Comvita SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comvita Bundle

Comvita's strengths lie in its premium brand reputation and strong customer loyalty, while its reliance on natural ingredients presents potential supply chain vulnerabilities. Understanding these dynamics is crucial for any investor or strategist. Discover the complete picture behind Comvita's market position with our full SWOT analysis, revealing actionable insights and strategic takeaways.

Strengths

Comvita stands as a dominant force in the global Manuka honey and bee consumer goods market, a position cemented by its operations since 1974. This extensive experience translates into a significant competitive advantage and deep consumer trust.

The company commands a substantial market share in crucial Asian markets, including China, Singapore, Hong Kong, and South Korea. For instance, in 2024, Comvita reported robust sales growth in these regions, demonstrating sustained demand for its premium Manuka honey products.

Comvita's ownership of apiaries and native forests provides a secure, sustainable supply of high-quality Manuka honey, a critical raw material. This vertical integration extends to their own government-recognized laboratory, which rigorously tests bee products, ensuring purity and efficacy that customers value.

Comvita's brand is a significant asset, recognized globally for its commitment to natural health and wellness, especially through its premium Manuka honey. This strong reputation allows Comvita to maintain a premium price point, differentiating it from competitors in the wider honey market and safeguarding its brand value.

Diversified Product Portfolio and Research Focus

Comvita's strength lies in its diverse product range, extending beyond its core Manuka honey to include olive leaf extract, propolis, and Medihoney. This broad offering effectively addresses a wider spectrum of consumer health and wellness demands.

The company's commitment to research and development is a significant asset. By investing in scientific understanding of Manuka trees, bee health, and product efficacy, Comvita fosters innovation and supports the expansion of its product lines.

Financial data from the fiscal year ending June 30, 2024, highlights Comvita's robust market position. Total revenue reached NZ$238.5 million, with a notable 15% increase in the ANZ region, driven by strong performance in both Manuka honey and complementary health products.

- Diversified Revenue Streams: Comvita's portfolio beyond Manuka honey, including olive leaf extract and propolis, mitigates reliance on a single product category.

- R&D Investment: Significant investment in research, evidenced by their ongoing studies into the bioactives of Manuka, underpins product development and scientific validation.

- Market Penetration: The company's expanded presence in international markets, with a 10% growth in Asia Pacific sales in FY24, demonstrates its ability to leverage its diverse product offerings.

Expanding Global Presence and Omnichannel Strategy

Comvita boasts a robust international footprint, operating across key markets including Greater China, ANZ, the rest of Asia, North America, and EMEA. This extensive network facilitates broad product distribution and market penetration.

The company is actively enhancing its omnichannel strategy, focusing on growing e-commerce sales while preserving a strong foundation in traditional retail and distributor channels. This approach aims to provide consumers with greater accessibility and convenience across diverse purchasing environments.

- Global Reach: Comvita's presence spans Greater China, ANZ, Rest of Asia, North America, and EMEA, ensuring wide market access.

- Omnichannel Growth: Focus on increasing e-commerce sales alongside established retail and distributor networks.

- Enhanced Accessibility: Strategy designed to make products more readily available to a global consumer base.

Comvita's established reputation and deep consumer trust, built since 1974, form a core strength. Their significant market share in key Asian markets, like China, underscores consistent demand. The company's vertical integration, controlling apiaries and forests, ensures a secure, high-quality Manuka honey supply, further bolstered by their in-house rigorous testing laboratory.

| Strength | Description | Supporting Data (FY24) |

|---|---|---|

| Brand Reputation & Trust | Globally recognized for natural health and wellness, particularly premium Manuka honey. | Maintains premium pricing due to strong brand value. |

| Market Share in Asia | Dominant position in crucial markets like China, Singapore, Hong Kong, and South Korea. | 10% growth in Asia Pacific sales in FY24. |

| Vertical Integration & Supply Chain Control | Ownership of apiaries and forests ensures a sustainable, high-quality Manuka honey supply. | Government-recognized laboratory for rigorous product testing. |

| Product Diversification | Offers a range beyond Manuka honey, including olive leaf extract and propolis. | Robust sales growth across Manuka honey and complementary health products. |

What is included in the product

Delivers a strategic overview of Comvita’s internal and external business factors, highlighting its strong brand reputation and premium product positioning alongside potential supply chain vulnerabilities and competitive pressures.

Comvita's SWOT analysis offers a clear roadmap to identify and address internal weaknesses and external threats, transforming potential challenges into actionable strategies for growth and market leadership.

Weaknesses

Comvita has experienced notable financial setbacks, including a net loss of NZD 6.48 million for the six months ending December 31, 2024. This follows a significant restated net loss before tax of NZD 85.8 million for the entire fiscal year ending June 30, 2024.

The company has also had to account for substantial non-cash impairment charges. These charges, totaling NZD 67.5 million in the first half of FY25, highlight concerns about the carrying value of its assets and suggest underlying financial strain.

Comvita's reputation has been tarnished by accounting irregularities disclosed in its FY23 and FY24 reports. These issues resulted in an overstatement of after-tax earnings by NZD 4 million, stemming from overstated sales in China and Singapore, alongside under-accrued sales expenses.

While the company has implemented internal control enhancements and reorganized reporting structures to address these weaknesses, the impact on investor confidence is undeniable. These events highlight significant governance concerns that require ongoing scrutiny and demonstrate a need for robust financial oversight.

Comvita's significant exposure to the Chinese market presents a key weakness. Recent reports indicate substantial sales drops in this region, driven by a combination of subdued consumer confidence and aggressive pricing from competitors. For instance, in the first half of fiscal year 2024, sales in China fell by 13.5%, highlighting the impact of these challenges.

This heavy dependence on China, a market currently grappling with economic slowdown and fierce competition, creates a considerable risk for Comvita's top-line performance. The company's revenue streams are thus vulnerable to shifts in Chinese consumer behavior and market dynamics.

Declining Gross Margins and Intense Price Competition

Comvita is facing significant headwinds from declining gross margins, a key weakness for the company. For the six months ending December 31, 2024, gross margin fell sharply to 50.7%, a drop of 930 basis points compared to the prior year. This erosion in profitability is primarily driven by intense price competition across all its operating markets.

The broader market is also experiencing a surplus of lower-priced honey, which further exacerbates the pricing pressure. Despite Comvita's strategic focus on maintaining its premium brand positioning, this market dynamic is making it challenging to protect its profit margins.

- Declining Gross Margin: Reported at 50.7% for the half-year ended December 31, 2024.

- Basis Point Drop: A significant decrease of 930 basis points year-on-year.

- Key Drivers: Aggressive price competition and a market glut of cheaper honey.

- Impact: Pressure on profitability despite premium brand efforts.

High Debt Levels and Banking Covenant Challenges

Comvita's financial health is a significant concern, primarily due to its substantial debt burden. As of December 2024, the company’s net debt stood at NZD 81.6 million. This level of indebtedness has led to difficulties in complying with its banking covenants.

The company has been forced to seek waivers from its lenders and is actively engaged in negotiations to restructure its existing banking facilities. These actions highlight the financial strain Comvita is experiencing and raise questions about its short-term liquidity and ability to manage its financial obligations effectively.

- High Net Debt: NZD 81.6 million as of December 2024.

- Covenant Breaches: Faced challenges meeting banking covenant requirements.

- Lender Negotiations: Secured waivers and is in ongoing discussions for facility restructuring.

- Liquidity Concerns: The situation indicates potential liquidity pressures.

Comvita's financial performance has been notably weak, marked by a NZD 6.48 million net loss in the first half of FY25 and a significant restated net loss before tax of NZD 85.8 million for FY24. These losses are compounded by substantial non-cash impairment charges, amounting to NZD 67.5 million in H1 FY25, indicating potential overvaluation of assets and underlying financial instability.

The company’s profitability is further undermined by declining gross margins, which fell to 50.7% in H1 FY25, a drop of 930 basis points year-on-year, largely due to intense price competition and a market surplus of lower-priced honey. This erosion of margins puts pressure on Comvita's ability to maintain its premium brand positioning and overall profitability.

Comvita faces significant financial strain due to its high net debt of NZD 81.6 million as of December 2024, which has led to covenant breaches with lenders. The company has had to seek waivers and is negotiating facility restructures, signaling potential liquidity concerns and challenges in managing its financial obligations.

| Financial Metric | FY24 (Restated) | H1 FY25 (Ending Dec 2024) | Key Concerns |

| Net Loss Before Tax | NZD 85.8 million | N/A | Significant financial underperformance |

| Net Loss | N/A | NZD 6.48 million | Continued profitability issues |

| Impairment Charges | N/A | NZD 67.5 million | Asset valuation concerns |

| Gross Margin | N/A | 50.7% (down 930 bps) | Margin erosion due to competition |

| Net Debt | N/A | NZD 81.6 million | High leverage, covenant issues |

What You See Is What You Get

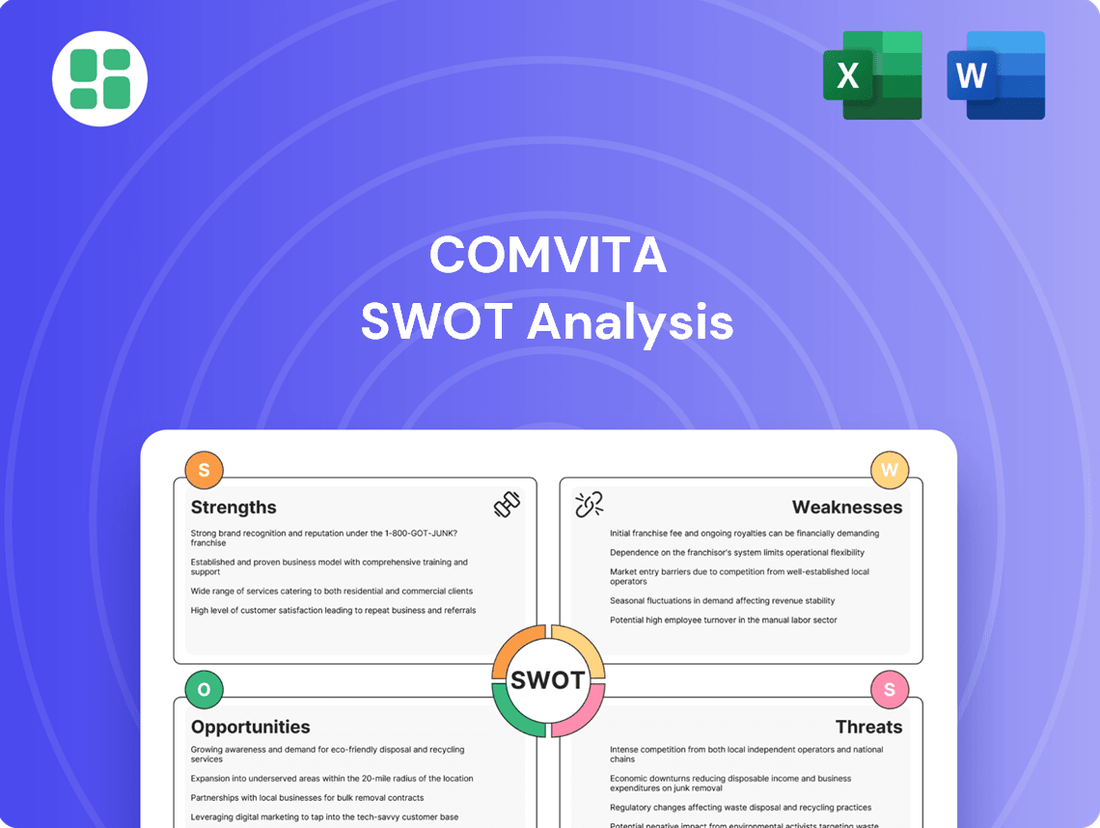

Comvita SWOT Analysis

This is the actual Comvita SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full Comvita SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive strategic overview.

This is a real excerpt from the complete Comvita SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing for customization and integration into your business planning.

Opportunities

The worldwide market for natural health products is booming, with consumers increasingly prioritizing wellness and seeking out natural, organic options. This trend is a significant opportunity for companies like Comvita, especially given the unique properties of Manuka honey.

The global natural health and wellness market was valued at approximately $525 billion in 2023 and is projected to reach over $700 billion by 2027, showcasing robust expansion. Comvita's focus on Manuka honey, recognized for its potent antibacterial and anti-inflammatory benefits, aligns perfectly with this growing consumer demand for effective, natural health solutions.

Comvita's strategic expansion into new geographies and channels presents a significant opportunity. The company has demonstrated success in North America and various Asian markets, signaling strong potential for further penetration into emerging economies. For instance, Comvita reported a 15.5% increase in its North American sales for the first half of the 2024 financial year, highlighting this region's growth trajectory.

Leveraging its well-recognized brand and existing distribution infrastructure, Comvita can effectively enter new, untapped markets. Furthermore, strengthening its presence in growing segments like e-commerce, which saw a 22% uplift in Comvita's online sales in FY23, and specialized health stores offers a clear path to increased market share and revenue diversification.

Comvita has a significant opportunity to expand its product range beyond traditional honey. By leveraging its expertise in Manuka honey, the company can develop innovative supplements, advanced skincare formulations, and other natural health products that cater to growing consumer interest in wellness and natural ingredients. This diversification could tap into new market segments and revenue streams.

For instance, the global natural and organic personal care market was valued at approximately USD 20.7 billion in 2023 and is projected to reach USD 38.2 billion by 2030, growing at a CAGR of 9.1%. Comvita's established brand reputation and commitment to quality ingredients position it well to capture a share of this expanding market with new Manuka honey-infused offerings.

Leveraging Sustainability and ESG Credentials

Comvita's dedication to sustainable beekeeping, native tree planting, and its B Corp certification are significant opportunities. These initiatives resonate strongly with a growing segment of consumers who actively seek out environmentally responsible and ethically produced goods. This commitment can foster deeper brand loyalty and attract new customers who align with Comvita's values.

Leveraging these ESG strengths can translate into tangible market advantages. For instance, a 2024 report indicated that 70% of consumers are more likely to purchase from brands with strong sustainability commitments. Comvita's existing credentials position it well to capture this market share, potentially leading to increased sales and market penetration.

- Sustainable Practices: Comvita's focus on responsible beekeeping and native reforestation directly addresses environmental concerns.

- B Corp Certification: This globally recognized standard validates Comvita's commitment to social and environmental performance, accountability, and transparency.

- Consumer Demand: Increasing consumer preference for ethical and sustainable brands presents a clear avenue for growth and enhanced brand perception.

- Market Differentiation: Strong ESG credentials offer a competitive edge in a crowded marketplace, attracting value-driven customers.

Strategic Partnerships and Acquisitions

Comvita has a proven track record of expanding its reach and capabilities through strategic alliances and takeovers. A notable example is its acquisition of HoneyWorld Singapore, which bolstered its market position. These moves are crucial for strengthening supply chains and increasing market presence.

Looking ahead, Comvita can further accelerate its growth by identifying and pursuing additional partnerships or acquisitions. Focusing on high-growth market segments or untapped geographic regions offers significant potential for synergistic advantages and faster market penetration. For instance, expanding into emerging markets in Asia could leverage existing demand for health and wellness products.

- Strategic Acquisitions: Comvita's past acquisitions, like HoneyWorld Singapore, demonstrate a successful strategy for market expansion and supply chain enhancement.

- Joint Ventures: The company has utilized joint ventures to solidify its market standing and secure vital supply chains.

- Future Growth Avenues: Exploring new partnerships or acquisitions in high-growth sectors and new territories presents opportunities for synergistic benefits and accelerated market entry.

- Market Penetration: Strategic collaborations can significantly speed up Comvita's ability to reach new customer bases and increase market share.

Comvita is well-positioned to capitalize on the expanding global natural health market, projected to exceed $700 billion by 2027, with Manuka honey's unique properties aligning with consumer demand for natural wellness solutions.

The company's strategic expansion into North America, showing a 15.5% sales increase in H1 FY24, and its growing e-commerce presence, up 22% in FY23, highlight opportunities for further market penetration and revenue diversification.

Expanding its product line into supplements and skincare, tapping into the natural personal care market valued at $20.7 billion in 2023, offers Comvita new revenue streams and market segments.

Comvita's commitment to sustainability and its B Corp certification appeal to the 70% of consumers favoring environmentally responsible brands, providing a significant competitive advantage and fostering brand loyalty.

Threats

The Manuka honey market is certainly feeling the heat from increased competition. We're seeing a lot of supply out there, which is leading to some pretty aggressive price cuts from rivals. This is putting pressure on Comvita's ability to maintain its market share and profit margins.

New companies are jumping into the market, and there are more and more cheaper alternatives popping up. This trend could really ramp up the competition and make it harder for Comvita to hold onto its premium brand image. For instance, in the year ending June 30, 2023, Comvita reported a revenue of NZ$200.8 million, and increased competition could challenge this growth.

A significant threat to Comvita stems from the ongoing global economic slowdown and particularly weak consumer sentiment in China. This subdued demand directly impacts Comvita's revenue streams, as consumers may reduce discretionary spending on health and wellness products.

The critical Chinese market, a key growth driver for Comvita, is experiencing a noticeable downturn. This slowdown can lead to reduced sales volumes, especially during important shopping periods like the Double 11 festival, which directly affects Comvita's ability to meet revenue targets.

For instance, in early 2024, China's consumer confidence remained fragile, with retail sales growth showing volatility. This environment makes it challenging for Comvita to rely on strong consumer spending, impacting its sales forecasts and overall profitability.

Comvita's honey supply, while supported by its own apiaries, remains vulnerable to weather patterns. For instance, adverse climatic conditions in key beekeeping regions can significantly reduce honey yields, directly impacting raw material availability and driving up costs. This susceptibility to nature's unpredictability is a persistent threat.

Furthermore, the broader global supply chain continues to present challenges. Disruptions in shipping, logistics, and manufacturing, coupled with persistent inflationary pressures observed throughout 2024 and into 2025, can hinder Comvita's ability to produce and distribute its products efficiently, adding layers of operational risk.

Regulatory Changes and Authenticity Challenges

The Manuka honey sector grapples with persistent authenticity and counterfeiting issues, potentially undermining the premium perception and consumer confidence in the product. For instance, in 2023, reports indicated continued efforts by regulatory bodies to combat fraudulent Manuka honey, with some batches failing to meet established authenticity standards.

Furthermore, evolving international trade regulations, import tariffs, and stringent food safety requirements in crucial markets present significant operational hurdles for Comvita. These regulatory shifts can directly influence market access and cost structures, impacting global sales performance.

- Regulatory Scrutiny: Increased testing and certification requirements for Manuka honey in markets like the UK and EU could add compliance costs.

- Tariff Impacts: Changes in trade agreements or the imposition of new tariffs could affect the landed cost of Comvita's products in key export destinations.

- Authenticity Verification: The ongoing need for robust traceability and verification systems to combat counterfeits requires continuous investment and vigilance.

Brand Image Damage from Accounting Irregularities

The recent disclosure of accounting irregularities, including overstated sales and under-accrued expenses, could severely damage Comvita's reputation and investor confidence. In the fiscal year ending June 30, 2023, Comvita reported a net profit after tax of NZ$22.1 million, a significant drop from NZ$35.7 million in the prior year, partly attributed to these issues. Restoring trust among stakeholders and demonstrating robust financial governance will be critical to mitigating this long-term threat.

This damage to brand image can translate into tangible financial consequences. For instance, a sustained loss of investor confidence could lead to a lower stock valuation. Comvita's share price experienced volatility following the announcements, highlighting market sensitivity to such disclosures. The company's ability to implement and communicate effective remedial actions will be paramount.

- Reputational Harm: Overstated sales and under-accrued expenses erode trust, impacting customer loyalty and supplier relationships.

- Investor Confidence Decline: Market reactions, like share price drops, signal a loss of faith in financial reporting accuracy.

- Increased Scrutiny: Regulatory bodies and auditors will likely impose stricter oversight, potentially increasing compliance costs and operational burdens.

- Difficulty in Capital Raising: A tarnished reputation can make it harder and more expensive for Comvita to secure future funding.

Increased competition from new entrants and cheaper alternatives presents a significant threat, potentially diluting Comvita's premium brand positioning. The ongoing global economic slowdown and weak consumer sentiment, particularly in China, directly impact discretionary spending on products like Manuka honey. For example, in early 2024, China's consumer confidence remained fragile, impacting retail sales and Comvita's revenue forecasts.

Adverse weather patterns affecting honey yields and global supply chain disruptions, including shipping and inflation, pose ongoing operational risks. The persistent issue of Manuka honey authenticity and counterfeiting, with regulatory bodies actively combating fraudulent batches, continues to threaten consumer trust and Comvita's brand integrity. Evolving international trade regulations and stringent food safety requirements in key markets can also create significant market access hurdles and increase costs.

The recent disclosure of accounting irregularities, including overstated sales and under-accrued expenses, has severely damaged Comvita's reputation and investor confidence. This led to a significant drop in net profit after tax to NZ$22.1 million for the year ending June 30, 2023, down from NZ$35.7 million in the prior year. Restoring trust and demonstrating robust financial governance is crucial to mitigating this long-term threat and its impact on market valuation and future capital raising.

SWOT Analysis Data Sources

This Comvita SWOT analysis is built upon a foundation of credible data, including the company's official financial reports, comprehensive market research, and expert industry analysis to ensure a robust and insightful assessment.