Consigli Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consigli Construction Bundle

Consigli Construction navigates a competitive landscape shaped by powerful forces like buyer bargaining power and the threat of new entrants. Understanding these dynamics is crucial for strategic advantage.

The complete report reveals the real forces shaping Consigli Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for key construction materials like steel and concrete directly influences Consigli Construction's operational costs. A limited number of suppliers for essential or specialized components, particularly those needed for sustainable building practices, can amplify their leverage, potentially driving up the cost of inputs for Consigli.

The bargaining power of suppliers for Consigli is significantly influenced by switching costs. If Consigli has invested heavily in specialized equipment or software from a particular supplier, the financial and operational hurdles to transition to a new vendor can be substantial. For instance, if a key supplier provides proprietary project management software that is deeply integrated into Consigli's workflow, the cost of data migration, retraining staff, and potential project delays could easily run into hundreds of thousands of dollars, making it difficult to switch.

Suppliers offering unique or highly specialized inputs, such as advanced sustainable building materials or specific high-tech components for life sciences facilities, hold significant bargaining power. Consigli Construction's reliance on these distinct offerings, which often have few readily available substitutes, enables these suppliers to negotiate higher prices.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power against Consigli Construction. If key suppliers, particularly those offering specialized components or services, possess the capability and inclination to move into construction services themselves, they can exert considerable pressure.

While less frequent for raw material providers, this threat is more pronounced with specialized subcontractors or technology integrators. For instance, a leading BIM (Building Information Modeling) software provider might also offer design and project management services, directly competing with a general contractor like Consigli. This potential for direct competition means suppliers can demand more favorable terms, knowing Consigli might face higher costs or disruptions if they don't comply.

- Increased Supplier Leverage: Suppliers capable of forward integration can dictate terms, potentially increasing material costs or service fees for Consigli.

- Competitive Pressure: Specialized subcontractors or technology providers entering the construction service market directly challenge Consigli's core business.

- Strategic Implications: Consigli must monitor supplier capabilities and consider strategic partnerships or vertical integration to mitigate this threat.

Labor Union Strength and Skilled Trades Availability

The strength of labor unions and the availability of skilled trades significantly impact supplier power in construction. In 2024, the construction industry continued to grapple with a shortage of skilled labor, particularly in specialized areas like electrical, plumbing, and HVAC. This scarcity directly translates to higher labor costs for companies like Consigli Construction, diminishing their bargaining power with these essential suppliers.

For instance, a report from the Associated General Contractors of America in early 2024 indicated that over 70% of construction firms reported difficulty finding qualified workers. This tight labor market, often exacerbated by unionized workforces demanding competitive wages and benefits, allows skilled trades to command higher rates, directly affecting project budgets and Consigli's ability to negotiate favorable terms.

- Labor Shortage Impact: In 2024, a persistent shortage of skilled construction workers, especially in specialized trades, increased labor costs.

- Union Influence: Strong labor unions in the construction sector can negotiate higher wages and benefits, further empowering suppliers.

- Negotiating Leverage: When specialized skills are scarce, Consigli's ability to negotiate down labor costs is reduced, increasing supplier power.

- Sector-Specific Demand: Projects in complex sectors like healthcare and academic facilities often require highly specialized trades, amplifying this supplier power.

The bargaining power of suppliers for Consigli Construction is amplified by the lack of readily available substitutes for critical materials and specialized labor. When unique components or skilled trades are essential and difficult to source elsewhere, suppliers can command higher prices and less favorable terms for Consigli.

For example, in 2024, the demand for advanced, eco-friendly building materials, often sourced from a limited number of manufacturers, allowed these suppliers to increase their pricing. This is particularly true for projects with stringent sustainability requirements, where Consigli has fewer alternatives.

The concentration of suppliers for essential construction inputs like structural steel and concrete also plays a crucial role. A market dominated by a few large players means these suppliers have considerable leverage, impacting Consigli's raw material costs and project profitability.

| Factor | Impact on Consigli Construction | 2024 Data/Trend |

|---|---|---|

| Lack of Substitutes | Increases supplier pricing power. | High demand for specialized sustainable materials. |

| Supplier Concentration | Allows dominant suppliers to dictate terms. | Key materials like steel and concrete often have limited producers. |

| Switching Costs | Deters Consigli from changing suppliers. | Proprietary software integration can be costly to replace. |

| Forward Integration Threat | Creates competitive pressure from suppliers. | Tech providers offering BIM services also enter project management. |

What is included in the product

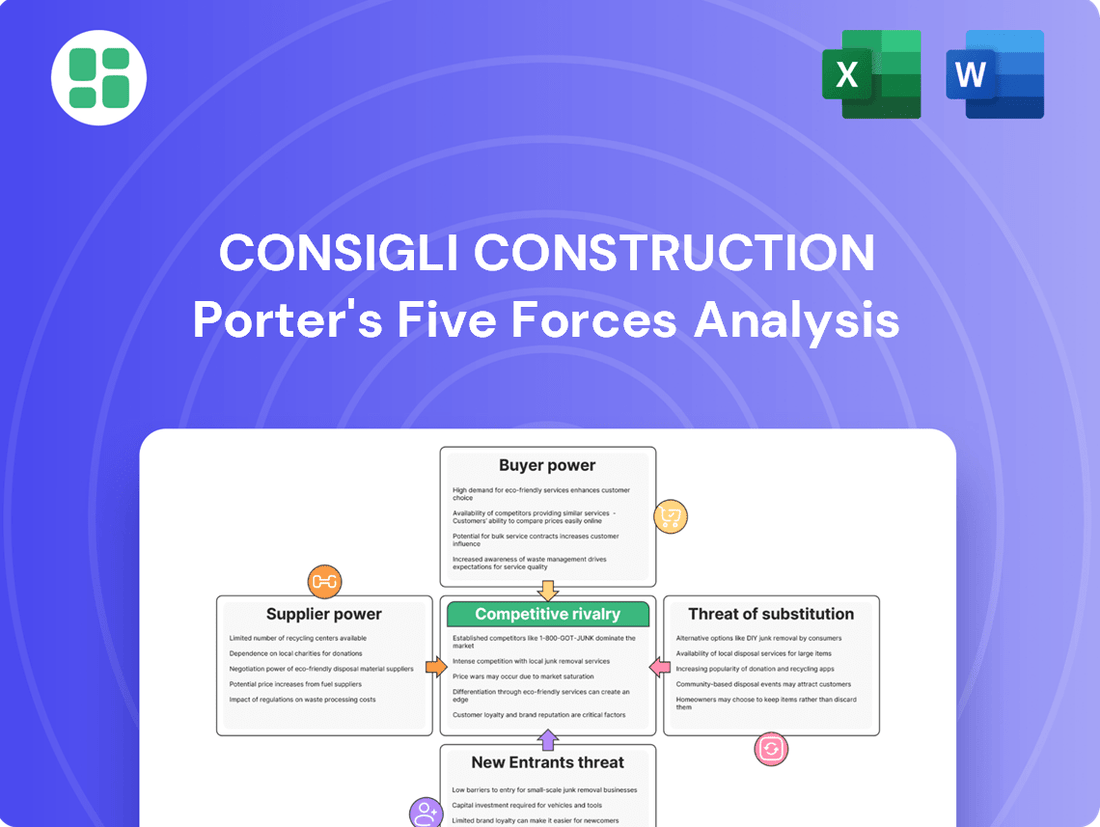

Tailored exclusively for Consigli Construction, this analysis dissects the five competitive forces shaping its industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, enabling rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Consigli Construction's focus on large, complex projects means a few key clients can represent a substantial chunk of their annual revenue. For instance, a single university or hospital system project could easily account for 10-15% or more of Consigli's annual revenue, giving that client significant leverage.

This concentration of revenue in large projects amplifies the bargaining power of these institutional customers. They understand the value of their business to Consigli, allowing them to negotiate more favorable terms, pricing, and contract conditions, especially when the project's scale is substantial.

Institutional clients, especially those in education and healthcare, often face tight budget limitations. This makes them very sensitive to pricing, which in turn amplifies their negotiating power with construction firms like Consigli.

For example, in 2024, many universities and hospital systems reported increased operating costs, leading to more rigorous procurement processes and a heightened focus on cost-effectiveness for capital projects. This environment compels Consigli to offer competitive bids and efficient project execution to secure contracts.

Consigli Construction operates in a market where customers, particularly those undertaking large and complex projects, have a significant number of alternative construction management firms to choose from. This availability of other major players means clients can easily compare offerings and negotiate more favorable pricing and contract terms. For instance, in 2024, the U.S. construction industry saw robust activity, with numerous large-scale projects being tendered, highlighting the competitive landscape for firms like Consigli.

Customer's Ability to Self-Perform or Integrate Backward

Consigli Construction's customers, particularly large institutional clients, possess a degree of bargaining power if they have the capacity for self-performance or backward integration. While directly undertaking Consigli's complex, large-scale projects is improbable, the mere potential for clients to manage smaller projects internally or leverage in-house facilities and project management teams can exert pressure.

This latent threat, even if not fully realized, subtly shifts the power dynamic. For instance, a major university with a robust internal facilities department might negotiate more aggressively on project scope or pricing, knowing they could potentially handle certain maintenance or smaller capital improvements themselves.

- Client Self-Performance: Institutional clients may possess internal teams capable of managing smaller construction or renovation projects, reducing their reliance on external general contractors for these specific needs.

- Backward Integration Threat: The possibility, however remote for large projects, of a client developing in-house capabilities to manage aspects of construction or project oversight acts as a deterrent against excessive pricing or unfavorable terms.

- Impact on Negotiation: This customer capability can influence pricing, contract terms, and service level agreements, as Consigli must remain competitive against the perceived alternative of in-house execution.

Importance of Project Outcome to Customer

For clients such as hospitals and universities, the successful and timely completion of a new facility is absolutely crucial to their core operations. This dependence on project success directly translates into significant leverage for these customers.

Consigli Construction, therefore, faces strong pressure from these clients regarding project performance, the quality of workmanship, and strict adherence to established schedules. This heightened customer expectation and the mission-critical nature of the projects amplify the bargaining power of customers.

- Mission-Critical Projects: Hospitals and universities rely heavily on new or renovated facilities to maintain and expand their services, making project outcomes vital to their mission.

- High Stakes for Clients: Delays or quality issues can have severe consequences, impacting patient care, educational delivery, and institutional reputation, thus empowering clients to demand more.

- Increased Scrutiny: The importance of the outcome leads to closer client oversight and a greater willingness to negotiate terms that ensure satisfaction and minimize risk.

- Demand for Quality and Timeliness: Clients will exert considerable influence to ensure Consigli meets or exceeds performance, quality, and schedule expectations, reinforcing their bargaining power.

Consigli Construction's customers, particularly large institutional clients like universities and hospitals, possess significant bargaining power due to the concentrated nature of their business and the critical importance of project outcomes. In 2024, many of these institutions faced increased operating costs, intensifying their focus on cost-effectiveness and driving more rigorous procurement processes, which naturally amplifies their negotiating leverage with construction firms.

The availability of numerous alternative construction management firms in the competitive U.S. market, as evidenced by robust project tendering in 2024, further empowers clients. They can readily compare offerings and negotiate for better pricing and terms. Additionally, the potential for clients to manage smaller projects internally, or the threat of backward integration, subtly shifts the power dynamic, encouraging Consigli to offer competitive bids and efficient execution to secure these vital contracts.

| Customer Segment | Key Leverage Factors | 2024 Market Context Impact |

|---|---|---|

| Large Institutional Clients (Universities, Hospitals) | Concentration of revenue, mission-critical project needs, budget sensitivity, potential for self-performance on smaller tasks. | Increased operating costs for institutions led to heightened focus on cost-effectiveness and rigorous procurement, amplifying client negotiation power. |

| General Market Clients | Availability of numerous competing construction firms, ability to switch providers. | Robust activity in the U.S. construction sector in 2024 meant ample alternatives for clients, strengthening their position to negotiate favorable terms. |

Full Version Awaits

Consigli Construction Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Consigli Construction's Porter's Five Forces Analysis, providing a comprehensive overview of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. This in-depth analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The construction management sector, particularly for large institutional, healthcare, and academic projects, is highly competitive. Consigli Construction operates within an arena populated by numerous well-established regional and national firms, all vying for significant contracts.

This intense rivalry means Consigli frequently encounters other large players in bid processes, leading to considerable competition for market share within its specialized segments. For instance, in 2024, the U.S. construction industry saw continued robust activity, with major firms like Turner Construction and Skanska USA also actively pursuing similar high-value projects, intensifying the bidding landscape.

The construction industry's growth rate significantly influences competitive rivalry. While some specialized sectors, such as life sciences construction, experienced strong demand and growth in 2024, the broader construction market remains susceptible to economic cycles. For instance, the U.S. construction spending saw fluctuations throughout 2024, with residential construction facing headwinds while non-residential sectors showed more resilience.

Periods of slower overall market growth can intensify competition among firms like Consigli. When the number of available projects shrinks, companies are often forced to compete more aggressively for each contract. This heightened rivalry can manifest as price undercutting or offering more favorable terms, potentially squeezing profit margins for all players involved.

Consigli Construction distinguishes itself through a strong emphasis on sustainable building practices and a proven track record with complex, large-scale projects. However, the construction industry is highly competitive, with rivals actively pursuing their own unique selling propositions to capture market share.

The intensity of rivalry is directly shaped by how effectively competitors can differentiate their offerings. This differentiation often hinges on service quality, specialized expertise in niche construction areas, and innovative project delivery methods. For instance, in 2024, many firms highlighted their adoption of advanced BIM (Building Information Modeling) technologies to streamline design and construction, a move that directly impacts competitive positioning.

High Fixed Costs and Exit Barriers

The construction industry, including players like Consigli Construction, is characterized by substantial fixed costs. These include investments in heavy machinery, skilled labor, and sophisticated project management systems. For instance, a single large crane can cost upwards of $1 million, and maintaining a skilled workforce requires ongoing training and benefits.

High exit barriers further intensify competitive rivalry. Specialized construction equipment often has limited resale value, and long-term contracts can bind firms to projects for years. This makes it financially difficult and strategically unappealing for companies to leave the market, even when profitability is low. As a result, firms are compelled to remain active and compete fiercely for available projects.

- High Fixed Costs: Construction firms invest heavily in equipment, personnel, and infrastructure, leading to significant overhead.

- Exit Barriers: Specialized assets and long-term contractual obligations make it costly and difficult for companies to exit the market.

- Incentive to Compete: The combination of high fixed costs and exit barriers encourages firms to stay and fight for market share, even in challenging economic conditions.

- Impact on Rivalry: This dynamic leads to intense competition among existing players, potentially pressuring profit margins.

Switching Costs for Customers

For large, complex construction projects, clients face substantial switching costs. These costs aren't just financial; they include the risk of project delays, potential quality issues, and the loss of established working relationships if they move to a new construction manager mid-stream. This often creates a degree of client loyalty for firms that consistently deliver.

While switching costs can lock in existing clients, the initial pursuit of new business remains intensely competitive. Clients meticulously assess potential construction managers based on their track record, proposed budget, and demonstrated expertise in specific project types. For instance, a 2024 study by the Construction Industry Association highlighted that over 70% of clients prioritize a firm's specialized experience in similar projects when making their initial selection.

- High Switching Costs: Clients incur significant financial, operational, and reputational risks when changing construction managers during a project.

- Client Retention: Proven expertise and consistent delivery can lead to strong client retention due to these high switching barriers.

- Competitive Bidding: The initial phase remains highly competitive, with clients prioritizing reputation, cost, and specialized experience.

- 2024 Data Point: Over 70% of clients in a 2024 industry survey cited specialized experience as a primary selection criterion.

Consigli Construction faces intense rivalry from numerous established regional and national firms, all competing for large-scale institutional, healthcare, and academic projects. This competition is amplified by the industry's cyclical nature and the drive for market share, as seen in 2024 with major players actively pursuing similar high-value contracts.

The differentiation strategies employed by competitors, such as adopting advanced BIM technologies in 2024, directly influence the intensity of this rivalry. High fixed costs and exit barriers further compel firms to remain active and compete aggressively, often leading to price pressures and impacting profit margins for all involved.

| Competitor Type | Key Differentiators (2024 Focus) | Impact on Rivalry |

|---|---|---|

| Large National Firms (e.g., Turner, Skanska) | Scale, established brand, diverse service offerings | Intensify competition for major contracts, price sensitivity |

| Specialized Regional Firms | Niche expertise, local relationships, agility | Compete fiercely in specific project types, focus on value-added services |

| Firms Adopting New Tech (e.g., advanced BIM) | Efficiency, cost savings, improved project delivery | Raise the bar for operational excellence, pressure slower adopters |

SSubstitutes Threaten

Large institutions, particularly healthcare systems, may opt to build or enhance their in-house construction management divisions for specific projects like renovations or smaller expansions. This internal capability presents a subtle substitute threat to companies like Consigli, which typically focuses on larger, more complex endeavors.

Emerging construction methods, like advanced modular and prefabricated building techniques, present a growing threat of substitution for traditional on-site construction management. These innovative approaches can offer faster build times and potentially lower costs for specific project types, directly challenging the necessity of Consigli's core competencies if adopted widely and rapidly.

While Consigli actively integrates new technologies, a significant acceleration in the adoption of these alternative methods, particularly for standardized building segments, could bypass their established on-site expertise. For instance, the global modular construction market was valued at approximately $125 billion in 2023 and is projected to grow substantially, indicating a tangible shift in how buildings are erected.

The threat of substitutes for Consigli Construction is significantly amplified by the potential for clients to delay or cancel projects altogether. Economic downturns, such as the projected slowdown in global GDP growth for 2024, can severely impact client budgets and confidence, leading to a pause or complete abandonment of planned construction initiatives. This decision not to build, rather than seeking an alternative contractor, represents a direct substitute for Consigli's core offering.

Renovation vs. New Construction

The threat of substitutes for Consigli Construction, particularly in the realm of renovation versus new construction, is a significant consideration. For many clients, extensive renovation and repurposing of existing facilities can serve as a viable alternative to entirely new ground-up construction projects. This trend directly impacts the demand for Consigli's core services.

While Consigli does offer renovation services, a pronounced market shift favoring adaptive reuse over new builds could potentially divert demand away from their traditional large-scale new construction projects. This dynamic presents a strategic challenge that requires careful market analysis and service adaptation.

- Market Trend: In 2024, the demand for renovation and adaptive reuse projects continued to grow, driven by factors such as sustainability initiatives and the desire to preserve historical character.

- Cost-Effectiveness: Renovations can often be more cost-effective than new construction, especially when considering land acquisition and permitting costs.

- Regulatory Environment: Evolving zoning laws and incentives in many municipalities are increasingly encouraging the renovation and upgrading of existing structures rather than new development.

- Client Preference: A growing segment of clients, particularly in urban areas, express a preference for the unique architectural qualities and established locations offered by renovated buildings.

Technology-Driven Project Management Platforms

The increasing sophistication of technology-driven project management platforms presents a potential threat of substitutes for traditional construction management services. These digital tools, such as Procore or Autodesk Construction Cloud, empower clients with greater oversight and control, potentially reducing their perceived need for external management expertise on certain projects. In 2024, the adoption of these platforms continued to grow, with many firms reporting increased efficiency and transparency, which could, in extreme scenarios, enable clients to internalize more project management functions.

While these platforms are largely adopted by construction managers themselves to enhance their offerings, their advanced capabilities could theoretically allow clients to manage more complex projects with less reliance on full-service construction management firms. This trend is particularly relevant for clients with in-house technical expertise. For instance, a 2023 industry survey indicated that over 70% of construction companies utilize cloud-based project management software, highlighting the widespread availability and capability of these digital solutions.

- Increased Client Self-Sufficiency: Advanced platforms offer features like real-time progress tracking, document management, and communication tools, enabling clients to oversee projects more directly.

- Cost Reduction Potential: By internalizing some management tasks, clients might aim to reduce fees associated with external construction management firms.

- Focus on Niche Services: Construction management firms may need to emphasize specialized expertise and value-added services beyond basic project coordination to counter this threat.

- Market Evolution: The integration of AI and advanced analytics into these platforms by 2025 is expected to further enhance their capabilities, potentially broadening the scope of what clients can manage independently.

The threat of substitutes for Consigli Construction is multifaceted. Clients might opt for in-house construction management for smaller projects, or embrace advanced modular and prefabricated building techniques that bypass traditional on-site expertise. The global modular construction market, valued around $125 billion in 2023, exemplifies this shift.

Furthermore, economic headwinds, like the projected slowdown in global GDP for 2024, can lead clients to delay or cancel projects entirely, a direct substitute for engaging a construction manager. The increasing preference for renovation and adaptive reuse over new builds also presents a substitute, with the renovation market showing continued growth in 2024 due to sustainability and cost-effectiveness factors.

Technology also plays a role, with sophisticated project management platforms potentially enabling clients to manage more tasks internally, reducing reliance on external firms. The widespread adoption of cloud-based project management software, used by over 70% of construction companies in 2023, underscores this trend.

| Substitute Type | Description | 2023/2024 Relevance | Impact on Consigli |

|---|---|---|---|

| In-house Management | Clients managing smaller projects internally | Ongoing trend for institutional clients | Reduced demand for smaller projects |

| Modular/Prefab Construction | Off-site construction methods | Global market ~ $125B (2023), growing | Challenges traditional on-site expertise |

| Project Delays/Cancellations | Economic downturns impacting client budgets | Projected global GDP slowdown (2024) | Direct loss of potential revenue |

| Renovation/Adaptive Reuse | Upgrading existing structures vs. new builds | Growing demand in 2024 (sustainability, cost) | Shifts focus from new construction |

| Client-Managed Platforms | Clients using advanced PM software | Over 70% of firms use cloud PM (2023) | Potential for clients to internalize management |

Entrants Threaten

Entering the specialized construction management sector, particularly for academic, healthcare, and life sciences facilities, demands considerable upfront capital. New firms must invest heavily in advanced equipment, secure substantial bonding capacity, implement sophisticated technology, and recruit highly skilled professionals. For instance, a mid-sized construction management firm might need to allocate upwards of $5 million to $10 million for initial infrastructure and operational setup, with bonding requirements alone often exceeding $1 million for significant projects.

Consigli Construction's established reputation and deep-rooted client relationships act as a significant barrier to new entrants. Securing large, complex projects, a hallmark of Consigli's success, often hinges on trust and a demonstrated history of reliable execution. For instance, in 2024, Consigli continued to win bids on major infrastructure and institutional projects, reinforcing its market standing.

The construction industry faces significant regulatory hurdles, including stringent permit and licensing requirements that vary by jurisdiction and project type. For instance, specialized construction, such as that for healthcare facilities or life sciences labs, demands even more complex certifications and adherence to specific building codes, creating a substantial barrier for newcomers lacking established expertise and relationships with regulatory bodies.

Access to Specialized Skilled Labor and Subcontractors

Consigli Construction's success in undertaking intricate projects hinges on its established relationships with specialized skilled labor and subcontractors. For new companies entering the construction arena, replicating these vital networks and securing the necessary talent, particularly for cutting-edge sustainable or technologically demanding projects, presents a significant hurdle.

This difficulty in accessing specialized expertise acts as a substantial barrier to entry. For instance, in 2024, the demand for skilled trades in areas like advanced building information modeling (BIM) and green construction techniques outpaced supply, making it challenging for newcomers to find qualified teams. Consigli's existing partnerships provide a competitive edge by ensuring project timelines and quality standards are consistently met, something a new entrant would find arduous to achieve quickly.

- Limited access to specialized talent: New construction firms face challenges in recruiting and retaining highly skilled labor, particularly in niche areas like modular construction or advanced façade systems.

- Difficulty in securing reliable subcontractors: Building a trusted network of subcontractors with proven track records in complex projects takes time and significant relationship-building efforts.

- Higher initial labor costs for new entrants: Without established relationships, new companies often pay premium rates to attract scarce skilled labor and subcontractors, impacting project profitability.

- Inability to match quality and efficiency: The lack of experienced teams and reliable partners can lead to lower quality workmanship and extended project durations, making it difficult to compete with established players like Consigli.

Economies of Scale and Experience Curve

Established construction firms like Consigli Construction leverage significant economies of scale. This advantage is particularly evident in their purchasing power, allowing them to secure better pricing on materials and equipment. For instance, in 2024, large-scale contractors often negotiate bulk discounts that can be 5-10% lower than what smaller, newer firms can achieve.

Furthermore, Consigli benefits from an experience curve, meaning their operational efficiency and project management expertise improve with each completed project. This accumulated knowledge translates into reduced waste, optimized timelines, and fewer costly errors. New entrants, lacking this deep well of experience, often face higher initial costs and a steeper learning curve, making it difficult to compete on price for major construction contracts.

The threat of new entrants is therefore moderated by these inherent cost advantages. New companies would need substantial capital to achieve comparable scale and would likely operate at a cost disadvantage for several years. This barrier is a key factor in maintaining the competitive landscape for established players.

The threat of new entrants into Consigli Construction's specialized market is significantly mitigated by high capital requirements and substantial regulatory barriers. New firms need extensive funding for equipment, bonding, and technology, often exceeding $5 million to $10 million for initial setup. Furthermore, navigating complex permitting and licensing, especially for healthcare or life sciences projects, demands specialized expertise and established relationships with regulatory bodies, which newcomers lack.

Consigli's established reputation and deep client relationships, combined with its access to skilled labor and reliable subcontractors, create formidable entry barriers. In 2024, Consigli continued to secure major institutional projects, underscoring its market strength. New entrants struggle to replicate these networks and gain the trust necessary for complex, high-value contracts, facing higher initial labor costs and an inability to match the quality and efficiency of established firms.

Economies of scale and the experience curve further deter new entrants. Consigli's purchasing power allows for 5-10% lower material costs through bulk discounts in 2024. Their accumulated project management expertise reduces waste and errors, leading to cost efficiencies that new firms, operating at a disadvantage, cannot easily match. These factors collectively moderate the threat of new competition.

| Barrier Type | Description | Estimated Cost/Impact for New Entrant | Consigli's Advantage |

| Capital Requirements | Initial investment in equipment, technology, and bonding capacity. | $5M - $10M+ | Established financial infrastructure and access to credit. |

| Regulatory Hurdles | Permits, licenses, and adherence to specialized building codes. | Significant time and expertise required; potential project delays. | Proven track record and established relationships with regulatory bodies. |

| Skilled Labor & Subcontractors | Access to experienced talent and reliable specialized partners. | Higher initial labor costs (premium rates); difficulty securing trusted subcontractors. | Long-standing relationships ensuring quality and timely execution. |

| Economies of Scale | Bulk purchasing power for materials and equipment. | 5-10% higher material costs compared to established firms. | Negotiated bulk discounts leading to cost savings. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Consigli Construction is built upon a foundation of industry-specific market research reports, company financial statements, and competitor public disclosures. We also incorporate data from construction industry trade publications and economic indicators to provide a comprehensive view of the competitive landscape.