Conduent Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conduent Bundle

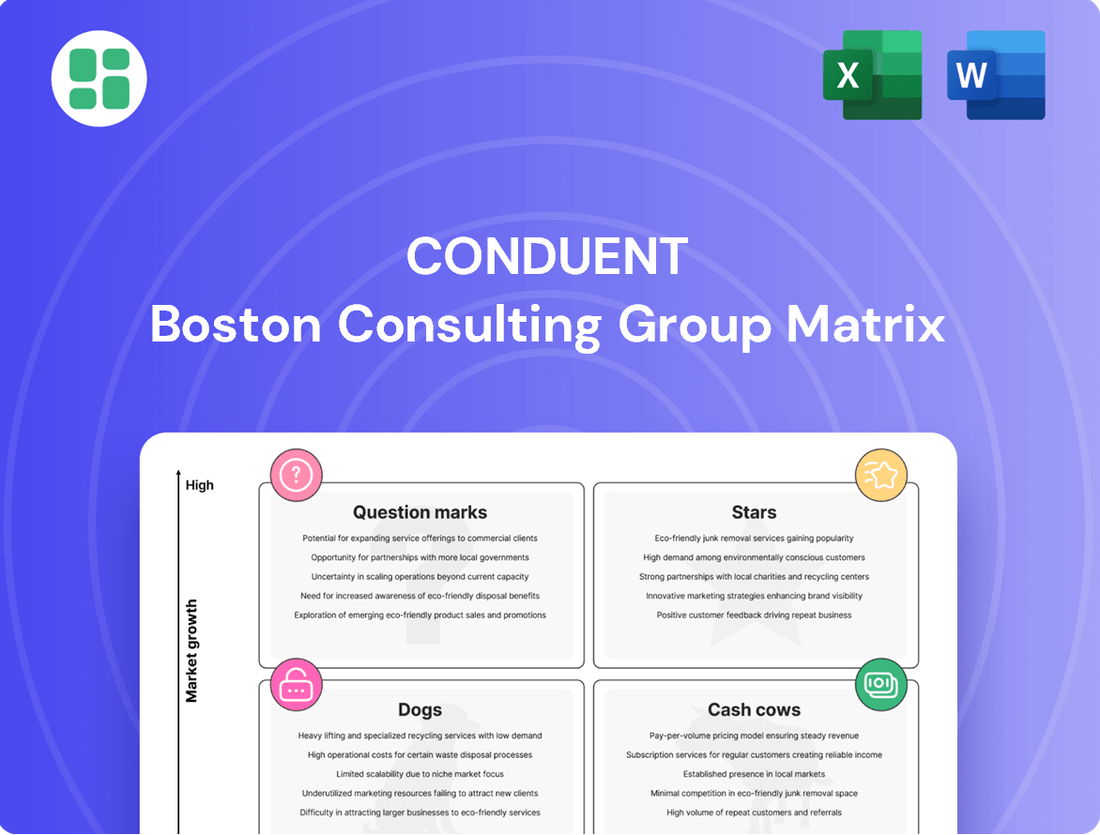

Unlock the strategic potential of Conduent's product portfolio with a clear view of its Stars, Cash Cows, Dogs, and Question Marks. This essential analysis helps you understand where resources are best allocated and which offerings demand immediate attention. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to drive Conduent's future success.

Stars

Conduent's Next-Gen Transportation Tolling & Transit Systems are experiencing significant growth, driven by investments in advanced technologies like 3D fare gates and open payment systems. This segment is a key growth driver for the company, with accelerated performance and increasing sales opportunities across various regions, particularly in Europe.

The company's focus on modernizing fare collection, including EMV contactless systems, positions it as a leader in delivering essential tolling and transit solutions. Conduent reported substantial revenue increases in its transportation segment throughout 2023, reflecting the strong demand for these upgraded systems.

Conduent is actively integrating AI and generative AI into its fraud detection offerings, a strategic move that directly addresses the escalating demand for robust security in digital transactions, especially within government services. This technological advancement positions Conduent to capture a larger share of the burgeoning cybersecurity and fraud management market.

The company's investment in these advanced AI capabilities is expected to yield significant returns, as the global fraud detection and prevention market was projected to reach approximately $100 billion by 2027, with AI-driven solutions being a key growth driver. Conduent's focus on government services, a sector often targeted by sophisticated fraud schemes, provides a substantial opportunity for market penetration and expansion.

Conduent is enhancing government payment platforms with modernized digital features, including mobile management for SNAP EBT accounts. This initiative boosts user control and combats fraud, positioning Conduent to capitalize on the public sector's digital evolution. This segment is experiencing significant growth as governments prioritize efficiency and enhanced security in their service delivery.

Advanced Customer Experience (CX) Transformation Services

Conduent's Advanced Customer Experience (CX) Transformation Services are positioned as a strong contender in the market, reflecting its leadership in key areas identified by ISG. The company's focus on Digital Operations, Intelligent Agent Experience, and Intelligent CX (AI and Analytics) underscores its commitment to evolving customer service landscapes. This strategic alignment with high-demand sectors, particularly those integrating AI, solidifies its standing.

The recognition in the 2024 ISG Provider Lens for Customer Experience Services is a testament to Conduent's robust market presence. This acknowledgment specifically highlights their strengths in areas crucial for modern customer engagement, such as AI-driven analytics and sophisticated agent support systems. These capabilities are vital for businesses aiming to enhance customer satisfaction and operational efficiency in an increasingly digital world.

- Market Leadership: Conduent is identified as a leader in the 2024 ISG Provider Lens for Customer Experience Services.

- Key Strengths: Recognized for excellence in Digital Operations, Intelligent Agent Experience, and Intelligent CX (AI and Analytics).

- Growth Driver: Positioned to capitalize on the growing demand for AI-enhanced and seamless customer interactions.

- Strategic Focus: Leverages automation and advanced analytics to deliver superior customer experience outcomes.

Healthcare Payer Operations Transformation

Conduent's consistent recognition as a 'Leader' in NelsonHall's 2024 NEAT Summary Report for Healthcare Payer Operations Transformation underscores their robust market position. This repeated accolade highlights their significant and expanding share in a sector actively pursuing digital advancements to boost efficiency and cut expenses. Conduent's offerings are instrumental in helping healthcare payers simplify intricate workflows and achieve superior results.

The healthcare payer market is experiencing a substantial digital overhaul, driven by the need for operational enhancements. Conduent's success in this arena, as evidenced by their leadership status, suggests a strong alignment with market demands for streamlined processes and improved outcomes. Their solutions are designed to address these critical needs, fostering a more efficient and effective healthcare ecosystem.

- Market Leadership: Conduent named a 'Leader' in NelsonHall's 2024 NEAT Report for Healthcare Payer Operations Transformation for the second year running.

- Digital Transformation Focus: The healthcare payer sector is undergoing significant digital transformation to enhance efficiency and reduce costs.

- Streamlined Operations: Conduent provides solutions that help payers simplify complex processes and achieve better outcomes.

- Growing Market Share: Their consistent leadership recognition points to a strong and increasing presence in this evolving market.

Conduent's Next-Gen Transportation Tolling & Transit Systems are a prime example of a Star in the BCG matrix. These systems are experiencing robust growth, fueled by significant investments in advanced technologies like 3D fare gates and open payment systems. The company's strategic focus on modernizing fare collection, including EMV contactless systems, solidifies its leadership in this high-demand sector.

The company's strong performance in transportation is further evidenced by substantial revenue increases reported throughout 2023. This segment is a key growth driver, demonstrating accelerated performance and expanding sales opportunities globally, particularly in Europe, as Conduent continues to integrate AI for enhanced fraud detection within these critical infrastructure services.

| Segment | Growth Rate | Market Share | Key Offerings | 2023 Performance Indicator |

|---|---|---|---|---|

| Next-Gen Transportation Tolling & Transit | High | Leading | 3D Fare Gates, Open Payment Systems, EMV Contactless | Substantial Revenue Increase |

What is included in the product

The Conduent BCG Matrix offers a strategic overview of their portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

It guides Conduent in making informed decisions about resource allocation, highlighting which units to invest in, hold, or divest.

The Conduent BCG Matrix offers a clear, actionable overview, relieving the pain of strategic uncertainty by visually categorizing business units.

Cash Cows

Conduent's traditional government payment disbursement services represent a classic Cash Cow. Annually, the company handles approximately $85 billion to $100 billion in government payments, a testament to its substantial and stable market position.

This segment benefits from a mature market, yet its essential function ensures a reliable and predictable revenue flow, bolstered by enduring government contracts. The strategy here emphasizes operational excellence and cost management to maximize profitability from this established business.

Conduent's Core Human Capital Solutions (HCS) for large enterprises are a classic Cash Cow. They leverage deep HR operational expertise, managing complex processes for companies with over 15,000 employees, including HR administration, global payroll, and benefits. This segment holds a significant market share in a mature BPO market, ensuring stable revenue streams with minimal need for aggressive growth investment.

Conduent's legacy customer contact center solutions represent a classic Cash Cow. The company facilitates around 2.3 billion customer service interactions annually, demonstrating a strong foothold in a well-established market. This consistent volume translates into significant and dependable revenue streams, even without rapid growth, as businesses continue to rely heavily on customer support.

Standard Business Operations Solutions (BOS)

The Commercial segment, representing over 50% of Conduent's total revenues in 2024, acts as a significant cash cow. This segment is anchored by traditional business operations solutions that are critical for client operations but exist within a mature market landscape. These offerings are primarily designed to reduce costs and enhance operational efficiencies for businesses, thereby generating consistent and reliable cash flow. The stability is further bolstered by deeply entrenched client relationships and the inherent contractual nature of these services.

Conduent's extensive experience and established presence within this segment provide a substantial competitive edge. The company's long history in delivering these essential business operations solutions translates into a strong market position and client loyalty. This segment is characterized by its ability to generate substantial, predictable earnings, which are vital for funding other areas of the business or for reinvestment.

- Commercial Segment Dominance: Accounted for over 50% of Conduent's total revenues in 2024.

- Mature Market Operations: Focuses on traditional business operations solutions essential for clients.

- Steady Cash Flow Generation: Driven by cost reduction and efficiency improvement services.

- Competitive Advantage: Leverages Conduent's long history and established client relationships.

Established Tolling and Transit Operations Management

Conduent's established tolling and transit operations management stands as a prime example of a Cash Cow within the BCG matrix. The company processes an impressive volume, handling close to 13 million tolling transactions daily, which underscores its significant market penetration in managing existing transportation networks. This segment is characterized by a steady and substantial revenue stream derived from providing fundamental services that are in constant demand.

The reliability of this segment is further amplified by its consistent performance, even as the company explores new technological advancements in transportation. The core business of managing these established systems acts as a dependable engine for generating cash, providing a stable financial foundation for Conduent's broader operations. This consistent revenue generation is crucial for funding other ventures within the company's portfolio.

- Dominant Market Share: Processing nearly 13 million tolling transactions daily, Conduent holds a commanding position in managing existing transportation infrastructure.

- Consistent Revenue Stream: This segment generates high-volume, predictable revenue from essential tolling and transit services.

- Operational Stability: The core management of these established systems provides a reliable cash flow, acting as a financial bedrock for the company.

- Foundation for Growth: The cash generated here supports investment in newer, potentially high-growth areas like advanced transportation technologies.

Conduent's government payment disbursement services, handling between $85 billion and $100 billion annually, are a prime example of a Cash Cow. This segment benefits from a mature market and stable government contracts, ensuring a predictable revenue flow through operational excellence and cost management.

The company's Core Human Capital Solutions (HCS) for large enterprises, managing complex HR processes for over 15,000 employees, also function as a Cash Cow. This mature BPO market segment provides stable revenue streams with minimal need for aggressive growth investment.

Conduent's legacy customer contact center solutions, facilitating approximately 2.3 billion customer service interactions annually, represent another Cash Cow. This consistent volume in a well-established market translates into significant and dependable revenue streams.

The Commercial segment, representing over 50% of Conduent's total revenues in 2024, is a significant cash cow. Anchored by traditional business operations solutions within a mature market, it generates consistent cash flow by reducing costs and enhancing client operational efficiencies, supported by strong client relationships and contracts.

Conduent's tolling and transit operations management, processing close to 13 million tolling transactions daily, is a strong Cash Cow. This segment provides a steady, substantial revenue stream from essential services in constant demand, acting as a reliable engine for cash generation.

| Conduent Cash Cow Segments | Key Characteristics | 2024 Revenue Impact | Operational Metric Example |

|---|---|---|---|

| Government Payment Disbursement | Mature market, stable contracts | Significant contributor | $85B - $100B annually processed |

| Core Human Capital Solutions (HCS) | Mature BPO market, deep HR expertise | Stable revenue streams | Serves enterprises with 15,000+ employees |

| Legacy Customer Contact Centers | Established market, consistent demand | Dependable revenue | ~2.3 billion interactions annually |

| Commercial Segment | Mature market, essential operations solutions | Over 50% of total 2024 revenue | Focus on cost reduction & efficiency |

| Tolling & Transit Operations Management | Essential services, constant demand | Steady and substantial revenue | ~13 million tolling transactions daily |

Preview = Final Product

Conduent BCG Matrix

The Conduent BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered formatting—just the complete, professionally designed strategic analysis ready for your immediate use. You can confidently assess its value knowing that the file you see is the exact, ready-to-deploy resource that will be delivered to you. This ensures a seamless integration into your strategic planning processes without any surprises or need for further editing.

Dogs

The BenefitWallet Health Savings Account Portfolio, a former segment of Conduent, was strategically divested in the second quarter of 2024. This sale brought in $425 million, signaling its position outside Conduent's core growth strategy or its underperformance in the market.

Conduent's Curbside Management and Public Safety businesses, divested in Q2 2024 for $230 million, were likely considered Stars or Cash Cows that no longer fit the company's future direction. This strategic move suggests these operations, while potentially profitable, were not aligned with Conduent's pivot towards digital transformation and advanced analytics.

Conduent's Casualty Claims Solutions Business was classified as a Dog in the BCG Matrix, a designation reflecting its low market share and low market growth. This assessment likely informed the company's decision to divest the unit.

The sale of this business in Q3 2024 for $224 million underscores its status as a non-core asset. Such divestitures are common when a business unit struggles to compete or generate substantial profits, freeing up capital for more promising ventures.

Outdated Legacy IT Infrastructure Management

Outdated legacy IT infrastructure management services, characterized by commoditization and the need for substantial, ongoing maintenance investments yielding diminishing returns, would likely be categorized as Dogs within Conduent's BCG Matrix. These are areas where growth prospects are minimal, and profit margins are typically thin.

Conduent's strategic emphasis on digital transformation naturally steers the company away from these legacy offerings. This suggests that such IT infrastructure management services are considered low-growth and low-margin segments, requiring careful management to minimize resource drain.

- Low Market Growth: The demand for traditional, on-premise IT infrastructure management is declining as businesses adopt cloud-native solutions.

- Low Profit Margins: Highly commoditized services often lead to price wars, squeezing profitability.

- High Maintenance Costs: Maintaining aging infrastructure demands significant capital and operational expenditure.

- Strategic Shift: Conduent's investment in digital solutions indicates a divestment or de-emphasis of these legacy IT services.

Highly Commoditized, Undifferentiated BPO Services

Highly commoditized, undifferentiated Business Process Outsourcing (BPO) services, often competing solely on price, fall into the Dogs category within the Conduent BCG Matrix. These offerings typically exhibit low market share and minimal growth prospects, making them less attractive from a strategic investment standpoint. For instance, basic data entry or customer service roles that can be easily replicated by competitors often represent this segment.

These services struggle to command premium pricing due to their lack of unique value propositions. In 2024, the BPO market, while growing, saw intense competition in these undifferentiated segments, with many providers unable to achieve significant profit margins. Companies with a high concentration of such services may find themselves with declining revenues and a need for strategic re-evaluation.

- Low Market Share: Typically hold a small percentage of the overall market for their specific BPO function.

- Low Growth Potential: The market segment itself is not expanding significantly, limiting opportunities for increased volume.

- Intense Price Competition: Competitors often undercut each other, eroding profitability.

- Minimal Differentiation: Services are easily replicable, offering no unique selling points.

Conduent's Casualty Claims Solutions Business, divested in Q3 2024 for $224 million, was identified as a Dog due to its low market share and low market growth. This classification indicated it was a non-core asset, struggling to compete effectively and generate substantial profits. Such divestitures are common for businesses that are resource-intensive without delivering commensurate returns, allowing capital reallocation to more promising areas of the company.

Outdated IT infrastructure management services, characterized by commoditization and high maintenance costs with diminishing returns, also fit the Dog profile. These segments offer minimal growth prospects and thin profit margins, often requiring significant investment simply to maintain their current state. Conduent's strategic pivot towards digital transformation naturally deemphasizes these legacy offerings, which are seen as low-growth and low-margin burdens.

Undifferentiated Business Process Outsourcing (BPO) services, competing primarily on price, are also categorized as Dogs. These typically have low market share and minimal growth potential, with intense price competition eroding profitability. The lack of unique value propositions makes these services easily replicable, leading to challenges in achieving significant margins or market expansion in 2024.

Question Marks

Conduent is actively testing generative AI for healthcare claims, aiming to speed up processing by automatically extracting data from documents. This is a rapidly expanding field with significant future promise.

While the potential is vast, Conduent’s current footprint in these emerging AI applications is still quite small. Substantial investment will be necessary to transform these early trials into fully developed, income-generating services.

Conduent's integration of Fairmarkit's AI, including GenAI, enhances its FastCap Finance Analytics, aiming to streamline finance and procurement. This move targets the burgeoning intelligent automation market, which is projected to reach $50 billion by 2027, according to recent industry forecasts.

While this collaboration positions Conduent in a high-growth area, its market share for these advanced AI solutions is still nascent. Significant investment is needed to establish a strong presence and capture substantial market share in this competitive landscape.

Emerging digital solutions for government, like complex bespoke platforms and smart city initiatives, present a high-growth, yet currently low-share, opportunity for Conduent. These areas require substantial upfront investment to establish viability and scale.

In 2024, the global smart city market was valued at approximately $510 billion, with projections indicating significant expansion. Conduent's focus on these nascent, yet potentially lucrative, digital transformation projects positions them to capture a share of this growing sector.

Standalone Advanced Analytics Services

Standalone Advanced Analytics Services represent a question mark for Conduent within the BCG Matrix. While Conduent integrates analytics into its existing solutions, offering advanced, predictive, or prescriptive analytics as a distinct service to a wider market requires careful consideration.

The market for standalone advanced analytics is experiencing significant growth, with global spending projected to reach over $300 billion in 2024. However, Conduent's specific competitive edge and market penetration in this specialized area are still emerging. This necessitates substantial investment in both sales infrastructure and product development to establish a strong foothold.

- Market Growth: The global advanced analytics market is expanding rapidly, indicating strong demand for specialized services.

- Competitive Landscape: Conduent faces established players and innovative startups in the standalone analytics space.

- Investment Needs: Significant capital will be required for sales force expansion and enhancing analytical capabilities to compete effectively.

- Differentiation Strategy: Conduent must clearly define its unique value proposition to stand out in a crowded market.

New International Market Entries for Digital Platforms

Conduent's expansion of its digital platforms, automation, and analytics into new international markets, where its current footprint is minimal, positions these ventures as question marks within the BCG matrix. These initiatives demand significant capital outlay and carry inherent risks, yet they offer the potential for substantial future growth if Conduent can successfully establish a strong market position.

For instance, Conduent's reported revenue in 2023 was $4.1 billion, with a notable portion derived from its commercial and government solutions segments, which heavily leverage digital platforms. Entering emerging markets in Southeast Asia or Africa, for example, could represent a question mark opportunity. These regions are experiencing rapid digital adoption, with the global digital transformation market projected to reach $15.5 trillion by 2030, according to some industry forecasts.

- High Investment, Uncertain Returns: New international market entries for Conduent's digital solutions require substantial upfront investment in infrastructure, marketing, and local talent, with success not guaranteed.

- Potential for High Growth: If Conduent can effectively adapt its offerings to local needs and regulations, these question marks could evolve into stars, capitalizing on the increasing demand for automation and analytics globally. For example, the business process outsourcing market in India alone was valued at over $30 billion in 2023.

- Strategic Importance: These ventures are crucial for Conduent's long-term strategy to diversify its revenue streams and reduce reliance on established markets, aiming to capture future market share in rapidly developing economies.

Question Marks represent business areas with low market share but high growth potential. For Conduent, these are often new technology ventures or expansions into undeveloped markets. They require significant investment to grow and may not always succeed.

Conduent's exploration of generative AI in healthcare claims processing and its integration of AI into finance analytics are prime examples of Question Marks. These areas show promise for future revenue but currently have limited market penetration and demand substantial capital for development and market capture.

Entering new international markets with digital solutions also falls into the Question Mark category. While these markets offer high growth prospects, Conduent's existing presence is minimal, necessitating considerable investment to build a foothold and compete effectively.

The standalone advanced analytics services also fit the Question Mark profile. The market is large and growing, but Conduent needs to invest heavily in sales and product enhancement to establish a competitive advantage.

| Business Area | Market Growth | Market Share | Investment Needs | Potential |

| Generative AI in Healthcare Claims | High | Low | Substantial | High |

| AI-Enhanced Finance Analytics | High | Low | Substantial | High |

| New International Digital Markets | High | Low | Substantial | High |

| Standalone Advanced Analytics | High | Low | Substantial | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.