Conduent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conduent Bundle

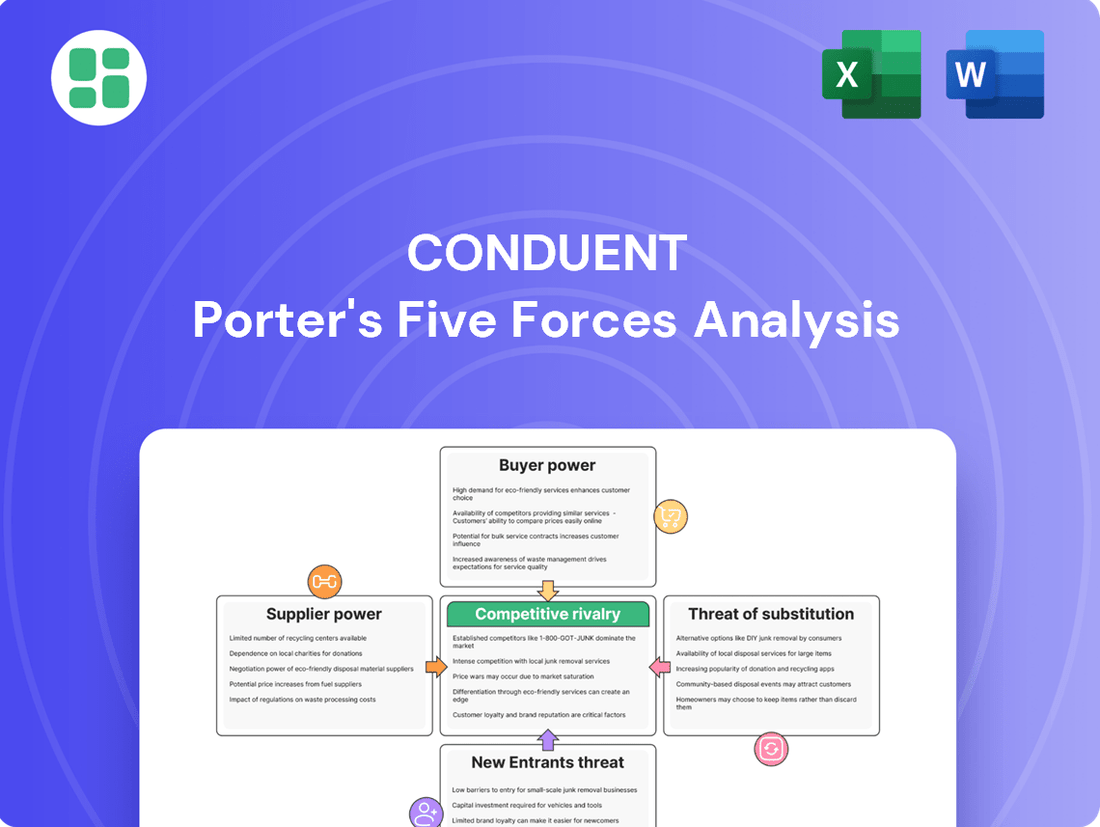

Conduent operates in a dynamic market shaped by several key competitive forces. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Conduent’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Conduent sources a wide array of technology and service providers for its digital platforms, automation, and analytics. The broad availability of IT infrastructure and software suppliers means that most individual suppliers have limited leverage over a major client like Conduent.

However, the landscape shifts with specialized providers. For instance, companies offering unique AI and GenAI solutions, such as Fairmarkit, operate in more concentrated markets. These specialized partners, due to their distinct capabilities, can wield greater bargaining power.

Switching costs for Conduent to change core technology or infrastructure suppliers can range from moderate to high, particularly when dealing with deeply integrated platforms or specialized AI tools. The complexity of migrating extensive datasets, the necessity of retraining staff on new systems, and ensuring flawless integration with existing client solutions all contribute to a potential reliance on current vendors. This dependency significantly bolsters the suppliers' leverage, especially for components that are critical to Conduent's operational continuity.

While many IT components are readily available and interchangeable, suppliers offering advanced AI, machine learning, and automation technologies present a different scenario. These specialized capabilities are not easily replicated and are becoming essential for companies like Conduent to maintain their competitive edge in the market.

Conduent's strategic move to integrate Fairmarkit's AI-powered technologies, including generative AI, into its finance and procurement solutions highlights a clear dependence on these unique supplier offerings. This reliance on distinctive technological solutions can significantly bolster a supplier's bargaining power, as their value proposition is unique and finding suitable alternatives is challenging.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into Conduent's core business process services (BPS) is generally low. Most technology providers concentrate on creating and selling their software or hardware, not on running intricate client operations themselves.

However, a few major tech companies do offer their own BPS solutions, which can indirectly boost their bargaining power by introducing competition. Conduent's own operational model relies on integrating technologies like cloud computing, AI, and automation, demonstrating a reliance on these supplier innovations.

- Low Direct Threat: Technology suppliers typically license their products, not directly compete in BPS operations.

- Indirect Influence: Large tech firms offering BPS solutions can increase supplier power through competitive pressure.

- Conduent's Tech Integration: Conduent utilizes cloud, AI, and automation, showcasing its dependence on supplier technologies.

Importance of Conduent to Suppliers

Conduent, a major player in business process services, works with numerous Fortune 100 companies and government entities. This makes Conduent a crucial customer for its technology and service providers.

The sheer scale of Conduent's operations means that suppliers often rely heavily on the revenue generated from their contracts. For instance, in 2024, Conduent reported revenues of approximately $4.2 billion, indicating substantial business flow to its supply chain partners.

This significant business volume grants Conduent a degree of bargaining power. Suppliers may be hesitant to risk losing Conduent as a client, as such a loss could substantially affect their own financial performance and market standing.

- Significant Client Base: Conduent's work with top-tier companies and government bodies makes it a valuable contract for suppliers.

- Revenue Dependence: Suppliers can be significantly impacted by losing Conduent's business, giving Conduent leverage.

- Mutual Dependency: The reliance is often two-way, creating a balance in bargaining power between Conduent and its suppliers.

Conduent's bargaining power with suppliers is influenced by its scale and the nature of the technologies it procures. While the company's substantial revenue, approximately $4.2 billion in 2024, makes it a critical client, the availability of specialized AI and GenAI solutions, like those from Fairmarkit, can shift leverage towards suppliers offering unique capabilities.

Switching costs for integrated platforms and specialized AI tools are a significant factor, potentially increasing supplier power due to the complexity of migration and retraining. However, the threat of suppliers entering Conduent's core business process services (BPS) remains low, though large tech firms offering BPS can indirectly enhance their bargaining position.

| Factor | Conduent's Position | Supplier Leverage |

|---|---|---|

| Conduent's Revenue (2024) | ~$4.2 billion | Suppliers depend on this revenue, giving Conduent leverage. |

| Availability of Tech | Broad for standard IT, concentrated for specialized AI/GenAI. | Limited for standard IT, high for specialized AI/GenAI. |

| Switching Costs | Moderate to high for integrated/specialized systems. | High for critical, integrated technologies. |

What is included in the product

Conduent's Porter's Five Forces Analysis dissects the competitive intensity and profitability of its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its served industries.

Instantly visualize competitive intensity with a dynamic, interactive dashboard, transforming complex market data into actionable insights.

Customers Bargaining Power

Conduent's customer base is quite varied, including many large commercial businesses and over 600 government organizations. This diversity is a strength, but it's important to note that some of these clients are Fortune 100 companies.

The significant revenue generated from a few large contracts, particularly with government bodies or major corporations, means that individual customers can hold considerable sway. This concentration of revenue from specific large clients amplifies their bargaining power.

Switching Business Process Services (BPS) providers for Conduent's clients often entails substantial costs. These expenses stem from the intricate integration of Conduent's services into a client's existing operational framework, the technical challenges of migrating vast amounts of data, and the potential for significant disruption to essential business functions during the transition. For instance, a client relying on Conduent for complex payroll processing or customer support management would face considerable hurdles in moving these operations to a new vendor.

Conduent's business model thrives on managing these critical back-office and customer-facing operations across diverse industries, from healthcare to transportation. This deep entanglement means that a client's decision to switch providers is not a simple vendor change but a major operational overhaul. In 2024, the average cost for a large enterprise to switch BPS providers was estimated to be in the millions, factoring in system integration, data transfer, and employee training.

Consequently, these high switching costs effectively create a "lock-in" effect for Conduent's existing clientele. Once a contract is established and the integration process is complete, the immediate bargaining power of these customers is significantly diminished. This allows Conduent to maintain stronger pricing power and reduces the likelihood of clients seeking alternative solutions in the short to medium term, as the perceived cost and risk of switching outweigh the potential benefits.

Customers in the Business Process Services (BPS) market, especially governments and major corporations, are frequently very sensitive to price. This is because they are always looking for ways to cut costs and operate more efficiently. Conduent's services are designed to help these clients achieve exactly that, making cost-effectiveness a major factor in their buying decisions.

This strong price sensitivity means Conduent must constantly offer competitive pricing to win and keep business. For example, in 2023, Conduent reported revenue of $3.8 billion, and maintaining competitive pricing across its diverse service offerings, including government solutions and commercial BPS, is crucial for market share. This pressure can directly impact the company's profit margins.

Customer Information and Transparency

Sophisticated clients often possess significant information regarding market prices, alternative providers, and service level agreements, which naturally enhances their negotiation leverage. For instance, Conduent's clients, being large organizations, likely have dedicated procurement teams and access to industry benchmarks, enabling them to demand favorable terms and pricing structures.

The company's performance and service quality are consistently subject to intense scrutiny from its clientele. A testament to this is Conduent being named Supplier of the Year by General Motors, highlighting the high expectations and performance standards clients hold.

- Informed Clientele: Large enterprise clients possess detailed market knowledge, including pricing and competitor offerings.

- Procurement Expertise: Conduent's customers often employ specialized procurement teams skilled in negotiating advantageous contracts.

- Performance Benchmarking: Clients actively compare Conduent's service levels against industry standards and peer performance.

- Supplier Recognition: Awards like General Motors Supplier of the Year underscore the critical importance of meeting client performance demands.

Threat of Backward Integration by Customers

Conduent's customers possess significant bargaining power, partly due to the increasing threat of backward integration. As automation and AI technologies become more accessible, clients can explore bringing business process outsourcing (BPO) functions in-house. This capability is particularly relevant for standardized or less complex services where the cost and effort of internalizing are more manageable.

The widespread adoption of robotic process automation (RPA) and AI-driven tools is a key enabler of this trend. These technologies allow companies to automate repetitive tasks, thereby reducing their dependence on external BPO providers like Conduent. For instance, many customer service and data entry functions, historically core BPO offerings, are now prime candidates for in-house automation.

This potential for clients to insource operations directly enhances their leverage in negotiations. When customers can credibly threaten to develop their own capabilities, they are in a stronger position to demand lower prices, better service terms, or more customized solutions from BPO providers. This is especially true for clients who manage high volumes of straightforward processes.

- Customer Bargaining Power: Enhanced by the threat of backward integration.

- Technological Enablers: RPA and AI facilitate in-house automation of BPO tasks.

- Impact on Conduent: Increased pressure on pricing and service delivery for standardized offerings.

Conduent's customers, particularly large corporations and government entities, wield considerable bargaining power. This stems from their significant spending, sophisticated procurement practices, and the high costs associated with switching providers, which can range into the millions for large enterprises in 2024.

Clients' price sensitivity is a key driver, as they constantly seek cost efficiencies. Conduent's $3.8 billion revenue in 2023 underscores the need for competitive pricing across its diverse service portfolio to maintain market share.

Furthermore, the growing accessibility of automation and AI technologies empowers clients to bring BPO functions in-house, increasing their leverage and pressuring Conduent on pricing and service for standardized offerings.

| Factor | Impact on Conduent | Supporting Data/Trend |

|---|---|---|

| Customer Concentration | High bargaining power for key clients | Significant revenue from a few large contracts, including Fortune 100 companies. |

| Switching Costs | Customer lock-in, but also a barrier to entry for new clients. | Millions of dollars in estimated switching costs for large enterprises (2024). |

| Price Sensitivity | Pressure on profit margins | Conduent's 2023 revenue of $3.8 billion requires competitive pricing. |

| Backward Integration Threat | Increased negotiation leverage for clients | Widespread adoption of RPA and AI enabling in-house automation of BPO tasks. |

Preview Before You Purchase

Conduent Porter's Five Forces Analysis

This preview showcases the complete Conduent Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape for the company. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, ensuring you gain instant access to this valuable strategic tool without any alterations or omissions.

Rivalry Among Competitors

The Business Process Services (BPS) market is incredibly crowded, featuring a mix of massive global players and niche specialists. Conduent finds itself competing against giants like Accenture, which often hold a more significant market share. This dynamic means Conduent is up against formidable competition as businesses seek BPS solutions.

In 2024, the BPS market continues to be characterized by this intense rivalry. While specific market share figures for Conduent can fluctuate, it's generally understood to be a mid-tier player in the broader professional services landscape. This fragmentation fuels aggressive competition for client contracts, as many companies are vying for the same business.

The global Business Process Services (BPS) market is on a strong growth trajectory, with projections indicating it will reach USD 560 billion by 2033. This expansion, fueled by digital transformation and AI, suggests a growing market that could potentially ease some competitive intensity.

The market is expected to grow at a compound annual growth rate (CAGR) of approximately 6.3% between 2025 and 2033. While this growth offers opportunities, it also acts as a magnet for new entrants and existing players alike, intensifying the battle for market share.

Conduent actively differentiates its business process services (BPS) by concentrating on advanced digital platforms, automation, and sophisticated analytics tailored for sectors such as healthcare, transportation, and government. This focus highlights their commitment to technology-driven solutions, including AI applications designed to curb fraud and streamline operational workflows.

The company's strategic emphasis on these technology-led advancements aims to move beyond the perception of commoditization often associated with BPS. For instance, Conduent's 2024 investor presentations often detail investments in AI and automation, pointing to specific use cases in healthcare claims processing or traffic management systems that offer tangible efficiency gains for clients.

However, the inherent nature of many BPS offerings means they can still be viewed as standardized services. This creates a persistent risk of price-based competition, especially if Conduent fails to effectively communicate and demonstrate the unique value and return on investment derived from its differentiated, technology-enhanced solutions to its client base.

Exit Barriers

High exit barriers in the Business Process Services (BPS) market, such as significant investments in specialized technology and long-term customer contracts, can make it difficult for companies like Conduent to leave unprofitable segments. These factors can trap firms in the market, intensifying competition as companies are incentivized to stay rather than incur substantial exit costs. Conduent's strategic divestitures in recent years, such as the sale of its Midas healthcare IT business in 2024, illustrate the complex and costly nature of exiting specific BPS areas, aiming to streamline operations but highlighting the underlying exit challenges.

These substantial exit barriers contribute to heightened competitive rivalry. Companies may continue to operate in less profitable BPS sectors due to the high costs associated with shutting down operations, including severance packages for employees and the disposal of specialized assets. This reluctance to exit forces businesses to compete more aggressively for market share, potentially leading to price wars and reduced profitability across the industry.

- Specialized Assets: Significant capital tied up in proprietary technology and infrastructure.

- Long-Term Contracts: Commitments to clients that extend for multiple years, making early termination costly.

- Employee Severance Costs: Expenses related to laying off a specialized workforce.

- Brand Reputation: Potential damage to a company's overall brand by exiting a market segment.

Strategic Commitments and Acquisitions

Companies in the Business Process Services (BPS) sector are heavily investing in AI and automation. For instance, Conduent's strategic commitment includes a collaboration with Fairmarkit, leveraging AI for procurement, aiming to boost efficiency and client value. This focus on advanced technology is a key differentiator.

Mergers and acquisitions are frequent in the BPS industry, as firms seek to expand their market share or acquire specific technological expertise. These strategic moves intensify competition by consolidating capabilities and creating larger, more formidable players. For example, in 2024, the BPS market continued to see consolidation activity as companies looked to integrate new technologies and broaden service portfolios.

- AI and Automation Investments: Conduent's partnership with Fairmarkit exemplifies the industry trend of strategic commitments to AI for enhanced service offerings.

- Market Consolidation: Mergers and acquisitions are prevalent, driven by the desire to gain market share and specialized capabilities, reshaping the competitive environment.

- Competitive Intensity: These strategic actions, including technological advancements and M&A, directly increase the rivalry among BPS providers.

Competitive rivalry within the Business Process Services (BPS) market is intense, with Conduent facing numerous global and niche competitors. The market's growth, projected to reach USD 560 billion by 2033, attracts new entrants and existing players, fueling aggressive competition for contracts.

Conduent differentiates itself through digital platforms, automation, and analytics, particularly in healthcare, transportation, and government sectors, aiming to avoid commoditization. Despite these efforts, the potential for price-based competition remains, especially if the unique value of its technology-driven solutions isn't clearly communicated.

High exit barriers, such as specialized technology investments and long-term contracts, can trap companies in less profitable segments, intensifying overall rivalry. Conduent's 2024 divestiture of its Midas healthcare IT business highlights the challenges and costs associated with exiting specific BPS areas.

The industry's focus on AI and automation, exemplified by Conduent's collaboration with Fairmarkit, alongside frequent mergers and acquisitions, further reshapes the competitive landscape, creating larger, more capable players and increasing overall market intensity.

| Key Competitors | Market Focus | Competitive Strategy |

|---|---|---|

| Accenture | Broad range of BPS, digital transformation | Scale, comprehensive service offerings |

| IBM | IT BPS, cloud, AI integration | Technology leadership, enterprise solutions |

| Capgemini | Digital BPS, consulting, technology services | Digital innovation, client partnerships |

| Conduent | Specialized BPS (healthcare, transport, gov't), digital platforms | Technology-led differentiation, automation, AI |

SSubstitutes Threaten

The threat of substitutes for Conduent's business process services is significant, primarily stemming from clients choosing to handle tasks internally or adopt automation technologies. Many organizations are finding that advancements in artificial intelligence (AI) and robotic process automation (RPA) make it feasible to bring previously outsourced functions back in-house, potentially reducing costs.

The growing accessibility of cloud-based platforms further empowers businesses to manage their own processes, diminishing the need for external service providers like Conduent. For instance, the global RPA market was projected to reach over $3 billion in 2023, indicating a strong trend towards internal automation adoption.

The price-performance trade-off for substitute solutions, especially those powered by AI, is rapidly improving. This trend makes it increasingly appealing for companies to develop and manage their own in-house automation capabilities. As AI technology matures, routine tasks that Conduent currently handles for clients can be automated more affordably internally.

Conduent's core value proposition often revolves around cost reduction and efficiency gains for its clients. However, the accelerating pace of AI development means that the cost-effectiveness of outsourcing these functions is under constant scrutiny. Clients are actively assessing whether maintaining these operations in-house, leveraging new AI tools, presents a more financially advantageous path forward than continuing to rely on external service providers.

Customer propensity to substitute for Conduent's services is significantly shaped by how much control clients have over their data, their perception of security risks, and their need for operational flexibility. For example, if Conduent experienced a major cyberattack, like a breach at their Electronic Benefits Transfer (EBT) call center, it could heighten client worries about entrusting sensitive information to a third party, making in-house solutions seem more attractive.

Clients also evaluate the strategic importance of the processes Conduent handles. If a client views a particular function as a core competency, they might be more inclined to bring it back in-house to maintain direct control and build internal expertise, thereby reducing reliance on external providers like Conduent.

Evolution of Technology and Automation

The rapid evolution of technology, particularly in artificial intelligence and automation, presents a significant threat of substitutes for Conduent's services. As AI capabilities advance, more business processes that were once the domain of human-delivered services can now be automated internally by clients.

Studies indicate that a substantial portion of jobs, especially those involving repetitive tasks, are susceptible to AI-driven automation. For instance, by 2025, it was projected that a significant percentage of jobs could be impacted by AI automation, directly affecting the demand for certain outsourced services.

This technological shift means Conduent must continually innovate to offer solutions that go beyond what clients can achieve with readily available automation tools. The threat lies in clients opting for in-house, AI-powered solutions rather than outsourcing to companies like Conduent.

Key areas where substitutes are emerging include:

- Customer Service: AI-powered chatbots and virtual assistants can handle a growing volume of customer inquiries.

- Data Processing and Analytics: Advanced algorithms and machine learning can automate many data-related tasks.

- Back-Office Operations: Robotic Process Automation (RPA) is increasingly capable of managing routine administrative functions.

Regulatory and Compliance Considerations

The complexity of regulatory compliance, particularly for government and healthcare services, can significantly deter potential substitutes. Conduent's established expertise and infrastructure in navigating these intricate frameworks, such as its work with SNAP recipients and public transit systems, create a substantial barrier. For instance, in 2023, Conduent processed over $1.2 billion in government benefits, showcasing its deep integration within regulated sectors.

However, this barrier is not immutable. If regulatory landscapes simplify or if emerging technologies can readily meet compliance demands, the threat of substitutes could escalate. This would require competitors to invest heavily in understanding and adhering to these evolving standards, a hurdle Conduent has already overcome.

- Regulatory Hurdles as a Substitute Barrier: Conduent's deep understanding of complex regulations in sectors like government and healthcare acts as a shield against new entrants.

- Conduent's Proven Compliance: The company's extensive experience with programs like SNAP and transit systems demonstrates its ability to manage stringent compliance requirements.

- Potential for Increased Substitution: Simplification of regulations or the advent of easily compliant technologies could lower barriers and invite new competitors.

- Impact on Market Dynamics: Changes in regulatory environments directly influence the threat of substitutes, potentially altering Conduent's competitive position.

The threat of substitutes for Conduent's services is amplified by advancements in AI and automation, enabling clients to bring processes in-house more affordably. For example, the global RPA market was projected to exceed $3 billion in 2023, highlighting a growing trend towards internal automation adoption.

Clients are increasingly evaluating whether in-house AI solutions offer a better cost-benefit than outsourcing, especially as AI technology matures and handles routine tasks more efficiently. This technological shift means Conduent must continuously innovate beyond what clients can achieve independently with readily available automation tools.

While regulatory complexity, such as Conduent's work with SNAP benefits (processing over $1.2 billion in 2023), acts as a barrier, simplifying regulations or compliant technologies could increase substitution threats.

Entrants Threaten

Entering the Business Process Services (BPS) market, especially at the scale and complexity Conduent operates within, demands substantial capital. Think about the investment needed for advanced technology, robust infrastructure, and a skilled global workforce. This is a significant hurdle for potential newcomers.

While cloud technology can reduce some upfront IT expenses, building a complete service delivery system, a capable sales team, and a strong client support network still requires considerable financial backing. For instance, in 2024, major BPS providers continued to invest billions in digital transformation and AI capabilities, a cost prohibitive for many startups.

Established players like Conduent leverage significant economies of scale, which is a major barrier for new entrants. For instance, Conduent's extensive operations in business process services, serving millions of transactions annually, allow for substantial cost reductions per unit. Newcomers would find it exceptionally difficult to match these per-transaction costs without a similarly vast customer base.

Furthermore, Conduent's economies of scope, offering diverse services from digital interactions to payment solutions across various sectors, create integrated efficiencies. A new entrant attempting to replicate this breadth of services would face immense upfront investment and operational complexity, hindering their ability to compete on price or service integration.

Newcomers face a major hurdle in accessing established distribution channels, a critical factor for reaching customers. Conduent's existing, deep-rooted relationships with Fortune 100 companies and various government entities provide a significant advantage, making it difficult for new entrants to secure similar access.

Building the necessary trust and a reputation for reliability and expertise is a time-consuming and capital-intensive process. This lengthy development period acts as a formidable barrier to entry, deterring potential competitors from challenging Conduent's market position.

Proprietary Technology and Expertise

Conduent's significant investments in proprietary technology, including artificial intelligence and machine learning, establish a formidable barrier to entry. Their deep process expertise across diverse segments like Commercial, Government, and Transportation is not easily replicated.

For instance, Conduent's ongoing commitment to AI initiatives, as evidenced by their strategic partnerships and internal development efforts throughout 2024, further solidifies this advantage. Newcomers would face substantial hurdles in matching this technological sophistication and accumulated domain knowledge.

- Proprietary Technology: Conduent utilizes advanced AI, machine learning, and automation.

- Deep Process Expertise: Specialized knowledge across Commercial, Government, and Transportation sectors.

- High Replication Cost: New entrants would need significant time and capital to develop similar capabilities.

- Ongoing Investment: Conduent's continued focus on AI strengthens its technological moat.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants for companies like Conduent, particularly in its public sector work. Complex procurement processes, often characterized by lengthy bidding periods and detailed compliance checks, can deter smaller or less experienced firms. For instance, in 2024, many government agencies continued to emphasize cybersecurity certifications and data privacy standards, requiring substantial investment from potential new vendors to meet these benchmarks.

Stringent regulatory requirements in areas such as payment processing and benefits administration create substantial hurdles. New entrants must invest heavily in understanding and adhering to evolving compliance landscapes, including those related to financial transactions and personal data handling. Conduent's established expertise in managing programs like Electronic Benefit Transfer (EBT) demonstrates the deep regulatory knowledge required, which is difficult for newcomers to replicate quickly.

- High Compliance Costs: New entrants face significant upfront costs to meet regulatory standards in government contracting.

- Navigating Bureaucracy: Understanding and successfully navigating complex government procurement and approval processes acts as a major barrier.

- Specialized Certifications: Obtaining necessary certifications and clearances can be time-consuming and expensive, limiting the pool of potential competitors.

- Long Contract Cycles: The extended duration of government contracts means new entrants may face a prolonged period before realizing returns on their investment, if they can even secure initial contracts.

The threat of new entrants in the business process services (BPS) sector, where Conduent operates, is moderate. Significant capital investment is required for technology, infrastructure, and talent, with major BPS players investing billions in digital transformation and AI in 2024. Economies of scale and scope, coupled with established client relationships and brand reputation, create substantial barriers.

Proprietary technology, deep process expertise, and ongoing investment in AI further solidify Conduent's competitive advantage, making replication costly and time-consuming for newcomers. Additionally, navigating complex government regulations and procurement processes, which demand significant investment in compliance and certifications, deters many potential entrants.

| Barrier Type | Description | Impact on New Entrants | Example/Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment in technology, infrastructure, and skilled workforce. | Significant hurdle for startups. | Billions invested by BPS leaders in digital transformation and AI. |

| Economies of Scale/Scope | Cost advantages from large-scale operations and diverse service offerings. | Difficult for new entrants to match per-unit costs and integrated efficiencies. | Conduent's extensive operations serving millions of transactions annually. |

| Brand Reputation & Relationships | Established trust and deep client relationships, especially with large enterprises and government. | Access to key markets is challenging for newcomers. | Conduent's existing relationships with Fortune 100 companies and government entities. |

| Proprietary Technology & Expertise | Advanced AI, ML, automation, and deep domain knowledge across sectors. | High replication cost and time investment. | Conduent's ongoing AI initiatives and deep process expertise in Commercial, Government, and Transportation. |

| Government Regulations & Procurement | Complex compliance, lengthy bidding, and stringent standards. | Deters less experienced firms and requires substantial investment. | Emphasis on cybersecurity certifications and data privacy standards in government contracting. |

Porter's Five Forces Analysis Data Sources

Our Conduent Porter's Five Forces analysis is built upon a robust foundation of diverse data sources, including Conduent's own investor relations materials, SEC filings, and publicly available financial reports. We also incorporate insights from industry-specific market research, competitor analysis, and relevant trade publications to provide a comprehensive view of the competitive landscape.