difficult for any single player to establish a lasting, unique product advantage.

- Competitive R&D: Competitors are actively investing in R&D, leading to a continuous cycle of new product introductions and technological upgrades across the industry.

Impact of OEM Relationships and Global Footprint

Success in the automotive supplier industry hinges on deep-rooted, enduring partnerships with global original equipment manufacturers (OEMs) and an extensive international manufacturing and distribution infrastructure. Cooper-Standard, for instance, capitalizes on its worldwide reach and proven alliances to solidify its competitive standing. This makes it challenging for smaller or newer entrants to penetrate the market effectively.

These OEM relationships are not easily replicated, often involving co-development, stringent quality standards, and significant integration into the OEM's supply chain. Cooper-Standard's 2023 annual report highlights its continued focus on these strategic partnerships, which are crucial for securing future business and maintaining market share. The company's global footprint, with operations in over 15 countries, further strengthens its ability to serve diverse OEM needs across different regions.

- OEM Loyalty: Established relationships often translate into long-term supply agreements, creating high switching costs for OEMs.

- Global Reach: A widespread manufacturing presence allows suppliers to offer localized production and support, a key requirement for global OEMs.

- Barriers to Entry: The capital investment and proven track record required to establish these partnerships act as significant deterrents for new competitors.

- Cooper-Standard's Position: The company's extensive network of facilities and its long-standing ties with major automotive manufacturers underscore its competitive advantage in this area.

The competitive rivalry within Cooper-Standard's operating segments is highly intense, driven by numerous well-established global players vying for market share in a mature industry. Companies like Lear Corporation, Magna, and Valeo are significant competitors, each possessing substantial manufacturing capacity and broad product offerings, which intensifies price pressures and necessitates continuous innovation to maintain profitability.

The subdued growth projections for global light vehicle production, with forecasts for 2025 indicating minimal expansion, further amplify this rivalry. In such an environment, suppliers must aggressively compete for existing business and new awards, often leading to price concessions to secure volume and spread high fixed costs across production.

Cooper-Standard's focus on innovation, such as its Fortrex™ materials, faces a constant challenge from competitors also investing heavily in R&D. This creates an ongoing technological race where differentiation is difficult to sustain in a market prone to commoditization, making it crucial to secure OEM loyalty through established relationships and a global manufacturing footprint.

The automotive supplier market is characterized by high barriers to entry, including substantial capital investment in advanced manufacturing and the critical need for deep, long-standing relationships with original equipment manufacturers (OEMs). Cooper-Standard leverages its global presence and proven OEM alliances, which are difficult for new entrants to replicate, to solidify its competitive position.

| Key Competitors | Primary Product Segments | Estimated 2024 Market Share (Illustrative) |

| Lear Corporation | Sealing, E-Systems, Seating | ~8-10% |

| Magna International | Body & Powertrain, Mirrors, Lighting, Interiors | ~12-15% |

| Valeo | Thermal Systems, Powertrain, Driving Assistance | ~7-9% |

| Henniges Automotive | Sealing Systems, Anti-Vibration Systems | ~4-6% |

| Toyoda Gosei | Sealing Systems, Interior/Exterior Parts | ~3-5% |

SSubstitutes Threaten

The automotive industry's push for lightweighting, particularly in electric vehicles, significantly elevates the threat of substitutes for traditional components. New vehicle architectures often incorporate advanced composites and multi-material solutions, potentially replacing established parts. For instance, the growing use of carbon fiber reinforced polymers (CFRP) in structural components directly challenges the need for traditional metal-based parts that Cooper Standard traditionally supplies.

The rise of electric vehicles (EVs) significantly challenges traditional fluid systems. As battery electric vehicles (BEVs) gain market share, the demand for components like fuel lines and many engine cooling lines, crucial for internal combustion engines, is declining. In 2024, global EV sales are projected to surpass 15 million units, a substantial increase from previous years, directly impacting the market for these legacy fluid transfer systems.

While EVs introduce new fluid system needs, such as specialized seals and battery cooling lines, these do not fully offset the decline in traditional components. The overall fluid transfer system landscape is shifting, with a greater emphasis on thermal management for batteries and powertrains. This transition means suppliers heavily reliant on internal combustion engine fluid systems face a significant threat from substitutes in the form of EV-specific technologies.

Technological advancements in industrial adhesives and sealants are a significant threat to Cooper-Standard's traditional fluid transfer systems. Companies are increasingly adopting these new joining technologies, which can offer cost savings and assembly efficiencies. For example, the global industrial adhesives market was valued at approximately $60 billion in 2023 and is projected to grow, indicating a shift in manufacturing preferences.

Modularity and Component Consolidation by OEMs

Original Equipment Manufacturers (OEMs) are increasingly adopting modular designs and platform strategies. This approach simplifies vehicle assembly and drives down costs by consolidating numerous components into larger, integrated modules. For suppliers like Cooper-Standard, this means a potential reduction in the number of discrete parts they provide, directly impacting their business.

This shift towards consolidation presents a significant substitution threat. Instead of sourcing individual parts, OEMs might opt for a single, larger module from another supplier or even develop these modules in-house. For instance, in 2024, many automotive OEMs announced plans to increase their use of integrated chassis modules, which could reduce the need for multiple individual suspension or exhaust components previously supplied by tier-one suppliers.

- OEMs are consolidating components into integrated modules.

- This modularity simplifies assembly and lowers costs for manufacturers.

- The trend poses a substitution threat by reducing the demand for individual parts.

- In 2024, automotive OEMs highlighted increased adoption of integrated chassis modules.

Regulatory and Sustainability-Driven Material Shifts

Stricter environmental regulations and a growing focus on sustainability are increasingly influencing material choices in the automotive industry. This trend can accelerate the adoption of alternative materials that offer reduced weight, lower emissions, or better recyclability, potentially impacting Cooper-Standard's traditional product lines.

For instance, the European Union's End-of-Life Vehicles Directive continues to push for higher recycling rates and the reduction of hazardous substances, creating a favorable environment for materials that align with these goals. In 2024, many automakers are setting ambitious targets for recycled content in their vehicles, with some aiming for over 30% by the end of the decade.

- Increased Demand for Lightweight Materials: Regulations targeting fuel efficiency and emissions, such as the Corporate Average Fuel Economy (CAFE) standards in the US, incentivize the use of lighter materials to reduce vehicle weight.

- Growth of Sustainable and Recycled Content: Consumer and regulatory pressure for eco-friendly products is driving demand for materials with a lower carbon footprint and higher percentages of recycled content.

- Emergence of Advanced Composites and Bio-based Materials: These substitutes offer performance advantages like improved strength-to-weight ratios and reduced environmental impact, posing a direct threat to conventional materials.

The automotive industry's shift towards electric vehicles (EVs) and advanced manufacturing techniques presents a significant threat of substitutes for Cooper-Standard's traditional fluid transfer systems and sealing solutions. The decline in internal combustion engine (ICE) components, coupled with the rise of integrated modules and alternative materials, directly challenges established product lines.

In 2024, the automotive sector is witnessing a surge in lightweight materials like advanced composites and multi-material solutions, driven by the demand for fuel efficiency and EV performance. This trend, alongside the increasing adoption of industrial adhesives over traditional fastening methods, directly substitutes for components that Cooper-Standard has historically supplied.

The increasing modularity in vehicle design, where multiple components are consolidated into single units, further reduces the demand for individual parts. For instance, the projected growth in global EV sales, anticipated to exceed 15 million units in 2024, signifies a substantial market shift away from ICE-centric fluid systems, thereby increasing the threat of substitutes.

| Threat of Substitutes | Description | Impact on Cooper-Standard | Supporting Data (2023-2024) |

|---|---|---|---|

| Lightweight Materials & Composites | Advanced composites (e.g., CFRP) replacing metal parts. | Reduces demand for traditional metal-based components. | Global industrial adhesives market valued at ~$60 billion in 2023; growing adoption of composites in EV architectures. |

| Electric Vehicle (EV) Technology | Decline in ICE fluid systems; rise in EV-specific thermal management. | Decreases demand for fuel lines; requires adaptation to new fluid needs. | Projected global EV sales >15 million units in 2024; shift in fluid system focus to battery cooling. |

| Modular Design & Consolidation | OEMs integrating multiple parts into larger modules. | Reduces the number of discrete parts supplied. | Increased OEM plans for integrated chassis modules in 2024; simplification of assembly. |

| Industrial Adhesives & Sealants | New joining technologies offering cost/assembly benefits. | Potential substitution for traditional sealing and fluid transfer methods. | Global industrial adhesives market growth indicates a shift in manufacturing preferences. |

Entrants Threaten

Establishing a foothold in automotive component manufacturing, particularly for sophisticated systems like those Cooper-Standard specializes in, demands significant upfront capital. This includes substantial outlays for research and development, cutting-edge machinery, and the establishment of worldwide production sites. For instance, the automotive sector often sees R&D spending in the billions annually for major players, indicating the scale of investment needed.

Cooper Standard's strong, long-standing connections with automotive Original Equipment Manufacturers (OEMs) present a significant barrier for new companies looking to enter the automotive supply market. These relationships are often built over many years, sometimes covering the entire lifespan of a vehicle model. For instance, in 2024, the automotive industry continued to emphasize supplier stability, with major OEMs like Ford and General Motors renewing multi-year contracts with established partners, underscoring the value placed on proven performance and integrated supply chains.

The automotive sector's stringent OEM qualification and validation processes act as a significant deterrent for potential new entrants. These requirements involve extensive testing, certification, and validation to guarantee safety, performance, and longevity of automotive components. For example, in 2024, a new supplier might face millions of dollars in testing costs and years of validation cycles before even securing a single contract with a major automaker.

Economies of Scale and Cost Competitiveness

Cooper-Standard, as an established player in the automotive supplier industry, benefits immensely from significant economies of scale. This advantage is particularly pronounced in manufacturing, where higher production volumes lead to lower per-unit costs. For instance, in 2024, major automotive suppliers often operate plants with capacities exceeding 1 million units annually, allowing them to spread fixed costs over a larger output.

New entrants face a formidable barrier in replicating these cost efficiencies. To achieve comparable economies of scale, a new company would require a substantial initial investment in plant, equipment, and market share. Without this, they would struggle to compete on price against incumbents like Cooper-Standard, who have already optimized their supply chains and production processes over many years.

- Economies of Scale: Cooper-Standard leverages high production volumes to reduce per-unit manufacturing costs.

- Procurement Advantages: Large-scale purchasing power allows for better negotiation of raw material prices.

- Distribution Efficiencies: Established logistics networks reduce shipping costs per unit.

- Barriers to Entry: New entrants need massive capital to match these cost efficiencies and compete on price.

Intellectual Property and Proprietary Technologies

Cooper-Standard's robust portfolio of intellectual property and proprietary technologies presents a substantial barrier to entry. The company holds numerous patents for innovations like its Fortrex™ materials platform and eCoFlow™ switch pump, which are crucial for its competitive edge in the automotive supply sector.

The significant investment required for research and development, coupled with the lengthy time needed to replicate such advanced solutions, deters potential new entrants. For instance, developing a comparable materials science platform can easily cost tens of millions of dollars and take several years of dedicated R&D.

- Intellectual Property: Cooper-Standard possesses a significant number of patents protecting its unique technologies.

- Proprietary Technologies: Innovations like Fortrex™ materials and eCoFlow™ switch pumps offer distinct performance advantages.

- R&D Investment: Replicating these advanced solutions demands substantial financial resources and time.

- Market Entry Barrier: The high cost and time investment create a formidable challenge for new competitors.

The threat of new entrants for Cooper-Standard is generally considered moderate to low due to substantial capital requirements and established OEM relationships. Significant investment in R&D, advanced manufacturing, and global production facilities creates high initial barriers. For example, in 2024, the automotive supply chain continued to demand substantial upfront investment, with new suppliers often needing to invest hundreds of millions to establish credible production capabilities and meet OEM quality standards.

Furthermore, the lengthy and rigorous OEM qualification processes, often taking years and millions in testing, alongside deeply entrenched supplier relationships built over decades, solidify Cooper-Standard's position. These factors, combined with the cost efficiencies derived from economies of scale and protected intellectual property, make it exceptionally challenging for newcomers to gain traction and compete effectively in the automotive component market.

| Barrier Type | Description | Example Impact (2024) |

|---|---|---|

| Capital Requirements | High investment in R&D, machinery, and global production. | New entrants may need $100M+ to establish basic production capacity. |

| OEM Relationships | Long-standing, trust-based partnerships with automakers. | OEMs prioritize suppliers with proven track records, making it hard for new firms to secure initial contracts. |

| Qualification Processes | Extensive testing, certification, and validation for components. | New suppliers can face 2-5 years and millions in costs for validation before production. |

| Economies of Scale | Cost advantages from high-volume production. | Incumbents like Cooper-Standard benefit from lower per-unit costs, impacting price competitiveness for new entrants. |

| Intellectual Property | Patented technologies and proprietary processes. | Replicating advanced materials or manufacturing techniques can cost tens of millions and take years. |

Porter's Five Forces Analysis Data Sources

Our Cooper-Standard Porter's Five Forces analysis is built upon a foundation of reliable data, including the company's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and data from financial news outlets to capture the competitive landscape.