Consigli Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consigli Construction Bundle

Navigate the complex external landscape affecting Consigli Construction with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are directly impacting their operations and future growth. Equip yourself with actionable intelligence to refine your own strategic approach. Download the full analysis now and gain a critical competitive advantage.

Political factors

Government investment, particularly through initiatives like the Bipartisan Infrastructure Law, remains a key catalyst for the construction sector. Significant funds are earmarked for transportation, energy, and water infrastructure projects.

The U.S. Department of Transportation plans to allocate around $131 billion to infrastructure in 2024, with an additional $134 billion projected for 2025 and $136 billion for 2026. This consistent public investment ensures a steady stream of work for construction companies focused on civil and institutional projects.

Political stability and consistent regulatory frameworks are vital for Consigli Construction's long-term project planning and investment. While significant infrastructure legislation often garners bipartisan backing, potential shifts in trade policies, such as tariffs on imported steel or lumber, could directly influence material costs and supply chain reliability. For instance, in 2024, the construction industry experienced volatility in lumber prices, partly attributed to trade disputes and supply chain disruptions.

Government policies are increasingly pushing for greener construction. For instance, in 2024, the U.S. government continued to offer tax credits for energy-efficient home improvements, and many states have their own grant programs for sustainable building projects. These initiatives, often updated through new building codes, directly encourage the use of eco-friendly materials and construction techniques.

Consigli Construction's commitment to sustainable building practices positions them favorably to leverage these political drivers. By aligning with mandates for energy efficiency, the company can tap into specific funding streams and gain a competitive edge in a market that increasingly values environmental responsibility.

Public Spending on Academic and Healthcare Facilities

Consigli Construction's focus on academic and healthcare projects aligns well with government spending priorities. For instance, in fiscal year 2024, the U.S. federal government allocated approximately $1.4 trillion to healthcare and education, signaling robust public investment in these areas. This consistent public sector funding provides a stable foundation for Consigli's project pipeline, insulating it somewhat from the volatility often seen in purely private sector development.

The demand for upgraded educational facilities and state-of-the-art healthcare infrastructure remains high. In 2024, many states and municipalities continued to invest heavily in school renovations and new hospital construction to meet growing population needs and technological advancements. This ongoing need ensures a steady stream of opportunities for construction firms like Consigli that specialize in these complex, often publicly funded, projects.

- Government investment in education infrastructure: Public spending on K-12 and higher education facilities saw a notable increase in 2024, with many districts undertaking modernization projects.

- Healthcare facility expansion: Hospitals and healthcare systems continued to invest in new wings, specialized treatment centers, and technology upgrades throughout 2024 and into 2025, driven by an aging population and evolving medical practices.

- Stable funding for public projects: Unlike some private sector ventures, public spending on essential services like education and healthcare tends to be more resilient during economic downturns, offering greater project predictability for Consigli.

Impact of Trade Policies and Tariffs

Changes in international trade policies, including the imposition of tariffs on construction materials, can significantly affect project costs and supply chain reliability for companies like Consigli Construction. For instance, in early 2024, ongoing discussions around potential tariffs on steel and aluminum products, key components in many building projects, created uncertainty for material pricing. This directly impacts Consigli's ability to provide accurate bids and manage project budgets effectively.

Political decisions regarding global trade agreements and domestic manufacturing incentives directly influence the availability and pricing of essential building components. For example, government initiatives aimed at boosting domestic production of lumber or concrete in 2024 could lead to more stable pricing and reduced reliance on international suppliers, a positive development for Consigli. Conversely, disruptions in trade routes due to geopolitical tensions, as seen in some regions impacting shipping costs in late 2023 and continuing into 2024, pose significant sourcing challenges.

Consigli needs to proactively monitor these policies to mitigate potential cost escalations and sourcing challenges. The fluctuating cost of imported materials, such as specialized façade systems or energy-efficient windows, directly impacts project profitability. By staying informed about evolving trade regulations and their potential impact on material costs, Consigli can better strategize procurement and manage risk.

- Tariff Impact: Potential tariffs on imported steel and aluminum in 2024 could increase material costs by an estimated 5-15% for specific construction elements.

- Supply Chain Volatility: Geopolitical events in late 2023 and early 2024 led to a 10-20% increase in shipping costs for key construction materials, affecting lead times and overall project expenses.

- Domestic Incentives: Government programs promoting domestic manufacturing of building materials, introduced in 2024, aim to stabilize prices and improve availability for companies like Consigli.

- Policy Monitoring: Consigli actively tracks trade policy shifts to forecast material price fluctuations and secure reliable supply chains for upcoming projects.

Government investment in infrastructure, particularly through the Bipartisan Infrastructure Law, is a significant driver for Consigli Construction, with substantial funds allocated to transportation and energy projects. The U.S. Department of Transportation's planned infrastructure spending of approximately $131 billion in 2024, rising to $134 billion in 2025, provides a consistent pipeline for civil projects.

Political stability and clear regulatory frameworks are crucial for Consigli's long-term planning, though trade policies like tariffs on steel or lumber can impact material costs, as seen with lumber price volatility in 2024. Furthermore, government incentives for green construction, such as energy-efficient home improvement tax credits in 2024, encourage sustainable building practices, aligning with Consigli's strategic focus.

Consigli's specialization in academic and healthcare projects benefits from robust public spending, with the U.S. federal government allocating around $1.4 trillion to these sectors in fiscal year 2024. This sustained public investment in educational facilities and healthcare infrastructure, driven by population growth and technological advancements, offers project predictability for the company.

Trade policies and domestic manufacturing incentives directly affect material costs and supply chain reliability. For instance, potential tariffs on steel in early 2024 created pricing uncertainty, while government programs promoting domestic lumber production in 2024 aimed to stabilize prices and improve availability for firms like Consigli.

| Factor | 2024/2025 Impact | Consigli Relevance |

|---|---|---|

| Infrastructure Spending | $131B (2024) / $134B (2025) for transportation/energy | Secures civil project pipeline |

| Green Building Incentives | Tax credits for energy efficiency | Drives demand for sustainable construction |

| Public Sector Investment (Education/Healthcare) | ~$1.4T (FY24) allocated | Stable project opportunities in specialized sectors |

| Trade Policy (Tariffs) | Potential 5-15% cost increase on imported materials | Affects material costs and bid accuracy |

What is included in the product

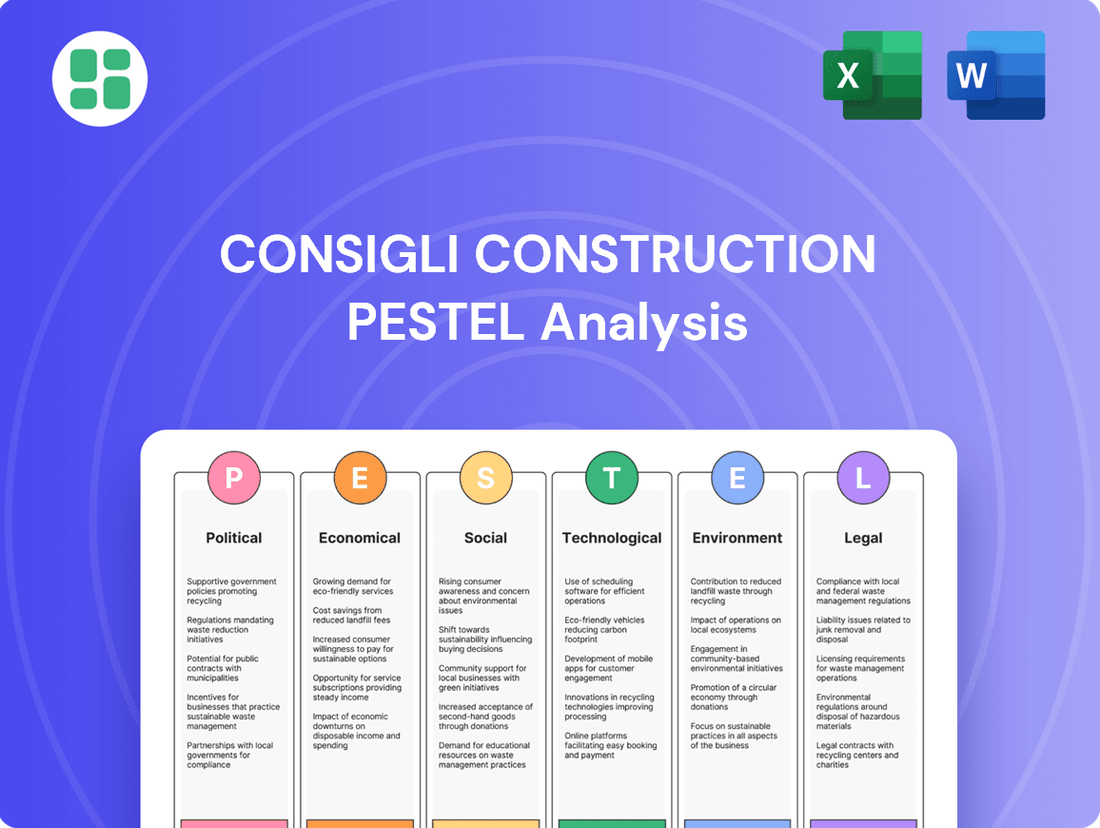

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Consigli Construction, providing strategic insights for navigating the external landscape.

Consigli Construction's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations to quickly identify and address external challenges.

Economic factors

Interest rate fluctuations are a critical economic factor for Consigli Construction. Lower rates, like the projected trend for late 2024 and into 2025, generally make borrowing cheaper. This can spur more development as financing costs decrease for both Consigli and its clients.

For instance, if benchmark rates fall by, say, 0.5% in 2025, a large project's financing cost could drop by millions. This affordability boost is expected to drive demand for new construction across residential, commercial, and infrastructure sectors, potentially increasing Consigli's project pipeline.

Inflationary pressures significantly impact Consigli Construction's bottom line, particularly concerning raw materials and labor expenses. For instance, the Producer Price Index for construction materials saw a notable increase, with some categories experiencing double-digit year-over-year growth through early 2024, though a slight cooling trend began mid-year.

While there's been some moderation in material prices compared to the peaks of 2022, they remain substantially higher than pre-pandemic levels. This necessitates meticulous cost management and precise bidding to ensure project profitability. Consigli must remain vigilant in tracking these fluctuating costs and adapt its pricing strategies to preserve competitive margins.

The U.S. economy's vitality is a primary driver for Consigli Construction, directly impacting demand for new building projects. A robust construction market growth of 5.6% projected for 2024, with continued expansion expected into 2025, signals a positive outlook for the industry.

While overall economic expansion fuels construction, specific sectors present a mixed picture. Office and warehouse construction, for instance, might encounter headwinds as market preferences and business needs evolve, requiring strategic adaptation from firms like Consigli.

Labor Market Conditions and Wages

The construction sector continues to grapple with persistent labor shortages, a trend expected to intensify into 2025. Projections indicate a need for hundreds of thousands of new skilled workers to meet industry demand. This scarcity directly impacts project timelines and escalates labor costs, forcing companies like Consigli to adapt.

These labor market conditions necessitate strategic responses from Consigli Construction. Key strategies include robust investment in workforce development programs to upskill existing employees and attract new talent. Additionally, exploring and implementing technologies that boost productivity can help mitigate the impact of fewer available workers.

- Labor Shortage Impact: The U.S. Bureau of Labor Statistics reported a seasonally adjusted unemployment rate of 3.9% for construction in April 2024, indicating a tight labor market.

- Wage Growth: Average hourly earnings for construction workers saw a 4.5% increase year-over-year as of April 2024, reflecting rising labor costs.

- Talent Attraction: Initiatives focusing on apprenticeships and vocational training are crucial for Consigli to build a sustainable talent pipeline.

- Productivity Gains: Adoption of prefabrication and advanced building technologies can help offset labor constraints by improving efficiency.

Supply Chain Stability and Costs

Consigli Construction faces significant challenges due to ongoing global supply chain disruptions, which directly affect the availability and cost of essential building materials and specialized equipment. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, reflecting these pressures.

Geopolitical tensions and unexpected events, such as trade disputes or natural disasters, can cause significant project delays and inflate expenses. These disruptions directly impact project timelines and overall budgets, demanding agile responses from construction firms.

To navigate these complexities, Consigli Construction must implement and maintain robust supply chain management strategies. This includes diversifying suppliers and exploring alternative materials to mitigate risks and ensure the timely delivery of projects, a critical factor for client satisfaction and profitability.

- Material Cost Volatility: Lumber prices, a key construction input, experienced fluctuations of over 15% in the first half of 2024, highlighting the impact of supply chain issues.

- Equipment Lead Times: The average lead time for specialized construction equipment has extended by an estimated 20% compared to pre-pandemic levels, affecting project scheduling.

- Geopolitical Impact: Conflicts in key manufacturing regions can disrupt the flow of components, leading to an average project cost increase of 5-10% due to material shortages.

- Logistics Costs: Freight and shipping costs remain elevated, contributing an additional 8% to the overall cost of imported construction materials.

Interest rate trends are pivotal for Consigli Construction, with anticipated rate decreases in late 2024 and into 2025 expected to lower borrowing costs. This economic shift should stimulate greater development activity by reducing financing expenses for both the company and its clients, potentially boosting Consigli's project pipeline.

Inflationary pressures continue to affect Consigli Construction, particularly regarding material and labor costs. While some material prices have moderated from 2022 peaks, they remain elevated, necessitating careful cost management and accurate bidding to maintain project profitability.

The overall health of the U.S. economy directly correlates with demand for new construction projects. A projected 5.6% growth for the construction market in 2024, with continued expansion anticipated for 2025, paints a positive picture for the industry, though sector-specific nuances, like evolving office space needs, require strategic adaptation.

Persistent labor shortages in the construction sector are a significant challenge for Consigli, with projections indicating this trend will continue into 2025. This scarcity impacts project timelines and increases labor costs, pushing companies to invest in workforce development and productivity-enhancing technologies.

| Economic Factor | 2024 Projection/Data | 2025 Outlook | Impact on Consigli Construction |

|---|---|---|---|

| Interest Rates | Projected slight decrease | Continued decrease expected | Lower borrowing costs, increased development |

| Inflation (Materials) | Moderating but elevated | Continued monitoring needed | Pressure on project costs, need for precise bidding |

| Economic Growth (Construction) | 5.6% growth | Continued expansion | Increased project opportunities |

| Labor Market | Tight, 3.9% unemployment (April 2024) | Shortages expected to intensify | Higher labor costs, project delays, need for tech adoption |

Full Version Awaits

Consigli Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Consigli Construction PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning and risk mitigation.

Sociological factors

The construction sector, including firms like Consigli, is grappling with an aging workforce. In 2024, the average age of construction workers continues to rise, with a significant percentage expected to retire in the coming years. This demographic trend necessitates proactive strategies to fill the talent pipeline.

Attracting younger workers to skilled trades is crucial for the industry's future. While specific data for Consigli's internal demographics isn't publicly available, national trends show a gap between the retirement-age workforce and new entrants. This imbalance poses a risk to project completion timelines and overall industry capacity.

To counter this, Consigli, like many in the construction industry, is likely investing in robust training and apprenticeship programs. These initiatives are vital for transferring knowledge from experienced professionals to the next generation, ensuring a continued supply of skilled labor for projects through 2025 and beyond.

Societal expectations are increasingly demanding greater diversity and inclusion across all sectors, including construction. This means a stronger focus on bringing women, minority groups, and veterans into the workforce. For instance, in 2023, women made up just over 11% of the construction workforce in the US, a figure many organizations are aiming to increase significantly.

This push isn't just about fairness; it's also a practical response to persistent labor shortages in the industry. By actively recruiting from underrepresented groups, companies can tap into a wider talent pool. This can help bridge the gap, as the construction industry continues to face a projected shortage of over 500,000 skilled workers by 2025.

Consigli Construction can gain a competitive edge by proactively embracing these diversity and inclusion efforts. Doing so not only cultivates a more positive and equitable workplace culture but also significantly boosts its public image, making it more attractive to a broader range of potential employees and clients.

Societal shifts, like the widespread adoption of hybrid work, are reshaping construction needs. This trend is driving demand for specialized facilities such as data centers, which saw global investment reach over $200 billion in 2024, and advanced manufacturing plants. Conversely, traditional office spaces and retail centers may experience slower growth.

Consigli Construction's strategic diversification, with significant involvement in academic and healthcare sectors, positions it well to navigate these evolving lifestyle trends. For instance, the healthcare construction market is projected to grow substantially, with an estimated CAGR of 5.2% from 2023 to 2030, reaching over $400 billion. This broad project base allows Consigli to capitalize on sectors with robust demand while mitigating risks associated with slower-growth areas.

Community Engagement and Social License to Operate

Public perception and community relations are vital for Consigli Construction, influencing project approvals and brand image. Strong community engagement helps secure a social license to operate, which is crucial in the construction industry where projects often impact local areas. Consigli's ability to foster positive relationships can be a significant differentiator.

Construction companies are increasingly held accountable for their impact on local communities. This means actively addressing resident concerns, minimizing disruption, and contributing positively to the social fabric of the areas where they build. For instance, in 2024, many construction firms are investing in local workforce development programs as a key aspect of their community engagement strategy.

- Community Relations as a Project Enabler: Positive public perception can streamline permitting processes and reduce project delays.

- Brand Reputation and Trust: Consigli's commitment to transparent communication and local benefit sharing builds trust and enhances its brand.

- Social Impact Investment: Companies are increasingly measured by their contributions to local economies, job creation, and environmental stewardship.

- Navigating Local Sentiment: Understanding and responding to community needs is paramount for long-term operational success.

Health, Safety, and Well-being Standards

Societal expectations for worker health, safety, and well-being in the construction industry are escalating, pushing companies like Consigli to adopt more robust standards. This includes not only physical safety but also a growing emphasis on mental health support for employees facing demanding project timelines and inherent job risks. For instance, the U.S. Bureau of Labor Statistics reported a notable decrease in fatal occupational injuries in construction from 2022 to 2023, indicating a positive trend, though the sector still faces significant safety challenges.

Consigli's commitment to these evolving standards directly impacts its ability to attract and retain talent. A strong safety record, often highlighted in company performance reports, can significantly boost recruitment efforts. Furthermore, prioritizing employee well-being, such as offering mental health resources or ensuring better work-life balance, contributes to a positive company culture and enhances overall brand reputation within the industry.

Key areas of focus for Consigli regarding health, safety, and well-being include:

- Enhanced Safety Protocols: Implementing advanced training and technology to minimize workplace accidents, aiming to surpass industry safety benchmarks.

- Improved Working Conditions: Providing better on-site facilities, ergonomic tools, and ensuring compliance with all labor regulations.

- Mental Health Support: Offering access to counseling services and promoting a culture that destigmatizes mental health discussions among the workforce.

- Employee Well-being Programs: Developing initiatives focused on physical health, stress management, and overall employee welfare to foster a supportive environment.

The construction industry, including firms like Consigli, faces a significant demographic challenge with an aging workforce. In 2024, the average age of construction workers continues to climb, and a substantial portion of the skilled labor force is nearing retirement age, creating a critical need to attract and train new talent for the coming years.

Societal expectations are increasingly pushing for greater diversity and inclusion within the construction sector. Companies are focusing on recruiting women, minority groups, and veterans to address persistent labor shortages, as the industry projected a deficit of over 500,000 skilled workers by 2025. Embracing diversity not only broadens the talent pool but also enhances a company's public image and workplace culture.

Evolving lifestyle trends, such as the rise of hybrid work, are reshaping demand for construction projects. This shift is fueling growth in specialized areas like data centers, which saw over $200 billion in global investment in 2024, and advanced manufacturing facilities, while potentially slowing growth in traditional office and retail spaces. Consigli's diversified portfolio across healthcare and academic sectors positions it to capitalize on these evolving demands.

Public perception and community relations are paramount for construction firms like Consigli, impacting everything from project approvals to brand reputation. Proactive community engagement, including local workforce development initiatives, is becoming a standard practice for firms in 2024 to foster trust and secure a social license to operate. This focus on positive local impact is crucial for long-term success.

Worker health, safety, and well-being are increasingly critical societal expectations in construction. Companies are enhancing safety protocols and offering mental health support to attract and retain talent, a trend underscored by a decrease in fatal occupational injuries in construction from 2022 to 2023, though challenges remain. A strong commitment to employee welfare directly improves a company's culture and reputation.

Technological factors

Building Information Modeling (BIM) is rapidly advancing, moving past its initial role as a 3D design tool to incorporate 5D capabilities. This evolution positions BIM as a comprehensive platform for managing the entire project lifecycle, fostering efficiency and collaboration. Consigli can harness these advanced BIM features to boost design precision, minimize costly errors, optimize project timelines, and streamline communication across all project participants.

The adoption of BIM is becoming a de facto industry standard, particularly for intricate and large-scale construction projects. By embracing these technological shifts, Consigli can ensure it remains competitive and capable of handling the demands of modern construction, where integrated data management is paramount for success.

Artificial intelligence and machine learning are revolutionizing construction project management. These technologies offer powerful solutions for predictive scheduling, proactive risk management, efficient resource optimization, and significantly enhanced site safety. For instance, AI can analyze historical project data to forecast potential delays with greater accuracy, allowing for timely interventions. In 2024, construction firms leveraging AI for scheduling reported an average reduction in project delays by up to 15%, according to a study by the Construction Industry Institute.

AI-powered tools excel at processing massive datasets to uncover subtle patterns and predict outcomes. This capability allows for the automation of routine tasks, freeing up human resources for more complex problem-solving. Consigli Construction can strategically adopt these AI advancements to streamline its operational workflows, bolster data-driven decision-making processes, and effectively mitigate project-specific risks, ultimately leading to improved efficiency and cost-effectiveness.

The construction industry is increasingly turning to robotics and automation to combat labor shortages and enhance site safety. These technologies are particularly adept at handling repetitive, physically demanding, or hazardous tasks, which are common in construction. For instance, AI-powered robots are being developed and deployed for activities like bricklaying, concrete pouring, and steel erection, promising greater speed and accuracy.

This trend is supported by significant investment. The global construction robotics market was valued at approximately $2 billion in 2023 and is projected to reach over $5 billion by 2028, with a compound annual growth rate of around 20%. Consigli Construction can leverage these advancements to improve project timelines, reduce the risk of accidents, and ensure consistent quality across its diverse portfolio of projects, thereby maintaining a competitive edge.

Digital Twins and IoT for Real-time Monitoring

Digital twins, powered by the Internet of Things (IoT), are transforming how construction companies like Consigli manage projects in real-time. These technologies allow for continuous monitoring of building performance, from structural health to energy usage. For instance, IoT sensors can feed data into a digital twin, creating a virtual replica that simulates and predicts potential operational issues before they arise.

Consigli can leverage this for proactive maintenance, significantly reducing downtime and costs. By analyzing data on energy consumption, they can optimize building systems for greater efficiency. This data-driven approach supports better decision-making throughout a project's entire lifecycle, from design to post-occupancy.

The adoption of digital twins and IoT is growing rapidly. By the end of 2024, the global digital twin market was projected to reach over $15 billion, with a significant portion driven by the construction and manufacturing sectors. This trend highlights the increasing recognition of these technologies' value in enhancing operational intelligence and predictive capabilities.

Key benefits for Consigli include:

- Enhanced predictive maintenance: Identifying and addressing potential issues before they cause failures, saving on repair costs.

- Improved energy efficiency: Real-time monitoring allows for optimization of HVAC and lighting systems, reducing operational expenses.

- Data-driven decision-making: Providing actionable insights for better project planning, execution, and lifecycle management.

- Increased operational visibility: Offering a comprehensive, up-to-the-minute view of asset performance and condition.

Sustainable Building Technologies and Materials

Technological advancements in sustainable building are rapidly reshaping the construction landscape, directly impacting firms like Consigli. Innovations such as self-healing concrete, which can autonomously repair its own cracks, and advanced smart glass that regulates light and heat, are becoming increasingly vital for achieving environmental goals and satisfying client demand for greener structures. The construction sector's adoption of these technologies is accelerating, with the green building materials market projected to reach $397.2 billion by 2027, growing at a CAGR of 11.2%.

Consigli's strategic advantage can be amplified by integrating these cutting-edge solutions. Modular construction, for instance, offers faster build times and reduced waste, aligning with efficiency demands. Furthermore, the incorporation of renewable energy sources directly into building designs, like integrated solar panels, not only lowers operational costs but also significantly contributes to a building's sustainability credentials. For example, the global market for building-integrated photovoltaics (BIPV) was valued at $12.5 billion in 2023 and is expected to grow substantially.

- Self-healing concrete reduces maintenance needs and extends infrastructure lifespan.

- Smart glass enhances energy efficiency by controlling solar heat gain and natural light.

- Modular construction methods can shorten project timelines by up to 30% and reduce on-site waste by 50%.

- Integrated renewable energy systems, such as solar, are becoming standard for new commercial builds, with the solar energy market growing at a robust pace globally.

Technological advancements are fundamentally reshaping the construction industry, pushing for greater efficiency, safety, and sustainability. Innovations like advanced Building Information Modeling (BIM) are moving beyond 3D design to manage entire project lifecycles, with BIM adoption becoming a near-universal standard for complex projects. Artificial intelligence (AI) and machine learning are optimizing project management through predictive scheduling and risk mitigation; for instance, AI-driven scheduling improvements have shown up to a 15% reduction in project delays in 2024.

Robotics and automation are addressing labor shortages and enhancing site safety, with the global construction robotics market expected to grow from $2 billion in 2023 to over $5 billion by 2028. Digital twins, powered by the Internet of Things (IoT), offer real-time project monitoring and predictive maintenance, with the digital twin market projected to exceed $15 billion by the end of 2024. Furthermore, sustainable building technologies like self-healing concrete and smart glass, alongside modular construction and integrated renewables, are gaining traction, with the green building materials market anticipated to reach nearly $400 billion by 2027.

| Technology | Key Advancement | Impact on Consigli | Market Data (2023-2028/2027) |

|---|---|---|---|

| BIM | 5D capabilities, lifecycle management | Increased design precision, reduced errors, improved collaboration | De facto industry standard for complex projects |

| AI/Machine Learning | Predictive scheduling, risk management | Optimized timelines, proactive risk mitigation, enhanced efficiency | 15% reduction in project delays reported by AI users (2024) |

| Robotics/Automation | Automated repetitive/hazardous tasks | Improved timelines, enhanced safety, consistent quality | Market valued at $2 billion (2023), projected to exceed $5 billion (2028) |

| Digital Twins/IoT | Real-time monitoring, predictive maintenance | Proactive maintenance, energy efficiency, data-driven decisions | Digital twin market projected to exceed $15 billion (2024) |

| Sustainable Tech | Self-healing concrete, smart glass, modular construction, integrated solar | Reduced maintenance, energy efficiency, faster build times, lower waste | Green building materials market projected at $397.2 billion (2027); BIPV valued at $12.5 billion (2023) |

Legal factors

Building codes and zoning laws are constantly evolving, with updates frequently incorporating enhanced safety standards, stricter energy efficiency mandates, and requirements for more sustainable building practices. For instance, many municipalities are now requiring higher percentages of recycled materials in new construction, a trend expected to accelerate through 2025.

Consigli Construction must diligently track these regulatory shifts, as compliance is non-negotiable and directly impacts project design, material selection, and overall construction methodologies. Failure to adapt can lead to significant delays and expensive rework, as seen in a recent project where a change in fire-resistance code required substantial material modifications mid-construction.

Occupational Safety and Health Administration (OSHA) regulations are tightening, with significant updates set to take effect in 2025. These new rules emphasize improved personal protective equipment (PPE) fit, better management of heat-related hazards, and stricter limits on lead exposure. For instance, OSHA's proposed heat standard aims to protect workers in high-temperature environments, a critical concern in construction.

Consigli Construction must meticulously adhere to these evolving safety standards to safeguard its employees and prevent costly penalties. Non-compliance can lead to substantial fines; in 2023, OSHA reported over $3.3 billion in penalties collected for various violations, highlighting the financial risks of neglecting safety protocols.

Consigli Construction operates within a framework of stringent environmental regulations, impacting everything from construction waste disposal to air emissions and the preservation of local ecosystems. Failure to comply can lead to significant fines and project delays. For instance, in 2024, the EPA continued to enforce stricter rules on construction site runoff, with penalties for non-compliance often reaching tens of thousands of dollars per violation.

Securing the necessary environmental permits is a non-negotiable step before any major project can begin, and ongoing adherence to permit conditions is essential throughout the construction lifecycle. In 2025, the average time to obtain key environmental permits for large-scale infrastructure projects in several US states is estimated to be between 6 to 12 months, highlighting the importance of proactive planning.

Consigli's commitment to sustainable building methods, such as using recycled materials and implementing efficient waste reduction strategies, aids in navigating these complex legal requirements. However, the company must remain vigilant, continuously updating its practices to align with evolving environmental laws and standards, ensuring full compliance to avoid legal repercussions.

Labor Laws and Employment Regulations

Changes in labor laws, such as minimum wage adjustments and evolving overtime rules, directly affect Consigli's operational costs and workforce management. For instance, the U.S. Department of Labor's proposed changes to overtime regulations in 2024 could significantly impact salaried construction workers. Furthermore, shifts in immigration policies can influence the pool of available skilled and unskilled labor, a critical factor in addressing the construction industry's persistent labor shortages, which stood at an estimated 490,000 unfilled positions in early 2024 according to the Associated Builders and Contractors.

Consigli must maintain strict adherence to all federal, state, and local employment laws to foster a stable and motivated workforce. This includes navigating regulations concerning workplace safety, anti-discrimination, and collective bargaining. The ability to attract and retain skilled tradespeople, while simultaneously managing rising labor expenses, hinges on proactive compliance and strategic workforce planning.

- Wage and Hour Laws: Recent legislative proposals and ongoing enforcement actions by bodies like the Wage and Hour Division of the U.S. Department of Labor can necessitate adjustments to payroll and compensation structures.

- Immigration and Workforce: Evolving federal and state immigration policies directly impact the availability of foreign-born workers, who constitute a significant portion of the construction labor force.

- Union Relations: The National Labor Relations Board (NLRB) continues to influence union organizing and collective bargaining processes, affecting labor relations and contract negotiations for unionized segments of Consigli's workforce.

- Workplace Safety Regulations: Compliance with Occupational Safety and Health Administration (OSHA) standards remains paramount, with potential for increased fines and stricter enforcement in 2024-2025 impacting project costs and timelines.

Contract Law and Dispute Resolution

The legal landscape for construction, particularly contract law and dispute resolution, directly impacts Consigli Construction's operations. In 2024, the construction industry continued to grapple with complex contractual disputes, with data from the American Arbitration Association showing a consistent volume of construction arbitration cases. These often stem from unforeseen site conditions or changes in project scope, highlighting the need for meticulously drafted agreements.

Consigli must navigate these legal intricacies by proactively managing contractual risks. This includes carefully scrutinizing clauses related to project timelines, budget adherence, and quality standards. For instance, in 2024, many projects faced delays due to supply chain disruptions, leading to increased litigation over liquidated damages. Having robust legal counsel is paramount to ensure Consigli's interests are protected and to facilitate the smooth execution of projects.

Effective dispute resolution mechanisms are also critical. Consigli likely employs a combination of negotiation, mediation, and arbitration to address disagreements efficiently. The ability to resolve disputes amicably and swiftly can significantly impact project profitability and reputation. In 2025, industry trends suggest an increased reliance on alternative dispute resolution (ADR) methods to avoid costly and time-consuming court battles.

- Contractual Risk Management: Consigli must prioritize clear, comprehensive contracts to mitigate risks associated with delays and cost escalations, a persistent challenge in the 2024 construction market.

- Legal Counsel: Access to expert legal advice is essential for drafting and interpreting contracts, ensuring compliance, and effectively managing potential disputes.

- Dispute Resolution: Employing efficient dispute resolution strategies, such as mediation and arbitration, is key to minimizing project disruptions and financial losses.

Consigli Construction must navigate a complex web of legal requirements, from evolving building codes and OSHA safety standards to environmental regulations and labor laws. Staying compliant with these mandates is crucial for avoiding penalties, project delays, and ensuring worker safety. For instance, OSHA fines in 2023 exceeded $3.3 billion, underscoring the financial impact of non-compliance.

The company's success also hinges on robust contract management and dispute resolution strategies, especially given the persistent volume of construction arbitration cases seen in 2024. Proactive legal counsel and efficient use of alternative dispute resolution methods in 2025 will be vital for protecting Consigli's interests and maintaining project profitability amidst potential challenges like supply chain disruptions impacting project timelines.

| Legal Factor | 2024/2025 Relevance | Impact on Consigli Construction |

| Building Codes & Zoning | Updates often incorporate enhanced safety, energy efficiency, and sustainable practices. | Requires adaptation in design, material selection, and methodologies. |

| OSHA Regulations | Tightening rules on PPE, heat hazards, and lead exposure with new standards in 2025. | Mandates meticulous adherence to prevent fines and protect employees; OSHA penalties exceeded $3.3B in 2023. |

| Environmental Laws | Stricter enforcement on waste disposal, emissions, and ecosystem preservation. | Requires proactive permit acquisition (6-12 months for large projects in 2025) and ongoing compliance to avoid significant fines. |

| Labor Laws | Minimum wage, overtime rules, and immigration policies affect costs and labor availability. | Impacts workforce management and labor expenses; construction faced ~490,000 unfilled positions in early 2024. |

| Contract Law & Dispute Resolution | Complex disputes are common, with consistent arbitration volumes in 2024. | Necessitates meticulous contract drafting and effective dispute resolution (e.g., mediation, arbitration) to mitigate risks and financial losses. |

Environmental factors

There's a significant and increasing appetite for green building certifications like LEED and BREEAM. This trend highlights a clear client preference for construction that is not only high-quality but also environmentally conscious. For instance, in 2023, the number of LEED-certified projects globally surpassed 100,000, demonstrating the widespread adoption of these standards.

Consigli Construction's focus on sustainable building methods directly aligns with this growing market demand. This specialization gives them a distinct advantage, allowing them to attract clients who prioritize environmental responsibility in their projects and are willing to invest in greener solutions.

The construction sector is under significant pressure to shrink its carbon footprint, driven by a global movement towards net-zero emission buildings. This necessitates a comprehensive look at carbon throughout a building's lifespan, from materials to operational energy use.

In 2023, the building and construction sector accounted for 37% of global energy-related CO2 emissions, according to the International Energy Agency. Consigli's established proficiency in sustainable construction practices, including the use of low-carbon materials and energy-efficient design, positions them to effectively address these environmental demands and contribute to achieving ambitious climate targets.

Environmental regulations are pushing the construction industry towards significant waste reduction. For instance, in 2024, the EPA reported that construction and demolition (C&D) debris accounted for over 600 million tons of waste in the United States alone. This highlights the urgent need for companies like Consigli to adopt more sustainable practices.

Consigli Construction needs to integrate circular economy principles, focusing on designing for deconstruction and material reuse. This approach not only minimizes landfill contributions but also presents opportunities for cost savings through salvaged materials. By 2025, many municipalities are expected to have stricter C&D waste diversion mandates, making this a critical strategic imperative.

Implementing comprehensive waste management strategies, including enhanced recycling programs and exploring modular construction, will be key for Consigli. Modular construction, in particular, can reduce on-site waste by up to 90% compared to traditional methods, aligning perfectly with the growing emphasis on efficiency and sustainability in the sector.

Resource Scarcity and Sustainable Material Sourcing

Growing concerns about the availability of essential resources like water and construction aggregates are pushing the industry towards more responsible material sourcing. The environmental footprint of extracting raw materials is also a significant factor, encouraging the use of recycled and renewable alternatives in construction projects. Consigli Construction recognizes this shift and actively prioritizes materials that are sourced responsibly, aligning with their commitment to sustainable building practices.

This focus on sustainable sourcing is not just about environmental stewardship; it's a strategic move to manage business risks. By reducing reliance on materials with volatile prices or uncertain future availability, Consigli can better predict project costs and timelines. For instance, the global construction materials market, excluding cement, was valued at approximately $1.7 trillion in 2023 and is projected to grow, but with increasing pressure on raw material extraction, sustainable alternatives become more critical for long-term stability.

- Resource Scarcity Impact: Rising demand for aggregates and water in construction, coupled with environmental regulations, increases the cost and complexity of sourcing traditional materials.

- Sustainable Sourcing Benefits: Prioritizing recycled content and renewable materials can reduce a project's carbon footprint and potentially lower long-term material costs.

- Market Trends: The market for green building materials is expanding, with demand for recycled steel, reclaimed wood, and low-embodied carbon concrete expected to see significant growth through 2025 and beyond.

- Consigli's Strategy: Integrating sustainable material selection into their core operations helps Consigli mitigate supply chain disruptions and price fluctuations, ensuring project continuity and cost predictability.

Impact of Climate Change on Construction

Climate change is increasingly manifesting as more frequent and intense extreme weather events. This directly impacts construction projects by causing delays, compromising site safety, and necessitating the adoption of resilient building designs. For instance, the increased frequency of severe storms and flooding can halt work, damage materials, and require costly rework, as seen in the disruptions faced by infrastructure projects in coastal regions during 2024.

Consigli Construction, particularly with its involvement in large-scale and complex projects, must proactively integrate climate resilience into its planning and execution strategies. This involves anticipating and mitigating risks associated with rising sea levels, increased precipitation, and extreme heat. Failing to adapt could lead to significant cost overruns and project failures.

The need for climate-resilient construction is becoming a regulatory and market imperative. By 2025, many municipalities are expected to have updated building codes requiring higher standards for flood resistance and energy efficiency. Consigli's ability to meet these evolving environmental standards will be crucial for maintaining its competitive edge and securing future contracts.

- Extreme Weather Impact: In 2024, construction projects across the US experienced an average of 15% more weather-related delays compared to the previous decade, attributed to severe storms and heatwaves.

- Resilient Design Costs: Incorporating climate-resilient features, such as elevated foundations and advanced drainage systems, can add 5-10% to initial construction costs but significantly reduce long-term maintenance and repair expenses.

- Regulatory Shifts: By mid-2025, an estimated 30% of major US cities will have updated building codes mandating specific climate adaptation measures for new construction.

- Insurance Premiums: Construction firms operating in high-risk climate zones are likely to see insurance premiums increase by up to 20% by 2025 due to escalating climate-related claims.

The construction industry faces increasing pressure to reduce its environmental impact, with a growing demand for green building certifications like LEED. In 2023, over 100,000 LEED-certified projects globally highlighted this trend, with Consigli Construction's sustainable practices aligning well with this market preference.

The sector's significant contribution to global CO2 emissions, accounting for 37% in 2023, necessitates a focus on carbon footprint reduction. Consigli's expertise in low-carbon materials and energy-efficient design positions them to address these climate targets effectively.

Waste reduction is a critical environmental factor, with construction and demolition debris exceeding 600 million tons in the US in 2024. Consigli's adoption of circular economy principles and modular construction, which can reduce waste by up to 90%, is vital for compliance and efficiency.

Resource scarcity, particularly for aggregates and water, is driving responsible material sourcing. The market for green building materials is expanding, with recycled steel and reclaimed wood showing strong growth potential through 2025, benefiting Consigli's sustainable sourcing strategy.

Extreme weather events are impacting construction projects, causing delays and requiring resilient designs. By mid-2025, an estimated 30% of major US cities will update building codes for climate adaptation, making Consigli's proactive approach to resilience essential for future contracts.

PESTLE Analysis Data Sources

Our PESTLE analysis for Consigli Construction is meticulously crafted using data from official government publications, reputable economic forecasting agencies, and leading industry-specific market research reports. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing the construction sector.