Consigli Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consigli Construction Bundle

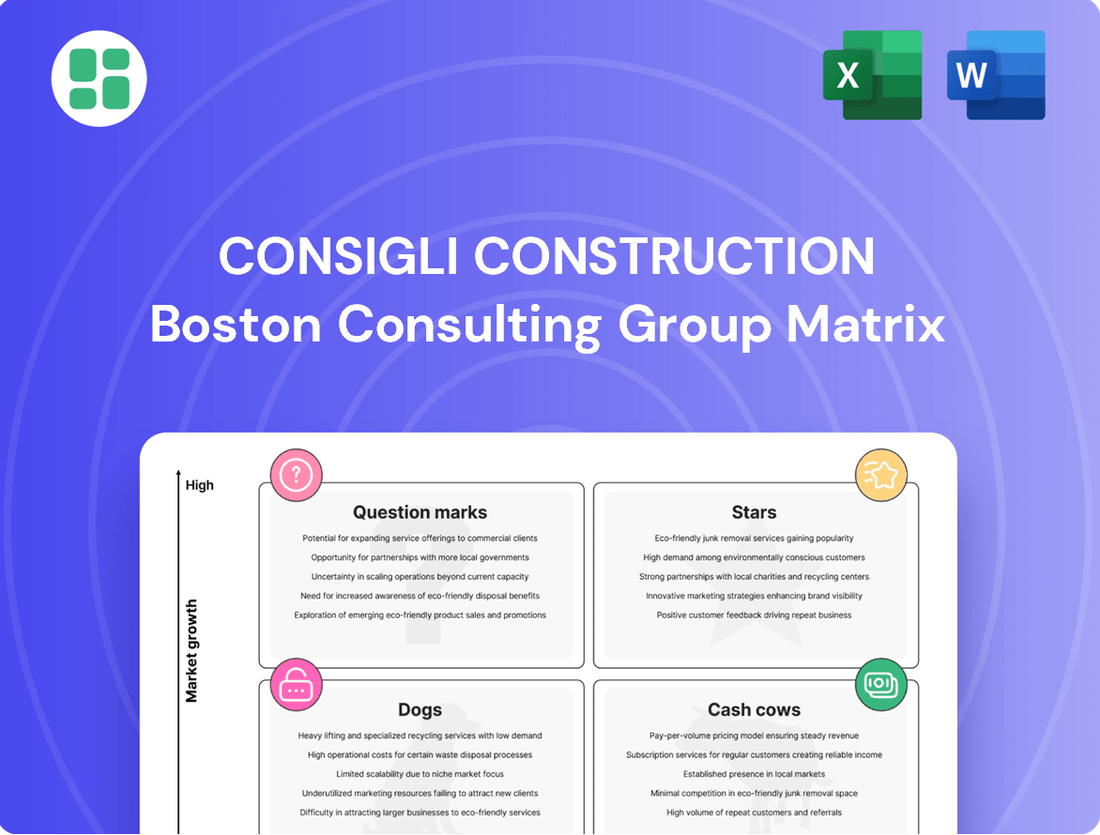

This glimpse into Consigli Construction's BCG Matrix reveals their strategic positioning, but to truly unlock their growth potential, you need the full picture. Understand which of their services are Stars driving future revenue and which are Cash Cows funding innovation.

Don't be left guessing about Consigli Construction's market performance. Purchase the complete BCG Matrix to gain a detailed quadrant breakdown, identify potential Dogs that need divestment, and uncover the lucrative opportunities hidden within their Question Marks. This is your key to informed decision-making and strategic advantage.

Elevate your understanding of Consigli Construction's product portfolio. The full BCG Matrix report provides the granular data and actionable insights necessary to optimize resource allocation and drive sustainable growth. Invest in clarity and secure your competitive edge today.

Stars

Consigli Construction's strategic acquisition of Lendlease's New York and New Jersey operations, which included a substantial healthcare and life sciences portfolio, has significantly bolstered its position in this rapidly expanding sector. This move is particularly impactful as it brings a wealth of experience in a market segment ripe for growth.

While some established life sciences hubs, such as Boston-Cambridge, are currently navigating a period of oversupply, this presents a clear opportunity for Consigli to explore and establish a footprint in emerging life sciences markets. These developing regions often offer a more favorable landscape for new construction projects and infrastructure development.

Consigli Construction's sustainable building and decarbonization projects, including their Arch Energy division, represent a significant growth opportunity, aligning with increasing regulatory demands like NYC Local Law 97 and Boston BERDO. These initiatives cater to a strong client demand for net-zero objectives, positioning Consigli as a leader in a rapidly expanding sector.

Their work on projects such as 345 Hudson exemplifies their capability in tackling complex decarbonization challenges for existing structures. The market for green building is projected to continue its upward trajectory, with the U.S. green building market expected to reach $378.9 billion by 2025, underscoring the strategic importance of these endeavors for Consigli.

Consigli Construction actively integrates advanced technologies such as Building Information Modeling (BIM+), OpenSpace for reality capture, and drone technology to enhance project visualization and progress tracking. Their embrace of prefabrication and industrialized construction methods is evident in their project execution, boosting efficiency and precision.

This technological adoption allows Consigli to tackle increasingly complex projects, offering clients streamlined delivery and predictable outcomes. For instance, in 2024, projects utilizing BIM saw an average reduction of 8-10% in rework, according to industry reports, a benefit Consigli leverages to its advantage.

Academic Sector Expansion with Innovative Facilities

Consigli Construction is a major player in the academic sector, consistently taking on substantial projects. Their involvement in building advanced educational spaces, such as the Roux Institute's Alfond Center, highlights their capability in integrating cutting-edge technology and sustainable design. This focus on creating inspiring learning environments, particularly with smart and eco-friendly features, solidifies their leadership in a dynamic market.

Their commitment to the academic sector is evident in their project portfolio. For instance, the Alfond Center at the Roux Institute, completed in 2021, represents a significant investment in future-ready educational infrastructure. Consigli's expertise ensures these facilities not only meet current needs but also anticipate future advancements in teaching and research.

- Academic Sector Focus: Consigli consistently secures large-scale academic construction projects.

- Innovation Integration: Expertise in incorporating advanced technology and sustainability in educational facilities.

- Market Leadership: Recognized for creating inspiring and forward-thinking learning environments.

- Project Example: The Roux Institute's Alfond Center showcases their capabilities in modern academic building.

Design-Build and Preconstruction Services for Complex Projects

Consigli Construction's full spectrum of services, particularly their strong preconstruction and design-build offerings, positions them to effectively manage highly complex projects from their initial stages. This integrated approach is highly appreciated by clients, as it simplifies project execution and provides greater assurance of successful completion, especially in demanding construction environments.

Their expertise in navigating intricate project requirements, from early planning and budgeting to final execution, is a key differentiator. For instance, in 2024, Consigli was involved in several high-profile, complex projects, including major institutional and healthcare facilities, where their preconstruction services were instrumental in identifying potential challenges and optimizing project delivery timelines and costs.

- Design-Build Capabilities: Consigli manages the entire project lifecycle, from design conceptualization to construction completion, ensuring seamless integration and accountability.

- Preconstruction Excellence: Their robust preconstruction services include detailed cost estimating, constructability reviews, and value engineering, crucial for complex undertakings.

- Client Value Proposition: Clients benefit from streamlined processes, reduced risk, and a higher degree of certainty regarding project outcomes.

- Complex Project Focus: Consigli's strategic emphasis on design-build and preconstruction for complex projects aligns with market demand for integrated, reliable construction solutions.

Consigli Construction's focus on the academic sector, particularly in creating advanced, sustainable learning environments, positions them as a strong contender in the Stars category. Their consistent securing of large-scale projects and integration of cutting-edge technology, exemplified by the Roux Institute's Alfond Center, demonstrate market leadership and a forward-thinking approach. This strategic emphasis on innovation and quality in educational infrastructure aligns with high growth potential and strong market demand.

What is included in the product

Strategic overview of Consigli's portfolio, categorizing units by market share and growth.

Consigli Construction's BCG Matrix provides a clear, one-page overview, relieving the pain point of deciphering complex business unit performance.

Cash Cows

Consigli Construction's established healthcare facility construction and expansion projects represent a classic Cash Cow. The healthcare sector, while mature, continues its steady demand for renovations, expansions, and new specialized facilities, ensuring a consistent revenue stream. In 2024, the healthcare construction market in the US alone was projected to reach over $100 billion, highlighting the ongoing need for such services.

Consigli Construction's long history and reputation for intricate landmark restoration and institutional projects position these as potential Cash Cows. Their work on projects like the Thompson Block renovation highlights a stable market segment where specialized craftsmanship and experience lead to high profit margins and repeat business. This niche relies heavily on proven expertise and a strong track record.

Consigli Construction's general construction management services in the Northeast/Mid-Atlantic are their established cash cows. These services cater to a wide array of mature markets, contributing a stable and significant portion of their revenue due to high market share. The company’s robust network of regional offices underpins the extensive reach of these core operations.

Repeat Client Engagements and Long-Term Partnerships

Consigli Construction's repeat client engagements and long-term partnerships are a prime example of a cash cow within their business portfolio. A remarkable 73% of their work originates from clients they've served before, underscoring a high level of client satisfaction and trust.

This consistent demand from a loyal customer base generates a stable and predictable revenue stream, a hallmark of a cash cow. It allows Consigli to allocate resources efficiently, knowing a significant portion of their business is secured.

- 73% of Consigli's revenue comes from repeat clients.

- This high retention rate signifies strong client satisfaction.

- Repeat business provides a predictable and stable income.

- These established relationships are a core strength, generating consistent cash flow.

Self-Perform Capabilities in Core Trades

Consigli Construction's self-perform capabilities in core trades, such as carpentry, labor, and masonry, position them as a strong Cash Cow within the BCG matrix. With a substantial workforce of over 700 skilled tradespeople, this internal capacity provides significant advantages.

This extensive in-house expertise directly translates to enhanced control over project quality, adherence to schedules, and effective cost management. By reducing dependence on external subcontractors for fundamental construction tasks, Consigli can often realize higher profit margins on projects where these self-perform services are utilized.

- Skilled Workforce: Over 700 carpenters, laborers, and masons on staff.

- Quality Control: Direct oversight of core trade execution.

- Cost Efficiency: Reduced subcontractor reliance can improve project profitability.

- Schedule Predictability: Internal resource management enhances timeline reliability.

Consigli Construction's established healthcare facility construction and expansion projects represent a classic Cash Cow. The healthcare sector, while mature, continues its steady demand for renovations, expansions, and new specialized facilities, ensuring a consistent revenue stream. In 2024, the healthcare construction market in the US alone was projected to reach over $100 billion, highlighting the ongoing need for such services.

Consigli Construction's general construction management services in the Northeast/Mid-Atlantic are their established cash cows. These services cater to a wide array of mature markets, contributing a stable and significant portion of their revenue due to high market share. The company’s robust network of regional offices underpins the extensive reach of these core operations.

Consigli Construction's repeat client engagements and long-term partnerships are a prime example of a cash cow within their business portfolio. A remarkable 73% of their work originates from clients they've served before, underscoring a high level of client satisfaction and trust. This consistent demand from a loyal customer base generates a stable and predictable revenue stream, a hallmark of a cash cow.

| Business Segment | BCG Category | Key Strengths | Revenue Contribution |

|---|---|---|---|

| Healthcare Construction | Cash Cow | Steady demand, specialized expertise | Significant and consistent |

| Institutional Projects | Cash Cow | Proven track record, repeat business | Stable revenue stream |

| General Construction Management (Northeast/Mid-Atlantic) | Cash Cow | High market share, extensive network | Core revenue driver |

| Repeat Client Engagements | Cash Cow | Client satisfaction, loyalty | Predictable income source |

What You See Is What You Get

Consigli Construction BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently proceed knowing that the file you see is precisely the file that will be delivered, enabling you to make informed decisions without any additional steps or surprises.

Dogs

Small-scale, highly commoditized residential construction doesn't align with Consigli Construction's strategic focus. Their expertise lies in large, intricate projects, making this sector a poor fit for their resources and capabilities.

For Consigli, entering this segment would likely result in a low market share and minimal growth. This is because it represents a low-growth, low-market-share quadrant in the BCG matrix, often referred to as a 'dog'.

Standardized, low-complexity commercial office fit-outs represent a segment where Consigli Construction might not hold a dominant position. While they do undertake interior work, focusing on these straightforward projects without a niche specialization, like advanced life sciences facilities or intricate corporate campuses, positions them in a low-margin, low-growth market. In this space, smaller, more nimble competitors often have an advantage.

Projects in geographies where Consigli Construction lacks an established presence or a clear strategic fit often fall into the 'dog' category of the BCG matrix. Venturing into these new markets without the support of a strategic acquisition, existing client relationships, or a robust local team typically leads to a low market share and necessitates substantial investment, positioning them as dogs until considerable market penetration is achieved.

While Consigli's recent strategic expansions into New York/New Jersey and North Carolina represent calculated moves that could potentially shift these ventures out of the 'dog' classification, other unestablished geographic projects would likely mirror this challenging profile. For instance, if a project in a completely new region requires extensive brand building and operational setup from scratch, the initial capital outlay and uncertain returns would firmly place it in the dog quadrant.

Projects Lacking Sustainability or Advanced Technology Requirements

Projects that don't prioritize sustainability or advanced technology can be a drag on Consigli Construction's growth. These types of projects don't align with their core strategy, which is built around innovation and eco-friendly practices. Focusing on these less strategic ventures might mean competing on price, a tough game in crowded markets.

For instance, in 2024, the construction industry saw a significant push towards green building. The U.S. Green Building Council reported that the market for green building materials was projected to reach $170.9 billion by 2026. Projects that ignore these trends miss out on a growing segment of demand and potentially higher margins.

- Misalignment with Core Strengths: Projects lacking sustainability or advanced tech requirements dilute Consigli's market positioning as an innovator.

- Price-Based Competition: Entering markets for these projects often forces a race to the bottom on price, squeezing profitability.

- Reduced Market Share Potential: Failing to offer innovative or sustainable solutions limits appeal to clients seeking forward-thinking construction.

- Opportunity Cost: Resources spent on low-tech, non-sustainable projects could be better invested in areas that leverage Consigli's technological edge.

Highly Price-Sensitive, Public Sector General Contracting (Non-Specialized)

Highly price-sensitive, public sector general contracting for non-specialized projects, even those involving federal work, can represent a 'dog' in the BCG matrix. This is particularly true when contracts are awarded solely on the lowest bid, without a need for specialized expertise. Such segments often yield slim profit margins and face fierce competition, making them less attractive for growth and investment.

The low-margin nature of these bids is a significant concern. For instance, in 2024, the average profit margin for general contractors on purely bid-based public sector projects in the US hovered around 2-4%. This contrasts sharply with specialized projects where margins can reach 8-15% or higher.

- Low Profitability: Intense bidding wars on non-specialized public sector contracts in 2024 typically resulted in profit margins between 2% and 4%.

- High Competition: The barrier to entry for general contracting on standard public works is relatively low, leading to a crowded marketplace.

- Limited Growth Potential: Without a need for specialized skills, these projects offer minimal opportunities for upselling or value-added services.

- Cash Flow Strain: The combination of low margins and potentially long payment cycles can put a strain on cash flow for contractors.

Projects that Consigli Construction undertakes but do not align with their core competencies or market strategy are considered 'dogs'. These are ventures with low market share and low growth prospects, draining resources without significant returns.

These projects often involve highly commoditized services or operate in geographies where Consigli lacks a strong presence. Entering such segments typically leads to intense price competition and limited differentiation, making it difficult to gain traction.

For example, in 2024, the construction industry continued to see a bifurcation between specialized, high-margin projects and generalized, low-margin work. Consigli's 'dog' segments would be those that fall into the latter category, where their expertise is not a key differentiator.

The financial implications are clear: these projects consume capital and management attention that could be better allocated to Consigli's 'stars' or 'question marks', hindering overall portfolio growth and profitability.

| BCG Category | Market Growth | Market Share | Consigli Construction Relevance | Example Scenario |

|---|---|---|---|---|

| Dogs | Low | Low | Poor strategic fit, low profitability | General contracting for non-specialized public sector projects with low bid margins (2-4% in 2024) |

| Dogs | Low | Low | Lack of expertise or established presence | Entering new, unproven geographic markets without prior investment or partnerships |

| Dogs | Low | Low | Not aligned with innovation focus | Projects that do not incorporate sustainable building practices or advanced technology |

Question Marks

Consigli Construction's recent acquisition of Lendlease's New York/New Jersey operations and its expansion into North Carolina are clear strategic plays, bolstering its presence in established and growing markets. These moves are designed to leverage existing capabilities and market knowledge.

However, entering entirely new, undeveloped geographic markets without a similar strategic acquisition or established foothold presents a different challenge. Such ventures would necessitate substantial upfront investment in building brand recognition, establishing local relationships, and developing operational infrastructure, with uncertain timelines for market share capture and profitability.

Consigli Construction's exploration into highly specialized green technologies, such as novel bio-based concrete additives or advanced carbon capture systems for demolition waste, positions them in a BCG matrix's question mark quadrant. These innovations, while potentially disruptive and offering significant future growth, currently exhibit low market adoption within the broader construction industry, reflecting their nascent stage and the inherent risks associated with unproven solutions.

Developing proprietary prefabrication or modular construction facilities for Consigli Construction would place it in a question mark category within the BCG matrix. This move signifies a substantial capital outlay into a sector with high growth potential, driven by demand for efficiency and sustainability in construction. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly, with some estimates reaching over $200 billion by 2030.

However, the success hinges on Consigli's ability to achieve high utilization rates and operational efficiencies within these new facilities. If these facilities are underutilized or if market penetration remains low, the investment could become a drain on resources, mirroring the characteristics of a question mark. Achieving significant market share in a potentially crowded prefabrication space requires not only investment but also a clear strategy for differentiation and market capture.

Entry into New Vertical Markets (e.g., Data Centers, Advanced Manufacturing beyond existing scope)

Consigli Construction's potential entry into highly specialized new vertical markets, such as hyperscale data centers or advanced manufacturing beyond their current scope, presents a significant question mark on the BCG matrix. While the company has experience in advanced technology and mission-critical projects, these emerging sectors demand substantial new expertise and a dedicated strategy for market penetration.

The data center market, for instance, is experiencing robust growth. In 2024, global data center construction spending was projected to reach over $200 billion, driven by AI and cloud computing demand. Similarly, advanced manufacturing, particularly in areas like semiconductor fabrication, requires extremely precise construction methodologies and specialized cleanroom environments. Consigli would need to invest heavily in training, technology, and talent acquisition to compete effectively in these demanding fields.

- High Growth Potential: These verticals offer substantial revenue opportunities, with the global data center market alone expected to grow at a CAGR of over 10% through 2028.

- Significant Investment Required: Entering these markets necessitates considerable upfront investment in specialized equipment, technology, and workforce development, potentially impacting short-term profitability.

- Expertise Gap: Existing capabilities in advanced technology and mission-critical projects may not fully translate to the unique demands of hyperscale data centers or highly specialized advanced manufacturing facilities.

- Market Penetration Challenges: Establishing a strong foothold against incumbent specialized contractors will require aggressive business development and a compelling value proposition.

AI-Driven Project Management and Predictive Analytics Services

Consigli, while tech-forward, is exploring AI-driven project management and predictive analytics as potential new service offerings. This positions them in a high-growth, nascent market, characteristic of a question mark in the BCG matrix. Significant investment in research and development, alongside substantial market education, would be critical for success in this emerging area.

- Market Potential: The global AI in construction market was valued at approximately $1.2 billion in 2023 and is projected to reach over $5.4 billion by 2028, indicating robust growth potential.

- R&D Investment: Companies entering this space often need to allocate 10-15% of their revenue to R&D to stay competitive and develop proprietary AI solutions.

- Market Education Needs: A significant portion of the construction industry still operates with traditional methods, requiring clear demonstrations of AI's ROI to drive adoption.

- Competitive Landscape: While many tech firms offer AI solutions, specialized construction AI platforms are still developing, presenting an opportunity for early movers.

Consigli Construction's ventures into novel green technologies, proprietary prefabrication facilities, specialized new verticals like data centers, and AI-driven project management all represent potential question marks on the BCG matrix. These initiatives are characterized by high growth potential in emerging markets but also demand significant upfront investment and carry inherent risks due to unproven market adoption or the need for new expertise.

For instance, the global modular construction market, a potential question mark for Consigli, was valued around $100 billion in 2023 and is expected to exceed $200 billion by 2030. Similarly, AI in construction is a rapidly growing field, projected to reach over $5.4 billion by 2028 from $1.2 billion in 2023. These figures highlight the substantial opportunities but also the scale of investment and strategic focus required to succeed.

The success of these question mark initiatives hinges on Consigli's ability to navigate market uncertainties, develop necessary expertise, and achieve strong market penetration against established or emerging competitors. Without clear strategies for differentiation and market capture, these investments could face challenges in generating adequate returns.

| Initiative | BCG Category | Market Potential | Investment Needs | Key Challenges |

|---|---|---|---|---|

| Green Technologies | Question Mark | High (Disruptive potential) | Significant R&D | Market adoption, proving ROI |

| Prefabrication Facilities | Question Mark | High ($100B in 2023 to $200B+ by 2030) | Capital Intensive | Utilization rates, market penetration |

| Data Centers/Advanced Mfg. | Question Mark | Very High ($200B+ construction spend in 2024) | Specialized Expertise, Tech | Expertise gap, competition |

| AI Project Management | Question Mark | High ($1.2B in 2023 to $5.4B by 2028) | R&D, Market Education | Industry adoption, competitive AI solutions |

BCG Matrix Data Sources

Our Consigli Construction BCG Matrix leverages a robust foundation of industry-specific financial reports, project performance data, and market growth projections to inform strategic decisions.