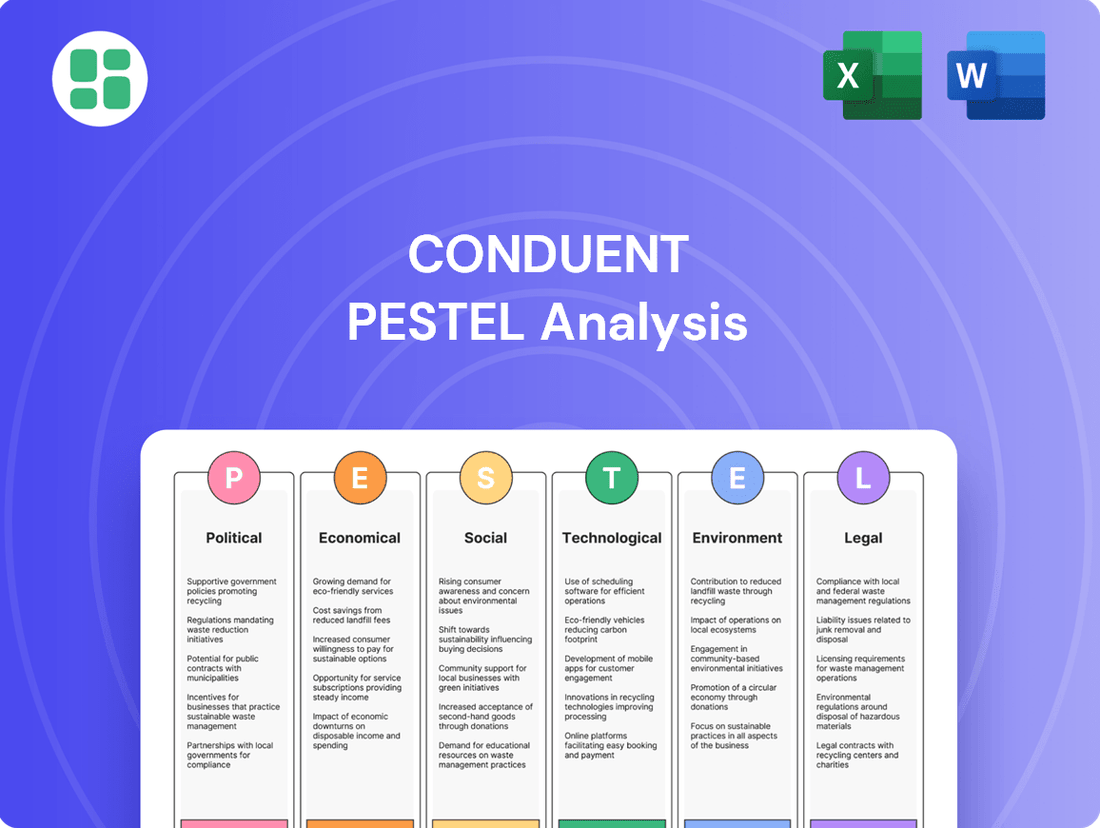

Conduent PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conduent Bundle

Navigate the complex external forces shaping Conduent's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with critical insights to inform your strategic decisions and gain a competitive edge. Download the full analysis now for actionable intelligence.

Political factors

Conduent's business model exhibits a significant reliance on government contracts, particularly in critical sectors like healthcare, transportation, and public assistance programs. This dependency means that shifts in government fiscal policy or political leadership can directly influence the company's revenue streams and contract profitability.

For instance, a change in administration or a re-evaluation of public spending priorities could lead to altered budget allocations for services Conduent provides. In 2024, governments globally are facing fiscal pressures, potentially impacting the size and number of outsourcing contracts available.

Furthermore, policy decisions regarding the insourcing or outsourcing of public services represent a key political variable. A trend towards insourcing could reduce opportunities for companies like Conduent, while a continued embrace of outsourcing would present growth potential.

Conduent operates in heavily regulated industries, particularly healthcare and transportation, making it sensitive to shifts in government policy. For instance, changes in HIPAA regulations impacting patient data handling or new federal infrastructure spending bills can directly influence Conduent's service offerings and compliance costs. The company's 2024 revenue from its government segment, which is subject to these regulations, was a significant portion of its overall performance.

Conduent's global operations are significantly shaped by geopolitical stability and evolving trade policies. For instance, the ongoing trade disputes between major economies, which saw tariffs on goods and services increase in 2023 and early 2024, directly affect the cost of technology components and the ease of cross-border service delivery. Such tensions can disrupt supply chains and necessitate adjustments to operational strategies to mitigate risks, impacting Conduent's ability to efficiently serve its international client base.

Public Procurement and Bidding Processes

Government procurement processes are inherently complex and can involve lengthy bidding periods, often subjected to intense political scrutiny. Conduent's success in securing new government contracts and renewing existing ones hinges on its proficiency in navigating these intricate procedures. For instance, the US federal government's procurement spending reached an estimated $7.4 trillion over a five-year period ending in fiscal year 2023, highlighting the significant market opportunity but also the competitive landscape.

Changes in procurement regulations, a rise in competition, or political directives that favor domestic or local service providers can directly impact Conduent's market access and future growth trajectories. In 2024, many governments are focusing on digital transformation initiatives, which can create new avenues for companies like Conduent but also necessitate adaptation to evolving tender requirements and cybersecurity standards.

- Navigating Complexity: Conduent must effectively manage lengthy and politically sensitive government bidding processes to secure contracts.

- Regulatory Impact: Shifts in procurement rules or political pressures can alter Conduent's market access and growth potential.

- Competitive Landscape: Increased competition, particularly from local providers, poses a challenge to market share in government sectors.

- Digital Transformation: Evolving government demands for digital solutions in 2024 require Conduent to adapt its offerings and compliance strategies.

Policy Support for Digital Transformation

Governments worldwide are actively promoting digital transformation, recognizing its potential to enhance efficiency and citizen services. This political push creates a favorable environment for companies like Conduent, which specialize in digital platforms and automation. For instance, the U.S. government's ongoing investments in modernizing federal IT infrastructure, as highlighted by initiatives aimed at cloud migration and data analytics, directly benefit Conduent's service offerings. The Biden administration's focus on digital government, including efforts to streamline online services and improve cybersecurity, signals continued political support for the very technologies Conduent provides.

Political initiatives that allocate funding or offer incentives for adopting advanced technologies, such as artificial intelligence and sophisticated analytics, are crucial drivers of demand for Conduent's solutions. These programs can accelerate the modernization of public sector operations. For example, the European Union's Digital Decade targets, aiming for widespread digital skills and secure digital infrastructure by 2030, encourage member states to invest in digital public services, thereby creating market opportunities for Conduent. Conversely, a reduction in government spending on technology modernization or a lack of supportive policies could significantly dampen market adoption of Conduent's advanced solutions.

- Increased Government Spending: The U.S. federal government's IT spending was projected to reach $136 billion in fiscal year 2024, with a significant portion allocated to modernization efforts.

- Digital Transformation Initiatives: The European Union's Digital Decade aims to have 80% of citizens using digital identity solutions by 2030, requiring robust technological support.

- AI and Analytics Adoption: Many governments are exploring AI for fraud detection and process automation, creating direct demand for Conduent's expertise.

Political factors significantly influence Conduent's operations, particularly its reliance on government contracts. Shifts in government fiscal policy and leadership can directly impact revenue and contract profitability, as seen with global fiscal pressures in 2024 affecting outsourcing opportunities.

Policy decisions on insourcing versus outsourcing public services are critical; a move towards insourcing could reduce Conduent's market access, while continued outsourcing presents growth. Conduent's exposure to regulated sectors like healthcare means changes in policies such as HIPAA or infrastructure spending bills directly affect its service offerings and compliance costs.

Geopolitical stability and trade policies also play a role, with trade disputes impacting technology component costs and cross-border service delivery. Navigating complex government procurement processes, which are politically scrutinized, is essential for securing contracts, with the US federal government's significant procurement spending highlighting both opportunity and competition.

| Political Factor | Impact on Conduent | 2024/2025 Relevance |

|---|---|---|

| Government Spending Priorities | Directly affects contract availability and funding for services. | Governments facing fiscal pressures may alter budget allocations for outsourcing. |

| Regulatory Environment | Influences service offerings, compliance costs, and market access. | Changes in healthcare data handling or infrastructure spending bills are key. |

| Procurement Policies | Determines ease of securing and renewing government contracts. | Evolving tender requirements and cybersecurity standards are crucial for digital transformation bids. |

| Digital Transformation Initiatives | Creates demand for Conduent's technology and automation solutions. | US federal IT modernization spending and EU digital decade targets drive opportunities. |

What is included in the product

This Conduent PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's strategic landscape.

It offers actionable insights and forward-looking perspectives to help stakeholders identify opportunities and mitigate risks within Conduent's operating environment.

A Conduent PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

Conduent's performance is closely tied to the health of the global economy. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, which could temper client spending on business process services.

During economic slowdowns, like the potential for a mild recession in some developed economies in 2024-2025, clients often tighten budgets. This can lead governments and commercial entities to reduce discretionary spending, impacting demand for Conduent's offerings and potentially increasing pressure on pricing as clients seek cost efficiencies.

Conduent's core offerings in areas like business process services and digital transformation are inherently attractive when clients are focused on cutting expenses. For instance, in the first quarter of 2024, Conduent reported that its Government segment, which often serves cost-sensitive public sector clients, saw revenue increase by 2.7% year-over-year, indicating demand for efficiency-driving solutions.

However, economic headwinds can intensify budget scrutiny, potentially leading clients to push for lower pricing or seek out competitors offering less expensive alternatives. This pressure was evident in the broader BPO market in late 2023 and early 2024, where contract renegotiations became more common as companies sought to optimize their spending.

To counter this, Conduent must consistently prove its value proposition by highlighting measurable return on investment. The company's focus on driving operational efficiencies, such as reducing processing times or improving customer satisfaction scores, directly addresses these client cost reduction imperatives, ensuring continued relevance and client retention.

Rising inflation presents a significant challenge for Conduent, directly increasing expenses for labor, technology, and energy in 2024 and projected into 2025. For instance, the US Consumer Price Index (CPI) saw a notable increase, impacting the cost of goods and services that Conduent relies on.

While Conduent strives for operational efficiency, sustained inflationary pressures can squeeze profit margins if increased costs cannot be effectively passed on to clients through contract renegotiations. This necessitates a proactive approach to cost control and adaptive pricing models to maintain profitability.

Currency Exchange Rate Fluctuations

Conduent's global operations mean it's directly affected by changes in currency exchange rates. A strengthening U.S. dollar, for example, can reduce the reported value of earnings from overseas business activities when converted back into dollars, potentially impacting overall profitability.

For instance, in the first quarter of 2024, Conduent noted that foreign currency headwinds impacted its results, although specific figures were not detailed in their public statements, it's a recurring factor in their financial reporting. This exposure necessitates careful management to maintain financial health.

- Managing Currency Risk: Conduent employs strategies like financial hedging to mitigate the impact of adverse currency movements.

- Geographic Diversification: Spreading operations across various countries helps to naturally offset some currency risks.

- Impact on Revenue: A strong dollar can make Conduent's services more expensive for international clients, potentially affecting sales volumes.

- Profitability Concerns: Fluctuations can directly reduce the dollar-denominated profit margins on international contracts.

Interest Rates and Investment Climate

Interest rate fluctuations significantly impact Conduent's operational costs and strategic flexibility. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, has seen periods of increase. In late 2023, the Fed maintained its target range for the federal funds rate at 5.25% to 5.50%, a level not seen in over two decades, making capital more expensive for companies like Conduent looking to invest in new technologies or infrastructure upgrades.

A higher interest rate environment directly translates to increased borrowing costs for Conduent. This can make funding major strategic initiatives, such as acquisitions or significant digital transformation projects, more challenging and less attractive due to a higher hurdle rate for returns. For example, if Conduent were to issue new debt in a 6% interest rate environment versus a 3% environment, the annual interest expense on the same principal amount would double.

Beyond direct borrowing costs, interest rates shape the broader investment climate for Conduent's clients. When interest rates are high, businesses may become more cautious about their own spending and investment in large-scale transformation projects, which are core to Conduent's service offerings. This reduced client appetite for investment can indirectly impact Conduent's revenue streams and growth prospects.

The prevailing interest rate environment also affects the valuation of Conduent and its potential acquisition targets. Higher discount rates, driven by elevated interest rates, can lead to lower present values for future cash flows, potentially impacting merger and acquisition activity and the overall attractiveness of the market for business process services.

Economic factors significantly shape Conduent's operating environment, influencing client spending and the company's cost structure. Global economic growth projections, such as the IMF's forecast of 3.2% for 2024, directly impact the demand for business process services as clients adjust their budgets. Inflationary pressures, exemplified by the US CPI increases in 2024, raise operating expenses for Conduent, necessitating careful cost management and pricing strategies to protect profit margins.

Currency exchange rate fluctuations and interest rate movements also play a crucial role. A strengthening U.S. dollar can diminish the value of foreign earnings, while higher interest rates increase borrowing costs and can dampen client investment in transformation projects. For instance, the Federal Reserve's maintained benchmark rate of 5.25%-5.50% in late 2023 highlights the elevated cost of capital impacting strategic investments.

| Economic Factor | Impact on Conduent | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Influences client spending on services. | IMF projected 3.2% global growth for 2024, a slight slowdown. |

| Inflation | Increases operating costs (labor, energy, tech). | Significant US CPI increases in 2024 impacting input costs. |

| Interest Rates | Affects borrowing costs and client investment appetite. | Fed rate maintained at 5.25%-5.50% late 2023, increasing capital costs. |

| Currency Exchange Rates | Impacts reported value of foreign earnings. | Strengthening USD can reduce international revenue translation. |

Preview Before You Purchase

Conduent PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Conduent PESTLE analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Sociological factors

Customers today demand effortless, digital interactions, expecting personalized service from companies and public agencies alike. This shift means Conduent needs to constantly upgrade its offerings to align with these rising expectations, focusing on intuitive design and accessible support channels.

The increasing prevalence of remote work and the gig economy significantly reshapes how companies like Conduent manage their workforce and attract talent. Employee expectations are also evolving, with a greater emphasis on flexibility and purpose-driven work. For instance, a 2024 survey indicated that over 60% of employees prefer hybrid or fully remote work arrangements.

Securing skilled labor, especially in high-demand fields such as artificial intelligence, data analytics, and cybersecurity, presents a considerable challenge. The competition for these specialized skills is fierce, with many tech-focused roles seeing double-digit percentage increases in average salaries over the past year. Conduent needs to actively adapt its employment models, potentially offering more flexible benefits and development opportunities to attract and retain top talent in these critical areas.

Public trust in data privacy and security is absolutely critical for Conduent, given its role in managing vast quantities of sensitive information for both government agencies and private companies. A single breach or even the perception of one can lead to significant reputational damage and strain client relationships, impacting future business opportunities.

Societal anxieties surrounding the collection, storage, and utilization of personal data are growing. This means Conduent must not only implement stringent security protocols but also maintain transparent communication about its data handling practices to foster and maintain public confidence.

For instance, a 2024 survey indicated that over 70% of consumers are concerned about how their personal data is used by third-party vendors, highlighting the need for companies like Conduent to proactively address these fears through clear policies and demonstrable security.

Demand for Ethical AI and Automation

Societal demand for ethical AI is a significant sociological factor for Conduent. As AI and automation become more integrated into business processes, consumers and employees alike are increasingly concerned about issues like algorithmic bias, the potential for job displacement, and the transparency of automated decision-making. For instance, a 2024 survey indicated that over 70% of consumers expect companies to be transparent about how AI is used in their services.

Conduent must actively address these concerns to maintain public trust and brand reputation. This involves not only developing AI solutions that are fair and unbiased but also clearly communicating their capabilities and limitations. Failing to do so could lead to backlash and regulatory scrutiny, impacting Conduent's market position.

- Growing public awareness: Over 60% of adults surveyed in early 2025 expressed concern about AI's impact on employment, highlighting a key societal pressure.

- Demand for transparency: Consumers increasingly expect clear explanations of how AI systems make decisions, especially in sensitive areas like customer service or benefits processing.

- Ethical AI frameworks: Many organizations are adopting ethical AI guidelines, and Conduent's adherence to these standards will be crucial for stakeholder acceptance.

- Reputational risk: Negative publicity surrounding biased or opaque AI implementations can significantly damage a company's image and customer loyalty.

Societal Push for Digital Inclusion

As societies increasingly rely on digital platforms, there's a growing imperative for digital inclusion, particularly within government services. Conduent's public sector solutions must therefore navigate this by ensuring their digital transformation initiatives maintain accessibility for all citizens, regardless of their digital literacy or access to technology. This means balancing the drive for efficiency with the fundamental need for equitable access to essential services.

This societal push is evident in various initiatives. For instance, in 2024, the US government continued to invest in broadband expansion and digital skills training programs, aiming to bridge the digital divide. Conduent's role involves developing user-friendly interfaces and offering alternative, non-digital channels where necessary to serve a wider demographic, ensuring no one is left behind by technological advancements.

- Bridging the Digital Divide: Efforts to increase internet access continue, with a focus on rural and underserved communities.

- Accessibility Standards: Government agencies are increasingly mandated to adhere to strict accessibility guidelines for digital services.

- Digital Literacy Programs: Societal demand for programs that enhance digital skills is growing, impacting how services are designed and delivered.

- Citizen Engagement: Ensuring all citizens can interact with government services digitally or through alternative means is a key societal expectation.

Societal expectations for personalized and seamless digital experiences are paramount. Conduent must continually enhance its platforms to meet these demands, prioritizing user-friendly design and accessible support. The increasing prevalence of remote work also reshapes workforce management, with a 2024 survey showing over 60% of employees prefer flexible arrangements.

Concerns about data privacy and ethical AI are growing, with over 70% of consumers in 2024 expressing worry about third-party data usage. Conduent must maintain transparency and robust security to build and retain public trust, especially regarding AI applications and potential job displacement, a concern for over 60% of adults surveyed in early 2025.

Ensuring digital inclusion is a key societal driver, particularly for government services. Conduent's solutions must remain accessible to all, balancing technological advancement with equitable access. Initiatives like US broadband expansion in 2024 underscore the need for user-friendly interfaces and alternative service channels.

Technological factors

Conduent's business model is intrinsically linked to technological progress, particularly in AI and automation. The company leverages these tools across its core offerings, from customer experience management to business process solutions. This reliance means that the pace of innovation in areas like Generative AI and Robotic Process Automation (RPA) directly impacts Conduent's ability to deliver value and maintain its competitive edge.

The rapid evolution of AI, including advancements in Generative AI, offers significant opportunities for Conduent. These technologies can enhance service delivery by automating complex tasks, personalizing customer interactions, and driving operational efficiencies. For instance, AI-powered analytics can provide deeper insights into customer behavior, allowing Conduent to tailor solutions more effectively, potentially boosting client satisfaction and reducing costs.

Staying ahead of the curve in AI and automation is not just an advantage but a necessity for Conduent. In 2024, the global AI market is projected to reach hundreds of billions of dollars, with significant growth expected in enterprise applications. Companies like Conduent that can effectively integrate and scale these technologies will be better positioned to offer innovative solutions and capture market share against competitors who lag behind.

Conduent, as a processor of sensitive client information, is constantly exposed to escalating cybersecurity threats. The company must invest heavily in advanced threat detection and secure cloud infrastructure to protect data and maintain operational integrity. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

The widespread adoption of cloud computing is a significant technological factor for Conduent, enabling highly scalable and flexible service delivery. This allows the company to adjust resources dynamically based on client demand, a crucial advantage in the fluctuating business process services market.

By leveraging secure cloud platforms and developing integrated digital solutions, Conduent can offer more agile and efficient services. For instance, the global cloud computing market was projected to reach over $1.3 trillion by the end of 2024, indicating substantial investment and reliance on these technologies across industries.

Furthermore, these technological advancements directly support Conduent's ability to manage remote operations and distributed workforces effectively. This adaptability is vital for maintaining business continuity and optimizing operational costs, especially as hybrid work models continue to be prevalent in 2024 and beyond.

Data Analytics and Predictive Insights

Conduent leverages sophisticated data analytics to offer clients actionable insights, directly impacting their decision-making processes. The company's ongoing commitment to enhancing its advanced analytics and predictive modeling capabilities is crucial for delivering premium services and optimizing client operations.

These technological advancements enable Conduent to not only identify emerging trends but also to solidify its role as a strategic partner, increasing the overall value proposition for its clientele. For instance, in its 2023 fiscal year, Conduent reported a significant increase in its focus on digital transformation and data-driven solutions, contributing to revenue growth in its commercial segment.

- Data-driven insights: Conduent utilizes analytics to provide clients with a deeper understanding of their operations and customer behavior.

- Predictive modeling: Investments in predictive analytics help clients anticipate market shifts and proactively adjust strategies.

- Enhanced service value: Advanced analytics allow Conduent to offer more sophisticated and value-added services, moving beyond traditional processing.

- Strategic partnerships: By delivering tangible improvements through data, Conduent strengthens its relationships with clients, fostering long-term alliances.

Emerging Technologies and Digital Infrastructure

Conduent's investment in emerging technologies is crucial, with a significant portion of its 2024-2025 budget allocated to digital infrastructure upgrades. This focus is driven by the need to integrate advancements like blockchain for enhanced transaction security and next-generation biometric authentication systems to improve client data protection. For instance, Conduent announced a strategic partnership in early 2025 to pilot a new blockchain-based solution for secure claims processing, aiming to reduce fraud by an estimated 15%.

The company is also investing in new communication protocols and cloud-native architectures to ensure scalability and efficiency in its service delivery. These efforts are directly linked to their ability to adapt and offer competitive solutions in a rapidly evolving digital landscape. In 2024, Conduent reported a 10% increase in R&D spending dedicated to exploring AI-driven automation and advanced analytics, underscoring its commitment to technological innovation.

- Blockchain Integration: Piloting blockchain for secure transaction processing to combat fraud.

- Biometric Authentication: Enhancing data security through advanced biometric solutions.

- Digital Infrastructure Modernization: Investing in cloud-native architectures for scalability.

- AI and Analytics: Increasing R&D for AI-driven automation and data insights.

Technological advancements, particularly in AI and automation, are central to Conduent's operational strategy and competitive positioning. The company is actively integrating these technologies to enhance service delivery and drive efficiency across its business process solutions. This focus ensures Conduent remains agile in a market where innovation is paramount.

Conduent's commitment to digital transformation is evident in its substantial investments in cloud computing and data analytics. These technologies enable scalable operations and provide clients with crucial insights, bolstering Conduent's role as a strategic partner. The global cloud market's expansion to over $1.3 trillion by the end of 2024 underscores the critical nature of these investments.

The company is also prioritizing cybersecurity and emerging technologies like blockchain and biometrics to safeguard sensitive data and improve transaction security. Conduent's 2024-2025 budget reflects a significant allocation towards upgrading digital infrastructure, including piloting blockchain for fraud reduction, aiming for an estimated 15% decrease in fraud.

| Technology Area | Conduent's Focus | Impact/Goal | Relevant Market Data (2024/2025) |

|---|---|---|---|

| Artificial Intelligence (AI) & Automation | Generative AI, RPA, AI-driven analytics | Enhanced service delivery, operational efficiency, personalized customer interactions | Global AI market projected to reach hundreds of billions in 2024 |

| Cloud Computing | Scalable and flexible service delivery | Dynamic resource adjustment, improved operational costs | Global cloud computing market projected to exceed $1.3 trillion by end of 2024 |

| Cybersecurity | Advanced threat detection, secure cloud infrastructure | Data protection, operational integrity, mitigating breach costs | Global average cost of data breach reached $4.45 million in 2023 |

| Emerging Technologies | Blockchain, Biometric Authentication | Enhanced transaction security, fraud reduction (est. 15%), improved data protection | Significant R&D spending increase (10%) in 2024 for AI and analytics |

Legal factors

Conduent's global operations necessitate strict adherence to a patchwork of data protection laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside numerous other regional mandates. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher. The company must continuously adapt its practices to these evolving and rigorous privacy standards to maintain client trust and avoid significant reputational harm.

Conduent operates in sectors with stringent, industry-specific compliance requirements. In healthcare, adherence to regulations like HIPAA is paramount, dictating secure patient data handling and privacy. For financial services, a complex web of compliance laws governs transactions, reporting, and customer data protection, demanding specialized expertise and continuous adaptation.

Conduent, as a global employer, operates under a complex web of labor laws. For instance, the rise of remote work has led many countries, including those in the EU, to update regulations regarding employee rights, taxation, and data privacy for distributed workforces. Navigating these varying international employment regulations, from worker classification in the US to contract specifics in India, directly influences Conduent's operational costs and talent acquisition strategies.

Contractual Obligations and Service Level Agreements

Conduent's operations are intrinsically tied to its contractual agreements with clients, often featuring stringent Service Level Agreements (SLAs) that define performance benchmarks. Failure to meet these agreed-upon metrics can trigger significant financial penalties, directly impacting revenue and profitability. For instance, in 2023, Conduent reported that its revenue was heavily influenced by its ability to maintain strong client relationships and deliver on contractual promises, highlighting the critical nature of these legal frameworks.

Managing these complex, often multi-year, contracts necessitates a robust legal and compliance infrastructure. This ensures adherence to all contractual terms and mitigates risks associated with potential breaches or disputes. The company's investment in legal and compliance functions is therefore a direct reflection of the importance of these contractual obligations in safeguarding its business operations and financial stability.

- SLA Penalties: Conduent's contracts often include clauses for financial penalties if service levels are not met, directly impacting earnings.

- Contractual Risk: The company's revenue is heavily dependent on fulfilling its obligations under these legally binding agreements.

- Compliance Investment: Significant resources are allocated to legal and compliance teams to manage and adhere to complex client contracts.

- Client Retention: Meeting SLA targets is crucial for client retention and securing future business, directly linked to legal performance.

Intellectual Property Rights and Technology Licensing

Conduent's reliance on proprietary digital platforms and technologies necessitates robust intellectual property protection. The company actively pursues patents and trademarks to safeguard its innovations, a critical legal step in maintaining a competitive edge. For instance, in 2023, Conduent continued to invest in its technology portfolio, though specific IP filing numbers are not publicly detailed, the trend indicates ongoing protection efforts.

Licensing agreements for both inbound and outbound technology are a significant legal consideration. Conduent must ensure compliance with software licenses to prevent costly infringement claims and maintain uninterrupted operations. In 2024, the evolving landscape of data privacy regulations, such as potential updates to GDPR or CCPA, will further influence how technology licensing and IP are managed, requiring careful legal navigation.

- Intellectual Property Protection: Conduent's legal strategy involves securing patents and trademarks for its digital platforms and technologies.

- Technology Licensing: The company manages a complex web of licensing agreements for both proprietary and third-party technologies.

- Compliance: Adherence to software licensing terms is a legal imperative to avoid infringement and operational disruptions.

- Regulatory Impact: Evolving data privacy laws in 2024 and beyond will shape Conduent's approach to IP and technology licensing.

Conduent must navigate a complex legal landscape, particularly concerning data privacy. Regulations like GDPR and CCPA impose strict requirements on handling personal information, with non-compliance risking significant fines, potentially up to 4% of global annual turnover. The company's 2023 annual report indicated ongoing efforts to strengthen data governance frameworks in response to these evolving legal demands.

Environmental factors

Clients, investors, and the public are increasingly demanding that companies like Conduent showcase robust Environmental, Social, and Governance (ESG) performance. This trend is a significant environmental factor influencing business operations and strategy.

Conduent's dedication to sustainability, as detailed in its corporate social responsibility reports, directly impacts its brand image and appeal to stakeholders who prioritize ethical and environmentally sound practices. For instance, Conduent's 2023 CSR report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline, a figure that resonates with environmentally conscious clients.

Conduent's extensive operations, including its data centers and numerous office locations, are significant consumers of energy, directly impacting its overall carbon footprint. This energy usage is a key environmental factor that the company must manage.

In response to growing regulatory pressures and increasing client demand for demonstrable environmental stewardship, Conduent is compelled to invest in strategies aimed at reducing its impact. This includes enhancing energy efficiency across its facilities, actively sourcing renewable energy, and implementing robust greenhouse gas (GHG) emissions management programs.

For instance, as of 2023, many companies in the business process services sector, similar to Conduent, are setting targets for renewable energy adoption. Some aim for 100% renewable electricity by 2030, reflecting a broader industry trend driven by both compliance and competitive advantage.

As a technology-reliant company, Conduent inevitably generates electronic waste (e-waste) through its IT operations and the solutions it provides to clients. The responsible management and recycling of this e-waste are paramount environmental duties for any modern business.

Conduent's commitment to environmental stewardship is demonstrated through its implementation of comprehensive recycling programs and strict adherence to evolving e-waste regulations. For instance, in 2024, the global e-waste generation was projected to reach 61.3 million metric tons, highlighting the scale of the challenge and the importance of corporate responsibility in managing these materials.

Climate Change Adaptation and Resilience

While Conduent's core business isn't directly tied to heavy manufacturing, the increasing frequency and intensity of extreme weather events, a consequence of climate change, pose indirect risks. These events, such as major storms or floods, could disrupt Conduent's operational centers or impact third-party service providers within its supply chain, potentially leading to service interruptions for its clients.

To mitigate these risks, Conduent, like many global companies, likely focuses on developing robust business continuity plans. This involves assessing potential vulnerabilities in its operational infrastructure and implementing strategies to ensure continued service delivery even when faced with environmental disruptions. Building resilience into its IT systems and data centers is a key component of this strategy.

- Global Climate Action: As of early 2024, nations continue to implement policies aimed at reducing greenhouse gas emissions, influencing operational costs and potentially creating new compliance requirements for businesses.

- Supply Chain Vulnerability: Extreme weather events in 2023, such as widespread flooding in parts of Asia and severe storms in North America, highlighted the fragility of global supply chains and the need for diversified operational footprints.

- Resilience Investment: Companies are increasingly investing in disaster recovery and business continuity solutions, with the global business continuity management market projected to grow significantly in the coming years.

Client Demand for Green Business Processes

Clients are increasingly prioritizing business process services that support their own sustainability objectives. This trend is driving demand for partners who can demonstrate a commitment to environmental responsibility. For instance, a significant portion of consumers, estimated at over 70% in recent surveys, consider sustainability when making purchasing decisions, a sentiment that extends to their B2B relationships.

Conduent can leverage this by highlighting its 'greener' solutions. Offering services like fully paperless workflows, optimizing logistics for reduced emissions in transportation management, or promoting cloud-based platforms that minimize the need for physical data centers are key differentiators. These offerings directly address the growing market expectation for environmentally conscious business partners.

- Growing Client Emphasis: Reports indicate a substantial increase, often exceeding 20% year-over-year, in client inquiries specifically about a vendor's environmental, social, and governance (ESG) practices.

- Paperless Process Adoption: The global market for digital document management, a core component of paperless processes, is projected to reach over $45 billion by 2027, reflecting strong adoption.

- Sustainable Logistics Demand: Businesses are actively seeking logistics providers who can demonstrate carbon footprint reduction, with some major corporations setting targets to reduce transportation emissions by 30% by 2030.

- Cloud Infrastructure Efficiency: Migrating to cloud services can reduce an organization's carbon footprint by as much as 59%, a compelling statistic for clients looking to outsource their IT infrastructure needs.

Conduent's environmental strategy is shaped by global climate action, with nations implementing policies to reduce greenhouse gas emissions, impacting operational costs and compliance. Extreme weather events in 2023 underscored supply chain vulnerabilities, pushing companies like Conduent to invest in resilience and business continuity. The company must manage its significant energy consumption and e-waste generation, with global e-waste projected to reach 61.3 million metric tons in 2024. Conduent's commitment to sustainability, including a 15% reduction in Scope 1 and 2 GHG emissions by 2023 from a 2020 baseline, is crucial for attracting environmentally conscious clients.

| Environmental Factor | Conduent's Response/Impact | Industry Trend/Data (2023-2025) |

|---|---|---|

| Climate Change & Emissions | Focus on energy efficiency, renewable energy sourcing, and GHG management programs. Highlighted 15% GHG reduction (Scope 1 & 2) vs. 2020 baseline by 2023. | Nations implementing emission reduction policies. Many companies aiming for 100% renewable electricity by 2030. |

| Extreme Weather Events | Developing robust business continuity and disaster recovery plans to mitigate operational disruptions. | 2023 events highlighted supply chain fragility. Global business continuity management market projected for significant growth. |

| E-Waste Management | Implementing comprehensive recycling programs and adhering to e-waste regulations. | Global e-waste projected at 61.3 million metric tons in 2024. |

| Client Demand for Sustainability | Offering 'greener' solutions like paperless workflows and optimized logistics. | Over 70% of consumers consider sustainability in purchasing. 20%+ year-over-year increase in client ESG inquiries. Digital document management market projected over $45 billion by 2027. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, leading economic institutions like the IMF and World Bank, and comprehensive industry-specific market research. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and timely.