Constellation Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

Navigate the complex external forces shaping Constellation Energy's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this energy giant. Gain a strategic advantage by downloading the full analysis today and equipping yourself with the essential intelligence to make informed decisions.

Political factors

Constellation Energy is a major beneficiary of robust, bipartisan political backing for clean energy, especially nuclear power. This support stems from nuclear's crucial role in achieving decarbonization goals and ensuring grid stability, a sentiment echoed across the political spectrum.

The Inflation Reduction Act of 2022 is a prime example, offering significant tax credits and incentives that directly support Constellation's existing nuclear fleet and future clean energy ventures. These financial mechanisms are designed to make clean energy investments more predictable and attractive.

The Biden administration's ambitious targets to boost domestic nuclear capacity, aiming for expanded capacity by 2035 and continued growth through 2040, create a powerful political tailwind. This forward-looking policy landscape provides a stable and encouraging environment for Constellation's strategic planning and operational expansion.

Political efforts to streamline regulatory processes are vital for Constellation Energy's growth and the continued operation of its nuclear fleet. The ADVANCE Act, enacted in 2024, is a significant step towards accelerating the deployment of advanced nuclear reactors by reducing regulatory hurdles.

Further bolstering this favorable environment, executive orders issued by the Trump administration in May 2025 directed the Nuclear Regulatory Commission (NRC) to expedite approval processes. This policy shift is expected to facilitate quicker project development and license extensions for Constellation's existing nuclear power plants, potentially improving operational efficiency and expanding capacity.

The federal government's dedication to clean energy sourcing significantly bolsters Constellation Energy. A landmark 10-year contract with the U.S. General Services Administration (GSA), valued at $840 million and commencing in 2025, will provide nuclear power to over a dozen federal agencies.

This substantial agreement signals a clear federal energy policy pivot towards carbon-free electricity generation. Beyond just energy supply, the partnership also encompasses energy efficiency improvements for federal buildings, underscoring nuclear power's importance for both governmental and corporate sustainability objectives.

Energy Market Policy and Deregulation

Constellation Energy's financial performance is significantly influenced by energy market policies, particularly ongoing debates surrounding deregulation and re-regulation. These shifts can directly affect the company's operational agility and profit margins. For instance, the Inflation Reduction Act of 2022, which includes a nuclear production tax credit, provides a substantial financial incentive, with the credit valued at $15 per megawatt-hour for nuclear power generation. This policy support is crucial for Constellation's ability to leverage its clean energy assets effectively.

The broader political landscape emphasizes energy reliability and affordability, shaping the environment in which Constellation operates. While specific deregulation actions beyond clean energy initiatives were less detailed in recent analyses, the underlying political direction supports stable energy markets. Constellation's strategic navigation of these market structures and its capacity to capitalize on policy advantages, such as the aforementioned nuclear tax credit, are paramount to its sustained financial success.

- Nuclear Production Tax Credit: The Inflation Reduction Act of 2022 provides a credit of $15/MWh for nuclear power, directly benefiting Constellation's nuclear fleet.

- Energy Affordability Goals: Political pressure to keep energy costs down can influence market rules and Constellation's pricing strategies.

- Grid Modernization Initiatives: Government funding and policy support for grid upgrades can create opportunities for Constellation to invest in and benefit from a more resilient energy infrastructure.

- Clean Energy Mandates: Policies promoting renewable energy and emissions reductions, while potentially creating competition, also highlight the value of Constellation's zero-emission nuclear assets.

Geopolitical Stability and Energy Security

Global geopolitical shifts and domestic energy security concerns are increasingly driving political decisions that favor stable, baseload power sources, such as nuclear energy. This trend directly benefits Constellation Energy, which operates a significant nuclear fleet. For instance, in 2024, the U.S. Department of Energy continued to emphasize the role of nuclear power in achieving national energy security goals, reinforcing the strategic value of companies like Constellation.

The political focus on American-made energy and reducing dependence on foreign fossil fuels, evident in recent legislative actions and executive pronouncements, elevates Constellation's diverse energy portfolio, including its nuclear assets, to a critical national asset. This strategic positioning can translate into sustained policy backing and investment in its infrastructure, crucial for achieving long-term energy independence.

- Policy Support: Government initiatives in 2024 and projections for 2025 continue to prioritize nuclear power for grid stability and emissions reduction.

- Investment Climate: Favorable political sentiment supports ongoing investment in nuclear plant upgrades and potential new builds.

- Energy Independence: Constellation's role in providing reliable, domestic energy aligns with national security objectives.

Political support for nuclear energy remains a significant tailwind for Constellation Energy, driven by bipartisan recognition of its role in decarbonization and grid reliability. Legislation like the Inflation Reduction Act of 2022, offering a $15/MWh production tax credit for nuclear power, directly enhances the financial viability of Constellation's operations.

The Biden administration's commitment to expanding nuclear capacity by 2035 and 2040, coupled with executive actions in 2025 to streamline regulatory approvals via the ADVANCE Act, creates a favorable policy environment. Furthermore, a $840 million federal contract with the GSA starting in 2025 to supply nuclear power to government agencies underscores the strategic importance of Constellation's assets.

| Policy/Initiative | Year Enacted/Effective | Impact on Constellation Energy |

| Inflation Reduction Act (Nuclear Production Tax Credit) | 2022 | $15/MWh credit for nuclear power generation |

| ADVANCE Act (Streamlining Nuclear Deployment) | 2024 | Accelerates deployment of advanced nuclear reactors |

| GSA Contract for Nuclear Power | Commencing 2025 | $840 million over 10 years, supplying federal agencies |

| Executive Orders (Expediting NRC Approvals) | May 2025 | Facilitates quicker project development and license extensions |

What is included in the product

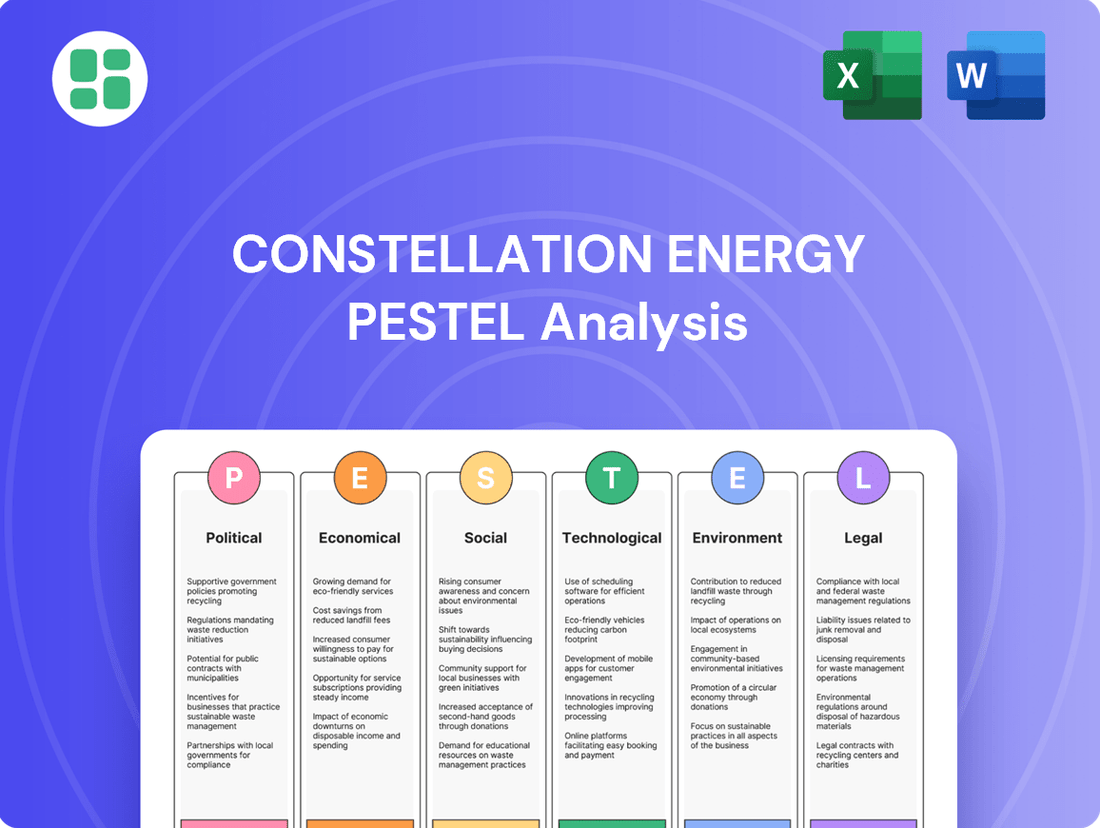

This PESTLE analysis of Constellation Energy examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides actionable insights into how macro-environmental shifts create both challenges and avenues for growth within the energy sector.

A concise Constellation Energy PESTLE analysis that highlights key external factors, simplifying complex market dynamics for strategic decision-making and reducing the burden of extensive research.

Economic factors

The escalating demand for electricity, especially from data-intensive industries like AI and cloud computing, presents a significant economic tailwind for Constellation Energy. These sectors require substantial and consistent power, with a growing preference for clean, carbon-free sources.

Constellation is strategically positioned to capitalize on this trend, forging key alliances with major technology firms such as Microsoft. These partnerships are designed to supply nuclear-generated power for new, energy-hungry data centers, highlighting the economic advantage of their clean energy portfolio.

The company's financial performance in 2024 underscores this economic opportunity, with strong results directly attributed to the robust demand for reliable, emission-free electricity. This increasing need for clean power translates into substantial revenue growth and market share expansion for Constellation.

Fluctuations in wholesale and retail electricity prices are a critical economic factor for Constellation Energy. These price swings directly affect the company's revenue streams and overall profitability. For instance, in 2024, Constellation reported strong financial performance, partly due to its strategic positioning in these volatile markets, which allowed it to capitalize on favorable price environments.

The company's success hinges on its ability to effectively manage these market prices, often through hedging strategies and long-term contracts. This proactive approach to price management is essential for maintaining stable margins and ensuring financial resilience against the inherent unpredictability of energy markets.

Constellation Energy's economic resilience is significantly driven by its robust capital expenditure plans. The company has earmarked over $2.5 billion for 2025, a substantial sum dedicated to both maintaining its current operations and pursuing growth initiatives. This includes crucial investments aimed at enhancing the output of its nuclear facilities and expanding its ownership in other energy assets.

This aggressive investment strategy is further facilitated by a favorable financing landscape for nuclear energy projects. Constellation Energy has successfully leveraged this environment, notably through the issuance of corporate green bonds. These financial instruments not only provide the necessary capital but also underscore the company's commitment to sustainable energy development.

Inflationary Pressures and Operational Costs

Constellation Energy has shown impressive financial results, with increased profitability in 2024. However, persistent inflationary pressures are driving up operational costs across the energy sector, posing a potential challenge to maintaining these gains.

The company's operational efficiency, particularly its high nuclear fleet capacity factors, is a key strength in offsetting these rising expenses. For instance, in the first quarter of 2024, Constellation reported a nuclear capacity factor of 94.1%, demonstrating excellent performance. This efficiency helps to stabilize input costs relative to output.

- Inflationary Impact: Rising costs for fuel, labor, and materials can squeeze profit margins.

- Operational Efficiency as a Buffer: High nuclear fleet capacity factors (e.g., 94.1% in Q1 2024) help mitigate cost increases.

- Cost Management Focus: Continued emphasis on expense control is vital for preserving profitability in a fluctuating economic climate.

Shareholder Returns and Financial Health

Constellation Energy's financial health is a key driver of shareholder returns, as evidenced by its strong performance. In 2024, the company reported impressive financial results, which translated into tangible benefits for investors through increased dividends and substantial share repurchase programs. This positive trajectory underscores the company's commitment to rewarding its shareholders.

Further solidifying its financial standing, Moody's upgraded Constellation Energy's issuer credit rating to Baa1. This upgrade, effective in early 2024, reflects improved debt coverage ratios and the company's consistently strong financial performance. Such a rating signifies a lower risk profile for investors and enhances the company's ability to access capital.

The robust financial position achieved by Constellation Energy directly supports its strategic investments in clean energy initiatives. This financial strength not only enables the company to pursue growth opportunities in the evolving energy landscape but also ensures the creation of long-term value for its shareholders through sustainable business practices and profitable operations.

- Strong 2024 Financial Results: Constellation Energy demonstrated robust financial performance throughout 2024, setting a positive tone for shareholder value.

- Increased Shareholder Distributions: The company actively returned capital to shareholders through higher dividend payouts and significant share buyback programs.

- Moody's Baa1 Issuer Credit Rating: An upgrade to Baa1 by Moody's in early 2024 highlights improved debt coverage and overall financial strength.

- Enabling Clean Energy Investment: The solid financial foundation allows for continued strategic investment in clean energy, fostering long-term growth and shareholder value.

The increasing demand for clean, reliable electricity, particularly from burgeoning sectors like artificial intelligence and cloud computing, provides a substantial economic advantage for Constellation Energy. These industries require significant and consistent power, with a strong preference for emission-free sources, a niche Constellation is well-positioned to fill through its nuclear fleet.

Constellation's strategic partnerships, such as its agreement with Microsoft to supply nuclear power for data centers, underscore the economic viability of its clean energy offerings. The company's robust financial performance in 2024 directly reflects this growing demand, translating into revenue growth and market share gains.

Economic factors like fluctuating wholesale and retail electricity prices directly impact Constellation's revenue and profitability. The company's ability to manage these price volatilities through hedging and long-term contracts is crucial for maintaining stable margins and financial resilience, as demonstrated by its strong 2024 performance which capitalized on favorable market prices.

Constellation Energy's commitment to growth is evident in its substantial capital expenditure plans, with over $2.5 billion allocated for 2025 to maintain operations and expand its energy asset ownership. This investment is supported by a favorable financing environment for nuclear energy, highlighted by their successful issuance of corporate green bonds.

| Economic Factor | Impact on Constellation Energy | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Clean Electricity | Significant growth driver, especially from data centers. | Key partnerships with tech firms (e.g., Microsoft) for nuclear power supply. Strong 2024 financial results attributed to clean energy demand. |

| Electricity Price Volatility | Directly affects revenue and profitability. | Strategic positioning and hedging strategies used to capitalize on favorable price environments in 2024. |

| Inflationary Pressures | Increases operational costs, potentially impacting margins. | Reported strong profitability in 2024 despite inflationary headwinds. High nuclear fleet capacity factors (94.1% in Q1 2024) help offset rising expenses. |

| Capital Expenditures | Supports operational maintenance and growth initiatives. | Over $2.5 billion planned for 2025 for facility upgrades and asset expansion. Successful issuance of corporate green bonds. |

| Financial Health & Investor Returns | Enables strategic investment and rewards shareholders. | Strong 2024 financial results leading to increased dividends and share repurchases. Moody's upgraded issuer credit rating to Baa1 in early 2024. |

What You See Is What You Get

Constellation Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Constellation Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of how these external forces shape Constellation Energy's market position and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for stakeholders looking to understand the dynamic landscape in which Constellation Energy operates.

Sociological factors

Public perception of nuclear energy significantly influences its acceptance and, consequently, Constellation Energy's operational landscape. Historically, incidents have fostered apprehension, but a shift is occurring. For instance, a 2023 Gallup poll indicated that 55% of Americans view nuclear energy favorably, a notable increase from previous years, highlighting growing acceptance.

This evolving public sentiment is bolstered by a growing recognition among policymakers and stakeholders of nuclear energy's crucial role in meeting escalating energy demands while combating climate change. Constellation actively capitalizes on this by advocating for nuclear power as a clean, reliable, and cost-effective solution, even offering specialized nuclear-powered electricity plans to residential customers, demonstrating a direct engagement with public acceptance.

Societal pressure for environmentally friendly energy is intensifying, directly benefiting companies like Constellation Energy that focus on clean power. Consumers and businesses alike are increasingly prioritizing carbon-free options, aligning perfectly with Constellation's operational focus.

Constellation Energy is well-positioned to capitalize on this trend, as its current generation mix is nearly 90% carbon-free, with a stated goal of achieving 100% by 2040. This commitment resonates strongly with an environmentally aware public and drives demand for their services.

The growing demand for sustainable solutions fuels Constellation's strategic expansion into various clean energy technologies and reinforces its engagement in corporate sustainability efforts, making it a key player in the evolving energy landscape.

The specialized nature of the nuclear and clean energy sectors demands a robust approach to workforce development and talent acquisition. Constellation Energy's proactive efforts in restaffing and training, particularly for facilities like the Crane Clean Energy Center, underscore the critical need to secure and maintain a highly skilled workforce to operate these complex energy assets.

Attracting and retaining top talent is paramount, and Constellation's designation as a Great Place to Work® in 2024 speaks volumes about its internal sociological environment. This recognition suggests a positive company culture that fosters employee engagement and loyalty, crucial for long-term operational success and stability in a competitive industry.

Community Engagement and Local Impact

Constellation Energy prioritizes robust community engagement, investing significantly in local development and historically underserved areas. In 2023 alone, the company contributed over $10 million to various community organizations and saw its employees dedicate more than 20,000 volunteer hours. This commitment fosters positive relationships and operational acceptance.

Evidence of this strong local impact includes widespread community support for new projects, such as the rallies held in central Pennsylvania advocating for the Crane Clean Energy Center. Such initiatives highlight the tangible benefits and local buy-in that Constellation's operations can generate, reinforcing its role as a responsible corporate citizen.

- Community Investment: Over $10 million contributed to community organizations in 2023.

- Employee Volunteerism: More than 20,000 volunteer hours logged by employees in 2023.

- Local Project Support: Public rallies in Pennsylvania demonstrate community backing for new energy centers.

Consumer Behavior and Energy Efficiency

Consumer behavior is increasingly prioritizing energy efficiency and reducing carbon footprints, directly impacting demand for Constellation's diverse energy solutions. This trend is evident as consumers, both individuals and businesses, actively seek ways to manage their environmental impact and energy costs.

Constellation directly addresses this by offering comprehensive energy management services, competitive electricity and natural gas supply, and innovative solutions such as offsite renewables and on-site solar installations. These services are designed to help clients, spanning residential, commercial, industrial, and governmental sectors, achieve their emission reduction targets and optimize overall energy consumption.

- Growing Demand for Green Energy: A significant portion of consumers, particularly younger demographics, are willing to pay a premium for renewable energy options. For instance, a 2024 survey indicated that over 60% of U.S. consumers are more likely to choose an energy provider offering green energy plans.

- Focus on Energy Efficiency: Beyond sourcing, consumers are investing in energy-efficient appliances and smart home technology, driving demand for smart grid solutions and energy monitoring services. In 2025, sales of ENERGY STAR certified products are projected to increase by 15% year-over-year.

- Corporate Sustainability Goals: Businesses are setting ambitious Environmental, Social, and Governance (ESG) targets, creating a substantial market for Constellation's commercial and industrial solutions. Many Fortune 500 companies have pledged to achieve net-zero emissions by 2040, requiring significant investment in renewable energy procurement and efficiency upgrades.

Societal shifts towards sustainability and clean energy directly benefit Constellation Energy, as evidenced by growing consumer preference for carbon-free options. This trend is further amplified by corporate commitments to ESG goals, creating a substantial market for Constellation's renewable solutions. The company's nearly 90% carbon-free generation mix positions it favorably to meet this escalating demand.

Constellation's strong community engagement, including over $10 million in community contributions in 2023 and more than 20,000 employee volunteer hours, fosters positive local relationships and operational acceptance, exemplified by community support for new energy centers.

The company's recognition as a Great Place to Work® in 2024 highlights a positive internal culture, crucial for attracting and retaining the skilled workforce needed to operate complex energy assets like those at the Crane Clean Energy Center.

| Sociological Factor | 2023/2024 Data Point | Impact on Constellation Energy |

|---|---|---|

| Public Perception of Nuclear Energy | 55% favorable (Gallup, 2023) | Increased acceptance aids operational landscape and advocacy efforts. |

| Demand for Green Energy | 60%+ consumers more likely to choose green plans (2024 Survey) | Drives demand for Constellation's carbon-free generation and specialized plans. |

| Community Investment | >$10 million contributed to organizations (2023) | Builds goodwill and operational acceptance through local support. |

| Employee Volunteerism | >20,000 hours logged (2023) | Enhances corporate image and employee engagement. |

| Workforce Development | Designated Great Place to Work® (2024) | Aids in attracting and retaining skilled talent for complex operations. |

Technological factors

Constellation Energy, operating the largest nuclear fleet in the U.S., is heavily invested in and influenced by advancements in nuclear reactor technology. This includes the development and potential deployment of small modular reactors (SMRs) and efforts to increase the output of existing plants through uprates.

The company's strategy involves enhancing the efficiency and capacity of its current nuclear facilities. For instance, Constellation Energy aims to boost the output of its nuclear plants by integrating new equipment, a move projected to add as much as one gigawatt of clean energy capacity to the grid.

Further underscoring this technological shift, the Department of Energy (DOE) is backing projects focused on advanced SMRs and microreactors. These initiatives represent a significant push towards future innovations within the nuclear energy sector, directly impacting companies like Constellation Energy.

Technological advancements in energy storage, particularly in battery technology, are crucial for integrating renewable energy sources. While Constellation's nuclear fleet provides stable baseload power, these grid enhancements improve the overall energy ecosystem.

Grid modernization, including digitalization and the use of AI and data analytics, allows for more efficient operation and management of the energy network. For instance, by mid-2024, the US Department of Energy reported significant investments in grid modernization projects aimed at improving resilience and accommodating distributed energy resources.

Constellation is leveraging digitalization and data analytics to significantly enhance its operational efficiency. This includes optimizing power plant performance through advanced monitoring and predictive maintenance, aiming to minimize costly downtime. For instance, by mid-2024, the company reported a notable increase in asset reliability metrics directly attributable to these technological investments.

The energy trading segment also benefits from sophisticated data analytics, allowing for more precise forecasting and risk management in volatile markets. This data-driven approach helps Constellation navigate market complexities and capitalize on opportunities, contributing to its competitive edge in the energy sector throughout 2024 and into 2025.

Furthermore, the burgeoning demand from data centers, a key growth area for energy consumption, underscores the critical role of digital infrastructure. Constellation's ability to service this demand efficiently is directly linked to its own advancements in digitalization and data analytics, creating a mutually beneficial technological ecosystem.

Renewable Energy Efficiency Improvements

Constellation Energy is capitalizing on significant advancements in renewable energy efficiency. Beyond its substantial nuclear fleet, the company actively operates and expands its hydro, wind, and solar power generation capabilities. These renewable sources are experiencing continuous technological improvements, enhancing their output and cost-effectiveness.

For instance, solar panel efficiency has seen steady gains, with commercial modules now frequently exceeding 22% efficiency, a notable increase from earlier generations. Similarly, wind turbine technology continues to evolve, with larger rotor diameters and improved aerodynamic designs leading to higher capacity factors. Constellation's investment in these cleaner energy sources directly benefits from these ongoing efficiency leaps, allowing for a more robust and diverse carbon-free energy portfolio.

The company's strategic focus on expanding its clean energy resources is directly supported by these technological advancements. This commitment ensures Constellation can offer an increasingly efficient and varied mix of zero-emission electricity to its customers, aligning with market demands for sustainable energy solutions.

- Solar Efficiency Gains: Commercial solar panels now regularly achieve over 22% efficiency, up from previous benchmarks.

- Wind Turbine Advancements: Larger rotor diameters and improved designs are boosting wind power capacity factors.

- Portfolio Diversification: Constellation's expansion in hydro, wind, and solar leverages these efficiency improvements.

Cybersecurity for Energy Infrastructure

The increasing digitization of energy infrastructure, from smart grids to operational technology, makes robust cybersecurity paramount. This trend is driven by the need to protect against sophisticated cyber threats targeting critical national infrastructure. The U.S. Department of Energy has been actively investing in and promoting cybersecurity initiatives for the energy sector, recognizing its vital role in national security and economic stability.

While specific Constellation Energy cybersecurity investments aren't publicly detailed in general reports, the industry faces growing threats. For instance, reports from 2023 and early 2024 highlighted a significant rise in ransomware attacks targeting utility companies globally, underscoring the operational necessity for advanced defenses. Constellation, as a major energy provider, would be expected to implement comprehensive cybersecurity strategies to safeguard its operations and customer data.

- Increased Interconnectivity: The integration of IoT devices and advanced analytics in energy systems creates a larger attack surface.

- Evolving Threat Landscape: Nation-state actors and organized cybercriminal groups are increasingly targeting energy infrastructure.

- Regulatory Focus: Government agencies like the Cybersecurity and Infrastructure Security Agency (CISA) are continuously updating guidelines for critical infrastructure protection.

- Investment in Advanced Solutions: Companies are adopting AI-driven threat detection, zero-trust architectures, and continuous monitoring to bolster defenses.

Constellation Energy's technological landscape is significantly shaped by its leadership in nuclear power, focusing on advancements like Small Modular Reactors (SMRs) and efficiency upgrades for existing plants. By mid-2024, the U.S. Department of Energy was actively supporting SMR development, a trend Constellation is poised to leverage.

The company is also integrating renewable energy sources, benefiting from technological leaps in solar panel efficiency, which now frequently exceed 22%, and wind turbine designs that enhance capacity factors. Furthermore, grid modernization, including AI and data analytics, is improving operational efficiency, with significant federal investments in this area reported by mid-2024 to bolster resilience.

Cybersecurity is a critical technological factor, with a notable rise in attacks on utilities reported in 2023 and early 2024, prompting increased investment in advanced defense strategies like AI-driven threat detection. Constellation's digital infrastructure, including its energy trading platforms, relies heavily on sophisticated data analytics for forecasting and risk management.

Legal factors

Constellation Energy navigates a complex web of environmental regulations and emissions standards, a key aspect of its PESTLE analysis. The company's core strategy revolves around its significant investments in carbon-free energy production, directly addressing these stringent requirements.

A testament to its commitment, Constellation Energy has achieved an impressive 80% reduction in its emissions footprint compared to 2005 levels. This proactive approach is further underscored by its ambitious target to achieve 100% elimination of greenhouse gas emissions by 2040, demonstrating a forward-looking sustainability agenda.

Adherence to these evolving environmental mandates is not merely a compliance issue but is intrinsically linked to Constellation Energy's operational viability and its overarching sustainability framework. The company's ability to meet and exceed these standards is crucial for maintaining its license to operate and for enhancing its corporate reputation in the energy sector.

The Nuclear Regulatory Commission (NRC) is a key legal entity, setting the rules for licensing and safety for Constellation Energy's nuclear power plants. This means Constellation must adhere to strict regulations for operating and maintaining its facilities.

Constellation Energy frequently engages with the NRC to secure renewals for its existing nuclear plant licenses. These renewals are not automatic; they require extensive reviews and approvals to ensure continued safe operation.

Legislation like the ADVANCE Act, passed in 2024, reflects political efforts to make NRC processes more efficient. The goal is to speed up licensing and renewal procedures, including for advanced nuclear technologies, without compromising the high safety standards the NRC enforces.

Constellation Energy navigates a complex web of state-level energy mandates, with Renewable Portfolio Standards (RPS) being particularly influential. As the nation's largest producer of carbon-free energy, the company must align its operations and investment strategies with varying clean energy targets set by individual states. For instance, states like Maryland and Illinois have ambitious RPS goals, requiring a significant percentage of electricity to come from renewable sources by specific dates, directly impacting Constellation's market approach and compliance efforts.

Antitrust and Market Competition Laws

Antitrust and market competition laws are critical for Constellation Energy, a major player in the energy sector. These regulations are in place to prevent monopolies and ensure a level playing field for all participants. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) are key bodies that scrutinize mergers and acquisitions to safeguard competition.

Constellation's strategic moves, such as its acquisition of Calpine Corporation, are directly impacted by these legal frameworks. This particular deal, valued at approximately $4.5 billion, combined substantial generation capacity, creating a more consolidated entity. Such consolidation necessitates careful review to ensure it doesn't unduly stifle competition in the energy markets.

The implications of these laws extend to Constellation's market conduct and future growth strategies. They influence how the company can expand its operations, enter new markets, and engage in pricing practices. Compliance with these regulations is paramount to avoid penalties and maintain operational freedom.

- Federal Oversight: The FTC and DOJ actively monitor the energy sector for anti-competitive practices.

- Merger Scrutiny: Large acquisitions like the Calpine deal (approx. $4.5 billion) undergo rigorous antitrust review.

- Market Impact: These laws shape Constellation's ability to grow and compete effectively.

- Compliance: Adherence to antitrust regulations is essential for avoiding legal challenges and maintaining market access.

Contractual Agreements and Power Purchase Agreements

Constellation Energy's operations are heavily influenced by contractual agreements, particularly long-term Power Purchase Agreements (PPAs). These legally binding contracts are crucial for securing revenue streams and financing new energy projects. For instance, a significant 20-year PPA was established with Microsoft for Constellation's Crane Clean Energy Center, demonstrating the substantial legal commitments made to major corporate clients for clean energy supply.

These PPAs provide essential revenue visibility, which is a cornerstone for making large-scale capital investments in energy infrastructure. The predictability offered by these agreements helps Constellation Energy manage financial risk and plan for future growth. The legal framework of these contracts ensures stability for both Constellation and its customers.

- Long-term PPAs: Constellation Energy secures its revenue through extended contractual agreements with customers.

- Microsoft PPA: A 20-year PPA with Microsoft for the Crane Clean Energy Center exemplifies these commitments.

- Revenue Visibility: These legally binding contracts provide predictable income, crucial for investment planning.

- Underpinning Investments: PPAs are fundamental to Constellation's ability to finance and execute major energy projects.

Constellation Energy's operations are deeply intertwined with environmental laws, particularly those concerning emissions and clean energy mandates. The company's substantial investments in carbon-free generation, including nuclear and renewables, are a direct response to these regulations. For example, Constellation aims for 100% greenhouse gas emission elimination by 2040, building on an 80% reduction achieved since 2005.

Nuclear power plant operations are strictly governed by the Nuclear Regulatory Commission (NRC), requiring continuous adherence to safety and licensing protocols. Legislation like the 2024 ADVANCE Act seeks to streamline NRC processes for licensing, including for advanced nuclear technologies, while maintaining safety standards.

State-level Renewable Portfolio Standards (RPS) significantly shape Constellation's market strategy, as seen in states like Maryland and Illinois with ambitious clean energy targets. Antitrust laws, enforced by the FTC and DOJ, also play a crucial role, impacting major acquisitions such as the approximately $4.5 billion deal for Calpine Corporation, which underwent scrutiny to ensure market competition.

Long-term Power Purchase Agreements (PPAs), like the 20-year deal with Microsoft for the Crane Clean Energy Center, are legally binding contracts vital for revenue stability and financing new projects. These agreements provide the predictable income necessary for Constellation's large-scale capital investments in the energy sector.

Environmental factors

Climate change is a significant environmental factor influencing Constellation Energy, driving a global shift towards decarbonization. As the leading producer of carbon-free energy in the United States, Constellation plays a crucial role in this transition.

Constellation Energy generates nearly 90% of its annual electricity output without carbon emissions, a testament to its commitment to clean energy. This strong foundation supports ambitious targets: the company aims to deliver 95% carbon-free electricity by 2030 and achieve 100% by 2040.

These goals directly address the urgency of the climate crisis and align Constellation with worldwide decarbonization initiatives. By expanding its carbon-free generation capacity, Constellation is positioning itself to meet evolving regulatory landscapes and growing market demand for sustainable energy solutions.

Constellation Energy is making significant strides in carbon emission reduction, having already achieved an impressive 80% decrease in its carbon footprint compared to 2005 levels. This commitment is clearly outlined in their 2024 and 2025 Sustainability Reports, which showcase their ongoing efforts to provide emissions-free energy through a diverse portfolio including nuclear, hydro, wind, and solar power generation.

The company's strategic focus on expanding its clean energy offerings positions it as a crucial contributor to decarbonization within the power sector. By prioritizing nuclear, hydro, wind, and solar, Constellation is actively demonstrating its dedication to environmental stewardship and a sustainable energy future.

Water resource management is a significant environmental factor for power generation, especially for nuclear facilities like those operated by Constellation Energy. These plants rely heavily on water for cooling. While specific 2024 or 2025 data for Constellation's water usage isn't readily available, the industry trend emphasizes sustainable practices to ensure long-term operational capacity and minimize environmental impact.

Nuclear Waste Disposal and Management

The long-term disposal of nuclear waste is a persistent environmental hurdle for Constellation Energy and the broader nuclear sector. While nuclear power plants like those operated by Constellation provide carbon-free electricity during operation, the safe management of spent nuclear fuel and other radioactive materials demands ongoing attention and sophisticated, long-term solutions. This includes secure storage and eventual disposal, all under strict regulatory frameworks.

Constellation Energy, as a major operator of nuclear power facilities, must navigate complex regulations and invest in advanced waste management technologies. The U.S. Department of Energy, for instance, continues to manage the nation's nuclear waste, with ongoing efforts to develop permanent disposal sites. As of 2024, the U.S. has accumulated over 80,000 metric tons of spent nuclear fuel, highlighting the scale of the challenge.

- Regulatory Compliance: Constellation must adhere to stringent federal and state regulations governing the handling, storage, and transportation of nuclear waste, ensuring safety and environmental protection.

- Technological Advancements: Continued investment in and adoption of advanced waste management techniques, such as dry cask storage, are crucial for the secure interim containment of spent fuel.

- Public Perception: Managing nuclear waste effectively is vital for maintaining public trust and support for nuclear energy, a key component of Constellation's clean energy portfolio.

Land Use and Biodiversity Conservation

Developing new energy infrastructure, particularly renewable projects like solar and wind farms, necessitates substantial land acquisition. This can lead to habitat fragmentation and impact local biodiversity, a critical consideration for Constellation Energy as it expands its generation portfolio. For instance, large-scale solar projects often require clearing significant acreage, potentially affecting sensitive ecosystems.

Constellation's strategy involves careful site selection and land management to mitigate these environmental effects. The company's commitment to responsible development means balancing energy needs with conservation goals. This includes assessing the ecological value of potential sites and implementing measures to protect or restore habitats where possible.

- Land Use Impact: New energy projects, especially renewables, require considerable land, potentially affecting ecosystems.

- Biodiversity Concerns: Habitat fragmentation and species displacement are key environmental challenges for new site developments.

- Constellation's Approach: The company prioritizes responsible land management and environmental stewardship in its expansion plans.

Constellation Energy's environmental strategy is deeply intertwined with the global push for decarbonization, aiming for 95% carbon-free electricity by 2030 and 100% by 2040. The company has already achieved an 80% reduction in its carbon footprint from 2005 levels, underscoring its commitment to clean energy sources like nuclear, hydro, wind, and solar.

Nuclear operations necessitate careful water resource management for cooling, while the long-term disposal of nuclear waste remains a significant environmental challenge, with the U.S. having accumulated over 80,000 metric tons of spent nuclear fuel by 2024. Furthermore, the expansion of renewable infrastructure requires careful land use planning to mitigate impacts on biodiversity and habitats.

| Environmental Factor | Constellation Energy's Position/Action | Data/Context (2024/2025) |

|---|---|---|

| Climate Change & Decarbonization | Leading producer of carbon-free energy; aims for 95% carbon-free electricity by 2030 and 100% by 2040. | Achieved 80% reduction in carbon footprint vs. 2005 levels. |

| Water Resource Management | Nuclear facilities require significant water for cooling. | Industry focus on sustainable practices for long-term operations. |

| Nuclear Waste Disposal | Manages spent nuclear fuel under strict regulations. | U.S. accumulated over 80,000 metric tons of spent nuclear fuel by 2024. |

| Land Use & Biodiversity | Expands renewable projects (solar, wind), requiring land acquisition. | Prioritizes responsible site selection and land management to mitigate habitat fragmentation. |

PESTLE Analysis Data Sources

Our Constellation Energy PESTLE Analysis is built on robust data from government energy agencies, reputable financial institutions, and leading industry publications. We meticulously gather insights on political stability, economic trends, technological advancements, environmental regulations, and societal shifts impacting the energy sector.