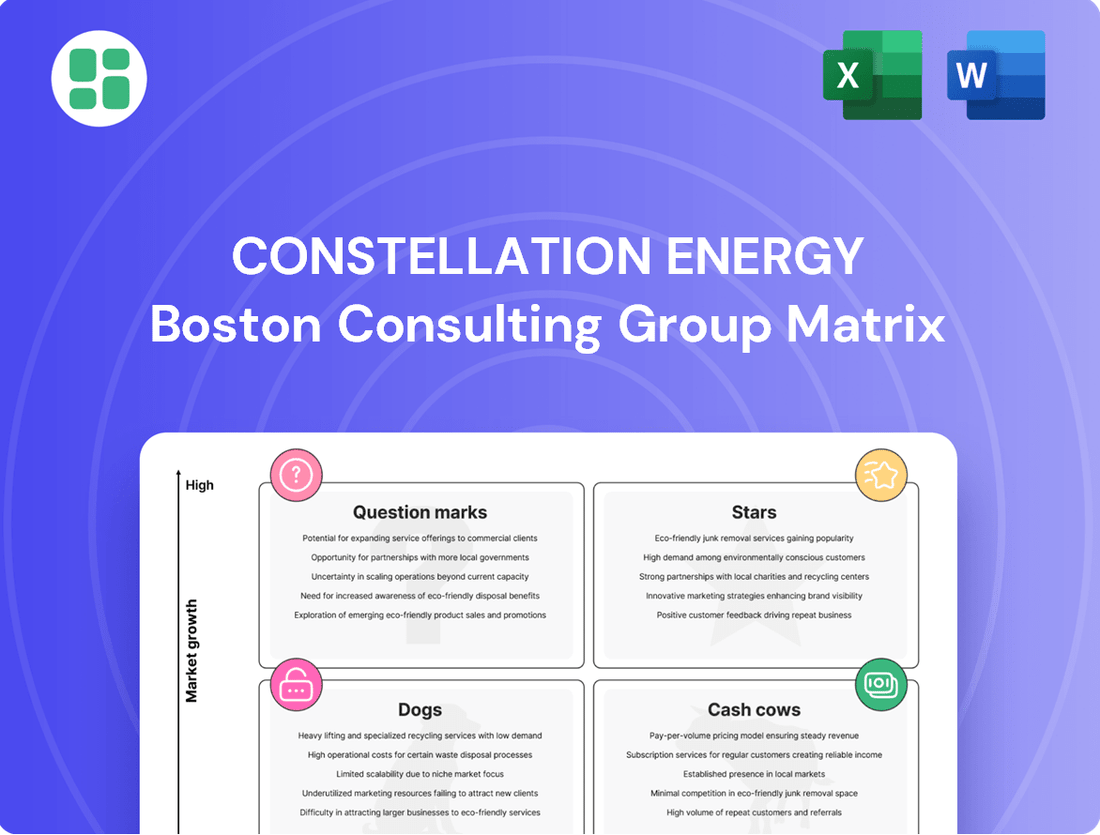

Constellation Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

Constellation Energy's strategic positioning is laid bare in its BCG Matrix, highlighting its current market standing. Understand which segments are driving growth and which require careful management to optimize resource allocation.

This preview offers a glimpse into Constellation Energy's product portfolio dynamics. Purchase the full BCG Matrix to unlock detailed quadrant analysis, revealing Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights for future investment decisions.

Stars

Constellation Energy is strategically investing in new nuclear power, including exploring Small Modular Reactors (SMRs), to fuel the immense energy needs of expanding data centers. This positions them to capitalize on the tech industry's rapid growth and its increasing demand for reliable, carbon-free electricity. Their status as the largest clean energy producer in the U.S. is a significant advantage in this high-growth sector.

This focus on nuclear expansion for data centers represents a prime "Star" category within the BCG Matrix for Constellation Energy. The surging demand from tech giants for consistent, low-carbon power creates a high-market-growth scenario. Constellation's existing infrastructure and expertise in nuclear operations give them a substantial market share in providing this critical energy solution.

Real-world traction is evident through secured power purchase agreements with major tech players like Microsoft and Meta. These partnerships underscore the market's confidence and the direct demand for Constellation's clean energy solutions to power their data-intensive operations. For instance, Constellation announced in 2024 a significant agreement to supply clean energy to Microsoft, further solidifying their role in supporting the tech sector's expansion.

Constellation Energy is making substantial investments in clean hydrogen production, notably at its LaSalle Clean Energy Center, utilizing its nuclear power generation. This strategic move positions the company to capitalize on a rapidly expanding market, bolstered by significant government backing like the Inflation Reduction Act's tax credits.

The company's commitment to this sector, particularly leveraging its nuclear fleet for a high-growth, low-emission energy source, signals a strong potential for future expansion and market leadership in the clean energy transition.

Constellation Energy's acquisition of Calpine, slated for completion by late 2025, is a pivotal strategic move. This deal is set to bolster their clean energy capacity by integrating Calpine's substantial geothermal and natural gas assets into Constellation's existing portfolio.

This expansion is projected to significantly enhance Constellation's market share and overall capacity within the rapidly expanding clean energy sector. The integration of Calpine's diverse asset base will further solidify Constellation's position as a leader in delivering reliable, low-emissions power solutions to a broad customer base.

Hourly Carbon-Free Energy Matching Services

Constellation is leading the charge with services that enable customers to precisely match their energy usage with carbon-free electricity generation on an hourly basis. This is a critical development for businesses aiming to meet stringent environmental targets and demonstrate genuine sustainability efforts.

This innovative approach taps into a surging market demand for transparent and verifiable clean energy solutions. By offering hourly matching, Constellation is positioning itself as a key player in a premium, high-growth segment of the energy market.

- Pioneering Hourly Matching: Constellation's service allows for granular alignment of energy consumption with carbon-free sources.

- Addressing Sustainability Goals: This is crucial for corporations with ambitious Environmental, Social, and Governance (ESG) commitments.

- Market Growth: The demand for verifiable clean energy is expanding rapidly, creating a lucrative market for such services.

- Competitive Advantage: By offering this advanced solution, Constellation differentiates itself in the competitive energy landscape.

Existing Nuclear Fleet Uprates and Life Extensions

Constellation Energy is actively pursuing uprates and life extensions for its existing nuclear fleet, a strategic move to boost clean energy output. These initiatives are crucial for meeting the escalating demand for carbon-free electricity.

These projects are cost-effective, delivering additional megawatts of clean power with significantly lower capital investment compared to building new facilities. For instance, in 2023, Constellation completed uprate projects at its Nine Mile Point and Fitzpatrick nuclear stations, adding approximately 130 megawatts of clean energy capacity.

- Increased Capacity: Uprates can add tens of megawatts of power per reactor.

- Extended Lifespan: Life extensions allow reactors to operate safely for decades longer.

- Cost Efficiency: These projects offer a lower cost per megawatt compared to new builds.

- Clean Energy Contribution: They directly support decarbonization goals by providing reliable, emission-free power.

Constellation's strategic focus on nuclear power for data centers, clean hydrogen, and enhanced nuclear capacity through uprates and life extensions firmly places these initiatives within the "Stars" category of the BCG Matrix. The burgeoning demand from the tech sector for reliable, carbon-free energy, coupled with government incentives for clean hydrogen, signifies high market growth. Constellation's substantial existing infrastructure and expertise, including its position as the largest clean energy producer in the U.S., translate to a strong market share in these areas. For example, in 2024, Constellation secured a significant clean energy agreement with Microsoft to power its data centers, demonstrating direct market validation.

| Initiative | Market Growth Potential | Constellation's Market Share | Key Supporting Data (2024/Recent) |

|---|---|---|---|

| Nuclear for Data Centers | Very High (Tech Sector Expansion) | High (Existing Infrastructure) | Secured PPA with Microsoft; Growing demand for low-carbon data center power. |

| Clean Hydrogen Production | High (Government Incentives, Decarbonization Goals) | Growing (Leveraging Nuclear Assets) | Inflation Reduction Act tax credits; Investment in LaSalle Clean Energy Center. |

| Nuclear Uprates & Life Extensions | Moderate to High (Need for reliable clean baseload) | High (Existing Fleet) | Added ~130 MW in 2023 from Nine Mile Point and Fitzpatrick uprates. |

What is included in the product

This BCG Matrix overview for Constellation Energy details strategic recommendations for investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

A clear Constellation Energy BCG Matrix visualizes business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Constellation Energy's baseload nuclear power generation is a quintessential cash cow. The company boasts the nation's largest nuclear fleet, comprising 21 reactors at 12 sites, consistently achieving an impressive capacity factor exceeding 94%.

This segment is a powerhouse of stable and substantial cash flow. Its mature technology, high operational efficiency, and crucial function in supplying a significant portion of the country's carbon-free baseload electricity solidify its position.

Constellation Energy's established wholesale electricity sales from its diverse, largely depreciated generation fleet, including nuclear, hydro, wind, and solar assets, are significant cash cows. These operations, primarily in mature energy markets, consistently generate substantial revenue, underpinned by long-term contracts that ensure predictable income streams.

The need for ongoing promotional investment in these wholesale sales is minimal. This is due to Constellation's strong, established market positions and the nature of its existing contracts, allowing these segments to function as highly efficient cash generators for the company.

In 2023, Constellation Energy reported total revenue of $26.3 billion, with its generation segment, which includes these wholesale sales, being a primary contributor. The company's strategy leverages these mature, low-growth assets to fund investments in newer, higher-growth areas.

Constellation's retail electricity and natural gas supply operations in mature markets are a prime example of a Cash Cow. This segment serves a diverse clientele, from homes to large industrial facilities, across numerous states.

The company leverages deep customer relationships and a highly efficient supply chain to generate consistent revenue and robust profit margins. These strengths translate directly into a reliable and significant contribution to Constellation's overall cash flow.

For instance, in 2023, Constellation reported approximately $38.6 billion in total revenue, with its retail segment playing a substantial role in this figure, demonstrating its maturity and consistent performance.

Hydroelectric and Legacy Renewable Assets

Constellation Energy's established hydroelectric and legacy renewable assets, including older wind and solar facilities, function as Cash Cows in their business portfolio. These assets generate consistent, low-cost, and carbon-free electricity, demonstrating strong market positions within their respective regional grids. Their reliable cash flow generation requires minimal additional investment for growth or market development.

- Consistent Cash Flow: These assets provide a stable and predictable income stream.

- Low Operating Costs: Hydroelectric and mature renewables typically have lower ongoing operational expenses.

- High Market Share: They hold significant positions in their regional energy markets.

- Minimal Reinvestment Needs: Unlike growth-oriented assets, these require less capital for expansion or promotion.

Energy Management and Efficiency Services for Existing Clients

Constellation Energy's provision of energy management and efficiency services to its existing commercial and industrial client base, especially Fortune 100 companies, is a significant cash cow. This segment benefits from deeply entrenched relationships and specialized expertise, minimizing the need for costly new market penetration efforts. These services generate consistent and predictable cash flows, underscoring their role as a stable revenue generator for the company.

- Stable Revenue Stream: Services for existing clients, particularly Fortune 100 companies, provide a reliable income.

- Leverages Existing Relationships: Expertise and established ties reduce the need for extensive new business development.

- Predictable Cash Flow: A loyal customer base ensures consistent revenue generation.

- Low Investment Needs: Less capital is required for market expansion, boosting profitability.

Constellation Energy's nuclear fleet, the largest in the U.S. with 21 reactors, is a prime example of a cash cow. These assets provide a stable, substantial cash flow due to their high operational efficiency, consistently exceeding 94% capacity factor. This mature, low-growth segment requires minimal additional investment, allowing it to fund other company initiatives.

| Segment | Description | BCG Category | Key Financial Characteristic |

|---|---|---|---|

| Nuclear Power Generation | Nation's largest fleet (21 reactors) | Cash Cow | Stable, high cash flow, low reinvestment needs |

| Wholesale Electricity Sales | Sales from diverse, depreciated fleet | Cash Cow | Predictable income from long-term contracts |

| Retail Electricity & Gas Supply | Serving residential and industrial clients | Cash Cow | Consistent revenue and robust profit margins |

| Hydroelectric & Legacy Renewables | Older wind and solar facilities | Cash Cow | Low-cost, reliable electricity, strong regional positions |

What You See Is What You Get

Constellation Energy BCG Matrix

The Constellation Energy BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and actionable analysis. You can confidently use this preview as a direct representation of the high-quality strategic tool you'll acquire for your business planning needs.

Dogs

Constellation Energy’s legacy natural gas assets, particularly older, less efficient plants, may be positioned as question marks or even dogs in a BCG matrix. These assets could struggle in markets with declining demand or intense competition from cleaner energy sources. For instance, as of the end of 2023, while Constellation has invested heavily in renewables and nuclear, some of its older gas-fired facilities might face increasing operational costs due to environmental compliance mandates, potentially hindering their profitability.

Certain highly specialized or outdated energy consulting services, such as those focused on legacy fossil fuel technologies or niche regulatory compliance for declining industries, may fall into the Dogs quadrant. These offerings often face declining market demand and limited growth prospects, failing to align with Constellation Energy's core mission of carbon-free and sustainable energy solutions.

For instance, consulting on coal-fired power plant efficiency or specific, outdated environmental permitting for non-renewable energy sources would likely represent a Dog. Such services might cater to a very small, shrinking client base and generate negligible revenue, making continued investment in their development or marketing unsustainable. In 2023, the global market for fossil fuel-related consulting services saw a continued decline as investments shifted towards renewable energy infrastructure and services.

Divested or decommissioned fossil fuel plants are typically categorized as Dogs within the BCG Matrix. These assets, often older and less efficient, face declining demand and increasing regulatory scrutiny, leading to minimal or negative growth prospects. For instance, as of early 2024, numerous coal-fired power plants across the United States have been retired or are slated for closure due to environmental regulations and economic unviability, reflecting their position as low-market-share, low-growth assets.

Small, Isolated Renewable Projects with Limited Scalability

Small, isolated renewable projects with limited scalability, such as a single community solar farm in a rural area, would likely fall into the Dogs category within Constellation Energy's BCG Matrix. These projects often have high per-unit costs due to their lack of economies of scale and struggle to compete with larger, more established renewable energy developments. For instance, a 5 MW solar project might not achieve the same cost efficiencies as a 100 MW utility-scale installation.

These "Dogs" typically exhibit low market share within the broader energy sector and face limited growth prospects. Their inability to significantly impact Constellation's overall energy generation capacity or financial performance means they require careful management to minimize losses or potential divestment. In 2024, the average cost of utility-scale solar PV was around $1,100 per kilowatt, a figure that can be substantially higher for smaller, less optimized projects.

- Low Market Share: These projects represent a negligible portion of Constellation's total installed renewable capacity.

- Limited Growth Potential: Geographic isolation and lack of infrastructure hinder expansion and increased output.

- Cost Inefficiencies: Smaller scale prevents realization of economies of scale common in larger renewable developments.

Underperforming Regional Retail Energy Markets

Certain regional retail energy markets represent Constellation Energy's underperforming segments within the BCG matrix. These are areas where the company holds a minimal market share and contends with formidable competition, often lacking a distinct advantage or clear strategy for growth. For instance, in some smaller, more localized retail electricity markets in the Midwest, Constellation might face established regional providers with strong customer loyalty and entrenched distribution networks.

These markets demand significant investment in marketing and operational adjustments to achieve even modest gains. The return on these efforts is often disproportionately low compared to the resources expended. For example, a market with a high density of independent brokers or a strong preference for specific, niche energy products could present substantial hurdles for a broader retail energy provider like Constellation.

- Low Market Share: Constellation's presence in these regions is often in the single digits, making it difficult to achieve economies of scale.

- Intense Competition: Established local utilities and agile independent energy providers dominate these markets, creating significant barriers to entry.

- Limited Growth Potential: Without a clear differentiation strategy or a strong value proposition, gaining substantial traction is challenging, leading to minimal returns on investment.

- High Operational Costs: Adapting to diverse regional regulations and customer preferences in these smaller markets can inflate operational expenses.

Constellation Energy's "Dogs" are assets or business units with low market share and low growth potential, often requiring careful management to minimize losses. These could include older, less efficient natural gas plants struggling against cleaner alternatives or highly specialized consulting services for declining fossil fuel industries. For instance, by the end of 2023, the global shift towards renewables meant that consulting on coal plant efficiency saw continued decline.

Small, unscalable renewable projects, like a single community solar farm, can also be dogs due to high per-unit costs and limited impact. Similarly, certain regional retail energy markets where Constellation holds minimal share and faces intense competition fall into this category. In 2024, the average cost per kilowatt for utility-scale solar was around $1,100, a figure that would be significantly higher for smaller, less optimized projects.

These segments are characterized by their inability to contribute significantly to overall capacity or financial performance, often necessitating divestment or strategic repositioning. As of early 2024, numerous coal plants were retired due to economic unviability, highlighting the challenges faced by low-growth, low-share assets in the energy sector.

The key indicators for Constellation's "Dogs" are low market share, limited growth prospects, cost inefficiencies, and intense competition, all of which hinder profitability and scalability.

| Category | Characteristics | Examples for Constellation Energy | Financial Implication | 2024 Market Context |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Older natural gas plants, niche fossil fuel consulting, small unscalable solar projects, underperforming regional retail markets | Low profitability, potential cash drain, minimal return on investment | Declining demand for fossil fuels, high costs for small renewables, intense competition in retail markets |

Question Marks

Small Modular Reactors (SMRs) currently represent a Question Mark for Constellation Energy within a BCG matrix framework. While the potential for high growth in the nuclear energy sector is evident, SMRs face substantial upfront capital requirements, complex regulatory approvals, and the challenge of proving commercial viability at scale. These factors necessitate significant investment without guaranteed near-term returns, placing them in this category.

Constellation is actively investigating SMR applications, particularly for powering data centers, which are increasingly energy-intensive. However, the widespread deployment of SMRs and achieving cost-competitiveness with existing energy sources remain developmental hurdles. This ongoing investment phase, critical for future market positioning, highlights their Question Mark status.

Constellation Energy is exploring Direct Air Capture (DAC) technology, a move that perfectly complements its carbon-free energy goals. While the potential for growth in carbon removal is significant as climate concerns mount, DAC is still in its early stages and demands considerable financial backing.

This positions DAC as a potential 'Question Mark' in Constellation's BCG matrix. The technology is capital-intensive, with projects like Climeworks' Orca facility in Iceland costing tens of millions, and the broader market for DAC is still developing.

Constellation's current market share in this nascent sector is minimal, necessitating substantial investment to demonstrate its effectiveness and achieve scalability. The long-term viability and market acceptance of DAC will be key factors in its future success.

Constellation Energy's investment in advanced energy storage, particularly long-duration technologies, aligns with a high-growth market essential for grid stability as renewable energy sources expand. This sector is crucial for managing intermittency and ensuring reliable power supply.

These long-duration storage solutions are likely in their nascent stages for Constellation, demanding substantial research and development alongside efforts to gain market traction. The company's current position here may be considered a question mark, requiring significant capital and strategic focus to mature into a strong contender.

The global market for long-duration energy storage is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, driven by decarbonization goals and the need for grid flexibility. For instance, by 2025, the U.S. Department of Energy aims to deploy 10 GW of long-duration energy storage.

New Geographic Market Expansion for Retail Supply

Expanding into new, high-growth geographic markets for retail electricity and natural gas supply represents Constellation Energy's potential "Question Marks" in the BCG Matrix. These regions, where Constellation currently holds a minimal market share, offer substantial growth opportunities. For instance, the U.S. retail electricity market alone was projected to reach over $450 billion in 2024, with significant untapped potential in emerging states.

Success in these new territories is not guaranteed and requires substantial upfront investment. Constellation would need to allocate considerable capital towards building brand awareness, establishing necessary infrastructure, and aggressively acquiring new customers. This strategic move carries inherent risk, as the return on investment is uncertain until market penetration is achieved.

- Geographic Focus: Targeting regions with high projected demand growth for electricity and natural gas, potentially including states with evolving energy policies or a growing population.

- Investment Requirements: Significant capital outlay for marketing campaigns, localized infrastructure development, and customer acquisition programs to establish a foothold.

- Market Potential: These markets offer the chance to capture new customer bases and diversify Constellation's retail footprint, aligning with long-term growth strategies.

- Risk Assessment: The success hinges on effectively navigating competitive landscapes and consumer adoption, making market research and agile strategy crucial.

Pilot Projects for Next-Generation Nuclear Technologies

Constellation Energy's focus on next-generation nuclear technologies, beyond Small Modular Reactors (SMRs), places these advanced concepts firmly in the 'Question Mark' category of the BCG Matrix. These are the frontier technologies, characterized by high innovation and significant future potential, but currently possess minimal market share and demand substantial, high-risk investment in research and development to achieve commercial viability.

Exploration and pilot projects are crucial for these advanced designs. For instance, the U.S. Department of Energy's Advanced Reactor Demonstration Program (ARDP) has allocated significant funding, with over $2.2 billion committed to two advanced reactor demonstration projects as of early 2024, aiming to accelerate the commercialization of these innovative designs.

- Generation IV Reactors: These designs, such as sodium-cooled fast reactors and molten salt reactors, offer enhanced safety, efficiency, and waste reduction capabilities, but are years away from widespread commercial deployment.

- Fusion Energy Research: While not strictly fission, advancements in fusion technology, like the recent net energy gain at the National Ignition Facility, represent a long-term, high-potential 'Question Mark' requiring massive R&D investment.

- High-Temperature Gas Reactors (HTGRs): These reactors, capable of higher operating temperatures for industrial process heat, are also in early demonstration phases, facing technical and regulatory hurdles before market entry.

Constellation Energy's foray into new geographic markets for retail electricity and natural gas represents a strategic 'Question Mark'. These areas offer substantial growth potential with high projected demand, but Constellation currently holds minimal market share.

Significant upfront investment is required for marketing, infrastructure, and customer acquisition to gain traction in these competitive landscapes. The success of these ventures hinges on effectively navigating these challenges and achieving consumer adoption.

The U.S. retail electricity market alone was projected to exceed $450 billion in 2024, indicating the vast opportunity in untapped states where Constellation could expand its footprint.

| Category | Constellation's Position | Market Growth Potential | Investment & Risk |

| New Geographic Retail Markets | Low Market Share | High (e.g., $450B+ U.S. Retail Electricity Market in 2024) | High Investment, Uncertain Returns |

BCG Matrix Data Sources

Our Constellation Energy BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.